VPR Brands Announces Q1 2021 Financial Results; with increased revenue greater than 200% over Q1 2020

May 21 2021 - 7:00AM

InvestorsHub NewsWire

VPR Brands Announces Q1

2021 Financial Results; with increased revenue greater than 200%

over Q1 2020

Fort Lauderdale, Fl -- May

21, 2021 -- InvestorsHub NewsWire -- VPR Brands LP (OTC:

VPRB) a market leading

supplier and patent holder for electronic cigarettes or vaporizers

for nicotine, cannabis and cannabidiol (CBD) and other related

accessories such as Lighters recently

announced its first quarter 2021 financial results, posting

increased revenues and a narrowed net loss as compared to

2020.

While increasing its

quarterly revenues approximately 209% to

$1.25 million, the Company also reduced its net loss from $421,590

in 2020 to $101,651 in 2021 and the company was also able to

strengthen its gross operating margins to 43% in the

1st Quarter 2021 from 35% in Q1,

2020.

"We are back in business” said Kevin Frija CEO of VPR

Brands “After a difficult year in 2020 due to circumstances beyond

our control, we are grateful to be able to come back strong and

continue where we left off in 2019 and we look forward to the

rest of 2021 and beyond.”

"Our company made great strides in regaining revenues

to pre Covid-19 levels, and with marked increases to our direct to

customer business and the addition of Dissim Lighters to our

portfolio our profit margins have started to trend upwards.” Said

Dan Hoff COO of VPR

Brands. “As much of the country opens up and business

continues to recover we eagerly await what lies ahead for the

company. "

Results of Operations

for the Three Months Ended March 31, 2021 Compared to the Three

Months Ended March 31, 2020

Revenues

Our revenues for the three months ended March 31,

2021 and 2020 were $1,252,058 and $598,633, respectively. The

increase was a result of an industry-wide health-related crisis

that hampered sales significantly in 2020, as well as increased

direct on-line sales in 2021.

Cost of

Sales

Cost of sales for the three months ended March 31,

2021 and 2020 was $710,501 and $386,128, respectively. Gross

margins increased to 43% in 2021 compared to 35% in 2020, due to

pricing pressures from the decreased demand related to the industry

crisis in 2020, and increased direct sales in

2021.

Operating

Expenses

Operating expenses for the three months ended March

31, 2021 were $537,903 as compared to $476,824 for the three months

ended March 31, 2020. The increase in expenses is primarily due to

increased sales activity in 2021.

Other Income

(Expense)

Interest expense decreased to $105,305 for the

three months ended March 31, 2021 as compared to $157,271 for the

three months ended March 31, 2020 due to less interest expense

recognized on related party loans in 2021.

Net

Loss

Net loss for the three months ended March 31, 2021

was $101,651 compared to a net loss of $421,590 for the three

months ended March 31, 2020.

Liquidity and Capital

Resources

The Company used cash in operating activities of

$138,245 for three months ended March 31,

2021 as compared to $21,386 of cash used in

three months ended March 31, 2020. Cash used in operations in 2021

related to the Company’s net loss of approximately $102,000, offset

by an increase in accounts payable offset by an increase in vendor

deposits. Cash used in operations in 2020 related to the Company’s

net loss of approximately $422,000, offset by decreases in

inventory and accounts receivable levels as well as increase in

accounts payable.

During the three months ended March 31, 2021, the

Company received $180,000 from the issuance of notes payable to

related parties, repaid $183,754 of principal on notes payable to

related parties, repaid $42,251 of principal on notes payable, and

received $190,057 of notes payable proceeds under the Paycheck

Protection Program (“PPP”) and Economic Injury Disaster Loan

(“EIDL”) program. Both the PPP and EIDL are financial programs

under the Coronavirus Aid, Relief and Economic Security Act (“CARES

Act”) signed into law by the U.S. President on March 27, 2020 to

provide economic relief to small businesses adversely impacted by

COVID-19.

During the three months ended March 31, 2020, the

Company received $290,000 of proceeds from the issuance of notes

payable to related parties, repaid $185,622 of principal on notes

payable to related parties, and repaid $101,141 of principal on

notes payable.

Assets

At March 31, 2021 and December 31, 2020, we had

total assets of $1,018,165 and $908,345, respectively. Assets

primarily consist of the cash accounts held by the Company,

inventory, vendor deposits, accounts receivable and a right-to-use

asset. In 2021, the Company’s vendor deposits increased by $117,078

and inventory was decreased by approximately $51,000 as a result of

increased demand from direct customers.

Liabilities

At March 31, 2021 and December 31, 2020, we had

total liabilities of $3,361,785 and $3,150,314, respectively. The

increase was primarily due to the issuance of a PPP Loan in the

amount of $190,057 in 2021.

For the Rest of the information

filed:

https://www.sec.gov/Archives/edgar/data/0001376231/000089109221004547/e13142-10q.htm.

About VPR Brands,

LP:

VPR Brands is a technology company, whose assets

include issued U.S. and Chinese patents for atomization

related products including technology for medical marijuana

vaporizers and electronic cigarette products and components as well

as lighters. The company is also engaged in product development for

the vapor or vaping market, including e-liquids, vaporizers and

electronic cigarettes (also known as e-cigarettes) which are

devices which deliver nicotine and or cannabis through atomization

or vaping, and without smoke and other chemical constituents

typically found in traditional products. For more information about

VPR Brands, please visit the company on the web

at www.vprbrands.com.

Forward-looking

statements:

This news release contains

statements that involve expectations, plans or intentions, and

other factors discussed from time to time in the company's

Securities and Exchange Commission filings. These statements are

forward-looking and are subject to risks and uncertainties, so

actual results may vary materially. The company cautions readers

not to place undue reliance on any forward-looking statements,

which speak only as of the date made. The company disclaims any

obligation subsequently to revise any forward-looking statements to

reflect events or circumstances after the date of such statements

or to reflect the occurrence of anticipated or unanticipated

events.

Corporate

Communications:

kevin.frija@vprbrands |

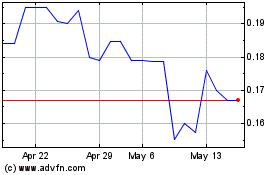

VPR Brands (QB) (USOTC:VPRB)

Historical Stock Chart

From Dec 2024 to Jan 2025

VPR Brands (QB) (USOTC:VPRB)

Historical Stock Chart

From Jan 2024 to Jan 2025