LONDON MARKETS: Pound Tumbles As British Factory Output Hits Seven-year Low Ahead Of Brexit Showdown

September 02 2019 - 6:45AM

Dow Jones News

By Callum Keown

The pound tumbled following dismal British manufacturing data on

Monday ahead of a crunch week for Brexit in Parliament.

The internationally-exposed FTSE 100 climbed 1.2% as the pound

continued its downward spiral on no-deal Brexit fears and weak

factory activity.

Domestic stocks were helped by Europe-wide positivity over

U.S.-China trade tensions

(http://www.marketwatch.com/story/european-stocks-nudge-higher-despite-fresh-us-china-tariffs-coming-into-force-2019-09-02),

with the FTSE 250 edging up 0.4%.

U.S. markets are closed on Monday for the Labor Day holiday.

What's moving the markets?

Sterling continued its descent on Monday, sinking 0.5% to

$1.2095 ahead of an important week of Brexit debate in

Parliament.

MPs opposing British Prime Minister Boris Johnson will bring

forward legislation blocking a no-deal Brexit later this week.

Conservative MPs voting against the government could be

deselected and thrown out of the party

(http://www.marketwatch.com/story/boris-johnson-takes-aim-against-opponents-of-brexit-plans-2019-09-02),

according to reports, ramping up the chances of the U.K. leaving

the European Union without a withdrawal agreement in place.

British factory activity hit a seven-year low in August, also

contributing to the pound's fall.

The IHS Markit/CIPS U.K. Manufacturing Purchasing Managers'

Index (PMI) dropped to 47.4 from 48 in July and business optimism

fell to a record low.

The survey cited economic and political uncertainty, which hit

domestic and export orders.

Neil Wilson, an analyst at Markets.com, said: "The manufacturing

PMI data is simply shocking.

"It's wrong to pin this all on Brexit--as the report authors

make clear, the global economic slowdown is the primary cause of

the decline, albeit there was some impact from supply-chain

reshoring as businesses seek to mitigate the impact of a no-deal

Brexit."

Which stocks are active?

AstraZeneca (AZN.LN) shares jumped 3.1% to all-time highs as the

pharmaceutical company said Farxig, its type-2 diabetes drug,

reduced the chances of cardiovascular death or worsening heart

failure by 26% in a recent trial. Its cardiovascular drug Brilinta

also reduced the risk of death and heart attack by 10%.

Gold miner Centamin climbed 1.1% as the company continued its

reshuffle, adding two new executive directors to the board. The

FTSE 250 company expects a stronger second half of the year from

its Sukari gold mine in Egypt.

(END) Dow Jones Newswires

September 02, 2019 07:30 ET (11:30 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

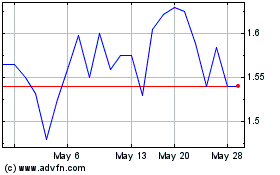

Centamin (PK) (USOTC:CELTF)

Historical Stock Chart

From Nov 2024 to Dec 2024

Centamin (PK) (USOTC:CELTF)

Historical Stock Chart

From Dec 2023 to Dec 2024