NetworkNewsWire Editorial Coverage:

Everywhere you go these days, heads are bent over smartphones and

tablets—shopping, checking Facebook, scanning news headlines,

watching movies, accessing banking information, checking emails

and, of course, gaming. Though it was once a wide-spread belief

that a mobile gaming enterprise could not survive as a publicly

traded company, the tide has turned. Several leading brands in the

industry are proving they can not only survive, but can thrive as

publicly traded entities in the global gaming market. As public

mobile gaming stocks continue gaining market share within the

videogame industry, companies like Tapinator, Inc. (OTCQB:

TAPM) (Tapinator Profile),

Zynga, Inc. (NASDAQ: ZNGA), Electronic

Arts, Inc. (NASDAQ: EA), Glu Mobile, Inc. (NASDAQ:

GLUU) and Activision Blizzard, Inc. (NASDAQ:

ATVI) are showing they mean business in this stalwart,

promising market.

In the past, debates have abounded over whether venture capital

funding was the right thing for mobile gaming companies because,

essentially, having hit games was the determining factor in whether

or not they would find success. While that is still fundamentally

true, mobile gaming companies have figured a few things out to

greatly bolster their profitability—like how to cash in on in-game

advertising, how to sustainably acquire users, how to employ

user-friendly monetization methods, and how to successfully and

effectively integrate brands into their games.

Investors are certainly feeling friendlier toward mobile games

companies, and the market outlook is rosy. An annual

report released by Juniper Research in February 2017 predicted

the overall videogame market (including both mobile and PC games)

would grow to $132 billion in revenues by 2021. A Global Games

Market Report

released by Newzoo in April 2017 projected global game revenues

would reach $108.9 billion during 2017—an increase of 7.8 percent

from 2016. Within the global gaming market, mobile gaming has

proven to be the most profitable segment, grabbing 42 percent of

the market share. By 2020, the same Newzoo report predicts, mobile

gaming will amount to more than half of the total games market

worldwide.

For companies like Tapinator, Inc.

(TAPM), it’s all good news.

Engaging millions of players with its diversified portfolio of

over 300 mobile games, Tapinator is generating alluring and

predictable returns through the sale of branded advertisements and

consumer app store transactions. Hundreds of thousands of daily

downloads on the iOS, Google Play and Amazon platforms have made

Tapinator “One to

Watch” in the mobile gaming market.

The business strategy employed by Tapinator includes creating

segment-leading full-featured games, like “ROCKY™” and “Solitaire

Dash,” that give gamers unique, in-depth content as well as

fostering long-term player retention and producing higher ROIs.

This full-featured games model makes it possible for Tapinator to

create potentially $100 million+ franchise-type games that are

sustainable and have product lifespans of five years or more. The

company utilizes a set of proprietary dynamic development and

marketing processes that are factored on gaming category, estimated

player retention, and projected player profitability. In a press

release earlier this month, the company said it expects

Full-Featured Games Bookings to increase by more than 200% in 2017

as compared to 2016 (http://nnw.fm/LW8yt).

Tapinator recently launched two new full-featured games: “Big

Sport Fishing 2017” - which had more than 520,000 player downloads

within the first seven days of its global release - and “Dice Mage

2.” Both were recognized as “New Games We Love” on the Apple iOS

platform, as noted in a recent press release announcing updates to

Dice Mage 2 (http://nnw.fm/Xy3V5).

Additionally, Tapinator’s Rapid-Launch Games division recently

experienced a spike in player interest with the launch of “Fidget

Spinner Superhero” and “Scary Shark Evolution 3D.”

Coming up during Q4 2017 and Q1 2018, Tapinator is scheduled to

release four new titles: “ColorFill,” “Divide & Conquer,”

“Shadowborne” and “Fusion Heroes.” The formula behind these games

consists of a combination of proven gameplay elements;

class-leading monetization systems; and the creative magic of the

robust team of developers, strategists and product specialists that

is Tapinator’s backbone.

Diversified revenue sources for Tapinator include 54 percent

derived from in-game advertising and 46 percent from consumer

purchases made through app stores. Advertising placement is

strategically limited to appear between game levels, and video ads

additionally play on a rewards basis that is directly tied to game

currency.

The company is currently exploring promising opportunities in

virtual reality and augmented reality and has exploratorily

released several prototype virtual reality games to gather data

before pursuing a more significant product in this category.

Tapinator further intends to pursue publishing transactions

leveraging its network, platform relationships and operational

prowess and is additionally exploring notable gaming IP expansion

opportunities to new platforms like Steam and to leading messaging

apps.

While Tapinator may yet be an unknown name to some (though that

isn’t likely to remain true for long), both gamers and non-gamers

alike easily recognize the name of Zynga, Inc.

(ZNGA), the developer behind such hugely popular games as

“FarmVille” and “Words with Friends.” It hasn’t always been smooth

sailing for Zynga, but the stock price for this social games leader

has been on the rise, going from less than $3 to more than $4 over

the course of the past year. Part of this success may be attributed

to the company appointing Frank Gibeau, former executive at

Electronic Arts Inc. (EA), as its new CEO in March

2016. Various other former EA execs were then brought aboard by

Gibeau, and attention was turned to live operations and increasing

the revenues of Zynga’s existing properties instead of gambling on

expensive new launches.

Meanwhile, EA’s stock price has been on an incredible upward

climb for several years now, steadily soaring from less than $15 at

the commencement of 2013 to breaking the $120 mark this year. The

company’s portfolio includes such chartbusting gaming brands as

“The Sims,” “Madden NFL,” “EA SPORTS FIFA,” “Battlefield,” “Dragon

Age” and “Plants vs. Zombies.”

Like Zynga, Glu Mobile Inc. (GLUU) has had ups

and downs, but it, too, seems to be making a steady recovery,

having dropped below $2 at one point this year but then climbed

above $4 and, to date, stayed there. Glu Mobile’s focus is on

creating original IP games, with a portfolio that includes

“Contract Killer,” “Cooking Dash,” “Deer Hunter,” “Diner Dash,”

“Dino Hunter: Deadly Shores,” “Eternity Warriors,” “Frontline

Commando” and more. The company additionally offers branded IP

games that include “Kim Kardashian: Hollywood,” “Sniper X with

Jason Statham,” “Gordon Ramsey Dash” and “Britney Spears: American

Dream.”

Another interactive games player that has enjoyed a steady

upward climb in recent years is Activision Blizzard, Inc.

(ATVI), the creator of such blockbuster franchises as

“Call of Duty,” “Skylanders” and “Destiny.” Activision Blizzard’s

stock price was below $11 at the commencement of 2013; this year,

the company’s stock has broken $66.

The global gaming industry is certainly going strong, with

mobile gaming taking an increasingly large bite of the market share

with every passing year. The outlook is good and the future is

bright in this thriving industry, and the aggressive, innovative

companies are proving they have staying power as publicly traded

entities.

For more information on Tapinator, Inc., visit

Tapinator, Inc.

(TAPM)

About NetworkNewsWire

NetworkNewsWire (NNW) is an information service that provides

(1) access to our news aggregation and syndication servers, (2)

NetworkNewsBreaks that summarize corporate news and

information, (3) enhanced press release services, (4) social media

distribution and optimization services, and (5) a full array of

corporate communication solutions. As a multifaceted financial news

and content distribution company with an extensive team of

contributing journalists and writers, NNW is uniquely positioned to

best serve private and public companies that desire to reach a wide

audience of investors, consumers, journalists and the general

public. NNW has an ever-growing distribution network of more than

5,000 key syndication outlets across the country. By cutting

through the overload of information in today’s market, NNW brings

its clients unparalleled visibility, recognition and brand

awareness. NNW is where news, content and information converge.

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: http://NNW.fm/Disclaimer

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by NNW are

solely those of NNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW for any investment

decisions by their readers or subscribers. NNW are a news

dissemination and financial marketing solutions provider and are

NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

NNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and NNW undertake no

obligation to update such statements.

Source:

NetworkNewsWire

Contact:

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

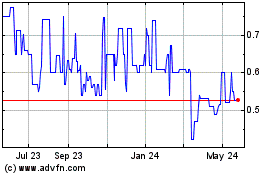

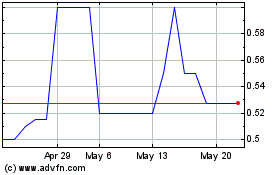

Tapinator (PK) (USOTC:TAPM)

Historical Stock Chart

From Jan 2025 to Feb 2025

Tapinator (PK) (USOTC:TAPM)

Historical Stock Chart

From Feb 2024 to Feb 2025