Standard Life Private Eqty Trst PLC Edison review: Standard Life Private Equity Trust

February 07 2018 - 5:38AM

RNS Non-Regulatory

TIDMSLPE

Standard Life Private Eqty Trst PLC

07 February 2018

London, UK, 7 February 2018

Edison issues review on Standard Life Private Equity Trust

(SLPE)

Standard Life Private Equity Trust (SLPET) takes a long-term,

conviction approach to fund selection, evidenced by its new primary

commitments in FY17 being made to private equity managers where

there was a strong existing relationship. NAV total returns have

been ahead of peers over three and five years, and share price

returns have noticeably outpaced NAV returns over one year. The

share price discount to NAV has narrowed markedly from c 36% in

early 2016 to c 14% currently, arguably due in part to the strength

of SLPET's underlying performance, as well as its revised dividend

policy, with improved and more frequent payouts scheduled. The

manager sees portfolio companies' earnings growth continuing to

drive value creation, with the maturity profile of SLPET's

portfolio suggesting further near-term upside potential from

prospective realisations.

SLPET's share price discount to NAV has narrowed markedly from

its five-year high of 36.3% in March 2016 to its current level of

14.2%, which is towards the lower end of the peer group range. The

total dividend was more than doubled to 12.0p for FY17 and the

board intends to pay four quarterly dividends of 3.1p for FY18.

Click here to view the full report.

All reports published by Edison are available to download free

of charge from its website

www.edisoninvestmentresearch.com

About Edison: Edison is an investment research and advisory

company, with offices in North America, Europe, the Middle East and

AsiaPac. The heart of Edison is our world-renowned equity research

platform and deep multi-sector expertise. At Edison Investment

Research, our research is widely read by international investors,

advisers and stakeholders. Edison Advisors leverages our core

research platform to provide differentiated services including

investor relations and strategic consulting.

Edison is authorised and regulated by the Financial Conduct

Authority.

Edison is not an adviser or broker-dealer and does not provide

investment advice. Edison's reports are not solicitations to buy or

sell any securities.

For more information please contact Edison:

Gavin Wood, +44 (0)20 3681 2503

Sarah Godfrey, +44 (0)20 3681 2519

Investmenttrusts@edisongroup.com

Learn more at www.edisongroup.com and connect with Edison

on:

LinkedIn https://www.linkedin.com/company/edison-investment-research

Twitter www.twitter.com/Edison_Inv_Res

YouTube www.youtube.com/edisonitv

This information is provided by RNS

The company news service from the London Stock Exchange

END

NRAFMGGZMNVGRZM

(END) Dow Jones Newswires

February 07, 2018 06:38 ET (11:38 GMT)

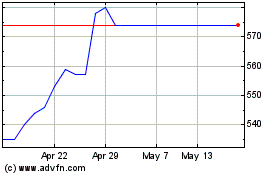

Abrdn Private Equity Opp... (LSE:APEO)

Historical Stock Chart

From Apr 2024 to May 2024

Abrdn Private Equity Opp... (LSE:APEO)

Historical Stock Chart

From May 2023 to May 2024