TIDMBWRA

RNS Number : 2589B

Bristol Water PLC

01 June 2023

Announcement of unaudited preliminary financial results for the

year ended 31 March 2023

Bristol Water plc (the "Company") announces its unaudited

results for the twelve months ending 31 March 2023.

The Company's interim financial results are set out below and

can also be accessed via the Company's website.

FINANCIAL PERFORMANCE

2022/23 2021/22

(10 months (12 months trading)

trading)

restated

Revenue GBP109.0m GBP125.5m

Underlying revenue(1,2) GBP115.6m GBP125.5m

Underlying (loss)/profit before (GBP3.8m) GBP15.1m

tax(1)

Non-underlying items before (GBP20.9m) (GBP0.1m)

tax [1]

(Loss)/profit before tax (GBP24.7m) GBP15.0m

Earnings per share

Statutory loss per share (336.7p) (175.0p)

Highlights

-- The full year results include the 10 months trading of

Bristol Water plc as a statutory water undertaker, to the point of

the statutory transfer which transferred its licence, trading,

assets and liabilities to South West Water Limited on 1(st)

February 2023. All comparators are for 12 months of trading.

-- Post the statutory transfer, no transactions were recognised

in the income statement except for those relating to the remaining

preference shares, debentures and pension asset. Going forward

remaining obligations relating to these will be met from matching

intra-group contracted assets and related receipts.

-- GBP115.6 million underlying Revenue - reduction reflecting 2

months fewer of trading, offset by increased tariffs in line with

the regulatory mechanism.

-- GBP3.8 million underlying loss before tax - reduction

reflecting the near-term pressures on earnings from inflation

driven power pricing and financing costs.

-- Significant net non-underlying reduction in profits -

delivering on our WaterShare+ commitments and cost resulting from

the statutory transfer to South West Water Limited, including bond

redemption costs and legal costs.

-- Statutory loss per share of 336.7 pence includes significant

non-underlying items. Statutory loss per share for 2021/22 was

impacted by the significant non-underlying deferred tax charge in

respect of the change in corporation tax rate.

For further information, please contact:

Paul Boote Group Chief Financial Officer 01392 443 168

Jennifer Cooke Group Head of Investor Relations

James Murgatroyd

Harry Worthington FGS Global 020 7251 3801

PERFORMANCE REPORT

On 1 February 2023, the merger of South West Water and Bristol

Water completed with Bristol Water's operating licence transferring

to South West Water Limited ('SWW'). As part of the transfer

scheme, the trade and majority of assets and liabilities of Bristol

Water plc ('BW') were transferred to SWW. SWW will continue to

operate under the Bristol Water name in the area Bristol Water

serves. From this date, the operating activities of BW ceased with

only residual preference shares, debt and the pension surplus

remaining in the company. Any commitments under these instruments

are fully supported by interest bearing loans receivable from SWW.

As a result of the above, the financial performance included in

this announcement relates to 10 months of trade up to the point of

the statutory transfer.

Revenue reduced in the year reflecting 2 months fewer of

trading, offset by increased tariffs in line with the regulatory

mechanism. Household demand continues to reduce as the number of

people working from home after COVID-19 continues to reduce, and as

a result Non-household demand continues to recover towards

pre-COVID-19 levels.

Significant levels of inflation in the year resulted in a number

of costs increasing markedly. Power prices increased significantly

in the year, and while we were hedged to a high level in the first

half of the year the second half resulted in cost around 50% higher

than previous year. Chemicals prices also increased by around the

same proportion (including secondary power increase effects).

In addition the very warm summer led to increased usage of the

northern area of our supply region's resources, which require more

power and chemical consumption, in order to maintain resilience to

our supply.

As a result of the high levels of inflation over the last two

years, our indexation costs remained high.

A number of non-underlying items have been incurred this year as

a result of the statutory transfer. Customers were able to take

advantage of the WaterShare+ scheme which led to GBP6.6 million

being returned to customers as a bill credit or shares, and our

index linked bond was redeemed resulting in a loss of GBP13.1

million.

BRISTOL WATER PLC

UNAUDITED PRELIMINARY FINANCIAL STATEMENTS

FOR THE YEARED 31 MARCH 2023

INCOME STATEMENT (UNAUDITED)

for the year ended 31 March 2023

2023 2022

Restated

(note 4)

Notes GBPm GBPm

Revenue before non underlying items 5 115.6 125.5

Non underlying revenue 5 (6.6) -

--------- ----------

Total revenue 109.0 125.5

Operating costs excluding impairment losses on trade receivables 6 (84.6) (88.8)

Impairment losses on trade receivables 6 (3.5) (2.7)

Operating costs before non underlying items (88.1) (91.5)

Non underlying operating costs 6 (1.2) (0.1)

Total net operating costs 6 (89.3) (91.6)

Operating profit 19.7 33.9

Interest payable and similar charges before non underlying items 7 (34.0) (22.8)

Interest receivable and similar charges before non underlying items 7 2.7 3.9

Non underlying interest payable and similar charges 7 (13.1) -

Total net interest payable and similar charges 7 (44.4) (18.9)

--------- ----------

(Loss) / profit before tax (24.7) 15.0

Taxation on profit on ordinary activities 8 4.5 (25.5)

Loss for the financial year (20.2) (10.5)

--------- ----------

Loss per ordinary share 9 (336.7)p (175.0)p

--------- ----------

Substantially all of the Company's operations were discontinued in the year.

STATEMENT OF COMPREHENSIVE INCOME (UNAUDITED)

for the year ended 31 March 2023

2023 2022

Restated

(note 4)

Notes GBPm GBPm

Loss for the financial year (20.2) (10.5)

Other comprehensive income/(loss):

Items that will not be reclassified to profit and loss

Actuarial loss on retirement benefit surplus 0.5 (1.0)

Remeasurement of defined benefit pension scheme restriction 8 (0.1) 0.4

Other comprehensive income/(loss) for the year, net of tax 0.4 (0.6)

------- ----------

Total comprehensive loss for the year (19.8) (11.1)

------- ----------

STATEMENT OF FINANCIAL POSITION (UNAUDITED)

at 31 March 2023

2023 2022

Restated

(note 4)

Notes GBPm GBPm

Non-current assets

Property, plant and equipment - 696.6

Intangible assets - 12.7

Other investments - Loans to group

undertakings - 61.1

Other receivables 26.6 -

Retirement benefit surplus 8.2 8.1

------- ----------

34.8 778.5

------- ----------

Current assets

Inventory - 1.9

Trade and other receivables 10 144.5 29.5

Current tax asset 10 0.7 -

Cash and cash equivalents 0.1 12.0

------- ----------

145.3 43.4

------- ----------

Total assets 180.1 821.9

------- ----------

Non-current liabilities

Lease liabilities - (1.1)

Deferred income tax liabilities - (99.6)

Borrowings and derivatives 11 (1.6) (399.7)

8.75% irredeemable cumulative

preference shares 11 (12.5) (12.5)

Deferred income - (18.5)

Government grants - (0.3)

(14.1) (531.7)

------- ----------

Current liabilities

Lease liabilities - (0.4)

Current portion of deferred income - (2.7)

Trade and other payables (0.9) (36.7)

Current tax liability - (1.3)

(0.9) (41.1)

Total liabilities (15.0) (572.8)

------- ----------

Net assets 165.1 249.1

------- ----------

Equity

Called-up share capital 6.0 6.0

Share premium account 4.4 4.4

Other reserves 5.8 5.8

Retained earnings 148.9 232.9

Total Equity 165.1 249.1

------- ----------

STATEMENT OF CHANGES IN EQUITY (UNAUDITED)

For the year ended 31 March 2023

Called up share Share premium Capital redemption Retained earnings Total

capital account reserve

GBPm GBPm GBPm GBPm GBPm

Balance at 1 April 2021

(as restated) (note 4) 6.0 4.4 5.8 252.8 269.0

------------------- -------------- ------------------- ------------------ ---------

Loss for the year (as

restated) - - - (10.5) (10.5)

Other comprehensive loss

for the year:

Actuarial loss

recognised in respect

of

retirement benefit

obligations - - - (1.0) (1.0)

Remeasurement of

defined benefit

pension scheme - - - 0.4 0.4

Total comprehensive

loss for the year - - - (11.1) (11.1)

------------------- -------------- ------------------- ------------------ ---------

Ordinary dividends - - - (8.9) (8.9)

Share based payments 0.1 0.1

Balance as at 31 March

2022 (restated) (note

4) 6.0 4.4 5.8 232.9 249.1

------------------- -------------- ------------------- ------------------ ---------

Balance as at 1 April

2022 (restated) (note

4) 6.0 4.4 5.8 232.9 249.1

------------------- -------------- ------------------- ------------------ ---------

Loss for the year - - - (20.2) (20.2)

Other comprehensive

income for the year:

Actuarial profit

recognised in respect

of

retirement benefit

obligations - - - 0.5 0.5

Remeasurement of

defined benefit

pension scheme - - - (0.1) (0.1)

Total comprehensive

loss for the year - - - (19.8) (19.8)

------------------- -------------- ------------------- ------------------ ---------

Ordinary dividends - - - (64.3) (64.3)

Share based payments - - - 0.1 0.1

Balance as at 31 March

2023 6.0 4.4 5.8 148.9 165.1

------------------- -------------- ------------------- ------------------ ---------

The Board has not proposed a final dividend in respect of the

financial year 2022/23 (2022: GBPnil).

CASH FLOW STATEMENT (UNAUDITED)

For the year ended 31 March 2023

2023 2022

Restated

(note 4)

Notes GBPm GBPm

Cash flows from operating activities

(Loss)/profit before taxation (24.7) 15.0

Adjustments for:

Share based payments 0.1 0.1

Deferred income amortisation (3.3) (3.2)

Depreciation 6 21.4 25.0

Amortisation of intangibles 6 2.9 3.9

Difference between pension charges and

contributions paid 0.6 0.9

Loss / (profit) on disposal of assets 6 0.1 (0.1)

Interest income 7 (2.4) (3.6)

Interest expense 7 47.1 22.8

Pension interest income 7 (0.3) (0.3)

(Increase) in inventory (0.5) (0.2)

Decrease/(increase) in trade and other receivables 0.5 (1.3)

Increase/(decrease) in trade and other creditors and provisions 9.5 (0.7)

Cash generated from operations 51.0 58.3

Interest paid (21.4) (12.4)

Corporation taxes paid (1.6) (1.9)

Contributions received 2.8 2.1

Net cash generated from operating activities 30.8 46.1

------- ----------

Cash flows from investing activities

Purchase of property, plant and equipment and intangibles (40.7) (40.4)

Proceeds from sale of fixed assets - 0.2

Interest received 7 2.4 3.6

Repayment of intercompany loan receivable 61.1 -

Disposal of trade and assets 15 (5.1) -

------- ----------

Net cash used in investing activities 17.7 (36.6)

------- ----------

Cash flows from financing activities

Proceeds from loans and borrowings 81.1 11.0

Repayment of loans and borrowings (75.8) (9.0)

Payment of lease liabilities (0.3) (0.4)

Preference dividends paid 7 (1.1) (1.1)

Equity dividends paid (64.3) (8.9)

Net cash used in financing activities (60.4) (8.4)

------- ----------

Net (decrease)/increase in cash and cash equivalents (11.9) 1.1

Cash and cash equivalents, beginning of year 12.0 10.9

Cash and cash equivalents, end of year 0.1 12.0

======= ==========

Substantially all of the Company's operations were discontinued

in the year.

NOTES TO THE FINANCIAL STATEMENTS

1 General information

Bristol Water plc is a public company, limited by shares, with

irredeemable preference shares and debenture stock listed on

the London Stock Exchange.

The Company is incorporated and domiciled in England, United

Kingdom. The address of its registered office is Bridgwater Road,

Bristol, BS13 7AT, England.

2 Basis of preparation

The unaudited financial statements of the Company are prepared

on a historical cost basis, except for financial assets and financial

liabilities (including derivative instruments) measured at fair

value and in accordance with UK adopted international financial

reporting standards (IFRS) in conformity with the requirements

of the Companies Act 2006.

The preparation of financial statements in conformity with IFRS

requires the use of certain critical accounting estimates. It

also requires management to exercise its judgement in the process

of applying the Company's accounting policies.

New and amended standards adopted by the Company

The Company has applied the following amendments for the first

time for their annual reporting period commencing 31 March 2023:

-- Property, Plant and Equipment: Proceeds before Intended Use

- Amendments to IAS 16; and

-- Annual Improvements to IFRS Standards 2018-2020.

The amendments listed above did not have any impact on the amounts

recognised in prior periods and are not expected to significantly

affect the current or future periods.

New standards and interpretations not yet adopted

Certain new accounting standards, amendments to accounting standards

and interpretations have been published that are not mandatory

for 31 March 2023 reporting periods and have not been early adopted

by the Company. These standards, amendments or interpretations

are not expected to have a material impact on the entity in the

current or future reporting periods and on foreseeable future

transactions.

3 Going concern

The Company's licence, trade, assets and obligations were transferred

to South West Water Limited as a going concern on 1 February

2023, the consideration being the net asset carrying value of

GBP171.1m settled via an intercompany debtor. Post the statutory

transfer, no transactions were recognised in the income statement

except for those relating to the remaining preference shares,

debentures, pension asset and intercompany loans. Going forward

remaining obligations relating to these will be met from matching

intra-group contracted assets and related receipts. The Company

has received confirmation from Pennon Group plc that it will

provide support to the Company should it be required, to meet

its liabilities as they fall due for the foreseeable future.

As a result, the Directors have concluded that the Company has

adequate resources, or the reasonable expectation of raising

further resources as required, to continue in operational existence

for the foreseeable future. The Company therefore continues to

adopt the going concern basis in preparing its financial statements.

4 Change in accounting policies

As a result of the acquisition of the Company by Pennon Group Plc

on 3 June 2021, the Company's accounting policies adopted for the

statutory financial statements have been aligned with those of

Pennon Group Plc. This note explains the impact of these accounting

policies on the Company's financial statements.

Reconciliation of equity as at 1 April 2021

and 31 March 2022

31 March Change 31 March 31 March Change 31 March

2021 2021 2022 2022

as originally restated as originally restated

presented (unaudited presented (unaudited

) )

Note GBPm GBPm GBPm GBPm GBPm GBPm

Non-current assets

Property, plant

and equipment 682.9 - 682.9 696.6 - 696.6

Intangible assets 13.3 - 13.3 12.7 - 12.7

Investments 61.1 - 61.1 61.1 - 61.1

Deferred tax assets B 5.9 (5.9) - 7.9 (7.9) -

Retirement benefit

surplus 9.1 - 9.1 8.1 - 8.1

--------------- ------- ------------ --------------- ------- ------------

772.3 (5.9) 766.4 786.4 (7.9) 778.5

Current assets

Inventory 1.7 - 1.7 1.9 - 1.9

Trade and other

receivables 29.6 - 29.6 29.5 - 29.5

Cash and cash equivalents 10.9 - 10.9 12.0 - 12.0

--------------- ------- ------------ --------------- ------- ------------

42.2 - 42.2 43.4 - 43.4

--------------- ------- ------------ --------------- ------- ------------

Total assets 814.5 (5.9) 808.6 829.8 (7.9) 821.9

--------------- ------- ------------ --------------- ------- ------------

Non-current liabilities

Lease liabilities (1.5) (1.5) (1.1) - (1.1)

Deferred tax liabilities B (72.3) (6.3) (78.6) (93.2) (6.4) (99.6)

Borrowings and

derivatives (379.2) - (379.2) (399.7) - (399.7)

8.75% irredeemable

cumulative preference

shares (12.5) - (12.5) (12.5) - (12.5)

Deferred income A (82.9) 63.3 (19.6) (83.0) 64.5 (18.5)

Government grants (0.3) - (0.3) (0.3) - (0.3)

--------------- ------- ------------ --------------- ------- ------------

(548.7) 57.0 (491.7) (589.8) 58.1 (531.7)

--------------- ------- ------------ --------------- ------- ------------

Current liabilities

Lease liabilities (0.4) - (0.4) (0.4) - (0.4)

Borrowings and

derivatives (9.0) - (9.0) - - -

Deferred income A (1.8) (0.9) (2.7) (1.9) (0.8) (2.7)

Trade and other

payables (35.3) - (35.3) (38.0) - (38.0)

Provisions for

liabilities (0.5) - (0.5)

--------------- ------- ------------ --------------- ------- ------------

(47.0) (0.9) (47.9) (40.3) (0.8) (41.1)

--------------- ------- ------------ --------------- ------- ------------

Total liabilities (595.7) 56.1 (539.6) (630.1) 57.3 (572.8)

--------------- ------- ------------ --------------- ------- ------------

Net assets 218.8 50.2 269.0 199.7 49.4 249.1

Equity

Called-up share

capital 6.0 - 6.0 6.0 - 6.0

Share premium account 4.4 - 4.4 4.4 - 4.4

Other reserves 5.8 - 5.8 5.8 - 5.8

Retained earnings A,B 202.6 50.2 252.8 183.5 49.4 232.9

Total Equity 218.8 50.2 269.0 199.7 49.4 249.1

--------------- ------- ------------ --------------- ------- ------------

The impact of the above adjustments includes the correction of a

presentational error whereby deferred tax assets should have been

offset against deferred tax liabilities in line with IAS 12.

4 Change in accounting policies (continued)

Reconciliation of total comprehensive income for the year ended

31 March 2022

Year to Change Year to

31 March 2022 31 March 2022

as originally presented restated

(unaudited)

Note GBPm GBPm GBPm

Revenue A 124.2 1.3 125.5

Total operating costs (91.6) - (91.6)

------------------------- ------- ---------------

Operating profit 32.6 1.3 33.9

Net interest payable and similar charges (18.9) - (18.9)

Profit on ordinary activities before taxation 13.7 1.3 15.0

Taxation on profit on ordinary activities B (23.4) (2.1) (25.5)

Loss for the year (9.7) (0.8) (10.5)

------------------------- ------- ---------------

Other comprehensive loss for the year, net of tax (0.6) - (0.6)

Total comprehensive loss for the year (10.3) (0.8) (11.1)

------------------------- ------- ---------------

Notes to the reconciliation of equity as at 1 April 2021 and 31 March

2022 and total comprehensive loss for the year ended 31 March 2022

Developer contributions

The Company previously recognised all contributions received from

developers in respect of network and other assets as deferred income

and amortised this to revenue over a period of 60 years. This policy

has been changed to align with the Pennon Group plc's policy as follows.

A Contributions relating to connections or alterations to the water

network.

Where the performance obligation relates solely to a connection

to the network, revenue is recognised at the point of connection

when the customer is deemed to obtain control.

Contributions paid in advance where the connection has not yet

completed are treated as a contract liability and are recognised

in deferred income on the balance sheet.

As at 31 March 2022, GBP63.7m (1 April 2021: GBP62.4m) cumulative

additional revenue has been recognised.

Revenues and profit before tax for the year ended 31 March 2023

was increased by GBP2.0m (31 March 2022, increased by GBP1.3m).

B Taxation

The adjustments per note A leads to different temporary taxation

differences. In line with the Company's accounting policies, the

Company has accounted for such differences and recognised the related

net deferred tax and corporation tax liabilities.

At 31 March 2022, an increase in deferred tax liability of GBP14.3m

(1 April 2021: GBP12.2m) was recognised, resulting in a reclassification

from assets to liabilities on the balance sheet.

5 REVENUE

2023 2022

GBPm Restated

GBPm

Appointed income

Household - measured 50.0 55.3

Household - unmeasured 36.1 40.9

Non-household - measured 22.2 22.2

Non-household - unmeasured 0.3 0.3

Contributions from developers 3.3 3.2

Third party services 1.8 1.4

Rental income 1.0 1.0

114.7 124.3

Non-appointed income

Recreations 0.5 0.7

Rental income 0.2 0.2

Other 0.2 0.3

---------- ---------------

0.9 1.2

Underlying income 115.6 125.5

---------- ---------------

Non-Underlying income

Watershare + (6.6) -

Total income 109.0 125.5

---------- ---------------

Appointed income is income earned under the Company's licence

to supply water for the period until 1 February 2023 when the

licence was transferred to SWW. Non-appointed income relates

to activities that do not require a water supply licence. All

revenue relates to the trade and assets transferred to SWW.

In the year, the Company offered Pennon Group plc's, its parent

company, WaterShare+ scheme to its customers whereby customers

could choose to accept a credit on their bill or take shares

in Pennon Group plc. The value of the rebate equated to GBP13

per customer and the total value of GBP6.6 million was recognised

in full as a non-underlying reduction to revenue in the year

ended 31 March 2023. This item was non-underlying in nature given

its individual size and its non-recurring nature.

6 OPERATING COSTS

(a) Operating costs include:

2023 2022

Restated

GBPm GBPm

Wages and salaries 19.0 22.2

Social security costs 2.1 2.4

Defined contribution scheme costs 2.2 2.2

Defined benefit scheme costs 0.4 0.9

Share-based payments 0.1 0.1

Total payroll cost 23.8 27.8

Less capitalised as tangible and intangible

assets (9.8) (10.8)

Net staff costs 14.0 17.0

---------- ---------------

Inventory recognised as an expense 4.5 2.8

Depreciation of tangible assets including impairment

On owned assets 21.0 24.5

On leased assets 0.4 0.5

Amortisation of intangible assets

On owned assets 2.9 3.9

Other operating charges

Auditor's remuneration 0.3 0.3

Loss / (profit) on disposal of tangible

assets 0.1 (0.1)

Other charges less recoveries 41.4 39.9

Operating costs excluding impairment losses

on trade receivables 84.6 88.8

Impairment of trade receivables 3.5 2.7

---------- ---------------

Total operating costs before non underlying

items 88.1 91.5

Legal costs 1.0 -

Integration costs 0.2 -

Acquisition costs - 0.1

Total non underlying items in the income statement 1.2 0.1

Total net operating costs 89.3 91.6

On 17 October 2022 the Company gave notice of redemption of the

GBP40m bonds due to be repaid in March 2041. The bonds were redeemed

as part of the statutory transfer of the Company's business to

South West Water. Associated legal costs of cGBP1m were incurred

in relation to the bond redemption. The redemption of the bonds

is non-recurring and of a material value, hence the expense has

been treated as non-underlying.

The Company incurred expenses of GBP0.2m relating to the integration

and statutory transfer of the Company's trade, assets and obligations

to South West Water. These costs are classified as non-underlying

due to their non-recurring nature.

In the year ended 31 March 2022 costs were incurred in relation

to the acquisition of the Company by Pennon Group plc and the

resulting merger review by the Competition and Markets Authority.

6 OPERATING COSTS (continued)

(b) Employee details

The monthly average number of employees by activity, including Directors on a service contract,

(on a full-time equivalents basis) during the year to 31 January 2023 was as follows. From

the 1 February 2023 the Company has nil employees.

2023 2022

No. No.

Water treatment and distribution 215 207

Support services 141 137

Administration 181 182

Non-appointed activities 14 14

----------- -----------

551 540

(c) Directors' emoluments

2023 2022

GBPm GBPm

Aggregate emoluments of Directors, being remuneration, bonus, pension, LTIP and

benefits in

kind 0.7 1.1

-------- --------

0.7 1.1

The highest paid Director during the year was Mr Karam.

(d) Independent auditors' remuneration

During the year the Company obtained the following services from the Company's auditors and

its associates:

2023 2022

GBP'000 GBP'000

Fees payable for the audit of the Company's annual statutory financial statement 274.0 188.0

Fees payable for other services:

services pursuant to legislation, principally assurance and audit of regulatory

accounts and

returns - 45.0

Review of interim financial statements 20.0 31.0

Total non-audit fees 20.0 76.0

7 NET INTEREST PAYABLE AND SIMILAR CHARGES

2023 2022

GBPm GBPm

Interest payable and similar charges relate to:

Bank borrowings 3.7 2.0

Term loans and debentures:

Interest charges 9.4 10.4

Indexation 20.0 9.6

Leases 0.1 0.1

Capitalisation of borrowing cost (0.9) (0.4)

Dividends on 8.75% irredeemable cumulative preference shares 1.1 1.1

Loan from Pennon Group plc 0.6 -

34.0 22.8

Less interest receivable and similar income:

Interest income in respect of retirement benefit scheme (0.3) (0.3)

Interest income on intercompany loans (2.4) (3.6)

(2.7) (3.9)

Total underlying net interest payable and similar charges 31.3 18.9

---------------- -------

Bond redemption costs 13.1 -

Total net interest payable and similar charges 44.4 18.9

Bonds with a carrying value of GBP59.2m were redeemed on 17 November 2022 for GBP72.3 million.

The difference of GBP13.1m arising on early settlement was debited to finance costs in the

year. The redemption of the bonds is non-recurring and of a material value, hence the debit

has been treated as non-underlying.

The rate used to determine the amount of borrowing costs eligible for capitalisation was 8.7%

(2022: 5.0%), which is the weighted average interest rate of applicable borrowings.

Dividends on the 8.75% irredeemable cumulative preference shares are payable at a fixed rate

of 4.375% on 1 April and 1 October each year. Payment by the Company to the share registrars

is made two business days earlier. The payments are classified as interest in accordance with

IFRS 9.

8 TAXATION

2023 2022

Restated

GBPm GBPm

Tax (income)/expense included in Income Statement

Current tax:

Corporation tax on profits for the year 0.4 1.3

Adjustment to prior years (0.1) 3.3

-------- ------------

Total current tax 0.3 4.6

Deferred tax:

Origination and reversal of timing differences (4.9) 1.6

Adjustment to prior years 0.1 (3.1)

Effect of change in UK corporation tax rate - 22.4

Total deferred tax (4.8) 20.9

Tax (income)/expense on (loss) / profit (4.5) 25.5

-------- ------------

Tax expense/(income) included in other comprehensive income/(loss)

Remeasurement of post-employment benefit liability 0.1 (0.4)

-------- ------------

Total tax expense/(income) included in other comprehensive income/(loss) 0.1 (0.4)

8 TAXATION (continued)

Reconciliation of the tax on profit on ordinary activities

The current tax rate for the year is lower than (2022: higher) the standard rate of tax. A

reconciliation between tax (income)/expense and the product of accounting (loss)/profit multiplied

by UK corporation tax rate is as follows:

2023 2022

GBPm GBPm

(Loss)/Profit before tax (24.7) 15.0

At statutory income tax rate of 19% (2022: 19%) (4.7) 2.9

Adjustment in respect of prior years' current tax 0.1 3.3

Adjustment in respect of prior years' deferred tax (0.1) (3.1)

Non-deductible expenses for tax purposes:

8.75% irredeemable cumulative preference share 0.2 0.2

Non-qualifying asset depreciation 0.1 0.1

Other 0.1 0.1

Capital expenditure tax depreciation super deduction allowances (0.2) (0.4)

-------- ----------

(4.5) 3.1

Effective tax rate before change in UK corporation tax rate 18.2% 20.7%

Effect of tax rate change on opening balances - 22.4

Total taxation expense included in income statement (4.5) 25.5

Effective tax rate after change in UK corporation tax rate 18.2% 170.0%

From 1 April 2021 to 31 March 2023, a "super-deduction" on qualifying plant and machinery

equivalent to 130% of spend on expenditure relating to contracts entered into after 3 March

2021 is available in respect of qualifying expenditure. The Company incurs significant capital

expenditure each year as it maintains and enhances its assets for the benefit of its customers,

communities and the environment. The first year allowance on certain other types of assets,

including long-life was boosted to 50% for the same period, again for contracts entered into

after 3 March 2021. These enhanced allowances have increased capital allowance claims for

the year and hence reduced the current tax charge for the year ended 31 March 2022. The tax

credit was increased for the year ended 31 March 2023 for the same reason. There is also a

consequently higher deferred tax liability and charge due to the additional capital allowance

deductions.

9 LOSS PER ORDINARY SHARE

2023 2022

m m

Basic loss per ordinary share have been calculated as follows:

Loss attributable to ordinary shares GBP20.2 GBP10.5

Weighted average number of ordinary shares 6.0 6.0

--------- ---------

336.7p 175.0p

As the Company has no obligation to issue further shares, disclosure of earnings per share

on a fully diluted basis is not relevant.

10 TRADE AND OTHER RECEIVABLES

Trade and other receivables comprise: 2023 2022

GBPm GBPm

Trade receivables - 25.7

Less bad debt provision - (16.1)

---------------- --------

- 9.6

Amounts owed by group undertakings (a) 144.5 2.3

Other receivables - 1.8

Prepayments and accrued income - 15.8

Corporation tax 0.7 -

---------------- --------

145.2 29.5

---------------- --------

As at 31 March 2022 GBP16.1m of trade receivables were considered

impaired and were provided for.

The Company's policy is to consider the trade receivables impairment

to be allocated on a collective basis and only impaired for the

purposes of IFRS 7, 'Financial Instruments: Disclosures' when

the loss can be specifically identified with the trade receivables.

The Company is required to continue providing residential customers

with water regardless of payment.

Other receivables at 31 March 2022 were not impaired.

(a) The current year amounts owed by group undertakings relate

to amounts owed by the Company's parent company, South West Water

Limited, as a result of the transfer of the Company's trade and

assets. The amounts due are repayable on demand. The prior year

balance included the sum of GBP0.4m in respect of amounts advanced

to Bristol Wessex Billing Services Limited ("BWBSL"), a joint

venture company between Bristol Water Holdings Limited ("BWH"),

an intermediate parent company until 1 February 2023, and Wessex

Water Services Limited, to fund the purchase of tangible assets.

This amount had no fixed repayment date.

11 BORROWINGS AND DERIVATIVES

2023 2022

GBPm GBPm

Amounts falling due after more than one year but less than five years

Bank and other term loans - secured - 58.0

Net unamortised premiums arising on issue of term loans - 0.3

- 58.3

Amounts falling due after more than five years

Bank and other term loans - secured - 339.0

Net unamortised premiums arising on issue of term loans - 0.8

- 339.8

Irredeemable

Debentures 1.6 1.6

8.75% irredeemable cumulative preference shares 12.5 12.5

------ -------

14.1 14.1

Total 14.1 412.2

------ -------

None of the bank and other term loans included within creditors are payable in instalments.

Bonds with a carrying value of GBP59.2m were redeemed on 17 November 2022 for GBP72.3 million.

The difference of GBP13.1m arising on early settlement was debited to finance costs in the

year.

11 BORROWINGS AND DERIVATIVES (continued)

Interest rate Total Total

Maturity 2023 2022

GBPm GBPm

Non current loans and borrowings

GBP42,000,000 bank loan 1.06% 21 Jun 2023 - 42.0

GBP16,000,000 bank loan 1.06% 2 Dec 2023 - 16.0

GBP50,000,000 bank loan 1.24% 14 Jun 2028 - 50.0

GBP25,000,000 bank loan 2.61% 24 Aug 2028 - 25.0

GBP91,109,686 indexed linked term loan 3.64% 30 Sept 2032 - 151.0

GBP57,500,000 term loan 6.01% 30 Sept 2033 - 57.5

GBP40,000,000 indexed linked term loan 2.70% 25 Mar 2041 - 55.5

Net unamortised premiums - 1.1

GBP1,405,218 Consolidated debentures 4.00% irredeemable 1.4 1.4

GBP36,740 perpetual debentures 4.25% irredeemable - -

GBP54,875 perpetual debentures 4.00% irredeemable 0.1 0.1

GBP72,900 perpetual debentures 3.50% irredeemable 0.1 0.1

GBP12,500,000 cumulative preference shares 8.75% irredeemable 12.5 12.5

------ ------

Total non- current loans and borrowings 14.1 412.2

------ ------

Borrowing facilities

Unutilised borrowing facilities are as follows: 2023 2022

GBPm GBPm

Expiring in June 2023 - 19.0

Expiring in December 2023 - 8.0

- 27.0

------------------------------------------------------------------------------ ------

The facilities are floating rate and incur non-utilisation fees at market rates.

12 COMMITMENTS

Capital commitments at 31 March 2023 contracted for but not provided were

GBPnil (2022: GBP6.9m).

13 ULTIMATE PARENT COMPANY AND CONTROLLING PARTY

As at 31 March 2022 the immediate parent company for this entity

was Bristol Water Core Holdings Limited ("BWCH"), a company

incorporated in England and Wales. On 1 February 2023 the share

capital of the Company was transferred to SWW, a subsidiary

of Pennon Group plc. As a result SWW became the immediate parent

company.

As at 31 March 2022 and 31 March 2023 the Directors considered

the ultimate parent and controlling party to be Pennon Group

plc.

The smallest and largest group in which the Company is consolidated

is Pennon Group plc which is registered in England and copies

of its consolidated annual report and accounts are available

from Peninsula House, Rydon Lane, Exeter, Devon, England, EX2

7HR.

14. RELATED PARTY TRANSACTIONS

From 3 June 2021 related parties include members and joint ventures of the Pennon Water plc

group of companies and key management personnel. Until 2 June 2021 related parties included

members and joint ventures of the Bristol Water Group Limited group of companies; members

of the iCON Infrastructure LLP group of companies; members of Itochu Corporation; and key

management personnel.

The principal related parties are:

Pennon Group plc ("PG"), registered in England and Wales, whose year end is 31 March, and

is the Company's ultimate UK holding company.

SWW, the Company's immediate parent, registered in England and Wales, whose year end is 31

March.

BWHUK , registered in England and Wales, whose year end is 31 March.

BWCH , registered in England and Wales, whose year end is 31 March.

BWBSL , registered in England and Wales, whose year-end is 31 March. The joint venture interest

is held by Bristol Water Holdings Limited, an intermediate holding company within the BWHUK

group of companies, which owns 100 class 'B' shares in the company, representing a holding

of 50% of the voting and equity rights of the company. BWBSL is a joint venture undertaking

between Bristol Water Holdings Limited and Wessex Water Services Limited, and provides meter

reading, billing, debt recovery and customer contact management services to this Company and

Wessex Water Services Limited, under a cost sharing arrangement.

Water 2 Business Limited ("W2B" ), registered in England and Wales, whose year-end is 30

June. The interest is held by BWH Limited, an intermediate holding company, which owns 30

class 'B' shares in the company representing a holding of 30% of equity rights and 40% of

voting rights of the company. W2B has a retail water and sewerage supply licence and provides

retail water services to non-household customers.

Pennon Water Services Limited ("PWS"), registered in England and Wales, whose year-end is

31 March. The interest is held by PG, the ultimate parent company, which owns 80% of PWS.

On 3 June 2021, following the acquisition by Pennon Group plc, PWS became a related party

of the Company. PWS has a retail water and sewerage supply licence and provides retail water

services to non-household customers.

Bristol Water Group Limited ("BWG"), registered in England and Wales, whose year end is 31

March, and until 2 June 2021 was the Company's ultimate UK holding company. F ollowing the

acquisition by Pennon Group plc, BWG ceased to be a related party of the Company on 2 June

2021.

Trading transactions

During the year the Company entered into trading transactions with related parties totalling:

Sales of goods and services Purchases of goods and services

2023 2022 2023 2022

GBPm GBPm GBPm GBPm

Joint ventures and associates of the

Pennon Group plc group

BWBSL

- management charges - - 2.5 2.8

- capital expenditure - - 0.3 0.2

- other recharges - - 0.1 0.1

W2B

- non-household supply of water 16.2 16.7 - -

PWS

- non-household supply of water 0.9 0.6 - -

17.1 17.3 2.9 3.1

-------------- -------------- ---------------- ----------------

The current year amounts above relate to the period to 31 January 2023. The trade and assets

of the Company were transferred to SWW on 1 February 2023. The prior year amounts above relating

to PWS are for the period from 3 June 2021, when PWS became a related party of the Company,

to 31 March 2022.

14. RELATED PARTY TRANSACTIONS (continued)

Non trading transactions

During the year BW received GBPnil (2022: GBP1.6m) from BWG for employee services to BWG relating

to the sale of the business. At 31 March 2022 the balance was GBPnil.

At the year end the balances held with related parties were:

Amounts due from Amounts due to

2023 2022 2023 2022

GBPm GBPm GBPm GBPm

Joint ventures and associates of the Bristol Water Group Limited group

BWBSL - 0.9 - 1.4

W2B - 1.4 - 0.3

PWS - - - -

- 2.3 - 1.7

---------- ------- -------- -------

The amounts outstanding at 31 March 2022 were unsecured and were settled in cash. The trade

and assets of the Company were transferred to SWW on 1 February 2023.

15. DISCONTINUED OPERATIONS

On 1 February 2023 the trade and majority of assets and liabilities of the Company were transferred

to SWW, the Company's parent company. Consideration for the transfer was settled via an intercompany

debtor created as part of the transfer. Settlement of this intercompany debtor is expected

in the year to 31 March 2024. The net assets transferred on the date of transfer are shown

below.

Assets GBPm

Property, plant and equipment 713.3

Intangible assets 13.6

Inventory 2.4

Trade and other receivables 29.1

Cash and cash equivalents 5.1

------------------

Total assets 763.5

Liabilities

Borrowings (423.9)

Leases (1.2)

Deferred income (20.6)

Government grants (0.3)

Trade and other payables (51.5)

Deferred tax liabilities (94.9)

Total liabilities (592.4)

Net assets disposed of 171.1

------------------

Net cash outflow arising on disposal

Cash and cash deposits disposed of (5.1)

16. CIRCULATION

This unaudited announcement is available on the Bristol Water website. Paper copies are also

available from the Company's parent company's registered office at Peninsula House, Rydon

Lane, Exeter EX2 7HR.

[1] Non-underlying items are adjusted for by virtue of their

size, nature or incidence to enable a full understanding of

financial performance

2 The Company's statutory revenue for 2022/23 of GBP109m

included non-underlying revenue reductions of GBP6.6m in respect of

a customer bill credit under WaterShare+

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR SDWEFFEDSEDI

(END) Dow Jones Newswires

June 01, 2023 02:00 ET (06:00 GMT)

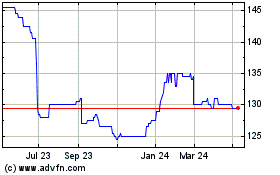

Bristol Wtr.8t% (LSE:BWRA)

Historical Stock Chart

From Oct 2024 to Nov 2024

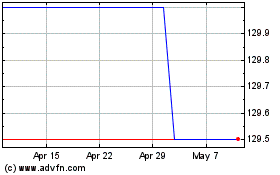

Bristol Wtr.8t% (LSE:BWRA)

Historical Stock Chart

From Nov 2023 to Nov 2024