Cambria Africa PLC FY17 Trading Update Leads to Open Offer Extension (5557V)

January 31 2017 - 1:04AM

UK Regulatory

TIDMCMB

RNS Number : 5557V

Cambria Africa PLC

31 January 2017

Cambria Africa Plc

("Cambria" or the "Company")

FY 2017 Trading Update Leads to Open Offer Extension

Last Friday the Company announced a trading update for the

current financial year indicating Payserv, the Company's largest

subsidiary, achieved a 131% increase in Profit Before Tax for the 4

months ended 31 December 2016

(http://www.cambriaafrica.com/rns?id=13109693). Accordingly,

Cambria is extending the closing date of its Open Offer to 15

February 2017 to allow Qualifying Shareholders to consider the

significance of this and other updated results repeated below in

their investment choices.

The Open Offer Issue Price of 1.00p per share represents a

discount of 16.7% to the closing price of 1.20p on Friday, 27

January 2017 and a 17.4% discount to the 10-day Volume Weighted

Average Price of 1.21p.

The Open Offer guarantees Qualifying Shareholders a price of

1.00p per share for up to a 1.194 Open Offer shares for each share

held. If they take up their full Open Offer Entitlement,

shareholders can apply for additional Open Offer Shares through an

Excess Application Facility .

Qualifying Shareholders have received the Open Offer Circular

and Application which appear on the Company's website

(http://www.cambriaafrica.com/investors/shareholder-documents). If

you are a Qualifying Shareholder and have not been notified or have

questions about the application process, please contact the

Company's registrar, Capita Asset Services by telephone on +44

(0)371 664 0321.

The revised timetable of principal events is detailed below.

Capitalised terms in this announcement are as defined in the Open

Offer circular

(http://www.cambriaafrica.com/investors/shareholder-documents)

unless the context otherwise requires.

Trading update

As outlined in the Company's results announcement of 27 January

2017 and repeated below, FY 2017 has started positively.

After Fiscal Year-End 2016, unaudited management accounts for

the 4 months ended 31 December 2016 reflect an acceleration of the

performance gains achieved in FY 2016.

In comparison to the same period in FY 2016, the salient results

are as follows:

Payserv:

-- PBT increased by 131% to $660,000 from $286,000,

-- EBITDA increased by 51.8% to $850,000 from $560,000,

-- Revenues increased by 23.4% to $2.16 million from $1.75 million,

-- Paynet's EDI volumes up by 46.3%,

-- Tradanet loan volumes down 35.4%.

The significant increase in EDI volumes is believed to be

attributable to an increase in electronic payments as a result of

the cash shortages in Zimbabwe and multiple salary payments during

the same month by employers. Tradanet loans fell as a result of a

temporary discontinuation in the credit partner loan program. This

program is expected to be reinstated in early 2017 and will result

in a restoration of loans to FY 2016 levels.

Although the current record EDI volumes may abate in future

should current conditions change, Paynet's management expects

normalisation of Tradanet loan volumes to mitigate any such

reduction.

Millchem:

-- Revenues flat at $1.2 million,

-- EBITDA loss further reduced by 30% to $38,000 from a loss of $55,000,

-- Pre-tax loss reduced by 27.7% to $47,000 from a loss of $65,000.

Central:

-- Central costs, excluding legal expenses, continue to track

the improved levels reported in FY 2016.

OPEN OFFER: REVISED TIMETABLE OF PRINCIPAL EVENTS

Recommended latest time and date 4:30pm on 9

for requesting withdrawal of Open February 2017

Offer Entitlements from CREST

Latest time and date for depositing 3.00pm on 10

Open Offer Entitlements into CREST February 2017

Latest time and date for splitting 3.00pm on 13

Application Forms (to satisfy February 2017

bona fide market claims only)

Latest time and date for acceptance 11.00am on 15

of the Open Offer and receipt February 2017

of completed Non-CREST Application

Forms and payment in full under

the Open Offer or settlement of

relevant CREST instruction (if

appropriate)

Announcement of result of Open 16 February

Offer 2017

Admission and commencement of 22 February

dealings in the Shares on AIM 2017

New Ordinary Shares credited to 22 February

CREST members' accounts 2017

New Ordinary Shares in certificated 1 March 2017

form

All references are to London time.

This announcement contains inside information for the purposes

of Article 7 of Regulation 596/2014.

Contacts

Cambria Africa Plc: www.cambriaafrica.com

+44 (0) 207 669

Samir Shasha 0115

Email: info@cambriaafrica.com

WH Ireland Limited: www.wh-ireland.co.uk

+44 (0) 20 7220

James Joyce / Nick Prowting 1666

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCGMGFMNMZGNZG

(END) Dow Jones Newswires

January 31, 2017 02:04 ET (07:04 GMT)

Cambria Africa (LSE:CMB)

Historical Stock Chart

From Apr 2024 to May 2024

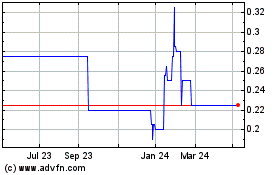

Cambria Africa (LSE:CMB)

Historical Stock Chart

From May 2023 to May 2024