TIDMALT

RNS Number : 0300H

Altitude Group PLC

25 July 2023

Altitude Group plc

("Altitude", the "Company" or the "Group")

Audited Annual Results for the Year Ended 31 March 2023 and

Notice of Annual General Meeting

ALTITUDE DELIVERS IN CURRENT YEAR AND LOCKS IN FUTURE GROWTH

Financial Highlights

-- Group revenues increased by GBP6.9 million to GBP18.8

million, up 57.2% (2022: GBP11.9 million)

-- Gross profit increased 39.9% by GBP2.5 million to GBP8.6 million (2022: GBP6.2 million)

-- We are proud to report a record Group adjusted operating

profit* growing by 83.4% to GBP2.0 million (2022: GBP1.1 million)

replacing GBP0.5m of US Government retention credit with

sustainable profitable growth

-- Basic and diluted earnings per share increased by 293% to 0.55p (2022: 0.14p)

-- Cash inflow from operating activities increased by GBP1.8

million to GBP1.6 million (2022: outflow GBP0.2m) driven by

significant revenue growth and increased trading activities

-- Cash outflow from investing activities of GBP1.1 million (2022: GBP0.9 million)

-- Cash increased by GBP0.3 million to GBP1.2 million (2022: GBP0.9 million)

-- The Group secured a financing facility of $1.7 million to

support future substantial growth in Merchanting. The facility

remains undrawn and the Group is debt-free

* Operating profit before share-based payment charges,

amortisation of intangible assets, depreciation of tangible assets

and exceptional charges

Key corporate developments and operational highlights

-- The Group enjoyed a record year of adjusted operating profit

-- The Group invested in pipeline growth and business

development efforts, which have paid off, and driven significant

growth across its Merchanting divisions, providing GBP1.6 million

of operating cashflow to drive future growth

-- The US delivered adjusted operating profit growth of 49%

reaching $4.1 million (2022: $2.8 million)

-- The Group's adjacent market solution has proven to be

disruptive in the sector and is driving hyper-growth across the

Group with the signing of high-value multi-year contracts which

will all generate revenue in the first half of the current

financial year. Further contracts have been signed after the

year-end.

-- ACS added significant revenue growth, doubling the annualised

expected revenue run-rate from Affiliates in the year

-- Services revenue has grown by 35%, which delivers a 90.6% fall through to gross margin

-- US AIM membership has continued to grow, and currently totals

2,214 global members, up from 1,917 at acquisition, consolidating

its position as one of the largest distributor organisations

Please note that percentages are calculated based on unrounded

numbers as reported in the primary statements.

Notice of Annual General meeting ("AGM")

The Company also gives notice that its AGM will be held at the

offices of Zeus, 125 Old Broad Street, 12th Floor, London, EC2N 1AR

on 14 September 2023 at 11 a.m. The Notice of AGM and the Annual

Report for the year ended 31 March 2023 will be posted to

shareholders and will be available on the Group's website (

https://www.altitudeplc.com/reports-results ) in due course.

Outlook

-- Preferred Partner service revenues underlyingly grew by 21.5%

in the US compared to reported growth of 11.4%-15.6% Industry

reported distributor sales growth reflecting a healthy, active

membership network. Source (ASI and PPAI).

-- New ACS Merchanting affiliates doubling expected annualised

revenue signed during the year with full year impact in FY24

-- Significant new adjacent market contracts won and expected to

start transacting by September 2023 with further investment in

pipeline for continued scalable growth

-- The Group remains debt free with an increased facility to support growth

-- The Board is confident that the Group will deliver

substantial growth for FY24 and win further material contracts for

future years

Nichole Stella , Group CEO of Altitude, said:

"This financial year was one of great progress, strong trading

and record breaking results. We increased market share in our core

markets and proved to be a disruptive force in a new market. As a

result, the Group has shown growth across the business far

exceeding our original expectations. This performance is a

testament to not only the incredible hard work of our dedicated

staff and management team but also a testament to the success of

the strategy that was put in place when I arrived and renewed with

vigour in 2021. I am delighted that we grew the existing business

by 57.2% which in itself is no small feat, but to do it on a global

basis whilst establishing a new vertical is a great achievement. We

have a business that is robust, ambitious and is very well

positioned for scalable growth. We look forward to the future, both

near term and longer term, with great confidence."

Altitude Group plc Via Zeus

Nichole Stella, Chief Executive Officer

Graham Feltham, Chief Financial Officer

Zeus (Nominated Adviser & Broker) Tel: +44 (0) 203

Dan Bate/David Foreman/James Edis (Investment 829 5000

Banking)

Dominic King (Corporate Broking)

Chairman's Statement

I am pleased to report that the Group has shown strong

performance in FY23 and once again delivered revenue growth

exceeding 50%.

The management team remained highly focused on operational

gearing and delivery of continuous scalable growth despite

macro-economic headwinds. This focus proved successful and the

Group delivered 57% revenue growth to GBP18.8 million via the

continued delivery of growth in AIM Services and the scaling of our

Merchanting programmes. Growth in adjusted operating profit of 83%

to GBP2.0 million has been achieved against the previous year that

included a non-recurring GBP0.5m US Government credit. This is an

excellent result and is testament to the continued delivery of our

strategy and the power of our business model.

The management team continued development of our technology and

marketing platforms to provide our AIM distributors, ACS Affiliates

and Preferred Partner suppliers with market leading capabilities.

The AIM distribution network continues to grow, with ACS Affiliates

doubling their expected annualised revenue. Significant new

contracts were signed in our Adjacent Market Programme to further

boost revenue in FY24 and build an exciting new growth engine for

future years.

Year in Focus

We have seen growth in both our core businesses and our Adjacent

Market Programmes outstrip the market.

This is a very positive demonstration of our commitment to

provide value to our superb network of excellent suppliers and

distributors via exceptional service and the highest standards.

Technology innovation and development remain at the core of our

business as we continue to gain more expert users and utilise their

demands and needs to drive improvement. Our technology partnership

with Fully Promoted is a prime example who selected to work with us

after carrying out an industry wide review of fit-for-purpose

technology. We will continue to invest capital and resource in

technology for the benefit of all our stakeholders.

The strategy to develop diversified revenue streams within our

Merchanting business has yielded excellent results. In our Adjacent

Markets we have won a significant number of material contracts in

the education sector in its first year of business development, via

our fresh and innovative approach to the sector. The doubling of

our revenue base for ACS has resulted from the exceptional support

we provide to them to grow their business unencumbered by

bureaucracy. The results of this investment in Merchanting can be

seen in this report but the full impact will be seen in future

years through diversity, growth rate, and significantly enhanced

pipeline. The focus of the management team is firmly on delivery

and execution of this strategy. They have repeatedly delivered

above market expectations during this year, and I have trust in

them to continue their excellent performance.

Cash has been managed well during the year generating an

additional GBP0.3 million. Prudently the process was undertaken to

extend our existing credit facility from $0.7 million to $1.7

million in anticipation of growth in Adjacent Markets where there

is an element of up-front investment in fit out and inventory to

service the 5 year contracts. The facility has been secured ahead

of time and will be under constant review. The Group remains debt

free with the material credit facility in place to support future

growth as opportunity arises.

Looking Forward

A business only moves forward though the dedication of its

people. On behalf of the Board I'd like to thank all the Altitude

Group's employees for their hard work and passion which has

delivered another strong set of results.

As we move through 2023 and 2024, we will focus on the world

class onboarding of the material contracts won, accelerating

acquisition of new contracts, and continuing to develop our

technology to expand and enhance our unique promotional goods

marketplace. The Management team are under no illusions, the

success of our contract wins provides operational challenges to

navigate and overcome whilst maintaining the hunger to further

improve and win new business. I am confident we have the right team

in place under the dynamic and agile leadership of Nichole to

continue delivery of our strategy.

We have made significant progress, achieved notable milestones,

and positioned ourselves for sustained growth in a dynamic

marketplace. We remain committed to listening to and delivering

superior value to our stakeholders and look forward to the exciting

opportunities that lie ahead.

David Smith

Non-Executive Chairman

24 July 2023

Chief Executive's Statement

The year ended 31 March 2023 ("FY23") has proven to be a

breakthrough year for the Group, setting new records and heralding

a notable phase of transformation and scalability across the entire

organisation. Against a backdrop of macro-economic challenges, the

Group has seen strong growth in our promotional products divisions

and the rapid advancement and expansion in our Adjacent Markets

Programs (AMPs) throughout North America.

Via our AMPs we identified, targeted, and seized a significant

opportunity in the higher-education space and successfully launched

our Gear Shop solution providing technology & e-commerce

solutions, marketing tools, supply chain know-how and innovative

retail experiences across the US markets. Throughout the year we

expanded our pipeline and collaborated closely with our course

material partner. The combination of different specialisms and

enhanced services proved disruptive within the Educational/

Collegiate markets. In the year the Group delivered significant

multi-year contract wins and maintained an ever-growing pipeline.

Continued expansion and delivery of our Gear Shop technology

solutions, marketing tools, supply chain know-how and innovative

retail experiences across the US markets will remain a primary and

growing focus within the Group's business model.

Thanks to the team's unwavering dedication, exceptional

performance, and relentless pursuit of growth, the Group has once

again achieved a year of outstanding results. Group revenues

increased 57.2% to GBP18.8 million (2022: GBP11.9 million) and

Group adjusted operating profit* increased 83.4% to GBP2.0 million

(2022: GBP1.1 million). Further, I am pleased to report our above

stated growth significantly out-paced the market. The promotional

product industry trade association, PPAI, recently released the

U.S. promotional products market, which grew by 15.6% over 2022 and

reported sales figures to $25.5 billion (2022: $22.1 billion).

Operational Excellence

As a company we are always focused on continuous improvement and

heightened operational gearing. We do this by regularly evaluating

and implementing new strategies to drive process optimisation,

building programmes that focus on economies of scale and improve

our technology and systems to increase production efficiency. Over

the last year, the Group has made great gains in streamlining

operations which have empowered us to invest back in the business

to drive pipeline growth and new revenue generating activities.

This focus on operational gearing has enhanced our ability to adapt

to changing market conditions and take advantage of new

opportunities.

Services

During FY23, our Services Revenue demonstrated remarkable

growth, increasing 35.1% and reaching GBP8.5 million (2022: GBP6.3

million). Simultaneously, our Merchanting Revenue experienced a

81.9% increase, totalling GBP10.2 million (2022: GBP5.6 million).

These impressive outcomes serve as a testament to the achievements

and advancements made by our business in expanding our market

presence and diversifying our revenue streams.

Our Services programs have a global reach, with members located

in every state in the US, as well as across Canada and the UK.

Currently, our global membership stands at 2476, with an impressive

aggregate pipeline sales of GBP2.9 billion and an average

individual annual turnover of GBP1.2 million. Furthermore, we are

proud to have established partnerships with over 300 Preferred

Partners across the US, Canada, and the UK.

Merchanting

In contrast, our Merchanting programs are exclusively focused in

the US, and are steadily expanding across the country. These

programmes consist of ACS, where we recruit high-calibre

promotional product sales professionals to join ACS. These sales

professionals act as our sales agent and in return we provide

access to our Preferred Partner network and administrative,

accounting and financial assistance. Also within our Merchanting

revenue stream is our AMPs, where we provide branded merchandise

solutions within adjacent markets. This includes our Gear Shop

solution.

In FY23, we doubled our revenue base for ACS, to GBP9.7 million

(2022: GBP5.4 million). This growth highlights the strong emphasis

we place on recruitment of high-quality affiliates and our

commitment to maintaining exceptional quality standards.

Additionally, throughout the financial year we invested in our

AMPs pipeline. As previously noted, we identified, targeted, and

invested in business development and pipeline growth within the

higher-education space and successfully launched our Gear Shop

solution. This investment proved powerful and disruptive within the

sector, and the Group successfully signed multiple new significant

contracts. All contracts are expected to begin generating revenue

for the Group in the first half of the financial year ending 31

March 2024 ("FY24").

Technology

The core of all our operations, across both the Services and

Merchanting segments of our business, is our technology platforms.

Operating within an agile and continuous improvement environment,

we have consistently invested in enhancing our systems. This

ongoing commitment enables us to achieve greater efficiency,

leverage valuable data insights, and establish best-in-industry

integrations and systems. The result is a streamlined and optimised

operation that empowers us to deliver exceptional services to our

clients.

As a testament to the power of our technology, in FY23, we

continued to attract a growing number of users, including notable

partnerships like Fully Promoted. Fully Promoted, a global

franchise group, chose our order management platform after

conducting a comprehensive industry-wide review of over 20 tech

providers.

We are always focused on new technology and have begun to

harness the power of AI within the Group. Our core development

teams continue to review how we as a Group can maximize AI

technology to drive automation and streamline efficiency across all

of our platforms and business divisions.

Credit Facility

We were also pleased to report in the financial year that the

Group secured an increase in its working capital credit facility

(the "Facility") with TD Bank N.A. to $1.7 million, previously

$700k. The facility increase was secured from continued successful

delivery across all areas of the business. The Facility has no

significant financial covenants and will provide access to

non-dilutive funding to support the continued execution of the

Group's growth strategy. The Facility is currently undrawn.

The Management team continues to be focused on scalable growth

in the new financial year and accelerating future growth. We are

focused on delivery and committed to achieving our aspirations to

build a $100 million business.

Market Opportunities

As noted previously, PPAI's market research estimates the

current size of the U.S. promotional products market in 2022, a

healthy increase of more than 15% over 2021. Their report further

states that the market remains optimistic for 2023 with nearly 70%

of the industry's distributors expecting even higher sales in 2023,

meaning we could continue to see the industry's momentum continue

to gain higher ground. The market remains highly fragmented with a

network of 23,000 distributors and the top 5 market-leading

distributor organisations representing a small segment of the

market at c.$3 billion in sales.

At present, the Group boasts a network of over 2,214

distributors in North America, accounting for approximately 10% of

the total distributor companies in the industry. With a highly

skilled management team and advanced technology tailored to the

industry, we offer comprehensive solutions to suppliers, including

pricing benefits, marketing support, finance assistance, and

administrative services. This strong foundation positions us

optimally to drive business growth through our service programs,

namely AIM Membership, our Preferred Partner program, and our

merchanting program known as ACS Affiliate Services.

Pairing ongoing industry expansion and the presence of an

untapped addressable market, along with our powerful software

solutions and programs, we are confident in the Group's continued

significant promotional product market opportunity.

Additionally, we are seeing incredible momentum within the Group

across identified adjacent markets opportunities. Our primary areas

of focus are the print industry with a reported market size of c$79

billion and the higher education service provider sector with a

stated $12 billion market size. Currently we are actively and

aggressively building our pipeline, closing opportunities and

disrupting the higher education adjacent market. Having signed

significant multi-year contracts in this financial year, we see

this as an important and significant growth area for the Group in

the immediate term and future.

Our People & Our Commitment

Our workforce and community form the backbone of our business.

We remain dedicated to fostering employee growth and cultivating a

welcoming and engaging culture that recognises the achievements and

contributions of all employees at every level of the organisation.

Throughout the year, we continued to prioritise internal

promotions, enabling 12 individuals to advance their careers and

expand their skill sets.

Diversity, Equity & Inclusion

Our organisation fully embraces and upholds the values of

diversity, equity, and inclusion (DEI). These principles play a

vital role in how we form our teams, develop our leaders, and

establish collaborative, innovative, and inclusive environments

within the Altitude Group and our wider industry. Our inclusive

culture fosters a range of perspectives, encourages open and honest

discussions, and empowers each individual within our team and the

broader communities we serve.

Community Engagement & Giving Back

At Altitude, our commitment to community engagement and giving

back is core to who we are and what we believe to be vital for the

overall success and well-being of society. We actively participated

in a variety of community-based initiatives in the financial year

including launching a JustGiving fundraiser with a corporate match

for those impacted by the war in Ukraine and the "adoption" of an

animal rescue whose mission is to rescue, rehabilitate and educate,

as well as providing scholarship funds to students within the

campus communities we serve. We know this commitment fosters a

strong bond between our company and the communities we operate in,

and also increases loyalty and employee satisfaction. Our goal is

to be a part of a growing commitment to corporate responsibility

that contributes to a more inclusive resilient society that works

towards the betterment of all.

Outlook

This financial year was one of great progress, strong trading

and record breaking results. We increased market share in our core

markets and proved to be a disruptive force in a new market. As a

result, the Group has shown growth across the business far

exceeding our original expectations. This performance is a

testament to not only the incredible hard work of our dedicated

staff and management team but also a testament to the success of

the strategy that was put in place when I arrived and renewed with

vigour in 2021. I am delighted that we grew the existing business

by 57.2% which in itself is no small feat, but to do it on a global

basis whilst establishing a new vertical is a great achievement. We

have a business that is robust, ambitious and is very well

positioned for scalable growth. We look forward to the future, both

near term and longer term, with great confidence.

Nichole Stella

Chief Executive

24 July 2023

Chief Operating Officer's Report

We continued to invest strategically in technology development

and operational efficiencies during the year. As a result, the

Group ended FY23 with significantly greater functionality and

infrastructure to support both our Merchanting and Services

business segments. This period saw a particular focus on leveraging

technology to support increasing volumes and enhance operational

efficiency along with continuing advancements to our feature rich

member and affiliate Tech Suite solutions.

Product Innovation and Development

Our proprietary e-commerce and marketplace technology suite

provides an end-to-end SaaS solution that enables our users to

source, showcase and fulfil orders for branded items throughout the

US and UK. Technological advancement remains core to our strategy,

and we made remarkable progress in developing and launching new

functionality to members and affiliates. Our talented in-house

research and development team introduced several advancements to

the AIM and ACS Tech Suite that address the evolving needs of our

users. These innovations have not only driven customer satisfaction

but also contributed to our revenue growth, by enabling more

efficient platform usage by larger volume affiliates and quicker

onboarding of users.

Throughout this period seven planned technology releases were

made available to users which included over 25 substantial new user

facing features including: API company store order integrations

expanding our customer reach; enhancements to our in-built

presentation tools to advance users sales capabilities and

optimised purchasing capabilities to increase user; and internal

order processing efficiencies.

Core to our systems is the accuracy and availability of data

that is exchanged between users and Preferred Partners. Access to

live inventory, order and shipping information from Preferred

Partners allows users to process orders efficiently and in a

centralised location, while making communications more efficient

for Preferred Partners. The Group now have over 200 integrations

exchanging live data between Preferred Partners and Tech Suite

users.

The Group has witnessed an increase in the depth of system usage

with a 14.5% growth over 2022 in users processing orders through

the Tech Suite platform and a 16% growth in volume of orders

processed. There are currently 478 distributors utilising the Tech

Suite for search and order creation.

Following the Group's introduction of adjacent market programmes

in 2022, IT and system environments including fixed and mobile

point-of-sale configurations with shared inventory-based ecommerce

websites, were designed to support the groups Merchanting revenues.

There are currently 11 point-of-sale locations, 18 ecommerce

solutions and complementary pop-up ecommerce stores transactional

with a robust operational plan to enable further scaling.

Operational Excellence

We continued to enhance our operational efficiency and agility

through various initiatives. We have initiatives to implement

artificial intelligence across different departments, resulting in

streamlined processes and greater ability to scale more

effectively. We have also implemented greater automation in areas

such as data conversion resulting in the capacity to migrate groups

of users at greater pace.

Cybersecurity and Data Protection

Safeguarding our systems, data, and customer information is of

paramount importance. We have implemented increased cybersecurity

measures to protect our digital infrastructure from evolving

threats and increased the frequency of employee training on cyber

security and related topics. Furthermore, we have reinforced our

commitment to data protection, privacy compliance and payment

industry standards and rolled this out into our adjacent market

operations.

Looking Ahead

As we look ahead, we remain committed to providing best-in-class

solutions to our market by embracing customer feedback and emerging

trends to support our business strategies. We will continue to

invest in research and development, data intelligence and further

exploring areas such as artificial intelligence and automation to

enhance user experiences and drive scalable growth through

operational efficiency.

Deborah Wilkinson

Chief operating Officer

24 July 2023

Chief Financial Officer's Report

Financial Results

Group revenues for the year increased by GBP6.9 million to

GBP18.8 million (2022: GBP11.9 million), an increase of 57% with an

underlying growth of 41% at constant currency.

FY23 is the year of 'lift off' for Altitude with 35% growth in

Services and an 82% growth in Merchanting. Service growth is mainly

driven from throughput revenue, derived from membership activity

through our VIP Supplier network, surpassing the industry

distributor average of 15.6% (as reported in PPAI Research), which

reflects our commitment to a high quality distributor membership

model. The Merchanting Division has grown from additions to our

Affiliate sales network, which is the main driver behind the 82%

increase over last year. Importantly, we have also grown our

Adjacent Market Programmes ('AMPs') focusing on our Gear Shops

within the Educational Sector. Altitude's entrance into a

complementary adjacent market provides growth opportunities as well

as diversification. As communicated we have secured a number of

contracts that will positively impact the results in future

years.

Operational gearing is a key area of focus for us with the

profitability generated from our Services business model we have

invested in the growth of our Merchanting Division. With ACS

delivering high levels of revenue growth for lower margin,

profitability is sensitive to overhead increases therefore process

efficiency and cost control is essential to maximise profit fall

through. Within our Gear Shops we assess returns on each contract

to measure the appropriate level of investment in a strong central

team. The central Gear Shop team will then be equipped to deliver

further growth. To ensure scalability in FY24 we are investing in

systems and processes.

Year ended Year ended

31 March 31 March

2023 2022

GBP'000 GBP'000

----------- -----------

Group Group Change % Change

Turnover

Services 8,523 6,308 2,215 35.1%

Merchanting 10,238 5,628 4,610 81.9%

Total 18,761 11,936 6,825 57.2%

--------------- ----------- ----------- -------

Gross Profit

Services 7,718 5,750 1,968 34.2%

Merchanting 887 400 487 121.8%

Total 8,605 6,150 2,455 39.9%

--------------- ----------- ----------- -------

Gross Profit

Margin

Services 90.6% 91.2%

Merchanting 8.7% 7.1%

Total 45.9% 51.5%

--------------- ----------- -----------

Gross profit has increased by GBP2.5 million, a 40% increase, to

GBP8.6 million (2022: GBP6.2 million). This is mainly driven by an

increase in the AIM distributors purchasing through our Preferred

Partner network, demonstrating the value of our services to our

Preferred Partners.

Gross margin was 45.9% (2022: 51.5%) reflecting the growth in

lower margin Merchanting activity, whilst Services retained a

consistently high margin. The relationship of the growth in AMPs

and our ACS Affiliate model impacts our Gross Profit margin. AMPs

deliver a higher gross profit margin than the ACS Affiliate model,

which is a volume business. ACS won some larger one-off orders this

year, which is testament to our goal of enabling our Affiliates to

grow and deliver more activity and value.

Administration expenses before share-based payments,

amortisation of intangible assets, depreciation of tangible assets

and exceptional charges of GBP6.6 million (2022: GBP5.1 million)

are ahead of prior year by GBP1.5 million. This increase has been

driven by a prior year one-off US Government Employee Retention

Scheme Credit of GBP0.5 million, a GBP0.5 million foreign currency

translation, with the remaining increase of GBP0.5 million driven

from a mix of additional travel and marketing activities to drive

pipeline and people costs.

Adjusted operating profit* increased by 83.4% to GBP2.0 million

(2022: GBP1.1 million). The statutory profit before taxation was

GBP0.4 million (2022: profit of GBP0.1 million), whilst the

adjusted profit*** before taxation increased by GBP0.8 million to

GBP0.9 million (2022: GBP0.1 million). Please see below for

constant currency analysis.

Exceptional costs

The Group incurred exceptional costs of GBP0.1 million (2022:

GBP0.2 million) relating to second-phase finance transformation

costs, along with a provision for the historic portion of a VAT

reclaim and legal costs.

Development

The Group capitalised GBP0.9 million of software development

(2022: GBP0.8 million). The commitment to investing in our

technology is underpinned by our spend and our close relationship

with our Affiliates and members in driving customer focused

improvements. This is discussed in more detail in the COO

review.

Earnings per share

Basic earnings per share were 0.55p (2022: 0.14p), an increase

of 293%. Adjusted basic earnings per share** was 1.63p (2022:

0.48p), representing an increase of 240%. The calculation for

adjusted earning per share has been updated to be consistent with

external measures by adding back amortisation on acquired

intangibles whereas previously all depreciation and amortisation

was added back.

Taxation

The Group is carrying a deferred taxation asset of GBP 458,000

mainly in respect of tax losses carried forward. Based on future

forecasts the Directors believe the Group's profits will be

sufficient to fully utilise the deferred tax asset within the next

four years. The Group was again successful in its application for

the R&D tax credit although expect that this will reduce in

light of the UK Governments budget resulting in a profit and loss

tax credit of GBP193,000 (2022: GBP254,000).

Cash ow

Operating cash inflow before changes in working capital was

GBP2.0 million (2022: GBP1.1 million). Working capital represented

an outflow of GBP0.4 million (2022: GBP1.5 million) principally

driven by an increase in inventory driven by the early start of a

significant Merchanting contract. Operating cash inflow therefore

increased by GBP1.8 million to GBP1.6 million (2022: outflow GBP0.2

million). Net cash outflow from investing activities of GBP1.1

million (2022: GBP0.9 million outflow) is mainly represented by our

development spend. Financing activities included the repayment of

finance agreements and interest of GBP0.2 million (2022: GBP0.2

million). Total net cash inflow was GBP0.2 million (2022: GBP1.2

million outflow). The year-end cash balance stood at GBP1.2 million

(2022: GBP0.9 million) with no debt.

Treasury

The Group continues to manage the cash position in a manner

designed to meet the operational needs of the businesses. Cash

balances held in foreign currencies reflect the geographies in

which the Group operates. There is no policy to hedge the Group ' s

currency exposures arising from the profit translation or the

effect of exchange rate movements on the Group ' s overseas net

assets.

The Group has secured an increased credit facility (the

"Facility") with TD Bank N.A., to $1.7m (2022: $0.7 million). The

Facility has no significant financial covenants and is secured by

the assets of the US Group with a parental guarantee from Altitude

Group PLC and is senior to the subordinated Intercreditor loans.

The Facility will provide access to non-dilutive funding to support

the Group in executing its growth strategy. The Facility has a

small annual arrangement fee and incurs interest at 1% above the US

Prime Rate on drawdown. This Facility remains undrawn at the year

end.

Share capital

The number of shares increased by 166,666 to 70,847,830 (2022:

70,681,164). All of the shares issued in the period were in respect

of options exercised by employees and are detailed in the full

notes to the Annual Report.

The Company issued share options to senior management of

2,648,000 (2022: 444,444). During the year the number of share

options exercised was 166,666 (2022: 213,896) with the number of

share options forfeited being 1,211,110 (2022: 2,329,667). The

total number of share options outstanding at the year-end is

6,357,447 (2022: 4,299,445).

Key performance indicators

The Group ' s key performance indicators as discussed above

are:

Year Year Impact Underlying Total

ended ended of currency change Change

translation

31 March 31 March

2023 2022

GBP'000 GBP'000 GBP'000 %

--------- --------- ------------- -------- ----- --------

Revenue 18,761 11,936 1,988 4,837 41% 6,825

Gross profit 8,605 6,150 853 1,602 26% 2,455

Gross margin 46% 52%

Adjusted operating

profit* 1,957 1,067 326 564 53% 890

Statutory profit/(loss)

before tax 152 (157) 1 308 309

Adjusted profit before

tax*** 915 84 26 805 958% 831

-------- -----

*Adjusted operating profit is before share-based payment

charges, amortisation of intangible assets, depreciation of

tangible assets and exceptional charges is a consistently used

measure used to show the performance of the revenue generating

activities and the related costs involved in the delivery of the

revenue for the current year

** Basic adjusted earnings per share is calculated using profit

after tax but before share-based payment charges, amortisation of

acquired intangible assets and exceptional charges and the weighted

average number of equity voting shares in issue and, when relevant,

in respect of diluted earnings per share includes the effect of

share options that could potentially dilute basic earnings per

share. This provides a consistent metric with the Income Statement

for underlying performance

***Adjusted profit before tax is profit before tax adjusted for

share based charges, exceptional costs and amortisation on acquired

intangibles. This metric is to review the performance of the

underlying business including the depreciation for development

costs.

Significant judgements and estimates

In preparing the financial statements the Directors have made

judgements and estimates in applying accounting policies. Details

of the most significant areas where judgements and estimates have

been made are set out in note 1 to the group financial

statements.

Principal risks and uncertainties

The Group ' s financial and operational performance is subject

to a number of risks. The Board seeks to ensure that appropriate

processes are put in place to manage, monitor and mitigate these

risks. The Board considers the principal risks faced by the Group

to be as follows at 31 March 2023:

-- a significant deterioration in economic conditions,

particularly in USA affecting SME's, the principal target customers

for the Group's technology products

-- significant delays and or cost overruns in developing and

delivering products to meet customer requirements in the targeted

market sectors

-- a risk of cyber attack that targets our systems causing

downtime to end user processing or point of sale

-- predatory pricing or other actions by established competitors in our market sectors

-- the risk of bad debts arising from AIM Capital Solutions

-- a significant, adverse movement in the short-term in the US $ exchange rate compared with GBP

-- the propensity of AIM distributor members to migrate orders to AIM preferred suppliers

-- the propensity of AIM distributor members to upgrade

membership to include enhanced marketing and sales support

services

-- deteriorating retention of the membership base of the acquired AIM business

-- a risk of under-reported revenue through incomplete visibility of member transactions

In all cases the Group seeks to mitigate these risks wherever

possible by continuous marketing initiatives and promotions to

stimulate market demand and continuous development of enhanced

member services and the promotion of AIM Capital Solutions to high

quality distributors with careful attention to credit risk. In

addition, we maintain close relationships with all customers with

service contracts based on transactional volume, and monitor

progress using data sampling and quarterly confirmation. We also

manage development projects closely and ensure that we continue to

offer services that meet our customer needs. The Group has also

expanded its reach and diversified with AMPs and extended into the

Education sector.

Historically operations in the USA have been funded from the UK,

exposing the group to adverse short-term exchange rate movements.

US operations are now self-funding, mitigating the risk from short

term exchange rate fluctuations. The US now regularly remits funds

back to the UK, generally on a monthly basis at relatively low

levels. Management have reviewed the requirement of a formal

hedging strategy however this will only be necessary if the funding

levels increase. In the meantime, spot rates have been utilised

with an outsourced foreign currency firm.

The Board are considering, with the onset of growth and

potential utilisation of the US credit facility in FY24, to

undertake a review of the primary economic environment that the

Group is operating in and re-evaluating the functional for the

Group.

AIM is the largest distributor member organisation in the USA,

with circa 9% market share in a very fragmented market. We assess

the risk of predatory pricing from other established competitors to

be low as they do not possess the scale or geographic coverage

necessary influence the market as a whole. AIM members are

incentivised to order from AIM preferred suppliers through the

provision of significant discounts.

Cyber Security processes and controls including reminders and

training and regularly provided to all staff to ensure they remain

extra vigilant and exercise extreme caution when using email and

the internet.

Liquidity

The Group remains debt free with a cash balance of GBP1.2

million as at the year end.

We have extended our finance facility by $1.0 million to $1.7

million with TD Bank. The facility will support the growth in

Merchanting specifically with our AMPs new contract signings into

the new year.

Graham Feltham

Chief Financial Officer

24 July 2023

Consolidated Statement of Comprehensive Income

for the year ended 31 March 2023

Year Year

to to

31 March 31 March

Notes 2023 2022

GBP'000 GBP'000

Revenue 2 18,761 11,936

Cost of sales (10,156) (5,786)

Gross profit: 8,605 6,150

------------------------------------------------ ------ --------- ---------

Administrative expenses before share-based

payment charges, depreciation, amortisation,

and exceptional charges (6,648) (5,083)

Operating profit before share-based payment

charges, depreciation, amortisation, and

exceptional charges 1,957 1,067

Share-based payment (charges)/credits (511) 127

Depreciation and Amortisation (1,131) (1,044)

Exceptional charges 3 (101) (234)

------------------------------------------------ ------ --------- ---------

Total administrative expenses (8,391) (6,234)

------------------------------------------------ ------ --------- ---------

Operating profit/(loss) 214 (84)

------------------------------------------------ ------ --------- ---------

Finance charges (62) (73)

Profit/(loss) before taxation 152 (157)

------------------------------------------------ ------ --------- ---------

Taxation 238 254

Profit attributable to operations 390 97

------------------------------------------------ ------ --------- ---------

Other comprehensive income:

Items that may be reclassified subsequently

to profit and loss:

-- Foreign exchange differences 425 302

Total comprehensive income for the year 815 399

------------------------------------------------ ------ --------- ---------

Earnings per ordinary share attributable

to the equity shareholders of the Company:

- Basic and diluted (pence) 4 0.55p 0.14p

Consolidated Statement of Changes in Equity

for the year ended 31 March 2023

Foreign

exchange

Share Share Retained translation Total

capital premium losses reserve equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Group

At 31 March 2021 282 20,151 (11,932) (712) 7,789

------------------------------ -------- -------- --------- ------------- --------

Profit for the period - - 97 - 97

Foreign exchange differences - - - 302 302

Total comprehensive income - - 97 302 399

------------------------------ -------- -------- --------- ------------- --------

Transactions with owners

recorded directly in equity

Share-based payment credit - - (127) - (127)

Shares issued for cash 1 43 - - 44

Total transactions with

owners 1 43 (127) - (83)

------------------------------ -------- -------- --------- ------------- --------

At 31 March 2022 283 20,194 (11,962) (410) 8,105

------------------------------ -------- -------- --------- ------------- --------

Profit for the period - - 390 - 390

Foreign exchange differences - - - 425 425

Total comprehensive income - - 390 425 815

------------------------------ -------- -------- --------- ------------- --------

Transactions with owners

recorded directly in equity

Share-based payment charge - - 511 - 511

Shares issued for cash - - - - -

Total transactions with

owners - - 511 - 511

------------------------------ -------- -------- --------- ------------- --------

At 31 March 2023 283 20,194 (11,061) 15 9,431

------------------------------ -------- -------- --------- ------------- --------

Consolidated Balance Sheet

as at 31 March 2023

As at As at

31 March 31 March

2023 2022

GBP'000 GBP'000

Non-current assets

Goodwill 2,934 2,781

Intangible assets 2,652 2,477

Property, plant and equipment 202 139

Right of use assets 471 606

Deferred tax assets 458 436

Total non-current assets 6,717 6,439

---------------------------------------- --------- ---------

Current assets

Inventory 361 29

Trade and other receivables 5,521 3,875

Corporation Tax Receivable 91 42

Cash and cash equivalents 1,173 902

Total current assets 7,146 4,848

---------------------------------------- --------- ---------

Total assets 13,863 11,287

---------------------------------------- --------- ---------

Liabilities

Current liabilities

Trade and other payables (3,699) (2,282)

(3,699) (2,282)

--------------------------------------- --------- ---------

Net current assets 3,447 2,566

---------------------------------------- --------- ---------

Non-current liabilities

Deferred tax liabilities (347) (364)

Lease liabilities (386) (536)

(733) (900)

--------------------------------------- --------- ---------

Total liabilities (4,261) (3,182)

---------------------------------------- --------- ---------

Net assets 9,431 8,105

---------------------------------------- --------- ---------

Equity attributable to equity holders

of the Company

Called up share capital 283 283

Share premium account 20,194 20,194

Retained losses and foreign exchange (11,046) (12,372)

Total equity 9,431 8,105

---------------------------------------- --------- ---------

Consolidated Cash Flow Statement

for the year ended 31 March 2023

Year to Year to

31 March 31 March

2023 2022

GBP'000 GBP'000

Operating profit/(loss) 214 (84)

Amortisation of intangible assets 901 845

Depreciation 230 199

Share-based payment charges 511 (127)

Exceptional items 101 234

Operating cash flow before changes in working

capital 1,957 1,067

------------------------------------------------------ --------- ---------

Movement in inventory (339) (29)

Movement in trade and other receivables (1,532) (1,398)

Movement in trade and other payables 1,404 (101)

Changes in working capital (467) (1,528)

------------------------------------------------------ --------- ---------

Net cash flow from operating activities before

exceptional items 1,490 (461)

------------------------------------------------------ --------- ---------

Exceptional items (84) (179)

Net cash flow from operating activities after

exceptional items 1,406 (640)

------------------------------------------------------ --------- ---------

Income tax received 144 413

Net cash flow from operating activities 1,550 (227)

------------------------------------------------------ --------- ---------

Cash ows from investing activities

Purchase of tangible assets (119) (64)

Purchase of intangible assets (986) (788)

Net cash flow from investing activities (1,105) (852)

------------------------------------------------------ --------- ---------

Cash ows from financing activities

Repayment of lease borrowings (163) (135)

Lease interest paid (47) (52)

Other interest paid (15) (21)

Issue of shares for cash (net of expenses) - 44

Net cash flow from financing activities (225) (164)

------------------------------------------------------ --------- ---------

Net increase/(decrease) in cash and cash equivalents 220 (1,243)

------------------------------------------------------ --------- ---------

Cash and cash equivalents at the beginning

of the period 902 2,095

------------------------------------------------------ --------- ---------

Effect of foreign exchange rate changes on cash

and cash equivalents 51 50

Net (decrease)/increase in cash and cash equivalents 220 (1,243)

Cash and cash equivalents at the end of the

period 1,173 902

------------------------------------------------------ --------- ---------

Notes to the Consolidated Financial Statements

1. Financial Information

The financial information in this preliminary announcement has

been extracted from the audited Group Financial Statements for the

year ended 31 March 2023 and does not constitute statutory accounts

within the meaning of section 434 of the Companies Act 2006.

The Group Financial Statements for 2022 were delivered to the

registrar of companies, and those for 2023 will be delivered in due

course. The auditor's report on the Group Financial Statements for

2022 and 2023 were both unqualified and unmodified. The auditors'

report was signed on 24 July 2023. The Group Financial Statements

and this preliminary announcement were approved by the Board of

Directors on 24 July 2023

The audited accounts will be posted to all shareholders and will

be available on the Group's website (

https://www.altitudeplc.com/reports-results ) in due course.

Basis of preparation

The group financial statements have been prepared in accordance

with UK adopted International Accounting Standards. The Company

financial statements have been prepared under FRS 101.

Both financial statements have been prepared on the historical

cost basis, with the exception of certain items which are measured

at fair value as disclosed in the principal accounting policies set

out below. The financial information is presented in Sterling and

has been rounded to the nearest thousand (GBP000).

The preparation of financial statements in conformity with IFRSs

requires management to make judgements, estimates and assumptions

that affect the application of policies and reported amounts of

assets and liabilities, income and expenses. The estimates and

associated assumptions are based on historical experience and

various other factors that are believed to be reasonable under the

circumstances, the results of which form the basis of making the

judgements about carrying values of assets and liabilities that are

not readily apparent from other sources of information. Actual

results may differ from these estimates.

The estimates and underlying assumptions are reviewed on an

ongoing basis. Revisions to accounting estimates are recognised in

the period in which the estimate is revised if the revision affects

only that period, or in the period of the revision and future

periods if the revision affects both current and future

periods.

The Group has consistently applied the accounting policies to

all periods presented in these consolidated financial

statements.

New standards impacting the Group that have not been adopted in

the annual financial statements for the year ended 31 March 2023

are:

-- Classification of Liabilities as Current or Non-current (Amendments to IAS 1)

-- Disclosure of Accounting Policies (Amendments to IAS 1 and IFRS Practice Statement 2)

-- Definition of Accounting Estimate (Amendments to IAS 8)

-- Deferred Tax related to Assets and Liabilities arising from a

Single Transaction (Amendments to IAS 12)

-- Non-Current Liabilities with Covenants (Amendments to IAS 1)

Management anticipates that these new standards, interpretations

and amendments will be adopted in the financial statements as and

when they are applicable and adoption of these new standards,

interpretations and amendments, will be reviewed for their impact

on the financial statements prior to their initial application.

The following principal accounting policies have been applied

consistently to all periods presented in these Group financial

statements:

Going concern

The financial statements have been prepared on a going concern

basis.

The Group is following a strong growth trajectory despite the

macro-economic conditions of high inflation and growing interest

rates amidst fears of recession. The prolonged war in Ukraine and

corrections in the Banking industry has created instability and a

slowing down in the global economic recovery. The Promo Industry

has continued to grow but at far lower growth rates experienced

last year as the Industry came out of the pandemic. With single

digit growth reported by the industry bodies in the quarter ending

March 2023 there is a degree of caution with some level of churn in

distributers expected along with a potential reluctance to change

network or affiliation. The Group continues to maintain strong

relationships within the AIM network and additionally has entered

into strategic partnerships and added diversifying revenues from

the AMPs whilst constantly monitoring growth spend and cash

forecasts.

The Board is confident that the Group has sufficient liquidity

to manage the growth of the company and can flex on overhead spend

should any part of the business underperform against our

expectations. The financial statements have therefore been prepared

on a going concern basis. The directors have taken steps to ensure

that they believe the going concern basis of preparation remains

appropriate. The key conditions are summarised below:

-- The Directors have prepared cash flow forecasts extending to

September 2024. The cash flow forecasts include a mid scenario and

sensitised cases.

-- The low scenario assumes reductions in revenue of c12% compared to the mid-scenario.

-- The forecasts assume regular collections and payments in line

with the normalised conditions experienced with detailed modelling

of growth cash outflows included.

-- The base and sensitised cash flow forecasts do not include

any mitigating factors available to management in terms of:

-- discontinuing the development of AIM Capital Services to release working capital

-- reactionary cost reduction programmes in respect of headcount and organisation

-- securing new working capital facilities in respect of any

growth of Merchanting business outside of the sensitised

forecast.

-- The Group maintains the distributor membership and preferred

suppliers throughout the forecast period.

-- The Group continues to develop the product offerings to meet

the demands of the market and customers.

-- The Directors have considered the position of the individual

trading companies in the Group to ensure that these companies are

also able to continue to meet their obligations as they fall

due.

-- There are not believed to be any contingent liabilities which

could result in a significant impact on the business if they were

to crystallise.

Based on the above indications and assumptions, the Directors

believe that it remains appropriate to prepare the financial

statements on a going concern basis.

The financial statements do not include any adjustments that

would result from the basis of preparation being inappropriate.

Basis of consolidation

The consolidated financial statements incorporate the financial

statements of the Company and the entities controlled by the

Company (its subsidiaries) made up to 31 March each period. Control

is achieved when the Company:

-- has the power over the investee

-- is exposed, or has rights, to variable return from its involvement with the investee and

-- has the ability to use its power to affect returns

The Company reassesses whether or not it controls an investee if

facts and circumstances indicate that there are changes to one or

more of the three elements above. Consolidation of a subsidiary

begins when the Company obtains control over the subsidiary and

ceases when the Company loses control over the subsidiary.

The acquisition method of accounting is used to account for the

acquisition of subsidiaries by the Group. The cost of an

acquisition is measured as the fair value of the assets given,

equity instruments issued, and liabilities incurred or assumed at

the date of exchange. Identifiable assets acquired and liabilities

and contingent liabilities assumed in a business combination are

measured initially at their fair values at the acquisition date,

irrespective of the extent of any minority interest. The excess of

the cost of acquisition over the fair value of the Group's share of

the identifiable net assets acquired is recorded as goodwill. If

the cost of acquisition is less than the fair value of net assets

of the subsidiary acquired, the difference is recognised directly

in the Consolidated Statement of Comprehensive Income.

All intra-group balances and transactions, including unrealised

profits arising from intra-group transactions, are eliminated fully

on consolidation.

Contract costs

Costs to fulfil a contract are capitalised, amortised and

assessed for impairment if they meet the required criteria. If the

costs do not meet the criteria they are expensed as incurred.

Costs to fulfil a contract are recognised as an asset only if

they:

-- Relate directly to a contract, or to an anticipated contract

that can be specifically identified

-- Generate or enhance resources to be used to satisfy performance obligations in future, and

-- Are expected to be recovered.

The policy applies to contracts that are greater than one year

in length.

The asset is amortised over the life of the contract once the

contract is live.

Revenue recognition

Revenue represents the amounts receivable, excluding sales

related taxes, for goods and services supplied during the period to

external customers shown net of sales taxes, returns, rebates and

discounts.

When assessing revenue recognition against IFRS15, the Group

assess the contract against the five steps of IFRS15:

-- Identifying the contract with a customer

-- Identifying the performance obligations

-- Determining the transaction price

-- Allocating the transaction price to the performance obligations

-- Recognising revenue when/as performance obligation(s) are satisfied

This process includes the assessment of the performance

obligations within the contract and the allocation of contract

revenue across these performance obligations once identified.

Revenue is recognised either at a point in time or over time, when,

or as, the Group satisfies performance obligations by transferring

the promised goods or services to its customers.

The difference between the amount of income recognised and the

amount invoiced on a particular contract is included in the

statement of financial position as accrued or deferred income.

Amounts included in accrued and deferred income due within one year

are expected to be recognised within one year and are included

within current assets and current liabilities respectively.

The Group has a number of different revenue streams which are

described below.

Services Revenue

Includes a range of member and member-related revenues as well

as legacy software license revenue.

Member subscription revenues

AIM distributor members pay a monthly subscription fee for basic

membership which confers immediate access to a range of commercial

benefits at no additional cost to the member. Members may elect to

upgrade their membership to access a range of enhanced services

provided by AIM in exchange for an increased monthly subscription

fee. Subscription revenues are recognised on a monthly basis over

the membership period.

Other discretionary services

Certain other services are made available to AIM members on a

discretionary usage basis such as artwork processing services,

catalogues and merchandise boxes. These revenues are recognised

upon performance of the service or delivery of the product. For

example, catalogue and merchandise box revenues are recognised on

dispatch of the products to members.

Events and exhibitions revenues

AIM promotes and arranges events for AIM members and groups of

supplier customers to meet and build relationships. Revenue from

these events is recognised once the performance obligations have

been satisfied, typically on completion of an event or

exhibition.

Preferred Partner revenues

AIM provides services to vendors within the promotional products

industry whereby Preferred Partners are actively promoted to AIM

members via a variety of methods including utilising the AIM

technology platform, webinars, email communications and quarterly

publications.

Revenues are variable and depend on the value of purchases made

and services utilised by the AIM members from Preferred Partners.

Revenue is recognised over time by reference to the value of

transactions in the period. Payment for AIM's marketing services is

made by Preferred Partner customers on a calendar quarter or annual

basis. Revenue is recognised to the extent that it is highly

probable that it will not reverse based on historic fact pattern

and latest market information.

Software and technology services revenues

Revenues in respect of software product licences and associated

maintenance and support services are recognised evenly over the

period to which they relate. An element of technology services

revenue is dependent on the value of orders processed via the

Group's technology platforms. Revenue is accrued based on the value

of underlying transactions and the relevant contractual

arrangements with the customer. Revenue is constrained to the

extent that is that it is highly probable that it will not

reverse.

Merchanting revenues

Merchanting revenues arise when group companies contract with

customers to supply promotional products. By far the most

significant operation that carries out merchanting is within ACS.

Over the past 18 months significant investment in our technology

and the evolution of contracting with our affiliates along with

enforcement of contractual terms has prompted the Directors to

re-evaluate the application of IFRS 15. Under the terms of the ACS

contract the AIM member affiliates act as independent sales

representatives of ACS to secure sales with customers. The

contracts have evolved since the inception of ACS along with

enforcement, monitoring and control over the substance of the

contracts. All transactions are mandatorily processed through the

AIM technology platform and utilise ACS people and know-how to

efficiently operate the full end to end process.

ACS bears the risk of the transaction as Principal, provisioning

of orders and contracting with the customer, determining the

transaction price, provision of fulfilment and supplier contracts

and pricing, performing credit control and processing payments. The

sale of the promotional products, with the related costs of goods

supplied, freight and AIM affiliates selling commission recognised

as the cost of goods sold. The revenue is recognised on the

shipment of the goods from the supplier and as notified by the

supplier invoice which are raised following shipment. The Directors

accept that the technical transfer of risks and rewards to the

customer occur on delivery of the goods which are usually delivered

within 2-5 days of shipment. The Directors use a proxy of the

shipment date as the trigger for recognising revenue.

The Group also sources products directly through its network of

Preferred Partners, which it sells to AIM members and adjacent

markets, where such sales do not conflict with the interest of

either suppliers or the AIM membership. The Group Buy scheme falls

under Merchanting and is a facility that supported the sales of

Personal Protective Equipment in the prior year.

2. Segmental information

The chief operating decision maker has been identified as the

Board of Directors and the segmental analysis is presented based on

the Group's internal reporting to the Board. At 31 March 2023, the

Group has two operating segments, North America, and the United

Kingdom & Europe along with a Central segment. The Group

further analyses performance to Gross Profit by presenting

'Service' and 'Merchanting' as shown. Service revenues are derived

from servicing our AIM membership base and generating throughput

with our contracted Preferred Partners. Merchanting revenues are

sales of promotional products where the Group acts as principal in

the underlying transaction.

Segment assets consist primarily of property, plant and

equipment, intangible assets, trade and other receivables and cash

and cash equivalents. Segment liabilities comprise operating

liabilities. Capital expenditure comprises additions to property,

plant and equipment and intangible assets, including additions

resulting from acquisitions through business combinations. Assets

and liabilities at 31 March 2023 and capital expenditure for the

period then ended are as follows.

Year Year Year Year

ended ended ended ended

31 March 31 March 31 March 31 March

2023 2023 2023 2023

GBP'000 GBP'000 GBP'000 GBP'000

--------- --------- --------- ---------

North UK and Central Group

America Europe

Turnover

Services 7,155 1,368 - 8,523

Merchanting 10,238 - - 10,238

Total 17,393 1,368 - 18,761

---------------------------------------------- --------- --------- --------- ---------

Cost of Sales

Services (582) (223) - (805)

Merchanting (9,351) - - (9,351)

Total (9,933) (223) - (10,156)

---------------------------------------------- --------- --------- --------- ---------

Gross Profit

Services 6,573 1,145 - 7,718

Merchanting 887 - - 887

Total 7,460 1,145 - 8,605

---------------------------------------------- --------- --------- --------- ---------

Operating Profit/(Loss) before

share-based payment charges, depreciation,

amortisation, and exceptional charges 3,426 170 (1,639) 1,957

Share-based payment charges - - (511) (511)

Depreciation (171) (59) - (230)

Amortisation (168) (733) - (901)

Management fees (2,397) 778 1,619 -

Exceptional charges (65) (14) (22) (101)

Finance charges (41) (21) - (62)

Segmental profit before income

tax 584 121 (553) 152

---------------------------------------------- --------- --------- --------- ---------

Assets* 11,187 2,368 308 13,863

Liabilities* (3,475) (462) (495) (4,432)

Net Assets 7,712 1,906 (187) 9,431

---------------------------------------------- --------- --------- --------- ---------

*external balances disclosed for

segmental purposes

Capital expenditure

Intangible assets (99) (887) - (986)

Property, plant and equipment (91) (26) (2) (119)

Right of use assets - - - -

Capital Expenditure (190) (913) (2) (1,105)

---------------------------------------------- --------- --------- --------- ---------

Year Year Year Year

ended ended ended ended

31 March 31 March 31 March 31 March

2023 2023 2023 2023

GBP'000 GBP'000 GBP'000 GBP'000

--------- --------- --------- ---------

North UK and Central Group

America Europe

Timing of Revenue Recognition

At a point in time 11,216 186 - 11,402

Over time 6,177 1,182 - 7,359

Total Revenue 17,393 1,368 - 18,761

-------------------------------- --------- --------- --------- ---------

Year Year Year Year

ended ended ended ended

31 March 31 March 31 March 31 March

2022 2022 2022 2022

GBP'000 GBP'000 GBP'000 GBP'000

--------- --------- --------- ---------

North UK and Central Group

America Europe

Turnover

Services 5,139 1,169 - 6,308

Merchanting 5,628 - - 5,628

Total 10,767 1,169 - 11,936

------------------------------------------------ --------- --------- --------- ---------

Cost of Sales

Services (518) (40) - (558)

Merchanting (5,228) - - (5,228)

Total (5,746) (40) - (5,786)

------------------------------------------------ --------- --------- --------- ---------

Gross Profit

Services 4,621 1,129 - 5,750

Merchanting 400 - - 400

Total 5,021 1,129 - 6,150

------------------------------------------------ --------- --------- --------- ---------

Operating Profit/(Loss) before share-based

payment charges, depreciation, amortisation,

and exceptional charges 2,034 286 (1,253) 1,067

Share-based payment charges - - 127 127

Depreciation (142) (57) - (199)

Amortisation (156) (689) - (845)

Management fees (1,495) 581 914 -

Exceptional charges (91) - (143) (234)

Finance charges (41) (32) - (73)

Segmental profit before income

tax 109 89 (355) (157)

------------------------------------------------ --------- --------- --------- ---------

Assets* 8,745 1,715 827 11,287

Liabilities* (1,689) (619) (874) (3,182)

Net Assets 7,056 1,096 (47) 8,105

------------------------------------------------ --------- --------- --------- ---------

*external balances disclosed for

segmental purposes

Capital expenditure

Intangible assets - (788) - (788)

Property, plant and equipment (51) (13) - (64)

Right of use assets - - - -

Capital Expenditure (51) (801) - (852)

------------------------------------------------ --------- --------- --------- ---------

Year Year Year Year

ended ended ended ended

31 March 31 March 31 March 31 March

2022 2022 2022 2022

GBP'000 GBP'000 GBP'000 GBP'000

--------- --------- --------- ---------

North UK and Central Group

America Europe

Timing of Revenue Recognition

At a point in time 5,984 47 - 6,031

Over time 4,783 1,122 - 5,905

Total Revenue 10,767 1,169 - 11,936

-------------------------------- --------- --------- --------- ---------

A central cost of GBP411,000 was previously reported as a cost

allocated to North America for FY22 and has been restated to a

central cost in the table above within Operating Profit/(Loss)

before share-based payment charges, depreciation, amortisation, and

exceptional charges. Central costs were previously reported at a

loss of GBP842,000 and North America was a profit of

GBP1,623,000.

3. Exceptional charges

Analysis of exceptional items:

Year ended Year ended

31 March 31 March

2023 2022

GBP'000 GBP'000

----------- -----------

Legal, professional and consultancy costs 84 168

Other exceptional costs 17 66

101 234

------------------------------------------- ----------- -----------

Exceptional charges principally relate to the second-phase of

finance transformation costs, along with a provision for the

historic portion of a VAT reclaim. (2022: relates to finance

transformation being the recruitment of a new CFO and business

modelling, the one-off costs relating to the change of our

corporate broker and NOMAD and the write-off of a bad debt). Other

exceptional costs principally relates to a reversal of a historic

tax prepayment (2022: relates to a bad-debt write-off).

4. Basic and diluted earnings per ordinary share

The calculation of earnings per ordinary share is based on the

profit for the period after taxation and the weighted average

number of equity voting shares in issue as follows:

Year ended Year ended

31 March 31 March

2023 2022

----------- -----------

Profit attributable to the equity shareholders

of the Company (GBP000) 390 97

Weighted average number of shares (number

'000) 70,813 70,657

Fully diluted weighted average number of

shares (number '000) 71,198 70,957

Basic and diluted profit per ordinary share

(pence) 0.55p 0.14p

Adjusted profit per ordinary share (pence)

Profit attributable to the equity shareholders

of the Company (GBP000) 390 97

add back:

Share based payments 511 (127)

Amortisation on acquired intangibles* 151 134

Exceptional charges 100 234

Adjusted earnings 1,152 338

Adjusted basic and diluted earnings per ordinary

share (pence) 1.63p 0.48p

*To be consistent with external metrics and the updated Group's

key performance indicators adjusted earnings has been amended to

only adjust for amortisation on acquired intangibles and not for

depreciation and other amortisation as reported in previous

years.

Disclosure of the number of shares in issue including the

effects of share options that could potentially dilute basic loss

per share in the future were not included in the table above as the

calculation of diluted earnings per share has an immaterial impact.

We determine potentially dilutive shares as any share which is

exercisable on publishing of the Annual Report.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR KZGZNGDLGFZZ

(END) Dow Jones Newswires

July 25, 2023 02:00 ET (06:00 GMT)

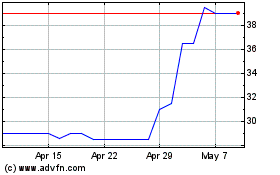

Altitude (LSE:ALT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Altitude (LSE:ALT)

Historical Stock Chart

From Feb 2024 to Feb 2025