false

0001006830

0001006830

2024-10-21

2024-10-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

October 21, 2024

(Date of report/date of earliest event reported)

CONSUMERS BANCORP, INC.

(Exact name of registrant as specified in its charter)

| Ohio |

033-79130 |

34-1771400 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

614 East Lincoln Way

P.O. Box 256

Minerva, Ohio 44657

(Address of principal executive offices) (Zip Code)

(330) 868-7701

(Registrant’s telephone number, including area code)

N/A

(Former name or former address if changed since the last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

None

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On October 21, 2024, Consumers Bancorp, Inc. issued a press release reporting its results for the first fiscal quarter ended September 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits

d. Exhibits

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Consumers Bancorp, Inc.

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Date: October 21, 2024

|

/s/ Ralph J. Lober

|

|

|

|

Ralph J. Lober, II President and Chief

|

|

|

|

Executive Officer

|

|

Exhibit 99.1

Consumers Bancorp, Inc. Reports:

| |

●

|

Net income was $2.2 million for the three-month period ended September 30, 2024.

|

| |

●

|

Net income increased $133 thousand, or 6.3%, for the three-month period ended September 30, 2024 compared with the quarter ended June 30, 2024.

|

| |

●

|

Total loans increased by $7.4 million, or an annualized 3.9%, for the three-month period ended September 30, 2024.

|

| |

●

|

Non-performing loans to total loans were 0.12%, of which 0.05% represents the government guaranteed portion, as of September 30, 2024.

|

| |

●

|

Total deposits increased by $25.9 million, or an annualized 10.7%, for the three-month period ended September 30, 2024.

|

| |

●

|

Shareholders’ equity increased by $9.6 million, or $3.07 per share, for the three-month period ended September 30, 2024.

|

Minerva, Ohio — October 21, 2024 (OTCQX: CBKM) Consumers Bancorp, Inc. (Consumers) today reported net income of $2.2 million for the first quarter of fiscal year 2025, an increase of $133 thousand, or 6.3%, from the quarter ended June 30, 2024. Earnings per share for the first quarter of fiscal year 2025 were $0.72, $0.67 for the quarter ended June 30, 2024, and $0.78 for the same period last year.

“The competitive pressures on deposit pricing that began to lessen during the fourth quarter of fiscal year 2024, eased further because of the 50-basis point cut in the discount rate in September 2024. We have been able to reduce the initial pricing on money market accounts and time deposits. Further, account yields are trending downward as guaranteed money market rate periods expire and time deposits renew at rates lower than the expiring coupons. We expect the cost of funds to trend downward in future quarters as these trends work their way through the respective portfolios. While quarterly loan production remains below previous levels, increases in commercial, mortgage and personal loan activity is reflected in stronger pipelines and resulted in total loan production (portfolio and held for sale) of $43.4 million during the first quarter of fiscal year 2025, an 18.8% increase over the previous quarter. The loan portfolio continues to perform well with low net charge-offs and nonaccrual balances, and very stable total delinquency ratios all point to resilient commercial and consumer borrowers. The discount rate cut and lower yields across the curve also had a positive impact on the market value of the bank’s securities portfolio which, in turn, contributed to a 15.1% increase in shareholders’ equity in the quarter,” said Ralph J. Lober II, President and Chief Executive Officer.

Quarterly Operating Results Overview

Net income was $2.2 million, or $0.72 per share, for the three months ended September 30, 2024, $2.1 million, or $0.67 per share, for the three months ended June 30, 2024, and $2.4 million, or $0.78 per share, for the same prior year period.

Net interest income was $8.0 million for the three-month period ended September 30, 2024 and $8.2 million for the same prior year period. The net interest margin was 2.92% for the quarter ended September 30, 2024, 2.99% for the quarter ended June 30, 2024, and 3.09% for the quarter ended September 30, 2023. The yield on average interest-earning assets was 4.81% for the quarter ended September 30, 2024, compared with 4.81% for the quarter ended June 30, 2024, and 4.45% for the quarter ended September 30, 2023. The cost of funds increased to 2.56% for the quarter ended September 30, 2024, compared with 2.48% for the quarter ended June 30, 2024, and 1.91% for the quarter ended September 30, 2023. The yield on interest-earning assets as well as the cost of funds have been impacted by the rapid increase in short-term market interest rates in 2022 and 2023.

The provision for credit losses was $32 thousand for the three-month period ended September 30, 2024, and included a $77 thousand provision for credit losses on loans and a reduction of $45 thousand to the reserve for unfunded commitments. This compares with a $119 thousand provision for credit losses for the three-month period ended September 30, 2023, which included a provision for credit losses on loans of $40 thousand and a $79 thousand provision for credit losses on unfunded commitments. Net charge-offs of $59 thousand were recorded for the three-month period ended September 30, 2024, compared with $34 thousand that were recorded for the three-month period ended September 30, 2023.

Other income increased by $236 thousand, or 20.4%, for the three-month period ended September 30, 2024, compared to the same prior year period. Other income for the three-month period ended September 30, 2023 included a $79 thousand loss on the sale of lower yielding securities. Excluding the securities loss, other income increased by $157, or 12.7%, for the three-month period ended September 30, 2024, compared with the same prior year period. Other income increased primarily due to debit card interchange income increasing by $65 thousand, or 11.8%, mortgage banking revenue increasing by $35 thousand, or 35.7%, and service charges on deposit accounts increasing by $24 thousand, or 5.6%.

Other expenses increased by $423 thousand, or 6.8%, for the three-month period ended September 30, 2024, compared to the same prior year period. Increases in salaries and benefits, software expenses, and debit card processing expenses all contributed to the increase in other expenses for the three-month period ended September 30, 2024, compared with the same prior year period.

Balance Sheet and Asset Quality Overview

Total assets were $1.12 billion as of September 30, 2024 and $1.10 billion as of June 30, 2024. From June 30, 2024 to September 30, 2024, total loans increased by $7.4 million, or an annualized 3.9%, and total deposits increased by $25.9 million, or an annualized 10.7%.

Total available-for-sale securities increased by $8.0 million to $272.8 million as of September 30, 2024, from $264.8 million as of June 30, 2024. The increase in the available-for-sale securities portfolio from June 30, 2024 to September 30, 2024, was from a $1.8 million net reduction in the portfolio from maturities and principal paydowns that were not reinvested into the portfolio and due to a $9.8 million improvement in the net unrealized mark to market loss. Total shareholders’ equity increased to $73.3 million as of September 30, 2024, from $63.7 million as of June 30, 2024, because of a reduction of $7.8 million in the accumulated other comprehensive loss from the mark-to-market of available-for-sale securities and from net income of $2.2 million for the first quarter of fiscal year 2025 which was partially offset by cash dividends paid of $594 thousand. The total accumulated other comprehensive loss was $20.6 million as of September 30, 2024. Available-for-sale securities and shareholders’ equity were impacted by rapidly rising interest rates during 2022 and 2023 causing the accumulated other comprehensive loss to increase as available-for-sale securities are marked to fair market value. As market interest rates rise, the fair value of fixed-rate securities decline with a corresponding net of tax decline recorded in the accumulated other comprehensive loss portion of equity. This unrealized loss in securities is adjusted monthly for additional market interest rate fluctuations, principal paydowns, calls, and maturities. Consumers has significant sources of liquidity and therefore does not expect to have to sell securities to fund growth and the unrealized losses are not credit related. Therefore, the losses have not and are not expected to be recorded through earnings as the securities values will recover as the securities approach maturity and mature.

Non-performing loans were $919 thousand as of September 30, 2024, of which $359 thousand is guaranteed by the Small Business Administration. Excluding the guaranteed portion, non-performing loans were $552 thousand, or 0.07% of total loans, as of September 30, 2024, and $502 thousand as of June 30, 2024. The allowance for credit losses (ACL) as a percent of total loans was 1.04% as of September 30, 2024 and June 30, 2024.

Consumers provides a complete range of banking and other investment services to businesses and clients through its twenty-one full-service locations and one loan production office in Carroll, Columbiana, Jefferson, Mahoning, Stark, and Summit counties in Ohio. Its market includes these counties as well as the sixteen contiguous counties in northeast Ohio, western Pennsylvania, and northern West Virginia. Information about Consumers National Bank can be accessed on the internet at https://www.consumers.bank.

Forward-Looking Information

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (“PSLRA”). The words “may,” “continue,” “estimate,” “intend,” “plan,” “seek,” “will,” “believe,” “project,” “expect,” “anticipate” and similar expressions are intended to identify forward-looking statements. These forward-looking statements cover, among other things, anticipated future revenue and expenses and future plans, objectives and strategies of Consumers. These statements are subject to inherent risks and uncertainties that could cause actual results to differ materially from those anticipated at the date of this press release. Risks and uncertainties that could adversely affect Consumers include, but are not limited to, the following: regional and national economic conditions becoming less favorable than expected, resulting in, among other things, high unemployment rates; rapid fluctuations in market interest rates could result in changes in fair market valuations and net interest income, pricing and liquidity pressures may result; a deterioration in credit quality of assets and the underlying value of collateral could prove to be less valuable than otherwise assumed or debtors being unable to meet their obligations; material unforeseen changes in the financial condition or results of Consumers National Bank’s (Consumers’ wholly-owned bank subsidiary) customers; legal proceedings, including those that may be instituted against Consumers, its board of directors, its executive officers and others; competitive pressures on product pricing and services; the economic impact from the oil and gas activity in the region could be less than expected or the timeline for development could be longer than anticipated; and the nature, extent, and timing of government and regulatory actions. While the list of factors presented here are considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. The forward-looking statements included in this press release speak only as of the date made and Consumers does not undertake a duty to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law.

Contact: Ralph J. Lober, President and Chief Executive Officer 1-330-868-7701 extension 1135.

Consumers Bancorp, Inc.

Consolidated Financial Highlights

|

(Dollars in thousands, except per share data)

|

|

Three Months Ended

|

|

|

Consolidated Statements of Income

|

|

September 30,

2024

|

|

|

June 30,

2024

|

|

|

September 30,

2023

|

|

|

Total interest income

|

|

$ |

13,154 |

|

|

$ |

12,889 |

|

|

$ |

11,735 |

|

|

Total interest expense

|

|

|

5,111 |

|

|

|

4,841 |

|

|

|

3,581 |

|

|

Net interest income

|

|

|

8,043 |

|

|

|

8,048 |

|

|

|

8,154 |

|

|

Provision for loan losses

|

|

|

32 |

|

|

|

137 |

|

|

|

119 |

|

|

Other income

|

|

|

1,393 |

|

|

|

1,278 |

|

|

|

1,157 |

|

|

Other expenses

|

|

|

6,688 |

|

|

|

6,628 |

|

|

|

6,265 |

|

|

Income before income taxes

|

|

|

2,716 |

|

|

|

2,561 |

|

|

|

2,927 |

|

|

Income tax expense

|

|

|

480 |

|

|

|

458 |

|

|

|

517 |

|

|

Net income

|

|

$ |

2,236 |

|

|

$ |

2,103 |

|

|

$ |

2,410 |

|

|

Basic and diluted earnings per share

|

|

$ |

0.72 |

|

|

$ |

0.67 |

|

|

$ |

0.78 |

|

|

Consolidated Statements of Financial Condition

|

|

September 30,

2024

|

|

|

June 30,

2024

|

|

|

September 30,

2023

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

26,925 |

|

|

$ |

17,723 |

|

|

$ |

19,643 |

|

|

Certificates of deposit in other financial institutions

|

|

|

— |

|

|

|

— |

|

|

|

2,493 |

|

|

Securities, available-for-sale

|

|

|

272,757 |

|

|

|

264,802 |

|

|

|

261,030 |

|

|

Securities, held-to-maturity

|

|

|

5,948 |

|

|

|

6,054 |

|

|

|

6,866 |

|

|

Equity securities, at fair value

|

|

|

381 |

|

|

|

381 |

|

|

|

386 |

|

|

Federal bank and other restricted stocks, at cost

|

|

|

2,072 |

|

|

|

2,186 |

|

|

|

1,982 |

|

|

Loans held for sale

|

|

|

2,240 |

|

|

|

908 |

|

|

|

— |

|

|

Total loans

|

|

|

766,473 |

|

|

|

759,114 |

|

|

|

717,921 |

|

|

Less: allowance for credit losses

|

|

|

7,948 |

|

|

|

7,930 |

|

|

|

7,782 |

|

|

Net loans

|

|

|

758,525 |

|

|

|

751,184 |

|

|

|

710,139 |

|

|

Other assets

|

|

|

55,005 |

|

|

|

53,851 |

|

|

|

54,977 |

|

|

Total assets

|

|

$ |

1,123,853 |

|

|

$ |

1,097,089 |

|

|

$ |

1,057,516 |

|

|

Liabilities and Shareholders’ Equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits

|

|

$ |

998,892 |

|

|

$ |

972,980 |

|

|

$ |

961,374 |

|

|

Other interest-bearing liabilities

|

|

|

35,188 |

|

|

|

30,007 |

|

|

|

30,091 |

|

|

Other liabilities

|

|

|

16,472 |

|

|

|

30,417 |

|

|

|

16,496 |

|

|

Total liabilities

|

|

|

1,050,552 |

|

|

|

1,033,404 |

|

|

|

1,007,961 |

|

|

Shareholders’ equity

|

|

|

73,301 |

|

|

|

63,685 |

|

|

|

49,555 |

|

|

Total liabilities and shareholders’ equity

|

|

$ |

1,123,853 |

|

|

$ |

1,097,089 |

|

|

$ |

1,057,516 |

|

| |

|

At or For the Three Months Ended

|

|

|

Performance Ratios:

|

|

September 30,

2024

|

|

|

June 30,

2024

|

|

|

September 30,

2023

|

|

|

Return on Average Assets (Annualized)

|

|

|

0.80 |

% |

|

|

0.78 |

% |

|

|

0.90 |

% |

|

Return on Average Equity (Annualized)

|

|

|

13.08 |

|

|

|

13.87 |

|

|

|

17.31 |

|

|

Average Equity to Average Assets

|

|

|

6.13 |

|

|

|

5.60 |

|

|

|

5.21 |

|

|

Net Interest Margin (Fully Tax Equivalent)

|

|

|

2.92 |

|

|

|

2.99 |

|

|

|

3.09 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Market Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Book Value to Common Share

|

|

$ |

23.44 |

|

|

$ |

20.39 |

|

|

$ |

15.94 |

|

|

Dividends Paid per Common Share (QTD)

|

|

$ |

0.19 |

|

|

$ |

0.18 |

|

|

$ |

0.18 |

|

|

Period End Common Shares

|

|

|

3,127,770 |

|

|

|

3,123,588 |

|

|

|

3,108,405 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Asset Quality:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Charge-offs to Total Loans (Annualized)

|

|

|

0.03 |

% |

|

|

0.08 |

% |

|

|

0.02 |

% |

|

Non-performing Assets to Total Assets

|

|

|

0.12 |

|

|

|

0.08 |

|

|

|

0.04 |

|

|

ACL to Total Loans

|

|

|

1.04 |

|

|

|

1.04 |

|

|

|

1.08 |

|

v3.24.3

Document And Entity Information

|

Oct. 21, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

CONSUMERS BANCORP, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 21, 2024

|

| Entity, Incorporation, State or Country Code |

OH

|

| Entity, File Number |

033-79130

|

| Entity, Tax Identification Number |

34-1771400

|

| Entity, Address, Address Line One |

614 East Lincoln Way

|

| Entity, Address, Address Line Two |

P.O. Box 256

|

| Entity, Address, City or Town |

Minerva

|

| Entity, Address, State or Province |

OH

|

| Entity, Address, Postal Zip Code |

44657

|

| City Area Code |

330

|

| Local Phone Number |

868-7701

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001006830

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

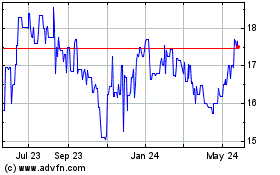

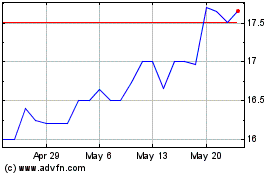

Consumers Bancorp (QX) (USOTC:CBKM)

Historical Stock Chart

From Nov 2024 to Dec 2024

Consumers Bancorp (QX) (USOTC:CBKM)

Historical Stock Chart

From Dec 2023 to Dec 2024