Alliance Trust PLC Alliance Trust Plc - Fixed Rate Note Borrowing

November 28 2018 - 10:20AM

UK Regulatory

TIDMATST

28 November 2018

ALLIANCE TRUST PLC

Fixed rate note borrowing

Alliance Trust PLC (the "Company") has issued GBP60m fixed rate

unsecured privately placed notes (the "Notes") with maturities of 15, 25

and 35 years and coupons for each respective GBP20m tranches of 2.657%,

2.936% and 2.897%. The closing and settlement date is today with

interest payable semi-annually.

The purpose of this transaction is to obtain unsecured, fixed rate, long

dated Sterling denominated financing at a pricing level that the Company

considers attractive. The transaction is expected to provide the Company

with a long term benefit through a full market cycle.

The proceeds of the financing will be used to repay GBP60m of the

Company's existing GBP127m of floating rate bank debt all of which is

currently short term funding, such that the Company's current drawn

borrowings will remain unchanged after the Notes' issuance at an amount

of GBP245.45m (this includes the existing GBP100m Note issue due 2029 at

a fair value of GBP118.45m as at 30(th) June 2018). Total borrowing

facilities including the Notes will increase by GBP60m to GBP360m

(including the existing Note issue at its nominal value of GBP100m and

GBP200m of committed bank facilities).

As a result, our fixed long term borrowing costs have reduced from 4.3%

to 3.7%. With the increased long term debt the weighted average interest

payable on drawn borrowing facilities will change from 2.7% to 3.1%

For more information, please contact:

Alliance Trust PLC

Tel. +44 (0)1382 321010

(END) Dow Jones Newswires

November 28, 2018 11:20 ET (16:20 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

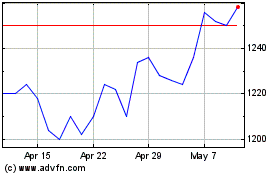

Alliance (LSE:ATST)

Historical Stock Chart

From Jun 2024 to Jul 2024

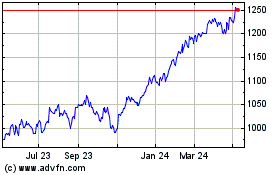

Alliance (LSE:ATST)

Historical Stock Chart

From Jul 2023 to Jul 2024