Third Century Bancorp (“Company”) (OTCBB: TDCB), the holding

company for Mutual Savings Bank (“Bank”) announced it had net

income of $178,000 for the quarter ended December 31, 2014, or

$0.14 per share, compared to net income of $19,000 for the quarter

ended December 31, 2013, or $0.01 per share. For the year ended

December 31, 2014, the Company recorded net income of $399,000, or

$0.31 per share, compared to net income of $311,000 for the year

ended December 31, 2013, or $0.24 per share.

For the three months ended December 31, 2014, net income

increased $159,000 to $178,000 as compared to the same period in

the prior year. The increase in net income for the fourth quarter

of 2014 was primarily the result of a decrease of $118,000 in the

provision for loan losses and a $149,000 decrease in noninterest

expenses.

For the year ended December 31, 2014, net income increased

$88,000, or 28.3%, to $399,000 compared to 2013. The increase in

net income for 2014 was primarily a result of a $127,000 decrease

in the provision for loan losses and a $149,000 decrease in

noninterest expenses. The improvement in the provision for loan

losses for both the quarter and year ended December 31, 2014 was

caused by a credit to the provision for loan losses of $118,000 and

$115,000, respectively, which was a result of improved credit

quality within the loan portfolio. The improvement in noninterest

expenses for both the quarter and year ended December 31, 2014 were

driven by cost reductions, including the closing of one branch

facility during 2014.

Total assets decreased $542,000 to $123.1 million at December

31, 2014 from $123.7 million at December 31, 2013, a decrease

of 0.43%. The decrease was primarily due to a $2.4 million decrease

in total loans outstanding.

Deposits increased $3.3 million, or 3.6%, to $93.7 million at

December 31, 2014 from $90.4 million at December 31, 2013. Federal

Home Loan Bank advances and other borrowings decreased $4.0

million, or 22.9%, to $13.5 million at December 31, 2014 from $17.5

million at December 31, 2013. At December 31, 2014 the weighted

average rate of all Federal Home Loan Bank advances was 1.57%

compared to 1.85% at December 31, 2013 and the weighted average

maturity was 2.9 years at December 31, 2014 compared with 3.2 years

at December 31, 2013.

Stockholders’ equity increased $210,000 to $15.7 million at

December 31, 2014, compared to $15.5 million at December 31, 2013.

Equity as a percentage of assets increased to 12.73% at December

31, 2014 compared to 12.51% at December 31, 2013. Book value per

share increased to $12.32 at December 31, 2014 from $12.15 at

December 31, 2013. The closing price per share at December 31, 2014

was $7.66, which was 62.17% of book value per share.

Founded in 1890, Mutual Savings Bank is a full-service financial

institution based in Johnson County, Indiana. In addition to its

main office at 80 East Jefferson Street, Franklin, Indiana, the

bank operates branches in Franklin at 1124 North Main Street and

the Franklin United Methodist Community, as well as in Nineveh and

Trafalgar, Indiana.

This press release contains certain forward-looking statements

that are based on assumptions and may describe future plans,

strategies and expectations of the Company. Forward-looking

statements can be identified by the fact that they do not relate

strictly to historical or current facts. They often include words

like “believe,” “expect,” “anticipate,” “estimate” and “intend” or

future or conditional verbs such as “will,” “would,” “should,”

“could” or “may.” Certain factors that could cause actual results

to differ materially from expected results include changes in the

interest rate environment, changes in general economic conditions,

legislative and regulatory changes that adversely affect the

business of the Company and the Bank, and changes in the securities

markets. Except as required by law, the Company does not undertake

any obligation to update any forward-looking statements to reflect

changes in belief, expectations or events.

Selected Consolidated Financial

Data

At December 31, At December 31,

2014

2013

Selected Consolidated Financial Condition Data:

(Dollars

In Thousands, Except Per Share Data) Assets $ 123,132 $ 123,674

Loans receivable-net 93,616 96,045 Cash and cash equivalents 9,517

6,561 Interest-earning time deposits 4,712 7,169 Investment

securities 9,867 7,154 Deposits 93,715 90,431 FHLB advances and

other borrowings 13,500 17,500 Stockholders’ equity-net 15,679

15,469 Book value per share 12.32 12.15

For the Three

Months Ended December 31,

2014

2013

(Dollars In Thousands, Except Share Data) Selected

Consolidated Earnings Data: Total interest income $ 1,120 $

1,169 Total interest expense

115

170 Net interest income 1,005 999 Provision

(credit) for losses on loans

(118

) 0 Net interest income

after provision for losses on loans 1,123 999 Noninterest income

176 186 Noninterest expenses 1,004 1,153 Income tax expense

117 13 Net income

$ 178 $

19 Earnings per share basic and diluted $ 0.14

$ 0.01

For the Year Ended December 31,

2014

2013

(Dollars In Thousands, Except Share Data) Selected

Consolidated Earnings Data: Total interest income $ 4,497 $

4,795 Total interest expense

495

701 Net interest income 4,002 4,094 Provision

(credit) for losses on loans

(115

) 12 Net interest income

after provision for losses on loans 4,117 4,082 Noninterest income

777 816 Noninterest expenses 4,231 4,380 Income tax expense

264 207 Net income

$ 399 $

311 Earnings per share – basic and diluted $

0.31 $ 0.24

Selected Financial Ratios and Other Data:

Interest rate spread during period 3.09 % 3.16 % Net yield on

interest-earning assets 3.36 3.35 Return on average assets 0.32

0.25 Return on average equity 2.57 2.02 Average Equity to assets

12.61 12.51 Average interest-earning assets to average

interest-bearing liabilities 136.14 133.77

Third Century BancorpRobert D. Heuchan, President and CEO,

317-736-7151orDavid A. Coffey, Executive Vice President, CFO and

COO, 317-736-7151Fax 317-736-1726

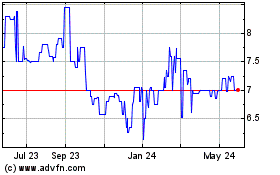

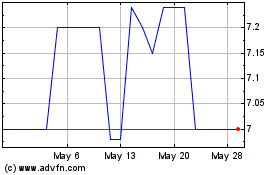

Third Century Bancorp (PK) (USOTC:TDCB)

Historical Stock Chart

From Jan 2025 to Feb 2025

Third Century Bancorp (PK) (USOTC:TDCB)

Historical Stock Chart

From Feb 2024 to Feb 2025