Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

January 07 2025 - 5:54AM

Edgar (US Regulatory)

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a - 16 or 15d - 16 of

the Securities Exchange Act of 1934

For the

month of January

HSBC Holdings plc

42nd

Floor, 8 Canada Square, London E14 5HQ, England

(Indicate

by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F).

Form

20-F X Form 40-F

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of

Hong Kong Limited take no responsibility for the contents of this

document, make no representation as to its accuracy or completeness

and expressly disclaim any liability whatsoever for any loss

howsoever arising from or in reliance upon the whole or any part of

the contents of this document.

7 January 2025

(Hong Kong Stock Code: 5)

HSBC HOLDINGS PLC

COMPANY INFORMATION SHEET

This information sheet is published pursuant to Rule 19.60 of the

Rules Governing the Listing of Securities on The Stock Exchange of

Hong Kong Limited (the "HK Listing

Rules") and is provided for the

purpose of giving information to the public about HSBC Holdings plc

(the "Company") as at the date of this information sheet. The

information does not purport to be a complete summary about the

Company and/or its securities.

Summary of Novel Waivers

The Company has been granted certain waivers from strict compliance

with the HK Listing Rules and the Code on Share Buy-backs (the

"Buy-backs

Code"). The following are the

novel waivers granted to the Company:

|

Relevant Rule Waived

|

Subject Matter

|

|

Rules

10.06(1) to (5) of the HK Listing Rules

|

Rule

10.06(1) to (5) sets out certain requirements and restrictions on

purchase of an issuer's shares or securities carrying a right to

subscribe or purchase shares by an issuer or its

subsidiaries.

The Intermediaries Exemption Waiver

Pursuant

to this waiver, purchases of the Company's shares made by HSBC

Securities (USA) Inc., HSBC Bank plc, The Hongkong and Shanghai

Banking Corporation Limited and HSBC France (collectively,

"the Relevant

Subsidiaries") in the ordinary course of business of the

respective Relevant Subsidiaries as an intermediary and in relation

to certain activities (such as client facilitation trading and

derivatives hedging) are exempt from compliance with Rules 10.06(1)

to (5).

This

waiver is granted subject to certain conditions, including that the

Company will report the net long positions held by the Relevant

Subsidiaries in the Company's shares (together with the net long

positions in the Company's CCSs pursuant to the CCS Waiver (as set

out below) to The Stock Exchange of Hong Kong Limited (the

"HK Stock Exchange") and the Securities and

Futures Commission when the aggregate of such net long positions at

the end of a trading day exceeds 0.5% of the Company's issued

shares.

This

waiver allows the Relevant Subsidiaries to take advantage of the

exemption under English law which allows subsidiaries to hold

shares in their parent company in their ordinary course of business

as an intermediary.

CCS Waiver

Contingent

convertible securities ("CCSs") are debt securities which may, in

certain prescribed circumstances, convert into ordinary shares of

the Company.

Pursuant

to this waiver, the distribution, acquisition, holding and disposal

of the CCSs by the Relevant Subsidiaries, including their roles as

manager, global co-ordinator, bookrunner, stabilising manager

and/or underwriter of any issuance of CCSs, and any market-making

activity in the secondary market or similar activity intended to

facilitate liquidity in the CCSs, are exempt from compliance with

Rules 10.06(1) to (5).

This

waiver is granted subject to certain conditions, including that the

Company will report the net long positions held by the Relevant

Subsidiaries in the Company's CCSs (together with the net long

positions in the Company's shares held pursuant to the

Intermediaries Exemption Waiver) to the HK Stock Exchange and the

SFC when the aggregate of such net long positions at the end of a

trading day exceeds 0.5% of the Company's issued

shares.

This

waiver allows the Relevant Subsidiaries to support the issuance of

CCSs by the Company in the abovementioned managing, underwriting

and/or market-making roles, which is common for financial

institutions issuing debt securities.

|

|

Rule

10.06(2)(e) of the HK Listing Rules

|

Rule

10.06(2)(e) stipulates that an issuer shall not purchase its shares

on the HK Stock Exchange during certain closed

periods.

Buyback during closed periods

This

waiver is granted in connection with a share buyback

(the

"Buyback")

by the Company in the United Kingdom and Hong Kong which will be

put forward for the shareholders' approval at the Company's annual

general meeting.

Pursuant

to this waiver, the Company is permitted to conduct the Buyback

during the closed periods or when the Company is in possession of

inside information, provided that the relevant broker(s) appointed

by the Company for the Buyback is appointed on irrevocable

non-discretionary basis and the Buyback will be subject to certain

purchase restrictions on the price that the broker must pay for the

shares and the volume and speed which it can make

purchases.

|

|

Rule

10.06(3) of the HK Listing Rules

|

Rule

10.06(3) requires that an issuer should seek the HK Stock

Exchange's approval before issuing new shares or announcing a new

issue of shares within 30 days after the issuer's purchase of its

own shares.

Consent to issue new CCSs

Pursuant

to this consent, the Company is permitted to issue new CCSs, within

30 days after purchase of shares under the buyback

program.

|

|

Rule

13.36(1) of the HK Listing Rules

|

Rule

13.36(1) requires that shareholders' approval shall be obtained

prior to issue of convertible securities.

Authority to issue CCSs

Pursuant

to this waiver, the Company is permitted to seek (and if approved,

to utilise) an authority (the "Mandate") to issue CCSs (and to allow

ordinary shares into which they may be converted or exchanged) in

excess of the limit of the general mandate of 20 per cent of the

Company's issued share capital.

This

waiver has been granted on terms that permit the Mandate, if

approved, to continue in force until: (1) the conclusion of the

first annual general meeting of the Company following the date on

which the Mandate is approved (or an earlier date which the Company

may specify) at which time the Mandate shall lapse unless it is

renewed, either unconditionally or subject to conditions; or (2)

such time as it is revoked or varied by ordinary resolutions of the

shareholders in general meeting.

|

|

Buy-backs

Code

|

The

Share Buy-backs Code sets out certain requirements and restrictions

for an issuer conducting share buyback.

As set

out in the paragraph headed "CCS Waiver" above, the Relevant

Subsidiaries of the Company will deal in the CCSs in the manner and

for the reasons stated above.

Dealings in CCSs

Pursuant

to this waiver, dealings by the Relevant Subsidiaries in the CCSs

are exempt from compliance with the Buy-backs Code.

|

The directors collectively and individually undertake to publish a

revised Company Information Sheet when there are any material

changes to the information disclosed since the last

publication.

The Board of Directors of HSBC Holdings plc as at the date of this

document comprises:

Sir Mark Edward Tucker*, Georges Bahjat Elhedery, Geraldine Joyce

Buckingham†,

Rachel Duan†, Dame Carolyn

Julie Fairbairn†, James

Anthony Forese†,

Ann Frances Godbehere†,

Steven Craig Guggenheimer†,

Manveen (Pam) Kaur, Dr José Antonio Meade

Kuribreña†,

Kalpana Jaisingh Morparia†,

Eileen K Murray†,

Brendan Robert Nelson† and

Swee Lian Teo†.

* Non-executive Group Chairman

† Independent non-executive Director

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

HSBC

Holdings plc

|

|

|

|

|

|

By:

|

|

|

Name:

Aileen Taylor

|

|

|

Title:

Group Company Secretary and Chief Governance Officer

|

|

|

|

|

|

Date:

07 January 2025

|

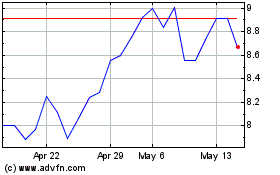

HSBC (PK) (USOTC:HBCYF)

Historical Stock Chart

From Dec 2024 to Jan 2025

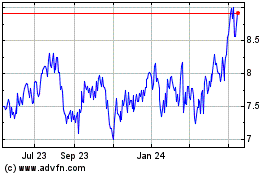

HSBC (PK) (USOTC:HBCYF)

Historical Stock Chart

From Jan 2024 to Jan 2025