OTCBB “TDCB” - Third Century Bancorp (“Company”), the holding

company for Mutual Savings Bank (“Bank”) announced it had net

income of $65,000 for the quarter ended June 30, 2014, or $0.05 per

share, compared to net income of $156,000 for the quarter ended

June 30, 2013, or $0.12 per share. For the six months ended June

30, 2014, the Company recorded net income of $120,000, or $0.09 per

share, compared to net income of $216,000 for the six months ended

June 30, 2013, or $0.17 per share.

For the three months ended June 30, 2014, net income decreased

$91,000, or 58.33%, to $65,000 and for the six months ended June

30, 2014, net income decreased $96,000, or 44.44% to $120,000,

primarily due to decreases in net interest income and noninterest

income and an increase in noninterest expense. Net interest income

was $995,000 for the second quarter of 2014 compared to $1.0

million for the second quarter of 2013 and $2.0 million for the six

months ended June 30, 2014 compared to $2.1 million for the six

months ended June 30, 2013. The decrease in net interest income was

primarily due to a decrease of $213,000 or 25.68%, in interest

income on commercial real estate mortgages to $615,000 for the six

months ended June 30, 2014 compared to $828,000 for the six months

ended June 30, 2013.

Total noninterest income decreased $32,000 to $209,000 for the

three months ended June 30, 2014 from $241,000 for the three months

ended June 30, 2013 and decreased $34,000 to $383,000 for the six

months ended June 30, 2014 from $417,000 for the six months ended

June 30, 2014. For both the three month and six month periods ended

June 30, 2014, the decreases were primarily due to the decrease in

the net gains on loan sales. Net gains on loan sales decreased

$59,000 to $1,000 for the three months ended June 30, 2014 and

$60,000 to $20,000 for the six months ended June 30, 2014.

Noninterest expenses for the second quarter of 2014 was $1.1

million compared to $1.0 million for the second quarter of 2013 and

$2.2 million for the six months ended June 30, 2014 compared to

$2.1 million for the six months ended June 30, 2013. The increase

in noninterest expense for the three and six month periods ended

June 30, 2014 compared to the three and six months ended June 30,

2013 was primarily due to increases in salaries and employee

benefits.

Total assets decreased $1.8 million to $121.9 million at June

30, 2014 from $123.7 million at December 31, 2013, a decrease

of 1.45%. The decrease was primarily due to the repayment of $3.0

million of Federal Home Loan Bank borrowings.

Deposits increased $1.1 million to $91.5 million at June 30,

2014 from $90.4 million at December 31, 2013. Savings, money market

and NOW accounts increased $1.8 million, or 3.93%, to $48.7 million

at June 30, 2014 from $46.9 million at December 31, 2013 and demand

deposits increased $299,000, or 1.84%, to $16.6 million at June 30,

2014 from $16.3 million at December 31, 2013. Time deposits

decreased $1.0 million, or 3.84% to $26.2 million at June 30, 2014

from $27.3 million at December 31, 2013.

Federal Home Loan Bank advances and other borrowings decreased

$3.0 million, or 17.14%, to $14.5 million at June 30, 2014 from

$17.5 million at December 31, 2013 due to the repayment of $3.0

million in Federal Home Loan Bank advances which matured during the

first quarter of 2014. At June 30, 2014 the weighted average rate

of all Federal Home Loan Bank advances was 1.52% compared to 1.85%

at December 31, 2013 and the weighted average maturity was 3.25

years at June 30, 2014 compared with 3.2 years at December 31,

2013.

Stockholders’ equity was $15.5 million at June 30, 2014 and

December 31, 2013. Stockholders’ equity decreased due to cash

dividends paid of $115,000 offset in part by net income of $120,000

for the six months ended June 30, 2014. Equity as a percentage of

assets increased 0.19% to 12.70% at June 30, 2014 compared to

12.51% at December 31, 2013.

Founded in 1890, Mutual Savings Bank is a full-service financial

institution based in Johnson County, Indiana. In addition to its

main office at 80 East Jefferson Street, Franklin, Indiana, the

bank operates branches in Franklin at 1124 North Main Street and

the Franklin United Methodist Community, as well as in Edinburgh,

Nineveh and Trafalgar, Indiana.

Selected Consolidated Financial Data

(unaudited) At June 30, At December 31,

2014 2013 Selected

Consolidated Financial Condition Data:

(In Thousands)

Assets $ 121,881 $ 123,674 Loans receivable-net 94,219 96,045 Cash

and cash equivalents 9,054 6,561 Interest-earning time deposits

6,176 7,169 Investment securities 6,364 7,154 Deposits 91,526

90,431 FHLB advances and other borrowings 14,500 17,500

Stockholders’ equity-net 15,476 15,469

For the Three

Months Ended June 30, 2014

2013 (Dollars In Thousands, Except Share

Data) Selected Consolidated Earnings Data: Total

interest income $ 1,114 $ 1,217 Total interest expense

119 176 Net interest

income 995 1,041

Provision (credit) for losses on loans

(1 ) 1

Net interest income after provision for

losses on loans

996 1,040 Noninterest income 209 241 Noninterest expense 1,097

1,022 Income tax expense

43

103 Net income

65

156 Earnings per share basic $ 0.05 $

0.12 Earnings per share diluted $ 0.05 $ 0.12

Selected

Financial Ratios and Other Data: Interest rate spread during

period 3.17 % 3.22 % Net yield on interest-earning assets 3.34 3.41

Return on average assets 0.21 0.49 Return on average equity 1.68

4.07 Equity to assets 12.70 11.94

Average interest-earning assets to average

interest-bearing liabilities

136.62 132.87 Non-performing assets to total assets 4.18 4.43

Allowance for loan losses to total loans

outstanding

1.95 2.20

Allowance for loan losses to

non-performing loans

37.78 43.71

Net charge-offs to average total loans

outstanding

0.12 0.04 Noninterest expense to average assets 0.90 0.81 Effective

income tax rate 39.81 39.77 Number of full service offices 6

6 Tangible book value per share $ 12.15 $ 12.12 Market closing

price at end of quarter $ 7.62 $ 6.40 Price-to-tangible book value

62.70 % 52.80 %

For the Six Months Ended June

30, 2014 2013

(Dollars In Thousands, Except Share Data) Selected

Consolidated Earnings Data: Total interest income $ 2,250 $

2,427 Total interest expense

263

356 Net interest income 1,987 2,071 Provision

for losses on loans

2

10

Net interest income after provision for

losses on loans

1,985 2,061 Noninterest income 383 417 Noninterest expense 2,170

2,119 Income tax expense

78

143 Net income $

120 $

216 Earnings per share basic $ 0.09 $ 0.17

Earnings per share diluted $ 0.09 $ 0.17

Selected

Financial Ratios and Other Data: Interest rate spread during

period 3.31 % 3.24 % Net yield on interest-earning assets 3.50 3.41

Return on average assets 0.19 0.34 Return on average equity 1.57

2.83 Equity to assets 12.70 11.92

Average interest-earning assets to average

interest-bearing liabilities

131.23 128.77 Non-performing assets to total assets 4.18 4.43

Allowance for loan losses to total loans

outstanding

1.95 2.20

Allowance for loan losses to

non-performing loans

37.78 43.71

Net charge-offs to average total loans

outstanding

0.12 0.04 Noninterest expense to average assets 1.76 1.68 Effective

income tax rate 39.39 39.83 Number of full service offices 6

6 Tangible book value per share $ 12.15 $ 12.12 Market closing

price at end of quarter $ 7.62 $ 5.15 Price-to-tangible book value

62.70 % 42.48 %

Third Century BancorpRobert D. Heuchan, President and CEODavid

A. Coffey, Executive Vice President, CFO and COOTel.

317-736-7151Fax 317-736-1726

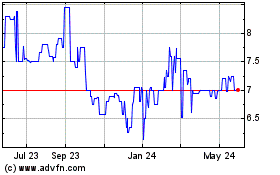

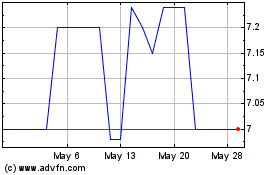

Third Century Bancorp (PK) (USOTC:TDCB)

Historical Stock Chart

From Jan 2025 to Feb 2025

Third Century Bancorp (PK) (USOTC:TDCB)

Historical Stock Chart

From Feb 2024 to Feb 2025