TIDMBSIF

RNS Number : 6946X

Bluefield Solar Income Fund Limited

22 December 2023

22 December 2023

Bluefield Solar Income Fund Limited

('Bluefield Solar' or the 'Company')

Strategic Partnership with GLIL Infrastructure ('GLIL')

Agreement set to enhance income diversification and facilitate

de-leveraging

-- Bluefield Solar to invest GBP20 million of equity, alongside

GBP200 million from GLIL, into a UK based solar portfolio and repay

GBP10 million of the Company's Revolving Credit Facility

('RCF').

-- Provisional agreement for GLIL to acquire a 50% stake in a

portfolio in excess of 100MW currently owned by Bluefield Solar, in

line with current valuation, in early 2024.

-- Strategic partnership agreement provisionally committing

Bluefield Solar and GLIL to funding a selection of the Company's

development pipeline.

Bluefield Solar (LON: BSIF), the London listed UK income fund

focused primarily on acquiring and managing solar energy assets, is

pleased to announce the signing of a Memorandum of Understanding

('MOU') with GLIL regarding the formation of a long-term strategic

partnership ('Strategic Partnership') which commits both parties to

investing together into UK focused solar assets, from development

through to operational plants. GLIL is a partnership of UK pension

funds, investing into core UK infrastructure, including Local

Pensions Partnership Investments, Greater Manchester Pension Fund,

Merseyside Pension Fund, West Yorkshire Pension Fund and Nest, and

has a GBP3 billion portfolio of infrastructure assets.

There are three distinct phases to the Strategic

Partnership:

In phase one, the Strategic Partnership has agreed the

acquisition of a 247MW portfolio of UK solar assets from

Lightsource bp (the 'Lightsource bp Portfolio'). The Lightsource bp

Portfolio is predominantly diversified across southern and central

England and comprises 58 operating sites: 184MW backed by Feed in

Tariff ('FiT') subsidies, 15MW by Renewable Obligation Certificates

('ROCs') and two subsidy free projects totalling 48MW. Through the

period 2023 to 2035 the proportion of fixed and regulated revenues

from the portfolio is projected to be approximately 80%. The

acquisition raises the level of regulated revenues in the Bluefield

Solar portfolio, whilst also increasing the proportion of FiT

income.

Bluefield Solar is investing GBP20 million, or 9% of the equity,

with GLIL investing the balance. The Company will fund the

acquisition using earnings which arose in the financial year ended

30 June 2023, after the payment of dividends, debt amortisation and

the Electricity Generator Levy ('EGL'). In addition, Bluefield

Solar will use a further GBP10 million of earnings to pay down a

portion of the Company's RCF. Total retained earnings before this

announcement were approximately GBP60 million. Following the

Lightsource bp Portfolio acquisition and the partial repayment of

the RCF, the Company's UK holding companies' RCF balance will stand

at GBP167 million, with long term amortising debt being GBP430

million. Overall, the Company's UK holding companies and its

subsidiaries have total outstanding debt of GBP597 million, with a

leverage level of circa 41% of Gross Asset Value (broadly unchanged

from 30 June 2023).

The acquisition is conditional on the joint venture between

Bluefield Solar and GLIL being an approved buyer under the National

Security and Investment Act 2021 as the parties have a combined

portfolio generation capacity of over 1GW. This is expected in

January 2024.

In phase two, GLIL has provisionally agreed to acquire a 50%

stake in a portfolio of more than 100MW of operational UK solar

assets currently owned by the Company ('Bluefield Portfolio'). The

provisional acquisition price is in line with the Company's current

valuation. The Strategic Partnership intends to reach financial

close in the first half of 2024. The sale of a stake in the

Bluefield Portfolio, as described, will provide Bluefield Solar

with additional liquidity, the proceeds of which provide the

opportunity to continue to pay down the drawn RCF.

In phase three, Bluefield Solar and GLIL intend via the

Strategic Partnership to commit capital in a selection of the

Company's development pipeline, assuming market conditions are

supportive. The identified development assets are expected to be

grid connected over the next two to three years.

The Board of Bluefield Solar reiterates its guidance of a raised

full year dividend of not less than 8.80pps for the period ending

30 June 2024 (increased from 8.60pps paid for the period ended 30

June 2023).

John Scott, Chair of Bluefield Solar, said : "Current capital

market conditions make it difficult for us to raise new capital

using the instruments which have served the Company and its

shareholders well through the past ten years. In response, the

Bluefield Solar board has been evaluating how best to continue our

development programme, while maximising value for our shareholders

over the long term. The strategic partnership with GLIL is an

exciting and significant development for the Company; it creates

the opportunity for both parties to invest in the sizeable

renewable energy pipeline which our Investment Adviser has

identified, while responding to shareholder feedback in reducing

our short-term debt position. The world is crying out for more

solar power and COP28 has called for a tripling of capacity by

2030. We see tremendous potential in this partnership as a means to

help Bluefield Solar play its part in achieving this goal."

James Armstrong, Managing Partner, Bluefield Partners,

Investment Adviser to Bluefield Solar, said: "We have been

listening to feedback from our shareholders and the strategic

partnership with GLIL enables us to deliver on a number of key

areas simultaneously: to continue to keep investment momentum in a

difficult time for public market infrastructure funds and

judiciously diversify the portfolios revenues; to provide an

additional external validation of asset values; to create

additional liquidity and lower the Company's overall debt burden;

and to partner with a like-minded investment group. As a long-term

investor into solar assets, GLIL is the ideal partner for a company

like Bluefield Solar, sharing our multi-decade view of asset

management. We have always focused on the long-term interests of

the shareholders, and we believe this strategic partnership can

deliver short-term solutions and long-term benefits to Bluefield

Solar investors."

Chris Rule, Member of the GLIL Infrastructure Executive

Committee , said: "Entering into a long-term strategic partnership

with one of the most respected and leading asset owners in this

sector is very exciting for GLIL. Being able to acquire and develop

further renewable energy assets is very important for our Members,

all of whom are deeply committed to investing in the energy

transition and working towards a sustainable net zero economy."

- Ends -

For further information:

Tel: +44 (0) 20 7078 0020

Bluefield Partners LLP (Company Investment Adviser) www.bluefieldllp.com

James Armstrong / Neil Wood / Giovanni Terranova

Deutsche Numis (Company Broker) Tel: +44 (0) 20 7260 1000

Tod Davis / David Benda / Matt Goss www.dbnumis.com

Ocorian Tel: +44 (0) 1481 742 742

(Company Secretary & Administrator) www.ocorian.com

Chezi Hanford

Media enquiries:

Buchanan (PR Adviser) Tel: +44 (0) 20 7466 5000

Henry Harrison-Topham / Henry Wilson www.buchanan.uk.com

BSIF@buchanan.uk.com

GLIL Infrastructure

Citypress www.citypress.co.uk

Justin Moll glil@citypress.co.uk

About Bluefield Solar

Bluefield Solar is a London listed income fund focused primarily

on acquiring and managing solar energy assets. Not less than 75% of

the Company's gross assets will be invested into UK solar assets.

The Company can also invest up to 25% of its gross assets into

other technologies, such as wind and storage. Bluefield Solar owns

and operates a UK portfolio of 812MW, comprising 754MW of solar and

58MW of onshore wind.

Further information can be viewed at www.bluefieldsif.com

About Bluefield Partners

Bluefield Partners LLP was established in 2009 and is an

investment adviser to companies and funds investing in renewable

energy infrastructure. It has a proven record in the selection,

acquisition and supervision of large-scale energy assets in the UK

and Europe. The team has been involved in over GBP6.5 billion

renewable funds and/or transactions in both the UK and Europe,

including over GBP1 billion in the UK since December 2011.

About GLIL Infrastructure

GLIL is a partnership of UK pension funds which invests in

Britain's future - creating jobs, supporting communities and

helping to power the economy. It is a proven investor, with a fund

specially designed to help pension fund members tap into the

stable, inflation-linked returns that infrastructure investment

offers. GLIL manages GBP3.6 billion of committed capital, with more

than GBP3.0 billion deployed into a growing portfolio of

infrastructure assets spanning renewable energy, energy storage,

utilities ports, trains, hospitals and schools. It invests on

behalf of Local Government Pension Scheme DB funds and pools

including Local Pensions Partnership Investments, Greater

Manchester Pension Fund, Merseyside Pension Fund, West Yorkshire

Pension Fund, as well as Nest, the government-established Defined

Contribution workplace pension provider. For more information on

GLIL, including its history, executive committee and investment

portfolio, please visit www.glil.co.uk .

About Lightsource bp

Lightsource bp is a global leader in the development and

management of solar energy projects. Most recently, bp has

announced the intention to fully acquire Lightsource bp. It is

currently operated as a 50:50 joint venture with bp. Our purpose is

to deliver affordable and sustainable solar power for businesses

and communities around the world. For more information on

Lightsource bp, please visit www.lightsourcebp.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDGZMZZLMFGFZM

(END) Dow Jones Newswires

December 22, 2023 02:00 ET (07:00 GMT)

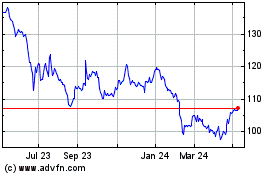

Bluefield Solar Income (LSE:BSIF)

Historical Stock Chart

From Mar 2024 to Apr 2024

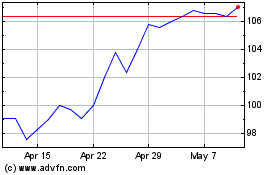

Bluefield Solar Income (LSE:BSIF)

Historical Stock Chart

From Apr 2023 to Apr 2024