AEW UK REIT plc: Acquisition of prime retail site in Bristol city centre (1210822)

June 23 2021 - 2:14AM

UK Regulatory

AEW UK REIT plc (AEWU)

AEW UK REIT plc: Acquisition of prime retail site in Bristol city centre

23-Jun-2021 / 08:13 GMT/BST

Dissemination of a Regulatory Announcement, transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

=----------------------------------------------------------------------------------------------------------------------

23 June 2021

AEW UK REIT Plc

Acquisition of prime retail site in Bristol city centre

AEW UK REIT plc (LSE: AEWU) (the "Company") is pleased to announce the acquisition of a prime retail site in the heart

of Bristol city centre for a purchase price of GBP10.19 million, equating to GBP161 per sq ft and reflecting a net initial

yield of 8%.

15-33 Union Street occupies a prominent location in Bristol city centre, opposite The Galleries Shopping Centre and

near Cabot Circus, Bristol's premier retail destination. Located on a busy thoroughfare for pedestrians, the 63,125 sq

ft property experiences high footfall and is ideally suited for retail or leisure use. The location of the site has

also been identified as a major regeneration area.

Constructed in 2001, the property currently comprises five purpose built split-level retail or leisure units over four

floors with road access to both Union Street and Fairfax Street. Four of the five units are let to three household

names and a successful local retailer. The remaining unit is currently vacant, with the vendor providing a 12 month

rent guarantee. We are currently in discussions with a number of parties who are keen to occupy this space.

Alex Short, Portfolio Manager, AEW UK REIT, commented: "We are pleased to have acquired this prominent and busy city

centre property. This is an excellent fit for our portfolio and will immediately contribute to AEWU's income stream.

The site offers the opportunity to benefit from the major regeneration currently underway in Bristol city centre over

the long-term. While we have made two recent investments in the retail sector, our overall exposure remains relatively

low compared to industrial. We continue to take a cautious approach to retail, judging each site on its specific

merits."

Following completion of the above purchase, the Company holds c. GBP6.7 million of cash and has available c. GBP4.5 million

of its debt facility up to the drawdown limit of 35% Loan to NAV.

The Company's portfolio exposure is broken down by sector as follows:

Sector Valuation (as provided by Knight Frank as at 31 March 2021 plus subsequent acquisitions at purchase

price)

GBP million %

Industrial 108.8 55.1

Retail 39.3 19.9

Office 36.8 18.6

Other 12.6 6.4

Total 197.5 100.0

Enquiries

AEW UK

Alex Short alex.short@eu.aew.com

+44(0) 20 7016 4848

Nicki Gladstone nicki.gladstone-ext@eu.aew.com

+44(0) 7711 401 021

Company Secretary

Link Company Matters Limited aewu.cosec@linkgroup.co.uk

+44(0) 1392 477 500

TB Cardew AEW@tbcardew.com

Ed Orlebar +44 (0) 7738 724 630

Tania Wild +44 (0) 7425 536 903

Lucas Bramwell +44 (0) 7939 694 437

Liberum Capital

Darren Vickers / Owen Matthews +44 (0) 20 3100 2000

Notes to Editors

About AEW UK REIT

AEW UK REIT plc (LSE: AEWU) aims to deliver an attractive total

return to shareholders by investing predominantly in smaller

commercial properties (typically less than GBP15 million), on

shorter occupational leases in strong commercial locations across

the United Kingdom. The Company is currently invested in office,

retail, industrial and leisure assets, with a focus on active asset

management, repositioning the properties and improving the quality

of income streams. AEWU is currently paying an annualised dividend

of 8p per share.

The Company was listed on the Official List of the UK Listing

Authority and admitted to trading on the Main Market of the London

Stock Exchange on 12 May 2015. www.aewukreit.com

LEI: 21380073LDXHV2LP5K50

About AEW UK Investment Management LLP

AEW UK Investment Management LLP employs a well-resourced team

comprising 26 individuals covering investment, asset management,

operations and strategy. It is part of AEW Group, one of the

world's largest real estate managers, with EUR72.8bn of assets

under management as at 31 March 2021. AEW Group comprises AEW SA

and AEW Capital Management L.P., a U.S. registered investment

manager and their respective subsidiaries. In Europe, as at 31

March 2021, AEW Group managed EUR35.7bn of real estate assets on

behalf of a number of funds and separate accounts with over 420

staff located in 9 offices. The Investment Manager is a 50:50 joint

venture between the principals of the Investment Manager and AEW.

In May 2019, AEW UK Investment Management LLP was awarded Property

Manager of the Year at the Pensions and Investment Provider

Awards.

www.aewuk.co.uk

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB00BWD24154

Category Code: MSCL

TIDM: AEWU

LEI Code: 21380073LDXHV2LP5K50

Sequence No.: 112922

EQS News ID: 1210822

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1210822&application_name=news

(END) Dow Jones Newswires

June 23, 2021 03:14 ET (07:14 GMT)

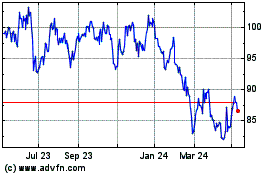

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From Jan 2025 to Feb 2025

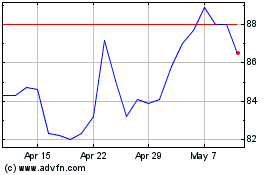

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From Feb 2024 to Feb 2025