false

--12-31

0001580490

0001580490

2023-12-15

2023-12-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): December 15, 2023

I-ON

DIGITAL CORP.

(Exact

Name of Registrant as Specified in its Charter)

| Delaware |

|

000-54995 |

|

46-3031328 |

(State of

Organization) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

1244

N. Stone St. Unit #3, Chicago, IL 60610

(Address

of principal executive offices)

Registrant’s

telephone number, including area code: (866) 440-2278

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12) |

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b)) |

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.0001 par value per share |

|

IONI |

|

OTC

Markets |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

2.01. |

Completion

of Acquisition or Disposition of Assets. |

On

December 15, 2023, I-ON Digital Corp. (the “Company”) consummated its previously announced transaction contemplated by that

certain Contribution and Exchange Agreement, dated as of October 30, 2023 (the “Contribution and Exchange Agreement”), by

and between the Company and Orebits Acquisition Group, a Wyoming limited liability company (“OAG”), pursuant to which the

Company acquired 910,000 shares of currently outstanding common stock of Orebits Corp. (“Orebits”), representing a controlling

interest in Orebits, in exchange for 910,000 shares of Series C Preferred Stock of the Company (“Series C Stock” and such

transaction, the “Transaction”). Carlos Montoya, the Company’s Chief Executive Officer and Chairman, owns a majority

of the outstanding units of OAG.

As

part of the Contribution and Exchange Agreement, upon and by virtue of the consummation of the Transaction, OAG transferred all its right,

title and interest in and to approximately 9,700 Orebits.AU gold-backed digital assets to the Company, which have an estimated value

of $18.2 million. The disinterested members of the Board of Directors determined that the consideration paid for the 910,000 shares of

Orebits approximated their fair market value.

A

copy of the press release reporting the consummation of the Transaction is attached as Exhibit 99.1 hereto and is incorporated by reference

herein.

| Item

5.03. |

Amendments

to Articles of Incorporation or Bylaws; Changes in Fiscal Year. |

On

December 15, 2023, the Company, pursuant to authority granted to the Board of Directors granted in the Company’s Certificate of

Incorporation, filed a Certificate of Designations amending its Certificate of Incorporation with the Secretary of State of the State

of Delaware, setting forth the terms of its Series C Stock. Each share of Series C Stock converts into twenty shares of Company common

stock (“Common Stock”), and each share of Series C Stock may cast one vote for each share of Common Stock into which it is

convertible. A copy of the Certificate of Designations relating to the Series C Preferred Stock is listed as Exhibit 3.1 to this Report

on Form 8-K and is incorporated herein by reference.

| Item

7.01. |

Regulation

FD Disclosure. |

On

December 18, 2023, the Company issued a press release announcing the closing of the Contribution and Exchange Agreement. The press

release is furnished herewith as Exhibit 99.1 and is incorporated by reference.

| Item

9.01. |

Financial

Statements and Exhibits. |

(b)

The Company will provide pro forma financial information reflecting the consummation of the Contribution and Exchange Agreement within

71 days of this filing, consistent with instruction under Item 9.01(b) of Form 8-K.

SIGNATURES

Pursuant

to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| Date:

December 18, 2023 |

I-ON DIGITAL CORP. |

| |

|

|

| |

By: |

/s/

Carlos X. Montoya |

| |

Name: |

Carlos X. Montoya |

| |

Title: |

Chief Executive Officer |

Exhibit

3.1

CERTIFICATE

OF DESIGNATION OF

SERIES C CONVERTIBLE PREFERRED STOCK OF

I-ON DIGITAL CORP.

Pursuant

to Section 151 of the General Corporation Law of the State of Delaware, I-ON Digital Corp., a Delaware corporation (the “Company”),

does hereby

certify:

FIRST:

That pursuant to authority expressly vested in it by the Certificate of Incorporation of the Company, the Board of Directors of the Company

has adopted the following unanimous consent resolutions establishing a new series of Preferred Stock of the Company, consisting of 910,000

shares designated “Series C Convertible Preferred Stock,” with such powers, designations, preferences and relative

participating, optional or other rights, if any, and the qualifications, limitations or restrictions thereof, as are set forth in the

resolutions, and in the form of Certificate of Designation set forth in Appendix A hereto:

RESOLVED,

that in the judgment of the Board of Directors of the Company, it is deemed advisable and in the best interests of the Company, and pursuant

to the authority granted to the Board of Directors in the Company’s Certificate of Incorporation, to amend the Company’s

Certificate of Incorporation to authorize and provide for the issuance of a preferred class of stock of the Company, including the creation

and designation of a new series of preferred stock to be known as Series C Convertible Preferred Stock, par value $.0001 per share

(the “Series C Stock”), which Series C Stock may be issued in the discretion of the Management of the Company.

FURTHER

RESOLVED, that the directors hereby create and establish a new series of preferred stock designated “Series C Convertible

Preferred Stock,” which series shall have the relative rights and preferences set forth in that certain Certificate of Designation

of Rights and Preferences for Series C Convertible Preferred Stock (the “Certificate of Designation”) attached hereto

as Appendix A and by this reference incorporated herein.

FURTHER

RESOLVED, that upon filing of the Amendment and the Certificate of Designation with the Secretary of State of Delaware, the officers

of the Company are hereby authorized and directed to issue shares of the Series C Stock.

FURTHER

RESOLVED, that the forms of Amendment and Certificate of Designation be, and the same hereby are, adopted and approved in all respects,

and that each of the executive officers of the Company be, and they hereby are, authorized and directed to execute and deliver said documents

in substantially the forms attached hereto, with such changes therein as such officers shall, upon advice of counsel, approve, which

approval shall be conclusively evidenced by such officers’ execution thereof.

FURTHER

RESOLVED, that the Chairman, the President, any Vice- President, and the Secretary of the Company be, and they hereby are, and each of

them hereby is, authorized and directed: (i) to execute, deliver and file, on behalf of the Company, the Amendment and the Certificate

of Designation; (ii) upon filing of the Amendment and the Certificate of Designation with the Secretary of State of Delaware, to issue

stock certificates representing shares of Series C Stock; (iii) to execute, deliver and file any and all additional certificates,

documents or other papers, and to do any and all things which they may deem necessary or appropriate in order to authorize the new class

of Preferred Stock, to authorize and issue the new Series C Preferred Stock of such class, as originally contemplated in the Debenture,

and to implement and carry out all matters herein authorized pursuant to the intent and purpose of the foregoing resolutions.

FURTHER

RESOLVED, that the actions of the officers and directors of the Company heretofore taken in connection with the authorization of the

new class of Preferred Stock be, and that same hereby are, ratified and approved in all respects.

SECOND:

That said resolutions of the directors of the Company were duly adopted in accordance with the provisions of Section 151(g) of the General

Corporation Law of the State of Delaware.

IN

WITNESS WHEREOF, the undersigned hereby affirms, under penalties of perjury, that the foregoing instrument is the act and deed of the

Company and that the facts stated therein are true.

December

15, 2023

| |

I-ON

DIGITAL CORP. |

| |

|

|

| |

|

/s/

Carlos X. Montoya |

| |

Name: |

Carlos

X. Montoya |

| |

Title: |

Chief

Executive Officer |

Appendix

A

SERIES

C CONVERTIBLE PREFERRED STOCK TERMS

I-ON

Digital Corp., a corporation organized and existing under the laws of the State of Delaware (“Company”), hereby certifies

that the Board of Directors of the Company (the “Board of Directors” or the “Board”), pursuant

to authority of the Board of Directors as required by applicable corporate law, and in accordance with the provisions of its certificate

of incorporation and bylaws, has and hereby authorizes a series of the Company’s previously authorized Preferred Stock, par value

$0.0001 per share (the “Preferred Stock”), and hereby states the designation and number of shares, and fixes the rights,

preferences, privileges, powers and restrictions thereof, as follows:

1.

Designation and Number of Shares. Pursuant to Article Fourth of the Company’s Certificate of Incorporation (which authorizes

10,000,000 shares of preferred stock, par value $0.0001 per share), there shall hereby be created and established a series of preferred

stock of the Company designated as “Series C Convertible Preferred Stock” (the “Series C Preferred

Shares”). The authorized number of Series C Preferred Shares shall be Nine Hundred Ten Thousand (910,000) shares. Each

Series C Preferred Share shall have a par value of $0.0001. Capitalized terms not defined herein shall have the meanings as set

forth in Section 15 below.

2.

Ranking. The Series C Preferred Shares shall rank junior to any existing and future indebtedness of the Company, and to

any existing series of the Company’s Preferred Stock; in respect of the preferences as to dividends, distributions and payments

upon the liquidation, dissolution and winding-up of the Company (collectively, the “Senior Securities”) or any future

series of existing indebtedness or preferred stock of pari passu rank to the Series C Preferred Shares in respect of the preferences

as to dividends, distributions and payments upon the liquidation, dissolution and winding-up of the Company (collectively, the “Parity

Stock”), all other shares of capital stock of the Company shall be junior in rank to all Series C Preferred Shares with

respect to the preferences as to dividends, distributions and payments upon the liquidation, dissolution and winding-up of the Company

(collectively, the “Junior Stock”). The rights of all such shares of capital stock of the Company shall be subject

to the rights, powers, preferences and privileges of the Series C Preferred Shares. In the event of the merger or consolidation

of the Company with or into another corporation, the Series C Preferred Shares shall maintain their relative rights, powers, preferences,

privileges, and designations provided for herein and no such merger or consolidation shall result inconsistent therewith.

3.

Conversion. From and after the date of issuance of any Series C Preferred Shares (the “Initial Issuance Date”),

each Series C Preferred Share shall be convertible into Twenty (20) (the “Conversion Rate”) validly issued,

fully paid and non-assessable shares of Common Stock (as defined below). To convert Series C Preferred Shares into validly issued,

fully paid and non-assessable shares of Common Stock on any date (a “Conversion Date”), a Holder shall deliver (via

electronic mail), for receipt on or prior to 5:00 p.m., New York time, on such date, a copy of an executed notice of conversion of Series

C Preferred Shares subject to such conversion in the form attached hereto as Exhibit A (the “Conversion Notice”)

to the Company. Within three (3) Trading Days following a conversion of any such Series C Preferred Shares as aforesaid, such

Holder shall surrender to a nationally recognized overnight delivery service for delivery to the Company the original certificates representing

the share(s) of Series C Preferred Shares (the “Series C Preferred Share Certificates”) so converted

as aforesaid. The Person or Persons entitled to receive the shares of Common Stock issuable upon a conversion of Series C Preferred

Shares shall be treated for all purposes as the record holder or holders of such shares of Common Stock on the Conversion Date. Notwithstanding

anything to the contrary set forth in this Section 3, upon conversion of any Series C Preferred Shares in accordance with the

terms hereof, no Holder thereof shall be required to physically surrender the certificate representing the Series C Preferred

Shares to the Company following conversion thereof unless the full or remaining number of Series C Preferred Shares represented

by the certificate are being converted. Each Holder and the Company shall maintain records showing the number of Series C Preferred

Shares so converted by such Holder and the dates of such conversions or shall use such other method, reasonably satisfactory to such

Holder and the Company, so as not to require physical surrender of the certificate representing the Series C Preferred Shares

upon each such conversion. The Company shall pay any and all documentary, stamp, transfer (but only in respect of the registered holder

thereof), issuance and other similar taxes that may be payable with respect to the issuance and delivery of shares of Common Stock upon

the conversion of Series C Preferred Shares.

4.

Adjustment of Conversion Price upon Subdivision or Combination of Common Stock. There shall be no adjustment to the Conversion

Rate should the Company at any time subdivide (by any stock split, stock dividend, recapitalization or otherwise) one or more classes

of its outstanding shares of Common Stock into a greater number of shares or if the Company at any time combines (by combination, reverse

stock split or otherwise) one or more classes of its outstanding shares of Common Stock into a smaller number of shares.

5.

Authorized Shares.

(a)

Reservation. The Company shall as of the Adjustment Date so long as any of the Series C Preferred Shares are outstanding,

take all action necessary to reserve and keep available out of its authorized and unissued shares of Common Stock, solely for the purpose

of effecting the conversion of the Series C Preferred Shares, as of any given date, 100% of the number of shares of Common Stock

as shall from time to time be necessary to effect the conversion of all of the Series C Preferred Shares issued or issuable pursuant

to this Certificate of Designation without taking into account any limitations on the issuance of securities set forth herein, provided

that at no time shall the number of shares of Common Stock so available be less than the number of shares required to be reserved by

the previous sentence (without regard to any limitations on conversions contained in this Certificate of Designation) (the “Required

Amount”). The initial number of shares of Common Stock reserved for conversions of the Series C Preferred Shares and

each increase in the number of shares so reserved shall be allocated pro rata among the Holders based on the number of Series C

Preferred Shares held by each Holder on the Initial Issuance Date or increase in the number of reserved shares (as the case may be) (the

“Authorized Share Allocation”). In the event a Holder shall sell or otherwise transfer any of such Holder’s

Series C Preferred Shares, each transferee shall be allocated a pro rata portion of such Holder’s Authorized Share Allocation.

Any shares of Common Stock reserved and allocated to any Person which ceases to hold any Series C Preferred Shares shall be allocated

to the remaining Holders of Series C Preferred Shares, pro rata based on the number of Series C Preferred Shares then held

by such Holders.

(b)

Insufficient Authorized Shares. If, notwithstanding Section 5(a) and not in limitation thereof, at any time while any of the Series

C Preferred Shares remain outstanding the Company does not have a sufficient number of authorized and unissued shares of Common Stock

to satisfy its obligation to have available for issuance upon conversion of the Series C Preferred Shares at least a number of

shares of Common Stock equal to the Required Amount (an “Authorized Share Failure”), then the Company shall immediately

take all action necessary to increase the Company’s authorized shares of Common Stock to an amount sufficient to allow the Company

to reserve and have available the Required Amount for all of the Series C Preferred Shares then outstanding. Without limiting

the generality of the foregoing sentence, as soon as practicable after the date of the occurrence of an Authorized Share Failure, but

in no event later than ninety (90) days after the occurrence of such Authorized Share Failure, the Company shall hold a meeting or obtain

written consent of its stockholders for the approval of an increase in the number of authorized shares of Common Stock. In connection

with such meeting, the Company shall provide each stockholder with a proxy statement or information statement, as applicable, and shall

use its best efforts to solicit its stockholders’ approval of such increase in authorized shares of Common Stock and to cause its

Board to recommend to the stockholders that they approve such proposal.

6.

Voting Rights. The Series C Preferred Stock shall be entitled to vote on matters as to which holders of Common Stock shall be

entitled to vote at a rate of one (1) vote per share of Series C Preferred Stock.

7.

Vote to Change the Terms of or Issue Series C Preferred Shares. In addition to any other rights provided by law, except

where the vote or written consent of the holders of a greater number of shares is required by law or by another provision of the Certificate

of Incorporation, without first obtaining the affirmative vote at a meeting duly called for such purpose or the written consent without

a meeting of the Required Holders, voting together as a single class, the Company shall not amend or repeal any provision of, or add

any provision to, its Certificate of incorporation or bylaws, or file any certificate of designations or articles of amendment of any

series of shares of preferred stock, if such action would adversely alter or change in any respect the preferences, rights, privileges

or powers, or restrictions provided for the benefit, of the Series C Preferred Shares, regardless of whether any such action shall

be by means of amendment to the Certificate of Incorporation or by merger, consolidation or otherwise.

8.

Lost or Stolen Certificates. Upon receipt by the Company of evidence reasonably satisfactory to the Company of the loss, theft,

destruction or mutilation of any certificates representing Series C Preferred Shares (as to which a written certification and

the indemnification contemplated below shall suffice as such evidence), and, in the case of loss, theft or destruction, of an indemnification

undertaking by the applicable Holder to the Company in customary and reasonable form and, in the case of mutilation, upon surrender and

cancellation of the certificate(s), the Company shall execute and deliver new certificate(s) of like tenor and date.

9.

Noncircumvention. The Company hereby covenants and agrees that the Company will not, by amendment of its Certificate of Incorporation,

bylaws or through any reorganization, transfer of assets, consolidation, merger, scheme of arrangement, dissolution, issue or sale of

securities, or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms of this Certificate

of Designation, and will at all times in good faith carry out all the provisions of this Certificate of Designation and take all action

as may be required to protect the rights of the Holders.

10.

Failure or Indulgence Not Waiver. No failure or delay on the part of a Holder in the exercise of any power, right or privilege

hereunder shall operate as a waiver thereof, nor shall any single or partial exercise of any such power, right or privilege preclude

other or further exercise thereof or of any other right, power or privilege. No waiver shall be effective unless it is in writing and

signed by an authorized representative of the waiving party. This Certificate of Designation shall be deemed to be jointly drafted by

the Company and all Holders and shall not be construed against any Person as the drafter hereof.

11.

Notices. The Company shall provide each Holder of Series C Preferred Shares with prompt written notice of all actions taken

pursuant to the terms of this Certificate of Designation, including in reasonable detail a description of such action and the reason

therefor. Whenever notice is required to be given under this Certificate of Designation, unless otherwise provided herein, such notice

shall be sufficiently given if given in writing and delivered by first class mail, postage prepaid, or if given in such other manner

as may be permitted in this Certificate of Designations, in the Certificate of incorporation or the Bylaws and by applicable law to the

Holder’s last known address as set forth in the records of the Company.

12.

Transfer of Series C Preferred Shares. Any Holder may transfer some or all of its Series C Preferred Shares without

the consent of the Company.

13.

Preferred Shares Register. The Company shall maintain at its principal executive offices (or such other office or agency of the

Company as it may designate by notice to the Holders), a register for the Series C Preferred Shares, in which the Company shall

record the name, address and facsimile number of the Persons in whose name the Series C Preferred Shares have been issued, as

well as the name and address of each transferee. The Company may treat the Person in whose name any Series C Preferred Shares

is registered on the register as the owner and holder thereof for all purposes, notwithstanding any notice to the contrary, but in all

events recognizing any properly made transfers.

14.

Amendment. This Certificate of Designation or any provision hereof may only be amended by obtaining the affirmative vote at a

meeting duly called for such purpose, or written consent without a meeting in accordance with the DGCL, of the Required Holders, voting

separate as a single, as may then be required pursuant to the DGCL and the Certificate of Incorporation.

15.

Certain Defined Terms. For purposes of this Certificate of Designation, the following terms shall have the following meanings:

(a)

“Business Day” means any day other than Saturday, Sunday or other day on which commercial banks in The City of New

York are authorized or required by law to remain closed.

(b)

“Common Stock” means (i) the Company’s shares of common stock, $0.0001 par value per share, and (ii) any capital

stock into which such common stock shall have been changed or any share capital resulting from a reclassification of such common stock.

(c)

“DGCL” means the Delaware General Corporation Law as in effect from time to time.

(d)

“Person” means an individual, a limited liability company, a partnership, a joint venture, a corporation, a trust,

an unincorporated organization, any other entity or a government or any department or agency thereof.

(e)

“Required Holders” means the holders of at least a majority of the outstanding Series C Preferred Shares.

(Remainder

of the page left intentionally blank.)

IN

WITNESS WHEREOF, the Company has caused this Certificate of Designation of Series C Convertible Preferred Stock of I-ON Digital Corp.

to be signed by its duly authorized officer on this 15th day of December, 2023

| |

I-ON

DIGITAL CORP. |

| |

|

|

| |

|

/s/

Carlos X. Montoya |

| |

Name:

|

Carlos

X. Montoya |

| |

Title:

|

Chief

Executive Officer |

EXHIBIT

A

I-ON

DIGITAL CORP. CONVERSION NOTICE

Reference

is made to the Certificate of Designation of Series C Convertible Preferred Stock of I-ON Digital Corp. (the “Certificate of

Designation”). In accordance with and pursuant to the Certificate of Designation, the undersigned hereby elects to convert

the number of shares of Series C Convertible Preferred Stock (the “Series C Preferred Shares”), of

I-ON Digital Corp., a Delaware corporation (the “Company”), indicated below into shares of common stock of

the Company, as of the date specified below.

Date

of Conversion: _______________________________________________________________________________

Number

of Series C Preferred Shares to be converted: ______________________________________________________

Share

certificate no(s). of Series C Preferred Shares to be converted: __________________________________________

Tax

ID Number (If applicable): _______________________________________________________________________

Conversion

Price: ________________________________________________________________________________

Number

of shares of Common Stock to be issued:________________________________________________________

Please

issue the shares of Common Stock into which the Series C Preferred Shares are being converted in the following name and to the

following address:

Issue

to:________________________________________________________________________________________

Address:

_______________________________________________________________________________________

Telephone

Number: _______________________________________________________________________________

Facsimile

Number: ________________________________________________________________________________

Holder:

________________________________________________________________________________________

By:_____________________________________________

Title:___________________________________________

Dated:__________________________________________

Account

Number (if electronic book entry transfer):

__________________________________________________

Transaction

Code Number (if electronic book entry transfer):

__________________________________________________

EXHIBIT

B

ACKNOWLEDGMENT

The

Company hereby acknowledges this Conversion Notice and hereby direct [_________] to issue the above indicated number of shares of Common

Stock in accordance with the Conversion Notice dated _____________ 202___ from the Company and acknowledged and agreed to by _________________.

| |

I-ON

DIGITAL CORP. |

| |

|

| |

|

|

| |

Name:

|

Carlos

Montoya |

| |

Title:

|

Chief

Executive Officer |

Exhibit 99.1

I-ON

Digital Corp. Acquires Controlling Interest in Orebits Corp. and Secures Significant Gold-Backed Digital Asset Holdings

I-ON

Digital Corp. (OTC: IONI) (“I-ON Digital” or the “Company”) announced the completion of its previously announced

Contribution and Exchange Agreement with Orebits Acquisition Group, LLC (“OAG”), by which I-ON Digital has acquired a controlling

interest in Orebits Corp. (“Orebits”), along with Orebits’ gold digitization patent portfolio, trademarks, brand marks,

and core intellectual property. As part of this transaction, I-ON Digital will assume control over the Orebits digital platform and 9,700

Orebits.au gold-backed digital assets in exchange for Series C Preferred Shares in I-ON Digital. The Company estimates that the transaction

will add approximately $18.2 million in shareholder equity to I-ON’s balance sheet.

I-ON

Digital is at the forefront of institutional-level asset digitization, tokenization, and securitization. The Company’s focus is

on tangible mineral assets like proven gold and other precious metals reserves. The Company recently added a SaaS platform that will

allow banks, broker-dealers and other financial intermediaries to onboard an institutional-level platform further facilitating receipt,

management, and reporting in the arena of digital assets. The Company is dedicated to offering innovative solutions to that bring tangible

value to the banking, financial technology and mineral asset industries.

Employing

proprietary means, the Company will immediately convert the 9,700 Orebits.au into I-ON’s own gold-backed digital securities, referred

to commercially as ION.au. By leveraging its internally developed and acquired patent & intellectual property portfolio, the Company

aims to enhance the underlying value of these digital securities. Having validated internal applications for institutional-level asset

digitization and treatment, the Company looks to renew its focus on the acquisition of US-based gold and other mineral asset claims.

With the addition of an estimated $18.2 million in shareholder equity, the Company believes that it will be able to offer a broader variety

of digital asset–based financial instruments to an expanding list of product and service offerings.

“We

are extremely excited to announce the completion of this transaction and can’t wait to deploy increased shareholder equity to further

expand and enhance our asset digitization offerings in the marketplace,” shared Ken Park, Director and Chief Marketing Officer

of I-ON Digital Corp. “This transaction builds on the technological progress we’ve made this year and will greatly enhance

our go-to-market strategies while expanding our product and service offerings along the way.”

About

I-ON Digital Corp:

I-ON

Digital Corp (OTC: IONI) is a leading-edge provider of asset-digitization and securitization solutions engineered to provide a secure,

fast, transparent, and institutional-grade ecosystem that digitizes documentary evidence of ownership, in accordance with a rigorous

onboarding and acceptance process, into secure, asset-backed digital certificates that bring liquidity and accepted value to a wide-array

of asset classes.

I-ON

develops, acquires, and deploys a portfolio of novel and patented next-generation technologies that have been integrated and engineered

into a comprehensive ecosystem built on a zero-trust, hybrid blockchain architecture that utilizes state-of-the-art smart contracts and

sophisticated workflow management AI technologies to digitize ownership records of recoverable gold, precious metal, and mineral reserves

into digital certificates that facilitate wealth transfer through new asset-backed financial instruments and asset classes that provide

reserve owners and investors a new channel to maximize portfolio liquidity.

By

offering services associated with asset digitization and securitization, and by licensing the Company’s expanding intellectual

property portfolio, I-ON is able to generate revenue through transaction fees while actively growing innovative platforms beneficial

for next-generation transactional models. Additional information is available at https://iondigitalcorp.com/.

Forward-Looking

Statements

This

news release contains forward-looking statements involving risks and uncertainties, which may cause results to differ materially from

the statements made. When used in this document, the words “may,” “would,” “could,” “will,”

“intend,” “look to,” plan,” “anticipate,” “believe,” “estimate,” “expect,”

“seek,” “potential,” “outlook,” and similar expressions are intended to identify forward-looking

statements. Such statements, including, but not limited to, I-ON’s current views with respect to future events and its financial

forecasts, are subject to such risks and uncertainties. Many factors could cause actual results to differ materially from the statements

made, including those risks described from time to time in filings made by I-ON with the Securities and Exchange Commission. In addition,

there is uncertainty about the further spread of the COVID-19 virus or new variants thereof, or the occurrence of another wave of cases

and the impact it may have on the Company’s operations, the demand for the Company’s products, global supply chains and economic

activity in general. These and other risks and uncertainties are detailed in the Company’s filings with the Securities and Exchange

Commission. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements

prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, or expected. Statements

in this news release regarding past trends or activities should not be taken as a representation that such trends or activities will

continue. I-ON does not intend or assume any obligation to update these forward-looking statements other than as required by law.

SOURCE:

I-ON Digital Corp (OTC: IONI)

Media

Contact:

Oktane

Media

IR@iondigitalcorp.com

(866) 440-2278

www.iondigitalcorp.com

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

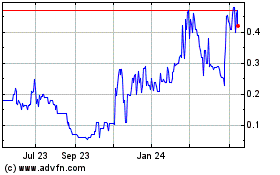

I ON Digital (PK) (USOTC:IONI)

Historical Stock Chart

From Nov 2024 to Dec 2024

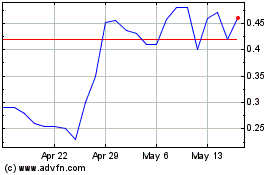

I ON Digital (PK) (USOTC:IONI)

Historical Stock Chart

From Dec 2023 to Dec 2024