Ceiba Investments Limited Net Asset Value(s)

June 20 2024 - 1:00AM

RNS Regulatory News

RNS Number : 1080T

Ceiba Investments Limited

20 June 2024

CEIBA INVESTMENTS

LIMITED

(TICKER CBA, ISIN:

GG00BFMDJH11)

Legal

Entity Identifier:

213800XGY151JV5B1E88

UNAUDITED NET ASSET VALUE PER

SHARE AS AT 31 MARCH 2024

CEIBA Investments Limited,

the largest listed foreign investor

solely dedicated to investing in Cuba, announces that its unaudited net asset value per share

("NAV") as at 31 March 2024

was USD1.1650 (31 December 2023: USD1.1514).

Applying the GBP:USD exchange rate

as at 31 March 2024 of USD1.2632 : GBP1.00 (31 December 2023:

USD1.2747 : GBP1.00), the unaudited NAV in Sterling was GBP0.9223

(31 December 2023: GBP0.9033) per

share.

As at 31 March 2024, the net assets

were USD160,392,100 (31 December 2023:

USD158,519,549).

For

further information, please contact:

|

Sebastiaan Berger

|

Via NSM Funds

Limited

|

|

Singer Capital

Markets

James Maxwell / Finn Gordon (Corporate

Finance)

James Waterlow

(Sales)

|

Tel: +44 (0)20 7496 3000

|

|

NSM

Funds Limited

|

Tel: +44 (0)1481 743030

|

www.ceibainvest.com

END OF ANNOUNCEMENT

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

NAVGPURCQUPCGCB

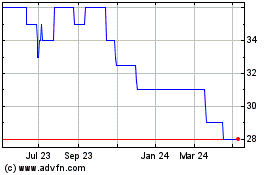

Ceiba Investments (LSE:CBA)

Historical Stock Chart

From Dec 2024 to Jan 2025

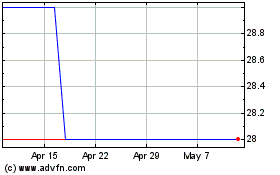

Ceiba Investments (LSE:CBA)

Historical Stock Chart

From Jan 2024 to Jan 2025