TIDMDPA

RNS Number : 4204Q

DP Aircraft I Limited

29 August 2014

DP Aircraft I Limited (the "Company")

Please see below the Unaudited Interim Report for the period

from 1 January 2014 to 30 June 2014. This Interim Report also

includes figures for the period since incorporation on 5 July 2013

to 30 June 2014.

COMPANY OVERVIEW

DP Aircraft I Limited was incorporated with limited liability

in Guernsey under The Companies (Guernsey) Law, 2008

as amended, on 5 July 2013 with registered number 56941.

The Company was established to invest in aircraft. The

Company is a holding company, and makes its investment

in aircraft through two wholly owned subsidiary entities,

DP Aircraft Guernsey I Limited and DP Aircraft Guernsey

II Limited (collectively and hereinafter, the 'Borrowers'),

each being a Guernsey Incorporated company limited by

shares and an intermediate lessor (the 'Lessor'), an

Irish incorporated private limited company. The Company

and its subsidiaries (the Borrowers and the Lessor) comprise

the Group.

Pursuant to the Company's Prospectus dated 27 September

2013, the Company offered 113,000,000

Ordinary Preference Shares (the 'Shares') of no par value

in the capital of the Company at an issue price of US$1.00

per Share by means of a Placing. The Company's Shares

were admitted to trading on the Official List of the

Channel Islands Stock Exchange and to trading on the

Specialist Fund Market of the London Stock Exchange on

4 October 2013.

INVESTMENT OBJECTIVE & POLICY

The Company's investment objective is to obtain income

and capital returns for its Shareholders by acquiring,

leasing and then, when the Board considers it appropriate,

selling aircraft (the 'Asset' or 'Assets').

To pursue its investment objective, the Company intends

to use the net proceeds of placings and other equity

capital raisings, together with loans and borrowings

facilities, to acquire aircraft which will be leased

to one or more international airlines.

THE BOARD

The Board comprises three independent non-executive directors.

The Directors of the Board are responsible for managing

the business affairs of the Company in accordance with

the Articles of Incorporation and have overall responsibility

for the Company's activities, including portfolio and

risk management while the asset management of the Group

is undertaken by DS Aviation GmBH & Co. KG (the 'Asset

Manager').

THE ASSET MANAGER

The Asset Manager has undertaken to provide the asset

management services to the Company under the terms of

an asset management agreement but does not undertake

any regulated activities for the purpose of the UK Financial

Services and Markets Act 2000.

DISTRIBUTION POLICY

The Company aims to provide Shareholders with an attractive

total return comprising income, from distributions through

the period of the Company's ownership of the Assets,

and capital, upon any sale of the Assets. The Company

targets a quarterly distribution in February, May, August

and November of each year. The target distribution is

2.25 cents per Share per quarter. Three quarterly distributions

have been made at the date of this report, each meeting

the 2.25 cents per Share target. The target dividends

are targets only and should not be treated as an assurance

or guarantee of performance or a profit forecast.

Fact Sheet - DP aircraft I Limited

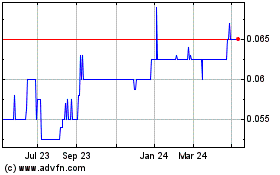

Ticker DPA

Company Number 56941

ISIN Number GG00BBP6HP33

SEDOL Number BBP6HP3

Traded SFM

SFM Admission Date 4 October 2013

Share Price 106 pence as at 14 August 2014

Listed CISE

CISE Listing Date 4 October 2013

Country of Incorporation Guernsey

Current Shares in Issue 113,000,000

Administrator and Company Secretary Dexion Capital (Guernsey) Limited

Asset Manager DS Aviation GmbH & Co. KG

Auditor and Reporting Accountant KPMG, Chartered Accountants

Corporate Broker Canaccord Genuity Limited

Aircraft Registration EI-LNA

EI-LNB

Aircraft Serial Number 35304

35305

Aircraft Type and Model B787-8

Lessee Norwegian Air Shuttle ASA

Website www.dpaircraft.com

HIGHLIGHTS

PROFIT BEFORE TAX

Profit Before Tax of 4.367 cents per Share for the interim

accounting period from 1 January 2014 to 30 June 2014,

driven by the leasing of two Boeing 787-8 aircraft. No

tax arises on the profit of the Company as it is Guernsey

resident where the standard rate of income tax for companies

is nil. Therefore the Profit Before and After tax is

the same.

NET ASSET VALUE

A Net Asset Value ('NAV') per Share (post the interim

dividends) of 95.262 cents per Share as at 30 June 2014.

INTERIM DIVIDENDS

Two interim dividends each of 2.25 cents per Share.

CHAIRMAN'S STATEMENT

I am pleased to present Shareholders with the second

interim report of the Company for the six month period

to 30 June 2014, as well as for the full period from

incorporation on 5 July 2013 to 30 June 2014. A separate

report for the period from incorporation to 31 December

2013 ("the first interim report") will be released shortly.

I and my fellow Directors, Didier Benaroya and Jeremy

Thompson, were delighted with the success of the initial

public offering (the 'IPO') and subsequent Listing and

Trading as described in the Company Overview introduction

in this report.

Two incidents in early 2013, prior to the launch of the

IPO, saw all Boeing 787-8 aircraft delivered prior to

that date grounded for approximately two months. Following

a redesign of the battery system providing for additional

layers of safety, the Federal Aviation Authority lifted

the flight ban on 19 April 2013, which allowed the IPO

preparation to continue.

On 9 October 2013, we completed the acquisition of our

first two aircraft, each a Boeing 787-8 or 'Dreamliner'.

A Dreamliner is a twin-engine long range aircraft, distinguished

by its entirely new aircraft design, composite materials

and variety of technical innovations. Each aircraft was

acquired by one of the Company's wholly owned subsidiaries,

DP Aircraft Guernsey I Limited and DP Aircraft Guernsey

II Limited. The Lessor and Trustee for each aircraft

is DP Aircraft Ireland Limited. Each aircraft was purchased

with the benefit of pre-negotiated leases with Norwegian

Air Shuttle ASA ('Norwegian' or the 'Lessee') each with

a term of twelve years from their respective commencement

dates, and these are successfully producing income for

our investors. I am pleased to report there are no issues

to bring to the attention of Shareholders concerning

the performance of the Lessee.

I recently flew on a Norwegian 787-8 to and from the

U.S.A. and from the U.K. and was impressed with the innovations

and superior environment.

The total shareholder return for this second accounting

period of 4.367 cents per Share is as expected. Full

performance by Norwegian of its lease obligations allowed

the Company to meet its target dividends of 2.25 cents

per Share for the quarters ending December, March and

June 2014. The net asset value per share as at 30 June

2014 was 95.262 cents per Share.

The outlook for the period to 31 December 2014, our first

full accounting period end, is described fully in the

Asset Manager's Report that follows. The Asset Manager

will advise the Directors of any further acquisition

opportunities as they arise.

The Company's annual general meeting ('AGM') is scheduled

for 2 January 2015. As our first full set of audited

financial statements will not be available for Shareholders

at that time we anticipate adjourning the AGM until a

later date in early 2015. It is expected that the normal

laying of audited financial statements at each future

AGM will take place.

I would like to thank our Investors for their support

in the IPO. I and my fellow Directors are available via

our Company Secretary whose details can be found at the

end of this report.

Jon Bridel

Chairman

ASSET MANAGER'S REPORT

Overview and Development - The Aviation Market

Growth in demand for air travel has continued steadily,

with passenger traffic in May 2014 up 6.2 per cent on

the previous year according to the International Air

Transport Association (IATA). On average it is estimated

that passenger traffic will grow by 5.9 per cent in 2014.

Moreover, airlines' financial performance during the

first quarter of 2014 has particularly improved on the

operating level. According to IATA's latest published

expectations, net profits for 2014 will be USD 18.0 billion,

which would be an increase of around 40 per cent on 2013.

Furthermore, it is estimated that 3.3 billion passenger

and goods worth USD 6.8 trillion will be transported

by air this year.

Taking a closer look at the European aviation market,

economic growth within the Eurozone came in below expectations

in the first quarter of 2014 but is expected to accelerate

in the second quarter. In May, the 6.4 per cent increase

in Revenue Passenger Kilometres (RPK) for European airlines

compared to the same month the previous year was above

the global average. In addition, it is anticipated that

net post-tax profits for European carriers may more than

quadruple in 2014.

Crude oil prices remain high, amongst other reasons due

to the conflict in Ukraine, Iraq, Syria and Israel. Given

that fuel represents the largest percentage of operating

costs for an airline, technological improvements and

the availability of a fleet of aircraft bene-fitting

from the latest technology, such as the Dreamliner Boeing

B787, are significant factors for an air carrier as it

seeks to optimise its cost level. Another way to ameliorate

the cost structure is through an increase in labour productivi-ty;

the latter is expected to increase globally by 2.5 per

cent. Despite this, total employment is also expected

to rise, by 2.6 per cent, due to overall global growth

in air traffic. There is also a more structural change

within the industry, with the air transport product becoming

ever more integrated with legacy carriers. As yields

have been under pressure in recent years, airlines have

concentrated on generating ancillary revenues e.g. by

charging for the reservation of seats with additional

legroom. This offers airlines the possibility to sig-nificantly

improve their operating results while still offering

competitive air fares.

The long term outlook for the aviation market and the

demand for new aircraft remain positive. Air travel and

air freight are products for which there are very few

substitutes. According to their current market outlooks,

Boeing (Current Market Out-look 2014-2033) and Airbus

(Global Market Forecast 2013-2032) are of the opinion

that passenger fleets will double by 2033 and 2032 respectively.

Boeing estimates annual growth rates of airline passengers

at 4.2 per cent and of airline traffic (RPK) at 5.0 per

cent on average; while global GDP will grow annually

by only 3.2 per cent on average. This year, IATA ex-pects

the global fleet to increase both in number (by around

600 aircraft) and also slightly by average size of aircraft.

According to the latest Airline Business Confidence Index

(April 2014 survey), 76 per cent of participating CFOs

and Heads of Cargo believe that there will be an increase

in de-mand for air travel over the next 12 months; this

is 4 per cent higher than the comparable figure from

the last survey in January 2014. On top of that, nearly

73 per cent of res-pondents believe that passenger yields

will remain stable or increase over the next 12 months.

Furthermore, the results of the survey in regard to cargo

are positive reflecting significant developments in the

demand environment; and the expectations of the last

survey that cargo volume will increase at rates not seen

since the middle of 2010 remain unchanged.

The Boeing B787 Dreamliner still ranks alongside the

Airbus A350 (which is expected to enter into service

in the fourth quarter this year) as the latest technological,

mid-size wide-body aircraft available in the market.

As at July 1 2014, 162 Boeing B787 had been delivered

to 21 different airlines and more than 20 million passengers

had been commercially transported. With a backlog of

over 860 aircraft in June 2014, and production fully

sold out until 2019, it is clear that the aircraft remains

in high demand. On top of that, Boeing's Current Market

Outlook highlights the fact that the B787-8 offers airlines

the opportunity to open up new markets and new non-stop

routes like London - Austin and Stockholm - Fort Lauderdale.

Since DP Aircraft I Limited took title of its two aircraft

last year (registration numbers EI-LNA and EI-LNB), Norwegian

has met all of its lease obligations in full. The airline

received its seventh B787-8 in June this year and one

more is due at the end of this year. Hence the minimum

target fleet size of five aircraft has been reached,

enabling the carrier to operate a long-haul network on

a fully economically efficient basis. The carrier operates

the aircraft in a two-class configuration seating 32

premium economy plus 259 economy passengers. The airline

reports that it and its customers are highly satisfied

with the aircraft.

Both of the aircraft were physically inspected at Stockholm's

Arlanda Airport in April this year. The inspection was

documented by photographs of the aircraft interior and

exterior. Norwegian's Maintenance Operation Manager,

as well as a Boeing Maintenance control engineer, were

present in case of the need for assistance. (At least

one Boeing representative is always on site during Norwegian's

B787 aircraft downtime at all destinations of the carrier's

long-haul network as part of the Gold Care Agreement

with Boeing.) No areas of concern could be found and

both aircraft appear to be maintained to a very high

standard.

The table overleaf below gives an overview about the

utilisation of airframe and engines. One of LNB's engines,

Engine Serial Number (ESN) 10130, and one of LNA`s engines,

ESN 10118, have undergone an upgrade at Rolls Royce's

Derby facilities. The upgrade extends the maintenance

intervals of the engines and therefore decreases maintenance

costs. LNA's second engine, ESN 10119, and LNB's second

engine, ESN 10135, are currently undergoing this upgrade

as well.

In May, DS Aviation GmbH & Co. KG, the Asset Manager

of DP Aircraft I Limited, and UK-based aircraft lessor,

marketing and management organisation Skytech-AIC formed

a new joint venture. This new company is named DS Skytech

Limited and will provide technical asset management in

regard to the combined owned and managed aircraft portfolio

of the two organisations. DS Skytech will also provide

technical asset management services to the Company from

May 2015 onwards.

DS Skytech is a UK-registered company located near Farnborough

in Hampshire and equally owned by DS Aviation, the aircraft

leasing unit of Dr. Peters Group, and Skytech-AIC. The

objective of this Joint Venture is to provide a new industry

benchmark in management service quality. In this way,

it is envisaged that DP Aircraft I Limited will profit

from the provision of enhanced in-house technical asset

management services.

The Assets- two Boeing DreamlinerB787-8

Airframe LNA LNB

Status

(30 June

2014)

Total June 2014 Total June 2014

Flight hours 4,217:08 250:51 4,034:57 384:57

Cycles 603 26 533 73

Block hours 11.46 8.35 12.93 12.82

Flight hours/

Cycles Ratio 6.99 : 1 9.64 : 1 7.57 : 1 5.27 : 1

Engine Data

(30 June 2014)

Engine Serial

Number 10118 10119 10130 10135

Engine Rolls-Royce Rolls-Royce Rolls-Royce Rolls-Royce

Manufacturer

Engine Type and Trent 1000 Trent 1000 Trent 1000 Trent 1000

Model

Total Time

[flight hours] 3,109:17 4,127:10 1,197:57 3,503:32

Total Cycles 497 594 115 423

LLP Various HPT Various HPT Various HPT Various HPT

Components Components Components Components

Cycles to LLP

Replacement 3,003 2,906 3,385 3,007

Location LNA In Shop LNA In Shop

Norwegian Air Shuttle - Scandinavia's second largest

airline - has been operating since 1993 and transported

more than 20 million passengers in 2013. Since May 2013

the airline has offered long-haul services; currently

operating to six destinations in Thailand and USA from

Scandinavia and London Gatwick. The next route to be

opened will be Copenhagen-Bangkok by end of October this

year. Norwegian attracts both passengers originating

in Scandinavia as well as in the United States and Asia.

As is well known, Asia in particular represents one of

the fastest growing tourism markets for outbound traffic,

offering Norwegian an attractive source for new business.

The 2013 financial year was the seventh consecutive year

in which the airline has made a profit despite some events

which have significantly impacted their results. A drop

in bookings due to the extraordinarily good summer weather

in Scandinavia 2013, higher expenses due to the necessary

wet-lease of Airbus A340 as a result of the late delivery

of the Dreamliner, as well as start-up investments to

establish long-haul operations and its new base in London

Gatwick, put Norwegian's yields and net profit under

pressure, seeing them decrease by 10 per cent and 30

per cent respectively. The carrier estimates the costs

associated with the start-up of the long-haul business

to be around NOK 216 million (around US$ 35.6 million).

Moreover, the consolidated financial statements for 2013

show a net profit of NOK 321,564 million (around US$

53 million), a decrease of 30 per cent on 2012. However,

the load factor only decreased by 1 per cent and EBITDAR

and EBIT (operating profit) increased by 53 per cent

and 140 per cent correspondingly. EBIT in 2013 amounted

to NOK 969,658 million (around US$ 160 million).

Norwegian's revenues in 2013 were around 15.6 NOK billion

(around US$ 2.6 billion) and up by 21 per cent against

2012. Ancillary revenues, which are important in Norwegian's

business strategy, increased by 6 per cent, whereas unit

costs decreased by 6 per cent in the same period. In

the first quarter of 2014, compared to the same period

of the preceding year, the carrier increased its ancillary

revenues by 25 per cent. The 2013 income statement showed

an increase in equity of 13 per cent and in cash of 25

per cent based on an YTD comparison between 2013 and

2012. The equity ratio stood at 18.6 per cent at the

end of 2013.

Norwegian Air Shuttle ASA continues to grow. The carrier

increased its number of passengers in June 2014 by 21

per cent compared to the same month in 2013. Furthermore

available seat kilometres (ASK) and RPK increased by

39 per cent and 45 per cent respectively over the same

period. On top of this, first quarter results for 2014

emphasised growing market shares in all markets of Norwegian

Air Shuttle ASA compared to the same period in 2013.

At Oslo Airport the carrier holds a market share of 39

per cent.

The airline is also optimising its cost structure and

cost levels, and is further developing its automated

booking system as well as introducing self-check-in and

self-baggage drop-off stations. Furthermore, the company

has been restructured to reflect its move towards further

international growth, establishing two fully owned subsidiaries,

each of them operating with their own air operator's

certificate (AOC). Long-haul destinations will be operated

by Norwegian Air International (NAI) with an Irish AOC,

which was granted by Ireland in February of this year.

It is planned that all of Norwegian's B787 aircraft will

eventually be operated by this subsidiary under a sublease

from Norwegian Air Shuttle ASA. The process of obtaining

a licence to operate transatlantic flights from the US

Department of Transportation is ongoing, but the airline

is being supported in this by the European Commission,

which is meeting with its US counterpart this month to

accelerate the process. The European Commission is of

the opinion that the interpretation of Article 17 of

the EU-US Open-Skies Agreement can only lead to the grant

of the licence to NAI. In any event, Norwegian's current

schedule is not dependent upon or affected by this approval

procedure, and the carrier continues to expand its long-haul

network, adding more aircraft with a view to operating

a fleet of ten Dreamliners by 2016. The ideal fleet size

of the carrier would be 20 to 25 aircraft with a growth

rate of 4-5 yearly, but due to ongoing high market demand

for Boeing's Dreamliner B787, Norwegian's requirements

cannot be met.

DS Aviation GmbH & Co. KG

Member of Dr. Peters Group

Stockholmer Allee 53

44269 Dortmund, Germany

DIRECTORS

The current Directors of the Company were appointed on

9 July 2013 and are as follows:

Jonathan (Jon) Bridel, Non- Executive Chairman (49)

Jon is a non-executive chairman or director of various

listed and unlisted investment funds and is resident

in Guernsey. These funds include listings on the premium

segment of the London Stock Exchange and the Official

List of the CISX. He was until 2011 managing director

of Royal Bank of Canada's investment businesses in Guernsey

and Jersey. This role had a strong focus on corporate

governance, oversight, regulatory and technical matters

and risk management. Jon previously worked with Price

Waterhouse Corporate Finance in London and subsequently

served in a number of senior management positions in

London, Australia and Guernsey in corporate and offshore

banking and specialised in credit. He was also chief

financial officer of two private multi-national businesses,

one of which raised private equity. He holds qualifications

from the Institute of Chartered Accountants in England

and Wales where he is a Fellow, the Chartered Institute

of Marketing, the Australian Institute of Company Directors

and an MBA from Durham University. Jon is a Chartered

Marketer and a member of the Chartered Institute of Marketing,

the Institute of Directors and is a Chartered Fellow

of the Chartered Institute for Securities and Investment.

Didier Benaroya, Non- Executive Director (64)

Having previously worked as the founder and senior partner

of the Transportation Group and the managing director

of Paine Webber, Didier has extensive experience in the

transportation industry. He is currently resident in

the UK and is the founder and a director of Numera Limited

and Numera Services Limited, which has advised investors,

lessors, banks, operating lease companies and airlines

on aircraft and airline related transactions (including

leasing, financing and restructuring) since 1995. Didier

holds a BS in Economics, an MS in Mathematics and Applied

Computer Science from the University of Paris, and an

MBA from Northwestern University's Kellog School of Management.

Jeremy Thompson, Non- Executive Director (59)

Jeremy is a Guernsey resident with sector experience

in finance, telecoms, aerospace & defence and oil & gas.

Since 2009 Jeremy has been a consultant to a number of

businesses which includes non-executive directorships

of investment vehicles relating to the BT pension scheme.

He is also a non-executive director of two private equity

funds and of a London listed oil and gas technology fund.

Between 2005 and 2009 he was a director of multiple businesses

within a private equity group. This entailed an active

participation in private, listed and SPV companies. Prior

to that he was chief executive officer of four autonomous

businesses within Cable & Wireless PLC (operating in

both regulated and unregulated markets), and earlier

held MD roles within the Dowty Group. Jeremy currently

serves as chairman of the States of Guernsey Renewable

Energy Team and is a commissioner within the Alderney

Gambling Control Commission and is also a member of the

Guernsey Tax Tribunal panel. Jeremy attended Brunel University

and was awarded an MBA from Cranfield University. He

was an invited member to the UK's senior defence course

(RCDS). Jeremy has been awarded the Institute of Directors'

Certificate and Diploma in Company Direction.

Carol Kilby was appointed as the sole director on formation

of the Company on 5 July 2013 and resigned this appointment

at the Company's launch meeting on 9 July 2013.

STATEMENT OF PRINCIPAL RISKS AND UNCERTAINTIES

Asset risk

The Company's Assets comprise two Boeing 787-8 aircraft.

The Boeing 787-8 is a newly developed generation of aircraft;

there is currently insufficient experience and data available

to be able to give a complete assessment of the long-term

use and operation of the aircraft; the Company is exposed

to the used aircraft market of the 787-8, which is untested.

Market risk

The airline industry is particularly sensitive to changes

in economic conditions and is highly competitive; risks

affecting the airline industry generally could affect

the ability of Norwegian (or any other lessee) to comply

with its obligations under the Leases (or any subsequent

lease).

There is no guarantee that, upon expiry of the Leases,

the Assets could be sold for an amount that will enable

Shareholders to realise a capital profit on their investment

or to avoid a loss. Costs regarding any future re-leasing

of the assets would depend upon various economic factors

and would be determinable only upon an individual re-leasing

event.

Key personnel risk

The ability of the Company to achieve its investment

objective is significantly dependent upon the expertise

of certain key personnel at DS Aviation; there is no

guarantee that such personnel will be available to provide

services to the Company for the scheduled term of the

Leases or following the termination of one or both Leases.

However, Key Man clauses within the Asset Management

agreement do provide a base line level of protection

against this risk.

Credit risk

Norwegian's stated strategy of providing low-cost long

haul flights is untested and may not be successful; failure

of this strategy, or of any other material part of Norwegian's

business, may adversely affect Norwegian's ability to

comply with its obligations under the Leases.

Any failure by Norwegian to pay any amounts when due

would have an adverse effect on the Group's ability to

comply with its obligations under loan agreements, could

ultimately have an impact on the Company's ability to

pay dividends and could result in the Lenders enforcing

their security and selling the relevant Asset or Assets

on the market potentially negatively impacting the returns

to investors. In mitigation, Norwegian is the second

largest airline in Scandinavia and the third largest

low-cost airline in Europe.

Liquidity risk

In order to finance the purchase of the Assets, the Group

has entered into two separate Loan Agreements pursuant

to which the Group has borrowed an amount of US$159,600,000

in total. Pursuant to the Loan Agreements, the Lenders

are given first ranking security over the Assets. Under

the provisions of each of the Loan Agreements, the Borrowers

are required to comply with loan covenants and undertakings.

A failure to comply with such covenants or undertakings

may result in the relevant Lenders recalling the relevant

Loan. In such circumstances, the Group may be required

to sell the relevant Asset to repay the outstanding relevant

Loan.

More detailed explanations of the above risks can be

found within the Notes to the Unaudited Consolidated

Financial Statements.

STATEMENT OF DIRECTORS' RESPONSIBILITIES

We confirm that to the best of our knowledge:

-- the unaudited Interim Report has been prepared in

accordance with IAS 34 Interim Financial Reporting;

-- the unaudited Interim Report (comprising the Chairman's

Statement, the Asset Manager's Report and the Statement

of Principal Risks and Uncertainties), meets the

requirements of an interim management report, and

includes a fair review of the information required

by:

(a) DTR 4.2.7R of the Disclosure and Transparency

Rules, being an indication of important events that

have occurred during the interim accounting period

from 1 January 2014 to 30 June 2014 and their impact

on the condensed set of financial statements; and

a description of the principal risks and uncertainties

for the remaining six months of the full financial

reporting period; and

(b) DTR 4.2.8R of the Disclosure and Transparency

Rules, being related party transactions that have

taken place during the interim accounting period

from 1 January 2014 to 30 June 2014 and that have

materially affected the financial position or performance

of the entity during that period.

GOING CONCERN

After making enquiries, the Directors have a reasonable

expectation that the Group has adequate resources to

continue in operational existence for the foreseeable

future. The Directors believe the Group is well placed

to manage its business risks successfully with the cooperation

of the Asset Manager. The Group's loan repayments are

hedged into a fixed payment which is more than covered

by the Group's lease rental income. Accordingly, and

in the absence of any material uncertainty that may cast

significant doubt upon the Group's ability to continue

as a going concern, the Directors have adopted the going

concern basis in the preparation of the condensed consolidated

unaudited financial statements.

By order of the Board

Jon Bridel

Chairman

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the period 1 January 2014 to 30 June 2014

1 January 5 July 2013

to to

30 June 30 June 2014

2014

Notes US$ US$

Revenue

Lease rental income 4 14,959,499 21,214,901

Expenses

Asset management, general and administrative

expenses 5 (559,081) (1,562,041)

Depreciation of Aircraft 6 (5,425,170) (8,137,755)

----------------------------------- ---------------------------- -------------- ------------------ ------------------

(5,984,251) (9,699,796)

Operating profit 8,975,248 11,515,105

Finance costs 9 (4,041,196) (5,867,026)

Finance income 9 870 3,075

----------------------------------- ---------------------------- -------------- ------------------ ------------------

Net Finance Costs (4,040,326) (5,863,951)

Unrealised foreign exchange gain (2) 9

Profit for the period 4,934,920 5,651,163

----------------------------------------------------------------- -------------- ------------------ ------------------

Other Comprehensive Income

Items that are or may be reclassified

to profit or loss

----------------------------------------------------------------- -------------- ------------------ ------------------

Cash flow hedges - changes in fair

value (3,124,486) (3,774,973)

----------------------------------------------------------------- -------------- ------------------ ------------------

Total Comprehensive Income for the

period 1,810,434 1,876,190

----------------------------------------------------------------- -------------- ------------------ ------------------

US$ US$

Earnings per Share for the period

- Basic and diluted 0.04367 0.05001

----------------------------------------------------------------- -------------- ------------------ ------------------

In arriving at the Total Comprehensive Income for the period,

all amounts above relate to continuing operations.

There is no comparative information.

The notes form part of these financial statements

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

as at 30 June 2014

30 June 2014

Notes US$

NON-CURRENT ASSETS

Aircraft 6 259,463,545

Total Non-Current Assets 259,463,545

CURRENT ASSETS

Cash and cash equivalents 8 4,815,822

Restricted cash 7 7,212,545

Trade and other receivables 10 724

----------------------------------------------------------------------- -------- ------------------ ------------------

Total Current Assets 12,029,091

TOTAL ASSETS 271,492,636

----------------------------------------------------------------------- -------- ------------------ ------------------

EQUITY

Share Capital 11 110,855,221

Hedging Reserve 15 (3,774,973)

Retained Earnings 566,163

----------------------------------------------------------------------- -------- ------------------ ------------------

Total Equity 107,646,411

NON-CURRENT LIABILITIES

Loans and Borrowings 12 140,822,955

Maintenance reserves 12 812,545

Security deposits 12 6,400,000

Derivative instrument liability 15 3,774,973

Total Non-Current Liabilities 151,810,473

CURRENT LIABILITIES

Loans and borrowings 13 10,414,982

Rent received in advance 13 1,160,189

Trade and other payables 13 460,582

----------------------------------------------------------------------- -------- ------------------ ------------------

Total Current Liabilities 12,035,753

TOTAL LIABILITIES 163,846,226

----------------------------------------------------------------------- -------- ------------------ ------------------

TOTAL EQUITY AND LIABILITIES 271,492,636

----------------------------------------------------------------------- -------- ------------------ ------------------

There is no comparative information.

These Financial Statements were approved by the Board of Directors

on 29 August 2014 and signed on its behalf by:

Jon Bridel Jeremy Thompson

Chairman Director

CONSOLIDATED STATEMENT OF CASH FLOWS

for the period 1 January 2014

to 30 June 2014

5 July 2013

to 30 June

2014

US$

OPERATING ACTIVITIES

Profit for the period 5,651,163

Adjusted for:

Depreciation of Aircraft 8,137,755

Amortisation of deferred loans

and borrowings

Finance costs 5,867,026

Facility fee 114,960

Changes in:

Increase/(decrease) in maintenance

reserves 812,545

Increase/(decrease) in security

deposits 6,400,000

Increase/(decrease) in rent

received in advance 1,160,189

Increase/(decrease) in trade

and other payables 460,582

Decrease/(increase) in receivables (724)

NET CASH FLOW FROM OPERATING

ACTIVITIES 28,603,496

-------------------------------------------------------- ----------------------- ------------------ ------------------

INVESTING ACTIVITIES

Purchase of Aircraft (265,041,612)

NET CASH FLOW FROM INVESTING

ACTIVITIES (265,041,612)

-------------------------------------------------------- ----------------------- ------------------ ------------------

FINANCING ACTIVITIES

Dividend paid (5,085,000)

Share issue proceeds 113,000,000

Share issue costs (5,994,469)

New loans and borrowings raised 159,600,000

Loan principal repaid (6,637,631)

Financing costs (5,867,026)

Deferred loans and borrowings

facility costs (1,839,391)

-------------------------------------------------------- ----------------------- ------------------ ------------------

NET CASH FLOW FROM FINANCING

ACTIVITIES 248,466,483

-------------------------------------------------------- ----------------------- ------------------ ------------------

CASH AND CASH EQUIVALENTS -

AT BEGINNING OF PERIOD

Increase in cash and cash equivalents 12,028,367

Restricted cash (7,212,545)

CASH AND CASH EQUIVALENTS AT END OF PERIOD 4,815,822

--------------------------------------------------------------------------------- ------------------ ------------------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the period 1 January 2014 to

30 June 2014

Ordinary Retained Hedging Total

Shares Earnings Reserve

Share Capital

US$ US$ US$ US$

Total Comprehensive Income

for the period

Profit for the period - 5,651,163 - 5,651,163

Other comprehensive income - - (3,774,973) (3,774,973)

---------------------------------------- ------------------- ------------------ ------------------ ------------------

Total comprehensive income - 5,651,163 (3,774,973) 1,876,190

---------------------------------------- ------------------- ------------------ ------------------ ------------------

Issue of ordinary shares 113,000,001 - - 113,000,001

Share issue costs (2,114,781) - - (2,114,781)

Dividends - (5,085,000) - (5,085,000)

---------------------------------------- ------------------- ------------------ ------------------ ------------------

Balance as at 30 June

2014 110,855,220 566,163 (3,774,973) 107,646,410

---------------------------------------- ------------------- ------------------ ------------------ ------------------

There is no comparative information.

The notes form part of these financial statements

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

for the period 1 January 2014 to 30 June 2014

1. GENERAL INFORMATION

The condensed consolidated unaudited financial statements

('financial statements') incorporate the results of the Company

and that of wholly owned subsidiary entities, DP Aircraft

Guernsey I Limited and DP Aircraft Guernsey II Limited (collectively

and hereinafter, the 'Borrowers'), each being a Guernsey

Incorporated company limited by shares and an intermediate

lessor (the 'Lessor'), an Irish incorporated private limited

company.

DP Aircraft I Limited (the 'Company') was incorporated on

5 July 2013 with registered number 56941. The Company is

listed on the Channel Islands Stock Exchange and admitted

to trading on the Specialist Fund Market of the London Stock

Exchange.

The Share Capital of the Company comprises 113,000,000 Ordinary

Preference Shares of no par value and one Subordinated Administrative

Share of no par value.

The Company's investment objective is to obtain income and

capital returns for its Shareholders by acquiring, leasing

and then, when the Board considers it appropriate, selling

aircraft.

2. SIGNIFICANT ACCOUNTING POLICIES

a) Basis of Preparation

The financial statements for the period 1 January 2014 to

30 June 2014 have been prepared in order to comply with the

listing rules of the Specialist Fund Market of the London

Stock Exchange and the Channel Islands Stock Exchange whereby

the Company must produce annual and half yearly reports.

These financial statements have been prepared in accordance

with International Accounting Standard 34 (Interim Financial

Reporting) ('IAS 34') issued by the International Accounting

Standards Board ('IASB'), the Disclosure and Transparency

Rules ('DTR's) of the UK's Financial Conduct Authority ('FCA')

and applicable Channel Islands Stock Exchange and Guernsey

law.

The financial statements do not include all of the information

required for full financial statements. As the Company was

only incorporated on 5 July 2013 and these financial statements

cover the second interim accounting period from 1 January

2014 to 30 June 2014, there is no comparative financial information

at the time of the approval of the financial statements.

The Directors are of the opinion that the affairs of the

Group are suitably structured to enable the Going Concern

basis to be adopted in the preparation of these financial

statements. A number of new standards, amendments to standards

and interpretations are effective for annual periods beginning

after 1 January 2014, and have not been applied in preparing

these financial statements. Those which may be relevant to

the Group are set out below. The Group does not plan to adopt

these standards early.

IFRS 9 Financial Instruments (2010), IFRS 9 Financial Instruments

(2009) (continued)

The International Accounting Standards Board (IASB) recently

completed the final element of its comprehensive response

to the financial crisis by issuing IFRS 9 Financial Instruments.

The package of improvements introduced by IFRS 9 includes

a logical model for classification and measurement, a single,

forward-looking 'expected loss' impairment model and a substantially-reformed

approach to hedge accounting. The new Standard will come

into effect on 1 January 2018 with early application permitted.

The key elements of the new Standard are:

Classification and Measurement - IFRS 9 introduces a logical

approach for the classification of financial assets, which

is driven by cash flow characteristics and the business model

in which an asset is held. The new model also results in

a single impairment model being applied to all financial

instruments.

Impairment - As part of IFRS 9, the IASB has introduced a

new, expected-loss impairment model that will require more

timely recognition of expected credit losses. The new Standard

requires entities to account for expected credit losses from

when financial instruments are first recognised and to recognise

full lifetime expected losses on a more timely basis.

Hedge accounting - IFRS 9 introduces a substantially-reformed

model for hedge accounting, with enhanced disclosures about

risk management activity. The new model represents a significant

overhaul of hedge accounting that aligns the accounting treatment

with risk management activities, enabling entities to better

reflect these activities in their financial statements.

Own credit - the Standard also removes the volatility in

profit or loss that was caused by changes in the credit risk

of liabilities elected to be measured at fair value. This

change in accounting means that gains caused by the deterioration

of an entity's own credit risk on such liabilities are no

longer recognised in profit or loss.

The adoption of these standards is expected to have an impact

on the Group's financial assets, but no impact on the Group's

financial liabilities.

b) Basis of measurement

The financial statements have been prepared on the historical

cost basis except for certain financial instruments that

are measured at fair value through profit or loss.

The financial statements are prepared in United States Dollars

(US$), rounded to the nearest Dollar, which is the functional

currency of the Company and its subsidiaries and presentation

currency of the Group.

In preparing these financial statements, the significant

judgements made by the Directors in applying the Company's

accounting policies and the key sources of estimation uncertainty

are disclosed in note 3.

c) Basis of consolidation

The financial statements include the results of the Company

and that of its wholly owned subsidiaries, DP Aircraft Guernsey

I Limited, DP Aircraft Guernsey II Limited and DP Aircraft

Ireland Limited (the 'Group'). Subsidiaries are entities

controlled by the Group. The Group controls an entity when

it is exposed to, or has a right to, variable returns from

its involvement with the entity and has the ability to affect

those returns through its power over the entity. The financial

statements of subsidiaries are included in the consolidated

financial statements from the date on which control commences

until the date on which control ceases.

Intra-group balances and transactions, and any unrealised

income and expenses arising from intra-group transactions,

have been eliminated in preparing the financial statements.

d) Taxation

The Company, DP Aircraft Guernsey I Limited and DP Aircraft

Guernsey II Limited are subject to income tax at the company

standard rate in Guernsey, which is currently zero per cent.

However, tax at rates greater than zero per cent will be

payable on any income received by the Guernsey Companies

from the ownership of lands and buildings in Guernsey or

from certain regulated activities. It is not intended that

the Guernsey Companies make any such investments or engage

in any of the regulated activities in question.

Shareholders of the Company, whether corporates or individuals,

who are not resident in Guernsey for tax purposes, will not

be subject to Guernsey income tax and will receive dividends

without deduction for Guernsey income tax. Individual shareholders

who are resident in Guernsey for tax purposes will be subject

to tax at the individual standard rate of 20 per cent upon

dividends.

DP Aircraft Ireland Limited is subject to resident taxes

in Ireland.

e) Property, plant and equipment - Aircraft (the 'Assets')

Upon delivery, aircraft are initially recognised at cost

plus initial direct costs which may be capitalised under

IAS 16. In accounting for property, plant and equipment,

the Group makes estimates about the expected useful lives,

the fair value of attached leases and the estimated residual

value of aircraft. In estimating useful lives, fair value

of leases and residual value of aircraft, the Group relies

upon actual industry experience, supported by estimates received

from independent appraisers, with the same or similar aircraft

types and considering our anticipated utilisation of the

aircraft.

The Company's policy is to depreciate the Assets over their

remaining lease life (given the intention to sell the Assets

at the end of the lease) to an appraised residual value at

the end of the lease. For the interim report, the directors

determined a residual valuation at the end of the lease based

on 50 per cent of the purchase cost in the absence of any

recent official appraisal. An official appraisal will be

carried out for the valuation to be presented within the

31 December 2014 audited accounts.

In accordance with IAS 16 - Property, Plant and Equipment,

the Group's aircraft that are to be held and used are reviewed

for impairment whenever events or changes in circumstances

indicate that the carrying value of the aircraft may not

be recoverable. An impairment review involves consideration

as to whether the carrying value of an aircraft is not recoverable

and is in excess of its fair value. In such circumstances

a loss is recognised as a write down of the carrying value

of the aircraft to the higher of value in use and fair value

less cost to sell. The review for recoverability has a level

of subjectivity and requires the use of judgement in the

assessment of estimated future cash flows associated with

the use of an item of property, plant and equipment and its

eventual disposition. Future cash flows are assumed to occur

under the prevailing market conditions and assume adequate

time for a sale between a willing buyer and a willing seller.

Expected future lease rates are based upon all relevant information

available, including the existing lease, current contracted

rates for similar aircraft, appraisal data and industry trends.

The future cash in-flows for the assets have been fixed at

a set rate as agreed between the Group, NordLB, as loan provider,

and the Lessee.

f) Financial instruments

A financial instrument is recognised when the Group becomes

a party to the contractual provisions of the instrument.

Regular way purchases and sales of financial assets are accounted

for at trade date, i.e., the date that the Group commits

itself to purchase or sell the asset. Financial liabilities

are derecognised if the Group's obligations, specified in

the contract, expire or are discharged or cancelled. Financial

assets are derecognised if the Group's contractual rights

to the cash flows from the financial assets expire, are extinguished,

or if the Group transfers the financial assets to a third

party and transfers all the risks and rewards of ownership

of the asset, or if the Group does not retain control of

the asset and transfers substantially all the risk and rewards

of ownership of the asset.

Non-derivative financial instruments

Non-derivative financial instruments comprise trade and other

receivables, cash and cash equivalents, restricted cash,

loans and borrowings, and trade and other payables. Non-derivative

financial instruments are recognised initially at fair value

plus, for instruments not at fair value through profit and

loss, any directly attributable transaction costs. Subsequent

to initial recognition, non-derivative financial instruments

are measured at amortised cost using the effective interest

rate method, less any impairment losses in the case of financial

assets.

Fair values of non-derivative financial instruments, which

are determined for disclosure purposes, are calculated based

on the present value of future principal and interest cash

flows, discounted at the market rate of interest at the reporting

date.

Derivative financial instruments

The Company invests in interest rate swaps in order to provide

for fixed-rate interest to be payable in respect of the Loans

and borrowings, matching the timing of the scheduled fixed

rental payments under the Leases, interest rate swaps have

been entered into to provide for surety of cash flow and

elimination of volatility.

On initial designation of the derivative as hedging instrument

the Company formally documents the relationship between the

hedging instrument and the hedged item, including the risk

management objective and strategy in undertaking the hedge

transaction and the hedged risk, together with the methods

that will be used to assess the effectiveness of the hedging

relationship. The Company makes an assessment, both at the

inception of the hedge relationship as well as on an ongoing

basis, of whether the hedging instruments are expected to

be highly effective in offsetting the changes in the fair

value of the respective hedged items attributable to the

hedged risk, and whether the actual results of each hedge

are within a range of 80% - 125%.

Fair value movements on the derivative instruments are recorded

as Other comprehensive income in the Statement of Comprehensive

Income; the fair value of the derivative instruments are

recorded as "derivative liability" or "derivative asset"

in the Statement of Financial Position.

Hedging Reserve

The hedging reserve comprises the cumulative net change in

the value of hedging instruments used in cash flow hedges

pending subsequent recognition in profit or loss as the hedged

cash flows affect profit or loss.

Cash and cash equivalents (Loans and Receivables under IAS

39.9)

Cash and cash equivalents comprise cash balances held for

the purpose of meeting short term cash commitments and investments

which are readily convertible to a known amount of cash and

are subject to an insignificant risk of changes in value.

Where investments are categorised as cash equivalents, the

related balance has a maturity of three months or less from

the date of acquisition. Cash and cash equivalents are carried

at amortised cost.

Restricted cash (Loans and Receivables under IAS 39.9)

Restricted cash comprises cash held by the Group but which

is ring-fenced or used as security for specific financing

arrangements, and to which the Group does not have unfettered

access. Restricted cash is measured at amortised cost.

Maintenance Reserve

Maintenance reserves are Lessee contributions to a retention

account held by the Lessor which are calculated by reference

to the budgeted cost of maintenance and overhaul events (the

'supplemental rentals'). They are intended to ensure that

at all times the Lessor holds sufficient funds to cover the

proportionate cost of maintenance and overhaul of the Assets

relating to the life used on the airframe, engines and parts

since new or since the last overhaul. During the term of

the Leases, all maintenance is required to be carried out

at the cost of Norwegian, and maintenance reserves are required

to be released only upon receipt of satisfactory evidence

that the relevant qualifying maintenance or overhaul has

been completed.

Maintenance reserves are recorded on the statement of financial

position during the term of each lease. Reimbursements will

be charged against this liability as qualifying maintenance

work is performed. Maintenance reserves are restricted and

not distributable until, at the end of a lease, the Group

is released from the obligation to make any further reimbursements

in relation to the aircraft, and the remaining balance of

maintenance reserves, if any, is released through profit

or loss.

Security Deposit

Lease contracts require the lessee to pay a security deposit,

either in cash or in the form of a letter of credit. These

deposits are refundable to the lessee upon expiration of

the lease and, where such deposits are received in cash,

they are recorded in the statement of financial position

as a liability. The cash received related to security deposits

is presented as restricted cash in the Statement of Financial

Position.

Trade and other receivables

Trade and other receivables are recognised initially at fair

value and are thereafter measured at amortised cost using

the effective interest rate less any provision for impairment.

Trade and other receivables are discounted when the time

value of money is considered material. A provision for impairment

of trade receivables is recognised when there is objective

evidence the Group will not be able to collect all amounts

due according to the original terms of the receivables. Significant

financial difficulties of the loans and borrowings or, probability

that the loans and borrowings or will enter bankruptcy or

financial reorganisation, and default or delinquency in payments

are considered indicators that the trade receivable is impaired.

Loans and borrowings

Loans and Borrowings are recognised initially at fair value,

net of transaction costs incurred. Loans and Borrowings are

subsequently stated at amortised cost; any difference between

the proceeds (net of transaction costs) and the redemption

value is recognised through profit or loss in the consolidated

statement of comprehensive income over the period of borrowings

using the effective interest rate method. Loans and Borrowings

are classified as current liabilities unless the Group has

an unconditional right to defer settlement of the liability

for at least one year after the reporting date.

Trade and other payables

Trade and other payables are recognised initially at fair

value and subsequently measured at amortised cost using the

effective interest method.

g) Share capital

Shares are classified as equity. Incremental costs directly

attributable to the issue of shares are recognised as a deduction

from equity.

h) Share based payments

For cash settled share-based payment arrangements with the

Asset Manager, which is classified as a non--employee, the

Company re-measures the goods or services from the non--employee

at each measurement date at their fair value. The cost of

the share--based payment exchanged for the goods or services

is recorded in equal amount over the period the services

are provided. (See note 19 Asset Management Agreement).

i) Lease rental income

Leases relating to the Aircraft are classified as operating

leases where the terms of the lease do not transfer substantially

all the risks and rewards of ownership to the lessee. Rental

income from operating leases is recognised on a straight-line

basis over the term of the lease.

The first Asset (for the purpose of this Note the 'First

Lease') is a Boeing 787-8. The manufacturer's serial number

is 35304. The First Lease consists of monthly lease rentals

of US$1,240,501 per month for the lease term. Lease rentals

are due in advance on the 15(th) day of each calendar month.

The second Asset (for the purpose of this Note the 'Second

Lease') is a Boeing 787-8. The manufacturer's serial number

is 35305. The Second Lease consists of monthly lease rentals

of US$1,245,620 per month for the lease term. Lease rentals

are due in advance on the 15(th) day of each calendar month.

j) Expenses

Expenses are accounted for on an accruals basis.

k) Finance costs - Interest payable - Loans

Interest on each Loan is payable in arrears on the last day

of each interest period, which will be one month long (the

'Interest Period'). Interest on each Loan generally accrues

at a floating rate of interest which is calculated using

US LIBOR for the length of the Interest Period and a margin

of 2.6 per cent per annum. If any amount is not paid by the

Group when due, interest will accrue on such amount at the

then current rate applicable to the Loan plus 2.0 per cent

per annum. Interest is calculated on an effective interest

basis.

l) Finance income

Interest income on cash and cash equivalents is accounted for on an

effective interest rate basis.

m) Foreign currency translation

Transactions denominated in foreign currencies are translated

into US$ at the rate of exchange ruling at the date of the

transaction.

Monetary assets and liabilities denominated in foreign currencies

at the reporting date are translated into US$ at the rate

of exchange ruling at the reporting date. Foreign exchange

gains or losses arising on translation are recognised through

profit or loss in the Consolidated Statement of Comprehensive

Income.

n) Initial direct costs

Aircraft:

Initial direct costs incurred during the purchase of an aircraft

which meet the capitalisation criteria of IAS16 are capitalised

to the cost of the aircraft and depreciated in line with

the depreciation policy.

Borrowings:

Initial direct costs related to loans and borrowings are

capitalised, presented net against the loans and borrowings

accrual and amortised to the Statement of Comprehensive Income

over the period of the related loan.

Lease Costs:

Initial direct costs incurred when settling up a lease are

capitalised to Property, Plant and Equipment and amortised

over the lease term.

o) Segmental reporting

The Directors are of the opinion that the Group is engaged

in a single segment of business, being acquiring, leasing

and subsequent selling of Aircraft.

p) Distribution policy

Dividends will be accrued for when declared by the Board

of Directors.

3. SIGNIFICANT JUDGEMENTS AND ESTIMATES

The preparation of financial statements in conformity with

IFRS requires that the Directors make estimates and assumptions

that affect the application of policies and reported amounts

of assets and liabilities, income and expenses. Such estimates

and associated assumptions are generally based on historical

experience and various other factors that are believed to

be reasonable under the circumstances, and form the basis

of making the judgements about attributing values of assets

and liabilities that are not readily apparent from other

sources.

As described in Note 2, the Company will depreciate the Assets

(which are significant) on a straight line basis over the

remaining lease life and taking into consideration the estimated

residual value. In making a judgement regarding these estimates

the Directors will consider previous sales of similar aircraft

and other available aviation information. The Company will

engage three Independent Expert Valuers each year, commencing

December 2014 to provide a valuation of the Assets and will

take into account the average of the three valuations provided.

The Company expects that, in performing their valuations,

the Independent Expert Valuers will have regard to factors

such as the condition of the Assets, the prevailing market

conditions (which may impact on the resale value of the Assets),

the Leases (including the scheduled rental payments and remaining

scheduled term of the Leases) and the creditworthiness of

the Lessee. Accordingly, any early termination of the Leases

may impact on the valuation of the Assets'. The Assets residual

value is based on appraised residual values.

4. LEASE RENTAL INCOME

1 January to 5 July 2013

30 June 2014 to

30 June 2014

US$ US$

Lease rental income from First

Asset ('LNA'):

Earned and received 7,464,349 10,585,610

7,464,349 10,585,610

-------------------------------------------------------- -------------------------------- -------------------

Lease rental income from Second

Asset ('LNB'):

Earned and received 7,495,150 10,629,291

7,495,150 10,629,291

-------------------------------------------------------- -------------------------------- -------------------

Total lease rental income 14,959,499 21,214,901

-------------------------------------------------------- -------------------------------- -------------------

All lease rental income is derived from a single customer in Norway.

OPERATING LEASES

As at 30 June 2014 the contracted cash lease rentals to

be received under non-cancellable operating leases comprised:

Next 12 2 to 5 years After 5 Total

months years

30 June 2014 US$ US$ US$ US$

Boeing 787-8 Serial

No: 35304 14,307,111 59,544,048 88,836,865 162,688,024

Boeing 787-8 Serial

No: 35305 14,366,151 59,789,760 91,496,761 165,652,672

--------------------- ----------- ------------- ------------ ------------

28,673,262 119,333,808 180,333,626 328,340,696

--------------------- ----------- ------------- ------------ ------------

5. ASSET MANAGEMENT, GENERAL AND ADMINISTRATIVE

EXPENSES

1 January to 5 July 2013

30 June 2014 to

30 June 2014

US$ US$

Asset management

fees 249,996 362,897

General 152,511 710,291

Administrative 156,574 488,853

Total operating

expenses 559,081 1,562,041

------------------------- ---------------------------------------------------- -------------------------

6. PROPERTY, PLANT AND EQUIPMENT - AIRCRAFT

Boeing 787-8 Boeing 787-8 Total

Serial No: Serial No:

35304 35305

COST US$ US$ US$

As at 5 July 2013 - - -

Additions-October 2013 133,446,738 134,154,562 267,601,300

As at 31 December 2013 133,446,738 134,154,562 267,601,300

---------------------------------------------------- --------------- ---------------- ---------------

As at 30 June 2014 133,446,738 134,154,562 267,601,300

---------------------------------------------------- --------------- ---------------- ---------------

ACCUMULATED DEPRECIATION

As at 5 July 2013 - - -

---------------------------------------------- --------------- ---------------- ---------------

Charge for the period 1,348,919 1,363,666 2,712,585

---------------------------------------------------- --------------- ---------------- ---------------

As at 31 December 2013 1,348,919 1,363,666 2,712,585

---------------------------------------------------- --------------- ---------------- ---------------

Charge for the period 2,697,839 2,727,331 5,425,170

---------------------------------------------------- --------------- ---------------- ---------------

As at 30 June 2014 4,046,758 4,090,997 8,137,755

CARRYING AMOUNT

---------------------------------------------- --------------- ---------------- ---------------

As at 31 December 2013 132,097,819 132,790,896 264,888,715

---------------------------------------------------- --------------- ---------------- ---------------

As at 30 June 2014 129,399,980 130,063,565 259,463,545

---------------------------------------------------- --------------- ---------------- ---------------

The Boeing 787-8 is a newly developed generation of aircraft

and the Company is exposed to the used aircraft market of

the 787-8 which is untested. Due to the new type of design,

in particular in respect of innovative materials and technology,

there is currently insufficient experience and data available

to be able to give a complete assessment of the long-term

use and operation of the aircraft. There is a risk that the

newly developed materials may be found to be less efficient

or durable than expected and thereby may lead to higher maintenance

and repair costs. Under the terms of the Leases, the cost

of repair and maintenance of the Assets will be borne by Norwegian.

However, upon expiry or termination of the Leases, the cost

of repair and maintenance will fall upon the Group. Therefore

upon expiry of the Leases, the Group may bear higher costs

and the terms of any subsequent leasing arrangement (including

terms for repair, maintenance and insurance costs relative

to those agreed under the Leases) may be adversely affected,

which could reduce the overall distributions paid to the Shareholders.

The estimated residual value of the Boeing 787-8 Assets as

at the end of their respective leases in 2025 will be re-evaluated

by independent experts for the first full financial accounting

period ending on 31 December 2014. The residual value will

depend upon a variety of factors including actual or anticipated

fluctuations in the results of the airline industry, market

perception of the airline industry, general economic and social

and political development, changes in industry conditions,

fuel prices or rates of inflation. For the interim report,

the directors determined a residual valuation at the end of

the lease based on 50 per cent of the purchase cost in absence

of any official appraisal. An official appraisal will be carried

out for the valuation to be presented within the 31 December

2014 audited accounts. The Loans entered into by the Company

to complete the purchase of the aircrafts are cross collateralised.

Each of the First Loan and the Second Loan are secured by

way of security taken over each of the first aircraft and

the second aircraft.

Both aircraft are being operated by a single customer in Norway.

7. RESTRICTED CASH As at 30 June

2014

US$

Security Deposit 6,400,000

NordLB - Maintenance reserve 507,258

NordLB - Maintenance reserve 305,287

7,212,545

---------------------------------------------------------------- --------------- ---------------------

Refer to Note 2 (f) for information

on restriction

8. CASH AND CASH EQUIVALENTS As at 30 June

2014

US$

NordLB 755,152

NordLB 755,152

Royal Bank of Scotland International

- Call 3,305,518

---------------------------------------------------------------- --------------- ---------------------

Total cash and cash equivalents 4,815,822

---------------------------------------------------------------- --------------- ---------------------

9. FINANCE INCOME AND EXPENSE 1 January 5 July 2013

to to

30 June 30 June 2014

2014

US$ US$

Finance income 870 3,075

---------------------------------------------------------------- --------------- ---------------------

870 3,075

Loan interest paid & payable (2,154,700) (3,165,114)

Deferred loan and borrowings facility

costs (76,640) (114,960)

---------------------------------------------------------------- --------------- ---------------------

Total interest at effective interest

rate (2,231,340) (3,280,074)

Swap interest paid & payable (1,809,856) (2,586,952)

---------------------------------------------------------------- --------------- ---------------------

Total finance income and expense (4,040,326) (5,863,951)

---------------------------------------------------------------- --------------- ---------------------

10. TRADE AND OTHER RECEIVABLES As at 30 June

2014

US$

Directors' and officers' insurance prepaid 724

Total receivables & pre-payments 724

--------------------------------------------------------------------------------- ---------------------

11. SHARE CAPITAL As at 30

June 2014

Subordinated Ordinary Total

Administrative Preference

Share Shares

US$ US$ US$

Administrative share issued

on incorporation July 2013 1 - 1

Shares issued pursuant to

the Placing

October 2013 - 113,000,000 113,000,000

Share issue costs - (2,114,781) (2,114,781)

Total share capital as at

30 June 2014 1 110,855,219 110,855,220

--------------------------------------------- ---------------------- ---------------- ------------

Subject to the applicable company law and the Company's

Articles of Incorporation, the Company may issue an unlimited

number of shares of par value and/or no par value or a combination

of both. Notwithstanding this, a maximum number of 113,000,000

Shares were issued pursuant to the Placing Agreement, dated

27 September 2013, between the Company, DS Aviation, JS

Holding (DS Aviation and JS Holding together the 'Asset

Manager Parties') and Canaccord Genuity (the Company's Corporate

Broker) whereby Canaccord Genuity acted as agent for the

Company, to procure subscribers for Shares under the initial

Placing of shares at the Issue Price (the 'Placing').

The Subordinated Administrative Share is held by DS Aviation

GmbH & Co. KG, (the Asset Manager).

Holders of Subordinated Administrative Shares are not entitled

to participate in any dividends and other distributions

of the Company. On a winding up of the Company the holders

of the Subordinated Administrative Shares are entitled to

an amount out of the surplus assets available for distribution

equal to the amount paid up, or credited as paid up, on

such shares after payment of an amount equal to the amount

paid up, or credited as paid up, on the Ordinary Shares

to the Shareholders. Holders of Subordinated Administrative

Shares shall not have the right to receive notice of and

have no right to attend, speak and vote at general meetings

of the Company except if there are no Ordinary Shares in

existence.

Without prejudice to the provisions of the applicable company

law and without prejudice to any rights attached to any

existing shares or class of shares, or the provisions of

the Articles of Incorporation, any share may be issued with

such preferred, deferred or other rights or restrictions,

as the Company may be ordinary resolution direct or, subject

to or in default of any such direction, as the Directors

may determine.

Although not utilised in the reporting accounting period,

the Directors were entitled to issue and allot Ordinary

Shares as well as C Shares immediately following the Placing

for cash or otherwise on a non pre-emptive basis.

The share issue costs include fees payable under the Placing

Agreement, registration, listing and admission fees, settlement

and escrow arrangements, printing, advertising and distribution

costs, legal fees, reporting accountant fees and a commission

of 1.5 per cent of the Placing Proceeds due to Canaccord

Genuity, as Placing Agent.

Refer to Note 15, Liquidity Proposal.

12. NON-CURRENT LIABILITIES As at 30

June 2014

US$

NordLB loan - Borrowings 71,188,631

NordLB loan - Borrowings 71,358,755

Deferred loans and borrowings facility fees (1,724,431)

--------------------------------------------------------------------------------------- ------------

140,822,955

Security deposit refundable to Norwegian (refer

Note 8) 6,400,000

Maintenance reserves 812,545

--------------------------------------------------------------------------------------- ------------

Total non-current liabilities 148,035,550

--------------------------------------------------------------------------------------- ------------

Loans

The Company utilised the Placing Proceeds and the proceeds

of two separate Loans, each of US$79,800,000, to fund the

purchase of the two Boeing 787-8 aircraft.

The loans, each of US$79,800,000 will be fully amortised

with monthly repayments in arrears over approximately twelve

years (until the scheduled expiry of the Lease, as drawdown

of the loans happened after the commencement of the First

Lease). There are no defaults or breaches under the loan

agreements.

Structure and term

The committed term of each Loan is from the drawdown date

until the date falling twelve years from the Delivery Date

of the relevant Asset. Each Loan will be amortised with repayments

every month in arrears over the term in amounts as set out

in a schedule agreed by the Company and the Lenders. Amortisation

will be on an annuity-style (i.e. mortgage-style) basis.

Interest

Interest on each Loan is payable in arrears on the last

day of each interest period, which is one month long (the

"Interest Period"). Interest on each Loan accrues at a floating

rate of interest which is calculated using LIBOR for the

length of the Interest Period and a margin of 2.6 per cent

per annum (the "Loan Margin") ("Loan Floating Rate"). For

the purposes of calculating the Loan Floating Rate, if on

the date when LIBOR is set prior to the beginning of an

Interest Period it is not possible for LIBOR to be determined

by reference to a screen rate at the time that LIBOR is

to be set for that Interest Period (a "Market Disruption

Event"), the amount of interest payable to each affected

Loan Lender during the Interest Period will be the aggregate

of each Lender's cost of funds during that monthly period

and the Loan Margin. If any amount is not paid by the Borrower

when due under the Loan Transaction Documents, interest

will accrue on such amount at the then current rate applicable

to the Loan plus 2.0 per cent per annum. The Group has entered

into ISDA-standard hedging arrangement with Norddeutsche

Landesbank Girozentrale as hedging provider in connection

with the Loans, in order to provide for a fixed interest