Idorsia announces financial results for the full year of 2023 –

Adapting the company to create sustainable value

Ad hoc announcement pursuant to Art. 53 LR

Allschwil, Switzerland – May 21,

2024

Idorsia Ltd (SIX: IDIA) today announced its financial results for

the full year of 2023.

Business highlights

- Sale of Idorsia Asia-Pacific operations (excluding

China): Sold to Nxera Pharma (previously known as Sosei

Heptares) for a total consideration of CHF 400 million in July

2023.

- Cost reduction initiative: Delivering a 50%

reduction in fixed cost at Swiss headquarters fully effective in

early 2024.

- Aprocitentan: Worldwide rights reacquired from

Janssen for a conditional consideration of CHF 306 million in

September 2023.

Commercial highlights

- QUVIVIQ™ (daridorexant): Total net sales of

CHF 31 million in 2023.

- QUVIVIQ: Expanded access and availability in

the US, Canada and across Europe.

Financial highlights FY 2023

- Net revenue FY 2023 at CHF 152 million.

- US GAAP operating expenses FY 2023 at CHF 409

million and non-GAAP operating expenses FY 2023 at

CHF 654 million.

- US GAAP operating loss FY 2023 of CHF 255

million and non-GAAP operating loss of

CHF 501 million.

Jean-Paul Clozel, MD and Chief Executive Officer,

commented:

“During 2023, we made great progress with expanding the

availability of QUVIVIQ and patient access in the US, Canada, and

across Europe. QUVIVIQ is rapidly being recognized by specialists

as a major advance in the field of insomnia. PIVLAZ became a very

successful drug in Japan, and regulatory submissions were advanced

for aprocitentan in the US and EU. As the development and launch of

these three products required substantial financial investments,

there was a need to lower our costs. Accordingly, we reduced our

headcount and prioritized our portfolio assets; we monetized our

Asia-Pacific operations; and we began negotiations with potential

partners. All these actions have been essential to the future of

the company.”

André C. Muller, Chief Financial Officer,

commented:

“2023 was a year of adaptation for Idorsia. When it became clear

that we would not hit our original sales targets, we needed to take

measures to reduce and control our cost base to deliver on our

operating guidance. Furthermore, we needed to advance several

funding and business initiatives to extend our cash runway. Our

activities resulted in a one-off income related to the Nxera Deal

and substantially reduced operating expenses throughout all

functions meaning we delivered a significantly lower operating loss

than forecast. With the reduced cost base, two marketed or

close-to-market products, and a rich unencumbered portfolio of

innovative assets, Idorsia entered 2024 in a much stronger

position.”

Financial results FY 2023

|

US GAAP results |

Full Year |

Fourth Quarter |

|

in CHF millions, except EPS (CHF) and number of shares

(millions) |

2023 |

2022 |

2023 |

2022 |

|

Net revenues |

152 |

97 |

22 |

54 |

|

Operating expenses |

(409) |

(900) |

(134) |

(247) |

|

Operating income (loss) |

(255) |

(803) |

(111) |

(193) |

|

Net income (loss) |

(298) |

(828) |

(117) |

(193) |

|

Basic EPS |

(1.67) |

(4.67) |

(0.65) |

(1.09) |

|

Basic weighted average number of shares |

178.2 |

177.4 |

178.6 |

177.5 |

|

Diluted EPS |

(1.67) |

(4.67) |

(0.65) |

(1.09) |

|

Diluted weighted average number of shares |

178.2 |

177.4 |

178.6 |

177.5 |

US GAAP net revenue of CHF 152 million in 2023 (CHF 97 million

in 2022) consisted of product sales of QUVIVIQ (CHF 30.9 million)

and PIVLAZ (CHF 34.4 million), the one-off impact of the Nxera Deal

(CHF 68 million), a CHF 9 million milestone payment from

Santhera, a revenue share from Johnson & Johnson (CHF 5

million) and other contract revenues mainly Mochida (CHF 4

million), and Neurocrine Biosciences, Inc. (CHF 2 million).

US GAAP operating expenses in 2023 amounted to CHF 409 million

(CHF 900 million in 2022), of which CHF 7 million related to cost

of sales (CHF 6 million in 2022), CHF 294 million to R&D

expenses (CHF 383 million in 2022) and CHF 392 million to

SG&A expenses (CHF 509 million in 2022)

CHF 11 million restructuring charges and a one-off income

of CHF 298 million relating to the Nxera Deal.

US GAAP net loss in 2023 amounted to CHF 298 million (CHF 828

million in 2022). The decrease of the net loss was mainly

attributable to the one-off income related to the Nxera Deal but

was also driven by higher revenues and lower operating expenses

throughout all functions.

The US GAAP net loss resulted in a net loss per share of CHF

1.67 (basic and diluted) in 2023, compared to a net loss per share

of CHF 4.67 (basic and diluted) in 2022.

|

Non-GAAP* measures |

Full Year |

Fourth Quarter |

|

in CHF millions, except EPS (CHF) and number of shares

(millions) |

2023 |

2022 |

2023 |

2022 |

|

Net revenues |

152 |

97 |

22 |

54 |

|

Operating expenses |

(654) |

(854) |

(137) |

(234) |

|

Operating income (loss) |

(501) |

(757) |

(115) |

(180) |

|

Net income (loss) |

(542) |

(782) |

(121) |

(186) |

|

Basic EPS |

(3.04) |

(4.41) |

(0.68) |

(1.05) |

|

Basic weighted average number of shares |

178.2 |

177.4 |

178.6 |

177.5 |

|

Diluted EPS |

(3.04) |

(4.41) |

(0.68) |

(1.05) |

|

Diluted weighted average number of shares |

178.2 |

177.4 |

178.6 |

177.5 |

* Idorsia measures, reports and issues guidance on non-GAAP

operating performance. Idorsia believes that these non-GAAP

financial measurements more accurately reflect the underlying

business performance and therefore provide useful supplementary

information to investors. These non-GAAP measures are reported in

addition to, not as a substitute for, US GAAP financial

performance.

Non-GAAP net loss in 2023 amounted to CHF 542 million: The CHF

244 million difference versus US GAAP net loss was mainly due to

the one-off effect of the Nxera Deal (CHF 305 million income),

depreciation and amortization (CHF 24 million), share-based

compensation (CHF 23 million), restructuring charges (CHF 11

million) and a loss on marketable securities (CHF 4 million).

The non-GAAP net loss resulted in a net loss per share of CHF

3.04 (basic and diluted) in 2023, compared to a net loss per share

of CHF 4.41 (basic and diluted) in 2022.

Nxera Deal (previously known as Sosei Deal)

In July 2023, Idorsia sold its operating businesses in the

Asia-Pacific (excluding China) region to Sosei Heptares (now known

as Nxera Pharma) for a total consideration of CHF 400 million. The

territories within the scope of the transaction are Australia,

Brunei, Cambodia, Indonesia, Japan, Laos, Malaysia, Myanmar, New

Zealand, Philippines, Singapore, South Korea, Thailand, Taiwan, and

Vietnam (hereafter the “Territories”).

The Nxera deal includes the sale of Idorsia’s Japanese and South

Korean affiliates, the assignment of the license for PIVLAZ

(clazosentan) for the Territories and of the (co-) exclusive

license for daridorexant for the Territories, and the assignment of

all potential milestones in connection with the co-exclusive

license for daridorexant granted to Mochida Pharmaceutical for

Japan. The Nxera deal also includes an option for Nxera Pharma to

license cenerimod and lucerastat for development and

commercialization in the Territories, with option fees of CHF 3

million and 7 million, respectively, and subsequent payment of

high-single-digit royalties on net sales in the Territories.

Cost reduction initiative

In July 2023, Idorsia launched a cost reduction initiative,

targeting a reduction of around 50% in its fixed cost base at

headquarters.

Approximately 475 positions at headquarters in Allschwil,

Switzerland, were eliminated through a combination of cancellation

of new positions, natural turnover, non-renewal of temporary

positions, and terminations, mainly in Research & Development

and associated support functions. The reduction of positions

resulted in a restructuring charge of CHF 11 million.

The initiative has been concluded, with the reduction of costs

becoming fully effective in early 2024.

Reacquisition of aprocitentan rights

In September 2023, Idorsia reached an agreement to reacquire the

development and commercialization rights for aprocitentan from

Johnson & Johnson Innovative Medicine (formerly known as

Janssen Biotech, Inc.). In return, Idorsia will pay Johnson &

Johnson Innovative Medicine a conditional consideration up to a

total cap of CHF 306 million, depending on Idorsia’s revenues, as

follows:

- 30% of any consideration received by Idorsia from a potential

out-licensing or divestment of aprocitentan,

- 10% of any consideration received by Idorsia from a potential

out-licensing or the divestment of any other Idorsia product,

following the first approval of aprocitentan, and

- low- to mid-single-digit royalties on total group product net

sales, beginning from the quarter after first aprocitentan

approval.

Johnson & Johnson Innovative Medicine will retain licenses

in the pulmonary hypertension field.

Liquidity and indebtedness (as of December 31,

2023)

At the end of 2023, Idorsia’s liquidity amounted to CHF 145

million.

|

(in CHF millions) |

Dec 31, 2023 |

Sep 30, 2023 |

Dec 31, 2022 |

|

Liquidity |

|

|

|

|

Cash and cash equivalents |

145 |

205 |

146 |

|

Short-term deposits |

- |

50 |

320 |

|

Total liquidity* |

145 |

255 |

466 |

|

|

|

|

|

|

Indebtedness |

|

|

|

|

Convertible loan |

335 |

335 |

335 |

|

Convertible bond |

796 |

796 |

795 |

|

Other financial debt |

162 |

162 |

162 |

|

Total indebtedness |

1,293 |

1,292 |

1,292 |

*rounding differences may occur

Results Day Center

Investor community: To make your job easier, we

provide all relevant documentation via the Results Day Center on

our corporate website: www.idorsia.com/results-day-center.

Human Resources

Idorsia reduced 423 positions worldwide in 2023, bringing the total

number of employees (permanent, post-doc, and apprentices) to 938

(2022: 1,361).

Annual Report

Details of the activities performed in 2023 are available in

Idorsia's 2023 Annual Report, consisting of the Business Report,

Governance Report, Compensation Report, Financial Report, and for

the first time, Sustainability Report, at

www.idorsia.com/annual-report.

Note to Shareholders

The Annual General Meeting (AGM) of Shareholders to approve the

Annual Report of the year ending December 31, 2023, will be held on

Thursday, June 13, 2024.

In order to vote at the Annual General Meeting, shareholders

must be registered in the company's shareholder register by June 4,

2024, at the latest.

Notes to the editor

About Idorsia

Idorsia Ltd is reaching out for more – We have more ideas, we see

more opportunities and we want to help more patients. In order to

achieve this, we will develop Idorsia into a leading

biopharmaceutical company, with a strong scientific core.

Headquartered near Basel, Switzerland – a European biotech-hub –

Idorsia is specialized in the discovery, development and

commercialization of small molecules to transform the horizon of

therapeutic options. Idorsia has a 25-year heritage of drug

discovery, a broad portfolio of innovative drugs in the pipeline,

an experienced team of professionals covering all disciplines from

bench to bedside, and commercial operations in Europe and North

America – the ideal constellation for bringing innovative medicines

to patients.

Idorsia was listed on the SIX Swiss Exchange (ticker symbol:

IDIA) in June 2017 and has over 750 highly qualified specialists

dedicated to realizing our ambitious targets.

For further information, please contact

Andrew C. Weiss

Senior Vice President, Head of Investor Relations & Corporate

Communications

Idorsia Pharmaceuticals Ltd, Hegenheimermattweg 91, CH-4123

Allschwil

+41 58 844 10 10

investor.relations@idorsia.com

media.relations@idorsia.com

www.idorsia.com

The above information contains certain "forward-looking

statements", relating to the company's business, which can be

identified by the use of forward-looking terminology such as

"estimates", "believes", "expects", "may", "are expected to",

"will", "will continue", "should", "would be", "seeks", "pending"

or "anticipates" or similar expressions, or by discussions of

strategy, plans or intentions. Such statements include descriptions

of the company's investment and research and development programs

and anticipated expenditures in connection therewith, descriptions

of new products expected to be introduced by the company and

anticipated customer demand for such products and products in the

company's existing portfolio. Such statements reflect the current

views of the company with respect to future events and are subject

to certain risks, uncertainties and assumptions. Many factors could

cause the actual results, performance or achievements of the

company to be materially different from any future results,

performances or achievements that may be expressed or implied by

such forward-looking statements. Should one or more of these risks

or uncertainties materialize, or should underlying assumptions

prove incorrect, actual results may vary materially from those

described herein as anticipated, believed, estimated or

expected.

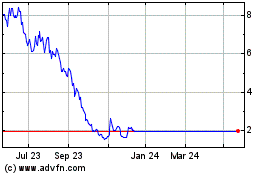

Idorsia (LSE:0RQE)

Historical Stock Chart

From Nov 2024 to Dec 2024

Idorsia (LSE:0RQE)

Historical Stock Chart

From Dec 2023 to Dec 2024