Armadale Capital PLC Mahenge Project Update (7077P)

February 13 2023 - 3:00AM

UK Regulatory

TIDMACP

RNS Number : 7077P

Armadale Capital PLC

13 February 2023

Armadale Capital Plc / Index: AIM / Epic: ACP / Sector:

Investment Company

13 February 2023

Armadale Capital Plc

('Armadale' the 'Company' or the 'Group')

Mahenge Project Update

Armadale, the AIM quoted investment company focused on natural

resource projects in Africa, is pleased to announce that it has

made further progress advancing towards commercial production at

the Mahenge Liandu Project in Tanzania. This is an important

strategic development as part of ongoing plans to expedite the path

to commissioning commercial mining operations. Furthermore, the

Company notes the improved investment climate which brings with it

increased potential to attract development funding in Tanzania.

Armadale notes the significant progress made at the neighbouring

Black Rock Resources project over the last 12 months.

Project Update

The Board has accelerated the development of the mining lease at

the Mahenge Liandu Project on several fronts, which collectively

enhance the progression towards commercial mining operations:

Ø The Group continues to collect environmental baseline data as

is required for the compliance of the mining lease and to assist in

the design and planning of the proposed mining operations. In

addition, the base line data for temperature, pressure, wind, moon

phase, humidity, solar radiation, rainfall and stream flow data

assists the local community to have access to regional weather data

for local planning requirements in the Mahenge region.

Ø Planning is underway for Geotech drilling to commence this dry

season, with the sites now prepared for the drill rig. The

information from the proposed drilling program will enable the

design of a plant and tails storage area. This information will

enhance the data from the test pits that were completed last

year.

Ø Logistics routes for the product continue to be assessed to

determine the optimum methods to ensure the final product will

enter the market at the desired price level.

Ø Discussions are ongoing with the Government of Tanzania

regarding the framework for the 16% ownership, with draft

Shareholder agreements, Articles of Association and Joint Financial

model being submitted to both parties for review.

Project Funding

The Group is continuing discussions with several potential

financing partners regarding the debt funding required for project

development. Moreover, significantly improved market fundamentals

and conditions for graphite has seen an increase in interest from

stakeholders capable of providing long-term project finance.

Graphite prices have continued to increase due to strong ongoing

demand from the EV sector, while Benchmark Mineral Intelligence see

further price upside due to a potential supply deficit

materialising in 2023. Current prices are materially above the

level used in the company's feasibility study.

Integral to securing project funding is lining up future

off-take partners. With the post-Covid improvement in graphite

market fundamentals globally, the Board has commenced re-engaging

with prospective end-users which are located in Europe and

China.

Nick Johansen, Director of Armadale, said: "With the global

graphite market in the midst of a cyclical upswing, due to strong

underlying fundamentals stemming from the buoyant EV sector, the

Board remains squarely focused on progressing plans to secure the

framework agreement with the Tanzanian government regarding the 16%

ownership. More importantly, the Board is re-doubling efforts to

secure long-term project finance from a reputable provider and

lining up off-take partners to generate a clear road map to

commissioning a viable commercial mining operation."

Mahenge Liandu Project Summary

The feasibility study completed in March 2020 confirms the

potential for Mahenge Liandu to be a significant supplier of high

quality graphite with a relatively low capex.

-- US$882m pre-tax cashflow generated from initial 17 year mine

life utilises just 25% of the resource, which remains open in

multiple directions offering significant further upside;

-- Estimated pre-tax NPV of US$358m and IRR of 91% with scope

for further positive improvement upon economics in near-term

through delivery of optimised DFS

-- Staged ramp-up planned to facilitate near term production

with 60,000tpa graphite concentrate to be produced for the first

four years (Stage 1) before increasing to 90,000tpa (Stage 2)

-- Capital cost estimate for Stage 1 is US$38.6m, which includes

a contingency of U$S4.1m or 15% of total direct capital cost, a

slight increase on the scoping study allowing for the staged ramp

up

-- 1.6 year payback for Stage 1 (after tax) based on an average sales price of US$1,179/t

-- Stage 2 expansion is expected to be funded from cashflow.

Enquiries:

Armadale Capital Plc

Nick Johansen, Chairman +44 (0) 20 7236

Tim Jones, Company Secretary 1177

Nomad and Broker: finnCap Ltd +44 (0) 20 7220

Christopher Raggett / Simon Hicks / Seamus Fricker 0500

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFIFFTFIIVLIV

(END) Dow Jones Newswires

February 13, 2023 04:00 ET (09:00 GMT)

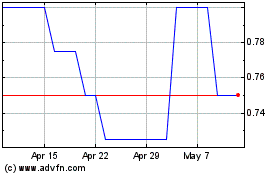

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Nov 2024 to Dec 2024

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Dec 2023 to Dec 2024