TIDMHLMA

RNS Number : 5313N

Halma PLC

25 September 2019

Halma, the FTSE100 group of life-saving technology companies,

today releases its scheduled trading update, for the period from 1

April 2019 to date, and is also updating on recent management

changes on its Executive Board.

Trading Update

Halma made good progress in this period. The Group's performance

was in line with the Board's expectations and included further

organic constant currency revenue growth against a strong

comparative period in the first half of 2019. Order intake was

ahead of revenue and was also ahead of the same period last

year.

All sectors delivered organic constant currency revenue growth.

The Environmental & Analysis sector performed well, while the

Medical and Infrastructure Safety sectors saw more modest rates of

growth. Revenue growth in Process Safety was in line with the

second half of last year.

There was widespread growth geographically, with organic

constant currency revenue increases in all major regions. There

were good rates of growth in the UK and the USA, with more moderate

growth in Europe and Asia-Pacific. The weakness of Sterling is

having a positive currency translation effect on the Group's

results (see Note 2).

Cash generation remains strong and our financial position

remains robust, allowing us to support continued investment in

growth, both organically and by acquisition.

We have a healthy acquisition pipeline and our M&A teams

continue to be active. In July, we announced that we had completed

the acquisition of the Ampac Group, a leading fire and evacuation

systems supplier in the Australian and New Zealand markets, for

A$135 million (GBP74 million) on a cash and debt free basis. We

also made two small bolt-on acquisitions in the period in the UK

and France, both in the Environmental & Analysis sector, for a

maximum total consideration of c.GBP7 million. The integrations of

these acquisitions are progressing well.

The results for the half year ending 30 September 2019 will be

released on 19 November 2019.

Executive Board Changes

During the period there have been three changes to Halma's

Executive Board arising from planned succession processes and the

evolution of our operational and digital growth strategies.

Sector Chief Executive

Laura Stoltenberg will succeed Adam Meyers as Sector Chief

Executive, Medical & Environmental from 1st October 2019. This

Sector Chief Executive role will be a member of the Halma Executive

Board.

Laura joined Halma as Divisional Chief Executive, Medical &

Environmental on January 1, 2019 from Medtronic where she was Vice

President and General Manager for MDI Solutions at Medtronic

Diabetes. Prior to Medtronic, Laura was Chief Commercial Officer at

Exact Sciences Corporation, responsible for sales, marketing,

market access and medical affairs. Earlier in her career she held

escalating leadership roles at General Electric, including GE

Healthcare Lunar, and drove several acquisitions for GE

Healthcare.

As announced in July 2019, Adam will support Laura in her

transition to ensure an orderly handover occurs and he will remain

on the Executive Board and the plc Board until July 2020. He has

agreed to support Halma beyond this date until mid-2021 should we

need it.

Group General Counsel and Company Secretary

Ruwan De Soyza has joined Halma as our General Counsel and

Company Secretary following the retirement of Carol Chesney. This

is a newly created role on Halma's Executive Board, with global

responsibility for the Group's legal, compliance, governance and

company secretarial affairs.

Before joining Halma, Ruwan was the Deputy General Counsel and

Head of Public Policy and Government Affairs at Worldpay Inc, the

NYSE listed payment processing company, having been Group General

Counsel of Worldpay Group plc. Prior to that, Ruwan held positions

at Standard Chartered Bank, Accenture and Clifford Chance LLP. He

holds a Diploma in Law and a Mechanical Engineering degree and is

qualified as a solicitor in England and Wales.

Chief Technology Officer

Catherine Michel has joined Halma as our first Chief Technology

Officer, a newly created role on Halma's Executive Board, with

global responsibility for IT and digital architecture. Prior to

joining Halma, Catherine was Chief Technology Officer and Chief

Strategy Officer at Sigma Systems. Catherine began her career at

Accenture and was founder and CTO of Tribold (later acquired by

Sigma Systems in 2013). Catherine will work closely with Inken

Braunschmidt in her role of driving the execution of Halma's

Digital and Innovation strategy.

Andrew Williams, Halma's CEO commented:

'These appointments bring important new capabilities to our

Executive Board which are aligned with our organic and acquisition

growth strategies. Laura, Ruwan and Catherine have all demonstrated

a strong understanding of Halma's unique operating culture and will

work closely with our sector and company Boards to help them

achieve their growth ambitions.'

For further information, please

contact:

Halma plc

Andrew Williams, Chief Executive On 25 September: +44 (0)7776

685948

Marc Ronchetti, Chief Financial Thereafter: +44 (0)1494 721111

Officer

Charles King, Head of Investor

Relations

MHP Communications

Rachel Hirst/ Andrew Jaques +44 (0)20 3128 8100

About Halma

Halma is a global group of life-saving technology companies,

focused on creating a safer, cleaner and healthier future for

people worldwide. Our innovative products and solutions address

many of the key issues facing the world today. We operate in four

sectors: Process Safety, Infrastructure Safety, Environmental &

Analysis and Medical. We employ over 6,000 people in 20 countries,

with major operations in Europe, the USA and Asia-Pacific. We

target global niche markets where sustainable growth and high

returns are supported by long-term drivers. Halma is listed on the

London Stock Exchange and has been a member of the FTSE 100 index

since December 2017.

Notes:

1. This Trading Update is based upon unaudited management

accounts information. Forward-looking statements have been made by

the Directors in good faith using information available up until

the date that they approved this statement. Forward-looking

statements should be regarded with caution because of the inherent

uncertainties in economic trends and business risks.

2. Sterling has weakened in the period relative to many

currencies, including the US Dollar and Euro. If current exchange

rates continue throughout the rest of the current financial year

the currency translation impact on the Group's results is expected

to be positive. Based on the mix of currency denominated revenue

and profit for the 2019 financial year, a 1% movement in the US

Dollar changes full year revenue by GBP5.5m and profit by GBP1.1m.

Similarly, a 1% movement in the Euro changes full year revenue by

GBP1.5m and profit by GBP0.3m. The weighted average exchange rates

relative to Sterling used to translate revenue and profit for the

year ended 31 March 2019 were: US Dollar 1.31, Euro 1.14.

3. Halma will be hosting a site visit for analysts and investors

on 1 October to its HWM Water subsidiary's headquarters in Cwmbran,

Wales. A summary of the presentation will be posted on our website,

www.halma.com, on that day.

4. A copy of this announcement, together with other information

about Halma, may be viewed on its website at www.halma.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTBLGDCBXDBGCS

(END) Dow Jones Newswires

September 25, 2019 02:00 ET (06:00 GMT)

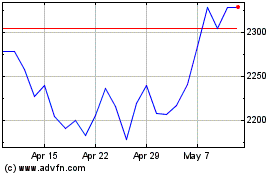

Halma (LSE:HLMA)

Historical Stock Chart

From Jan 2025 to Feb 2025

Halma (LSE:HLMA)

Historical Stock Chart

From Feb 2024 to Feb 2025