UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE

13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission File Number: 001-31819

Gold Reserve Inc.

(Translation of registrant’s name into English)

999 W. Riverside Avenue, Suite 401

Spokane, Washington 99201

(Address of principal executive office)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F ¨

Form 40-F x

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

On May 28, 2024 Gold Reserve Inc.

(the “Company”) issued a press release, a copy of which is furnished as Exhibit 99.1 to this Report on Form 6-K.

This Report on Form 6-K

and the exhibit attached hereto are hereby incorporated by reference into the Company’s effective registration statements (including

any prospectuses forming a part of such registration statements) on file with the U.S. Securities and Exchange Commission (the “SEC”)

and are to be a part thereof from the date on which this report is filed, to the extent not superseded by documents or reports subsequently

filed or furnished.

Cautionary Note Regarding Forward-Looking Statements

The information presented

or incorporated by reference in this report, other than statements of historical fact, are, or could be, “forward-looking statements”

(within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934,

as amended) or “forward-looking information” (within the meaning of applicable Canadian provincial and territorial securities

laws) (collectively referred to herein as “forward-looking statements”) that state the Company’s and its management’s

intentions, hopes, beliefs, expectations or predictions for the future.

Forward-looking statements

are necessarily based upon a number of estimates, expectations, and assumptions that, while considered reasonable by the Company and its

management at this time, are inherently subject to significant business, economic and competitive uncertainties and contingencies. The

Company cautions that such forward-looking statements involve known and unknown risks, uncertainties and other risks that may cause the

actual outcomes, financial results, performance or achievements to be materially different from those expressed or implied therein, many

of which are outside its control. Forward-looking statements speak only as of the date made, and any such forward-looking statements are

not intended to provide any assurances as to future results. The Company believes its estimates, expectations and assumptions are reasonable,

but there can be no assurance those reflected herein will be achieved. Accordingly, readers are cautioned not to place undue reliance

on forward-looking statements.

Forward-looking statements

involve risks and uncertainties, as well as assumptions, including those set out herein, that may never materialize, prove incorrect or

materialize other than as currently contemplated which could cause our results to differ materially from those expressed or implied by

such forward-looking statements. The words “believe,” “anticipate,” “expect,” “intend,”

“estimate,” “plan,” “may,” “could” and other similar expressions that are predictions

of or indicate future events and future trends, which do not relate to historical matters, identify forward-looking statements, although

not all forward-looking statements contain these words. Any such forward-looking statements are not intended to provide any assurances

as to future results.

Numerous factors could cause actual

results to differ materially from those described in the forward-looking statements, any of which could adversely affect the Company,

including, without limitation:

| · | risks associated with recovering funds (including related costs associated

therewith) under the Company’s settlement agreement (the “Settlement Agreement”) with the government of the Bolivarian

Republic of Venezuela (“Venezuela”) or its various proceedings against the government of Venezuela, including (a) the potential

ability of the Company to obtain funds as a result of the writ of attachment fieri facias granted by the U.S. District Court for the District

of Delaware with respect to shares of PDV Holdings, Inc. (“PDVH”), which was served on PDVH by the U.S. Marshal on April 5,

2024, and whereby the Company may potentially enforce its September 2014 arbitral award (the “Award”) and corresponding November

2015 U.S. judgment by obtaining proceeds from the potential sale of PDVH shares, and the potential ability of the Company to obtain the

funds that the Lisbon District Court attached in Portugal on the Company’s requests, and (b) the Company’s ability to repatriate

any funds obtained in the Lisbon proceedings, or any funds owed to the Company under the settlement arrangements that may become available; |

| · | risks associated with sanctions imposed by the U.S. and Canadian governments,

including without limitation those targeting Venezuela; |

| · | risks associated with whether the Company is able to obtain (or get results

from) relief from such sanctions, including whether and to what extent the U.S. Office of Foreign Asset Control grants licenses with respect

to any court-ordered sale of PDVH shares, including timing and terms of such licenses; |

| · | Venezuela’s breach of the Company’s Settlement Agreement with

it, with respect to its obligations to the Company in connection with the joint venture entity Empresa Mixta Ecosocialista Siembra Minera,

S.A. (“Siembra Minera”); |

| · | risks associated with the timing and ability to contest, reverse or otherwise

alter the resolution of the Venezuela Ministry of Mines to revoke the mining rights held by Siembra Minera for alleged non-compliance

with certain Venezuelan mining regulations (the “Resolution”), with various Venezuelan authorities; |

| · | risks associated with Venezuela’s ongoing failure to honor its commitments

associated with the formation, financing and operation of Siembra Minera and the inability of the Company and Venezuela to overcome certain

obstacles associated with the Siembra Minera project; |

| · | risks associated with the breach by Venezuela of one or more of the terms

of the underlying agreements governing the formation of Siembra Minera and the future development of the Siembra Minera project by Venezuela; |

| · | risks associated with changes in law in Venezuela, including the recent

enactment of the Law for Protection of the Assets, Rights, and Interests of the Bolivarian Republic of Venezuela and its Entities Abroad,

which negatively impacts the ability of the Company to carry on activities in Venezuela, including safety and security of personnel, the

repatriation of funds and other factors identified herein; |

| · | risks associated with the fact that the Company has no revenue producing

operations at this time and its future working capital position is dependent upon the collection of amounts due pursuant to the Settlement

Agreement and/or Award or the Company’s ability to raise additional funds from the capital markets or other external sources; |

| · | risks associated with activist campaigns, including potential costs and

distraction of management and the directors’ time and attention related thereto that would otherwise be spent on other matters including

contesting the Resolution; |

| · | risks associated with potential tax, accounting or financial impacts, including

any potential income tax liabilities in addition to those currently recorded, that may result from the current (or any future) audits

of our tax filings by U.S. and Canadian tax authorities; and |

| · | risks associated with any cybersecurity or data privacy incidents affecting

the Company or its third-party service providers. |

This list is not exhaustive of

the factors that may affect any of the Company’s forward-looking statements.

Investors are cautioned

not to put undue reliance on forward-looking statements, and investors should not infer that there has been no change in our affairs since

the date of this report that would warrant any modification of any forward-looking statement made in this document, other documents periodically

filed with the U.S. Securities and Exchange Commission (the “SEC”), the Ontario Securities Commission or other securities

regulators or presented on the Company's website. Forward-looking statements speak only as of the date made. Investors are urged to read

the Company's filings with U.S. and Canadian securities regulatory agencies, which can be viewed online at www.sec.gov and www.sedarplus.ca,

respectively.

These risks and uncertainties,

and additional risk factors that could cause results to differ materially from forward-looking statements, are more fully described in

the Company’s latest Annual Report on Form 40-F, including, but limited to, the section entitled “Risk Factors” therein,

and in the Company’s other filings with the SEC and Canadian securities regulatory agencies, which can be viewed online at www.sec.gov

and www.sedarplus.ca, respectively. Consider these factors carefully in evaluating the forward-looking statements. All subsequent

written and oral forward-looking statements attributable to the Company, the Company’s management, or other persons acting on the

Company’s behalf are expressly qualified in their entirety by this notice. The Company disclaims any intent or obligation to update

publicly or otherwise revise any forward-looking statements or the foregoing list of assumptions or factors, whether, as a result of new

information, future events or otherwise, subject to its disclosure obligations under applicable rules and regulations promulgated by the

SEC and applicable Canadian provincial and territorial securities laws. Any forward-looking information contained herein is presented

for the purpose of assisting investors in understanding the Company’s expected financial and operational performance and results

as at and for the periods ended on the dates presented in the Company’s plans and objectives and may not be appropriate for other

purposes.

EXHIBIT INDEX

| Exhibit No. |

Description |

|

99.1

|

Press release issued by Gold Reserve Inc. on May 28, 2024* |

| * Furnished herewith |

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: May 30, 2024

GOLD RESERVE INC. (Registrant)

By: /s/ David P. Onzay

David P. Onzay, its Chief Financial Officer

and its Principal Financial and Accounting Officer

Exhibit 99.1

| May 28, 2024 |

TSX.V: GRZ

NR-24-06 |

GOLD RESERVE ANNOUNCES PRIVATE PLACEMENT

INCLUDING FOR PURPOSES OF FUNDING A POTENTIAL TRANSACTION IN RELATION TO THE SALE OF THE SHARES OF PDV HOLDINGS, INC., UNDER THE DELAWARE

PROCEEDINGS

SPOKANE, Washington – May 28, 2024

– Gold Reserve Inc. (TSX.V: GRZ) (OTCQX: GDRZF) (“Gold Reserve” or the “Company”) announced

today that it has entered into an agreement with a lead agent and bookrunner (the “Agent”) to undertake a best efforts

private placement of Class A common shares of the Company (the "Common Shares") for anticipated gross proceeds of up

to US$10 million at a price per Common Share of US$3.50 (the “Share Offering”). The Share Offering is expected to be

completed on a best efforts basis pursuant to a formal agency agreement to be entered into between the Company and the Agent, as lead

agent and bookrunner.

The number of Common Shares to be sold will

be determined in the context of the market in conjunction with the marketing efforts and there can be no assurance as to completion of

the Share Offering. The closing of the Share Offering is expected to occur on or about June 7, 2024 (the “Offering Closing Date”)

and is subject to the completion of formal documentation and receipt of regulatory approvals, including the approval of the TSX Venture

Exchange.

The Company has granted the Agent an over-allotment

option exercisable, in whole or in part, in the sole discretion of the Agent, to arrange for the purchase of up to an additional 50% of

the number of Common Shares sold in the Share Offering at any time up to two days prior to the Offering Closing Date, on the same terms

and conditions as the Share Offering. If exercised in full, the Company would raise up to US$15 million in gross proceeds from the issuance

of Common Shares.

The Common Shares will be offered on a private

placement basis pursuant to applicable exemptions in each of the provinces of Canada under National Instrument 45-106 – Prospectus

Exemptions and in the United States on a private placement basis pursuant to applicable exemptions from the registration requirements

of the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) and applicable state securities

laws, and in such other jurisdictions as may be permitted. The Common Shares issuable to Canadian subscribers in connection with the Share

Offering will be subject to a statutory hold period in Canada which will run for four months from the Offering Closing Date of the Share

Offering. Any Common Shares sold to investors outside of Canada will be sold pursuant to OSC Rule 72-503.

The net proceeds of the Share Offering are

expected to be used to assist in funding certain expenses in connection with the Company evaluating and considering a potential transaction

(the “Potential Transaction”) in relation to the sale of the common shares of PDV Holdings, Inc. (“PDVH”),

the indirect parent company of CITGO Petroleum Corp (the “Sale Process”). In

connection with the Potential Transaction,

ancillary non-equity funding beyond the Share Offering will be required, which the Company is separately pursuing. There can be no assurance

that the Potential Transaction will be consummated and in such case, the net proceeds of the Share Offering may also be used for working

capital and general corporate purposes.

The securities referred

to in this news release have not been and will not be registered under the U.S. Securities Act, or the securities laws of any state of

the United States and may not be offered or sold within the United States or to, or for the account or benefit of, "U.S. persons"

(as defined in Regulation S under the U.S. Securities Act) unless registered under the U.S. Securities Act and applicable state securities

laws or pursuant to an exemption from such registration requirements. This news release does not constitute an offer to sell or a solicitation

of an offer to buy nor shall there be any sale of any of the securities in any jurisdiction in which such offer, solicitation or sale

would be unlawful.

On Behalf of the Board of Directors

Paul Rivett

Executive Vice-Chairman

Gold Reserve Inc. Contact

Jean Charles

Potvin

999 W. Riverside

Ave., Suite 401 Spokane, WA 99201 USA

Tel: (509) 623-1500

Fax: (509) 623-1634

Cautionary Statement Regarding Forward-Looking

statements

This release contains “forward-looking

statements” within the meaning of applicable U.S. federal securities laws and “forward-looking information” within the

meaning of applicable Canadian provincial and territorial securities laws and state Gold Reserve’s and its management’s intentions,

hopes, beliefs, expectations or predictions for the future. Forward-looking statements are necessarily based upon a number of estimates

and assumptions that, while considered reasonable by management at this time, are inherently subject to significant business, economic

and competitive uncertainties and contingencies. They are frequently characterized by words such as "anticipates", "plan",

"continue", "expect", "project", "intend", "believe", "anticipate", "estimate",

"may", "will", "potential", "proposed", "positioned" and other similar words, or statements

that certain events or conditions "may" or "will" occur. Forward-looking statements contained in this press release

include, but are not limited to, statements relating to the Share Offering and the Potential Transaction.

We caution that such forward-looking

statements involve known and unknown risks, uncertainties and other risks that may cause the actual events, outcomes or results of Gold

Reserve to be materially different from our estimated outcomes, results, performance, or achievements expressed or implied by those forward-looking

statements, including but not limited to: failure to obtain any necessary regulatory approvals in connection with the Share Offering;

the completion of the Share Offering and the closing thereof; the entering of definitive documentation (including the terms thereof) with

respect to any ancillary funding and the completion thereof; that the

proceeds obtained under the

Share Offering or any ancillary funding will be less than expected; the failure of the Company to negotiate or enter into any agreements

required for the Share Offering or any ancillary funding; the failure

of the Company to negotiate and/or submit a Potential Transaction, including as a result of failing to obtain sufficient equity and/or

debt financing to fund the expenses in connection with any Potential Transaction; that the proceeds of any equity/debt financing are used

for purposes other than expenses associated with the making of any Potential Transaction; that the Potential Transaction may not close

due to the Sale Process not being completed, including as a result of the United States Office of Foreign Asset Control (“OFAC”)

not granting an authorization in connection with any potential sale of PDVH shares and/or whether it changes its decision or guidance

regarding the Sale Process; failure of the Company or any other party to obtain any required shareholders and/or regulatory approvals

(including approvals of the TSX Venture Exchange) for, or satisfy other conditions to effect, any transaction related to the Potential

Transaction; that the Company forfeit any cash amount deposit made due to failing to complete the Potential Transaction or otherwise;

that the making of the Potential Transaction or any transaction resulting therefrom may involve unexpected costs, liabilities or delays;

that, prior to or as a result of the completion of any transaction contemplated by a Potential Transaction, the business of the Company

may experience significant disruptions due to transaction related uncertainty, industry conditions or other factor; the ability to enforce

the writ of attachment granted to the Company; the timing set for various reports and/or other matters with respect to the Sale Process

may not be met; the ability of the Company to otherwise participate in the Sale Process (and related costs associated therewith; the amount,

if any, of proceeds associated with the Sale Process; the competing claims of certain creditors, the “Other Creditors” (as

detailed in the applicable court documents filed with the Delaware Court) of Venezuela and the Company, including any interest on such

creditors’ judgements and any priority afforded thereto; uncertainties with respect to possible settlements between Venezuela and

other creditors and the impact of any such settlements on the amount of funds that may be available under the Sale Process; and the proceeds

from the Sale Process may not be sufficient to satisfy the amounts outstanding under the Company’s September 2014 arbitral award

and/or corresponding November 15, 2015 U.S. judgement in full and the ramifications of bankruptcy with respect to the Sale Process and/or

the Company’s claims, including as a result of the priority of other claims. This list is not exhaustive of the factors that may

affect any of the Company’s forward-looking statements. For a more detailed discussion of the risk factors affecting the Company’s

business, see the Company’s Annual Information Form on Form 40-F and Management’s Discussion & Analysis for the year ended

December 31, 2023 and other reports that have been filed on SEDAR+ and are available under the Company’s profile at www.sedarplus.ca

and which have been filed on EDGAR and are available under the Company’s profile at www.sec.gov/edgar, as well as subsequent filings

on such platforms.

Investors are cautioned not

to put undue reliance on forward-looking statements. All subsequent written and oral forward-looking statements attributable to Gold Reserve

or persons acting on its behalf are expressly qualified in their entirety by this notice. Gold Reserve disclaims any intent or obligation

to update publicly or otherwise revise any forward-looking statements or the foregoing list of assumptions or factors, whether as a result

of new information, future events or otherwise, subject to its disclosure obligations under applicable rules promulgated by the Securities

and Exchange Commission and applicable Canadian provincial and territorial securities laws.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES

PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS

RELEASE.

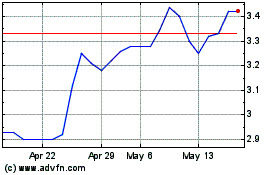

Gold Reserve (QX) (USOTC:GDRZF)

Historical Stock Chart

From Jan 2025 to Feb 2025

Gold Reserve (QX) (USOTC:GDRZF)

Historical Stock Chart

From Feb 2024 to Feb 2025