TIDMEME

RNS Number : 9915A

Empyrean Energy PLC

30 May 2023

This announcement contains inside information

Empyrean Energy Plc / Index: AIM / Epic: EME / Sector: Oil &

Gas

Empyrean Energy plc

Capital raising, Debt Restructure and Company Update

30 May 2023

Empyrean Energy plc ("Empyrean" or the "Company"), the oil and

gas development company with interests in China, Indonesia and the

United States, is pleased to announce a successful capital raise

and debt restructuring as well as an update on future activities at

the Mako Gas Field at the Duyung PSC (Empyrean 8.5%) ("Mako") and

the Topaz prospect at its Block 29/11 permit (Empyrean 100%),

offshore China ("Topaz").

HIGHLIGHTS

-- GBP1.52 million raised at a price of 0.8p

-- Placement oversubscribed

-- Mako Gas Sales Agreement binding terms expected late Q2 and

sell down news expected early Q3

-- Joint regional oil migration study with CNOOC team to be completed

-- 3D seismic inversion project to discriminate light oil from

water to commence at Topaz with a specialist seismic consultancy

with expertise in seismic inversion

-- Convertible Note debt restructure to reduce face value of the

Convertible Note and secure extended moratorium on interest

-- Management participation in the capital raising and agreement

to sacrifice one-third of salary for new equity to minimise cash

burn ahead of key developments

Empyrean is the operator of Block 29/11 in China and has 100%

working interest during the exploration phase. In the event of a

commercial discovery, its partner, China National Offshore Oil

Company ("CNOOC"), may assume a 51% participating interest in the

development and production phase.

Capital Raising

Empyrean is pleased to advise that it has entered into binding

subscription agreements to issue 189,753,783 new Ordinary Shares of

0.2p each in the Company (the "New Ordinary Shares") at a price of

0.8p per New Ordinary Share (the "Issue Price"), raising

GBP1,518,030 (before costs) (the "Subscription").

The Issue Price represents a 22.3% discount to the price of the

Company's ordinary shares of 0.2p each (the "Shares") as at close

of business on 26 May 2023 (1.03p) and a 33.5% discount to the

volume weighted average price of the Shares for the ten days prior

to close of business 26 May 2023 (1.12p) ("10 Day VWAP").

Empyrean advises that the Board has resolved to issue 2,887,500

Shares to advisors of the Company in lieu of part of the fees

incurred for the capital raising (the "Advisor shares").

The Subscription is being completed under the Company's existing

authorities and is not subject to the approval of shareholders.

Following the Subscription and issue of the Advisor shares, the

Company's enlarged issued share capital will comprise 981,073,175

Shares. This figure may be used by shareholders as the denominator

for the calculations by which they will determine if they are

required to notify their interest in, or a change to their interest

in, securities of the Company under the Financial Conduct

Authority's Disclosure and Transparency Rules.

Of the total raised under the Subscription, CEO and Managing

Director of Empyrean, Tom Kelly, has subscribed for 6,250,000 New

Ordinary Shares for a total consideration of GBP50,000. Following

his participation in the Subscription, Mr Kelly has an interest in

95,138,888 Shares, representing 9.69% of the enlarged issued share

capital of the Company. In addition, Technical Director of

Empyrean, Gaz Bisht, has subscribed for 1,850,000 New Ordinary

Shares for a total consideration of GBP14,800. Following his

participation in the Subscription, Mr Bisht has an interest in

33,671,429 Shares, representing 3.43% of the enlarged issued share

capital of the Company. Further, Company Secretary of Empyrean,

Jonathan Whyte, has subscribed for 500,000 New Ordinary Shares for

a total consideration of GBP4,000. Following his participation in

the Subscription, Mr Whyte has an interest in 673,572 Shares,

representing 0.07% of the enlarged issued share capital of the

Company.

The funds raised from the Subscription will be used as

follows:

-- for the completion of joint regional oil migration studies with CNOOC at Topaz ;

-- for the completion of a 3D seismic inversion study aimed to

discriminate between oil and water in the reservoir at Topaz;

-- for ongoing prospect, licensing fees and permit costs;

-- for post Jade well consultancy, analysis and residual exploration costs;

-- for front-end engineering design ("FEED"), studies and

surveys at Mako - including gas processing and export gas tie in at

the Kakap KF Platform; and

-- for general working capital requirements

Application will be made for the New Ordinary Shares and the

Adviser Shares to be admitted to trading on AIM. Admission is

expected to take place on 12 June 2023. The New Ordinary Shares and

the Adviser Shares will rank pari passu with existing Shares in

issue.

Future Activities

Mako Gas Field

As previously announced, Conrad Asia Energy ("Conrad"), the

operator and 76.5% partner in Mako has commenced a sell down

process with a global investment bank in order to fund the

development of Mako. Mako is the largest undeveloped gas

accumulation in the immediate region and Conrad have said that

industry interest in the project and sell down process is

encouraging. Mako has received government approval for a Plan of

Development. A Gas Sales Agreement is currently in advanced stages

of negotiation and a binding terms sheet is expected between the

partners, a Singaporean buyer and SKKMIGAS (the Indonesian

regulator) in the near term.

Topaz Prospect

Empyrean intends to conduct two further key projects that

capitalise on the excellent quality 3D seismic acquired by the

Company over the permit, shared regional 3D seismic that CNOOC has

and additional physical well data of both Empyrean and CNOOC. These

projects are designed to help address and mitigate the remaining

primary geological risk at Topaz - oil migration into the Topaz

trap.

Firstly, jointly with CNOOC, Empyrean intends to complete a

regional oil migration study. CNOOC bring excellence in local basin

modelling expertise along with crucial regional data that augments

the data Empyrean has on Block 29/11. The regional data includes

temperature, pressure, timing of oil maturation, and successful oil

migration pathway mapping. The project will map oil migration from

the proven source rock south west of Block 29/11 that charges the

four CNOOC oil discoveries (immediately west of Block 29/11 and

Topaz) and extend this into Block 29/11 and map these migration

pathways to Topaz. In addition, similar work will be conducted from

a new kitchen located entirely within Block 29/11 and oil migration

pathways will be mapped to Topaz. This project is expected to take

approximately 4 months to complete.

Secondly, Empyrean will conduct a 3D seismic inversion project

focussing on Topaz. The 3D seismic inversion project will utilise

the oil properties, reservoir temperature, reservoir pressure and

water salinity data from CNOOC oil discovery wells combined with

reservoir porosity and physical data from Empyrean well logs and

core to maximise the effectiveness of the inversion project

outcomes. The aim of the 3D seismic inversion project is to assess

whether Topaz has different elastic properties to that of three

water bearing wells in Block 29/11 and whether these properties can

discriminate between water and light oil in the high porosity

carbonate reservoir rocks on the high quality Topaz 3D seismic. The

3D seismic inversion project is expected to take approximately 3

months to complete.

Debt Restructuring

In December 2021, the Company announced that it had entered into

a Convertible Loan Note Agreement with a Melbourne-based investment

fund (the "Lender"), pursuant to which the Company issued a

convertible loan note to the Lender and received gross proceeds of

GBP4.0 million (the "Convertible Note").

As announced in May 2022, the Company and the Lender then

amended the key repayment terms of the Convertible Note, which at

that time included the right by the Lender to redeem the

Convertible Note within 5 business days of the announcement of the

results of the Jade well at Block 29/11. The face value of the loan

notes was reset to GBP3.3m with interest to commence and accrue at

GBP330,000 per calendar month from 1 December 2022.

The Company and the Lender have, in conjunction with and

conditional upon the completion of the Subscription, now reached

agreement on amended key terms to the Convertible Note to allow the

sales process for Mako to complete. The key terms of the amendment

are as follows:

1. The face value of the Convertible Note has been reduced from

GBP5.28m (accrued to the end of May 2023) to GBP4.6 million;

2. No interest shall accrue on the Convertible Note until 31

December 2023, with interest accruing thereafter at a rate of 20%

p.a.;

3. The conversion price on the Convertible Note has been reduced from 8p to 2.5p per Share;

4. Unless otherwise required by the joint operating agreement

entered into with Empyrean's licence partners (the "JOA") or with

the prior written consent of the Lender (such consent not to be

unreasonably withheld or delayed), Empyrean may only execute

agreements for the sale of its interest in Mako (in whole or in

part) if the terms of the sale provide for a payment to Empyrean at

completion of immediately available funds and for a sale price of

an amount that is at least the amounts owed to the Lender (as

described in 5 and 6 below):

5. On a successful sale of the Company's interest in Mako,

Empyrean must redeem the face value of the Convertible Note and pay

the Lender the greater of (a) US$1.5 million or (b) 15% of the

proceeds such sale;

6. In the event that the Company repays the Convertible Note

from sources other than a sale of its interest in Mako, Empyrean

must also pay the Lender US$1.5 million on redemption of the

Convertible Note together with a further payment based on either

(a) the actual valuation achieved on any sale within 2 years or (b)

an updated valuation of the Company's interest in Mako if not sold

within that 2 year period, in each case so that the total proceeds

paid to the Lender are 15% of the valuation of the Company's

interest in Mako;

7. In the event that the sale process being run on behalf of the

operator, Conrad, does not result in an offer being made to acquire

all or part of the Company's interest in Mako, then Empyrean must

work with the Lender in good faith to sell the Mako Interest as

soon as reasonably possible and, subject to applicable laws and the

terms of the JOA, may grant rights to the Lender to market this

interest on its behalf.

Salary Sacrifice

While the Company awaits the anticipated signing of the GSA and

the completion of the sell down process noted above, two of its

Directors, Tom Kelly and Gaz Bisht, together with its Company

Secretary, Jonathan Whyte, have agreed to take one third of their

salaries in new Shares ("Salary Sacrifice Shares") in lieu of cash

remuneration in order to preserve capital and ensure more funds are

directed towards project activities. The Salary Sacrifice Shares

will be issued at the same price as the Subscription Price ( 0.8p

per New Ordinary Share ) and will be issued to the relevant

participants at the end of each month starting June 2023. This

arrangement will conclude on the earlier of 31 December 2023 or the

signing of a binding agreement for the sale (in part or whole) of

Empyrean's interest in Mako.

Issue of Warrants

Empyrean advises that the Board has resolved to issue warrants

in respect of 2,833,333 Shares to advisors of the Company, for

consultancy and advisory services provided over the last 12 months

(the "Advisor Warrants").

The exercise price of the Advisor Warrants is 1.5p each and they

will expire on 30 May 2024.

Empyrean also advises that the Board has resolved to issue

incentive warrants in respect of 10,000,000 ordinary shares of 0.2

pence in the Company to the Company Secretary, Jonathan Whyte, or

his nominee (the "Incentive Warrants").

The Incentive Warrants have been granted as part of the

Company's strategy to retain and incentivise directors and

management of the Company. The Incentive Warrants will expire on 30

May 2026.

The Incentive Warrants are to be issued in two equal tranches of

5,000,000. The exercise price of the first tranche of Incentive

Warrants is 1.5p each, which represents an approximate 25% premium

to the volume weighted average price of the Shares for the ten days

prior to the date of grant. The exercise price of the second

tranche of Incentive Warrants is 2.0p each, which represents an

approximate 66% premium to the volume weighted average price of the

Ordinary Shares for the ten days prior to the date of grant.

The technical information contained in this announcement has

been reviewed by Empyrean's Executive Technical director, Gaz

Bisht, who has over 32 years' experience as a hydrocarbon geologist

and geoscientist.

Empyrean CEO, Tom Kelly, stated:

"Empyrean is very pleased with the outcome of this capital

raising and is grateful for the continued support from its

shareholders. We now look forward with great interest to the

conclusion of Gas Sales Agreement negotiations and to developments

on the sell down process of the Mako Gas Field. The macro

environment for gas in South East Asia, and Singapore in

particular, is expected to continue trending favourably with the

region transitioning from coal to gas as the preferred energy

source. Energy demand and gas demand are both forecast to continue

to grow.

In China, we will use the very latest technology to further

de-risk the very large 890 million barrel (P10) target at Topaz.

Following success on the regional oil migration study and 3 seismic

inversion project, we will continue our preparations for drilling

within the November - May 2024 drilling weather window."

For further information please contact the following:

Empyrean Energy plc

Tom Kelly Tel: +61 6146 5325

Cenkos Securities plc (Nominated Advisor and Broker)

Neil McDonald Tel: +44 (0) 20 7297 8900

Pearl Kellie

First Equity (Join Broker)

Jason Robertson Tel: +44 (0) 20 7330 1883

NOTIFICATION AND PUBLIC DISCLOSURE OF TRANSACTIONS BY PERSONS

DISCHARGING MANAGERIAL RESPONSIBILITIES AND PERSONS CLOSELY

ASSOCIATED WITH THEM

1 Details of the person discharging managerial responsibilities/person

closely associated

a) Name: Thomas Kelly

----------------------------- ----------------------------------------

2 Reason for the Notification

-----------------------------------------------------------------------

a) Position/Status: Managing Director/CEO

----------------------------- ----------------------------------------

b) Initial notification/ Initial Notification

Amendment:

----------------------------- ----------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-----------------------------------------------------------------------

a) Name: Empyrean Energy Plc

----------------------------- ----------------------------------------

b) LEI: 213800ZRH1WBHEWDFA57

----------------------------- ----------------------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

-----------------------------------------------------------------------

a) Description of the financial Ordinary shares of 0.2p each ("Shares")

instrument, type of GB00B09G2351

instrument:

Identification code:

----------------------------- ----------------------------------------

b) Nature of the transaction: Subscription for Shares

----------------------------- ----------------------------------------

c) Price(s) and Volume(s): Price Volume

0.8p 6,250,000

----------------------------- ----------------------------------------

d) Aggregated Information: N/A (Single transaction)

- Aggregated Volume

- Price

----------------------------- ----------------------------------------

e) Date of the Transaction: 30 May 2023

----------------------------- ----------------------------------------

f) Place of the Transaction: London Stock Exchange, AIM (LON:EME)

----------------------------- ----------------------------------------

1 Details of the person discharging managerial responsibilities/person

closely associated

a) Name: Gaz Bisht

----------------------------- ----------------------------------------

2 Reason for the Notification

-----------------------------------------------------------------------

a) Position/Status: Technical Director

----------------------------- ----------------------------------------

b) Initial notification/ Initial Notification

Amendment:

----------------------------- ----------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-----------------------------------------------------------------------

a) Name: Empyrean Energy Plc

----------------------------- ----------------------------------------

b) LEI: 213800ZRH1WBHEWDFA57

----------------------------- ----------------------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

-----------------------------------------------------------------------

a) Description of the financial Ordinary shares of 0.2p each ("Shares")

instrument, type of GB00B09G2351

instrument:

Identification code:

----------------------------- ----------------------------------------

b) Nature of the transaction: Subscription for Shares

----------------------------- ----------------------------------------

c) Price(s) and Volume(s): Price Volume

0.8p 1,850,000

----------------------------- ----------------------------------------

d) Aggregated Information: N/A (Single transaction)

- Aggregated Volume

- Price

----------------------------- ----------------------------------------

e) Date of the Transaction: 30 May 2023

----------------------------- ----------------------------------------

f) Place of the Transaction: London Stock Exchange, AIM (LON:EME)

----------------------------- ----------------------------------------

1 Details of the person discharging managerial responsibilities/person

closely associated

a) Name: Jonathan Whyte

----------------------------- ------------------------------------------------------

2 Reason for the Notification

-------------------------------------------------------------------------------------

a) Position/Status: Company Secretary

----------------------------- ------------------------------------------------------

b) Initial notification/ Initial Notification

Amendment:

----------------------------- ------------------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-------------------------------------------------------------------------------------

a) Name: Empyrean Energy Plc

----------------------------- ------------------------------------------------------

b) LEI: 213800ZRH1WBHEWDFA57

----------------------------- ------------------------------------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

-------------------------------------------------------------------------------------

a) Description of the financial Warrants over ordinary shares of 0.2p

instrument, type of each ("Shares")

instrument: GB00B09G2351

Identification code:

----------------------------- ------------------------------------------------------

b) Nature of the transaction: (i) Subscription for Shares

(ii) Grant of 10,00,000 Incentive

Warrants over Shares with an expiry

date of 30 May 2026.

----------------------------- ------------------------------------------------------

c) Price(s) and Volume(s): (i) Price Volume

0.8p 500,000

(ii) Exercise Price(s) Volume(s)

GBP0.015 5,000,000

----------

GBP0.02 5,000,000

----------

----------------------------- ------------------------------------------------------

d) Aggregated Information: N/A (Single transaction)

- Aggregated Volume

- Price

----------------------------- ------------------------------------------------------

e) Date of the Transaction: 30 May 2023

----------------------------- ------------------------------------------------------

f) Place of the Transaction: London Stock Exchange, AIM (LON:EME)

----------------------------- ------------------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDEAKSEDDLDEEA

(END) Dow Jones Newswires

May 30, 2023 02:36 ET (06:36 GMT)

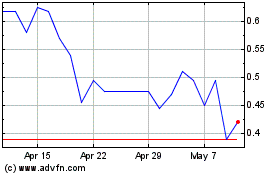

Empyrean Energy (LSE:EME)

Historical Stock Chart

From Nov 2024 to Dec 2024

Empyrean Energy (LSE:EME)

Historical Stock Chart

From Dec 2023 to Dec 2024