Armadale Capital PLC Test-Work Commenced with Leading EPC Contractor (3494G)

November 24 2020 - 6:03AM

UK Regulatory

TIDMACP

RNS Number : 3494G

Armadale Capital PLC

24 November 2020

Armadale Capital Plc / Index: AIM / Epic: ACP / Sector:

Investment Company

24 November 2020

Armadale Capital Plc ('Armadale' or 'the Company')

Bulk Test-work Commenced in China with Leading

EPC Contractor

Armadale Capital plc (LON:ACP) the AIM quoted investment group

focused on natural resource projects in Africa, is pleased to

report that the international Engineering, Procurement,

Construction and Manufacturing company Xinhai Mineral EPC

("Xinhai"), part of the Chinese Yantai Xinhai group, has been

selected to commence metallurgical bulk test work as part of the

first phase of the Front-End Engineering Design Studies ('FEED

Studies') for the development of the Mahenge Graphite project.

The objective of the bulk test work is to provide sufficient

data to confirm the results underpinning the definitive feasibility

study and confirm the preferred flow sheet prior to completion of

the Front-End Engineering Design to develop an EPCM fixed price

contract.

As part of this process, bulk ore samples were selected from

diamond core to produce a blend of 22% oxide ore and 78% fresh ore

with an average grade of between 12-14 % TGC which is

representative of the life of mine production profile.

The objectives of this test work include:

-- Confirm overall rates of graphite recovery for all material types

-- To maximise graphite flake sizes to achieve a minimum of 50% in excess of 150 microns

-- To achieve a minimum grade of 95% TGC in all size fractions

Bulk ore samples have been despatched and received by Xinhai

Mineral EPC with test work to commence this week. Xinhai will then

use this data in the final design of the processing plant.

Armadale Chairman, Nick Johansen, commented:

"After running a comprehensive selection process, we are pleased

to report that Armadale has moved forward with the selection of

Xinhai Mineral Processing to commence with this important step

forward in the development of the Mahenge Graphite project. Xinhai

are a highly experienced Chinese contracting group and leaders in

their field of optimising mineral processing solutions, mine design

and build and equipment manufacturing, and we very much look

forward to working with them.

We are also pleased to report that our first bulk ore samples

have now been received by Xinhai who are due to begin work upon

these imminently with the objective of completing a metallurgical

test programme to enable the detailed selection of the processing

plant equipment.

Development efforts are indeed gathering pace at Mahange and in

addition to this exciting appointment to drive forward the FEED

workstream, we are pleased to announce that following a positive

site visit and follow up consultation that the Environmental and

Social Impact Assessment (ESIA) is also progressing and we hope to

be in a positive to update further in this regard in the near

future. The ESIA is one of the final necessary components in the

Mining Licence process and receipt of a Mining Licence will be one

of the final and most important de-risking milestones for the

Project. Our financing discussions are also progressing well and we

continue to see strong levels of interest as we ensure that we put

the best options forward for shareholders at this exciting stage of

development for Armadale."

**ENDS**

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) No. 596/2014.

Enquiries:

Armadale Capital Plc

Nick Johansen, Non-Executive Director

Tim Jones, Company Secretary +44 (0) 20 7236 1177

Nomad and broker: finnCap Ltd

Christopher Raggett / Teddy Whiley +44 (0) 20 7220 0500

Joint Broker: SI Capital Ltd

Nick Emerson +44 (0) 1483 413500

Notes

Armadale Capital Plc is focused on investing in and developing a

portfolio of investments, targeting the natural resources and/or

infrastructure sectors in Africa. The Company, led by a team with

operational experience and a strong track record in Africa, has a

strategy of identifying high growth businesses where it can take an

active role in their advancement.

The Company owns the Mahenge Liandu graphite project in

south-east Tanzania, which is now its main focus. The Project is

located in a highly prospective region with a high-grade JORC

compliant Indicated and inferred mineral resource estimate of

59.48Mt @ 9.8% TGC, making it one of the largest high-grade

resources in Tanzania. The project has been established as a large,

long life graphite deposit capable of producing high quality

graphite concentrate for the rapidly emerging EV market.

Metallurgical test work has confirmed that Mahenge can produce high

quality, high purity graphite, with conventional technology

achieving consistent purity of above 97% TGC, with 99.99% TGC

achievable, making its product suitable for both the high growth

EV/battery market and the expandable and graphite foil markets.

An optimised Definitive Feasibility Study ('DFS') established

that US$985m pre-tax cashflow could be generated from an initial

15-year mine life, utilising just 25% of the resource, which

remains open in multiple directions offering significant further

upside. Based on average annual production of large flake

high-purity graphite of 109ktpa, this led to an estimated pre-tax

NPV of US$430m and IRR of 91%. Armadale intends to deliver low

cost, fast-tracked production through a staged ramp-up plan,

beginning with 60,000tpa graphite concentrate production for the

first three years (Stage 1) before increasing to a life of mine

average of 109,000tpa (Stage 2). Stage 1 has a low capital cost

estimate of US$39.7m, including a contingency of U$S4.1m or 15% of

total direct capital cost with 1.6 year (after tax) payback period

from first production based on an average sales price of

US$1,112/t. Stage 2 expansion is to be funded from cashflow.

Other assets Armadale has an interest in include the Mpokoto

Gold project in the Democratic Republic of Congo and a portfolio of

quoted investments.

More information can be found on the website

www.armadalecapitalplc.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCGZMZMZDGGGZM

(END) Dow Jones Newswires

November 24, 2020 07:03 ET (12:03 GMT)

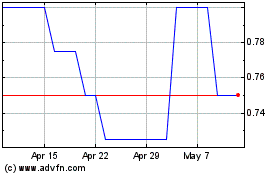

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Jan 2025 to Feb 2025

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Feb 2024 to Feb 2025