Conroy Gold & Natural Resources Plc Fundraising of £400,000

June 20 2023 - 1:00AM

UK Regulatory

TIDMCGNR

PRIOR TO PUBLICATION, THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT WAS

DEEMED BY THE COMPANY TO CONSTITUTE INSIDE INFORMATION FOR THE PURPOSES OF

REGULATION 11 OF THE MARKET ABUSE (AMENDMENT) (EU EXIT) REGULATIONS 2019/310.

WITH THE PUBLICATION OF THIS ANNOUNCEMENT, THIS INFORMATION IS NOW CONSIDERED

TO BE IN THE PUBLIC DOMAIN.

IN ADDITION, MARKET SOUNDINGS WERE TAKEN IN RESPECT OF CERTAIN OF THE MATTERS

CONTAINED WITHIN THIS ANNOUNCEMENT, WITH THE RESULT THAT CERTAIN PERSONS BECAME

AWARE OF INSIDE INFORMATION. UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A

REGULATORY INFORMATION SERVICE, THOSE PERSONS THAT RECEIVED INSIDE INFORMATION

IN A MARKET SOUNDING ARE NO LONGER IN POSSESSION OF SUCH INSIDE INFORMATION,

WHICH IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN.

Conroy Gold and Natural Resources plc

("Conroy Gold" or the "Company")

20 June 2023

FUNDRAISING OF £400,000

* Fundraising of £400,000 at 13.5 pence per Ordinary Share

* Funds to be used to accelerate exploration programmes in Ireland and

Finland and for general working capital

Conroy Gold and Natural Resources plc (AIM: CGNR), the gold exploration and

development company focused on Ireland and Finland, is pleased to announce a

fundraising of £400,000 to accelerate exploration on its exploration programmes

for gold and other minerals in Ireland and Finland. The funds raised are to be

put towards exploration programmes which are not covered by the Joint Venture

Agreement with Demir Export and for general working capital purposes.

Fundraising summary:

* Financing arranged to raise £400,000 through the issue of 2,962,962 new

ordinary shares of ?0.001 ("Ordinary Shares") at a price of 13.5 pence (the

"Issue Price") per Ordinary Share (the "Fundraising Shares") (together the

"Fundraising"). The Issue Price represents a discount of 9.2% to the

closing mid-market price of 14.875 pence per Ordinary Share on 19 June

2023.

* The fundraising increases the Company's exploration capacity and

strengthens its working capital position.

* Each Fundraising Share carries a warrant to subscribe for one new Ordinary

Share at a price of 22.5 pence per Ordinary Share exercisable at any point

from Admission (defined below) to 13 June 2026 (the "Warrants"). The

Warrants include an accelerator provision, whereby should the volume

weighted average Ordinary Share price trade for 5 consecutive days at 35

pence or greater, the Company will have the right to issue Warrant holders

with a two week notice to exercise their Warrants. Unexercised Warrants

would be cancelled, and any Warrants exercised under this notice must be

fully paid up to the Company within 10 business days of notification being

made to the Company that the Warrants will be exercised.

* By participating in the Fundraising, each Subscriber agreed that they are

subject to lock in provisions whereby the Fundraising Shares cannot be

traded until 13 December 2023.

Certain of the investors in the Fundraising were introduced by Roast PR Limited

who have elected to take their fees of £17,500 in relation to this transaction

through the issue of 129,630 new Ordinary Shares at the Issue Price (the "Fee

Shares"). Each Fee Share also carries a Warrant on the same terms as the

Fundraising Shares and is subject to the same lock-in provision as the

Fundraising Shares.

The fundraising has been conducted within the Company's existing share

authorities and is conditional on admission of the Fundraising Shares to

trading on AIM becoming effective.

2,592,592 Fundraising Shares are being issued to two new shareholders, one of

whom, Mr. Jonathan Swann, is subscribing for 2,222,222 Fundraising Shares and

as a consequence is expected to hold 4.64 per cent. of the enlarged share

capital of the Company on Admission. The remainder of the Fundraising Shares

are being issued to one existing shareholder, Mr. Philip Hannigan, who is

subscribing for 370,370 shares and is expected to be interested in 8,958,445

Ordinary Shares representing 18.72 per cent. of the enlarged share capital of

the Company on Admission.

Admission and Total Voting Rights

An application will be made to admit the Fundraising Shares and the Fee Shares

(totalling 3,092,592 new Ordinary Shares) to trading on the AIM market of the

London Stock Exchange on or around 23 June 2023 ("Admission").

Following the issue of the Fundraising Shares and the Fee Shares, and for the

purposes of the Disclosure Guidance and Transparency Rules, the Company's total

issued share capital on Admission will consist of 47,848,693 Ordinary Shares

with one voting right per ordinary share.

The above figure may be used by shareholders as the denominator for the

calculations by which they will determine if they are required to notify their

interest in, or a change to their interest in, the Company, under the FCA's

Disclosure Guidance and Transparency Rules.

Professor Richard Conroy, Chairman, commented:

"I am very pleased with this fundraising. Exploration expenditures, over ?

4.5million in Phase 1 alone, are covered by the Joint Venture Agreement which

the Company has in place with Demir Export to explore and develop the district

scale gold trend discovered by the Company in Ireland.

The Company has, however, other exploration interests, both in Ireland and in

Finland, which are not covered by the Joint Venture and which, for relatively

low expenditures, could potentially yield highly interesting results for the

Company. Other working capital expenditures must also be covered."

For further information please contact:

Further information:

Conroy Gold and Natural Resources plc

Professor Richard Conroy, Chairman +353-1-479-6180

Allenby Capital Limited (Nomad)

Nick Athanas / Nick Harriss +44-20-3328-5656

First Equity Limited (Broker)

Jason Robertson +44-20-7330-1883

Lothbury Financial Services

Michael Padley +44-20-3290-0707

Hall Communications

Don Hall +353-1-660-9377

Visit the website at: www.conroygold.com

END

(END) Dow Jones Newswires

June 20, 2023 02:00 ET (06:00 GMT)

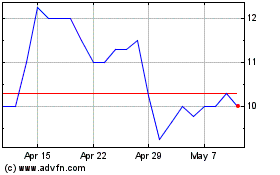

Conroy Gold & Natural Re... (LSE:CGNR)

Historical Stock Chart

From Apr 2024 to May 2024

Conroy Gold & Natural Re... (LSE:CGNR)

Historical Stock Chart

From May 2023 to May 2024