Alliance Trust PLC Alliance Trust Plc - Sale Of Alliance Trust Savings

October 22 2018 - 1:00AM

UK Regulatory

TIDMATST

22 October 2018

This announcement contains inside information

Alliance Trust PLC

("Alliance Trust" or "the Trust")

Alliance Trust announces the sale of Alliance Trust Savings

Alliance Trust today announces that it has agreed the sale of its

subsidiary company Alliance Trust Savings (ATS) to Interactive Investor

("ii"), the UK's second largest investment platform.

Lord Smith of Kelvin, Alliance Trust's Chairman, commented:

"The Board is pleased to announce the sale of ATS to Interactive

Investor. The two businesses are highly complementary and ATS customers,

many of whom are Alliance Trust shareholders, will benefit from

Interactive Investor's similar low flat-fee structure, as well as its

increased scale and focus. A key consideration for the Board was a

commitment to maintaining ATS' presence in Scotland. We are therefore

very pleased that ii plans to invest in ATS' Dundee operating centre."

Richard Wilson, CEO of ii, commented:

"This is another important step in our ambition to build the UK's best

investment platform. The acquisition brings together the country's two

largest fixed price providers, adding significant scale to ii, and

reinforcing our ability to deliver excellent choice, value and service

to all our customers."

The total price payable under the sale agreement is GBP40m, subject to

post completion adjustments, and includes Alliance Trust's office

building in Dundee, where ATS is based. The Trust, which has been

headquartered in Dundee since 1888, will continue to be based in the

City.

As at 30 June 2018, ATS, which represents 1.3% of the Trust's portfolio,

had a fair value of GBP38m and the Dundee building was valued at

GBP4.9m.

The sale is another positive step in Alliance Trust's strategy to focus

on its global equity portfolio. This has previously seen Alliance

Trust's successful sale of its in-house investment management arm,

Alliance Trust Investments, to Liontrust Investment Management, as well

as the recent agreement to sell off most of the Trust's private equity

assets.

The proceeds from the sale will be invested in the global equity

portfolio, managed by Willis Towers Watson, which following completion

will represent close to 100% of the Trust's investment portfolio.

Evercore is advising Alliance Trust and Rothschild is advising ii on the

acquisition of ATS. The sale is subject to regulatory approval from the

PRA and FCA.

-END-

Alliance Trust PLC

Gregor Stewart, Deputy

Chairman

Mark Atkinson, Marketing +44 (0) 138 232 1280 / +44

and Comms Manager (0) 791 872 4303

Tulchan (PR Advisor to +44 (0) 0207 353 4200 or

Alliance Trust PLC) alliancetrust@tulchangroup.com

---------------------------------------------------

Elizabeth Snow

---------------------------------------------------

Martin Pengelley

Lisa Jarrett Kerr

Interactive Investor +44 (0) 20 7680 3655

Richard Wilson, CEO

---------------------------------------------------

Alex Kovach, CCO

---------------------------------------------------

TB Cardew (PR Advisor

to ii) +44 (0) 207 930 0777 or ii@tbcardew.com

---------------------------------------------------

Tom Allison +44 (0) 7789 998 020

Shan Shan Willenbrock +44 (0) 7775 848 537

Lucy Featherstone +44 (0) 7789 374 663

About interactive investor

interactive investor (ii) is the UK's number one flat fee investment

platform. ii offers a wealth of unbiased information, analysis, tools

and expert ideas to help customers make better informed investment

decisions. ii's award-winning trading platform provides access to an

extensive choice of markets, instruments and currencies within Trading,

ISA and SIPP accounts. This comprehensive investing service is

underpinned by a strong focus on delivering great value for investors

demonstrated through an innovative and competitive pricing model --

featuring simple, flat fees and unique 'trading credits'.

Since 2013 the investment platforms market has almost doubled in size to

GBP500bn AUM, with an extra 2.2 million customer accounts opened in the

same period. ii has approximately 10% of the UK direct to consumer

investment platform market. www.ii.co.uk

(END) Dow Jones Newswires

October 22, 2018 02:00 ET (06:00 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

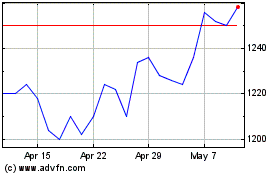

Alliance (LSE:ATST)

Historical Stock Chart

From Jun 2024 to Jul 2024

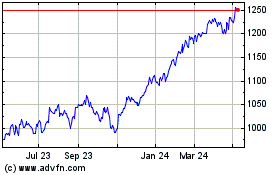

Alliance (LSE:ATST)

Historical Stock Chart

From Jul 2023 to Jul 2024