European Uranium Options Deli Jovan North Gold-Copper Property, Serbia

June 02 2014 - 6:00AM

Business Wire

European Uranium Resources Ltd. (the "Company") (TSXV: EUU) has

signed a binding letter of intent for an exploration agreement with

option to purchase (the “Transaction”) on the Deli Jovan North

gold-copper exploration property in Serbia with Appalachian

Resources Balkan doo (“ARB”), a private Serbian company.

Dorian (Dusty) Nicol, President and CEO of the Company said,

“The Deli Jovan North will be our first acquisition after arranging

the sale of the Company’s Slovak uranium assets. Deli Jovan North

is an exciting new play in a well-known, highly prospective region.

There is clearly potential for a porphyry copper-gold deposit on

the property. Based on geologic setting and mineralization styles

on nearby properties, there may also be potential for high

sulphidation epithermal and sediment hosted gold

mineralization.”

The Deli Jovan North Project

Deli Jovan North (the “Project”) has an area of 100 square

kilometres within the Bor Mining Region in central eastern Serbia.

It is located within 20 kilometres of three large (+ 800 million

tonne) porphyry copper-gold deposits (two currently in production,

one with associated smelter) and 25 kilometres from a new

copper-gold discovery by a joint venture between Freeport-McMoRan

Exploration Corp. (FMEC) and Reservoir Minerals, Inc.

(TSX-V:RMC). The attached map shows the location of the Project

relative to significant adjacent properties.

To view the map, please click onto the following link:

http://www.usetdas.com/maps/europeanuranium/DeliJovanMay2014.pdf

Historic sampling on the Project has found high grade copper and

gold mineralization (up to about 15% Cu and over 25 gpt Au).

Mineralization identified to date has hallmarks of porphyry-style

mineralization including potassic alteration, intrusive breccia,

and locally development of skarn. Based on the geologic setting and

on styles of mineralization on nearby properties, there is also the

potential for high sulphidation epithermal and sediment hosted gold

mineralization at Deli Jovan North. Several previously undocumented

mines are present in the area where semi-massive sulfide

mineralization was mined in the early 1950’s. Three holes were

drilled near historic workings in the early 1990’s, totaling 388

metres. All intersected mineralization, but had poor core recovery

and the program was terminated due to economic conditions

(hyper-inflation) at the time.

The Transaction

The Transaction is considered a fundamental acquisition by the

Company and is subject to the approval of the TSX Venture Exchange

(the “Exchange”). It is arms length and there is no finder’s fee.

ARB will act as operator, under the Company’s direction, during the

option phase of the agreement. The binding letter of intent will be

superseded by a definitive agreement by June 30, 2014 (the

“Agreement”). Pursuant to the Agreement the Company will have up to

three years to evaluate the Deli Jovan North project by paying a

total of US$260,000 in option payments and by funding US$3 million

in work commitments. The first year’s option payment of US$60,000

will be due by June 30, 2014, and the first year’s work commitments

of US$500,000 will be an obligation. On completion of the payment

of the option payments and work commitments, the Company may

exercise its option to purchase 100% of the Project for purchase

consideration of US$5 million in a combination of cash, or at the

Company’s election, in cash or shares on the following

schedule:

- US$1 million: this consisting of

US$500,000 cash + US$500,000 in cash or shares at EUU’s election on

exercising the option to purchase and;

- US $1.25 million: this consisting of -

US $250,000 cash + US $1.0 million in cash or shares at EUU’s

election on completion of a positive 43-101 Preliminary Economic

Assessment (Scoping Study) not later than 48 months from effective

date and;

- US $1.25 million: this consisting of -

US $250,000 cash + US $1.0 million in cash or shares at EUU’s

election on granting of a Mining License. If Mining License is not

granted within 66 months from effective date, then US $250,000 cash

and balance when Mining License is granted and;

- US $1.5 million - US $500,000 cash + US

$1.0 million in cash or shares at EUU’s election on completion of a

Bankable Feasibility Study.

The Company can elect to exercise purchase option early by

paying cumulative (but unpaid) Years 1 - 3 option payments in

addition to the purchase consideration. ARB will retain a 2% net

smelter return production royalty on the Project.

To support the application for approval with the Exchange, the

Company has commissioned work to begin on an independently prepared

Technical Report on the project (43-101 compliant), expected to be

completed by June 30. It is expected that this report will

recommend continuation of geologic mapping and geochemical sampling

with the expectation of drill targets being identified before the

end of 2014.

The Forte Energy NL Proposed Transaction

On May 9, 2014, the Company entered into a Share Purchase

Agreement (“SPA”) with Forte Energy NL that superseded a heads of

agreement (“HOA”) entered into on April 4, 2014. The SPA contains

the principal terms for the Proposed Transaction (being the

proposed sale of the Company's wholly-owned Slovakian subsidiaries,

Ludovika Energy and Ludovika Mining (the “Ludovika Entities”), to

Forte). The Ludovika Entities are the holders of the mineral

licenses located in the Slovak Republic which comprise the

Company's only remaining mineral properties, the Kuriskova and

Novaveska Huta (the “Licenses”) uranium projects in Slovakia. The

Proposed Transaction will result in the Company disposing of

substantially all of its assets.

The EUU Board has determined that the Proposed Transaction is in

the best interests of the Company and has recommended that the

Company’s shareholders vote for the special resolution at the June

13, 2014, annual general and special meeting. Should EUU

shareholders or Forte shareholders fail to approve the special

resolution by the requisite majority the Proposed Transaction will

not be implemented. Management’s Information Circular for the

meeting is on the Company’s web site, www.euresources.com, and on

the Company’s profile on www.sedar.com.

If approved, on closing of the Proposed Transaction, the Company

will have its initial funding to implement its business plan

including the funding of the Deli Jovan North project.

Qualified Person

The Company’s President and Chief Executive Officer, Dorian L.

(Dusty) Nicol, B.Sc. Geo, MA Geo, a Qualified Person as defined by

NI 43-101, has reviewed and approved the exploration information

disclosures contained in this Press Release.

EUROPEAN URANIUM RESOURCES LTD.

"Dusty Nicol"

Dorian L. (Dusty) Nicol, President and CEO

For further information please contact: Dorian (Dusty) Nicol,

at (604) 536-2711, or visit www.euresources.com.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Cautionary Statement:

This news release contains forward-looking statements that are

based on the Corporation's current expectations and estimates.

Forward-looking statements are frequently characterized by words

such as "plan", "expect", "project", "intend", "believe",

"anticipate", "estimate", "suggest", "indicate" and other similar

words or statements that certain events or conditions "may" or

"will" occur. Such forward-looking statements involve known and

unknown risks, uncertainties and other factors that could cause

actual events or results to differ materially from estimated or

anticipated events or results implied or expressed in such

forward-looking statements. Such factors include, among others: the

actual results of current exploration activities; conclusions of

economic evaluations; changes in project parameters as plans to

continue to be refined; possible variations in ore grade or

recovery rates; accidents, labour disputes and other risks of the

mining industry; delays in obtaining governmental approvals or

financing; and fluctuations in metal prices. There may be other

factors that cause actions, events or results not to be as

anticipated, estimated or intended. Any forward-looking statement

speaks only as of the date on which it is made and, except as may

be required by applicable securities laws, the Corporation

disclaims any intent or obligation to update any forward-looking

statement, whether as a result of new information, future events or

results or otherwise. Forward-looking statements are not guarantees

of future performance and accordingly undue reliance should not be

put on such statements due to the inherent uncertainty therein.

European Uranium Resources Ltd.Dorian (Dusty) Nicol,

604-536-2711President and CEO

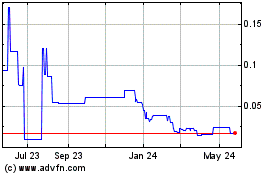

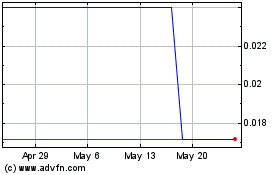

Azarga Metals (PK) (USOTC:EUUNF)

Historical Stock Chart

From Nov 2024 to Dec 2024

Azarga Metals (PK) (USOTC:EUUNF)

Historical Stock Chart

From Dec 2023 to Dec 2024