Spain 11,896 14,366 26,717 510 434 551

Other 18,718 19,729 39,808 990 1,093 1,084

162,909 172,101 346,136 49,477 53,158 53,620

4 Exceptional items

6 months ended 30 June 2012 6 months ended 30 June 2011 Year ended 31 December 2011

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

Customer redress and

associated costs 7,495 547 16,892

Restructuring costs 4,097 - -

Legacy scheme share based

payments 196 802 1,167

Total exceptional items 11,788 1,349 18,059

The GBP7,495,000 customer redress and associated costs in the

six month period relate to the further costs required to compensate

customers and other costs associated with the customer redress

exercise.

The GBP4,097,000 restructuring costs in the six month period

relate to redundancy programmes and associated costs across the

Group, the majority of which is in the UK as announced in the 2011

Annual Report and Accounts.

The tax credit arising in respect of these items is GBP2,851,000

(H1 2011: GBP345,000).

5 Taxation

Tax for the six month period is charged at 34.6% (six months

ended 30 June 2011: 31.0%; year ended 31 December 2011: 36.2%),

representing the best estimate of the average effective tax rate

expected for the full year, applied to the pre-tax income of the

six month period.

6 Dividends

6 months ended 30 June 2012 6 months ended 30 June 2011 Year ended 31 December 2011

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

Interim dividend for the year

ended 31 December 2011 of

2.42 pence - - 4,149

Final dividend for the year

ended 31 December 2011 of

nil pence (2010: 5.12 pence) - 8,776 8,776

Amounts recognised as

distributions to equity

holders in the period - 8,776 12,925

The Directors have not proposed an interim dividend for

2012.

7 Earnings per share

Basic and diluted earnings per share have been calculated in

accordance with IAS 33 "Earnings per Share". Underlying earnings

per share have also been presented in order to give a better

understanding of the performance of the business.

6 months Year ended

6 months ended ended 30 31 December

30 June 2012 June 2011 2011

(Unaudited) (Unaudited) (Audited)

Earnings GBP'000 GBP'000 GBP'000

Earnings for the purposes of basic and diluted earnings

per share 4,535 15,969 18,215

Customer redress and associated costs (net of

tax) 5,659 402 12,976

Restructuring costs (net of tax) 3,082 - -

Legacy scheme share based payments (net of tax) 196 592 1,167

Earnings for the purposes of underlying basic and diluted

earnings per share 13,472 16,963 32,358

Number of

shares Number Number Number

(thousands) (thousands) (thousands)

Weighted average number of ordinary shares for the purposes of

basic earnings per share 171,439 170,990 171,210

Effect of dilutive potential ordinary shares: share

options 3,112 1,959 787

Weighted average number of ordinary shares for the purposes of

diluted earnings per share 174,551 172,949 171,997

Earnings per

share Pence Pence Pence

(Unaudited) (Unaudited) (Audited)

Basic and diluted earnings per share from continuing

operations:

Basic shares 2.65 9.34 10.64

Diluted shares 2.60 9.23 10.59

Basic and diluted underlying earnings per share from continuing operations:

Basic shares 7.86 9.92 18.90

Diluted shares 7.72 9.81 18.81

8 Tangible and intangible assets

Goodwill Other intangible assets Property, plant and equipment Total

GBP'000 GBP'000 GBP'000 GBP'000

Six months ended 30 June 2012 (Unaudited)

Carrying amount at 1 January 2012 16,521 22,626 14,473 53,620

Additions - 1,360 687 2,047

Disposals - (64) (2) (66)

Depreciation / amortisation - (4,458) (1,543) (6,001)

Exchange adjustments (159) 11 25 (123)

Carrying amount at 30 June 2012 16,362 19,475 13,640 49,477

Six months ended 30 June 2011 (Unaudited)

Carrying amount at 1 January 2011 16,536 22,055 15,389 53,980

Additions - 4,560 833 5,393

Depreciation / amortisation - (4,109) (1,645) (5,754)

Exchange adjustments (480) 7 12 (461)

Carrying amount at 30 June 2011 16,056 22,513 14,589 53,158

Year ended 31 December 2011 (Audited)

Carrying amount at 1 January 2011 16,536 22,055 15,389 53,980

Additions - 9,417 2,435 11,852

Disposals - - (13) (13)

Depreciation / amortisation - (8,850) (3,240) (12,090)

Exchange adjustments (15) 4 (98) (109)

Carrying amount at 31 December 2011 16,521 22,626 14,473 53,620

9 Bank loans

30 June 2012 30 June 2011 31 December 2011

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

Repayments due within one year 43,500 - -

Less: unamortised issue costs (275) - -

Bank loans due within one year 43,225 - -

Repayments due in more than one year - 43,500 43,500

Less: unamortised issue costs - (642) (459)

Bank loans due in more than one year - 42,858 43,041

The Group's bank debt is in the form of a Revolving Credit

Facility (RCF). The Group is entitled to roll over amounts drawn

down, subject to all amounts outstanding falling due for repayment

on expiry of the facility in March 2013.

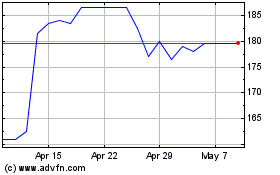

Cppgroup (LSE:CPP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cppgroup (LSE:CPP)

Historical Stock Chart

From Jul 2023 to Jul 2024