TIDMCRPR

RNS Number : 8604S

Cropper(James) PLC

09 November 2023

9 November 2023

James Cropper plc

("James Cropper", the "Company" or the "Group")

Interim Results

Accelerated growth strategy on track

Financial and operational performance drives gross margin

expansion and increased profitability in the Group

James Cropper plc (AIM: CRPR), a global market leader in

advanced materials, luxury packaging and paper products , announces

its results for the six months ended 30 September 2023 ('H1

FY24').

Financial Headlines:

-- Group revenue broadly in line with the Board's FY24

expectations despite ongoing market headwinds in Paper Products

-- Adjusted operating profit increased to GBP3.0m (H1 FY23:

GBP0.5m) with gross margin performance and cost management

improvement

-- Profit before tax up to GBP2.4m (H1 FY23: loss GBP(0.9)m)

supported by improved margins, a reduction in IAS 19 pension

adjustments and exceptional items

-- Earnings per share up to 19.4p (H1 FY23: loss per share (9.2)p)

-- Interim dividend declared at 3.0p per share (H1 FY23: 2.0p),

reflecting the Board's confidence in the ongoing implementation of

the accelerated growth strategy

-- Net debt of GBP13.3m, down GBP3.3m from GBP16.6m at FY23 (H1 FY23: GBP12.2m).

Operational Headlines:

-- Accelerated growth strategy on track with progress achieved during the period under review

-- Continued progress made as the Group unifies its business

identity under the James Cropper name, with launch ready for Q4

FY24

-- Solid performance in Advanced Materials division;

-- Future Energy's hydrogen offer continues to exceed

management's expectations

-- T echnical Fibres remains healthy with growth in core

customer base

-- Restructuring and consolidation of Paper and Colourform is progressing well

-- New leadership team in place across market-facing segments as well as at a Group level

-- Decarbonisation project advancing to phase one construction, supported by grant funding

-- Luxury Packaging wins internationally acclaimed Formes de Luxe award

Future Outlook:

-- Continued growth in Advanced Materials division:

-- Ongoing investment for expansion in the electrolyser

manufacturing operations

-- Opportunity pipeline and exploration into new growth markets

such as Carbon Capture and Electrolyser OEM

-- Ongoing progress in Paper Products division:

-- Restructuring due to complete in Q4 FY24, delivering further

margin improvement

-- Share in target markets maintained and well positioned for

anticipated recovery in global demand during FY25.

-- The actions taken to date give the Board confidence that the

Group is well positioned to deliver increased profitability in FY24

consistent with its expectations and that, in line with the

accelerated growth strategy, revenue growth will be delivered from

FY25 onwards.

Commenting on the half year results, James Cropper CEO Steve

Adams said:

"We have achieved a healthy first half performance with benefits

from our accelerated growth strategy now becoming evident,

following considerable hard work and commitment by the James

Cropper team.

In spite of ongoing wider macro-economic pressures and softer

demand across Paper, the actions taken to streamline the business

and focus on higher margin opportunities have helped deliver an

improvement in profitability. Advanced Materials continues to

perform well with Future Energy again exceeding expectations.

The continued focus on our unique recovered fibre upcycling

capability, moulded fibre luxury packaging offer and pioneering

activities in decarbonisation keep us differentiated and relevant

with our current and future customers.

Our access to the high growth Future Energy markets with an

equally differentiated product and technology offer in Advanced

Materials, brings significant opportunity for further growth. We

are committed to ongoing investment in our capabilities and

capacity with a new phase of expansion in our electrolyser

manufacturing operations.

We have also built significant strength in our talent and

leadership over the last year and will complement this with more

agile systems and processes. With the new leadership team, and our

talented global workforce, we are well positioned for greater

success; from redefining our Paper Products offer to satisfying

global demand for a low carbon economy through cutting edge

materials and components in renewable energy.

While still in the midst of our transformation, we are confident

in the future prospects of the business which is reflected in the

increase in interim dividend and I look forward to achieving

further value for our shareholders as we start the journey to

reposition ourselves as one company , unified under the Group name,

James Cropper."

S

Enquiries:

James Cropper plc

Rosina Merrett

Mob: +44 (0) 7500 083559

www.jamescropper.com

Shore Capital - NOMAD and Broker

Robert Finlay, Henry Willcocks, Lucy Bowden

Tel: +44 (0) 20 7601 6100

Buchanan Communications - Financial PR

Chris Lane, Charles Ryland, Jamie Hooper, Verity Parker

jamescropper@buchanancomms.co.uk

Tel: +44 (0) 207 466 5000

Notes for editors:

James Cropper is a market leader in Advanced Materials and Paper

Products, centred around four market audiences: Future Energy,

Technical Fibres, Luxury Packaging and Creative Papers.

A purpose-led business, built upon six generations of the

Cropper family, James Cropper has a 600+ international workforce

and an operational reach in over 50 countries.

Established in 1845, the Group manufactures creative papers,

luxury packaging and advanced materials incorporating pioneering

non-wovens and electrochemical coatings.

James Cropper is a specialist provider of niche solutions

tailored to a unique customer specification, ranging from

substrates and components in hydrogen electrolysis and fuel cells

to bespoke colours and textures in paper and moulded fibre

packaging designed to replace single use plastics.

The Group operates across multiple markets from luxury retail to

renewable energy. It is renowned globally for service, capability,

pioneering and multi award-winning commitment to the highest

standards of sustainability.

James Cropper's goal is to be operationally net zero by 2030 and

to reduce carbon through its entire supply chain to net zero by

2050.

Business review

Building on the previous year's strong second half, the first

six months of this year show an improved performance.

The economic climate continues to be challenging but overall,

profits for the Group were up, with profit before tax of GBP2.4m

(H1 FY23: loss GBP(0.9)m) and adjusted profit before tax at

GBP2.4m, compared with GBPnil in the prior comparative period. This

was due to an improved gross margin performance and cost management

as well as relief on energy procurement.

The Group continues to make significant progress in

repositioning James Cropper as an Advanced Materials and Paper

Products business, centred around four target audiences: Future

Energy, Technical Fibres, Luxury Packaging and Creative Papers,

with the accelerated growth strategy on track to capitalise on the

opportunities within its core and emerging end-markets.

A strategy for accelerated growth:

1. Profitable growth through new customer acquisition:

opportunities to expand in new and existing markets

2. World class execution: investment in global systems and functions

3. Technology and Innovation: Centre for Innovation will include

decarbonisation and waste fibres as well as exploring new ideas

4. Leaders in sustainability: recognising our responsibility to

reduce and ultimately eliminate our emissions

5. Inspiring our people: building a culture of trust, cooperation and involvement

6. Build the brand: presenting a more meaningful and relevant

face to our increasingly global customer base.

Over this period, the Group strengthened its leadership team

with Matthew Ratcliffe joining as General Counsel and Richard

Bracewell, internally appointed, as Managing Director of the Paper

Products division. As previously announced, Andrew Goody will join

the Company and the Board of Directors later this month as Chief

Financial and Operations Officer.

The Centre of Innovation function has further progressed the

decarbonisation programme with grant funding awarded. The project

has advanced to phase one construction to support the build of the

Low Carbon Energy Centre which will enable the electrification of

the paper manufacturing facility.

Revenue is broadly in line with the Board's expectations with

all divisions experiencing positive customer demand, albeit at a

lower rate than expected within Paper Products.

Advanced Materials (Future Energy and Technical Fibres)

Revenue for the division is ahead at GBP19.0m in comparison to

last year (H1 FY23: GBP17.4m).

Future Energy's hydrogen offer continues to exceed management's

expectations with profit and demand growing. In North America,

electrolyser manufacturers are now beginning to benefit from the

new coating line with its ability to shorten supply chain and

optimise logistics.

Demand within Technical Fibres remains steady, with growth seen

in its core customer base. The activation of the strategic growth

programmes is driving a healthy opportunity pipeline with

strengthened customer relationships, exploration of new business

partnerships and a focus on new growth markets such as Carbon

Capture and Electrolyser OEM.

Paper Products (Luxury Packaging and Creative Papers)

Over the last twelve months, measures have been implemented to

build strength and resilience in the division by restructuring and

consolidating operations to drive better asset utilisation with

increased efficiency and productivity.

The right-sizing of the division and consolidating Colourform

into Luxury Packaging and Creative Papers is showing gross margin

improvement and productivity gains despite tough market conditions

across the industry.

Operating margin has continued to improve, despite the Group no

longer applying an energy surcharge and some near term softening in

its paper markets. Revenue at GBP35.6m is broadly in line with the

previous year (H1 FY23: GBP42.0m) (H1 FY23: GBP38.1m excluding

energy surcharge).

The Board expects global demand, particularly within Luxury

Packaging, to normalise moving into FY25. In line with market

expectations, the division will be well positioned for further

gross margin improvements with the restructure completed and leaner

working practices implemented.

The capabilities within Paper have also widened with the new

Embossing Centre of Excellence in operation as well as expanding

the reclaimed and recycled fibre offer.

The long-standing partnership with the Royal British Legion saw

James Cropper support the launch of the first-ever 100%

plastic-free remembrance poppy, a partnership proudly held since

1978 and most recently, the division won the internationally

acclaimed Formes de Luxe award in the Moulded Pulp Packaging

category in collaboration with Maison Perrier-Jouët for Belle

Epoque 'Cocoon'.

Outlook

Within Advanced Materials, a scale up of additional capacity for

the Future Energy hydrogen offer is underway with accelerated

capital investment for the next phase of expansion in the UK

electrolyser manufacturing operations. New market opportunities for

Technical Fibres are expected to provide another year of

growth.

The Group also continues to make significant progress in

repositioning the business, unified under its business name, James

Cropper. To build greater brand equity in the market, the Group

will be launching a refreshed identity in Q4 FY24.

In the Paper division wider macro-economic pressures will endure

into the second half of the year. However, the completed

restructure and improved operational efficiencies will drive

further recovery in margin improvement and productivity.

The actions taken to date give the Board confidence that the

Group is well positioned to deliver increased profitability in FY24

consistent with its expectations and that, in line with the

accelerated growth strategy, revenue growth will be delivered from

FY25 onwards.

Financial Summary

Half-year Half-year Full-year

to 30 September to 24 September to 1

2023 2022 April

2023

GBPm GBPm GBPm

Revenue 56.5 61.6 129.7

Adjusted operating profit * 3.0 0.5 4.8

Operating profit /(loss) 3.6 (0.2) 3.3

Adjusted profit / (loss) before

tax * 2.4 (0.0) 3.2

Impact of IAS 19 (0.2) (0.3) (0.8)

Impact of exceptional items 0.2 (0.5) (1.1)

Profit / (loss) before tax 2.4 (0.9) 1.3

Earnings / (loss) per share - basic

and diluted 19.4p (9.2)p 5.4p

Dividend per share declared 3.0p 2.0p 6.0p

Net debt (13.3) (12.2) (16.6)

Equity shareholders' funds 33.9 34.3 32.1

Gearing % - before IAS 19 deficit 29% 28% 38%

Gearing % - after IAS 19 deficit 39% 35% 52%

Capital expenditure 1.4 2.4 5.8

* excludes the impact of IAS 19 and exceptional items (per note

8)

Financial Statement

Half-year Half-year Full-year

to 30 September to 24 September to 1 April

2023 2022 2023

GBP'000 GBP'000 GBP'000

Revenue

Paper Products division - excluding

energy surcharge 35,628 38,170 79,717

Paper Products division - energy

surcharge - 3,876 8,434

Colourform division 1,876 2,105 4,326

Technical Fibre Products division 18,995 17,432 37,187

---------------------------------------- ----------------- ----------------- ------------

56,499 61,583 129,664

Adjusted operating profit * 3,048 453 4,767

Fair value movement on derivatives - - (330)

Adjusted net interest (645) (466) (1,242)

---------------------------------------- ----------------- ----------------- ------------

Adjusted profit / (loss) before

tax * 2,403 (13) 3,195

IAS19 pension adjustments

Net current service charge against

operating profits 202 (126) (442)

Finance costs charged against interest (386) (178) (345)

---------------------------------------- ----------------- ----------------- ------------

2,219 (317) 2,408

Exceptional items (note 8) 340 (540) (986)

Exceptional finance costs (note

8) (131) - (109)

---------------------------------------- ----------------- ----------------- ------------

Profit / (loss) before tax 2,428 (857) 1,313

---------------------------------------- ----------------- ----------------- ------------

* excludes the impact of IAS 19 and exceptional items (per note

8)

Balance sheet summary Half-year Half-year Full-year

to 30 to 24 to 1

September September April

2023 2022 2023

GBP'000 GBP'000 GBP'000

Non-pension assets - excluding

cash 80,952 85,113 86,754

Non-pension liabilities - excluding

borrowings (21,636) (28,986) (25,990)

59,316 56,127 60,764

Net IAS19 pension deficit (after

deferred tax) (12,153) (9,677) (12,105)

------------------------------------- ----------- ----------- ----------

47,163 46,450 48,659

Net borrowings (13,312) (12,156) (16,594)

------------------------------------- ----------- ----------- ----------

Equity shareholders' funds 33,851 34,294 32,065

------------------------------------- ----------- ----------- ----------

Gearing % - before IAS19 deficit 29% 28% 38%

Gearing % - after IAS19 deficit 39% 35% 52%

Capital expenditure GBP'000 1,399 2,360 5,779

UN-AUDITED CONSOLIDATED INCOME STATEMENT

26 week 26 week 53 week

period period period

to 30 to 24 to 1

September September April

2023 2022 2023

---------------------------------------- ---------- ---------- ---------

GBP'000 GBP'000 GBP'000

Revenue 56,499 61,583 129,664

Provision for impairment (loss)

/ reversal (116) (69) 134

Other income 1,471 770 650

Changes in inventories (134) 1,975 817

Raw materials and consumables used (19,882) (23,359) (48,556)

Energy costs (3,866) (8,031) (15,162)

Employee benefit costs (17,845) (18,031) (34,459)

Depreciation and amortisation (2,289) (2,090) (4,278)

Other expenses (10,248) (12,961) (25,471)

Operating profit / (loss) 3,590 (213) 3,339

Fair value movement on derivatives - - (330)

Interest payable and similar charges (1,162) (644) (1,697)

Interest receivable and similar

income - - 1

Profit / (loss) before taxation 2,428 (857) 1,313

Taxation (570) (26) (797)

---------------------------------------- ---------- ---------- ---------

Profit / (loss) for the period 1,858 (883) 516

Earnings / (loss) per share - basic

and diluted 19.4p (9.2)p 5.4p

UN-AUDITED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Profit / (loss) for the period 1,858 (883) 516

---------------------------------------- ---------- ---------- ---------

Items that are or may be reclassified

to profit or loss

Exchange differences on translation

of foreign operations (80) 440 222

Cash flow hedges - effective portion

of changes in fair value 256 680 1,040

Cash flow hedges - cost of hedging 60 - (355)

Items that will never be reclassified

to profit or loss

Retirement benefit liabilities -

actuarial losses (411) (66) (3,888)

Deferred tax on actuarial losses

on retirement benefit liabilities 103 17 972

Other comprehensive income / (expense)

for the period (72) 1,071 (2,009)

---------------------------------------- ---------- ---------- ---------

Total comprehensive income / (expense)

for the period attributable to equity

holders of the Company 1,786 188 (1,493)

---------------------------------------- ---------- ---------- ---------

UN-AUDITED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

30 24 1

September September April

2023 2022 2023

GBP'000 GBP'000 GBP'000

------------------------------------- ------------ ------------------ ----------------

Assets

Intangible assets 1,441 2,219 1,524

Goodwill 1,264 1,264 1,264

Property, plant and equipment 32,191 31,636 32,717

Right of use assets 6,302 7,528 6,765

Other financial asset 657 - 654

Deferred tax assets 4,215 3,171 4,198

------------------------------------- ------------ ------------------ ----------------

Total non-current assets 46,070 45,818 47,122

------------------------------------- ------------ ------------------ ----------------

Inventories 18,166 19,638 18,304

Trade and other receivables 20,520 21,242 24,763

Provision for impairment (759) (846) (643)

Other financial assets 644 1,653 428

Cash and cash equivalents 12,348 14,147 7,679

Current tax assets 362 833 815

Total current assets 51,281 56,667 51,346

------------------------------------- ------------ ------------------ ----------------

Total assets 97,351 102,485 98,468

------------------------------------- ------------ ------------------ ----------------

Liabilities

Trade and other payables 16,678 24,864 21,106

Other financial liabilities - 415 58

Loans and borrowings 1,306 1,697 1,758

------------------------------------- ------------ ------------------ ----------------

Total current liabilities 17,984 26,976 22,922

------------------------------------- ------------ ------------------ ----------------

Long-term borrowings 24,354 24,606 22,515

Retirement benefit liabilities 16,204 12,902 16,140

Contingent consideration on business

acquisition 1,554 922 1,423

Deferred tax liabilities 3,404 2,785 3,403

Total non-current liabilities 45,516 41,215 43,481

------------------------------------- ------------ ------------------ ----------------

Total liabilities 63,500 68,191 66,403

------------------------------------- ------------ ------------------ ----------------

Equity

------------------------------------- ------------ ------------------ ----------------

Share capital 2,389 2,389 2,389

Share premium 1,588 1,588 1,588

Reserve for own shares (1,407) (1,407) (1,407)

Translation reserve 695 993 775

Cash flow hedging reserve 1,296 1,202 1,040

Cost of hedging reserve (295) - (355)

Retained earnings 29,585 29,529 28,035

------------------------------------- ------------ ------------------ ----------------

Total shareholders' equity 33,851 34,294 32,065

------------------------------------- ------------ ------------------ ----------------

Total equity and liabilities 97,351 102,485 98,468

------------------------------------- ------------ ------------------ ----------------

UN-AUDITED CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

26 week 26 week 53 week

period period period

to 30 to 24 to 1

September September April

2023 2022 2023

------------------------------------------------ ------------------- --------------------- ---------------------

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Profit / (loss) for the period 1,858 (883) 516

Adjustments for:

Tax expense 570 26 797

Depreciation and amortisation 2,289 2,090 4,278

Earn out adjustment on contingent consideration

on business acquisition - - 986

Net IAS 19 pension adjustments within

Statement of comprehensive income (202) 304 442

Past service pension deficit payments (531) (598) (1,665)

Foreign exchange differences (205) (125) (136)

Loss / (profit) on disposal of property,

plant and equipment 174 22 (589)

Net interest expense 1,162 464 1,696

Share based payments - - (59)

Fair value movement on derivatives - - 330

Changes in working capital:

Decrease /(increase) in inventories 171 (1,953) (696)

Decrease / (increase) in trade and other

receivables 4,318 1,517 (3,614)

(Decrease) / increase in trade and other

payables (4,495) 3,386 2,396

Tax (paid) /received (28) 1,057 868

Net cash generated from operating activities 5,081 5,307 5,550

Cash flows from investing activities

Purchase of intangible assets (5) (86) (1,126)

Purchases of property, plant and equipment (1,394) (2,274) (5,267)

Contingent consideration on business

acquisition paid - - (250)

Net cash used in investing activities (1,399) (2,360) (6,643 )

Cash flows from financing activities

Proceeds from issue of loans 2,000 5,189 5,050

Repayment of borrowings (201) (123) (288)

Repayment of lease liabilities (668) (674) (1,561)

Interest received - 1 1

Interest paid (481) (291) (858)

Non-deliverable forward contract payment - - (330)

Payments on interest rate cap - - (495)

Dividends paid to shareholders - (708) (897)

Net cash generated from financing activities 650 3,394 622

------------------------------------------------ ------------------- --------------------- ---------------------

Net increase/(decrease) in cash and

cash equivalents 4,332 6,341 (471)

Effect of exchange rate fluctuations

on cash held 337 56 400

------------------------------------------------ ------------------- --------------------- ---------------------

Net increase in cash and cash equivalents 4,669 6,397 (71)

Cash and cash equivalents at the start

of the period 7,679 7,750 7,750

------------------------------------------------ ------------------- --------------------- ---------------------

Cash and cash equivalents at the end

of the period 12,348 14,147 7,679

------------------------------------------------ ------------------- --------------------- ---------------------

Cash and cash equivalents consists

of:

Cash at bank and in hand 12,348 14,147 7,679

------------------------------------------------ ------------------- --------------------- ---------------------

UN-AUDITED CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Cash Cost

Reserve flow of

Share Share Translation for own hedging hedging Retained

capital premium reserve shares Reserve reserve earnings Total

-------------- --------- -------- ---------------- -------- ----------- ----------- ------------- ------------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 April

2023 2,389 1,588 775 (1,407) 1,040 (355) 28,035 32,065

Comprehensive

income

for the

period - - - - - - 1,858 1,858

Total other

comprehensive

income - - (80) 256 60 (308) (72)

Dividends paid - - - - - - - -

Total

contributions

by and -

distributions

to owners of

the Group - - - - - - -

-------------- --------- -------- ---------------- -------- ----------- ----------- ------------- ------------

At 30

September

2023 2,389 1,588 695 (1,407) 1,296 (295) 29,585 33,851

-------------- --------- -------- ---------------- -------- ----------- ----------- ------------- ------------

At 26 March

2022 2,389 1,588 553 (1,407) - - 31,691 34,814

Comprehensive

expense

for the

period - - - - - - (883) (883)

Total other

comprehensive

income - - 440 - 1,202 - (571) 1,071

Dividends paid - - - - - - (708) (708)

Total

contributions

by and

distributions

to owners of

the Group - - - - - - (708) (708)

-------------- --------- -------- ---------------- -------- ----------- ----------- ------------- ------------

At 24

September

2022 2,389 1,588 993 (1,407) 1,202 - 29,529 34,294

-------------- --------- -------- ---------------- -------- ----------- ----------- ------------- ------------

NOTES TO THE CONDENSED CONSOLIDATED HALF YEAR STATEMENTS

1 BASIS OF PREPARATION

James Cropper Plc (the Company) is a public limited company

incorporated and domiciled in the United Kingdom and listed on the

Alternative Investment Market (AIM) market of the London Stock

Exchange. The condensed consolidated half year financial statements

of the Company for the twenty six weeks ended 30 September 2023,

which have not been audited or reviewed, comprise the Company and

its subsidiaries (together referred to as the Group).

Basis of preparation

The condensed consolidated financial statements for the 26 week

periods ending 30 September 2023 and 24 September 2022 are

unaudited and were approved by the Directors on 8 November 2023.

They do not constitute statutory accounts as defined in s434 of the

Companies Act 2006. The financial statements for the year ended 1

April 2023 were prepared in accordance with UK adopted

international accounting standards and with those parts of the

Companies Act 2006 applicable to companies reporting under IFRS,

and have been delivered to the Registrar of Companies. The report

of the auditor on those financial statements was unqualified and

did not draw attention to any matters by way of emphasis of matter.

The Group's financial statements consolidate the financial

statements of James Cropper Plc and its subsidiaries.

Applicable standards

These unaudited consolidated interim financial statements have

been prepared in accordance with international accounting standards

as adopted by the UK, under the historical cost convention except

for the revaluation of certain financial instruments to fair value.

They have not been prepared in accordance with IAS 34, the

application of which is not required to the interim financial

statements of companies trading on the Alternative Investment

Market (AIM companies).

The consolidated financial statements of the Group for the 53

week period ended 1 April 2023 are available upon request from the

Company's registered office: Burneside Mills, Kendal, Cumbria, LA9

6PZ or at www.jamescropper.com .

The half year financial information is presented in Sterling and

all values are rounded to the nearest thousand pounds (GBP'000)

except where otherwise indicated.

Going concern

The Directors, at the time of approving these interim

statements, have a reasonable expectation that the Group has

adequate resources to continue in operational existence for at

least 12 months from this reporting date.

For the interim going concern review, the Board has reviewed the

Group's financial forecasts for the 2 year period ending 31 March

2025 against which a number of scenarios assess headroom against

facilities and impacts on bank covenants, which showed adequate

headroom and no covenant breaches.

Following this review the Directors are satisfied that the Group

have adequate resources to continue in operational existence for

the foreseeable future. Accordingly, they continue to adopt the

going concern basis in preparing the condensed consolidated

financial statements.

Significant accounting policies

The accounting policies applied by the Group in these condensed

consolidated financial statements are the same as those applied by

the Group in its consolidated financial statements as at and for

the 53 week period ended 1 April 2023.

2 Accounting estimates and judgements

The preparation of half year financial statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expenses. Actual

results may differ from these estimates.

The significant judgements made by management in applying the

Group's accounting policies and the key sources of estimation

uncertainty were the same as those applied to the consolidated

financial statements as at and for the 53 week period ended 1 April

2023.

3 Risks and uncertainties

The principal risks and uncertainties which may have the largest

impact on performance in the second half of the year are the same

as disclosed in the 2023 Annual Report on pages 21-25. The

principal risks set out in the 2023 Annual Report were:

Pension; network and systems security; security of supply; fire;

net zero emissions; employee health and safety; attraction and

retention of key skills and talent; energy price volatility and

corporate and regulatory compliance risk.

The Board considers that all principal risks and uncertainties

set out in the 2023 annual report have not changed and remain

relevant for the second half of the financial year.

4 Alternative performance measures

The Company uses alternative performance measures to allow users

of the financial statements to gain a clearer understanding of the

underlying performance of the business.

Profit before tax represents the Group's overall performance,

however it contains significant non-operational items relating to

IAS 19 that the directors believe make year-on-year comparison of

performance challenging.

Measures used to evaluate business performance are 'Adjusted

operating profit' (operating profit excluding the impact of IAS 19

and exceptional items) and 'Adjusted profit before tax' (profit

before tax excluding the impact of IAS 19 and exceptional items).

The alternative performance measures are reconciled in note 9.

The adjustment, which we refer to in these accounts as the "IAS

19 impact" represents the difference between the pension charge as

calculated under IAS 19 and the cash contributions for the current

service cost only as determined by the latest triennial valuation.

The Directors consider that the adjusted pension charge better

reflects the actual pension costs for ongoing service compared to

the IAS 19 charge. This adjustment is made internally when we

assess performance and is also used in the profit and earnings per

share targets used in management incentive schemes.

5 Earnings per share

Six months Six months

ended 30 ended 24 Year ended

September September 1 April

2023 2022 2023

-------------------------------- ----------- ----------- ------------

Earnings / (loss) per share

- basic and diluted 19.4p (9.2)p 5.4p

Profit / (loss) for the period

(GBP'000) 1,858 (883) 516

-------------------------------- ----------- ----------- ------------

Weighted average number of

shares -

basic and diluted 9,554,803 9,554,803 9,554,803

6 Dividends

The proposed interim dividend of 3.0p (H1 FY23: 2.0p) per 25p

ordinary share is payable on 8 January 2024 to those shareholders

on the register of the Company at the close of business on 8

December 2023, with an ex-dividend date of 7 December 2023.

7 Retirement benefit obligations

53 week

26 week period 26 week period period ended

ended 30 September ended 24 September 1 April

2023 2022 2023

------------------------------- -------------------- -------------------- --------------

GBP'000 GBP'000 GBP'000

Obligation brought forward (16,140) (13,130) (13,130)

Expense recognised in

the income statement (563) (568) (1,319)

Contributions paid to

the schemes 910 862 2,197

Actuarial (losses) recognised

in Other Comprehensive

Income (411) (66) (3,888)

------------------------------- -------------------- -------------------- --------------

Obligation carried forward (16,204) (12,902) (16,140)

------------------------------- -------------------- -------------------- --------------

8 Exceptional items

26 week 53 week

period ended 26 week period period

30 September ended 24 September ended 1

2023 2022 April 2023

------------------------------- ---------------- -------------------- ------------

GBP'000 GBP'000 GBP'000

Included in employee benefit

costs:

Restructuring costs 760

Included in other expenses:

Restructuring costs 304 - -

Increase in earn-out provisions - 540 986

Included in other income:

Legal settlement (1,404) - -

------------------------------- ---------------- -------------------- ------------

Exceptional items excluding

finance costs (340) 540 986

Included in finance costs:

Unwind of discount on

earn-out

provision 131 - 109

------------------------------- ---------------- -------------------- ------------

Exceptional items (209) 540 1,095

------------------------------- ---------------- -------------------- ------------

Restructuring costs incurred to date amount to GBP1,064k, the

group restructure is expected to be complete by year end.

A settlement of a historic pension legal dispute was agreed in

the current period resulting in the recognition of income of

GBP1,404k.

9 Alternative performance measures

26 week period 26 week period 52 week

ended 30 September ended 24 September period ended

2023 2022 1 April 2023

GBP'000 GBP'000 GBP'000

Adjusted operating

profit 3,048 453 4,767

Net IAS 19 pension

adjustments - current

service costs 202 (126) (442)

Exceptional items 340 (540) (986)

------------------------ -------------------- -------------------- --------------

Operating profit

/ (loss) 3,590 (213) 3,339

------------------------ -------------------- -------------------- --------------

26 week period 26 week period 53 week

ended 30 September ended 24 September period ended

2023 2022 1 April 2023

GBP'000 GBP'000 GBP'000

Adjusted profit / (loss)

before tax 2,403 (13) 3,195

Net IAS 19 pension

adjustments

- current service

costs (177) (390) (974)

- future service contributions

paid 379 264 532

- finance costs (386) (178) (345)

Exceptional items 209 (540) (1,095)

--------------------------------- -------------------- -------------------- --------------

Profit / (loss) before

tax 2,428 (857) 1,313

--------------------------------- -------------------- -------------------- --------------

10 Related parties

There have been no significant changes in the nature of related

party transactions in the period ended 30 September 2023 from that

disclosed in the 2023 annual report.

Statement of Directors' responsibilities

The Directors confirm that these condensed consolidated interim

financial statements have not been prepared in accordance with IAS

34 as adopted by the UK and that the interim management report

includes a fair review of the information required by DTR 4.2.7 and

DTR 4.2.8, namely:

(i) An indication of important events that have occurred during

the first six months and their impact on the condensed set of

financial statements, and a description of the principal risks and

uncertainties for the remaining six months of the financial year;

and

(ii) Material related party transactions in the first six months

and any material changes in the related party transactions

described in the last Annual report.

The Directors of James Cropper Plc are detailed on our Group website www.jamescropper.com

Forward-looking statements

Sections of this half-yearly financial report may contain

forward-looking statements with respect to the Group's plans and

expectations relating to its future performance, results, strategic

initiatives, objectives and financial position, including liquidity

and capital resources. These forward-looking statements are not

guarantees of future performance. By their very nature, all

forward-looking statements involve risks and uncertainties because

they relate to events that may or may not occur in the future and

are or may be beyond the Group's control. Accordingly, the Group's

actual results and financial condition may differ materially from

those expressed or implied in any forward-looking statements.

Forward-looking statements in this half-yearly financial report are

current only as of the date on which such statements are made. The

Group undertakes no obligation to update any forward-looking

statements, save in respect of any requirement under applicable law

or regulation. Nothing in this announcement shall be construed as a

profit forecast.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FSEESAEDSESF

(END) Dow Jones Newswires

November 09, 2023 02:00 ET (07:00 GMT)

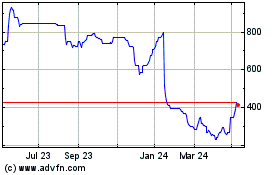

Cropper (james) (LSE:CRPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

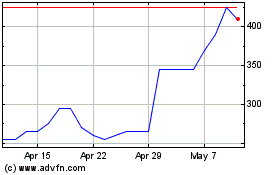

Cropper (james) (LSE:CRPR)

Historical Stock Chart

From Apr 2023 to Apr 2024