TIDMBOKU

RNS Number : 6550N

Boku Inc

26 September 2023

This announcement contains inside information

26 September 2023

Boku, Inc.

("Boku" or the "Company" and, together with its subsidiaries,

the "Group")

Interim results for the six months ended 30 June 2023

Investment in Local Payment Methods reaping rewards

Boku, a leading provider of global mobile payment solutions, is

pleased to announce the following unaudited interim results for the

six months ended 30 June 2023.

Group Highlights

Financial Highlights

-- Revenues up 26% to $38.2m in H1 (H1 2022: $30.3m) and up 32%

on a constant currency**** basis driven by increasing transaction

volumes from our major global merchants.

-- Revenues include $7.2m from Local Payment Methods ('LPMs) up

350% from $1.6m in H1 2022 following the launch of 15 new LPMs and

increasing adoption of these products by our key merchants.

-- Adjusted EBITDA* increased 28% to $12.2m in H1 (2022 H1:

$9.5m ) as a result of prudent cost control whilst continuing to

invest in Boku's mobile-first payment network.

-- Group profit after tax of $2.3m (H1 2022: $28.0m which

included the profit on the disposal of Boku's Identity division of

$24.6m).

-- Group cash balances were $113.9m at 30 June 2023 up from

$67.8m at 30 June 2022. Of this, approximately $54.4m is Boku's

'own cash' with the balance being merchant cash in transit. The

Group is debt free.

-- The average daily cash balance*****, a measure which smooths

out carrier collections and merchant payments, was $105.8m in June

2023, up from $63.3m in June 2022.

-- Final 'holdback' payment of $5.6m received from Twilio after

period end in full payment of the final balance of the sale of

Boku's Identity business in February 2022.

-- In H2 2022 Boku commenced a 'share buyback' scheme to

purchase its own shares to cover employee RSU awards annually so

that the annual RSU awards are non-dilutive to shareholders. In the

first half of 2023 Boku purchased 3,088,359 shares for a total

consideration of GBP4,416,626.

Operational Highlights

-- Continued significant growth in users and payments volume in H1:

o 32% increase in monthly active users*** ("MAUs") in June 2023

to 61.2m (June 2022: 46.3m).

o 32.7m new users made their first payment or bundling

transaction with Boku during the first half of the year.

o Total Payment Volume ("TPV")** up 16% to $5.0bn (H1 2022:

$4.3bn).

-- Growth driven by strong performance from Local Payment Methods ("LPMs"):

o Total LPMs connected to the mobile-first network increased to

40 connections in 17 countries, up from 25 connections in 14

countries in June 2022

o MAUs***** of eWallets and Account to Account ('A2A') solutions

increased 122% to over 4.7m in the month of June 2023, compared to

the same month in 2022.

o New users***** of LPMs increased by over 100% to 6.3m in H1

2023 (up from 3.1m in the same period in 2022).

-- Average take rate increased to 0.76% in H1 2023 from 0.70% in

H1 2022 as a result of higher take rates from eWallets.

-- Almost 50 new launches for Direct Carrier Billing ("DCB"),

eWallets and A2A in H1 2023 with existing and new merchants

including Apple, Amazon, Netflix, Sony, Spotify, Sky and Tencent.

Launches took place in 27 countries across Asia, Europe and the

Middle East; two thirds of these launches were for LPMs.

-- Most of our biggest merchants now use Boku for the newer LPMs

as well as DCB and we are confident of our ability to add more of

the global tech giants to this line of business.

-- 'M obile-first' payments network expanded to reach over 7.5bn

end user accounts, 46% of which are non-DCB.

-- As announced previously on 4 July 2023, Jon Prideaux is to

retire as CEO on 31 December 2023. He will -remain on the Board as

a Non-executive Director. Stuart Neal, former CFO of Boku, will

take over as CEO from 1 January 2024.

Jon Prideaux, Boku's CEO, commented : "I am delighted with

Boku's performance in the first half and that strong performance

has continued in the second half. All parts of the business are

performing well, and ahead of our internal budget at the time of

the capital markets day earlier this year. The triple digit growth

from wallets and account to account payments now means that these

newer payment methods have come from next to nothing this time last

year to account for nearly 20% of our revenue. We traded at record

levels in July and August. It is undeniable that our strategy is

working well. As I prepare to move from an executive to a

non-executive position, I have strong conviction that the Company

will continue on this growth path under Stuart's leadership. With

more merchants poised to adopt the newer payment methods and strong

momentum from existing live connections, the full year picture is

looking very healthy. As a result of the strong trading conditions

we are seeing, the Board now expects the Company's performance for

the full year to be slightly ahead of its previous expectations,

and we reiterate the medium term guidance communicated at the

capital markets day."

Following the disposal of Boku's Identity division on 28

February 2022 the prior year comparative Condensed Consolidated

Statement of Comprehensive income includes revenues and Adjusted

EBITDA relating only to the continuing Payments business.

* Adjusted EBITDA (Earnings before interest, taxation,

depreciation and amortization): Adjusted for stock option expenses,

foreign exchange gains/losses and Exceptional items. See

reconciliation per the Condensed Consolidated Statement of

Comprehensive income This is an APM

** TPV is the US$ value of transactions processed by the Boku

platform and includes transactions from DCB, Bundling, eWallets and

Account to Account payments. This is an APM.

*** Monthly Active Users (MAU) data includes all users who

successfully processed a payment or had an active bundle during the

last month of the period. This is an APM.

**** Constant currency calculated by applying the monthly

average foreign exchange rates in H1 2022 to the actual H1 2023

monthly results. This is an APM.

***** Alternative Performance Measure (APM)

Investor Webinar

Boku's management will be hosting an online presentation and

Q&A session at 5.30 p.m. BST today, Tuesday 26 September 2023.

This session is open to all existing and prospective shareholders.

Those who wish to attend should register via the following link

where they will be provided with access details:

https://us02web.zoom.us/webinar/register/WN_vhdCRQpoQRGN2H-W0VxBBQ

Participants will have the opportunity to submit questions

during the session, but questions are welcomed in advance and may

be submitted to: boku@investor-focus.co.uk

Enquiries:

Boku, Inc.

Jon Prideaux, Chief Executive Officer +44 (0)20 3934 6630

Stuart Neal, Chief Executive Officer Designate

Keith Butcher, Chief Financial Officer

Peel Hunt LLP (Nominated Adviser and Broker) +44 (0)20 7418

8900

Paul Gillam / Tom Ballard / James Smith

IFC Advisory Limited (Financial PR & IR) +44 (0)20 3934

6630

Tim Metcalfe / Graham Herring / Florence Chandler

Notes to Editors

Boku Inc. (AIM: BOKU) is a leading global provider of mobile

payment solutions. Boku's mobile-first payments network, including

mobile wallets, direct carrier billing, and account to

account/real-time payments schemes, reaches over 7.5 billion mobile

payment accounts through a single integration.

Customers that trust Boku to simplify sign-up, acquire new

paying users and prevent fraud include global leaders such as

Amazon, Apple, Meta Platforms, Google, Microsoft, Netflix, Sony,

Spotify and Tencent.

Boku, Inc. was incorporated in 2008 and is headquartered in

London, UK, with offices in the US, India, Brazil, China, Estonia,

France, Germany, Indonesia, Japan, Singapore, Spain, Taiwan and

Vietnam.

To learn more about Boku Inc., please visit:

https://www.boku.com

This Announcement contains inside information for the purposes

of article 7 of the Market Abuse Regulation (EU) 596/2014 which is

part of UK law by virtue of the European Union (withdrawal) Act

2018. The person responsible for arranging the release of this

Announcement on behalf of the Company is Keith Butcher, Chief

Financial Officer.

Chief Executive Officer's Report

Boku had a successful start to 2023. The momentum that built

throughout the previous year has continued. Revenue growth exceeded

30% in constant currency terms (26% at reported rates), up from 21%

in the second half of the previous year (7% at reported rates) and

7% in the first half of 2022 (-1% at reported rates).

This growth has been driven by a more than 3X increase in

revenues from Local Payment Methods ("LPMs") such as mobile wallets

and account to account based payments ("A2A"). These methods,

rather than Direct Carrier Billing ("DCB"), are now the primary

driver of our growth and strategic focus. What is particularly

pleasing is that this LPM growth is not driven by any one

particular customer or sector, but is broadly based across multiple

merchants in games, digital advertising, music and video streaming,

operating in about a dozen countries. Although we are pleased to

announce that we are now live with Amazon in twelve wallets in five

countries as we had anticipated, these connections are maturing and

do not yet make a significant contribution to revenue - that is yet

to come. Our global merchants continue to expand with us into new

geographies and we are a trusted partner in their own expansion

plans, providing access to ever greater numbers of customers

worldwide.

The triple digit growth in LPM's means that eWallets and A2A now

account for almost 20% of total revenue. That this growth has not

affected the performance in Carrier Commerce (comprising Direct

Carrier Billing ("DCB") and Carrier Bundling) has been encouraging

too. Revenues from those methods grew at 12% on a constant currency

basis (7% at market rates), with Carrier Bundling performance being

particularly strong.

All the non-financial indicators are also up and to the right,

flashing green: Monthly Active Users ("MAUs") have grown by 32% to

exceed 61m. New users - a good leading indicator - in the first

half were up by 10% to 32.7 million, with bundling take up being

particularly strong. Total Payment Volume ("TPV") was $5 billion,

up 16%. We continued our pace of delivery with around 50 new

deployments covering Apple, Amazon, Netflix, Sony, Spotify, Sky and

Tencent.

The Journey to the Big Pond

Back in our Annual Report for 2020, I talked about the feeling

of trepidation that one gets as one starts at the big school. No

longer the big fish in a small pond, you have to make your mark in

a bigger pond. Back in 2020, it was an aspiration for Boku to step

up and compete with much bigger payment companies. But wanting

something and delivering on it are not the same thing. It is now

clear that we have moved beyond aspiration: our investments are

manifestly starting to pay off.

The Quiet Revolution in Payments

Back in 2020, somewhat unnoticed in North America and Europe,

where most electronic payments were made using credit cards like

Visa and MasterCard, a quiet revolution was happening in the way

that people were paying for things online. The emergent middle

classes in Asia, the Middle East, Africa and Latin America were

buying online and using a bewildering array of different mobile

wallets and account to account based payments methods to do so.

And, since most people live in those regions, this fragmented set

of new local payment methods (LPMs) collectively came to account

for more than half of all online payments. Card usage had grown;

the growth of LPMs was greater still.

Fast forward to today and we can see increased usage of non-card

payments even in the card markets in the West. In the UK, many

people use Faster Payments to pay their friends and tradesmen; they

use Zelle or Venmo in the US for much the same thing. In Sweden,

Swish, a mobile payment scheme launched in 2012 is used by more

than two thirds of the population and is growing in popularity for

purchases from merchants and in the Netherlands, iDeal, a bank

based non-card payment method has long been the default online

payment tool for the Dutch. In the future, the possibilities of

Open Banking in the UK and the EU and the recently launched FedNow

in the US could disrupt cards over the longer term. Cards are here

to stay, but the era of card dominance is waning.

A substitute not an alternative

Card processors looked at these new payment types and called

them Alternative Payment Methods. Boku realised that the billions

of people who preferred to pay with Alipay, Dana or UPI or dozens

of other mobile wallets or A2A based payment systems did not see

them as an alternative to cards. They saw them as a better way to

pay. These new payment methods were all that these consumers knew.

Being mobile native, using the phone's facial recognition as

security and the camera to initiate a transaction from a QR code,

seemed natural. It was the simplest, most secure way to pay. It was

cards that looked antiquated.

The overlooked opportunity

As a DCB company, some payment companies looked at Boku as a bit

of an oddity. DCB worked differently to the payment methods that

they normally worked with. DCB was more expensive, settled more

slowly, could only be used for digital products and had low

transaction limits. Mainstream card processors choose to leave DCB

alone, seeing it as an anomaly, a curiosity. They didn't take us

that seriously. But Boku understood that mobile network operators

could be a valuable source of new customers and persuaded the

world's tech giants to adopt the service. Our focus on DCB won us a

priceless asset: direct payment integrations to the world's leading

digital companies.

Transferable skills: better results, easy to deal with

It turned out that the capabilities developed to work in the

fragmented world of DCB, where no two carrier systems were the

same, perfectly equipped Boku for the similarly fragmented

landscape of local payments. We developed the ability to optimise

different connections so that they performed better and helped our

merchants to recruit more users and sell more stuff.

If there is one universal law of business - at least in my

experience - it is this: there is never enough IT resource. In

every company on the planet, the management has to make decisions

about which projects to prioritise and which projects don't quite

make the cut. We help to fix that. Critical to Boku's success is

that we are prepared to do reverse integrations to our merchants.

Instead of having to deploy their engineers, our merchants can let

the Boku team take some of the burden of connecting their system to

the 7.5bn accounts that can be accessed through our Issuer

network.

A winning formula

Our formula of being a specialised payment company processing

only LPMs for the world's largest digital companies has proved to

be very compelling. Most of our biggest merchants - Amazon,

Spotify, Netflix, Meta, Tencent - use Boku not just for DCB but

also for the newer LPMs and I am increasingly confident of our

ability to secure at least some of the wallet and A2A business of

other tech giants as well.

A race without end

Business is often described as a race. But that, in my view, is

a poor analogy. Races have an end. A defined endpoint. A time when

we can say who won, who lost and by how much. If business is a

race, it is a race without end. We do report on our progress every

so often, but our value is as much about the expectation, the

promise of the future, as it is on past results. But careers do

have an end: in 2024, the fifteen-year journey that I have

travelled with Boku culminating in being CEO for nearly a decade is

to end. I will pass on the baton in the continuing relay race to

Stuart Neal. He has a long career in payments, including at both

Barclaycard and Vocalink. He understands the company's culture. I

am confident that he will be able to take the company forward to

new heights.

Growth: a longer perspective

During my time with Boku, we have seen tremendous growth in our

business. Annual TPV has grown from less than $100 million to a $10

billion run rate. The average number of monthly active users has

grown from 1.4 million to exceed 60 million. Monthly transactions

processed now exceed 100 million, up from around 2 million. The

Company has become profitable and cash generative. Business is a

team sport and the job of the CEO, in large measure, is to pick the

team and take credit for other people's work. I have been blessed

to work with many talented people and those people will continue,

alongside Stuart, to help drive the Company's fortunes forward. In

a very real sense, the true measure of a CEO's tenure is not to be

seen in the numbers and percentages achieved during his time at the

helm but, rather, from how the Company performs after he has

departed.

Outlook

As I move from an executive to a non-executive position, I

continue to believe that Boku's best days are ahead of it. With the

strong momentum that we currently enjoy, our relationships with

merchants and expertise in optimising specialised payment types,

the opportunities presented by A2A and the leadership provided by

Stuart and the rest of the management team, I have strong

conviction that the company will continue to go from strength to

strength and achieve the targets set out at our capital markets

day..

Chief Financial Officer's Report

The first half of 2023 saw extremely strong performance with

revenues up 26% to $38.2 million (and up 32% in constant currency)

as we started to reap the rewards of our investment in moving into

Local Payment Methods for global merchants, and a 28% jump in

Adjusted EBITDA to $12.2 million as the operating leverage inherent

in our model came through.

These results were underpinned by a 32% increase in monthly

active users to 61.2 million in the first half (H1 2022: 46.3

million) as we continue to add connections for our global merchants

to new payments methods and into new geographies. 32.7 million new

users made their first payment or bundling transaction with Boku

during the first half of the year.

We completed more than 50 new launches for DCB, eWallets and A2A

in H1 2023 with existing and new merchants including Apple, Amazon,

Netflix, Sony, Spotify, Sky and Tencent. Launches took place in 18

countries across Asia, Europe and the Middle East; two thirds were

for LPMs. These drove a 16% increase in Total Payment Volume

("TPV")** to $5.0 billion (H1 2022: $4.3 billion).

Much of the strong revenue growth in the first half was driven

by the exceptional growth in LPMs, including eWallets and A2A,

where revenue increased 350% to $7.2m up from $1.6m in the first

half of 2022. Monthly active users increased 122% to over 4.7

million in June 2023, compared to the same period in 2022. New

users of LPMs increased by over 100% to 6.3 million in H1 2023 (up

from 3.1 million in the same period in 2022). Our 'm obile-first'

payments network expanded to reach over 7.5bn end user accounts,

46% of which are non-DCB.

Financial review

Following the disposal of Boku's Identity division on 28

February 2022 the prior year comparative Condensed Consolidated

Statement of Comprehensive income includes revenues and Adjusted

EBITDA relating only to the continuing Payments business.

Group Condensed Consolidated Statement of Comprehensive income

to Adjusted EBITDA(*)

Revenues increased by 26% to $38.2 million (H1 2022: $30.3

million) and up 32% on a constant currency basis, with Adjusted

EBITDA* increasing 28% to $12.2 million in the first half (H1 2022:

$9.5 million) reflecting the strong revenue growth combined with

our continued planned investment in our mobile-first payments

platform. Gross margins for the continuing Payments business

remained at 97% (2022: 97%).

Average take rate (revenue divided by TPV) increased slightly to

0.76% as a result of higher take rates from LPMs. Our merchant

relationships and connections remain highly 'sticky' and as a

result, since IPO, Boku has not lost a material merchant.

Adjusted operating expenditure***** increased as per our stated

strategy, as we invested in our expanded 'mobile-first' payments

network, which now includes eWallets and A2A, with planned

increases in operational headcount and sales and marketing spend as

Boku moves into new markets. However, the operational leverage

inherent in our platform business remains strong and, as a result,

we expect Payments Adjusted EBITDA(*) margins to increase over the

medium term as outlined in our Capital Markets Day presentation in

February this year.

Adjusted Operating Expenditure (Payments only)*****

Unaudited Unaudited

Period ended Period ended

30-Jun 30-Jun

2023 2022

$'000 $'000

Gross profit 36,858 29,379

Adjusted EBITDA* (12,216) (9,506)

Adjusted Operating Expenditure 24,642 19,873

------------ ------------

Identity division (discontinued)

Boku's Identity division was divested during the first half of

2022 to Twilio. We received the final indemnity holdback payment

from Twilio in full on 05 September 2023 and there are no further

balances due.

Group Operating Profit (from Continuing Operations)

Group operating profit for H1 2023 was $2.1 million compared to

$4.1 million for the same period in 2022. This can be broken down

as follows:

-- Other income of $0.1 million relates to income from providing

ongoing accounting services to Twilio following the sale of the

Identity business in February 2022 to enable a smooth transition.

These services and associated fees ended in April 2023. This amount

has been excluded from Adjusted EBITDA* as a non-trading,

non-recurring item. The H1 2022 comparative of $0.4 million also

related to the provision of the same services to Twilio.

-- Gross margin increased to $36.9 million (H1 2022: $29.4

million) with gross margin percentage stable at 97% (H1 2022:

97%)

-- Depreciation and Amortisation charges increased marginally to

$3.1 million (H1 2022: $2.7 million)

-- Share Based Payments expense increased to $4.0 million in H1

2023 from $1.9 million in H1 2022 primarily because the number of

share awards increased in line with our increased staff headcount

and the effect of a of a National Insurance accrual as a result of

the lower share price at that period end. Boku has a policy of

making annual RSU awards to all staff which vest in full after

three years. These share awards are planned to be satisfied from

treasury stock as part of Boku's share buyback programme. See

Consolidated Statement of Financial Position and Condensed

Consolidated Statement of Cash Flows section below.

-- Foreign exchange movements resulted in a loss of $3.13

million made up of realised and unrealised losses primarily on

revaluation of non USD balances during the period (H1 2022: $0.06

million gain)

-- Exceptional Items in the period were $0.018 million credit

which relates to the fair value movement at the period end in

relation to the Amazon warrants (see note 7) (2022: expense $1.26

million). The 2022 comparative period charge related to the

impairment of the intangible relating to the Fortumo 'brand' which

was discontinued in that period. There were no Amazon warrants at

30 June 2022 the comparative prior period end.

-- Financing expenses decreased to $0.15 million in H1 2023 (H1 2022: $0.52 million).

Net Profit after tax

-- The Group reported a net profit after tax of $1.8 million for

the period (H1 2022: $28.0 million which was primarily driven by

profit from the discontinued Identity division of $24.6

million).

Condensed Consolidated Statement of Financial Position and

Condensed Consolidated Statement of Cash Flows

-- Group cash balances were $113.9 million on 30 June 2023 up

from $67.8 million on 30 June 2022 and slightly down from 31

December 2022 of $116.6 million. The Group is debt free.

-- The average daily cash balance, a measure which smooths out

the effect of carrier and merchant payments, was $105.8 million in

June 2023, up from $98.8 million in 31 December 2022 and up from

June $63.3 million in June 2022..

-- In the second half of 2022 Boku commenced a 'share buyback'

scheme to purchase its own shares to cover employee RSU awards

annually so that the annual RSU awards are non-dilutive to

shareholders. In the first half of 2023 we purchased 3,088,359

shares for a total consideration of GBP4,416,626.

-- Intangible assets

Unaudited Audited

Period ended Period ended

30-Jun 31-Dec

2023 2022

$'000 $'000

Goodwill 41,978 41,733

Other intangibles 15,204 14,497

Intangible assets 57,182 56,230

------------ -------------

We assessed our goodwill and other remaining intangibles for

impairment and deemed that there were no indicators of impairment

at 30 June 2023.

-- Deferred tax asset

During the course of our change in auditors to PWC, it was

identified that there was an under-recognised deferred tax asset

from prior years. Accordingly, the opening balances in the

Condensed Consolidated Statement of Changes in Equity for years

ended 31 December 2021 and 31 December 2022 have been restated.

Please see note 9 for full details.

Principal Risks and Uncertainties

Since the end of 2022, the Board have been monitoring and

mitigating the effects of global events on the Group's business,

including the global macro-economic environment, inflation and the

cost of living crisis across Europe and believe the principal risks

and uncertainties facing the Group remain consistent with the

Principal Risks and Uncertainties reported in Boku's 2022 Annual

Report. Boku is an international business operating in 92 countries

so any risk is spread and to date Boku has seen no discernible

impact from the macro-economic environment. Boku charges a

percentage of its merchants' transaction value, so as its

merchants' increase prices, Boku's revenues increase.

Going concern

In reaching their going concern assessment, the Directors have

considered the foreseeable future, a period extending at least 12

months from the date of approval of this interim financial report.

This assessment has included consideration of the forecast

performance of the business, as noted above and the cash and

financing facilities available to the Group. Considering all this

analysis, the Directors are satisfied that the Group has sufficient

cash resources over the period of at least 12 months from the date

of approval of the condensed consolidated interim financial

statements. As such, the condensed consolidated interim financial

statements have been prepared on a going concern basis.

Looking forward

These results show that Boku's strategic investment into adding

connections to Local Payment Methods globally for our major

international digital merchants is paying off and we expect the

strong growth we have seen in the period to continue. This has

resulted in a strong return to Adjusted EBITDA growth as a result

of the operating leverage inherent in our platform business.

Keith Butcher

Chief Financial Officer

25 September 2023

* Adjusted EBITDA (Earnings before interest, taxation, depreciation

and amortization): Adjusted for stock option expenses, Foreign

exchange gains/losses and Exceptional items. See reconciliation

to profit per the income statement

** TPV is the US$ value of transactions processed by the Boku platform

***** Adjusted operating expenditure is Gross Profit less Adjusted

EBITDA

Cautionary Statement

Boku has made forward-looking statements in this financial

information, including statements about the market and benefits of

its products and services; financial results; product development

plans; the potential benefits of business relationships with third

parties and business strategies. The Group considers any statements

that are not historical facts as "forward-looking statements". They

relate to events and trends that are subject to risk and

uncertainty that may cause actual results and the financial

performance of the Group to differ materially from those contained

in any forward-looking statement. These statements are made by the

directors in good faith based on the information available to them

and such statements should be treated with caution due to the

inherent uncertainties, including both economic and business risk

factors underlying any such forward-looking information.

Condensed Consolidated Statement of Comprehensive Income

(Unaudited) (Unaudited)

Period ended

Period ended 30 -Jun 2022

30-Jun 2023 $'000

Continuing Operations Note $'000

------- -------------

Revenue 3 38,174 30,339

----------------------------------------- ------- -------------- -------------

Cost of sales (1,316) (960)

-------------------------------------------------- -------------- =============

Gross profit 36,858 29,379

-------------------------------------------------- -------------- -------------

Other Income (non-recurring) 3 103 385

----------------------------------------- ------- -------------- -------------

Administrative expenses (34,836) (25,692)

-------------------------------------------------- -------------- =============

Operating profit analysed as:

----------------------------------------- ------- -------------- -------------

Adjusted EBITDA* 12,216 9,506

-------------------------------------------------- -------------- -------------

Other Income 3 103 385

----------------------------------------- ------- -------------- -------------

Depreciation and amortisation (3,102) (2,718)

-------------------------------------------------- -------------- -------------

Share based payments expense (3,978) (1,898)

-------------------------------------------------- -------------- -------------

Foreign exchange loss/(gain) (3,132) 61

-------------------------------------------------- -------------- -------------

Exceptional items 18 (1,264)

-------------------------------------------------- -------------- =============

Operating profit 2,125 4,072

-------------------------------------------------- -------------- -------------

Finance income 474 81

-------------------------------------------------- -------------- -------------

Finance expense (150) (518)

-------------------------------------------------- -------------- =============

Profit before tax 2,449 3,635

-------------------------------------------------- -------------- -------------

Tax expense (649) (216)

-------------------------------------------------- -------------- =============

Net Profit from continuing operations 1,800 3,419

-------------------------------------------------- -------------- =============

Discontinued operations

----------------------------------------- ------- -------------- =============

Profit from discontinued operations

after tax - 24,605

-------------------------------------------------- -------------- =============

Total Profit for the year 1,800 28,024

-------------------------------------------------- -------------- -------------

Other comprehensive profit/( losses)

net of tax

----------------------------------------- ------- -------------- -------------

Items that may be reclassified to

profit or loss

----------------------------------------- ------- -------------- -------------

Foreign currency translation gain/(loss) 1,141 (3,978)

-------------------------------------------------- -------------- -------------

Total other comprehensive gain/(loss)

for the period 1,141 (3,978)

-------------------------------------------------- -------------- -------------

Total comprehensive profit for

the period attributable to equity

holders of the parent company 2,941 24,046

-------------------------------------------------- -------------- -------------

EPS - Total

----------------------------------------- ------- -------------- -------------

Basic EPS ($) 0.0060 0.0941

-------------------------------------------------- -------------- -------------

Diluted EPS ($) 0.0055 0.0921

-------------------------------------------------- -------------- -------------

EPS from continuing operations

----------------------------------------- ------- -------------- -------------

Basic EPS ($) 0.0060 0.0115

-------------------------------------------------- -------------- -------------

Diluted EPS ($) 0.0055 0.0112

-------------------------------------------------- -------------- -------------

*Adjusted EBITDA (Earnings before interest, taxation,

depreciation, amortisation): Adjusted for share-based payment

expense, foreign exchange gains/(losses), exceptional items and

'other income' in 2023 and 2022. See reconciliation to profit per

income statement.

The accompanying notes are an integral part of these condensed

consolidated financial statements

Condensed Consolidated Statement of Financial Position

(Unaudited) (Audited)

30-Jun 2023 31-Dec 2022

Note $'000 $'000

Restated

----- --------------------

Non-current assets

Property, plant and equipment 654 696

Right of use assets 3,084 3,662

Intangible assets 57,182 56,230

Warrant contract asset 7 2,677 1,519

Deferred tax assets 15,991 16,481

----------------------------------------- ----- -------------------- ------------

Total non-current assets 79,588 78,588

================================================ -------------------- ------------

Current assets

----------------------------------------- ----- -------------------- ------------

Trade and other receivables 97,264 90,080

Financial asset at fair value through

profit or loss 5,600 5,600

Warrant contract asset 196 192

Cash and cash equivalents - unrestricted 5 99,167 99,551

Cash and cash equivalents - restricted

cash 14,699 16,962

----------------------------------------- ----- -------------------- ------------

Total current assets 216,926 212,385

------------------------------------------------ -------------------- ------------

Total assets 296,514 290,973

------------------------------------------------ -------------------- ------------

Current liabilities

----------------------------------------- ----- -------------------- ------------

Trade and other payables 159,767 156,263

Current tax payable 216 222

Lease liabilities 1,374 1,277

Bank Loans - -

----------------------------------------- ----- -------------------- ------------

Total current liabilities 161,357 157,762

================================================ -------------------- ------------

Non-current liabilities

----------------------------------------- ----- -------------------- ------------

Other payables 1,331 1,194

Deferred tax liabilities - -

Warrant liabilities 7 6,427 5,206

Lease liabilities 1,835 2,272

Bank Loans - -

----------------------------------------- ----- -------------------- ------------

Total non-current liabilities 9,593 8,672

================================================ -------------------- ------------

Total liabilities 170,950 166,434

================================================ -------------------- ------------

Net assets 125,564 124,539

------------------------------------------------ -------------------- ------------

Equity attributable to equity

holders of the company

----------------------------------------- ----- -------------------- ------------

Share capital 29 29

Other reserves 250,976 252,385

Foreign exchange reserve (5,149) (6,290)

Treasury share reserve (2,018) (1,835)

Retained losses (118,274) (119,750)

----------------------------------------- ----- -------------------- ------------

Total equity 125,564 124,539

------------------------------------------------ -------------------- ------------

The accompanying notes are an integral part of these condensed

consolidated financial statements

Condensed Consolidated Statement of Changes in Equity

Treasury Foreign

Share Other shares exchange Retained Total

capital reserves reserve reserve losses Equity

--------- ---------- -------- --------- ----------

$'000 $'000 $'000 $'000 $'000 $'000

------------------------------ --------- ---------- -------- --------- ---------- --------

Equity as at 1 January 2022

as previously reported 29 246,883 - (2,714) (161,752) 82,446

------------------------------ --------- ---------- -------- --------- ---------- --------

Impact of correction - - - - 14,828 14,828

------------------------------ --------- ---------- -------- --------- ---------- --------

Equity as at 1 January 2022

(restated) 29 246,883 - (2,714) (146,929) 97,274

------------------------------ --------- ---------- -------- --------- ---------- --------

Profit for the period - - - - 28,024 28,024

Other comprehensive expense - - - (3,978) - (3,978)

Issue of share capital upon

exercise of stock options - 315 - - - 315

Share based payment expense - 2,352 - - - 2,352

------------------------------ --------- ---------- -------- --------- ---------- --------

Equity as at 30 June 2022

(restated) 29 249,550 - (6,692) (118,900) 123,988

------------------------------ --------- ---------- -------- --------- ---------- --------

Treasury Foreign

Share Other shares exchange Retained Total

capital reserves reserve reserve losses Equity

------------------------------ --------- ---------- -------- --------- ---------- --------

$'000 $'000 $'000 $'000 $'000 $'000

------------------------------ --------- ---------- -------- --------- ---------- --------

Equity as of 31 December

2022 as previously reported 29 252,385 (1,835) (6,290) (132,848) 111,441

------------------------------ --------- ---------- -------- --------- ---------- --------

Impact of correction - - - - 13,098 13,098

------------------------------ --------- ---------- -------- --------- ---------- --------

Equity as at 31 December

2022 (restated) 29 252,385 (1,835) (6,290) (119,750) 124,539

------------------------------ --------- ---------- -------- --------- ---------- --------

Profit for the period - - - - 1,800 1,800

Other comprehensive income - - - 1,141 1,141

Issue of share capital upon

exercise of stock options - 40 - - - 40

Share based payment expense - 3,559 - - - 3,559

Deferred tax asset adjustment - - - - (55) (55)

Purchase of treasury shares - - (5,460) - - (5,460)

Issue of treasury shares to

employees - (5,008) 5,008 - - -

Loss on treasury shares - - 269 - (269) -

(2,018

Equity as at 30 June 2023 29 250,976 ) (5,149) (118,274) 125,564

--------- ---------- -------- --------- ----------

The accompanying notes are an integral part of these condensed

consolidated financial statements

Condensed Consolidated Statement of Cash Flows

(Unaudited) (Unaudited)

Period ended Period ended

30-Jun 2022

30-Jun 2023 $'000

Note $'000

============================================= --------------- ------------------ ==============

Cash generated from/(used in) operations 6 2,235 (7,761)

--------------------------------------------- --------------- ------------------ --------------

Income taxes paid (118) (185)

============================================= --------------- ------------------ ==============

Net cash generated from/(used in) operating

activities 2,117 (7,946)

============================================= --------------- ------------------ ==============

Investing activities

--------------------------------------------- --------------- ------------------ --------------

Purchase of property, plant and equipment (133) (104)

--------------------------------------------- --------------- ------------------ --------------

Capitalised software development (2,617) (2,677)

--------------------------------------------- --------------- ------------------ --------------

Proceeds from discontinued operations

(net of cash disposed) - 25,790

--------------------------------------------- --------------- ------------------ --------------

Proceeds from sale of assets - 1

--------------------------------------------- --------------- ------------------ --------------

Interest received 474 81

============================================= --------------- ------------------ ==============

Net cash used (in)/from investing activities (2,276) 23,091

--------------------------------------------- --------------- ------------------ --------------

Financing activities

--------------------------------------------- --------------- ------------------ --------------

Payment of principal to lease creditors (625) (649)

--------------------------------------------- --------------- ------------------ --------------

Payment of interest to lease creditors (99) (130)

--------------------------------------------- --------------- ------------------ --------------

Issue of share capital on exercise of

options and RSUs 40 315

--------------------------------------------- --------------- ------------------ --------------

Interest paid on borrowings (51) (76)

--------------------------------------------- --------------- ------------------ --------------

Purchase of treasury shares (5,460) -

--------------------------------------------- --------------- ------------------ --------------

Cash received on exercise on sale options 2,333 -

--------------------------------------------- --------------- ------------------ --------------

Loan settlement costs - (25)

--------------------------------------------- --------------- ------------------ --------------

Repayment of line of credit - (8,125)

--------------------------------------------- --------------- ------------------ --------------

Net cash used in financing activities (3,862) (8,690)

============================================= --------------- ------------------ ==============

Net (decrease)/increase in cash and cash

equivalents (4,021) 6,455

--------------------------------------------- --------------- ------------------ --------------

Effect of foreign currency translation

on cash and cash equivalents 1,374 (1,096)

--------------------------------------------- --------------- ------------------ --------------

Cash and cash equivalents at beginning

of period 116,513 62,440

============================================= --------------- ------------------ ==============

Cash and cash equivalents at end of period 113,866 67,799

--------------------------------------------- --------------- ------------------ --------------

The accompanying notes are an integral part of these condensed

consolidated financial statements

Notes to the Consolidated Financial Information

1. Corporate Information

The condensed consolidated interim financial statements

represents the results of Boku Inc. (the "Company") and its

subsidiaries (together referred to as the "Group").

Boku Inc. is a company incorporated and domiciled in the United

States of America. The business office of the Company is located at

660 Market St, Suite 400, San Francisco, CA 94105, United

States.

The Company's shares are quoted on the AIM Market of the London

Stock Exchange ("AIM").

The principal business of the Group is the provision of local

payment solutions for its merchants. These solutions enable

merchants to accept online payments, especially on mobile devices.

Boku's payments network provides multiple mobile payment methods,

including via mobile wallets, direct carrier billing and real-time

payment schemes.

The Board of Directors approved the condensed consolidated

interim financial statements on 25 September 2023.

2. Basis of preparation and accounting policies

The condensed consolidated interim financial statements have

been prepared using accounting policies consistent with

international accounting standards. While the financial figures

included in this half-yearly report have been computed in

accordance with international accounting standards applicable to

interim periods. This condensed consolidated interim financial

report for the half-year reporting period ended 30 June 2023 has

been prepared in accordance with International Accounting Standard

34, 'Interim Financial Reporting'. The interim report does not

include all of the notes of the type normally included in an annual

financial report.

They do not include all disclosures that would otherwise be

required in a complete set of financial statements and should be

read in conjunction with the Annual Report and Financial Statements

for 2022. The financial information for the half years ended 30

June 2023 and 30 June 2022 does not constitute full financial

statements and both periods are unaudited.

The annual financial statements of Boku Inc., (the "Group") are

prepared in accordance with IFRS as issued by the IASB. The Annual

Report and Financial Statements for 2022 have been issued and are

available on the Group's investor relations' website:

https://www.boku.com/investor-relations/reports-documents. The

Independent Auditors' Report on the Annual Report and Financial

Statements for the year ended 31 December 2022 was unqualified and

did not draw attention to any matters by way of emphasis.

The same accounting policies, presentation and methods of

computation are followed in these condensed consolidated interim

financial statements as were applied in the Group's latest annual

audited financial statements, except for the income tax which is

recognised based on management's estimate of the weighted average

effective annual income tax rate expected for the full financial

year and those that relate to new standards and interpretations

effective for the first time for periods beginning on (or after) 1

January 2023 and will be adopted in the 2023 financial statements.

There are deemed to be no new and amended standards and/or

interpretations that will apply for the first time in the next

annual financial statements that are expected to have a material

impact on the Group.

Going concern

The condensed consolidated interim financial statements have

been prepared on a going concern basis. The Group meets its

day-to-day working capital requirements through its own cash

balances and has a bank facility that it can use.

The Directors have prepared cash-flow forecasts covering a

period of at least 12 months from the date of approval of the

financial statements, with the forecasts and projections, taking

account of reasonable possible changes in trading performance. They

show that the Group expects to be able to operate within the level

of its current cash resources and bank facilities.

Furthermore, in carrying out the going concern assessment, the

directors have considered a number of scenarios, including changes

in sales volumes and the timing of settlement of existing debts

together with cost savings associated with these changes and the

directors have the ability to identify cost savings if necessary,

to help mitigate any impact on cash outflows.

Having assessed the principal risks and the other matters

discussed in connection with the going concern statement, the

Directors have a reasonable expectation that the Group has adequate

resources to continue in operational existence for the foreseeable

future and for at least 12 months from the date of approval of

these financial statements. For these reasons, they continue to

adopt the going concern basis of accounting and deem there to be no

emphasis over going concern, in preparing the financial

information.

Adjusted financial measure/Non-GAAP

Management regularly uses adjusted financial measures internally

to understand, manage and evaluate the business and make operating

decisions. These adjusted measures are among the primary factors

management uses in planning for and forecasting future periods. The

primary adjusted financial measures are EBITDA, Adjusted EBITDA,

Adjusted Operating expenses and Constant currency revenues which

management considers are relevant in understanding the Group's

financial performance. Management uses the adjusted financial

measures by excluding certain one-off items from the actual

results. The determination of whether one-off material or

non-recurring items should form part of the adjusted results is a

matter of judgement and is based on whether the inclusion/exclusion

from the results represent more closely the consistent trading

performance of the business. The definitions of adjusted items and

underlying adjusted results are disclosed at the end of this

report.

Accounting estimates, assumptions and judgements

In preparing these Condensed Consolidated financial statements,

the Group has made its best estimates and judgements of certain

amounts included in the financial statements, giving due

consideration to materiality. The Group regularly reviews these

estimates and judgements and updates them as required. Actual

results could differ. Unless otherwise indicated, the Group does

not believe that there is a significant risk of a material change

to the carrying value of assets and liabilities within the next

financial year related to the accounting judgements and assumptions

described below. The Group considers the following to be a

description of the most significant estimates and judgements, which

require the Group to make subjective and complex judgements related

to matters that are inherently uncertain.

3. Revenue

The Group's revenue is principally its service fees earned from

its merchants. All revenue is earned at the time the transaction is

processed and as a result, all revenue is recognised at that point

in time. The group has only one continuing operating segment, the

Payments business segment.

(Unaudited) (Unaudited)

30-Jun 30-Jun 2022

2023

Revenue from continuing operations $'000 $'000

------------

Revenue arises from:

------------ ------------

Provision of services 38,174 30,339

------------------------------------ ------------ ------------

Income earned from performing accounting services for the buyer

of Boku's Identity business, (sold on 28 February 2022), for the

period 1 January 2023 to 30 June 2023 has been recorded as 'Other

income' and amounted to $103,392. Prior year 'Other Income' relates

to performing the same accounting services for the period 1 March

2022 to 30 June 2022.

On 16 September 2022, the Group entered into a stock warrant

agreement with Amazon in conjunction with a commercial service

level agreement for the Group to provide payment processing

services to Amazon. The group outlines a detailed explanation of

the Amazon warrants and the accounting policy for warrants and the

valuation method used, in the Group's most recent 2022 Annual

Report (please refer to Note 3 for Accounting estimates,

assumptions and judgements and Note 4 for Revenue from contracts

with customers in the Annual Report and Accounts for the year ended

31 December 2022).

(https://wp-boku-2020.s3.eu-west-2.amazonaws.com/media/2023/06/Boku-Annual-Report-2022.pdf).

A reduction of revenue related to the amazon contract assets

amortization of $76,492 was recorded for the period 1 January 2023

to 30 June 2023 (see Note 7 for more details).

4. Key management personnel costs

(Unaudited) (Unaudited)

30-Jun 30-Jun

2023 2022

$'000 $'000

------------------------------------------------ ------------ -----------

Salaries 2,036 1,620

Short-term employee benefits (health insurance) 50 48

Social Security costs 686 366

Share based payments expense 1,605 1,246

Long term employee benefits (pension) 8 9

------------------------------------------------ ------------ -----------

4,385 3,289

5. Cash and cash equivalents and restricted cash

(Unaudited) (Audited)

30-Jun 2023 31-Dec 2022

$'000 $'000

Cash and cash equivalents 99,167 99,551

------------- ------------

Restricted cash 14,699 16,962

------------- ------------

Total cash 113,866 116,513

========================== ============= ============

Restricted cash primarily includes money received but not yet

paid to merchants (segregated funds, in transit), for Boku's

licenced entities, cash held in the form of a letter of credit to

secure a lease agreement for the Company's San Francisco office and

a certificate of deposit held at a financial institution to

collateralize Company credit cards.

6. Cash from operations

(Unaudited) (Unaudited)

30-Jun

2022

30-Jun 2023 $'000

$'000

========================================================= ============= ===========

Profit after tax 1,800 28,024

------------- -----------

Add back:

------------- -----------

Tax expense 649 216

------------- -----------

Amortisation of intangible assets 2,061 1,935

------------- -----------

Depreciation of property, plant and equipment 1,041 1,021

------------- -----------

Loss on disposal of property, plant and equipment 2 3

------------- -----------

Finance income (474) (81)

------------- -----------

Finance expense (includes interest on lease liabilities) 150 518

------------- -----------

Fair value adjustment on warrants valuation (18) -

------------- -----------

Gain on discontinued operations - (26,614)

------------- -----------

Amortization of warrant asset 76 -

------------- -----------

Foreign exchange (gain)/loss (707) 855

------------- -----------

Impairment of intangible assets - 1,264

------------- -----------

Employer taxes on stock options and restricted

stock units (accrual release) (113) (1,205)

------------- -----------

Share based payment expenses 3,559 2,352

------------- -----------

Cash from operations before working capital changes 8,026 8,288

------------- -----------

Increase in trade and other receivables (3,012) (6,253)

------------- -----------

Decrease in trade and other payables (2,779) (9,796)

------------- -----------

Cash from/(used in) operations 2,235 (7,761)

------------- -----------

The share based payment expense has been split between the

charge using the Black Scholes method for the period ($3,558,760)

and the change in the accrual for employer taxes on stock option

and restricted stock units (-$113,250). The total share based

payment expense in the Condensed Consolidated Statement of

Comprehensive Income includes $532,424 employer taxes paid via

payroll to tax authorities (30 June 2022: $406,087).

The impairment of intangible assets in the 2022 comparative

relates to the full impairment of the Fortumo trade name which was

discontinued in the period.

7. Amazon warrants

On 16 September 2022, the Group entered into a stock warrant

agreement with a subsidiary of Amazon Inc, Amazon.com NV Investment

Holdings LLC ('Amazon') in conjunction with a commercial service

level agreement for the Group to provide payment processing

services to Amazon.

Under the agreement, the Group issued warrants to Amazon

allowing them to purchase common stock that will vest

incrementally, based on the amount of revenue earned by the Group

from Amazon via Boku payment processing methods. The full details

of the award are disclosed in Note 25 of the Annual Report and

Accounts for the year ended 31 December 2022. There have been no

changes to the agreement. The warrant agreement grants Amazon the

right to acquire up to 11,215,142 shares of common stock in the

Group (equivalent to 3.75% of the Group's total common stock as at

the inception of the warrant agreement). 747,676 shares of common

stock vested immediately on the signing of the warrant agreement on

16 September 2022. 209,350 additional shares of common stock will

vest for every $1 million of 'qualifying' revenue generated by the

Group under its service level agreement with Amazon over a seven

year vesting period ending 15 September 2029. No further warrants

will vest if $50 million of qualifying revenue is generated under

the service level agreement, which results in a final vesting

increment of 209,316 shares of common stock. The exercise price of

vested warrants is 81.20p per share, based on the 30-day volume

weighted average trading price as at 16 September 2022.

The increase in fair value from 31 December 2022 to 30 June 2023

was primarily due to an increase in the number of warrants expected

to vest from 4,992,086 to 6,180,045. The warrants are classified as

Level 3 derivative liabilities as there is no current market for

the warrants, such that the determination of fair value requires

significant judgment or estimation. The Group values the warrants

using a combination of Monte Carlo Simulation and Black-Scholes

Model valuation methods

A significant increase, in isolation, in volatility used in

arriving at the fair value of warrants as at 30 June 2023 would

result in a significant change in fair value. If equity volatility

and revenue volatility were both to decrease by 5% to 35% and 25%

respectively, the total fair value of warrants would decrease to

$6,192,405, representing a decrease in fair value of $234,842. If

equity volatility and revenue volatility were both to increase by

5% to 45% and 35% respectively, the total fair value of warrants

would increase to $6,705,349, representing an increase in fair

value of $278,102.

The group outlines a detailed explanation of the Amazon warrants

and the accounting policy for warrants and the valuation method

used, in the Group's most recent annual report (please refer to

Note 3 Accounting estimates, assumptions and Judgements, Note 4

Accounting policies and Note 25 Warrants in the Annual Report and

Accounts for the year ended 31 December 2022).

(https://wp-boku-2020.s3.eu-west-2.amazonaws.com/media/2023/06/Boku-Annual-Report-2022.pdf).

8. Extended Share buyback programme

On 8 June 2023, the Board of directors approved an extension to

it's share buyback programme, which commenced on 7 July 2022, for a

further 12 months from the expiry of the original programme term.

The purpose of the Buyback Programme is to hold the Common Stock in

treasury for the purpose of satisfying future obligations in

relation to the staff equity remuneration programme.

The extended programme will involve the purchasing of common

stock with par value of $.0001 per share in the capital of the

Company ("Common Stock") up to an additional maximum aggregate

consideration of GBP10.5 million and up to an additional maximum of

5.25 million Common Stock (the "Extended Buyback Programme").

The Company instructed Peel Hunt LLP, the Company's broker, to

conduct the Extended Buyback Programme on its behalf. The Buyback

programme will be effected within certain pre-set parameters,

including that the maximum price paid per Common Stock shall be 105

per cent. of the trailing 5 day average mid-market price, and in

accordance with the authority granted by the Company's Board (the

"Authority").

The programme is effective from 8 June 2023 and will expire on

30 June 2024, or earlier, if either the maximum aggregate number of

Common Stock have been purchased or the maximum aggregate

consideration has been reached.

9. Deferred tax asset

During the course of our change in auditors, it was identified

that there was an under-recognised deferred tax asset from prior

years. Accordingly, the opening balances in the Condensed

Consolidated Statement of Changes in Equity f or years ended 31

December 2021 and 31 December 2022 have been restated. The year

ended 31 December 2021 has increased deferred tax assets recognised

from $2.47 million to $17.48 million and the year ended 31 December

2022 has increased deferred tax assets recognised from $3.38

million to $16.48 million. The net deferred tax asset recognised as

at 30 June 2023 is $15.99 million.

10. Post Balance Sheet Events

On 5 September 2023 the Company received $5,600,000 from Twilio

which represented full payment of the final indemnity holdback

payment due on the disposal of Boku's Identity business and which

is included in current assets in the Condensed Consolidated

Statement of Financial Position.

Non-GAAP Financial measures (alternative performance

measures)

Management present non-GAAP financial measures because they

believe that these and other similar measures are widely used by

certain investors, securities analysts and other interested parties

as supplemental measures of performance and liquidity. These

measures are also used internally to establish forecasts, budgets

and operational goals to manage and monitor the business, as well

as to evaluate the Group's underlying historical performance.

Management believes that these non-GAAP financial measures depict

the true performance of the business by encompassing only relevant

and controllable events, enabling us to evaluate and plan more

effectively for the future.

The primary adjusted financial measures are EBITDA, Adjusted

EBITDA, Adjusted Operating expenses and Constant currency measures

(Revenue only), which management considers are relevant in

understanding the Group's financial performance.

We define "EBITDA" as net income / (loss) for the year, less

discontinued operations gains, net of tax, before finance expenses

(including finance costs related to lease liabilities),

depreciation and amortisation (including depreciation of

right-of-use assets), and income tax expense / (benefit).

We define "Adjusted EBITDA" as EBITDA before the effect of the

following items: foreign exchange losses share based payments

expense, non recurring income and exceptional costs (see note 8).

We use Adjusted EBITDA internally to establish forecasts, budgets

and operational goals to manage and monitor our business, as well

as evaluate our underlying historical performance. We believe that

Adjusted EBITDA is a meaningful indicator of the health of our

business as it reflects our ability to generate cash that can be

used to fund recurring capital expenditures and growth. Adjusted

EBITDA from continuing operations also disregards non-cash or

non-recurring charges (exceptional costs) that we believe are not

reflective of our long-term performance. We also believe that

Adjusted EBITDA is widely used by investors, securities analysts

and other interested parties as a supplemental measure of

performance and liquidity.

We define "Adjusted Operating expenses" as Gross profit less

Adjusted EBITDA (as defined above).

Constant currency measures (Revenue only) are calculated by

applying the monthly average foreign exchange rates for each month

of 2022 to the actual 2023 monthly results.

Average daily cash balance is a measure which removes the daily

cash balances fluctuations and is used by management because it

reflects better the effect of carrier and merchant payments on the

month end balances.

Independent review report to Boku, Inc.

Report on the condensed consolidated interim financial

statements

Our conclusion

We have reviewed Boku, Inc.'s condensed consolidated interim

financial statements (the "interim financial statements") in the

interim results of Boku, Inc. for the period from 1 January 2023 to

30 June 2023 (the "period").

Based on our review, nothing has come to our attention that

causes us to believe that the interim financial statements are not

prepared, in all material respects, in accordance with

International Accounting Standard 34, 'Interim Financial Reporting

as issued by the IASB, and the AIM Rules for Companies.

The interim financial statements comprise:

-- the Condensed Consolidated Statement of Financial Position as at 30 June 2023;

-- the Condensed Consolidated Statement of Comprehensive Income for the period then ended;

-- the Condensed Consolidated Statement of Cash Flows for the period then ended;

-- the Condensed Consolidated Statement of Changes in Equity for the period then ended; and

-- the explanatory notes to the interim financial statements.

The interim financial statements included in the interim

financial information of Boku, Inc. have been prepared in

accordance with International Accounting Standard 34, 'Interim

Financial Reporting', as issued by the IASB and the AIM Rules for

Companies.

Basis for conclusion

We conducted our review in accordance with International

Standard on Review Engagements (UK) 2410, 'Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity' issued by the Financial Reporting Council for use in the

United Kingdom ("ISRE (UK) 2410"). A review of interim financial

information consists of making enquiries, primarily of persons

responsible for financial and accounting matters, and applying

analytical and other review procedures.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing (UK) and,

consequently, does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in

an audit. Accordingly, we do not express an audit opinion.

We have read the other information contained in the interim

financial information and considered whether it contains any

apparent misstatements or material inconsistencies with the

information in the interim financial statements.

Conclusions relating to going concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis for

conclusion section of this report, nothing has come to our

attention to suggest that the directors have inappropriately

adopted the going concern basis of accounting or that the directors

have identified material uncertainties relating to going concern

that are not appropriately disclosed. This conclusion is based on

the review procedures performed in accordance with ISRE (UK) 2410.

However, future events or conditions may cause the group to cease

to continue as a going concern.

Responsibilities for the interim financial statements and the

review

Our responsibilities and those of the directors

The interim financial information, including the interim

financial statements, is the responsibility of, and has been

approved by the directors. The directors are responsible for

preparing the interim financial information in accordance with the

AIM Rules for Companies which require that the financial

information must be presented and prepared in a form consistent

with that which will be adopted in the company's annual financial

statements. In preparing the interim financial information,

including the interim financial statements, the directors are

responsible for assessing the group's ability to continue as a

going concern, disclosing, as applicable, matters related to going

concern and using the going concern basis of accounting unless the

directors either intend to liquidate the group or to cease

operations, or have no realistic alternative but to do so.

Our responsibility is to express a conclusion on the interim

financial statements in the interim financial information based on

our review. Our conclusion, including our Conclusions relating to

going concern, is based on procedures that are less extensive than

audit procedures, as described in the Basis for conclusion

paragraph of this report. This report, including the conclusion,

has been prepared for and only for the company for the purpose of

complying with the AIM Rules for Companies and for no other

purpose. We do not, in giving this conclusion, accept or assume

responsibility for any other purpose or to any other person to whom

this report is shown or into whose hands it may come save where

expressly agreed by our prior consent in writing.

PricewaterhouseCoopers LLP

Chartered Accountants

London

25 September 2023

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FIFVSARIRFIV

(END) Dow Jones Newswires

September 26, 2023 02:00 ET (06:00 GMT)

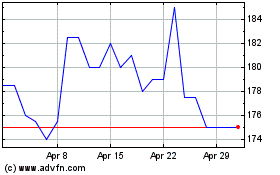

Boku (LSE:BOKU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Boku (LSE:BOKU)

Historical Stock Chart

From Apr 2023 to Apr 2024