By Anna Hirtenstein

French retailer Carrefour SA recently began its first share

buyback in a decade, spurred by strong cash flow and a belief that

the economic recovery is under way. And it isn't alone.

This year has seen a slew of companies in Europe putting forward

share repurchase programs, including luxury house LVMH Moët

Hennessy Louis Vuitton SE, personal care company L'Oréal SA and oil

major Eni SpA. Around 56 firms have released plans to buy their own

shares so far in 2021, the most for the comparable period in three

years, according to an analysis by Société Générale SA.

The trend signals growing confidence among corporate leaders and

marks a pivot in strategy in a region that has traditionally

favored dividends. The pandemic may have accelerated the shift

toward rewarding shareholders through buybacks, at least

temporarily, according to analysts at the French bank.

As lockdowns and social distancing hit earnings, many companies

cut or canceled dividend policies last year. For some industries,

such as banking, regulators required it. European firms issued

close to EUR1 trillion of debt last year, equivalent to $1.2

trillion, data from Dealogic showed, building up cash cushions to

weather the storm. Now that the recovery appears to have some

momentum, many are unwinding these emergency measures and preparing

payouts to shareholders.

"In 2020, a lot of companies were forced to cut dividends, which

is very painful," said Roland Kaloyan, head of European equity

strategy at Société Générale. "Buybacks, it's a way to return cash

to your shareholders, if you don't want to commit too much and too

soon to higher dividends in the coming quarters."

Many European companies have reported a growth rebound, with the

most positive earnings surprises in the first quarter since at

least 2008, according to an analysis from Goldman Sachs Group.

Firms upwardly revised their guidance for 2021 earnings per share

by an average of 10.6% so far this year, the most since at least

2013, the bank said.

Some analysts were already expecting the region's equity market

to outperform U.S. stocks this year, because European stocks

haven't recovered as strongly yet and are largely beginning from

lower valuations. A wave of buybacks could boost that effect,

analysts said.

Investors are cautioning companies to take it easy and not rush

into dividend policies, which are generally expected to be a

long-term commitment.

"It's prudent to do buybacks now rather than ramping up

dividends because you have extra cash at the moment," said Chi

Chan, a European equities portfolio manager at Federated Hermes.

"We don't know how the world is going to shake out

post-pandemic."

Share buybacks are common in the U.S. and often seen as a driver

of equity market performance. That is because earnings per share

increase as a company reduces the number of shares outstanding. The

S&P 500 rose 237% in the decade through to 2020, compared with

a 57% rise for the Stoxx Europe 600.

"In the U.S. in recent years, equity supply has been shrinking.

There have been more share buybacks; the corporate sector has been

a big buyer, " said Sharon Bell, a managing director with a focus

on European equity strategy at Goldman Sachs. "This can be a very

important influence on market prices for sure."

She added, "In Europe, given all these announcements, I would

expect some equity market shrinkage this year."

Buybacks are also surging in the U.S., with companies such as

JPMorgan Chase & Co., Apple Inc., Netflix Inc. and Lockheed

Martin Corp. announcing share repurchase plans in their

first-quarter results. Goldman Sachs is forecasting a 35% rise in

buybacks this year by S&P 500 companies and another 5% in

2022.

Société Générale is projecting European companies will spend

around EUR150 billion on share repurchases next year. That would be

a 25% increase from the average annual spend in the five years

before the pandemic. The buyback yield, a gauge of payouts to

shareholders, is expected to rise to the highest level in over a

decade. The following year the bank expects to see EUR190 billion

spent, propelling the yield to its highest since 2008.

A substantial rise in share repurchases could attract more

foreign investors to Europe, Mr. Kaloyan said. Net capital flows

into funds that invest in European equities rose to $112.2 billion

in March, the first inflow after six consecutive months of

outflows, according to data from Morningstar.

Shaunak Mazumder, a global equities portfolio manager at Legal

& General Investment Management, has recently increased his

allocation to European stocks.

"There is definitely a signaling effect you get from buybacks,

because you know that there's going to be an active buyer of the

stock," Mr. Mazumder said.

To be sure, this shift to buybacks may not be a long-term change

for European companies, due to the prevalence of income-focused

investors in the region such as insurers and pension funds.

Persistently low bond yields also mean that demand for steady

dividend payouts remains high.

Europe is likely to see more buybacks over the next few years,

"but I don't think this means that companies will suddenly renege

on dividends, " said Goldman's Ms. Bell. "This will be in

addition."

Write to Anna Hirtenstein at anna.hirtenstein@wsj.com

(END) Dow Jones Newswires

May 19, 2021 05:44 ET (09:44 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

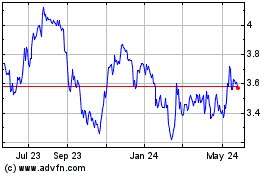

Carrefour (PK) (USOTC:CRRFY)

Historical Stock Chart

From Nov 2024 to Dec 2024

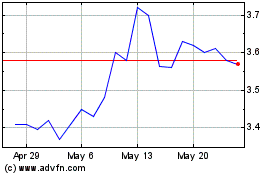

Carrefour (PK) (USOTC:CRRFY)

Historical Stock Chart

From Dec 2023 to Dec 2024