Tapinator Appoints Institutional Software Investor as Senior Advisor

October 30 2019 - 6:30AM

InvestorsHub NewsWire

Tapinator Appoints

Institutional Software Investor as Senior

Advisor

New York, NY -- October 30, 2019 -- InvestorsHub NewsWire

-- Tapinator, Inc.

(“Tapinator,” “we,” “our,” or “us”) (OTCQB:

TAPM),

a developer and publisher of category

leading apps for mobile platforms today announced that Nils

Tristan, an experienced Wall Street software investor, has joined

Tapinator as a Senior Advisor.

Mr. Tristan is currently the Managing Member of

Avenue Line Capital, a private investment firm, founded in

2017. Prior to founding Avenue Line Capital, Mr. Tristan was

a Senior Equity Analyst covering the Technology Sector at Soros

Fund Management from November 2010 to December 2014. While at

Soros, Mr. Tristan focused on Software and Internet equities. Prior

to Soros, Mr. Tristan was a Limited Partner at Level Global

Investors and a Senior Equity Analyst at SAC Capital Advisors and

started his career as a Financial Analyst in the Global Investment

Research division at Goldman Sachs covering the Software

Sector.

Mr. Tristan will assist Tapinator with its

positioning to the investment community, market research, corporate

development and introductions to institutional buy-side and

sell-side relationships. Prior to joining Tapinator, Mr.

Tristan had already made a personal investment in Tapinator by

acquiring shares in the open market and has agreed to a one-year

lockup on those shares.

Tapinator’s President &

CFO, Andrew Merkatz, commented on the addition of Mr. Tristan, “We

are thrilled to have someone with Nils’ pedigree as a technology

investor who shares our conviction for the significant value

creation opportunity at Tapinator. I am personally excited to

work closely with Nils over the coming months to improve the

quality and breadth of our investor relations activities and to

expand our network of institutional and high net-worth

investors.”

Mr. Tristan also expressed,

“The trends driving the Mobile Gaming Industry are powerful and

long term in nature. The global proliferation of more powerful

devices, coupled with increasing data communication speeds, has

created a huge opportunity for delivering high quality games.

Tapinator’s portfolio of Category Leading Apps represents

a strong foundation for the company’s future growth. Tapinator has

demonstrated success in the Social Casino genre, with hit games

like Video Poker Classic and Solitaire Dash. I

look forward to working with Tapinator’s experienced executive team

to build shareholder value and to expand its investor

base.”

About Tapinator

Tapinator Inc. (OTCQB:

TAPM) develops and publishes category leading apps for mobile

platforms, with a significant emphasis on social-casino games.

Tapinator's library includes over 300 titles that, collectively,

have achieved over 470 million mobile downloads, including notable

properties such as Video Poker Classic and Solitaire

Dash. Tapinator generates revenues through the sale of branded

advertising and via consumer transactions, including in-app

purchases and subscriptions. Founded in 2013, Tapinator is

headquartered in New York, with product development and marketing

teams located in North America, Europe and Asia. Consumers can find

high-quality mobile entertainment wherever they see the ‘T’

character logo, or at http://tapinator.com.

Forward Looking Statements

To the

extent that statements contained in this press release are not

descriptions of historical facts regarding Tapinator, they are

forward-looking statements reflecting the current beliefs and

expectations of management made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

Words such as “believe,” “plan,” “feel,” "may," "will," "expect,"

"anticipate," "estimate," "intend," and similar expressions (as

well as other words or expressions referencing future events,

conditions or circumstances) are intended to identify

forward-looking statements. Forward-looking statements in this

release involve substantial risks and uncertainties that could

cause the development and monetization of our mobile games, future

results, performance or achievements to differ significantly from

those expressed or implied by the forward-looking statements.

Tapinator undertakes no obligation to update or revise any

forward-looking statements. The quoting and trading of the

Company's common stock on the OTCQB is often thin and characterized

by wide fluctuations in trading prices, due to many factors that

may have little to do with the Company's operations or business

prospects. As a result, there may be volatility in the market price

of the shares of the Company's common stock for reasons unrelated

to operating performance. Moreover, the OTCQB is not a stock

exchange, and trading of securities on it is often more sporadic

than trading of securities listed on a national securities

exchange. Accordingly, stockholders may have difficulty reselling

any of their shares. For a further description of the risks and

uncertainties that could cause actual results to differ from those

expressed in these forward-looking statements, as well as risks

relating to the business of the Company, please see the Company's Annual Report on Form 10-K

for the year ended December 31, 2018, including but not limited to

the discussion under "Risk Factors" therein, which the Company

filed with the SEC and may be viewed at http://www.sec.gov.

CONTACT:

Tapinator

Investor Relations

investor.relations@tapinator.com

914.930.6232

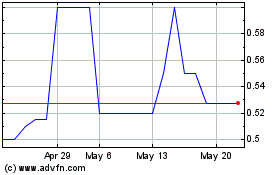

Tapinator (PK) (USOTC:TAPM)

Historical Stock Chart

From Jan 2025 to Feb 2025

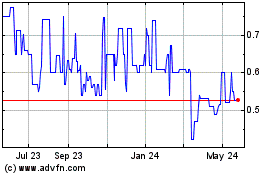

Tapinator (PK) (USOTC:TAPM)

Historical Stock Chart

From Feb 2024 to Feb 2025

Real-Time news about Tapinator Inc (PK) (OTCMarkets): 0 recent articles

More Tapinator, Inc. (QB) News Articles