TIDMBSV

RNS Number : 5277U

British Smaller Companies VCT PLC

24 November 2023

British Smaller Companies VCT plc

Unaudited Interim Results and Interim Management Report

for the six months ended 30 September 2023

British Smaller Companies VCT plc (the "Company") today

announces its unaudited interim results for the six months ended 30

September 2023.

HIGHLIGHTS

-- Total Return increase of 0.7p to 259.3p per share

-- Net Asset Value at 30 September 2023 of 82.4p per share (31

March 2023: 83.7p) following payment of 2.0p dividend in the

period

-- The Board has declared a second interim dividend of 2.0p per

share in respect of the year ending 31 March 2024, which will bring

total dividends paid in the current financial year to 4.0p per

share, which equates to 4.8 per cent of the opening net asset value

per share.

-- Two new investments and two follow-on investments totalling

GBP6.0 million were completed during the period. Subsequent to the

period end, a further follow-on investment totalling GBP0.8 million

has been completed.

-- GBP44.3 million raised in fully subscribed November 2022

offer, with shares allotted at the beginning of the year. Combined

applications exceeding GBP45 million received to date in relation

to September 2023 offer. Shares relating to approximately GBP30

million of combined applications to be allotted between 29 and 31

January 2024 with second and final allotment in early April

2024.

Chairman's Statement

I am pleased to present the interim results of British Smaller

Companies VCT plc (the "Company") for the six months to 30

September 2023.

The performance in the period reflects the Company's positive

progress despite ongoing macroeconomic challenges and geopolitical

uncertainty, achieving a Total Return of 0.7 pence, an increase of

0.8 per cent over the opening NAV. In contrast the FTSE Small Cap

fell by 0.4 per cent over the same period.

Underlying portfolio companies remain resilient, showing

adaptability to market conditions and focusing on efficient use of

capital. Revenues continue to grow, contributing to positive

revaluations even with valuation multiples remaining subdued.

Over the past six months, the Company has completed two new

investments to the portfolio, Workbuzz and GEEIQ totalling GBP4.9

million, and made two follow-on investments, totalling GBP1.1

million. Following the period end, a further GBP0.8 million has

also been invested, taking the total invested so far this year to

GBP6.8 million, following the GBP28.4 million invested in the full

year to 31 March 2023.

Realisations in the Period

Realisations of investments generated total proceeds of GBP1.8

million in the period.

The Company realised its investment in Ncam in April, generating

initial proceeds of GBP1.4 million. There is the potential for

additional receipts of up to GBP1.2 million depending on the

achievement of certain milestones over the coming years, which

would see the Company fully recover its investment; GBP0.3 million

of deferred proceeds have been recognised at the period end.

Post-period end, in November 2023, the Company exited its

investments in E2E, a consultancy in the satellite industry, for

GBP2.0 million, representing a 2.5x return on the Company's cost;

and MacroArt, a large scale branding and signage specialist, for

GBP1.5 million, representing a 2.0x return on the Company's cost.

This was a pleasing outcome for the Company following a challenging

hold period and reflects the Company's ethos of working hard to

generate positive returns from all of its investments.

Financial Results

The investment portfolio generated a return of GBP2.4 million in

the period, driven by positive revaluations from a number of

companies.

Given the current interest rate environment, the Company is

managing its treasury position to generate a positive return for

shareholders, balanced against the primary objective of capital

preservation. The Company's treasury operations generated GBP1.3

million of income in the period.

The movement in net asset value ("NAV") per ordinary share and

the dividends paid are set out in the table below.

Pence per GBP000

ordinary share

NAV at 31 March 2023 83.7p 157,032

Net gain arising from investment portfolio 1.0p 2,376

Net operating costs (0.1p) (197)

-------- -------- ------- --------

Comprehensive income in the period 0.9p 2,179

Issue/buy-back of new shares* (0.2p) 44,169

-------- -------- ------- --------

Total Return in the period 0.7p 46,348

-------- -------- ------- --------

NAV before the payment of dividends 84.4p 203,380

Dividends paid (2.0p) (4,816)

-------- -------- ------- --------

NAV at 30 September 2023 82.4p 198,564

Cumulative dividends paid 176.9p

-------- -------- ------- --------

Total Return: At 30 September 2023 259.3p

-------- -------- ------- --------

At 31 March 2023 258.6p

-------- -------- ------- --------

* The allotment of shares from the 2022/23 fundraising reduces

total return per ordinary share as the fundraising was priced at

the 31 December 2022 NAV, being the latest published NAV at the

allotment date shortly after 31 March 2023.

Dividends

An interim dividend of 2.0 pence per ordinary share in respect

of the year ending 31 March 2024 was paid on 28 July 2023, bringing

the cumulative dividends paid to date to 176.9 pence per ordinary

share.

The Board has announced a second interim dividend of 2.0 pence

per ordinary share for the year ending 31 March 2024 which, when

combined with the above dividend, will bring total dividends paid

in the current financial year to 4.0 pence per ordinary share

(2023: 8.5 pence per ordinary share). The dividend will be paid on

8 December 2023 to shareholders on the shareholder register on 10

November 2023.

Shareholder Relations

The shareholder workshop held on 20 June 2023 was well attended.

Attendees heard from Tom Dunlop, CEO of Summize, and Philip Hunt,

Chair of Vuealta.

The Company will be hosting an online webinar on 27 November

2023 to provide an update to shareholders; for further details

please contact Tracey Nice at tracey.nice@yfmep.com.

Documents such as the annual report are now received

electronically by 81 per cent of shareholders, rather than by post,

which helps to meet the Board's impact objectives and reduces

printing costs. The Board continues to encourage all shareholders

to take up this option.

The Company's website is refreshed on a regular basis and

provides a comprehensive level of information in what I hope is a

user-friendly format.

Regulatory Developments

In the Autumn Statement on 22 November 2023, the Government

announced it would extend the sunset clause currently in place for

Venture Capital Trusts until April 2035, and that it would include

legislation to achieve this in the next Finance Bill.

In the period there have been no regulatory changes that impact

the Company; the Manager continues to monitor for any

amendments.

Most new portfolio investments are now self-assured as VCT

qualifying on a case-by-case basis and always with confirmation

from professional advisers that they are Qualifying Investments.

Advance assurance is sought where there is an element of

uncertainty over the application of the rules.

Fundraising

On 4 April 2023 the Company allotted shares from its fully

subscribed 2022/23 share offer. GBP44.3 million was raised by the

Company, resulting in the allotment of 53,559,905 ordinary

shares.

Having assessed its expected cash requirements, the Company

announced a new share offer on 20 September 2023, alongside British

Smaller Companies VCT2 plc, with the intention of raising up to

GBP90 million (in aggregate), which includes an over-allotment

facility of GBP25 million. Applications exceeding GBP45 million

have been received as of the date of this report, of which GBP27

million relate to the Company. The first allotment of GBP30 million

of gross proceeds will take place between 29 and 31 January 2024.

The second and final allotment will take place in early April

2024.

Outlook

Over the past six months it has been pleasing to see portfolio

companies continue to grow revenues, and to see positive exit

outcomes despite challenging conditions. The Company has a

promising pipeline of both new investment and exit opportunities,

and will continue to look for opportunities to deploy capital into

the existing portfolio to support continued growth.

I thank shareholders for their continued support.

Rupert Cook

Chairman

Objectives and Strategy

The Company's objective is to maximise Total Return and provide

investors with a long-term tax free dividend yield whilst

maintaining the Company's status as a venture capital trust.

Investment Strategy

The Company seeks to build a broad portfolio of investments in

early-stage companies focused on growth, with the aim of spreading

the maturity profiles and maximising return, as well as ensuring

compliance with the VCT Regulations.

The Company predominantly invests in unquoted smaller companies

and expects that this will continue to make up the significant

majority of the portfolio. It will also retain holdings in cash or

near-cash investments to provide a reserve of liquidity which will

maximise the Company's flexibility as to the timing of investment

acquisitions and disposals, dividend payments and share

buy-backs.

Unquoted investments are structured using various investment

instruments, including ordinary shares, preference shares,

convertible securities and very occasionally loan stock, to achieve

an appropriate balance of income and capital growth, having regard

to the VCT Regulations. The portfolio is diversified by investing

in a broad range of industry sectors. The normal investment period

into the portfolio companies is expected to be typically between

the range of five to seven years.

Investment Policy

The investment policy of the Company is to invest in UK

businesses across a broad range of sectors that blends a mix of

businesses operating in established and emerging industries that

offer opportunities in the application and development of

innovation in their products and services.

These investments will all meet the definition of a Qualifying

Investment and be primarily in unquoted UK companies. It is

anticipated that the majority of these will be re-investing their

profits for growth and the investments will comprise mainly equity

instruments.

The Company seeks to build a broad portfolio of investments in

early-stage companies focused on growth with the aim of spreading

the maturity profiles and maximising return as well as ensuring

compliance with the VCT guidelines.

Investment Review

The Company's portfolio at 30 September 2023 has a value of

GBP130.3 million. The top ten investments represent 42.4 per cent

of the net asset value with the largest representing 12.7 per cent

of the net asset value.

The movements in the investment portfolio are set out below:

Portfolio Listed investment funds Investment portfolio

GBPmillion GBPmillion GBPmillion

--------------------------------------------------- ----------- ------------------------ ---------------------

Opening fair value at 1 April 2023 123.4 4.0 127.4

Additions 6.0 - 6.0

Disposal proceeds (1.7) (0.1) (1.8)

Gain (loss) arising from the investment portfolio 2.6 (0.3) 2.3

--------------------------------------------------- ----------- ------------------------ ---------------------

Closing fair value at 30 September 2023 130.3 3.6 133.9

--------------------------------------------------- ----------- ------------------------ ---------------------

The Company's portfolio delivered a positive performance over

the period, generating a return of GBP2.6 million.

There were upward revaluations from several portfolio companies

including Unbiased, Traveltek, E2E, Displayplan and MacroArt,

offset by decreases from Relative Insight, Wooshii and ACC.

Realisation of Investments

During the six months to 30 September 2023 the Company generated

GBP1.8 million from disposals, in line with the opening carrying

value and a loss of GBP0.9 million on cost. Further details are

given in note 6.

Investments

During the six months ended 30 September 2023, the Company

completed four investments, totalling GBP6.0 million. This

comprised two new investments of GBP4.9 million and two follow-on

investments totalling GBP1.1 million. The breakdown of these

investments is shown below:

New Follow-on Total

Company Description GBPmillion GBPmillion GBPmillion

----------------------------------------------------- ----------- ----------- -----------

SaaS-based employee engagement survey and insights

Workbuzz platform 2.6 - 2.6

Data and market intelligence platform in the gaming

GEEIQ space 2.3 - 2.3

Relative Insight AI-based text data analytics platform - 0.8 0.8

Elucidat An e-learning software authoring platform - 0.3 0.3

----------------------------------------------------- ----------- ----------- -----------

Invested in the period 4.9 1.1 6.0

------------------------------------------------------------------------------- ----------- ----------- -----------

Subsequent to the period end, the Company has invested GBP0.8

million into portfolio company Force24.

Cash Deposits and other Liquid Funds

Given the current environment of rising interest rates the

Company is taking an active approach to cash management, whilst

pursuing its primary aim of capital preservation. This is effected

through the use of a pool of money market funds (which can be

converted back to cash with immediate notice), cash deposits with

tier one banking institutions, and a small, diversified portfolio

of listed investment funds. At 30 September 2023 this listed

portfolio was valued at GBP3.6 million, or 1.8 per cent of net

assets; this reduced in value by GBP0.3 million in the period,

predominantly driven by a reduction in the valuation of its bond

investments.

Portfolio

The top 10 investments had a combined value of GBP84.1 million,

64.5 per cent of the total portfolio.

Name of company Sector First Amount Value at 30 Recognised Return to

investment invested Sept 2023 income/proceeds date

to date

GBP000 GBP000 GBP000 GBP000

-------------- -------------- ------------- ------------- ---------------- --------------

Matillion Limited Data Nov 16 2,666 25,233 7,071 32,304

-------------- -------------- ------------- ------------- ---------------- --------------

Tech-enabled

Unbiased EC1 Limited Services Dec 19 5,596 11,559 - 11,559

-------------- -------------- ------------- ------------- ---------------- --------------

Outpost VFX Limited New Media Feb 21 4,500 8,936 38 8,974

-------------- -------------- ------------- ------------- ---------------- --------------

Displayplan Holdings Business

Limited Services Jan 12 1,300 8,611 3,168 11,779

-------------- -------------- ------------- ------------- ---------------- --------------

Application

Elucidat Ltd Software May 19 4,260 6,494 197 6,691

-------------- -------------- ------------- ------------- ---------------- --------------

Wooshii Limited New Media May 19 4,644 6,006 581 6,587

-------------- -------------- ------------- ------------- ---------------- --------------

Application

Force24 Ltd Software Nov 20 3,150 4,792 - 4,792

-------------- -------------- ------------- ------------- ---------------- --------------

ACC Aviation Group Business

Limited Services Nov 14 2,068 4,405 5,280 9,685

-------------- -------------- ------------- ------------- ---------------- --------------

Vypr Validation Tech-enabled

Technologies Limited Services Jan 21 3,300 4,119 - 4,119

-------------- -------------- ------------- ------------- ---------------- --------------

Quality Clouds Cloud &

Limited DevOps May 22 3,916 3,942 - 3,942

-------------- -------------- ------------- ------------- ---------------- --------------

SharpCloud Limited Data Oct 19 3,407 3,859 - 3,859

-------------- -------------- ------------- ------------- ---------------- --------------

DrDoctor (via ICNH Application

Ltd) Software Feb 23 3,565 3,565 - 3,565

-------------- -------------- ------------- ------------- ---------------- --------------

Retail &

Tonkotsu Limited Brands Jun 19 2,388 2,961 - 2,961

-------------- -------------- ------------- ------------- ---------------- --------------

Workbuzz Analytics Application

Limited Software Jun 23 2,577 2,945 - 2,945

-------------- -------------- ------------- ------------- ---------------- --------------

Cloud &

AutomatePro Limited DevOps Dec 22 2,225 2,875 - 2,875

-------------- -------------- ------------- ------------- ---------------- --------------

Traveltek Group Application

Holdings Limited Software Oct 16 1,716 2,797 901 3,698

-------------- -------------- ------------- ------------- ---------------- --------------

GEEIQ (via Checkpoint

GG Limited) Data Sep 23 2,358 2,358 - 2,358

-------------- -------------- ------------- ------------- ---------------- --------------

Retail &

Frescobol Carioca Ltd Brands Mar 19 1,800 2,143 - 2,143

-------------- -------------- ------------- ------------- ---------------- --------------

Relative Insight Tech-enabled

Limited Services Mar 22 3,804 2,092 - 2,092

-------------- -------------- ------------- ------------- ---------------- --------------

Application

Summize Limited Software Oct 22 1,800 2,070 - 2,070

-------------- -------------- ------------- ------------- ---------------- --------------

Cloud &

Plandek Limited DevOps Oct 22 2,070 2,070 - 2,070

-------------- -------------- ------------- ------------- ---------------- --------------

KeTech Enterprises Tech-enabled

Limited Services Nov 15 2,000 2,059 2,599 4,658

-------------- -------------- ------------- ------------- ---------------- --------------

Vuealta Holdings Tech-enabled

Limited Services Sep 21 3,045 2,013 4,601 6,614

-------------- -------------- ------------- ------------- ---------------- --------------

E2E Engineering Business

Limited Services Sep 17 900 1,942 243 2,185

-------------- -------------- ------------- ------------- ---------------- --------------

Xapien (via Digital

Insight Technologies Application

Limited) Software Mar 23 1,740 1,846 - 1,846

-------------- -------------- ------------- ------------- ---------------- --------------

Application

Biorelate Limited Software Nov 22 1,560 1,562 - 1,562

-------------- -------------- ------------- ------------- ---------------- --------------

Panintelligence (via

Paninsight Limited) Data Nov 19 1,500 1,500 - 1,500

-------------- -------------- ------------- ------------- ---------------- --------------

Sipsynergy (via

Hosted Network Cloud &

Services Limited) DevOps Jun 16 2,654 1,346 1 1,347

-------------- -------------- ------------- ------------- ---------------- --------------

Macro Art Holdings Business

Limited Services Jun 14 1,260 1,210 1,002 2,212

-------------- -------------- ------------- ------------- ---------------- --------------

GBP1 million and below 11,153 2,983 6,819 9,802

------------- ------------- ---------------- --------------

Total portfolio 88,922 130,293 32,501 162,794

------------- ------------- ---------------- --------------

Full disposals to date 76,675 - 149,724 149,724

------------- ------------- ---------------- --------------

Total portfolio 165,597 130,293 182,225 312,518

------------- ------------- ---------------- --------------

Our Portfolio at a Glance

The charts on page 13 of the interim report illustrate the broad

range of the investment portfolio.

Principal Risks and Uncertainties

In accordance with DTR 4.2.7, the Board confirms that the

principal risks and uncertainties facing the Company have not

materially changed from those identified in the Annual Report and

Accounts for the year ended 31 March 2023. The Board acknowledges

that there is regulatory risk and continues to manage the Company's

affairs in such a manner as to comply with section 274 of the

Income Tax Act 2007.

In summary, the principal risks are:

> VCT Qualifying Status;

> Economic;

> Investment and Strategic;

> Regulatory;

> Legislative;

> Reputational;

> Operational;

> Cyber Security and Information Technology;

> ESG; and

> Liquidity.

Full details of the principal risks can be found in the

financial statements for the year ended 31 March 2023 on pages 31

to 33, a copy of which is available at www.bscfunds.com .

Directors' Responsibilities Statement

The directors of British Smaller Companies VCT plc confirm that,

to the best of their knowledge, the condensed set of financial

statements in this interim report have been prepared in accordance

with International Accounting Standard 34 "Interim Financial

Reporting" as adopted by the UK, and give a true and fair view of

the assets, liabilities, financial position and profit and loss of

British Smaller Companies VCT plc, and that the interim management

report includes a true and fair review of the information required

by DTR 4.2.7R and DTR 4.2.8R.

The directors of British Smaller Companies VCT plc are listed in

note 10 of these interim financial statements.

By order of the Board

Rupert Cook

Chairman

Unaudited Statement of Comprehensive Income

for the six months ended 30 September 2023

Notes Unaudited 6 months ended Unaudited 6 months ended

30 September 2023 30 September 2022

Revenue Capital Total Revenue Capital Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Gains on investments held at fair value 6 - 2,280 2,280 - 650 650

Profit on disposal of investments 6 - 96 96 - 2,849 2,849

---------------------------------------------- ------ --------- -------- -------- --------- -------- --------

- 2,376 2,376 - 3,499 3,499

Income 2 1,629 - 1,629 658 - 658

---------------------------------------------- ------ --------- -------- -------- --------- -------- --------

Total income 1,629 2,376 4,005 658 3,499 4,157

Administrative expenses:

Manager's fee (367) (1,100) (1,467) (351) (1,052) (1,403)

Other expenses (359) - (359) (329) - (329)

---------------------------------------------- ------ --------- -------- -------- --------- -------- --------

(726) (1,100) (1,826) (680) (1,052) (1,732)

---------------------------------------------- ------ --------- -------- -------- --------- -------- --------

Profit (loss) before taxation 903 1,276 2,179 (22) 2,447 2,425

Taxation 3 - - - - - -

---------------------------------------------- ------ --------- -------- -------- --------- -------- --------

Profit (loss) for the period 903 1,276 2,179 (22) 2,447 2,425

---------------------------------------------- ------ --------- -------- -------- --------- -------- --------

Total comprehensive income (expense) for the

period 903 1,276 2,179 (22) 2,447 2,425

---------------------------------------------- ------ --------- -------- -------- --------- -------- --------

Basic and diluted earnings (loss) per

ordinary share 5 0.38p 0.53p 0.91p (0.01p) 1.31p 1.30p

---------------------------------------------- ------ --------- -------- -------- --------- -------- --------

The Total column of this statement represents the Company's

Unaudited Statement of Comprehensive Income, prepared in accordance

with UK adopted international accounting standards. The

supplementary Revenue and Capital columns are prepared under the

Statement of Recommended Practice 'Financial Statements of

Investment Trust Companies and Venture Capital Trusts' (issued in

July 2022 - "SORP") published by the Association of Investment

Companies.

Unaudited Balance Sheet

as at 30 September 2023

Notes Unaudited Unaudited Audited

30 September 30 September 31 March

2023 2022 2023

GBP000 GBP000 GBP000

ASSETS

Non-current assets at fair value through profit or loss

Investments 6 130,293 99,010 123,361

Listed investment funds 6 3,620 4,181 4,045

--------------------------------------------------------- ------ -------------- -------------- ----------

Financial assets at fair value through profit or loss 6 133,913 103,191 127,406

Accrued income and other assets 1,891 1,014 1,556

--------------------------------------------------------- ------ -------------- -------------- ----------

135,804 104,205 128,962

Current assets

Accrued income and other assets 825 6,386 161

Current asset investments 32,500 14,471 7,501

Cash and cash equivalents 29,635 33,217 20,766

--------------------------------------------------------- ------ -------------- -------------- ----------

62,960 54,074 28,428

LIABILITIES

Current liabilities

Trade and other payables (200) (146) (358)

--------------------------------------------------------- ------ -------------- -------------- ----------

Net current assets 62,760 53,928 28,070

--------------------------------------------------------- ------ -------------- -------------- ----------

Net assets 198,564 158,133 157,032

--------------------------------------------------------- ------ -------------- -------------- ----------

Shareholders' equity

Share capital 26,452 20,612 20,969

Share premium account 41,586 62,861 1,700

Capital reserve 75,609 34,245 82,893

Investment holding gains and losses reserve 52,397 39,138 49,215

Revenue reserve 2,520 1,277 2,255

--------------------------------------------------------- ------ -------------- -------------- ----------

Total shareholders' equity 198,564 158,133 157,032

--------------------------------------------------------- ------ -------------- -------------- ----------

Net asset value per ordinary share 7 82.4p 85.0p 83.7p

--------------------------------------------------------- ------ -------------- -------------- ----------

Signed on behalf of the Board

Rupert Cook

Chairman

Unaudited Statement of Changes in Equity

for the six months ended 30 September 2023

Share capital Share premium Capital Investment Revenue reserve Total equity

account reserve holding gains

and losses

reserve

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------- -------------- --------------- --------------- --------------- ---------------- -------------

At 31 March

2022 20,510 62,123 33,620 41,982 1,299 159,534

---------------- -------------- --------------- --------------- --------------- ---------------- -------------

Revenue loss

for the period - - - - (22) (22)

Expenses

charged to

capital - - (1,052) - - (1,052)

Investment

holding gain

on investments

held at fair

value - - - 650 - 650

Realisation of

investments in

the period - - 2,849 - - 2,849

---------------- -------------- --------------- --------------- --------------- ---------------- -------------

Total

comprehensive

income

(expense) for

the period - - 1,797 650 (22) 2,425

---------------- -------------- --------------- --------------- --------------- ---------------- -------------

Issue of shares

- DRIS 102 760 - - - 862

Issue costs - (22) - - - (22)

Purchase of own

shares - - (941) - - (941)

Dividends - - (3,725) - - (3,725)

---------------- -------------- --------------- --------------- --------------- ---------------- -------------

Total

transactions

with owners 102 738 (4,666) - - (3,826)

Realisation of

prior year

investment

holding gains - - 3,494 (3,494) - -

---------------- -------------- --------------- --------------- --------------- ---------------- -------------

At 30 September

2022 20,612 62,861 34,245 39,138 1,277 158,133

---------------- -------------- --------------- --------------- --------------- ---------------- -------------

Revenue return

for the period - - - - 1,105 1,105

Expenses

charged to

capital - - (1,159) - - (1,159)

Investment

holding gain

on investments

held at fair

value - - - 7,502 - 7,502

Realisation of

investments in

the period - - 2,364 - - 2,364

---------------- -------------- --------------- --------------- --------------- ---------------- -------------

Total

comprehensive

income for the

period - - 1,205 7,502 1,105 9,812

---------------- -------------- --------------- --------------- --------------- ---------------- -------------

Issue of shares

- DRIS 357 2,485 - - - 2,842

Issue costs - (40) - - - (40)

Share premium

cancellation - (63,606) 63,606 - - -

Purchase of own

shares - - (1,556) - - (1,556)

Dividends - - (12,032) - (127) (12,159)

---------------- -------------- --------------- --------------- --------------- ---------------- -------------

Total

transactions

with owners 357 (61,161) 50,018 - (127) (10,913)

Realisation of

prior year

investment

holding losses - - (2,575) 2,575 - -

At 31 March

2023 20,969 1,700 82,893 49,215 2,255 157,032

---------------- -------------- --------------- --------------- --------------- ---------------- -------------

Revenue return

for the period - - - - 903 903

Expenses

charged to

capital - - (1,100) - - (1,100)

Investment

holding gain

on investments

held at fair

value - - - 2,280 - 2,280

Realisation of

investments in

the period - - 96 - - 96

---------------- -------------- --------------- --------------- --------------- ---------------- -------------

Total

comprehensive

(expense)

income for the

period - - (1,004) 2,280 903 2,179

---------------- -------------- --------------- --------------- --------------- ---------------- -------------

Issue of share

capital 5,356 40,893 - - - 46,249

Issue of shares

- DRIS 127 911 - - - 1,038

Issue costs - (1,918) - - - (1,918)

Purchase of own

shares - - (1,200) - - (1,200)

Dividends - - (4,178) - (638) (4,816)

---------------- -------------- --------------- --------------- --------------- ---------------- -------------

Total

transactions

with owners 5,483 39,886 (5,378) - (638) 39,353

Realisation of

prior year

investment

holding losses - - (902) 902 - -

---------------- -------------- --------------- --------------- --------------- ---------------- -------------

At 30 September

2023 26,452 41,586 75,609 52,397 2,520 198,564

---------------- -------------- --------------- --------------- --------------- ---------------- -------------

Reserves available for distribution

Under the Companies Act 2006, the capital reserve and the

revenue reserve are distributable reserves. The table below shows

amounts that are available for distribution.

Capital reserve Revenue reserve Total

GBP000 GBP000 GBP000

Distributable reserves as above 75,609 2,520 78,129

Less: Income/proceeds not yet distributable (399) (1,952) (2,351)

Less: Cancelled share premium not yet distributable (40,769) - (40,769)

----------------------------------------------------- ---------------- ---------------- ---------

Reserves available for distribution* 34,441 568 35,009

----------------------------------------------------- ---------------- ---------------- ---------

*subject to filing these interim financial statements at

Companies House.

The capital reserve and the revenue reserve are both

distributable reserves. These reserves total GBP78,129,000,

representing a decrease of GBP7,019,000 in the period since 31

March 2023. The directors also consider the level of the investment

holding gains and losses reserve and the future requirements of the

Company when determining the level of dividend payments.

Of the potentially distributable reserves of GBP78,129,000 shown

above, GBP2,351,000 relates to income and proceeds not yet

distributable and GBP40,769,000 relates to cancelled share premium

which becomes distributable from the dates shown below.

Total share premium cancelled is available for distribution from

the following dates:

GBP000

1 April 2024 7,157

1 April 2025 32,128

1 April 2026 1,484

------------------------------------------------------- -------

Cancelled share premium account not yet distributable 40,769

------------------------------------------------------- -------

Unaudited Statement of Cash Flows

for the six months ended 30 September 2023

Notes Unaudited Unaudited Audited

6 months 6 months year

ended ended ended

30 September 30 September 31 March

2023 2022 2023

GBP000 GBP000 GBP000

Profit before taxation 2,179 2,425 12,237

Decrease in trade and other payables (158) (641) (429)

Increase in accrued income and other assets (599) (224) (660)

Profit on disposal of investments (96) (2,849) (5,213)

Gains on investments held at fair value (2,280) (650) (8,152)

Capitalised income - - (60)

------------------------------------------------------------------ ------ -------------- -------------- ----------

Net cash outflow from operating activities (954) (1,939) (2,277)

------------------------------------------------------------------ ------ -------------- -------------- ----------

Cash flows from (used in) investing activities

Cash maturing from fixed term deposits - - 6,970

Purchase of financial assets at fair value through profit or loss 6 (6,039) (8,778) (28,832)

Proceeds from sale of financial assets at fair value through

profit or loss 6 1,508 8,832 20,716

------------------------------------------------------------------ ------ -------------- -------------- ----------

Net cash (outflow) inflow from investing activities (4,531) 54 (1,146)

------------------------------------------------------------------ ------ -------------- -------------- ----------

Cash flows from (used in) financing activities

Issue of ordinary shares 46,249 - -

Costs of ordinary share issues* (1,918) (22) (62)

Purchase of own shares (1,200) (941) (2,497)

Dividends paid 4 (3,778) (2,863) (12,180)

------------------------------------------------------------------ ------ -------------- -------------- ----------

Net cash inflow (outflow) from financing activities 39,353 (3,826) (14,739)

------------------------------------------------------------------ ------ -------------- -------------- ----------

Net increase (decrease) in cash and cash equivalents 33,868 (5,711) (18,162)

Cash and cash equivalents at the beginning of the period 28,267 46,429 46,429

------------------------------------------------------------------ ------ -------------- -------------- ----------

Cash and cash equivalents at the end of the period 62,135 40,718 28,267

------------------------------------------------------------------ ------ -------------- -------------- ----------

Cash and cash equivalents comprise

Money market funds 32,500 7,501 7,501

Cash at bank 29,635 33,217 20,766

------------------------------------------------------------------ ------ -------------- -------------- ----------

Cash and cash equivalents at the end of the period 62,135 40,718 28,267

------------------------------------------------------------------ ------ -------------- -------------- ----------

*Issue costs include both fundraising costs and expenses

incurred from the Company's DRIS.

Explanatory Notes to the Unaudited Condensed Financial

Statements

1 General Information, Basis of Preparation and Principal Accounting Policies

These half year statements have been approved by the directors

whose names appear at note 10, each of whom has confirmed that to

the best of their knowledge:

> the interim management report includes a fair review of the

information required by rules 4.2.7 and 4.2.8 of the Disclosure

Rules and the Transparency Rules; and

> the half year statements have been prepared in accordance

with IAS 34 'Interim financial reporting' and the Disclosure and

Transparency Rules of the Financial Conduct Authority.

The half year statements are unaudited and have not been

reviewed by the auditors pursuant to the International Standard on

Review Engagements (UK) 2410 guidance on Review of Interim

Financial Information performed by the independent Auditor of the

entity. They do not constitute full financial statements as defined

in section 435 of the Companies Act 2006. The comparative figures

for the year ended 31 March 2023 do not constitute full financial

statements and have been extracted from the Company's financial

statements for the year ended 31 March 2023. Those accounts were

reported upon without qualification by the auditors and have been

delivered to the Registrar of Companies.

The accounting policies and methods of computation followed in

the half year statements are the same as those adopted in the

preparation of the audited financial statements for the year ended

31 March 2023. They do not include all disclosures that would

otherwise be required in a complete set of financial statements and

should be read in conjunction with the 2023 annual report.

The accounts have been prepared on a going concern basis as set

out below and in accordance with UK adopted international

accounting standards.

The accounts have been prepared under the historical cost basis

as modified by the measurement of investments at fair value through

profit or loss.

The accounts have been prepared in compliance with the

recommendations set out in the Statement of Recommended Practice

'Financial Statements of Investment Trust Companies and Venture

Capital Trusts' issued by the Association of Investment Companies

(issued in July 2022 - "SORP") to the extent that they do not

conflict with UK adopted international accounting standards.

The financial statements are prepared in accordance with UK

adopted international accounting standards (IFRSs) and

interpretations in force at the reporting date. New standards

coming into force during the period and future standards that come

into effect after the period-end have not had a material impact on

these financial statements.

The Company has carried out an assessment of accounting

standards, amendments and interpretations that have been issued by

the IASB and that are effective for the current reporting period.

The Company has determined that the transitional effects of the

standards do not have a material impact.

The financial statements are presented in sterling and all

values are rounded to the nearest thousand (GBP000), except where

stated.

Going Concern : The directors have carefully considered the

issue of going concern and are satisfied that the Company has

sufficient resources to meet its obligations as they fall due for a

period of at least 12 months from the date these half year

statements were approved. As at 30 September 2023 the Company held

cash balances, fixed term deposits and other liquid resources with

a combined value of GBP65,755,000. Cash flow projections show the

Company has sufficient funds to meet both its contracted

expenditure and its discretionary cash outflows in the form of

share buy-backs and the dividend policy for at least 12 months from

the date of publication of this report.

In the year ended 31 March 2023 the Company's costs and

discretionary expenditures were:

GBP000

Administrative expenses (before fair value movements related to credit risk and incentive

fee) 3,480

Share buy-backs 2,497

Dividends (before DRIS) 15,884

------------------------------------------------------------------------------------------- -------

Total 21,861

------------------------------------------------------------------------------------------- -------

The directors therefore believe that it is appropriate to

continue to apply the going concern basis of accounting in

preparing these half year statements.

2 Income

Unaudited Unaudited

6 months 6 months

ended 30 ended 30

September September

2023 2022

GBP000 GBP000

Income from investments

- Interest on loans to unquoted companies 103 297

- Dividends from unquoted companies 243 172

------------------------------------------------------------------- ----------- -----------

Income from unquoted portfolio 346 469

Income from listed investment funds 62 54

------------------------------------------------------------------- ----------- -----------

Income from investments held at fair value through profit or loss 408 523

Interest on bank deposits/money market funds 1,221 135

------------------------------------------------------------------- ----------- -----------

1,629 658

------------------------------------------------------------------- ----------- -----------

3 Taxation

Unaudited 6 months ended Unaudited 6 months ended

30 September 2023 30 September 2022

Revenue Capital Total Revenue Capital Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Profit (loss) before taxation 903 1,276 2,179 (22) 2,447 2,425

-------------------------------------------------------- --------- --------- ------- --------- --------- -------

Profit (loss) before taxation multiplied by the

standard small company rate of corporation

tax in UK of 19.0% (2022: 19.0%) 172 242 414 (4) 465 461

Effect of:

UK dividends received (47) - (47) (35) - (35)

Non-taxable profits on investments - (451) (451) - (665) (665)

Deferred tax not recognised (125) 209 84 39 200 239

-------------------------------------------------------- --------- --------- ------- --------- --------- -------

Tax charge - - - - - -

-------------------------------------------------------- --------- --------- ------- --------- --------- -------

The Company has no provided, or unprovided, deferred tax

liability in either period.

Deferred tax assets in respect of losses have not been

recognised as the directors do not currently believe that it is

probable that sufficient taxable profits will be available against

which the assets can be recovered.

Due to the Company's status as a venture capital trust, and the

continued intention to meet the conditions required to comply with

Chapter 3 Part 6 of the Income Tax Act 2007, the Company has not

provided deferred tax on any capital gains or losses arising on the

revaluation or realisation of investments.

4 Dividends

Amounts recognised as distributions to equity holders in the

period:

Unaudited 6 months ended Unaudited 6 months ended

30 September 2023 30 September 2022

Revenue Capital Total Revenue Capital Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

First interim dividend for the year ending 31 March

2024 of 2.0p (2023: 2.0p) per ordinary

share 638 4,178 4,816 - 3,725 3,725

Proceeds from shares allotted under DRIS (1,038) (862)

-------------------------------------------------------- --------- -------- -------- --------- --------- -------

Dividends paid in the Statement of Cash Flows 3,778 2,863

-------------------------------------------------------- --------- -------- -------- --------- --------- -------

Audited year ended

31 March 2023

Revenue Capital Total

GBP000 GBP000 GBP000

First interim dividend for the year ending 31 March 2023 of 2.0p per ordinary share - 3,725 3,725

Second interim dividend for the year ended 31 March 2023 of 5.0p per ordinary share - 3,736 3,736

Third interim dividend for the year ended 31 March 2023 of 2.0p per ordinary share 127 8,296 8,423

------------------------------------------------------------------------------------- -------- -------- --------

127 15,757 15,884

Proceeds from shares allotted under DRIS (3,704)

------------------------------------------------------------------------------------- -------- -------- --------

Dividends paid in the Statement of Cash Flows 12,180

------------------------------------------------------------------------------------- -------- -------- --------

The interim dividend of 2.0 pence per ordinary share was paid on

28 July 2023 to shareholders on the register as at 30 June

2023.

A second interim dividend of 2.0p per ordinary share, amounting

to approximately GBP4.8 million, has been announced. This dividend

has not been recognised in these half year financial statements as

the obligation did not exist at the balance sheet date.

5 Basic and Diluted Earnings per Ordinary Share

The basic and diluted earnings per ordinary share is based on

the profit after tax attributable to equity shareholders of

GBP2,179,000 (30 September 2022: GBP2,425,000) and 240,246,488 (30

September 2022: 186,454,862) ordinary shares being the weighted

average number of ordinary shares in issue during the period.

The basic and diluted revenue earnings (loss) per ordinary share

is based on the revenue profit attributable to equity shareholders

of GBP903,000 (30 September 2022: loss of GBP22,000) and

240,246,488 (30 September 2022: 186,454,862) ordinary shares being

the weighted average number of ordinary shares in issue during the

period.

The basic and diluted capital earnings per ordinary share is

based on the capital profit attributable to equity shareholders of

GBP1,276,000 (30 September 2022: GBP2,447,000) and 240,246,488 (30

September 2022: 186,454,862) ordinary shares being the weighted

average number of ordinary shares in issue during the period.

During the period the Company allotted 53,559,905 new ordinary

shares in respect of the 2022/23 fundraising and 1,270,231 new

ordinary shares in respect of its DRIS.

The Company has also repurchased 1,517,931 of its own shares in

the period and these shares are held in the capital reserve. The

total of 23,525,696 treasury shares has been excluded in

calculating the weighted average number of ordinary shares during

the period.

The Company has no dilutive shares and consequently, basic and

diluted earnings per ordinary share are equivalent at 30 September

2023, 31 March 2023 and 30 September 2022.

6 Financial Assets at Fair Value through Profit or Loss

IFRS 13 and IFRS 7, in respect of financial instruments that are

measured in the balance sheet at fair value, require disclosure of

fair value measurements by level within the following fair value

measurement hierarchy:

> Level 1: quoted prices in active markets for identical

assets or liabilities. The fair value of financial instruments

traded in active markets is based on quoted market prices at the

balance sheet date. A market is defined as a market in which

transactions for the asset or liability take place with sufficient

frequency and volume to provide pricing information on an ongoing

basis. The quoted market price used for financial assets held by

the Company is the current bid price. These instruments are

included in Level 1 and comprise listed investment funds classified

as held at fair value through profit or loss.

> Level 2: the fair value of financial instruments that are

not traded in an active market is determined by using valuation

techniques. These valuation techniques maximise the use of

observable market data where it is available and rely as little as

possible on entity specific estimates. If all significant inputs

required to fair value an instrument are observable, the instrument

is included in Level 2. The Company held no such instruments in the

current or prior year.

> Level 3: the fair value of financial instruments that are

not traded in an active market (for example, investments in

unquoted companies) is determined by using valuation techniques

such as earnings or revenue multiples. If one or more of the

significant inputs is not based on observable market data, the

instrument is included in Level 3. The majority of the Company's

investments fall into this category.

Each investment is reviewed at least quarterly to ensure that it

has not ceased to meet the criteria of the level in which it was

included at the beginning of each accounting period. There have

been no transfers between these classifications in the period

(2022: none).

The change in fair value for the current and previous year is

recognised through profit or loss. All items held at fair value

through profit or loss were designated as such upon initial

recognition.

Valuation of Investments

Unquoted investments are valued in accordance with IFRS 13 "Fair

Value Measurement" and using the International Private Equity and

Venture Capital ("IPEVC") Valuation Guidelines ("the Guidelines")

issued in December 2022.

Initial measurement

The best estimate of the initial fair value of an unquoted

investment is the cost of the investment. Unless there are

indications that this is inappropriate, an unquoted investment will

be held at this value within the first three months of

investment.

Subsequent measurement

Based on the Guidelines we have identified six of the most

widely used valuation methodologies for unquoted investments. The

Guidelines advocate that the best valuation methodologies are those

that draw on external, objective market-based data in order to

derive a fair value.

Full details of the methods used by the Company were set out on

pages 66 and 67 of the financial statements for the year ended 31

March 2023, a copy of which can be found at www.bscfunds.com .

The primary methods used for valuing non-quoted investments, and

the key assumptions relating to them are:

Unquoted Investments

> revenue multiple. An appropriate multiple, given the risk

profile and revenue growth prospects of the underlying company, is

applied to the revenue of the company. The multiple is adjusted to

reflect any risk associated with lack of marketability and to take

account of the differences between the investee company and the

benchmark company or companies used to derive the multiple.

> earnings multiple. An appropriate multiple, given the risk

profile and earnings growth prospects of the underlying company, is

applied to the maintainable earnings of the company. The multiple

is adjusted to reflect any risk associated with lack of

marketability and to take account of the differences between the

investee company and the benchmark company or companies used to

derive the multiple.

Movements in investments at fair value through profit or loss

during the six months to 30 September 2023 are summarised as

follows:

IFRS 13 measurement classification Level 3 Level 1 Total

Unquoted investments Listed investment funds investments

GBP000 GBP000 GBP000

Opening cost 73,515 4,676 78,191

Opening valuation gain (loss) 49,846 (631) 49,215

----------------------------------------- --------------------- ------------------------ ------------

Opening fair value at 1 April 2023 123,361 4,045 127,406

Additions at cost 6,039 - 6,039

Disposal proceeds (1,668) (147) (1,815)

Net profit (loss) on disposals* 9 (6) 3

Change in fair value 2,228 (272) 1,956

Foreign exchange gain 324 - 324

----------------------------------------- --------------------- ------------------------ ------------

Closing fair value at 30 September 2023 130,293 3,620 133,913

----------------------------------------- --------------------- ------------------------ ------------

Closing cost 77,041 4,475 81,516

Closing valuation gain (loss) 53,252 (855) 52,397

----------------------------------------- --------------------- ------------------------ ------------

Closing fair value at 30 September 2023 130,293 3,620 133,913

----------------------------------------- --------------------- ------------------------ ------------

* The net profit on disposals in the table above is GBP3,000

whereas that shown in the Statement of Comprehensive Income is

GBP96,000. The difference comprises deferred proceeds in respect of

assets which have been disposed of in prior periods and were not

included in the portfolio at 1 April 2023.

Level 3 valuations include assumptions based on non-observable

data, such as discounts applied either to reflect changes in the

fair value of financial assets held at the price of recent

investment, or to adjust revenue or earnings multiples.

IFRS13 requires disclosure, by class of financial instruments,

if the effect of changing one or more inputs to reasonably possible

alternative assumptions would result in a significant change to

fair value measurement. Each unquoted portfolio company has been

reviewed and both downside and upside alternative assumptions have

been identified and applied to the valuation of each of the

unquoted investments. Applying the downside alternative, the value

of the unquoted investments would be GBP6,220,000 (4.8 per cent)

lower. Using the upside alternative, the value would be increased

by GBP6,157,000 (4.7 per cent).

97 per cent of the Company's investments are in unquoted

companies held at fair value. The valuation methodology for these

investments includes the application of externally produced revenue

and earnings multiples. Therefore, the value of the unquoted

element of the portfolio is also indirectly affected by price

movements on the listed market. Those using revenue and earnings

multiple methodologies include judgements regarding the level of

discount applied to that multiple. The effect of changing the level

of discounts applied to the multiples is considered above.

3 per cent of the Company's investments are investment funds

listed on the main market of the London Stock Exchange (including

FCA authorised and regulated UCITS funds). A 5 per cent increase in

stock prices as at 30 September 2023 would have increased the net

assets attributable to the Company's shareholders and the total

profit by GBP181,000. An equal change in the opposite direction

would have decreased the net assets attributable to the Company's

shareholders and the total profit by an equal amount.

There have been no individual fair value adjustments downwards

during the period that exceeded 5 per cent of the total assets of

the Company (31 March 2023: none).

The following disposals took place during the period.

Net proceeds from sale Cost Opening carrying value as Profit (loss) over opening

at 1 April 2023 carrying value

GBP000 GBP000 GBP000 GBP000

Unquoted investments

Ncam Technologies Limited 1,668 2,512 1,659 9

--------------------------- ----------------------- ------- -------------------------- ---------------------------

Total from portfolio 1,668 2,512 1,659 9

Listed investment funds 147 202 153 (6)

--------------------------- ----------------------- ------- -------------------------- ---------------------------

Total from investment

portfolio 1,815 2,714 1,812 3

Deferred consideration -

Wakefield Acoustics (via

Malvar Engineering

Limited) 93 - - 93

--------------------------- ----------------------- ------- -------------------------- ---------------------------

Total from investment

portfolio 1,908 2,714 1,812 96

--------------------------- ----------------------- ------- -------------------------- ---------------------------

The total from disposals in the table above is GBP1,908,000

whereas that shown in the Statement of Cash Flows is GBP1,508,000.

This is due to the timing differences between the recognition of

the deferred income and its receipt in cash.

7 Basic and Diluted Net Asset Value per Ordinary Share

The basic and diluted net asset value per ordinary share is

calculated on attributable assets of GBP198,564,000 (30 September

2022 and 31 March 2023: GBP158,133,000 and GBP157,032,000

respectively) and 240,991,484 (30 September 2022 and 31 March 2023:

186,112,757 and 187,679,279 respectively) ordinary shares in issue

at 30 September 2023.

The treasury shares have been excluded in calculating the number

of ordinary shares in issue at 30 September 2023.

The Company has no potentially dilutive shares and consequently,

basic and diluted net asset values are equivalent at 30 September

2023, 31 March 2023 and 30 September 2022.

8 Total Return

Total Return per ordinary share is calculated on cumulative

dividends paid of 176.9 pence per ordinary share (30 September

2022: 168.4 pence per ordinary share and 31 March 2023: 174.9 pence

per ordinary share) plus the net asset value as calculated in note

7.

9 Post Balance Sheet Events

Subsequent to the period end the Company has invested GBP0.8

million into portfolio company Force24.

In November 2023, the Company exited its investments in E2E for

GBP2.0 million and MacroArt for GBP1.5 million, in line with the

companies' valuations at 30 September 2023.

10 Directors

The directors of the Company are: Rupert Cook, Adam Bastin,

Jonathan Cartwright and Purvi Sapre.

11 Interim Dividend for the year ending 31 March 2024

The directors have previously announced the payment of a second

interim dividend for the year ending 31 March 2024 of 2.0 pence per

ordinary share ("Interim Dividend").

The Interim Dividend will be paid on 8 December 2023 to those

shareholders on the Company's register at the close of business on

10 November 2023. The ex-dividend date will be 9 November 2023.

12 Dividend Re-investment Scheme ("DRIS")

The Company operates a DRIS. The latest date for receipt of DRIS

elections so as to participate in the DRIS in respect of the

Interim Dividend is the close of business on 24 November 2023.

13 Inside Information

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU No. 596/2014). Upon the

publication of this announcement via Regulatory Information Service

this inside information is now considered to be in the public

domain.

For further information, please contact:

David Hall YFM Private Equity Limited Tel: 0113 244 1000

Alex Collins Panmure Gordon (UK) Limited Tel: 0207 886 2767

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BIBDBSDDDGXX

(END) Dow Jones Newswires

November 24, 2023 02:00 ET (07:00 GMT)

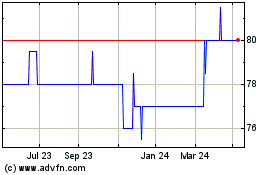

British Smaller Companie... (LSE:BSV)

Historical Stock Chart

From Apr 2024 to May 2024

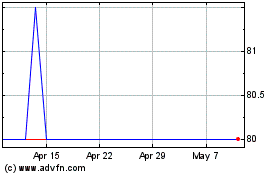

British Smaller Companie... (LSE:BSV)

Historical Stock Chart

From May 2023 to May 2024