TIDMAAZ

RNS Number : 7564Q

Anglo Asian Mining PLC

25 October 2011

Anglo Asian Mining plc / Ticker: AAZ / Index: AIM / Sector:

Mining

25 October 2011

Anglo Asian Mining plc ('Anglo Asian' or 'the Company')

Gedabek Gold/Copper Mine - Exploration Update, Positive Infill

Drilling Results

Anglo Asian Mining plc, the AIM listed gold producer, announces

positive results from its 5,460m Phase 1 drilling campaign at its

flagship Gedabek gold/copper mine ('Gedabek') in Azerbaijan.

Overview

-- 5,460m infill drilling programme undertaken to re-classify

the current mineral resources and ore reserves categories and

assess the spatial continuity and metallurgy of the existing

resource to consider future mineral processing options

-- Drilling concentrated on the existing resource pit boundaries

at Gedabek - results demonstrated consistent gold, silver and

copper grades and spatial continuity of mineralisation

-- Best intersections of 3.2m at 29.47 g/t gold ('Au'), 11.76

g/t silver ('Ag') and 0.61% copper ('Cu') and 17.3m at 11.57 g/t

Au, 46.52 g/t Ag and 0.88% Cu

-- CAE Mining conducting review of all drilling programmes

completed at Gedabek - new three dimensional orebody interpretation

and modelling expected to be completed by the end of 2011

-- Phase 2 drilling underway concentrating on outside the boundaries of the existing pit

-- Upgraded JORC resource report targeted for Q1 2012 followed

by a JORC compliant reserve estimate later in 2012

Anglo Asian CEO Reza Vaziri said, "These latest drilling results

covering the existing pit continue to demonstrate consistent solid

gold, silver and copper grades and continuity of mineralisation at

Gedabek. With a current resource base of 791,000oz of gold, 49,300t

of copper and 7,597,000oz of silver for all categories, it is our

intention to continue both infill and exploration drilling at

Gedabek. This is focussed on expanding the existing resource

outline in order to announce an increased and upgraded resource by

Q1 2012 and in turn, a JORC compliant reserve estimate thereafter.

Additionally the latest drilling programme has enabled the Company

to gain a better understanding of the metallurgy of the current

resource at Gedabek to help assess future mineral processing

options and ensure an accurate evaluation of the proposed agitation

leaching plant, which would potentially enable an increase in

Gedabek's mine life and thereby further improving the economic

fundamentals of the mine.

"In addition, with gold and copper production continuing to

perform solidly at Gedabek we remain confident of realising our

production target of 58,000 to 60,000oz of gold and 525 tonnes of

copper for FY 2011."

Detailed Information

The latest infill drilling programme at Gedabek comprised 59

holes over 5,460m across a 90,000 sq m area and concentrated within

the boundaries of the existing pit at Gedabek. The drilling

campaign was undertaken with a view to increasing and upgrading

Gedabek's JORC compliant resource, which currently stands at

791,000oz of gold, 49,300t of copper and 7,597,000oz of silver for

all categories. Drilling was also carried out to increase the

confidence of the spatial variability of the already known gold,

silver and copper mineralisation; to assess the metallurgy of the

existing resource and in turn future mineral processing

options.

The link to Table 1 shows the average grades of gold, silver and

copper of each infill drill hole with grades greater than or equal

to 0.3 g/t Au from the fourth drilling programme. The colour in

each drill hole interval highlights the classification of the

mineralisation, as follows:

-- Yellow highlighted results - 0.3 <= Au g/t < 1.5

-- Orange highlighted results - 1.5 <= Au g/t < 3.0

-- Red highlighted results - 3.0 <= Au g/t < 30.0

Link to Table 1

http://www.rns-pdf.londonstockexchange.com/rns/7564Q_-2011-10-24.pdf

Best intersections from this drilling programme at Gedabek

include:

-- SGSDD02 - 19m at 3.61 g/t Au, 10.52 g/t Ag and 0.18% Cu

-- SGSDD16 - 17.3m at 11.57 g/t Au, 46.52 g/t Ag and 0.88% Cu

-- SGSDD22A - 3.2m at 29.47 g/t Au, 11.76 g/t Ag and 0.61% Cu

-- SGSDD31 - 2.3m at 16.05 g/t Au, 73.54 g/t Ag and 3.45 % Cu

-- SGSDD33 - 2.1m at 9.35 g/t Au, 23.26 g/t Ag and 0.42 % Cu

A designated competent person from the mining consultants, CAE

Mining, has carried out a detailed review of the latest drilling

programme results and of those collated from the previous three

drilling campaigns. These data include plan and cross section

views, together with mineral resource models for Gedabek compiled

by mining consultants SRK in 2007 and SGS Geostat in 2010. The

review has confirmed the continuity of the gold, silver and copper

mineralisation and geological structures across the Gedabek

deposit. The new three dimensional orebody interpretation and

modelling is expected to be completed by the end of 2011 with a

view to announcing an upgraded JORC resource estimate by the first

quarter of 2012 and a JORC compliant reserve estimate

thereafter.

With the completion of this latest drilling programme the

drilling grid in the north area of the existing resource at Gedabek

has been reduced to 20 x 20 m in order to improve the

classification and increase the confidence of the spatial

distribution of gold, silver and copper grades across the mineral

resource.

In addition to Phase 1 drilling, the Company commenced Phase 2

of the exploration and development programme of Gedabek in the

first quarter of 2011. Drilling is focussed on increasing the

existing resource base and is concentrated on exploring outside of

the existing pit boundary. So far 55 drill holes for a total of

8,300m of drilling have been completed and some of the assays have

been received. Further drill holes have been planned as the ore

body shows extensions towards the south of the existing pit

boundary.

Other exploration activities continue within the Gedabek

Contract Area, namely at the Maarif target. To date, 1,520m of the

planned 3,000m drilling programme has been completed at Maarif, and

the samples have been sent for independent assay. Remote sensing

has also commenced and is being conducted across the entire Gedabek

Contract Area with several potential anomalies detected for further

investigations, which are planned for 2012.

Qualified Person

This announcement has been reviewed by Mr Gerard Evans the

Competent Person at mining consultants CAE Mining Inc, who has more

than 20 years of relevant experience in the field of activity

concerned. He has a B.Sc (Hons) in Geology, SACNASP registered

(reg. no: 400015/08), member of GSSA and GASA, and has consented to

the inclusion of the material in the form and context in which it

appears.

**ENDS**

For further information please visit www.aamining.com or

contact:

Reza Vaziri Anglo Asian Mining plc Tel: +994 12 596 3350

----------------- -------------------------- ----------------------

Andrew Herbert Anglo Asian Mining plc Tel: +994 12 596 3350

----------------- -------------------------- ----------------------

Stuart Skinner Numis Securities Limited, Tel: +44 (0) 20 7260

as Nominated Adviser 1000

----------------- -------------------------- ----------------------

James Black Numis Securities Limited, Tel: +44 (0) 20 7260

as Corporate Broker 1000

----------------- -------------------------- ----------------------

Felicity Edwards St Brides Media & Finance Tel: +44 (0) 20 7236

Ltd 1177

----------------- -------------------------- ----------------------

Hugo de Salis St Brides Media & Finance Tel: +44 (0) 20 7236

Ltd 1177

----------------- -------------------------- ----------------------

Notes:

Anglo Asian Mining plc (AIM:AAZ) is a gold producer in Central

Asia with a broad portfolio of production and exploration assets in

Azerbaijan. The Company has a 1,962 sq km prospective exploration

portfolio, assembled on the back of analysis of historic Soviet

geological data and held under a Production Sharing Agreement

('PSA') based on the Azeri oil industry. The Company developed

Azerbaijan's first operating gold/copper mine, Gedabek, which

commenced gold production in May 2009. Gold production for the year

ended 31 December 2010 totalled 67,267 oz of gold.

Anglo Asian is actively looking to exploit its first mover

advantage in Azerbaijan to identify additional projects, as well as

looking for other properties in Central Asia and Caucasia in order

to fulfil its expansion ambitions and become a mid-tier gold and

base metal production company focussed in these regions.

This information is provided by RNS

The company news service from the London Stock Exchange

END

DRLDBBDGBXDBGBS

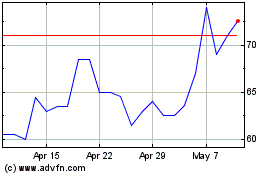

Anglo Asian Mining (LSE:AAZ)

Historical Stock Chart

From Feb 2025 to Mar 2025

Anglo Asian Mining (LSE:AAZ)

Historical Stock Chart

From Mar 2024 to Mar 2025