TIDMAJAX

RNS Number : 6763U

Ajax Resources PLC

27 November 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF REGULATION 11 OF THE MARKET ABUSE (AMMENT) (EU EXIT) REGULATIONS

2019/310.

27 November 2023

AJAX RESOURCES PLC

("Ajax" or the "Company")

Half-Yearly Report for the 6 months to 31 August 2023

Proposed General Meeting

The Board of Directors of Ajax (the " Board "), the UK listed

special purpose acquisition company with a focus on natural

resources [LSE: AJAX], announces its half-yearly results for the 6

months to 31 August 2023 (the " Interim Results "), and, in

addition, its intention to seek approval from shareholders for an

extension of its investment policy (the " Policy ").

Interim Results

The Board is pleased to announce the Company's unaudited

financial results for the 6 months to 31 August 2023. A full copy

of the Interim Results can be viewed at:

http://www.rns-pdf.londonstockexchange.com/rns/6763U_1-2023-11-27.pdf

A copy can also be viewed on the National Storage Mechanism and

on the Company's website:

(

https://www.ajaxresources.com/investors/key-documents/#tabs-financial-statements

)

Key elements of the Interim Results can also be viewed

below.

Proposed General Meeting

In the Company's prospectus published at the time of its

admission to trading on the Main Market of the London Stock

Exchange on 7 April 2022 (the " Prospectus "), the Board undertook

that if a suitable acquisition target was not identified within 18

months, then it would either seek a one-year extension or a winding

up of the Company.

The Board unanimously proposes to shareholders that a one-year

extension to the Policy is approved and intends to call a General

Meeting during February 2024.

A copy of the Prospectus can be viewed on the Company's website

at:

https://www.ajaxresources.com/investors/key-documents/#tabs-admission-documents

-S -

For further information:

Ajax Resources Plc Tel: + 44 (0) 208 146 6345

Ippolito Cattaneo, Chief Executive info@ajaxresources.com

Officer

Allenby Capital Limited (Financial Tel: + 44 (0) 203 328 5656

Adviser) n.harriss@allenbycapital.com

Nick Harriss / Daniel Dearden-Williams d.dearden-williams@allenbycapital.com

---------------------------------------

Chairman's Statement

The Company has continued to make good progress towards

successfully identifying an acquisition in the natural resources

sector.

Ajax has been evaluating various advanced gold and copper

exploration opportunities across several jurisdictions, as well as

certain metal recovery projects located in Central Asia utilizing

innovative, environmentally friendly technologies capable of

generating significant profitability.

We have continued, in view of our current development stage, to

maximise cost control in keeping expenditure to a minimum.

It is our belief that we are now potentially not far from

finding an opportunity that satisfies our development criteria, and

we consider the gradual recovery in UK market sentiment to

constitute an auspicious backdrop for our potential near-term

progress.

We thank shareholders for their continued trust and support as

we deliver on our mandate.

Michael Hutchinson

Non-Executive Chairman

November 27, 2023

Principal Financial Statements

The notes to the financial statements form an integral part of

these financial statements and can be viewed through the link

above.

STATEMENT OF COMPREHENSIVE INCOME

Notes 31/08/2023 31/08/2022

Unaudited Unaudited 6

6 months GBP months GBP

-------------------------------- ------ -------------- -------------

Revenues - -

Cost of sales -

-------------------------------- ------ -------------- -------------

Gross profit - -

Other interest receivable 28,120 -

Administrative expenses (124,128) (97,876)

-------------------------------- ------ -------------- -------------

Operating loss and loss

before income tax 4 (96,008) (97,876)

Taxation 5 - -

Loss and total comprehensive

loss for the period (96,008) (97,876)

-------------------------------- ------ -------------- -------------

Loss per share attributable 6

to the equity holders (pence)

Basic

Diluted (0.20) (0.21)

(0.20) (0.21)

-------------------------------- ------ -------------- -------------

STATEMENT OF FINANCIAL POSITION

Notes 31/08/2023 31/08/2022

Unaudited 6 months Unaudited 6 months

GBP GBP

--------------------------------- ----- ------------------- -------------------

Current assets

Other receivables 8 44,425 -

Negotiable Financial Instruments 8 170,413 -

VAT Credit 8 - 25,884

Cash and cash equivalents 9 818,124 1,249,546

--------------------------------- ----- ------------------- -------------------

1,032,962 1,275,430

Total assets 1,032,962 1,275,430

--------------------------------- ----- ------------------- -------------------

Equity

Ordinary shares 10 468,125 1,436,660

Share Premium Reserve 10 1,019,035

Options & Warrants 10 518,200

Retained earnings/(loss) (1,035,350) (177,501)

--------------------------------- ----- ------------------- -------------------

Total equity 970,010 1,259,159

Current Liabilities

Other payables 11 62,952 16,271

Total equity and liabilities 1,032,962 1,275,430

--------------------------------- ----- ------------------- -------------------

STATEMENT OF CASH FLOWS

31/08/2023 31/08/2022

--------------------------------------------

Unaudited 6 Unaudited 6

months months

GBP GBP

--------------------------------------------

Cash flows from operating activities

Loss before tax (96,008) (97,876)

Increase in receivables 18,581 11,952

Increase in payables 46,681 (6,109)

Change in working capital (256,125) -

-------------------------------------------- --------------------------- -----------------------------

Net cash used in operating activities (261,027) (92,033)

-------------------------------------------- --------------------------- -----------------------------

Negotiable Financial Instruments (170,413)

Cash flows from investing activities (170,413) -

Net cash used in investing activities (170,413) -

-------------------------------------------- --------------------------- -----------------------------

Cash flows from financing activities

Proceeds from the issue of ordinary shares

(net of issue costs) - 1,341,579

Net cash from financing activities - 1,341,579

-------------------------------------------- --------------------------- -----------------------------

Net increase / (decrease) in cash and

cash equivalents (431,422) 1,249,546

Cash and cash equivalents at the start 1,249,546 -

of the period

-------------------------------------------- --------------------------- -----------------------------

Cash and cash equivalents at the end

of the period 818,124 1,249,546

-------------------------------------------- --------------------------- -----------------------------

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR NKOBDKBDKDDB

(END) Dow Jones Newswires

November 27, 2023 02:00 ET (07:00 GMT)

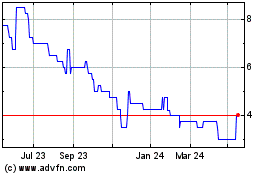

Ajax Resources (LSE:AJAX)

Historical Stock Chart

From Jan 2025 to Feb 2025

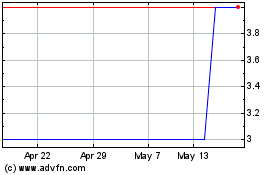

Ajax Resources (LSE:AJAX)

Historical Stock Chart

From Feb 2024 to Feb 2025