GlaxoSmithKline Expects Long-Term Sales, Profit Growth, Driven by Vaccines and Specialty Medicines -- Update

June 23 2021 - 7:32AM

Dow Jones News

--GlaxoSmithKline expects sales, profit growth in the next five

years, driven by new vaccines and specialty medicines

--The company expects its late-stage pipeline to underpin sales

in the longer term, until 2031

--R&D and commercial investment in vaccines and specialty

medicines will be priorities when the company spins off its

consumer healthcare business in 2022

By Cecilia Butini

GlaxoSmithKline PLC said Wednesday that it expects growth in

sales and adjusted operating profit over the next five years to be

underpinned by new vaccines and specialty medicines, as it set

targets for the medium and long term following the planned 2022

demerger of its consumer healthcare business.

The British pharmaceutical major said it expects to deliver

sales growth of more than 5% and adjusted operating profit of more

than 10% for 2021 to 2026, adding that these targets exclude

contributions from coronavirus-related revenue.

Adjusted operating margin is seen improving from the mid-20s% in

2021 to more than 30% by 2026, GSK said.

In the longer term, up to 2031, the company said it aims to

deliver sales of more than 33 billion pounds ($46.04 billion) at

constant exchange rates, which will be achieved by the commercial

execution of the company's late-stage pipeline.

GlaxoSmithKline said that, in formulating the outlooks until

2026 and then up to 2031, it took into account challenges in the

healthcare industry, which are expected to drag on in the coming

years, with continued covid-related uncertainty. Nonetheless, the

company said it expects volume demand for its products to increase,

particularly for its shingles vaccine Shingrix in the U.S., as

healthcare systems return to normal post-pandemic.

After the planned spinoff of its consumer-healthcare business,

the company--which management refers to as New GSK-- will

prioritize research and development and commercial investment in

vaccines and specialty medicines, GSK said. These areas are

expected to grow to around three-quarters of company sales by 2026,

it said. In terms of therapeutic areas, the company said it will

remain focused on infectious diseases, HIV, oncology and

immunology/respiratory.

The separation of the consumer-healthcare business, which is

still subject to shareholder approval, is set to take place by way

of a demerger of at least 80% of the company's 68% holding in the

unit to GSK shareholders. New GSK will retain up to 20% of the

former company's holding in the new consumer healthcare company, it

said. Following the separation, the two entities will have two

independent boards, GlaxoSmithKline said, adding that a process has

begun to form a board of directors for New GSK.

Write to Cecilia Butini at cecilia.butini@wsj.com

(END) Dow Jones Newswires

June 23, 2021 08:17 ET (12:17 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

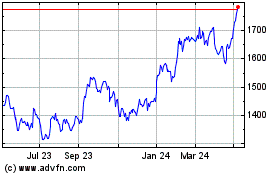

Gsk (LSE:GSK)

Historical Stock Chart

From Dec 2024 to Jan 2025

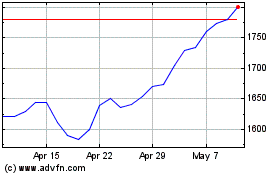

Gsk (LSE:GSK)

Historical Stock Chart

From Jan 2024 to Jan 2025