false

0000943535

0000943535

2024-07-02

2024-07-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of The Securities and Exchange Act of 1934

Date

of Report (Date of earliest event reported): July 2, 2024

WORLD

HEALTH ENERGY HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

000-30256 |

|

59-2762023 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

1825

NW Corporate Blvd. Suite 110

Boca

Raton, FL 33431

(Address

of principal executive offices, including zip code)

(561)

870-0440

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)). |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| None |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01. Entry into a Material Definitive Agreement.

On

July 2, 2024, World Health Energy Holdings, Inc., a Delaware corporation ( “WHEN”), entered into and executed an agreement

(the “Agreement”) with Intent HQ Limited (“IHQ”), a company incorporated under the laws of England and Wales

pursuant to which IHQ Invested and granted to WHEN a worldwide, royalty-free, perpetual, nonexclusive, sublicensable, irrevocable license

to IHQ’s Edge SDK, in both source-code and object-code formats and associated documentation (collectively, the “Perpetual

License”). In consideration of the Perpetual License. WHEN undertook to issue on or prior to July 13, 2024, 25,038,272,832 shares

(the “Consideration Shares”) of WHEN’s common stock, par value $0.00001 per share (the “Common Stock”).

The Consideration Shares represents approximately 4.8% of the issued and outstanding share capital of WHEN following such issuance. Under

the terms of the Agreement, IHQ also undertook to provide professional consulting services to enable WHEN to implement, develop and commercialize

its own and joined products based on the product materials or any portions or derivative works thereof, all subject to the terms and

conditions set forth therein.

The

strategic alliance represented by this agreement aims to leverage WHEN’s cybersecurity products in combination with IHQ’s

modules to introduce to the market novel products in the cybersecurity field applicable to both the business and individual level.

The

Agreement provides that the Consideration Shares are subject to a Lock Up Agreement for a period of 12 months from the date of their

issuance, but the lock up would be automatically canceled on the date of the Uplisting (as defined below). In addition, the lock up may

be cancelled unilaterally by IHQ, in its sole discretion, in which case the Perpetual License will be considered fully paid. Under the

terms of the Agreement, WHEN undertook to complete an uplisting (the “Uplisting”) of its shares of Common Stock on NYSE,

NASDAQ or the Chicago Board Options Exchange prior to June 28, 2025 (the “Uplisting Target Date”).

Under

the terms of the Agreement, WHEN may at any time prior to the Uplisting Target Date, at its sole discretion without any obligation whatsoever,

pay IHQ in cash $5 million dollar as a license fee for the Perpetual License, upon which the entirety of the Consideration Shares shall

be returned to WHEN. If the Uplisting occurs on or before the Uplisting Target Date, then upon Uplisting the Perpetual License shall

be deemed to have been fully paid for by the issuance of the Consideration Shares, and all of IHQ’s rights of termination of the

Agreement and rights related to cancellation of Lock Up shall terminate and no longer be in force and effect. However, if the Uplisting

does not occur before the Uplisting Target Date and, or WHEN has not paid $5 million license fee for the Perpetual License, then IHQ

has the right, within 30 days of the Uplisting Target Date, to terminate the Agreement and return to WHEN all of the Consideration Shares.

In

the event that WHEN or a subsidiary will raise funds on or prior to December 28, 2025 (the “Target Fundraise Period”) in

connection with, from or relating to the Uplisting (whether or not the Uplisting ultimately occurs) for a specified amount (the “Target

Fundraise”), WHEN is obligated to pay IHQ a marketing advisory fee at a specified the rate for each dollar cumulatively raised

during the Target Fundraise Period over and above the Target Fundraise

The

foregoing description of the Agreement and the Lock Up Agreement are not complete and are subject to and qualified in its entirety by

reference to the Agreement and the Lock Up Agreement, copies of which are filed with this Current Report on Form 8-K as Exhibits 10.1

and 10.2, respectively, and the terms of which are incorporated by reference herein.

Item 3.02 Unregistered Sales of Equity Securities;

The

disclosure set forth under Item 1.01 of this Current Report on Form 8-K is incorporated by reference in this Item 3.02. The issuance

of the Agreed Consideration Shares to IHQ shall be exempt from registration pursuant to Section 4(a)(2) of the Securities Act of 1933,

as amended (the “Act”), as a transaction by the Company not involving a public offering. At the time of their issuance, the

shares of common stock will be deemed to be restricted securities for purposes of the Act and will bear restrictive legends to that effect.

Item

9.01. Financial Statements and Exhibits.

*

Portions of this exhibit (indicated by bracketed asterisks) are omitted in accordance with the rules of the Securities and Exchange Commission

because they are both not material and the Company customarily and actually treats such information as private or confidential.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

WORLD

HEALTH ENERGY HOLDINGS, INC. |

| |

|

|

| Date:

July 8, 2024 |

By: |

/s/

Giora Rozensweig |

| |

|

Giora

Rozensweig |

| |

|

Chief

Executive Officer |

Exhibit

10.1

CERTAIN

INFORMATION HAS BEEN EXCLUDED FOM THE EXHIBIT AS SUCH INFORMATION IS NOT MATERIAL AND WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED

([***]).

INTENT

HQ LIMITED – WORLD HEALTH ENERGY HOLDINGS INC.

AGREEMENT

This

AGREEMENT (“Agreement”) is made and entered into as of July 2, 2024 (the “Effective Date”), by

and between Intent HQ Limited, a company incorporated under the laws of England and Wales under company number 07220983 with

principal offices at St Albans House, 57 – 59 Haymarket, London, SW1Y 4QX, UK (“IHQ”) and World Health

Energy Holdings Inc, a company incorporated under the laws of the State of Delaware, with principal offices at

1825 Nw Corporate Blvd, Suite 110 Boca Raton, Florida 33431 USA) “WHEN”) and the parties herein may be referred

to individually as a “Party” and collectively as the “Parties”).

Background:

WHEREAS,

IHQ has developed and commercializes a software development kit (“SDK”) known as “the Edge SDK” that provides

mobile app owners with a selection of optional tools to access various signals and data from within an end user’s mobile phone

and to apply machine learning and other heuristic algorithms on such data in the app, on the end user’s phone itself, while enabling

the mobile app owner to maintain the privacy of such end user’s personal data (the “Edge SDK”); and

WHEREAS,

WHEN: (i) is a holding company comprised of CrossMobile Sp z o.o., SG 77, Inc. and RNA Ltd, which develops and improves existing cybersecurity

solutions in the business to consumer and business to business marketplace; and (ii) whose Common Stock Shares are currently quoted on

the OTC Markets; and (iii) intends to list its Common Stock Shares on an Approved Stock Exchange; and

WHEREAS,

WHEN desires to obtain from IHQ, and IHQ desires to grant and provide to WHEN: (i) a license to the Edge SDK, in both source-code and

object-code formats, and associated documentation; and (ii) professional consulting services to enable WHEN to implement, develop and

commercialise its own products based on the Product Materials or any portions or derivative works thereof, all subject to the terms and

conditions set forth herein; and

WHEREAS,

IHQ acknowledges that WHEN has its own valuable, proprietary technology and products relating to cybersecurity solutions and both

Parties (while respecting each other’s intellectual property rights and all confidentiality protocols set out herein) intend to

cooperate, develop and improve their respective technologies and products, leveraging any joint development opportunities that may arise

from time to time on terms to be agreed in writing (the “Joint Venture Products”).

NOW,

THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree

as follows:

1. Interpretation;

Definitions

1.1 The

preamble and Schedules hereto constitute an integral part hereof. In the event of any inconsistency between the terms of any Schedule

and this Agreement, this Agreement prevails.

1.2 The

headings of the sections and subsections of this Agreement are for convenience or reference only and are not to be considered in construing

this Agreement.

1.3 In

this Agreement, unless the context otherwise requires:

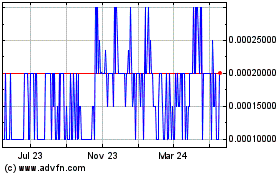

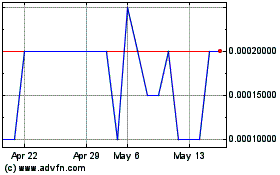

(a) “Agreed

Consideration Shares” means 25,038,272,832 Common Stock Shares, representing an

investment made by IHQ in WHEN in consideration for the USD $5 million Perpetual License fee at a per Common Stock Share effective price

of just under $0.0002 which each Party confirms to be a fair arms-length value of the Common Stock Shares as at the Effective Date).

(b) “Agreement”

means this Agreement and any and all Schedules, and attachments hereto.

(c) Alternative

Future Products” means any new products or services that are materially different to the products or services offered by WHEN

Group as at the date of this Agreement, unless IHQ has otherwise consented in writing to such products or services under Section 18.1.

For the sake of clarification, products and services provided by WHEN as of the date of this Agreement include cybersecurity and telecommunications

related products and services and as such shall not be deemed “Alternative Future Products”.

(d) “Applicable

Law(s)” means any applicable law, regulation, directive, or other binding local, state, federal, and international requirements

(each as may be implemented, amended, extended, superseded, or re-enacted from time to time), including without limitation all applicable

US securities laws and regulations and listing rules of the Approved Stock Exchange.

(e) “Approved

Stock Exchange” means one of the following stock exchanges, as elected by WHEN in its sole discretion: (a) NYSE; or (b) NASDAQ

or (c ) Chicago Board Options Exchange.

(f) “Business

Days” means any day except a Saturday or Sunday, any day which is a federal legal holiday in the United States or the United

Kingdom or any other day on which banking institutions in the State of Florida or the city of London are authorized or required by law

or other governmental action to close.

(g) “Common

Stock Shares” means common stock in WHEN, par value $0.00001 per share.

(h) “Comprehensive

Code” means the computer code that constitutes or is included in the Edge SDK, being the computer code and other materials

described in Schedule A, together with the agreed customizations to reflect agreed functionality, all Updates provided

by IHQ (or its Group Companies) under this Agreement, in each case in both source-code and object-code formats, as further described

in the patents listed in Schedule A (for clarity, the agreed customizations and functionality will reflect the possible customizations

and functionality that IHQ is able to make available to customers generally, as at the Effective Date).

(i) “Derivatives”

has the meaning set out in Section 4.1(b).

(j) “Documentation”

means the specifications, design documents and analyses, programming tools, plans, models, flow charts, reports and drawings, documentation

and any other descriptions related to the Software, which are sufficient to explain the intended functionality of the Software and include

all specifications, design documents and analyses, programming tools, plans, models, flow charts, reports and drawings, documentation

and any other descriptions that IHQ (or its Group Companies) possesses or controls that would be necessary to enable in the installation,

use, development, testing, maintenance, support and modification of the Software.

(k) “Equity

Transfer Date” has the meaning set out in Section 3.1.

(l) “Feature”

means any feature, capability, function, form, tool, module, or other component made available on or via the Software. (For the avoidance

of doubt, the Features are part of the Software, and references herein to Software shall be deemed to include the Features.)

(m) “Group

Company” means, with respect to a Party, an entity (from time to time) which, directly or indirectly, owns or Controls, is

owned or is controlled by, or is under common ownership or control of a Party, where “Control” means the power to

appoint a majority of the members of the board of directors or equivalent governing body of the entity, and “ownership”

means the beneficial ownership of more than fifty percent (50%) of the voting equity securities or other equivalent voting interests

of the entity (and “Group Companies” means every Group Company of a Party).

(n) “Implementation

Services” has the meaning set out in Section 7.1.

(o) “Initial

Code” means the non-customized basic computer code that constitutes or is included in the Edge SDK (iOS and Android), being

the SDK components described in the following dropbox file [******] as updated from time to time at IHQ’s sole discretion in order

to adapt to technical changes in third party mobile operating systems and telecommunications infrastructure.

(p) “Intellectual

Property Rights” means any and all right, title and interest in and to any and all trade secrets, patents, copyrights, service

marks, trademarks, know-how, trade names, rights in trade dress and packaging, moral rights, rights of privacy, publicity and similar

rights of any type, including any applications, continuations or other registrations with respect to any of the foregoing, under the

laws or regulations of any foreign or domestic governmental, regulatory or judicial authority.

(q) “Joint

Venture Products” has the meaning set out in the background section above.

(r) “Lock

Up” has the meaning set out in Section 3.2.

(s) “Lock

Up Period” has the meaning set out in Section 3.2(a).

(t) “Non-Dilutive

WHEN Issuance” means any issuance by WHEN of Common Stock Shares to any of (i) [******], (ii) [******]and provided further

that any issuance of stock options to a director or an officer under the Company’s shareholder approved stock option plans

for services rendered or to be rendered, whether or not subject to milestones (the “ESOP”) shall not be deemed to

be a Non-Dilutive WHEN Issuance so long as the options for Common Stock Shares or Common Stock Shares issued under such ESOP shall not,

in the aggregate exceed [******]% of the then outstanding Common Stock Shares.

(u) “Open

Source Software” means any open source, community or other free code or libraries of any type, including, without limitation,

any code which is made generally available on the Internet without charge (such as, for example purposes only, any code licensed under

any version of the Artistic, BSD, Apache, Mozilla or GNU GPL or LGPL licenses).

(v) “Product

Materials” means the Software and Documentation.

(w) “Software”

means the Initial Code and Comprehensive Code.

(x) “Third

Party Competitor” means: (i) each entity from time to time who directly competes with IHQ or its Group Companies in the licensing

and/or distribution of products and services materially similar to the Edge SDK.

(y) “Underwriter

Lock Up” any lock up of Common Stock Shares that may be demanded by an underwriter in connection with a capital raise undertaken

by WHEN in conjunction with the Uplisting,.

(z) “Uplisting”

means the listing of WHEN’s Common Stock Shares on an Approved Stock Exchange and “Uplisting Date” means the

date of listing of WHEN’s Common Stock Shares on an Approved Stock Exchange.

(aa) “Uplisting

Target Date” means the date that is 12 months immediately following the Effective Date.

(bb) “Uplisting

Transaction” means offering conducted in conjunction with the Uplisting.

(cc) “WHEN

Group” means WHEN and its Group Companies, subject to Section 18.5.

(dd) “WHEN

Products” means any and all products, offerings, distributions and services of WHEN Group that include all or portions of the

Software (including Software incorporated into Derivatives) or are derived from all or any portion of the Product Materials, in all cases

excluding Alternative Future Products.

2. Pre-Transaction

Assistance

2.1 On

and from the Effective Date as soon as practically possible, IHQ will:

| (a) | Work

with WHEN so that a press release agreed in writing between the Parties shall be released

on a date and at a time specified by WHEN. |

| (b) | Provide

up to 50 hours of senior management time assisting WHEN with enquiries regarding the benefits

of the Software and the joint development opportunities between the Parties, including attendance

at investor meetings and management interviews prior to the Uplisting. Unless otherwise agreed

in writing by the Parties, meeting and interview attendance by IHQ personnel will be remote. |

| (c) | Provide

demonstrations of the Software to potential investors, whether or not connected to the Uplisting,

to the extent reasonably requested by WHEN. |

| (d) | Promptly

engage with WHEN to agree a project plan for the testing support and knowledge transfer to

be provided to WHEN under Section 7.1 (IHQ will provide high level training on these elements

during this project plan process; Within 3 weeks of the Equity Transfer Date, IHQ will engage

with WHEN on the mutually agreed integration responsibilities of each Party, the scope of

customizations to the Initial Code and the market positioning of the joint activities described

in this Agreement, with appropriate work plans and timetables. |

| (e) | Engage

in good faith discussions with WHEN regarding the Joint Venture Products and potential joint

development opportunities that leverage both Parties’ technologies and expertise in

their respective products and solutions, with appropriate work plans and timetables. The

Parties may agree to joint ownership and joint commercialization of any jointly developed

products, such agreement to be on terms to be agreed between the parties from time to time. |

3. The

Agreed Consideration Shares

3.1 Within

15 Business Days of the Effective Date, WHEN, through its stock transfer agent, will issue the Agreed Consideration Shares to IHQ as

consideration for the grant under Section 4.1 of the Perpetual License. The date upon which WHEN issues the Agreed Consideration Shares

to IHQ, will be the “Equity Transfer Date”.

3.2 The

Agreed Consideration Shares shall be subject to lock up substantially in the form attached hereto as Schedule F (the “Lock

Up”) provided that:

| (a) | The

Lock Up is in place for 12 months from the Equity Transfer Date, but automatically cancels

on the Uplisting Date if the Uplisting occurs within 12 months of the Equity Transfer Date

(“Lock Up Period”). |

| (c) | The

Lock Up may be cancelled in accordance with Section 5.6. |

3.3 The

Agreed Consideration Shares, and IHQ’s ownership percentage in WHEN (as represented by the Agreed Consideration Shares), shall

not be subject to dilution prior to the Uplisting solely with respect to a Non-Dilutive WHEN Issuance. [******].

3.4 [******].

4. The

Perpetual License

4.1 On

the Equity Transfer Date, and subject to the terms of this Agreement, including the conditions specified in Section 4.2, IHQ grants to

WHEN (for itself and each of its Group Companies) a worldwide, royalty-free, perpetual, nonexclusive, non-assignable (except as provided

herein), sublicensable, irrevocable license (collectively, the “Perpetual License”) to:

| (a) | incorporate

the Product Materials (or parts thereof) into WHEN Products; |

| (b) | incorporate

any derivative works of the Product Materials into WHEN Products (“Derivatives”); |

| (c) | make

(including develop, enhance, customize, document, test, support and maintain), use, offer

to sell and sell, import and otherwise transfer and commercialize (including by license and

sublicense) WHEN Products; |

| (d) | use,

copy, reproduce, modify, publish, create Derivatives of, and distribute Derivatives and the

Product Materials, including in source or object code form; |

| (e) | commercialize,

sell or otherwise distribute WHEN Products incorporating Product Materials or Derivatives;

and |

| (f) | have

any of the foregoing performed on behalf of WHEN and its Group Companies or any authorized

sub-licensee of WHEN. |

4.2 The

Perpetual License is subject to the following conditions:

4.3 Contemporaneous

with the Equity Transfer Date, IHQ will deliver a copy of the Initial Code and related documentation to WHEN. Except as otherwise provided

in Section 5.6 and otherwise herein, and subject to WHEN’s full compliance with the terms of this Agreement, IHQ will deliver an

original copy of the Comprehensive Code and related documentation to WHEN [******]. Upon delivery of the Comprehensive Code to WHEN,

the Comprehensive Code shall be deemed accepted upon WHEN’s successful completion of the activities described in Schedule

B (the “Software Delivery Date”); provided that, if WHEN reasonably determines that the delivered Comprehensive

Code fail to meet the requirements of Schedule B, WHEN will provide IHQ with a written statement of errors no later than

20 Business Days of receipt of the Comprehensive Code, and will endeavor to provide such written statement of errors, if any, as soon

as reasonably possible after receipt of the Comprehensive Code. For the avoidance of doubt, in the event that WHEN does not deliver a

written statement of errors with 20 Business Days of receipt of the Comprehensive Code, it shall be deemed to have accepted the Comprehensive

Code and the Software Delivery Date shall be deemed to be the next calendar day. IHQ will use commercially reasonable efforts to promptly

correct the specified errors within 10 Business Days of the notification of the errors unless the Parties agree on a different timeframe

and provided that WHEN has disclosed all information regarding the errors, as reasonably requested by IHQ.

5. The

Uplisting

5.1 Warranties

and Agreements: The following warranties apply:

| (a) | WHEN

warrants that it will use its reasonable commercial efforts to complete the Uplisting on

or prior to the Uplisting Target Date; |

| (b) | WHEN

warrants that World Health Energy Holdings, Inc, is the WHEN Group entity carrying out the

Uplisting, not another Group Company or associated entity of the WHEN Group and |

| (c) | IHQ

warrants and agrees that upon Uplisting, the Perpetual License shall be deemed to have been

fully paid for by the issuance of the Agreed Consideration Shares [******] |

5.2 Consulting:

In the event that WHEN or any other WHEN Group Company raises funds during the 18 month period following the Effective Date of this

Agreement (the “Target Fundraise Period”) in connection with, from or relating to the Uplisting (whether or not the

Uplisting ultimately occurs) for any amount that exceeds [******] (the “Target Fundraise”), WHEN will pay IHQ a marketing

advisory fee at the rate of 15% for each dollar cumulatively raised by WHEN or any other WHEN Group Company during the Target Fundraise

Period over and above the Target Fundraise regardless of the number of capital fund raises that take place during the Target Fundraise

Period. Such fee will be calculated by WHEN and preliminarily confirmed to IHQ in writing within 20 Business Days’ of the close

of each capital fund raise, subject to final confirmation by WHEN’s accounting staff, and notwithstanding such confirmations, will

in all cases be paid to IHQ by no later than the 20th day following the end of WHEN’s fiscal quarter in which the funds

were raised and by direct bank transfer. IHQ will issue an invoice to WHEN for all amounts properly due. [******].

5.3 Cash

Payment: At any time prior to the Uplisting, WHEN may, at its sole discretion without any obligation whatsoever, pay IHQ in cash

and cleared funds USD $5 million dollar as a license fee for the Perpetual License, upon which the entirety of the WHEN Agreed Consideration

Shares shall be returned to WHEN. On the date that WHEN does pay IHQ the USD $5 million dollar license fee in cleared funds, IHQ’s

right under Section 5.5 no longer applies and Section 5.5 is deemed deleted from this Agreement.

5.4 General

WHEN Obligation: No later than the Uplisting Target Date, WHEN will either:

| (a) | Pay

IHQ USD $5 million dollars in cash and cleared funds under Section 5.3; or |

| (b) | Complete

the Uplisting [******]; or |

| (c) | Commence

monthly payments to IHQ, in cash and cleared funds, under either Section 6.1(a) or Section

6.1(b). |

5.5 General

IHQ Right: If, by the Uplisting Target Date:

| |

(a) |

The Uplisting does not occur; or |

| (b) | WHEN

has not fulfilled its obligations under and in accordance with Section 5.4, |

then

IHQ is entitled (but not obliged), within 30 days of the Uplisting Target Date, to terminate the Agreement on five (5) Business Days’

prior written notice to WHEN, in which case Section 17.5 applies, and return to WHEN the entirety of the Agreed Consideration Shares.

5.6 Cancellation

of Lock Up: Prior to the end of the Lock Up Period, subject to the provision of the next succeeding sentence, IHQ may at its sole

discretion on 30 days’ prior written notice to WHEN, concurrently cancel the Lock Up and IHQ’s rights under Section 5.5,

in which case:

| (d) | on

and from the Lock Up Cancellation Date, IHQ’s right under Section 5.5 will terminate

and no longer be of any force or effect and Section 5.5 is deemed deleted from this Agreement. |

IHQ’s

right to unliterally cancel the Lock Up is expressly subject to the delivery to WHEN within the prior 30 day notice period an original

copy of the Comprehensive Code and related documentation to WHEN, whereupon the provision of Section 4.3 shall come into effect.

5.7 For

the avoidance of doubt, the Product Materials (including any copies) are only licensed hereunder, and no title in or to the Product Materials

(or such copies) passes to WHEN Group. Any rights not expressly granted herein are hereby reserved by IHQ, and, except for the Perpetual

License, WHEN Group is granted no other right or licence to the Product Materials, whether by implied license, estoppel, exhaustion,

operation of law, or otherwise.

6. JOINT

VENTURE PRODUCTS

6.1 If

the Uplisting does not occur by the Uplisting Target Date and for as long as IHQ does not sell all of the Agreed Consideration Shares,

in an aggregated gross amount equal to USD $5 million dollars, WHEN will pay IHQ, on a monthly basis and on and from the JV Start Date,

the higher of:

For

the purposes of this Section, “JV Start Date” means the earlier of: (i) the date that IHQ is first entitled to receive

revenue in cash and cleared funds from the sale of Joint Venture Products under Section 6.1(a); or (ii) the date that is two months immediately

prior to the Uplisting Target Date.

6.2 The

Parties agree that, on the date that IHQ receives an aggregated amount equal to USD $5 million dollars from either a sale of all or any

part of the Agreed Consideration Shares, or via the revenue paid to IHQ under either Section 6.1(a) or Section 6.1(b), IHQ shall not

be entitled to any more payments under Sections 6.1(a) or Section 6.1(b). [******].

6.3 All

payments due to IHQ under Section 6.1(a) shall be made by direct bank transfer for receipt by IHQ before the end of the calendar month

following the month in which they are earned.

6.4 For

clarity, in the event that no monthly payments have been made to IHQ under Section 6.1(a) prior to the Uplisting Target Date, then WHEN’s

ability to comply with Section 5.4(c), if applicable, will be dependent upon WHEN commencing payment to IHQ under Section 6.1(b) prior

to the Uplisting Target Date.

7. Implementation

Services

7.1 On

and from the date the Comprehensive Code is delivered to WHEN under Section 4.3, IHQ shall provide the professional consulting

services described in Schedule C to enable Cross Mobile Sp. Z o.o. (“Cross Mobile”) to set up and implement the Software

on Cross Mobile’s environment, including training on the use, development, testing, maintenance, support and modification of the

Product Materials (the “Implementation Services”).

7.2 In

the event that professional consulting services are required for additional Group Company implementations other than Cross Mobile Sp.

Z o o’s, then IHQ will provide such services for a one off implementation fee, per implementation, at IHQ’s then current

rates.

8. Updates

8.1 From

time to time, IHQ or its Group Companies may develop bug fixes and/or patches to the Software for all of its clients (excluding new Features,

new versions or upgrades of the Product Materials or bugs and fixes for the Derivatives) (“Updates”). IHQ will[******]

(the “Support Term”), and in consideration of the transfer of the Agreed Consideration Shares under Section 3.1, make

such Updates available to WHEN to the extent generally made available by IHQ or its Group Companies to its supported clients under valid

support contracts.

8.2 At

the end of the Support Term, the provision of Updates will end, unless otherwise agreed in writing by the Parties.

9. WHEN’s

Obligations

9.1 Without

limiting the other provisions of this Agreement, WHEN is solely responsible for: (a) providing its own resources as may be required for

the integration and operation of the Product Materials inside its own platforms, at its own cost and expense; and (b) in relation to

WHEN Products, ensuring compliance with all Applicable Laws relating to the transfer of End User data onto or through WHEN customer products,

including all applicable privacy, data security and data protection regulations.

9.2 WHEN

will, and procure that each of its Group Companies will, at all times maintain the Software (and any copies) in a secure fashion and

will take reasonable measures to protect it from theft or unauthorized copying, reproduction, distribution, disclosure, dissemination

or use. Such measures will be no less stringent than the measures employed by WHEN Group at the time to protect the security of its own

proprietary source code.

9.3 WHEN

will: (a) send IHQ quarterly reports on the number of monthly End Users across WHEN Group; (b) keep IHQ reasonably informed on the development

of Derivatives (upon request, WHEN will deliver to IHQ in a reasonable format a copy of the Derivatives and relevant documentation);

(c) regularly provide IHQ will data sets from WHEN Products that incorporate or rely on the Software and Derivatives (this will enable

IHQ to continually improve its products); and (d) maintain a list of premises where the Software is held and the third parties to whom

a copy of the Software has been provided, and make such lists available to IHQ upon request. All such data sent to IHQ will be anonymized

by WHEN, subject to the strictest confidentiality protocols, only used by IHQ for internal testing purposes and will only be sent to

IHQ once the necessary consents and approvals have been obtained by WHEN.

9.4 IHQ

may, on at least 15 days’ prior written notice, subject to confidentiality obligations no less onerous than those contained in

Section 14 and no more than once per 6 month period, carry out an audit of WHEN’s compliance with the terms of Section 4.2 and

Section 9.3 of this Agreement.

9.5

Without limiting the other provisions of this Agreement, WHEN is solely responsible for all costs and expenses associated with the Uplisting

and ensuring compliance with all Applicable Laws relating to the Uplisting.

10. Intellectual

Property Rights

10.1 The

Product Materials. Subject to the rights and licenses granted to WHEN Group under this Agreement, WHEN acknowledges that IHQ or its

Group Companies retain all Intellectual Property Rights in the Product Materials. IHQ acknowledges that WHEN or its Group Companies retain

all Intellectual Property Rights in its own products and solutions.

10.2 Trademarks

and Publicity. Except as expressly set out in this Agreement, neither Party may make any public statement regarding this Agreement,

or use the other Party’s trade marks, trade names or logos, without the other Party’s prior written approval.

10.3 Modifications

and Derivatives. Subject to the rights and licenses granted to WHEN Group under this Agreement, all of IHQ’s and its Group

Companies’ right, title, and interest in and to the Product Materials, Updates and any derivatives to the Software performed by

IHQ or its Group Companies, are and shall be owned solely and exclusively by IHQ. All right, title, and interest in and to any Derivatives

created by WHEN Group or under its authority pursuant to the Perpetual License shall be owned solely and exclusively by WHEN Group, subject

to IHQ’s ownership of the underlying Intellectual Property Rights in the Software contained in the Derivatives (if any).

10.4 Copyright

Notices. WHEN shall not (and will procure that its Group Companies do not) remove or alter any copyright notice, trademark or other

proprietary or restrictive notice or legend affixed to, contained or included in, the Software or any other material provided by IHQ

or its Group Companies.

10.5 Infringements.

WHEN agrees to notify IHQ promptly in the event that WHEN becomes aware of any actual or threatened infringement of IHQ’s or its

Group Companies’ rights to the Software. WHEN will (and will procure that its Group Companies will) do all such things as may be

reasonably required to assist IHQ in taking or resisting proceedings in relation to any actual or threatened infringement.

11. Product

Warranties; Disclaimer of Warranties

11.1 Title.

IHQ hereby warrants that: (a) it owns all right, title and interest in the Product Materials, except for any specifically identified

third-party code in Schedule D, (b) there is no Open Source Software included in the Product Materials, except as is specifically

identified as part of the third-party code in Schedule D, and (c) no claims have been made against IHQ or its Group Companies

alleging that any of the Product Materials infringe or misappropriate the Intellectual Property Rights of any third party.

11.2 Performance

Warranty.

[******].

11.3 Malware

Warranty.

[******].

11.4 Warranty

Claims.

[******].

11.5 DISCLAIMER.

EXCEPT FOR THE WARRANTIES SPECIFIED IN SECTIONS 11.1 – 11.3, THE SOFTWARE, DOCUMENTATION, AND ALL SERVICES PROVIDED OR MADE AVAILABLE

TO WHEN HEREUNDER (INCLUDING THE SERVICES DESCRIBED IN SECTIONS 2.1(B)) AND 2.1(C) ARE PROVIDED ON AN “AS IS” AND “AS

AVAILABLE” BASIS, AND ALL EXPRESS, IMPLIED AND STATUTORY CONDITIONS AND WARRANTIES (INCLUDING WITHOUT LIMITATION ANY IMPLIED CONDITIONS

OR WARRANTIES OF MERCHANTABILITY, SATISFACTORY QUALITY, FITNESS FOR A PARTICULAR PURPOSE, TITLE, QUIET POSSESSION, NON-INFRINGEMENT,

OR QUALITY OF SERVICE, OR THAT OTHERWISE ARISE FROM A COURSE OF PERFORMANCE OR USAGE OF TRADE) ARE HEREBY DISCLAIMED. IHQ DOES NOT MAKE

ANY REPRESENTATION, WARRANTY, GUARANTEE OR CONDITION REGARDING THE EFFECTIVENESS, USEFULNESS, RELIABILITY, COMPLETENESS, OR QUALITY OF

THE FOREGOING, OR AS REGARDS COMPLIANCE WITH ANY LAWS OR REGULATIONS.

12. Limitation

of Liability

12.1 WITHOUT

LIMITING A PARTY’S OBLIGATIONS UNDER SECTION 13 (INDEMNIFICATION), IN NO EVENT SHALL EITHER PARTY, ITS SHAREHOLDERS, DIRECTORS,

OFFICERS, EMPLOYEES OR GROUP COMPANIES BE LIABLE FOR ANY INDIRECT, EXEMPLARY, INCIDENTAL OR CONSEQUENTIAL DAMAGES OF ANY KIND, INCLUDING

ECONOMIC DAMAGES OR INJURY TO PROPERTY OR LOST PROFITS, REVENUE OR BUSINESS, ARISING OUT OF OR OTHERWISE RELATING TO THE SUBJECT MATTER

OF THIS AGREEMENT, HOWEVER CAUSED, EVEN IF THE PARTY HAS BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES.

12.2 WITHOUT

LIMITING A PARTY’S OBLIGATIONS UNDER SECTION 13 (INDEMNIFICATION), IN NO EVENT SHALL EITHER PARTY’S AGGREGATE LIABILITY UNDER

THIS AGREEMENT TO THE OTHER PARTY, UNDER ANY THEORY OF LAW, EXCEED USD $[******]DOLLARS. THE EXISTENCE OF MORE THAN ONE CLAIM OR SUIT

WILL NOT ENLARGE OR EXTEND THIS LIMITATION.

13. INDEMNIFICATION

13.1 By

IHQ. IHQ is liable for, indemnifies, and holds WHEN harmless from, any third-party claim, lawsuit, or action against WHEN, its Group

Companies or any of their officers, directors or employees (a “WHEN Claim”), as well as any amounts and legal expenses

awarded against or imposed upon WHEN as they come due (or otherwise agreed in settlement) under WHEN Claim, to the extent such WHEN Claim

directly results from:

| (a) | IHQ’s

grossly negligent act or omission or intentional misconduct; |

| (b) | the

Software causing death, bodily injury, or property damage; or |

| (c) | a

claim that WHEN Group’s use of the Product Materials in accordance with this Agreement

violates or infringes any patent, copyright, trademark, trade secret, or other Intellectual

Property Right of any third party, except to the extent based upon, and if the infringement

would not have occurred but for, a combination with any third-party product or service (unless

pursuant to any instructions of IHQ), any instructions of WHEN Group, or any modifications

to the Software not authorized in writing by IHQ, or any Derivatives (“Excluded

IP Claims”). Without limiting its indemnification obligations, if IHQ finds or

reasonably believes that the Software infringes or violates another party’s Intellectual

Property Right, IHQ will do one or more of the following (at its election): (a) procure the

right for WHEN to use the Software; or (b) replace or modify the Software to avoid infringement,

provided that the replaced or modified Software is equivalent in functionality and performance. |

13.2 By

WHEN. WHEN is liable for, indemnifies, and holds IHQ and its Group Companies harmless from, any third-party claim, lawsuit, or action

(an “IHQ Claim”), as well as any amounts and legal expenses awarded against or imposed upon IHQ or its Group Companies

as they come due (or otherwise agreed in settlement) under the IHQ Claim, to the extent such IHQ Claim directly results from:

(a)

WHEN Group’s grossly negligent act or omission, intentional misconduct, or material misrepresentation;

(b) any

third party claims connected to or associated with funds raised following the Effective Date of this Agreement in connection with the

Uplisting (whether or not the Uplisting ultimately occurs);

(c) WHEN

Product causing damage or injury, including, without limitation, death, bodily injury, or property damage; or

(d) an

Excluded IP Claim.

13.3 Shared

Negligence. If WHEN Group and IHQ share negligence, each Party will pay its proportional share of the resulting expenses to resolve

the matter and to pay the associated legal costs.

13.4 Conditions

to Indemnification. An indemnified Party under this Agreement must: (a) promptly notify in writing the indemnifying Party (“Indemnitor”)

of WHEN Claim or IHQ Claim as the case may be (the “Claim”), and not admit any liability thereunder; (b) provide Indemnitor

with all necessary and appropriate information and assistance to defend or resolve the Claim; and (c) allow Indemnitor to control the

defense, disposition, and resolution of the Claim (but the indemnified Party’s counsel may, at its own expense, participate in

the defense, settlement discussions). If the indemnified Party fails to meet its obligations in this Section, Indemnitor is excused from

its obligation to indemnify, but only to the extent prejudiced by the indemnified Party’s failure to comply. Notwithstanding anything

to the contrary in this Agreement, neither Party may resolve a Claim without the other Party’s written consent if the resolution

includes any admission of fault of the other Party, imposes or triggers any non-monetary obligation binding the other Party, or involves

less than a full release and settlement of all claims against the other Party. Furthermore, each Party’s indemnity obligation hereunder

shall be its sole liability, and the other Party’s sole remedy, for the indemnified Claims.

14. Nondisclosure

14.1 Definition

of Confidential Information; Obligation of Confidentiality. In the performance of this Agreement or in contemplation thereof, either

party and its employees and agents may have access to private or confidential information owned or controlled by the other party, and

such information may contain proprietary details and disclosures. All information and data identified in writing as proprietary or confidential

by either party or that would otherwise be reasonably deemed to by proprietary or confidential (collectively, “Confidential

Information”) and so received by the other party or its employees or agents under this Agreement or in contemplation thereof

will be and will remain the disclosing party’s exclusive property, and the recipient will use all reasonable efforts (which in

any event will not be less than the efforts the recipient takes to ensure the confidentiality of its own proprietary and other confidential

information) to keep, and have its employees and agents keep, any and all Confidential Information confidential, and will not copy or

publish or disclose it to others, nor authorize its employees, or agents or anyone else to copy, publish or disclose it to others, without

the disclosing party’s written approval; nor will the recipient make use of the Confidential Information except for the purposes

of executing its obligations or exercising its rights hereunder, and (except as provided for herein) will return the Confidential Information

and data to the first party at its request (and upon termination of this Agreement, upon request). For clarity and notwithstanding anything

to the contrary in this Agreement, the Product Materials and any Derivatives, as incorporated into WHEN Products, will not be considered

Confidential Information of WHEN.

14.2 Exceptions.

The foregoing conditions will not apply to information or data: (a) which is or which becomes generally known to the public by publication

or by any means other than a breach of duty on the part of the recipient hereunder; (b) which is provable as previously known to the

recipient; (c) which is generally released by the owning party without restriction; (d) which is disclosed to the other party by a third

party without breach of duty; or (e) which is required to be disclosed pursuant to a legal, judicial or administrative proceeding or

by law, provided that the disclosing party shall promptly notify the other party of the impending disclosure and allow the other party

reasonable time to oppose such process before disclosing any Confidential Information.

14.3 Definition

of Feedback; Rights Therein. In addition to the exceptions set forth in Section 14.2, each Party may from time to time provide suggestions,

comments or other feedback to the disclosing Party with respect to Confidential Information provided originally by the disclosing Party

that does not relate to the technology or business plans of the Party providing the suggestions, comments or other feedback (“Feedback”).

Feedback, even if designated as confidential or proprietary by the Party offering the Feedback, shall not, absent a separate written

agreement, create any confidentiality obligation for the receiver of the Feedback. Except as otherwise provided herein or in a separate

subsequent written agreement between the Parties, the receiver of the Feedback shall be free to use, disclose, reproduce, license or

otherwise distribute, and exploit the Feedback provided to it as it sees fit, entirely without obligation or restriction of any kind

on account of intellectual property rights or otherwise.

For

clarity, this Section 14.3 shall not be deemed to grant to any Party a license under the disclosing Party’s trademarks, copyrights

or patents.

14.4 The

parties acknowledge that their respective Confidential Information is represented to be of a unique, special, and extraordinary character

which could be difficult or impossible to replace, and that a breach of any provision of this Agreement by the receiving party may cause

substantial and irreparable harm. In the event of a violation or breach of any provision of this Agreement, the disclosing party shall,

in addition to any and all other rights and remedies available hereunder, at law or otherwise, be entitled to seek an injunction, without

posting bond, and other equitable relief in addition to any other remedies available to it under this Agreement or under applicable law.

15. Compliance

with Applicable Laws. Each Party shall be solely responsible to comply with all Applicable Laws in performing obligations or

exercising rights under this Agreement.

16. Representations

and Warranties

16.1 WHEN

represents and warrants that:

(a)

it will comply with all of the terms of this Agreement, including when exercising its rights under the Perpetual License;

(b) the

Common Stock Shares outstanding on the date hereof (including the Agreed Consideration Shares) have been duly authorized and are validly

issued, fully paid and non-assessable; and

(c) The

Agreed Consideration Shares, when issued in accordance with the terms and for the consideration set forth in this Agreement, will be

free of restrictions on transfer, except as expressly set out in this Agreement or Applicable Laws.

16.2 Each

Party hereby represents and warrants to the other Party that:

(a) Execution

of the Transaction. It has the full power and authority to execute this Agreement and to consummate the transactions and obligations

contemplated hereby. All corporate action on its part necessary for the authorization, execution, delivery and performance of all obligations

made under the Agreement has been taken.

(b) Due

Authorization. This Agreement has been duly and validly authorized and executed by it and upon its execution by it, will constitute

its valid and binding obligation, and subject to all Applicable Laws, will be enforceable against it in accordance with its terms.

(c) No

Conflicts. Neither the execution of this Agreement nor the performance of the terms hereof nor the consummation of the transactions

contemplated hereby will conflict with, or result in a violation of, or constitute a default under its corporate documents or any agreement

or other instrument to which it is a party or by which it is bound, or to which any of its properties are subject, nor, to its knowledge,

will the performance by it of its obligations hereunder violate any law, consent, permit, rule, regulation or order of any court, or

any governmental agency or body having jurisdiction over it.

(d) Approvals

and Consents. No consent, approval, order, license, permit, action by, or authorization of, or designation, or declaration, on the

part of it is required, that has not been obtained or shall not be obtained by it prior to the date hereof in connection with the execution,

delivery and performance of this Agreement.

17. Termination

17.1 The

Term. This Agreement commences on the Effective Date and, subject to Sections 5.5 and 17.2- 17.4, continues unless and until it is

terminated in accordance with its terms.

17.2 Material

Breaches. In the event that a party commits a material breach of its obligations under this Agreement and fails to cure that breach

within ten Business Days after receiving written notice thereof, the other party may terminate this Agreement immediately upon written

notice to the breaching party. In any such event, termination of the Agreement shall be in addition to and not in lieu of any equitable

remedies available to the aggrieved party.

17.3 Insolvency.

In the event that a party ceases to do business, goes or is put into receivership or liquidation, passes a resolution for its winding

up (other than for the purposes of reconstruction or amalgamation), makes an arrangement for the benefit of its creditors, or takes or

suffers any similar action in consequence of debt, or if any similar event occurs under the laws of any jurisdiction.

17.4 Third

Party Competitor. IHQ may terminate WHEN’s rights (or any Group Company’s rights) under this Agreement in writing to

WHEN if a Third Party Competitor (or an affiliate thereof) acquires Control (as defined under Section 1.3(m)) of WHEN or that Group Company.

17.5 Consequences

of Termination.

(a) In

the event of termination under Sections 5.5 and 17.2 – 17.4 (excluding termination by WHEN under Sections 17.2 or 17.3), the Perpetual

License terminates on the date of termination, WHEN will (and will procure that its Group Companies will) discontinue use of the Product

Materials within five Business Days after such termination, and WHEN shall return to IHQ all copies of the Product Materials and, at

IHQ’s request, WHEN shall certify in writing that all copies of the Product Materials have been returned to IHQ and deleted from

WHEN Group’s storage media, provided that WHEN shall be authorized to maintain documentary copies thereof to the extent required

under Applicable Laws, but subject to the terms of Section 14 at all times.

(b) In

the event of any termination by IHQ under Section 5.5., IHQ shall, for nominal consideration of USD $1 dollar (the receipt and sufficiency

of which is hereby acknowledged), promptly transfer legal title in the Agreed Consideration Shares to WHEN and provide all certificates

which are necessary and required to effectuate such transfer to WHEN within 5 Business Days following the termination date of this Agreement.

(c) Any

provisions of this Agreement that ought by their nature (or are stated) to survive termination of this Agreement, shall survive (including

this Section 17.5), as shall Sections 10 (Intellectual Property Rights), 12 (Limitation of Liability), 13 (Indemnification), 14 (Nondisclosure)

and 18 (Miscellaneous).

18. Miscellaneous

18.1 Alternative

Future Products. IHQ will act reasonably and in good faith when considering any future product request from WHEN Group from time

to time. IHQ will offer additional licences to WHEN Group for Alternative Future Products on terms that are substantially similar to

those set out in this Agreement (pricing will be inflationary adjusted as applicable).

18.2 Notices.

Any and all notices and communications hereunder shall be in writing and shall be deemed to have been duly given when delivered personally

or by courier, or when receipt by email or similar means of communication is confirmed, or five Business Days after dispatch by registered

mail, addressed to the parties at the addresses set forth below or to such other addresses as either of the parties hereto may from time

to time in writing designate to the other party hereto:

If

to IHQ:

St

Albans House,

57

– 59 Haymarket,

London

SW1Y

4QX

UK

Attention:

Peter Munro

Email:

peter.munro@intenthq.com

__________________

If

to WHEN:

1825

Nw Corporate Blvd

Suite

110 Boca Raton

Florida

33431 USA

Attention:

Giora rozensweig Email: Giora@whengroup.com

18.3 Relationship

of Parties. Except as expressly set out in this Agreement, IHQ and WHEN are and intend to remain independent parties. Nothing contained

in this Agreement shall be deemed or construed to create the relationship of principal and agent or of partnership or joint venture,

and except as otherwise specifically agreed upon in writing by the parties, neither party shall hold itself out as an agent, legal representative,

partner, subsidiary, joint venturer, servant or employee of the other. Neither party nor any officer or employee thereof shall, in any

event, have any right collectively or individually, to bind the other party, to make any representations or warranties, to accept service

of process, to receive notice or to perform any act or thing on behalf of the other party, except as authorized in writing by such other

party in its sole discretion.

18.4 Modification,

Amendment, Waiver. No modification or amendment of any provision of this Agreement shall be effective unless approved in writing

by both parties to this Agreement. No party shall be deemed to have waived compliance by any other party with any provision of this Agreement

unless such waiver is in writing, and the failure of any party at any time to enforce any of the provisions of this Agreement shall in

no way be construed as a waiver of such or any other provision and shall not affect the rights of any party thereafter to enforce such

provisions in accordance with their terms. No waiver of any breach of any provision of this Agreement shall be deemed the waiver of any

subsequent breach thereof or of any other provision of this Agreement. The continued dealing of either party with the other party following

a breach of any provision hereof shall not be deemed to be a waiver of such or any other breach.

18.5 Assignment.

Neither this Agreement nor any of the rights, privileges or responsibilities of a Party hereunder shall be sold, assigned, transferred,

shared, or encumbered, by the Party, by operation of law or otherwise, without the prior written consent of the other Party. Any obligation

of a Party hereunder may be performed (in whole or in part), and any right or remedy or remedy of a Party may be exercised (in whole

or in part), by a Group Company of the Party, provided that: (i) each Party is liable for the acts and omissions of its Group Companies;

(ii) each Party will procure its Group Companies’ compliance with the terms and conditions in this Agreement; (iii) any Group Company

of WHEN purporting to exercise rights under this Agreement must not be a business or subsidiary engaged in the commercialisation of products

or services that are Alternative Future Products, subject to Section 18.1; and (iv) nothing in this Section permits WHEN to assign its

obligation under Section 5.1(b) to an Group Company.

18.6 Force

Majeure. Neither party will be responsible for delays resulting from causes beyond the reasonable control of such party, including

without limitation fire, explosion, flood, war, strike, or riot, provided that the nonperforming party uses commercially reasonable efforts

to avoid or remove such causes of nonperformance and continues performance under this Agreement with reasonable dispatch whenever such

causes are removed.

18.7 Applicable

Law; Jurisdiction. This Agreement shall be governed by and construed and enforced in accordance with the laws of England and Wales.

The Courts of England and Wales shall have exclusive jurisdiction in connection with any dispute between the parties in connection with

this Agreement.

18.8 Non-Solicitation

and Non-Hiring. Each Party undertakes that during the term of Agreement and for a period of twenty-four (24) months thereafter, each

Party shall not directly or indirectly: (a) solicit any employee of the other Party or its Group Companies, whose work relates primarily

to the Product Materials (an “SDK Employee”) or induce or attempt to induce any such SDK Employee to terminate or reduce

the scope of such SDK Employee’s engagement with such Party and shall not hire or retain any such SDK Employee whether directly

or indirectly; and (b) solicit or induce, or attempt to solicit or induce, any consultant, service provider, agent, distributor, WHEN

or supplier of the other Party or its Group Companies to terminate, reduce or modify the scope of such person’s engagement with

such Party. Notwithstanding the foregoing, WHEN shall not be in breach of its undertaking by reason of any general solicitation carried

out through the media or by a search firm, in either case, that is not directed specifically to any SDK Employees of IHQ or its Group

Companies, provided that in the event that an SDK Employee responds to such a solicitation, WHEN shall not hire such person for the duration

set forth in the first sentence of this Section 18.8.

18.9 Severability.

Any provision of this Agreement which may be determined by competent authority to be prohibited or unenforceable in any jurisdiction

shall, as to such jurisdiction, be ineffective to the extent of such prohibition or unenforceability without invalidating the remaining

provisions of this Agreement, and any such prohibition or unenforceability in such jurisdiction shall not invalidate or render unenforceable

such provision in any other jurisdiction. Moreover, if any one or more provisions contained in this Agreement shall for any reason be

held by any court of competition jurisdiction to be excessively broad as to time, duration, geographical scope, activity or subject,

it shall be construed, by limiting and reducing it, so as to be enforceable to the extent compatible with the applicable law as it shall

then appear.

18.10 Further

Assurances. Each Party agrees to do any and all acts required in order to give effect to the other Party’s express rights set

out in this Agreement, including executing and delivering any documentation reasonably required.

18.11 Entire

Agreement. This document, including its Schedules, constitutes the entire and sole agreement and understanding between the parties

hereto with respect to the subject matter hereof and supersedes any prior or contemporaneous understanding, agreements, representations

or warranties, whether oral or written, with respect to the subject matter. WHEN acknowledges and agrees that IHQ owes no other obligations

to WHEN other than as explicitly set forth herein.

18.12 Expenses.

Each party shall be responsible for its own transaction related fees and expenses incurred in connection with the negotiation, preparation

and execution of this Agreement.

18.13 Counterparts.

This Agreement may be executed in any number of counterparts, each of which shall be deemed an original and enforceable against the Parties

actually executing such counterpart, and all of which together shall constitute one and the same instrument.

IN

WITNESS WHEREOF, the parties hereto have executed this Agreement as of the day and year first above written.

| Intent

HQ Limited |

|

World

Heath Energy Holdings, Inc |

| |

|

|

|

|

| By:

|

/s/

Jonathan Laikin |

|

By: |

/s/

Giora Rozensweig |

| |

|

|

|

|

| Name: |

Jonathan

Laikin |

|

Name:

|

Giora

Rozensweig |

| |

|

|

|

|

| Date:

|

July

2, 2024 |

|

Date:

|

July

2, 2024 |

Schedule

A

Description

of the EDGE SDK Software

Software

[******]

Patents

[******]

Schedule

B

Acceptance

“Acceptance”

means [******].

Schedule

C

Implementation

Services

| 1) | Description

of Professional Services |

[******]

Schedule

D

Third

Party Dependencies

Third

party source code packages are shown in the following links. (Password: “iamajedai”):

[******]

Schedule

E

[RESERVED]

Schedule

F

LOCK-UP

AGREEMENT

THIS

LOCK-UP AGREEMENT (the “Agreement”) is entered into as of June __, 2024, by and between the undersigned Shareholder and World

Health Energy Holding, Inc., a Delaware corporation (the “Company”).

WHEREAS,

the Company and the undersigned hereto entered into that certain Agreement dated as of June __, 2024 (the “Primary Agreement”;

all capitalized terms shall, unless otherwise defined or the context otherwise requires, shall have the meanings ascribed to such terms

in the Primary Agreement) pursuant to which, among other things, the undersigned was issued the Agreed Consideration consisting of 25,038,272,832

shares of the Company’s common stock, at a per common stock share effective price of just under $0.0002 (the “Common

Stock”);

WHEREAS,

the undersigned and the Company desire to restrict the sale, assignment, transfer, encumbrance or other disposition of the Common Stock

(the “Company Securities”) as hereinafter provided.

NOW

THEREFORE, in consideration of the premises and of the terms and conditions contained herein and for other good and valuable consideration,

the receipt and sufficiency of which is hereby acknowledged, the parties hereto agree as follows:

1.

LOCK-UP OF SECURITIES.

(a)

Shareholder agrees that from the Equity Transfer Date (the “Effective Date”) until the last day of the Lock Up Period, the

Shareholder will not make or cause any sale, assignment, transfer, or encumbrance any of the Company Securities that the Shareholder

owns or has the power to control the disposition of, either of record or beneficially, except in accordance with Section 5.6 of the Primary

Agreement. After the completion of the Lock-Up Period, or if the Shareholder exercises its rights under Section 5.6 of the Primary Agreement,

this Agreement will terminate and Shareholder will be free to transfer or dispose of the Company Securities without limitation, except

that all such transfers or dispositions shall be in compliance with applicable Securities Laws as described in Section 3 below. Notwithstanding

anything to the contrary in this Section 1(a), the Shareholder may assign, distribute or transfer the Company Securities to any of the

Shareholder’s affiliates, any entity that is controlled by, controls or is under common control with the Shareholder and any investment

fund or other entity controlled or managed by the Shareholder; provided, that in the case of any such assignment, distribution or transfer,

the assignee, distributee and transferee shall execute and deliver to the Company a lock−up agreement in the form of this Agreement.

(b)

During the Lock-Up Period, Shareholder hereby authorizes the Company to cause any transfer agent for the Company Securities subject to

this Lock-Up Agreement to decline to transfer, and to note stop transfer restrictions on the stock register and other records relating

to the Company Securities, subject to this Agreement for which the Shareholder is the record holder and, in the case of Company Securities

subject to this Lock-Up Agreement for which the Shareholder is the beneficial owner but not the record holder, agrees during the Lock-Up

Period to cause the record holder to cause the relevant transfer agent to decline to transfer, and to note stop transfer restrictions

on the stock register and other records relating to the Company Securities subject to this Lock-Up Agreement, if such transfer would

constitute a violation or breach of this Agreement.

2.

TRANSFER; SUCCESSOR AND ASSIGNS.

The

terms and conditions of this Agreement shall inure to the benefit of and be binding upon the respective successors and assigns of the

parties. As provided above, any transfer (not limited to, but including any hypothecation) of stock shall require the transferee to execute

a Lock-Up Agreement in accordance with the same terms set forth herein. Nothing in this Agreement, expressed or implied, is intended

to confer upon any party other than the parties hereto or their respective successors and assigns, any rights, remedies, obligations,

or liabilities under or by reason of this Agreement, except as expressly provided in this Agreement.

3.

COMPLIANCE WITH SECURITIES LAWS.

Shareholder

shall not at any time following the Lockup Period make any transfer, except (i) transfers pursuant to an effective registration statement

under the Securities Act, (ii) transfers pursuant to the provisions of Rule 144, or (iii) if such Shareholder shall have furnished the

Company with an opinion of counsel, if reasonably requested by the Company, which opinion and counsel shall be reasonably satisfactory

to the Company, to the effect that the transfer is otherwise exempt from registration under the Securities Act and that the transfer

otherwise complies with the terms of this Agreement.

4.

OTHER RESTRICTIONS.

(a)

Legends. The Shareholder hereby agrees that each outstanding certificate representing shares of Common Stock issued to Shareholder

during the Lock-Up Period and all shares issued in book entry form, shall bear legends reflecting the agreements herein.

(b)

Copy of Agreement. A copy of this Agreement shall be filed with the corporate secretary of the Company, shall be kept with the

records of the Company and shall be made available for inspection by any shareholder of the Company. In addition, a copy of this Agreement

shall be filed with the Company’s transfer agent of record.

(c)

Recordation. The Company shall not record upon its books any transfer to any person except transfers in accordance with this Agreement.

5.

NO OTHER RIGHTS

The

Shareholder understands and agrees that the Company is under no obligation to register the sale, transfer or other disposition of Shareholder’s

Company Securities under the Securities Act or to take any other action necessary in order to make compliance with an exemption from

such registration available.

6.

NOTICES.

All

notices, statements, instructions or other documents required to be given hereunder shall be in writing and shall be given either personally,

electronic transmission (email) or by mailing the same in a sealed envelope, first-class mail, postage prepaid and either certified or

registered, return receipt requested, or by telecopy, and shall be addressed to the Company at its principal offices and to Shareholder

at the respective addresses furnished to the Company by Shareholder.

7.

SUCCESSORS AND ASSIGNS.

This

Agreement shall be binding upon and shall inure to the benefit of the parties and their respective successors and assigns.

8.

RECAPITALIZATIONS AND EXCHANGES AFFECTING SHARES.

The

provisions of this Agreement shall apply, to the full extent set forth herein with respect to the Company Securities, and to any and

all shares of capital stock or equity securities of the Company which may be issued by reason of any stock dividend, stock split, reverse

stock split, combination, recapitalization, reclassification or otherwise.

9.

GOVERNING LAW.

This

Agreement shall be governed by and construed in accordance with the laws of the State of Delaware.

10.

COUNTERPARTS.

This

Agreement may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute

one and the same instrument.

11.

ATTORNEYS’ FEES.

If

any action at law or in equity (including arbitration) is necessary to enforce or interpret the terms of this Agreement, the prevailing

party shall be entitled to reasonable attorneys’ fees, costs and necessary disbursements in addition to any other relief to which

such party may be entitled as determined by such court, equity or arbitration proceeding.

12.

AMENDMENTS AND WAIVERS.

Any

term of this Agreement may be amended with the written consent of the Company and the Shareholder. No delay or failure on the part of

the Company in exercising any power or right under this Agreement shall operate as a waiver of any power or right.

13.

SEVERABILITY.

If

one or more provisions of this Agreement are held to be unenforceable under applicable law, portions of such provisions, or such provisions

in their entirety, to the extent necessary, shall be severed from this Agreement and the balance of the Agreement shall be interpreted

as if such provision were so excluded and shall be enforceable in accordance with its terms.

14.

DELAYS OR OMISSIONS.

No

delay or omission to exercise any right, power or remedy accruing to any party to this Agreement, upon any breach or default of the other

party to this Agreement shall impair any such right, power or remedy of such holder nor shall it be construed to be a waiver of any such

breach or default, or an acquiescence therein, or of any similar breach or default thereafter occurring; nor shall any waiver of any

breach or default be deemed a waiver of any other breach or default theretofore or thereafter occurring. Any waiver, permit, consent

or approval of any kind or character on the part of any party to this Agreement of any breach or default under this Agreement, or any

waiver on the part of any party of any provisions or conditions of this Agreement, must be in writing and shall be effective only to

the extent specifically set forth in such writing. All remedies, either under this Agreement or by law or otherwise afforded to any holder

shall be cumulative and not alternative.

15.

ENTIRE AGREEMENT.

This

Agreement and the documents referred to herein constitute the entire agreement between the parties hereto pertaining to the subject matter

hereof, and any and all other written or oral agreements existing between the parties hereto are expressly canceled.

(Signature

page follows.)

IN

WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date first above written.

| |

COMPANY |

| |

|

|

| |

WORLD

HEALTH ENERGY HOLDINGS, INC. |

| |

|

|

| |

By: |

|

| |

|

|

| |

SHAREHOLDER |

| |

|

|

| |

INTENT

HQ LIMITED |

| |

|

|

| |

By: |

|

Exhibit

10.2

EXECUTION

COPY

LOCK-UP

AGREEMENT

THIS

LOCK-UP AGREEMENT (the “Agreement”) is entered into as of July 2, 2024, by and between the undersigned Shareholder and World

Health Energy Holding, Inc., a Delaware corporation (the “Company”).

WHEREAS,

the Company and the undersigned hereto entered into that certain Agreement dated as of June __, 2024 (the “Primary Agreement”;

all capitalized terms shall, unless otherwise defined or the context otherwise requires, shall have the meanings ascribed to such terms

in the Primary Agreement) pursuant to which, among other things, the undersigned was issued the Agreed Consideration consisting of 25,038,272,832

shares of the Company’s common stock, at a per common stock share effective price of just under $0.0002 (the “Common

Stock”);

WHEREAS,

the undersigned and the Company desire to restrict the sale, assignment, transfer, encumbrance or other disposition of the Common Stock

(the “Company Securities”) as hereinafter provided.

NOW

THEREFORE, in consideration of the premises and of the terms and conditions contained herein and for other good and valuable consideration,

the receipt and sufficiency of which is hereby acknowledged, the parties hereto agree as follows:

1.

LOCK-UP OF SECURITIES.

(a)

Shareholder agrees that from the Equity Transfer Date (the “Effective Date”) until the last day of the Lock Up Period, the

Shareholder will not make or cause any sale, assignment, transfer, or encumbrance any of the Company Securities that the Shareholder

owns or has the power to control the disposition of, either of record or beneficially, except in accordance with Section 5.6 of the Primary

Agreement. After the completion of the Lock-Up Period, or if the Shareholder exercises its rights under Section 5.6 of the Primary Agreement,

this Agreement will terminate and Shareholder will be free to transfer or dispose of the Company Securities without limitation, except

that all such transfers or dispositions shall be in compliance with applicable Securities Laws as described in Section 3 below. Notwithstanding

anything to the contrary in this Section 1(a), the Shareholder may assign, distribute or transfer the Company Securities to any of the

Shareholder’s affiliates, any entity that is controlled by, controls or is under common control with the Shareholder and any investment

fund or other entity controlled or managed by the Shareholder; provided, that in the case of any such assignment, distribution or transfer,

the assignee, distributee and transferee shall execute and deliver to the Company a lock−up agreement in the form of this Agreement.

(b)

During the Lock-Up Period, Shareholder hereby authorizes the Company to cause any transfer agent for the Company Securities subject to

this Lock-Up Agreement to decline to transfer, and to note stop transfer restrictions on the stock register and other records relating

to the Company Securities, subject to this Agreement for which the Shareholder is the record holder and, in the case of Company Securities