TIDMDNLM

RNS Number : 5776G

Dunelm Group plc

20 July 2023

20 July 2023

Dunelm Group plc

Q4 and full year trading update

Continued robust sales, profit expected to be slightly ahead of

current market expectations

Dunelm Group plc ("Dunelm" or "the Group"), the UK's leading

homewares retailer, updates on trading for the 13-week period ended

1 July 2023 and for the full year.

Full year YoY(2) Q4 FY23 YoY(2)

FY23

-----------------

Total sales GBP1,639m +6% GBP381m +6%

---------- ------- -------- -------

Digital % total

sales(1) 36% +1ppts 39% +2ppts

---------- ------- -------- -------

(1) Digital includes home delivery, Click & Collect and

tablet-based sales in store

(2) For statutory purposes, FY22 included a 53(rd) week. YoY

growths are presented on a comparable 13/52 week basis

Highlights

-- Continuing robust growth in Q4, with sales of GBP381m

-- Strong full year sales growth of 6%, in a challenging consumer environment

-- FY23 profit before tax expected to be slightly ahead of current market expectations(3)

(3) The current company compiled average of analysts'

expectations for FY23 PBT is GBP188m

Continued sales momentum and a strong Summer Sale

Q4 FY23

We continued to see good sales momentum in the fourth quarter,

with robust sales growth of 6% and total sales of GBP381m. Digital

sales made up 39% of total sales in the quarter, 2ppts higher than

FY22.

We remain, as ever, focussed on offering our customers a great

choice of products and outstanding value across all our ranges and

price points. During the quarter our customers were able to take

advantage of great offers during our Summer Sale, and we reduced

prices on over 1,000 lines. We are pleased that in the quarter we

saw particularly strong volume growth.

Our product offer continued to resonate strongly with customers

throughout the quarter, with cooler weather driving sales of our

bedding and rugs ranges, while our Summer Living collections, in

particular garden furniture and decorations, performed well in the

warmer weather towards the end of the period.

FY23

Total sales of GBP1,639m for the full year were 6% higher than

FY22, on a comparable 52-week basis. Compared to FY19 (the last

full year before any impact from Covid) total sales are nearly 50%

higher and digital sales now make up 36% of total sales (FY19:

20%). Dunelm is now a bigger and better business with a

significantly improved customer proposition and more customers

engaging with our brand.

Profit expected to be slightly ahead of market expectations

Gross margin for the full year is expected to be in line with

our guidance of c.50%.

We expect profit before tax for the full year to be slightly

ahead of current analysts' consensus of GBP188m. This performance

reflects our continued robust sales performance, strong commercial

disciplines and tight operational grip on costs.

Summary and outlook

We achieved another strong performance in FY23 against a

backdrop of increasing input cost prices for much of the year and

high general inflation. We continued to offer outstanding value

across our broad range of product categories, from everyday

necessities to rewarding essentials as well as more considered

purchases. Our tight operational grip delivered gross margin in

line with our expectations with profit before tax expected to be

slightly ahead of analysts' consensus.

We see very significant headroom to deliver further profitable

growth, seizing the opportunity to raise the bar further on our

customer offer, especially in terms of value. We will therefore

continue to invest in digitalising and developing our business to

improve both our customer offer and to make our operations more

efficient. Our next new store in South East London, our 180(th) ,

will open shortly, increasing the reach of our total retail system

and bringing our offer to more communities.

We are pleased with trading so far in the new financial year.

Whilst the consumer outlook remains uncertain, we will keep

focussing on delivering outstanding value and relevance to our

customers. We will continue to invest thoughtfully for the future

and are excited by the opportunities ahead to achieve further

market share gains.

Nick Wilkinson, Chief Executive Officer, commented:

"The breadth and relevance of our product offer has continued to

resonate with our home-loving customers over the last quarter of

the year. This has been reflected in our strong financial

performance despite the challenging broader consumer backdrop.

"Against this backdrop, our commitment to value is stronger than

ever. During the quarter we lowered prices on over 1,000 lines, and

our customers were also able to take advantage of great offers in

our Summer Sale.

"We have a strong business model, with committed colleagues and

suppliers, who strive every day to improve our customer

proposition. We continue to focus on further strengthening our

product mastery, developing our stores, enhancing our digital

channels, and building out our marketing ecosystem, in order to

create an even better experience for our customers. With these

improvements to our customer proposition and business capabilities

we see a compelling opportunity for sustainable and profitable

growth and are confident about the future."

For further information please contact:

Dunelm Group plc investorrelations@dunelm.com

Nick Wilkinson, Chief Executive Officer

Karen Witts, Chief Financial Officer

MHP 07595 461 231

Oliver Hughes / Rachel Farrington / Charles Hirst dunelm@mhpgroup.com

Next scheduled event:

Dunelm will make its preliminary results announcement on 20

September 2023 .

Quarterly analysis:

52 weeks to 1 July 2023

Q1 Q2 H1 Q3 Q4 H2 FY

---------- ---------- ---------- ---------- ---------- ---------- ------------

Total sales GBP356.7m GBP478.3m GBP835.0m GBP423.3m GBP380.5m GBP803.8m GBP1,638.8m

---------- ---------- ---------- ---------- ---------- ---------- ------------

Total sales

growth -8.3% 17.6% 5.0% 6.1% 6.1% 6.1% 5.5%

---------- ---------- ---------- ---------- ---------- ---------- ------------

Digital % total

sales 33% 35% 34% 36% 39% 37% 36%

---------- ---------- ---------- ---------- ---------- ---------- ------------

52 weeks to 25 June 2022

Q1 Q2 H1 Q3 Q4(4) H2(4) FY(4)

---------- ---------- ---------- ---------- ---------- ---------- ------------

Total sales GBP388.8m GBP406.8m GBP795.6m GBP399.0m GBP358.5m GBP757.5m GBP1,553.1m

---------- ---------- ---------- ---------- ---------- ---------- ------------

Total sales 22.8

growth 8.3% 12.9% 10.6% 68.6% -5.7% % 16.2%

---------- ---------- ---------- ---------- ---------- ---------- ------------

Digital % total

sales 33% 33% 33% 35% 37% 36 % 35%

---------- ---------- ---------- ---------- ---------- ---------- ------------

(4) FY22 results shown on a comparable 52-week basis. On a

53-week basis, Q4 sales were GBP386.7m and full year sales were

GBP1,581.4m.

Notes to Editors

Dunelm is the UK's market leader in homewares, with a specialist

offering for customers across multiple categories via its 179

predominantly out-of-town superstores and website, dunelm.com.

The business was founded in 1979 as a market stall, selling

ready-made curtains. The first shop was opened in Leicester in

1984, with the first superstore opening in 1991. With a vision to

become the 1(st) Choice for Home, Dunelm offers quality, value and

style throughout its extensive product range, alongside services

such as Home Delivery, Click & Collect and Made to Measure

window treatments. From its textiles heritage in areas such as

bedding, curtains, cushions, quilts and pillows, Dunelm has

broadened its range into categories including furniture,

kitchenware, dining, lighting, outdoor, craft and decoration. Its

c.65,000 product lines include specialist own brands and labels

such as Dorma and Fogarty, sourced from long-term committed

suppliers.

Dunelm's purpose is 'To help create the joy of truly feeling at

home, now and for generations to come'. It has an ambitious

'Pathway to Zero' strategy designed to drive its approach to

climate change, with a focus on reducing carbon emissions and

developing a circular economy mindset. In 2022 Dunelm launched

'Conscious Choice', a collection of products which help its

customers make more thoughtful decisions through products that last

longer and are made from more sustainable materials.

The business is headquartered in Leicester and employs over

11,000 colleagues. It has been listed on the London Stock Exchange

since October 2006 (DNLM.L) and has a current market capitalisation

of approximately GBP2.3bn.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTKZGMNNLLGFZM

(END) Dow Jones Newswires

July 20, 2023 02:00 ET (06:00 GMT)

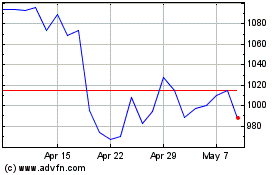

Dunelm (LSE:DNLM)

Historical Stock Chart

From Apr 2024 to May 2024

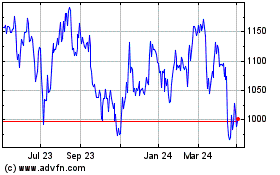

Dunelm (LSE:DNLM)

Historical Stock Chart

From May 2023 to May 2024