0001536089

false

Q3

--09-30

0001536089

2022-10-01

2023-06-30

0001536089

2023-08-17

0001536089

2023-06-30

0001536089

2022-09-30

0001536089

us-gaap:NonrelatedPartyMember

2023-06-30

0001536089

us-gaap:NonrelatedPartyMember

2022-09-30

0001536089

us-gaap:RelatedPartyMember

2023-06-30

0001536089

us-gaap:RelatedPartyMember

2022-09-30

0001536089

us-gaap:SeriesAPreferredStockMember

2023-06-30

0001536089

us-gaap:SeriesAPreferredStockMember

2022-09-30

0001536089

VRVR:SeriesBConvertiblePreferredStockMember

2023-06-30

0001536089

VRVR:SeriesBConvertiblePreferredStockMember

2022-09-30

0001536089

2023-04-01

2023-06-30

0001536089

2022-04-01

2022-06-30

0001536089

2021-10-01

2022-06-30

0001536089

us-gaap:RelatedPartyMember

2023-04-01

2023-06-30

0001536089

us-gaap:RelatedPartyMember

2022-04-01

2022-06-30

0001536089

us-gaap:RelatedPartyMember

2022-10-01

2023-06-30

0001536089

us-gaap:RelatedPartyMember

2021-10-01

2022-06-30

0001536089

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2023-03-31

0001536089

us-gaap:PreferredStockMember

VRVR:SeriesBConvertiblePreferredStockMember

2023-03-31

0001536089

us-gaap:CommonStockMember

2023-03-31

0001536089

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001536089

us-gaap:TreasuryStockCommonMember

2023-03-31

0001536089

us-gaap:RetainedEarningsMember

2023-03-31

0001536089

2023-03-31

0001536089

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2022-03-31

0001536089

us-gaap:PreferredStockMember

VRVR:SeriesBConvertiblePreferredStockMember

2022-03-31

0001536089

us-gaap:CommonStockMember

2022-03-31

0001536089

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001536089

us-gaap:TreasuryStockCommonMember

2022-03-31

0001536089

us-gaap:RetainedEarningsMember

2022-03-31

0001536089

2022-03-31

0001536089

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2022-09-30

0001536089

us-gaap:PreferredStockMember

VRVR:SeriesBConvertiblePreferredStockMember

2022-09-30

0001536089

us-gaap:CommonStockMember

2022-09-30

0001536089

us-gaap:AdditionalPaidInCapitalMember

2022-09-30

0001536089

us-gaap:TreasuryStockCommonMember

2022-09-30

0001536089

us-gaap:RetainedEarningsMember

2022-09-30

0001536089

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2021-09-30

0001536089

us-gaap:PreferredStockMember

VRVR:SeriesBConvertiblePreferredStockMember

2021-09-30

0001536089

us-gaap:CommonStockMember

2021-09-30

0001536089

us-gaap:AdditionalPaidInCapitalMember

2021-09-30

0001536089

us-gaap:TreasuryStockCommonMember

2021-09-30

0001536089

us-gaap:RetainedEarningsMember

2021-09-30

0001536089

2021-09-30

0001536089

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2023-04-01

2023-06-30

0001536089

us-gaap:PreferredStockMember

VRVR:SeriesBConvertiblePreferredStockMember

2023-04-01

2023-06-30

0001536089

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0001536089

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0001536089

us-gaap:TreasuryStockCommonMember

2023-04-01

2023-06-30

0001536089

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0001536089

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2022-04-01

2022-06-30

0001536089

us-gaap:PreferredStockMember

VRVR:SeriesBConvertiblePreferredStockMember

2022-04-01

2022-06-30

0001536089

us-gaap:CommonStockMember

2022-04-01

2022-06-30

0001536089

us-gaap:AdditionalPaidInCapitalMember

2022-04-01

2022-06-30

0001536089

us-gaap:TreasuryStockCommonMember

2022-04-01

2022-06-30

0001536089

us-gaap:RetainedEarningsMember

2022-04-01

2022-06-30

0001536089

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2022-10-01

2023-06-30

0001536089

us-gaap:PreferredStockMember

VRVR:SeriesBConvertiblePreferredStockMember

2022-10-01

2023-06-30

0001536089

us-gaap:CommonStockMember

2022-10-01

2023-06-30

0001536089

us-gaap:AdditionalPaidInCapitalMember

2022-10-01

2023-06-30

0001536089

us-gaap:TreasuryStockCommonMember

2022-10-01

2023-06-30

0001536089

us-gaap:RetainedEarningsMember

2022-10-01

2023-06-30

0001536089

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2021-10-01

2022-06-30

0001536089

us-gaap:PreferredStockMember

VRVR:SeriesBConvertiblePreferredStockMember

2021-10-01

2022-06-30

0001536089

us-gaap:CommonStockMember

2021-10-01

2022-06-30

0001536089

us-gaap:AdditionalPaidInCapitalMember

2021-10-01

2022-06-30

0001536089

us-gaap:TreasuryStockCommonMember

2021-10-01

2022-06-30

0001536089

us-gaap:RetainedEarningsMember

2021-10-01

2022-06-30

0001536089

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2023-06-30

0001536089

us-gaap:PreferredStockMember

VRVR:SeriesBConvertiblePreferredStockMember

2023-06-30

0001536089

us-gaap:CommonStockMember

2023-06-30

0001536089

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001536089

us-gaap:TreasuryStockCommonMember

2023-06-30

0001536089

us-gaap:RetainedEarningsMember

2023-06-30

0001536089

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2022-06-30

0001536089

us-gaap:PreferredStockMember

VRVR:SeriesBConvertiblePreferredStockMember

2022-06-30

0001536089

us-gaap:CommonStockMember

2022-06-30

0001536089

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001536089

us-gaap:TreasuryStockCommonMember

2022-06-30

0001536089

us-gaap:RetainedEarningsMember

2022-06-30

0001536089

2022-06-30

0001536089

VRVR:SeriesBConvertiblePreferredStockMember

2022-10-01

2023-06-30

0001536089

VRVR:SeriesBConvertiblePreferredStockMember

2021-10-01

2022-06-30

0001536089

us-gaap:StockOptionMember

us-gaap:CommonStockMember

2023-06-30

0001536089

us-gaap:StockOptionMember

2022-06-30

0001536089

VRVR:SeriesBConvertiblePreferredStockMember

2023-06-29

2023-06-30

0001536089

2022-03-01

2022-03-31

0001536089

VRVR:ConvertibleNotesMember

2022-10-01

2023-06-30

0001536089

VRVR:ConvertibleNotesMember

2021-10-01

2022-06-30

0001536089

VRVR:BermudaBankMember

2023-06-30

0001536089

VRVR:BermudaBankMember

2022-09-30

0001536089

srt:MaximumMember

2023-06-30

0001536089

VRVR:TerminationAgreementMember

2023-05-17

2023-05-17

0001536089

VRVR:TerminationAgreementMember

2023-07-04

2023-07-05

0001536089

VRVR:TerminationAgreementMember

2022-10-01

2023-06-30

0001536089

VRVR:OneYearAgreementMember

2022-08-15

2022-08-16

0001536089

VRVR:OneYearAgreementMember

2022-08-16

0001536089

VRVR:OneYearAgreementMember

2023-01-01

2023-06-30

0001536089

VRVR:OneYearAgreementMember

VRVR:TwoGroupAssistMember

2023-06-30

0001536089

VRVR:OneYearAgreementMember

VRVR:GroupMember

2022-10-25

2022-10-26

0001536089

VRVR:OneYearAgreementMember

VRVR:GroupMember

2022-10-26

0001536089

VRVR:OneYearAgreementMember

VRVR:GroupAssistMember

2023-06-30

0001536089

VRVR:FourMonthAgreementMember

2022-11-27

2022-11-28

0001536089

VRVR:FourMonthAgreementMember

2022-10-01

2022-12-31

0001536089

VRVR:FourMonthAgreementMember

2022-12-31

0001536089

srt:BoardOfDirectorsChairmanMember

2023-06-04

2023-06-05

0001536089

srt:BoardOfDirectorsChairmanMember

2023-06-05

0001536089

srt:BoardOfDirectorsChairmanMember

2023-04-01

2023-06-30

0001536089

us-gaap:SeriesBPreferredStockMember

2023-06-30

0001536089

us-gaap:SeriesBPreferredStockMember

2022-09-30

0001536089

VRVR:OneYearWarrantMember

VRVR:AugustSixteenTwoThousandTwentyTwoMember

2022-08-15

2022-08-16

0001536089

VRVR:OneYearWarrantMember

VRVR:AugustSixteenTwoThousandTwentyTwoMember

2022-08-16

0001536089

VRVR:TwoYearWarrantMember

VRVR:AugustSixteenTwoThousandTwentyTwoMember

2022-08-15

2022-08-16

0001536089

VRVR:TwoYearWarrantMember

VRVR:AugustSixteenTwoThousandTwentyTwoMember

2022-08-16

0001536089

VRVR:AugustSixteenTwoThousandTwentyTwoMember

us-gaap:MeasurementInputOptionVolatilityMember

2022-08-16

0001536089

VRVR:AugustSixteenTwoThousandTwentyTwoMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2022-08-16

0001536089

us-gaap:WarrantMember

VRVR:AugustSixteenTwoThousandTwentyTwoMember

2023-04-01

2023-06-30

0001536089

us-gaap:WarrantMember

VRVR:AugustSixteenTwoThousandTwentyTwoMember

2023-06-30

0001536089

VRVR:OneYearWarrantMember

VRVR:OctoberTwentySixTwoThousandTwentyTwoMember

2022-10-25

2022-10-26

0001536089

VRVR:OneYearWarrantMember

VRVR:OctoberTwentySixTwoThousandTwentyTwoMember

2022-10-26

0001536089

VRVR:TwoYearWarrantMember

VRVR:OctoberTwentySixTwoThousandTwentyTwoMember

2022-10-25

2022-10-26

0001536089

VRVR:TwoYearWarrantMember

VRVR:OctoberTwentySixTwoThousandTwentyTwoMember

2022-10-26

0001536089

VRVR:OctoberTwentySixTwoThousandTwentyTwoMember

2022-10-26

0001536089

srt:MinimumMember

VRVR:OctoberTwentySixTwoThousandTwentyTwoMember

us-gaap:MeasurementInputExpectedTermMember

2022-10-26

0001536089

srt:MaximumMember

VRVR:OctoberTwentySixTwoThousandTwentyTwoMember

us-gaap:MeasurementInputExpectedTermMember

2022-10-26

0001536089

VRVR:OctoberTwentySixTwoThousandTwentyTwoMember

us-gaap:MeasurementInputOptionVolatilityMember

2022-10-26

0001536089

VRVR:OctoberTwentySixTwoThousandTwentyTwoMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2022-10-26

0001536089

us-gaap:WarrantMember

VRVR:OctoberTwentySixTwoThousandTwentyTwoMember

2022-06-30

0001536089

us-gaap:WarrantMember

2023-06-30

0001536089

VRVR:TenYearOptionMember

VRVR:ConsultingAgreementMember

2023-06-04

2023-06-05

0001536089

VRVR:TenYearOptionMember

VRVR:ConsultingAgreementMember

2023-06-05

0001536089

VRVR:ConsultingAgreementMember

2023-06-04

2023-06-05

0001536089

us-gaap:StockOptionMember

VRVR:ConsultingAgreementMember

2023-04-01

2023-06-30

0001536089

us-gaap:StockOptionMember

2023-06-30

0001536089

us-gaap:WarrantMember

2022-09-30

0001536089

us-gaap:WarrantMember

2022-10-01

2023-06-30

0001536089

us-gaap:StockOptionMember

2022-09-30

0001536089

us-gaap:StockOptionMember

2022-10-01

2023-06-30

0001536089

VRVR:UnrelatedIndividualsMember

2019-03-20

0001536089

VRVR:UnrelatedIndividualsMember

2022-09-30

0001536089

VRVR:UnrelatedIndividualsMember

2023-06-30

0001536089

VRVR:UnrelatedThirdPartyOneMember

2021-09-23

0001536089

VRVR:UnrelatedThirdPartyOneMember

2021-09-22

2021-09-23

0001536089

VRVR:UnrelatedThirdPartyOneMember

2021-09-30

0001536089

VRVR:UnrelatedThirdPartyOneMember

2022-03-23

0001536089

VRVR:UnrelatedThirdPartyOneMember

2022-03-22

2022-03-23

0001536089

VRVR:UnrelatedThirdPartyOneMember

2021-10-01

2022-03-23

0001536089

VRVR:UnrelatedThirdPartyOneMember

2021-10-01

2022-06-30

0001536089

VRVR:UnrelatedThirdPartyOneMember

2022-06-30

0001536089

VRVR:UnrelatedThirdPartyOneMember

2023-06-30

0001536089

VRVR:UnrelatedThirdPartyTwoMember

2022-03-15

0001536089

VRVR:UnrelatedThirdPartyTwoMember

2022-03-14

2022-03-15

0001536089

VRVR:UnrelatedThirdPartyTwoMember

2023-06-30

0001536089

VRVR:UnrelatedThirdPartyTwoMember

2022-09-30

0001536089

VRVR:UnrelatedThirdPartyTwoMember

2023-03-28

0001536089

VRVR:UnrelatedThirdPartyTwoMember

2023-06-09

0001536089

VRVR:UnrelatedThirdPartyTwoMember

us-gaap:SubsequentEventMember

2023-07-13

0001536089

VRVR:UnrelatedThirdPartyTwoMember

2023-03-28

2023-03-28

0001536089

VRVR:UnrelatedThirdPartyTwoMember

2023-06-09

2023-06-09

0001536089

VRVR:UnrelatedThirdPartyTwoMember

us-gaap:SubsequentEventMember

2023-07-13

2023-07-13

0001536089

VRVR:UnrelatedThirdPartyThreeMember

2022-03-21

0001536089

VRVR:UnrelatedThirdPartyThreeMember

2022-03-20

2022-03-21

0001536089

VRVR:UnrelatedThirdPartyThreeMember

2023-06-30

0001536089

VRVR:UnrelatedThirdPartyThreeMember

2022-09-30

0001536089

VRVR:UnrelatedThirdPartyThreeMember

2023-03-29

0001536089

VRVR:UnrelatedThirdPartyThreeMember

us-gaap:SubsequentEventMember

2023-07-13

0001536089

VRVR:UnrelatedThirdPartyThreeMember

2023-03-28

2023-03-28

0001536089

VRVR:UnrelatedThirdPartyThreeMember

us-gaap:SubsequentEventMember

2023-07-13

2023-07-13

0001536089

VRVR:UnrelatedThirdPartyThreeMember

2023-04-01

2023-06-30

0001536089

VRVR:UnrelatedThirdPartyThreeMember

2022-04-01

2022-06-30

0001536089

VRVR:UnrelatedThirdPartyThreeMember

2022-10-01

2023-06-30

0001536089

VRVR:UnrelatedThirdPartyThreeMember

2021-10-01

2022-06-30

0001536089

srt:ChiefExecutiveOfficerMember

VRVR:UnsecuredPromissoryNoteMember

2018-03-29

0001536089

VRVR:UnsecuredPromissoryNoteMember

2018-03-29

0001536089

VRVR:UnsecuredPromissoryNoteMember

2018-03-29

2018-03-29

0001536089

VRVR:NotesPayableMember

2023-06-30

0001536089

VRVR:NotesPayableMember

2022-09-30

0001536089

VRVR:NotesPayableMember

2023-09-30

0001536089

VRVR:UnsecuredPromissoryNoteMember

2019-12-11

0001536089

VRVR:UnsecuredPromissoryNoteMember

2023-06-30

0001536089

VRVR:UnsecuredPromissoryNoteMember

2022-09-30

0001536089

VRVR:TerminationOfPreviousAgreementMember

2022-08-15

2022-08-16

0001536089

VRVR:TerminationOfPreviousAgreementMember

2022-08-16

0001536089

VRVR:TerminationOfPreviousAgreementMember

2022-08-15

2023-08-16

0001536089

VRVR:OneYearWarrantMember

VRVR:TerminationOfPreviousAgreementMember

2022-08-15

2022-08-16

0001536089

VRVR:OneYearWarrantMember

VRVR:TerminationOfPreviousAgreementMember

2022-08-16

0001536089

VRVR:TwoYearWarrantMember

VRVR:TerminationOfPreviousAgreementMember

2022-08-15

2022-08-16

0001536089

VRVR:TwoYearWarrantMember

VRVR:TerminationOfPreviousAgreementMember

2022-08-16

0001536089

2023-07-05

2023-07-05

0001536089

VRVR:TerminationOfPreviousAgreementMember

2023-07-05

2023-07-05

0001536089

us-gaap:SubsequentEventMember

us-gaap:SeriesCPreferredStockMember

2023-07-14

2023-07-14

0001536089

us-gaap:SubsequentEventMember

us-gaap:SeriesCPreferredStockMember

2023-07-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

iso4217:EUR

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

| ☒ |

Quarterly

Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act Of 1934 |

For

the quarterly period end June 30, 2023

| ☐ |

Transition

Report Under Section 13 or 15(d) of the Securities Exchange Act Of 1934 |

For

the transition period from __________ to __________

Commission

File Number: None

VIRTUAL

INTERACTIVE TECHNOLOGIES CORP.

(Exact

name of registrant as specified in its charter)

| nevada |

|

36-4752858 |

(State

or other jurisdiction

of

incorporation or organization) |

|

(I.R.S.

Employer

Identification

No.) |

600

17th Street, Suite

2800 South

Denver,

CO 80202

(Address

of principal executive offices, including Zip Code)

(303)

228-7120

(Issuer’s

telephone number, including area code)

Check

whether the issuer (1) has filed all reports required to be filed by section 13 or 15(d) of the Exchange Act during the past 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a small reporting company

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated

filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

|

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

|

Smaller

reporting company |

☒ |

| |

|

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| None |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

State

the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date: 8,151,534

shares of common stock as of August 17, 2023.

Virtual

Interactive Technologies Corp.

Index

Virtual

Interactive Technologies Corp.

Condensed

Consolidated Balance Sheets

As

of June 30, 2023 and September 30, 2022

(UNAUDITED)

| | |

June 30, 2023 | | |

September 30, 2022 | |

| ASSETS | |

| | | |

| | |

| CURRENT ASSETS: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 1,832 | | |

$ | 36,378 | |

| Royalties receivable | |

| 82,214 | | |

| 83,644 | |

| Interest receivable | |

| 5,708 | | |

| 4,586 | |

| Note receivable | |

| 25,000 | | |

| 25,000 | |

| Prepaid expenses | |

| - | | |

| 1,956,215 | |

| Total current assets | |

| 114,754 | | |

| 2,105,823 | |

| | |

| | | |

| | |

| TOTAL ASSETS | |

$ | 114,754 | | |

$ | 2,105,823 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | |

| | | |

| | |

| CURRENT LIABILITIES: | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

$ | 110,529 | | |

$ | 34,591 | |

| Interest payable, related party | |

| - | | |

| 223,940 | |

| Interest payable | |

| 350,843 | | |

| 34,129 | |

| Notes payable, related party | |

| - | | |

| 741,030 | |

| Notes payable | |

| 741,030 | | |

| - | |

| Convertible notes payable, net of discounts | |

| 470,000 | | |

| 262,686 | |

| Total current liabilities | |

| 1,672,402 | | |

| 1,296,376 | |

| | |

| | | |

| | |

| LONG-TERM LIABILITIES: | |

| | | |

| | |

| Notes payable | |

| 10,000 | | |

| 10,000 | |

| Interest payable | |

| 2,569 | | |

| 2,121 | |

| | |

| | | |

| | |

| Total long-term liabilities | |

| 12,569 | | |

| 12,121 | |

| Total liabilities | |

| 1,684,971 | | |

| 1,308,497 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| - | | |

| - | |

| | |

| | | |

| | |

| STOCKHOLDERS’ EQUITY (DEFICIT) | |

| | | |

| | |

| Series A Preferred Stock, $0.01 par value; 10,000,000 authorized; 50,000 shares issued and outstanding | |

| 500 | | |

| 500 | |

| Series B Convertible Preferred Stock $0.01 par value; 10,000,000 authorized; 270,612 shares issued and outstanding | |

| 2,706 | | |

| 2,706 | |

| Preferred stock

value | |

| | | |

| | |

| Common stock, $0.001 par value; 90,000,000 shares authorized, 8,842,784 shares issued and 8,151,534 shares outstanding at June 30, 2023, and 8,100,284 shares issued and 8,059,034 outstanding as of September 30, 2022 | |

| 8,151 | | |

| 8,059 | |

| Additional paid-in-capital | |

| 5,495,390 | | |

| 7,595,246 | |

| Treasury stock (691,250

and 41,250

shares at June 30, 2023 and September 30, 2022, respectively, $0

cost) | |

| - | | |

| - | |

| Accumulated deficit | |

| (7,076,964 | ) | |

| (6,809,185 | ) |

| Total stockholders’ equity (deficit) | |

| (1,570,217 | ) | |

| 797,326 | |

| Total liabilities and stockholders’ equity (deficit) | |

$ | 114,754 | | |

$ | 2,105,823 | |

The

accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Virtual

Interactive Technologies Corp.

Condensed

Consolidated Statements of Operations

For

the three and nine months ended June 30, 2023 and 2022

(UNAUDITED)

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

For the three months ended, | | |

For the nine months ended, | |

| | |

June 30, | | |

June 30, | | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Revenue – royalties | |

$ | 35,136 | | |

$ | 20,689 | | |

$ | 110,733 | | |

$ | 80,719 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Professional fees | |

| (1,480,843 | ) | |

| 254,364 | | |

| (28,426 | ) | |

| 486,057 | |

| Marketing and advertising | |

| 37,056 | | |

| 255,550 | | |

| 85,098 | | |

| 314,485 | |

| Research and development | |

| - | | |

| 16,539 | | |

| - | | |

| 16,539 | |

| General, administrative and selling | |

| 4,356 | | |

| 13,368 | | |

| 9,520 | | |

| 36,337 | |

| Total operating expenses | |

| (1,439,431 | ) | |

| 539,821 | | |

| 66,192 | | |

| 853,418 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income (loss) from operations | |

| 1,474,567 | | |

| (519,132 | ) | |

| 44,541 | | |

| (772,699 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense) | |

| | | |

| | | |

| | | |

| | |

| Other income | |

| 374 | | |

| 449 | | |

| 1,122 | | |

| 1,347 | |

| Amortization of debt discount | |

| - | | |

| (117,764 | ) | |

| (207,314 | ) | |

| (310,203 | ) |

| Interest expense, related party | |

| - | | |

| (14,084 | ) | |

| (27,637 | ) | |

| (42,373 | ) |

| Interest expense | |

| (36,148 | ) | |

| (16,741 | ) | |

| (78,085 | ) | |

| (32,784 | ) |

| Loss from foreign currency transactions | |

| (422 | ) | |

| (79 | ) | |

| (406 | ) | |

| (650 | ) |

| Total other income (expense) | |

| (36,196 | ) | |

| (148,219 | ) | |

| (312,320 | ) | |

| (384,663 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) | |

$ | 1,438,371 | | |

$ | (667,351 | ) | |

$ | (267,779 | ) | |

$ | (1,157,362 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income (loss) per share - | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.17 | | |

$ | (0.06 | ) | |

$ | (0.03 | ) | |

$ | (0.16 | ) |

| Diluted | |

$ | 0.16 | | |

$ | (0.06 | ) | |

$ | (0.03 | ) | |

$ | (0.16 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of shares outstanding – | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 8,320,435 | | |

| 7,369,188 | | |

| 8,266,314 | | |

| 7,083,577 | |

| Diluted | |

| 9,195,031 | | |

| 7,369,188 | | |

| 9,140,910 | | |

| 7,083,577 | |

The

accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Virtual

Interactive Technologies Corp.

Condensed

Consolidated Statements of Changes in Stockholders’ Equity (Deficit)

For

the three and nine months ended June 30, 2023 and 2022

(UNAUDITED)

For

the three months ended June 30, 2023

| | |

Shares | | |

Par Value | | |

Shares | | |

Par Value | | |

Shares | | |

Par Value | | |

Capital | | |

Shares | | |

Cost | | |

Deficit | | |

Deficit | |

| | |

Preferred Stock | | |

| | |

| | |

Additional | | |

| | |

| | |

| | |

Total | |

| | |

Series A | | |

Series B Convertible | | |

Common Stock | | |

Paid In | | |

Treasury Stock | | |

Accumulated | | |

Stockholders’ | |

| | |

Shares | | |

Par Value | | |

Shares | | |

Par Value | | |

Shares | | |

Par Value | | |

Capital | | |

Shares | | |

Cost | | |

Deficit | | |

Deficit | |

| Balance March 31,2022 | |

| 50,000 | | |

$ | 500 | | |

| 270,612 | | |

$ | 2,706 | | |

| 8,271,534 | | |

$ | 8,271 | | |

$ | 8,271,118 | | |

| 41,250 | | |

$ | - | | |

$ | (8,515,335 | ) | |

$ | (232,740 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock issued for services | |

| - | | |

| - | | |

| - | | |

| - | | |

| 530,000 | | |

| 530 | | |

| 78,970 | | |

| - | | |

| - | | |

| - | | |

| 79,500 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Redemption of stock issued for prepaid services | |

| - | | |

| - | | |

| - | | |

| - | | |

| (650,000 | ) | |

| (650 | ) | |

| (1,242,350 | ) | |

| 650,000 | | |

| - | | |

| - | | |

| (1,243,000 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Redemption of warrants issued for prepaid services | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1,649,518 | ) | |

| - | | |

| - | | |

| - | | |

| (1,649,518 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Options issued for services | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 37,170 | | |

| - | | |

| - | | |

| - | | |

| 37,170 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,438,371 | | |

| 1,438,371 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, June 30, 2023 | |

| 50,000 | | |

$ | 500 | | |

| 270,612 | | |

$ | 2,706 | | |

| 8,151,534 | | |

$ | 8,151 | | |

$ | 5,495,390 | | |

| 691,250 | | |

$ | - | | |

$ | (7,076,964 | ) | |

$ | (1,570,217 | ) |

For

the three months ended June 30, 2022

| | |

Preferred Stock | | |

| | |

| | |

Additional | | |

| | |

| | |

| | |

Total | |

| | |

Series A | | |

Series B Convertible | | |

Common Stock | | |

Paid In | | |

Treasury Stock | | |

Accumulated | | |

Stockholders’ | |

| | |

Shares | | |

Par Value | | |

Shares | | |

Par Value | | |

Shares | | |

Par Value | | |

Capital | | |

Shares | | |

Cost | | |

Deficit | | |

Deficit | |

| Balance March 31,2022 | |

| 50,000 | | |

$ | 500 | | |

| 595,612 | | |

$ | 5,956 | | |

| 7,001,534 | | |

$ | 7,002 | | |

$ | 4,817,495 | | |

| 41,250 | | |

$ | - | | |

$ | (5,629,087 | ) | |

$ | (798,134 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock issued for commitment fee debt discount on note payable | |

| - | | |

| - | | |

| - | | |

| - | | |

| 82,500 | | |

| 82 | | |

| 206,168 | | |

| - | | |

| - | | |

| - | | |

| 206,250 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock issued for cash | |

| - | | |

| - | | |

| - | | |

| - | | |

| 30,000 | | |

| 30 | | |

| 37,470 | | |

| - | | |

| - | | |

| - | | |

| 37,500 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Conversion of preferred B stock to common stock | |

| - | | |

| - | | |

| (325,000 | ) | |

| (3,250 | ) | |

| 325,000 | | |

| 325 | | |

| 2,925 | | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock issued for services | |

| - | | |

| - | | |

| - | | |

| - | | |

| 160,000 | | |

| 160 | | |

| 287,840 | | |

| - | | |

| - | | |

| - | | |

| 288,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (667,351 | ) | |

| (667,351 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, June 30, 2022 | |

| 50,000 | | |

$ | 500 | | |

| 270,612 | | |

$ | 2,706 | | |

| 7,599,034 | | |

$ | 7,599 | | |

$ | 5,351,898 | | |

| 41,250 | | |

$ | - | | |

$ | (6,296,438 | ) | |

$ | (933,735 | ) |

For

the nine months ended June 30, 2023

| | |

Preferred Stock | | |

| | |

| | |

Additional | | |

| | |

| | |

| | |

Total | |

| | |

Series A | | |

Series B Convertible | | |

Common Stock | | |

Paid-In | | |

Treasury Stock | | |

Accumulated | | |

Stockholders’ | |

| | |

Shares | | |

Par Value | | |

Shares | | |

Par Value | | |

Shares | | |

Par Value | | |

Capital | | |

Shares | | |

Cost | | |

Deficit | | |

Deficit | |

| Balance September 30, 2022 | |

| 50,000 | | |

$ | 500 | | |

| 270,612 | | |

$ | 2,706 | | |

| 8,059,034 | | |

$ | 8,059 | | |

$ | 7,595,246 | | |

| 41,250 | | |

$ | - | | |

$ | (6,809,185 | ) | |

$ | 797,326 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock issued for services | |

| - | | |

| - | | |

| - | | |

| - | | |

| 542,500 | | |

| 542 | | |

| 93,833 | | |

| - | | |

| - | | |

| - | | |

| 94,375 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Options issued for services | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 37,170 | | |

| - | | |

| - | | |

| - | | |

| 37,170 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Common stock issued for prepaid services | |

| - | | |

| - | | |

| - | | |

| - | | |

| 200,000 | | |

| 200 | | |

| 297,800 | | |

| - | | |

| - | | |

| - | | |

| 298,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Redemption of stock issued for prepaid services | |

| - | | |

| - | | |

| - | | |

| - | | |

| (650,000 | ) | |

| (650 | ) | |

| (1,242,350 | ) | |

| 650,000 | | |

| - | | |

| - | | |

| (1,243,000 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Redemption of warrants issued for prepaid services | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1,649,518 | ) | |

| - | | |

| - | | |

| - | | |

| (1,649,518 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Warrants issued for prepaid services | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 363,209 | | |

| - | | |

| - | | |

| - | | |

| 363,209 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (267,779 | ) | |

| (267,779 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, June 30, 2023 | |

| 50,000 | | |

$ | 500 | | |

| 270,612 | | |

$ | 2,706 | | |

| 8,151,534 | | |

$ | 8,151 | | |

$ | 5,495,390 | | |

| 691,250 | | |

$ | - | | |

$ | (7,076,964 | ) | |

$ | (1,570,217 | ) |

For

the nine months ended June 30, 2022

| | |

Preferred Stock | | |

| | |

| | |

Additional | | |

| | |

| | |

| | |

Total | |

| | |

Series A | | |

Series B Convertible | | |

Common Stock | | |

Paid-In | | |

Treasury Stock | | |

Accumulated | | |

Stockholders’ | |

| | |

Shares | | |

Par Value | | |

Shares | | |

Par Value | | |

Shares | | |

Par Value | | |

Capital | | |

Shares | | |

Cost | | |

Deficit | | |

Deficit | |

| Balance September 30, 2021 | |

| 50,000 | | |

$ | 500 | | |

| 595,612 | | |

$ | 5,956 | | |

| 6,900,284 | | |

$ | 6,900 | | |

$ | 4,518,347 | | |

| - | | |

$ | - | | |

$ | (5,139,076 | ) | |

$ | (607,373 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock issued for services | |

| - | | |

| - | | |

| - | | |

| - | | |

| 220,000 | | |

| 220 | | |

| 380,780 | | |

| - | | |

| - | | |

| - | | |

| 381,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock issued for cash | |

| - | | |

| - | | |

| - | | |

| - | | |

| 30,000 | | |

| 30 | | |

| 37,470 | | |

| - | | |

| - | | |

| - | | |

| 37,500 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock issued for commitment fee debt discount on note payable | |

| - | | |

| - | | |

| - | | |

| - | | |

| 165,000 | | |

| 165 | | |

| 412,335 | | |

| - | | |

| - | | |

| - | | |

| 412,500 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Redemption of previously issued commitment shares | |

| - | | |

| - | | |

| - | | |

| - | | |

| (41,250 | ) | |

| (41 | ) | |

| 41 | | |

| 41,250 | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Conversion of preferred B stock to common stock | |

| - | | |

| - | | |

| (325,000 | ) | |

| (3,250 | ) | |

| 325,000 | | |

| 325 | | |

| 2,925 | | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1,157,362 | ) | |

| (1,157,362 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, June 30, 2022 | |

| 50,000 | | |

$ | 500 | | |

| 270,612 | | |

$ | 2,706 | | |

| 7,599,034 | | |

$ | 7,599 | | |

$ | 5,351,898 | | |

| 41,250 | | |

$ | - | | |

$ | (6,296,438 | ) | |

$ | (933,735 | ) |

The

accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Virtual

Interactive Technologies Corp.

Condensed

Consolidated Statements of Cash flows

For

the Nine Months Ended June 30, 2023 and 2022

(UNAUDITED)

| |

|

June 30, 2023 |

|

|

June 30, 2022 |

|

| | |

For the nine months ended, | |

| |

|

June 30, 2023 |

|

|

June 30, 2022 |

|

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | |

| Net loss | |

$ | (267,779 | ) | |

$ | (1,157,362 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Stock issued for services | |

| 94,375 | | |

| 381,000 | |

| Amortization of debt discount | |

| 207,314 | | |

| 310,203 | |

| Net reversal of amortization of prepaid stock-based compensation | |

| (275,094 | ) | |

| - | |

| Options issued for services | |

| 37,170 | | |

| | |

| Changes in operating assets and operating liabilities: | |

| | | |

| | |

| Interest receivable | |

| (1,122 | ) | |

| (1,347 | ) |

| Royalties receivable | |

| 1,430 | | |

| 26,202 | |

| Accounts payable and accrued liabilities | |

| 75,938 | | |

| (34,714 | ) |

| Accrued interest payable, related party | |

| - | | |

| 42,372 | |

| Accrued interest payable | |

| 93,222 | | |

| 18,016 | |

| Net cash used in operating activities | |

| (34,546 | ) | |

| (415,630 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| - | | |

| - | |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Proceeds from notes payable | |

| - | | |

| 434,750 | |

| Proceeds from sale of common stock | |

| - | | |

| 37,500 | |

| Payment on notes payable, related parties | |

| - | | |

| (235,000 | ) |

| Net cash provided by financing activities | |

| - | | |

| 237,250 | |

| | |

| | | |

| | |

| Net change in cash and cash equivalents | |

| (34,546 | ) | |

| (178,380 | ) |

| | |

| | | |

| | |

| Cash and cash equivalents, beginning of period | |

| 36,378 | | |

| 251,064 | |

| | |

| | | |

| | |

| Cash and cash equivalents, end of period | |

$ | 1,832 | | |

$ | 72,684 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| Interest paid | |

$ | - | | |

$ | 14,769 | |

| Income taxes paid | |

$ | - | | |

$ | - | |

| Non-cash Investing and Financing Activities: | |

| | | |

| | |

| Debt discount on notes payable | |

$ | - | | |

$ | 35,250 | |

| Stock issued for commitment fee debt discount on note payable | |

$ | - | | |

$ | 412,500 | |

| Common stock issued for prepaid services | |

$ | 298,000 | | |

$ | - | |

| Redemption of common stock and warrants issued

for prepaid services | |

$ | 2,892,518 | | |

| - | |

| Warrants issued for prepaid services | |

$ | 363,209 | | |

$ | - | |

The

accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

VIRTUAL

INTERACTIVE TECHNOLOGIES CORP.

Notes

to Unaudited Condensed Consolidated Financial Statements

For

the Nine Months Ended

June

30, 2023

Note

1. Basis of Presentation

While

the information presented in the accompanying June 30, 2023 financial statements is unaudited and condensed, it includes all adjustments

which are, in the opinion of management, necessary to present fairly the financial position, results of operations and cash flows for

the periods presented in accordance with the accounting principles generally accepted in the United States of America (“US GAAP”).

In the opinion of management, all adjustments considered necessary for a fair presentation of the results of operations and financial

position have been included and all such adjustments are of a normal recurring nature. Certain information and footnote disclosures normally

included in financial statements prepared in accordance with US GAAP have been condensed or omitted. These financial statements should

be read in conjunction with the Company’s September 30, 2022 audited financial statements (and notes thereto). Operating results

for the three and nine months ended June 30, 2023 are not necessarily indicative of the results that can be expected for the year ending

September 30, 2023.

The

accompanying unaudited condensed consolidated financial statements herein contain the operations of Virtual Interactive Technologies

Corp. (OTCPINK: VRVR), and its wholly-owned subsidiaries Advanced Interactive Gaming Inc. (“AIG Inc.”) and Advanced Interactive

Gaming Ltd. (“AIG Ltd”) (collectively, the “Company” or “VIT”). All significant intercompany amounts

have been eliminated.

Note

2. Business

Nature

of Operations

The

Company is a next generation game and metaverse developer that creates immersion experiences by harnessing the latest technologies, including

Blockchain and digital assets. The Company’s newly launched brand, Extrosive, is building a metaverse that replaces traditional

boring financial experiences with a new paradigm, “global Prosperity space” (gPs). This new asset class dynamically augments

global and local realities and builds communities of aligned financial values, virtuous economies, and a trusted network. The result

would be a metaverse game for the glamourous world of Wall Street, High-Speed trading involving community building, quantified self,

and NFTs – a pure adrenal rush! In addition, the Company continues to build on its successful catalog that includes Carmageddon

Max Damage, Carmageddon Crashers, Interplanetary: Enhanced Edition, Catch & Release, and Worbitol. The Company also entered into

a joint development partnership with Duane Lee “Dog” Chapman, of the “Dog The Bounty Hunter” fame, to develop

and promote multiple games across several platforms.

Use

of Estimates

The

preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect certain

reported amounts and disclosures of contingent assets and liabilities at the dates of the financial statements and the reported amounts

of revenues and expenses during the reporting periods. Actual results could differ from those estimated.

Cash

Equivalents

The

Company considers all highly liquid instruments purchased with original maturities of three months or less to be cash equivalents. The

Company had no cash equivalents at June 30, 2023 or September 30, 2022.

Fair

Value of Financial Instruments

The

Company accounts for fair value measurements in accordance with accounting standard ASC 820-10-50, “Fair Value Measurements.”

ASC 820 defines fair value and establishes a three-level valuation hierarchy for disclosures of fair value measurement and enhances

disclosure requirements for fair value measures. The three levels are defined as follows:

| |

- |

Level

1 inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets. |

| |

|

|

| |

- |

Level

2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that

are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument. |

| |

|

|

| |

- |

Level

3 inputs to valuation methodology are unobservable and significant to the fair measurement. |

The

Company’s financial instruments consist of cash, royalties receivable, notes receivable and related accrued interest receivable,

accounts payable and accrued expenses, and notes payable and related accrued interest payable. The carrying value of these financial

instruments approximates fair value due to the short-term nature of the instruments.

Net

Income (Loss) Per Share

In

accordance with ASC 260 “Earnings per Share,” the basic net income (loss) per share (“EPS”) is

computed by dividing the net loss available to common stockholders by the weighted average number of common shares outstanding

during the period, excluding the effects of any potentially dilutive securities. Diluted EPS is computed by dividing the net loss

available to common stockholders by the weighted average number of common shares outstanding adjusted on an

“if-converted” basis. During the three and nine months ended June 30, 2023 and 2022, the Company had 270,612 and 595,612 shares,

respectively, of Series B Convertible Preferred stock issued and outstanding that are convertible into shares of common stock on a

one-for-one basis. During the three and nine month ended June 30, 2023 and 2022, the Company had 250,000 and

-0-

vested options outstanding respectively. Applying the treasury method, the dilutive effect on the options was 160,714

shares on June 30, 2023. In addition, in March 2022 the Company issued two $235,000 convertible notes that are convertible into

common shares at $1.25 per share. The dilutive effect of these convertible notes was 443,270 and 403,303 shares on June 30, 2023 and

2022 respectively. These potentially dilutive securities were excluded from the EPS computation due to their anti-dilutive effect

resulting from the Company’s net losses during the three months ended June 30, 2022, and nine months ended June 30, 2023 and

2022.

Stock

Based Compensation

We

follow ASC Topic 718, Compensation–Stock Compensation, which prescribes accounting and reporting standards for all

share-based payment transactions in which employee and non-employee services are acquired. Share-based payments to employees and

non-employees, including grants of stock warrants, are recognized as compensation expense in the financial statements based on the

stock awards’ fair values on the grant date. That expense is recognized over the period required to provide services in

exchange for the award, known as the requisite service period (usually the vesting period). Upon repurchase of the award, any

unrecognized compensation, net of cash payments are expensed immediately. Awards forfeited due to unfulfillment of obligations, such

as termination of employment prior to the award being fully vested, for no cash or other consideration, are not recognized as an

expense and any previously recognized costs are reversed in the period of forfeiture.

Foreign

Currency

The

Company’s functional currency is the US dollar. With the exception of stockholders’ equity (deficit), all transactions that

are originally denominated in foreign currency are translated to US dollars by our international customers, on a monthly basis, when

recognized by them and prior to paying royalties to the Company. All royalty revenues that are received and recognized by the Company

are recorded in US dollars.

Foreign

currency translation gains/losses are recorded in other accumulated comprehensive income (“AOCI”) based on exchange rates

prevalent on reporting dates for balance sheet items, and at weighted average exchange rates during the reporting period for the statement

of operations. Foreign currency transaction gains/losses are recorded as other income (expense) in the period of settlement. No AOCI

items were present during the three and nine months ended June 30, 2023 and 2022, as all financial statement items were denominated in

the US dollar. Losses from foreign currency transactions during the three months ended June 30, 2023 and 2022 totaled $422

and $79,

respectively, and $406 and $650 during the nine months ended June 30, 2023 and 2022, respectively.

Concentration

of Credit Risk

Some

of our US dollar balances are held in a Bermuda bank that is not insured. As of June 30, 2023 and September 30, 2022, uninsured deposits

in the Bermuda bank totaled $250 and $20,495, respectively. Our management believes that the financial institution is financially sound,

and the risk of loss is low. The Company is in the process of migrating all of its banking to the institutions in the United States,

which are insured by the FDIC up to $250,000.

Revenue

Recognition

The

Company follows the guidance contained in ASC 606, “Revenue Recognition.” The core principle of ASC 606 is that an

entity should recognize revenue to depict the transfer of goods of services to customers in an amount that reflects the consideration

to which the entity expects to be entitled in exchange for those goods or services. ASC 606 outlines the following five-step revenue

recognition model (along with other guidance impacted by this standard): (1) identify the contract with the customer; (2) identify the

performance obligations in the contract; (3) determine the transaction price; (4) allocate the transaction price to the performance obligations;

(5) recognize revenue when or as the entity satisfies a performance obligation.

Revenue

- Royalties

The

Company enters into agreements with third-party developers that require us to make payments for game development and production services.

In exchange for our payments, we receive the exclusive publishing and distribution rights to the finished game titles as well as, in

some cases, the underlying intellectual property rights. The Company has several contracts with video game developers that entitle us

to royalty streams as a percentage of revenues generated by the game sales, which vary from contract to contract. As of June 30, 2023,

the Company has four royalty contracts with three developers that are generating royalty revenue.

Once

a game has been developed and has met the terms of the underlying royalty agreement, the game is released for commercial sales. Per each

contract, the Company will receive reports on a regular basis from the game developers’ sales platforms that identify the amount

of game sales, from which consideration expected to be collected from the commercial customers is computed based on the applicable royalty

percentages. Royalty revenue is based on a percentage of net receipts as defined in each customer agreement and is recognized in accordance

with the sale-based royalty provisions of ASC 606, which requires revenue recognition after the subsequent sales occur. The Company’s

performance obligation under each royalty contract as an investor in the game is complete once funds are advanced to the gaming developer.

Subsequent consideration is then received by the Company from the developers in the amount of the Company’s percentage fee of royalty

income (net receipts) received by the customer. Net receipts include all gross revenues received by the customer as a result of sales

of the games or related exploitation less certain taxes, refunds, manufacturing costs, freight, and other items specified in the underlying

contract.

During

the three months ended June 30, 2023 and 2022, the Company recognized revenue from royalties of $35,136 and $20,689, respectively. During

the nine months ended June 30, 2023 and 2022, the Company recognized revenue from royalties of $110,733 and $80,719, respectively.

Royalties

Receivable

The

Company provides an allowance for doubtful accounts equal to the estimated uncollectible royalties. The Company’s estimate is based

on historical collection experience and a review of the current status of royalties receivable. It is reasonably possible that the Company’s

estimate of the allowance for doubtful accounts will change and that losses ultimately incurred could differ materially from the amounts

estimated in determining the allowance. The Company had royalties receivable of $82,214 and $83,644 at June 30, 2023 and September 30,

2022, respectively, and has determined that no allowance is necessary.

Going

Concern

The

accompanying consolidated financial statements have been prepared in conformity with US GAAP, which contemplates the Company’s

continuation as a going concern. The Company has not established profitable operations and has incurred significant losses since its

inception. The Company’s plan is to grow significantly over the next few years through strategic game development partnerships,

through internal game development and through the acquisition of independent game development companies globally.

The

Company has taken much of the cash flow from its first royalty agreement and has invested in royalty agreements for the development of

several other video games. By continuing to reinvest these royalties into agreements to develop new games, along with actively managing

corporate overhead, management’s plan is to substantially increase its video game royalty portfolio and cash flow over the next

several years. The Company intends to continue to grow its game portfolio over the next several years, focusing on console games, virtual

reality games and mobile games.

There

are no assurances that the Company will be able to either (1) achieve a level of revenues adequate to generate sufficient cash flow from

operations; or (2) obtain additional financing through either private placement, public offerings and/or debt financing necessary to

support its working capital requirements. To the extent that funds generated from operations and any private placements, public offerings

and/or debt financing are insufficient, the Company will have to raise additional working capital. No assurance can be given that additional

financing will be available, or if available, will be on terms acceptable to the Company. If adequate working capital is not available

to the Company, it may be required to curtail or cease its operations.

Due

to uncertainties related to these matters, there exists a substantial doubt about the ability of the Company to continue as a going concern.

The accompanying consolidated financial statements do not include any adjustments related to the recoverability or classification of

asset-carrying amounts or the amounts and classification of liabilities that may result should the Company be unable to continue as a

going concern.

New

Accounting Pronouncements

The

Company has evaluated all recently issued or enacted accounting pronouncements, and has determined that all such pronouncements either

do not apply or their impact is insignificant to the financial statements.

Note

3. Stockholders’ Equity (Deficit)

The

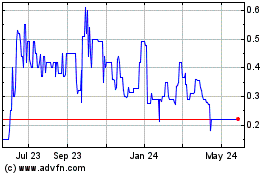

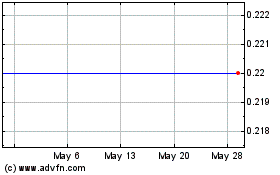

Company’s common stock is quoted under the symbol “VRVR” on the OTC Pink tier operated by OTC Markets Group, Inc. To

date, an active trading market for the Company’s common stock has not developed.

Treasury

Stock

The

Company accounts for treasury stock using the cost method. During the three months ended June 30, 2022, the Company acquired 41,250 shares

at $0 cost of its then-issued and outstanding common stock pursuant to a claw-back provision in one of its notes payable (Note 4). At

June 30, 2023 and September 30, 2022, the Company held these shares in the treasury.

During

the three months ended June 30, 2023, the Company acquired 200,000

shares at a $0

cost of its then-issued and outstanding common stock pursuant to a termination agreement dated May 17, 2023, regarding an agreement

dated October 26, 2022. Under the termination agreement, 200,000

shares that had been previously granted by the Company were returned to the Company treasury. On July 5, 2023, the Company acquired 450,000

shares at $0 cost pursuant to a termination agreement with two groups due to non-performance on an agreement dated August 16, 2022

(see Note 7). Because the non-performance was apparent on June 30, 2023, this transaction was deemed to be a type 1 subsequent

event. As such, the accounting treatment was reflected retroactively to June 30, 2023, and 450,000

shares were returned to the treasury.

At June 30, 2023 and September 30, 2022, the Company held 691,250 and 41,250

shares in treasury at $0 cost.

Common

Stock

The

Company is authorized to issue 90,000,000 shares of common stock at par value of $0.001. On June 30, 2023, the Company had 8,842,784

shares issued and 8,151,534 shares outstanding, with 941,250 shares held as treasury stock. On September 30, 2022, the Company had 8,100,284

shares issued and 8,059,034 shares outstanding, with 41,250 shares held as treasury stock.

On

August 16, 2022, the Company entered into a one-year agreement with two groups to assist the Company with creating interactive

gaming and entertainment experiences, including metaverse, utilizing blockchain and Non-Fungible Tokens, as well as assisting the

Company with investor and public relations. As part of the agreement, each group received 225,000 shares

which were valued at $2.10 per

share and a total expense of $945,000 was

recorded as prepaid expense and was to be amortized over the life of the contract. On July 5, 2023, the Company entered into a

termination agreement with these two groups due to non-performance, whereby the shares were returned to the Company’s treasury

(see Note 7). Because the non-performance was apparent on June 30, 2023, this transaction was deemed to be a type 1 subsequent

event. As such, the accounting treatment was reflected retroactively to June 30, 2023 and 450,000 shares

were returned to the treasury. The parties negotiated a cash payment of $45,000

for services rendered, which was expensed during the nine months ended June 30, 2023 and is reflected in accounts payable and

accrued liabilities at June 30, 2023. Under ASC Topic 718 Compensation - Stock Compensation, awards forfeited due to unfulfillment

of obligations are not recognized as an expense, and any previously recognized costs are reversed in the period of forfeitures. No

additional amortization of the prepaid expense was recorded during the three months ended June 30, 2023, and the previously-recorded

expense from the contract’s inception through March 31, 2023 of $587,712

was reversed on June 30, 2023 and reflected as a reduction to professional fees in the consolidated statements of operations.

On

October 26, 2022, the Company entered into a one-year agreement with a group to assist the Company with creating a customized

positive investment image and communicate that image to the investment community. As part of the agreement, they received 200,000 shares

which were valued at $1.49 per

share and a total of $298,000 was

recorded as prepaid expense to be amortized over the life of the contract. On May 17, 2023, the Company entered into a termination

agreement due to non-performance, whereby the 200,000 shares

were returned to the Company’s treasury. Under ASC Topic 718 Compensation - Stock Compensation, awards forfeited due to

unfulfillment of obligations are not recognized as an expense, and any previously recognize costs are reversed in the period of

forfeitures. No additional amortization of the prepaid expense was recorded during the three months ended June 30, 2023, and the

previously-recorded expense from the contract’s inception through March 31, 2023 of $127,364

was reversed on June 30, 2023 and reflected as a reduction to professional fees in the consolidated statements of operations.

On

November 28, 2022, the Company entered into a four-month agreement with a group to assist the Company with product awareness program

and to conduct customer lead generation activities. Under the agreement the Company agreed to issue the group 12,500 shares during each

month of the agreement. During the three months ended December 31, 2022, the Company issued 12,500 shares of common stock, which were

valued at $1.19 per share. The total expense recognized for the three months ended December 31, 2022 was $14,875. Work on this contract

was temporarily paused after one month so no further payments were made, and the Company is currently renegotiating the contract with

the vendor.

On

June 5, 2023, the Company’s Board of Directors approved the grant of 530,000

shares of common stock in total to three contractors and to three directors. The shares were valued at $0.15

per share, which was the closing price of the Company’s stock on the grant date. An expense of $79,500

was recognized for the quarter ended June 30, 2023.

Preferred

Stock

The

Company is authorized to issue 10,000,000 each of Series A and B preferred shares at a par value of $0.01. Series A preferred shares

are not convertible, whereas Series B preferred shares are convertible into common stock on a one-for-one basis at the option of the

holder and there is no redemption feature.

At

June 30, 2023 and September 30, 2022, the Company had 50,000

shares of Series A preferred stock and 270,612 shares of Series B convertible preferred stock issued and outstanding.

Warrants

In

connection with the August 16, 2022 agreements under “Common Stock” above, the Company issued one-year warrant to purchase

225,000

common shares at $1.00

and a two-year warrant to purchase 225,000

common shares at $1.00.

On the date of the grant, the Company elected to treat the warrants as a single award, and valued the warrants of 1 and 2 years, expected

volatility of 109.88%,

risk-free rate of 3.28%

and no dividend yield. The total expense of $1,286,309

was being amortized over the life of the contract.

On July 5, 2023, the Company entered into a termination agreement with these two groups due to non-performance, whereby the warrants

were forfeited. Because the non-performance was apparent at June 30, 2023, this transaction was deemed to be a type 1 subsequent event.

As such, the accounting treatment was reflected retroactively to June 30, 2023 and the 900,000

warrants were cancelled. Under ASC Topic 718

Compensation - Stock Compensation, awards forfeited due to unfulfillment of obligations are not recognized as an expense, and any previously

recognized costs are reversed in the period of forfeitures. No additional expense was recorded during the three months ended June 30,

2023, and the previously-recorded expense from the contract’s inception through March 31, 2023 of $799,978

was reversed on June 30, 2023 and reflected as a reduction to professional fees in the consolidated statements of operations.

In

connection with the October 26, 2022 agreement under “Common Stock” above, the Company issued a one-year warrant to purchase

200,000

common shares at $1.00

and a two-year warrant to purchase 200,000

common shares at $1.00.

On the date of the grant, the Company elected to treat the warrants as a single award, and valued the warrants at $363,209

using the Black-Scholes option pricing model

with the following assumptions: expected life of the options of 1

and 2

years, expected volatility of 111.16%,

risk-free rate of 4.75%

and no dividend yield. On May 17, 2023, the Company entered into a termination agreement with the group whereby the 400,000

warrants were cancelled. Under ASC Topic 718

Compensation - Stock Compensation, awards forfeited due to unfulfillment of obligations are not recognized as an expense, and any previously

recognize costs are reversed in the period of forfeitures. No additional expense was recorded during the three months ended June 30,

2023, and the previously-recorded expense from the contract’s inception through March 31, 2023 of $155,235 was reversed on June

30, 2023 and reflected as a reduction to professional fees in the consolidated statements of operations.

The

following table reflects a summary of Common Stock warrants outstanding and warrant activity during the nine months ended June 30,

2023:

Schedule of Common Stock Warrants Outstanding and Warrant Activity

| | |

Underlying Shares | | |

Weighted

Average Exercise

Price | | |

Weighted

Average Term

(Years) | |

| Warrants outstanding at September

30, 2022 | |

| 900,000 | | |

| 1.00 | | |

| 1.38 | |

| Granted | |

| 400,000 | | |

| 1.00 | | |

| 1.07 | |

| Exercised | |

| - | | |

| - | | |

| - | |

| Forfeited | |

| (1,300,000 | ) | |

| 1.00 | | |

| - | |

| Warrants

outstanding and exercisable at June 30, 2023 | |

| - | | |

$ | 1.00 | | |

| - | |

The

intrinsic value of warrants outstanding as of June 30, 2023 was $-0-, as the exercise price exceeded the Company’s stock price.

Options

In

connection with a consulting agreement with the Company’s new Director dated June 5, 2023, the Company issued a ten-year

option to purchase 1,000,000

common shares at $0.15

per share. The option to purchase 250,000

shares vested immediately and the option to purchase an additional 250,000

will vest on the anniversary date of the agreement in each of the following three years. On the date of the grant, the Company

valued the option at $148,679

using the Black-Scholes option pricing model with the following assumptions: expected life of the options of 10

years, expected volatility of 163.36%,

risk-free rate of 3.66%

and no dividend yield. The options are being expensed over the vesting period and an expense of $37,170

was recognized during the three months ended June 30, 2023.

Schedule of Option Activity

| | |

Underlying Shares | | |

Weighted

Average Exercise

Price | | |

Weighted

Average Term

(Years) | |

| Options outstanding at September 30, 2022 | |

| - | | |

| - | | |

| - | |

| Granted | |

| 1,000,000 | | |

| 0.15 | | |

| 9.94 | |

| Exercised | |

| - | | |

| - | | |

| - | |

| Forfeited | |

| - | | |

| - | | |

| - | |

| Options outstanding at June 30, 2023 | |

| 1,000,000 | | |

| 0.15 | | |

| 9.94 | |

| Options

exercisable at June 30, 2023 | |

| 250,000 | | |

$ | 0.15 | | |

| 9.94 | |

The

intrinsic value of options outstanding as of June 30, 2023 was $270,000.

Note

4. Notes and Convertible Notes Payable

On

March 20, 2019, an unrelated individual loaned VRVR $10,000.

The note carries a 6%

interest rate and was initially payable March 20, 2020, and then amended on July 27, 2022 to mature on March 20, 2024. The maturity date

has been extended to March 20, 2025. As of June 30, 2023 and September 30, 2022, the note balance was $10,000,

and accrued interest on the note totaled $2,569

and $2,121,

respectively.

On

September 23, 2021, an unrelated third party loaned VRVR $235,000 that consisted of cash received by the Company in the amount of $217,375

and an original issue discount of $17,625. This discount was amortized over the life of the note commencing October 1, 2021. The note

carried a 12.5% annual interest rate and matured on March 23, 2022. Under the terms of the agreement, the Company paid any accrued interest

on a monthly basis. In addition, under the terms of the agreement, the Company issued 82,500 commitment shares to the holder at $2.00

per share and an expense of $165,000 was applied as an additional discount to the note and amortized over the life of the note. The Company

had the right to redeem 41,250 of the commitment shares if the note was repaid on or before the maturity date. On September 30, 2021,

principal and accrued interest totaled $235,000 and $571, respectively. On March 23, 2022, the note payable balance of $235,000 and unpaid

interest of $1,958 were repaid in full in the amount of $236,958. During the period of October 1, 2021 through March 23, 2022, interest

payments totaling $12,811 were made, resulting in $14,769 total interest payments during the nine months ended June 30, 2022, and $0

principal and interest balances at June 30, 2022. As a result of this repayment, 41,250 of the commitment shares were redeemed at $0

cost and are being held in treasury.

On

March 15, 2022, an unrelated third party loaned VRVR $235,000 that consisted of cash received by the Company in the amount of $217,375

and an original issue discount of $17,625. This discount was amortized over the life of the note commencing March 15, 2022. The

note carries a 15% annual interest rate and matured on March 15, 2023. As of June 30, 2023 and September 30, 2022, the note balance was

$235,000 and $235,000, respectively, and the accrued interest was $45,584 and $19,218, respectively. The note is convertible at a price

of $1.25 per share. As of March 15, 2023, the note was in default. On March 28, 2023, June 9, 2023 and July 13, 2023, the Company paid

a total of $10,000 to extend the maturity date to August 31, 2023. These fees are included in interest expense on the statements of operations.

On