TIDMHLMA

RNS Number : 9288A

Halma PLC

27 January 2020

Halma, the leading safety, health and environmental technology

group, today announces two acquisitions for its Medical and

Infrastructure Safety sectors respectively.

Acquisition of NovaBone Products, LLC

Halma has acquired NovaBone Products, LLC ("NovaBone"), a

designer and manufacturer of US FDA-approved synthetic bone graft

products, based in Florida, USA.

NovaBone's products are used to accelerate bone regeneration,

primarily for orthopaedic and dental surgical procedures in the USA

(see notes 1 and 2). It will become part of Halma's Medical sector,

which includes a range of diagnostic and surgical device companies

serving niche applications in global healthcare markets. NovaBone's

management team, who were significant shareholders, will continue

to lead the business from its current location.

The initial cash consideration for NovaBone is US$97 million

(GBP74 million(3) ), on a cash and debt free basis, which will be

funded from Halma's existing facilities. When adjusted for tax

benefits with a net present value of approximately US$11 million

(GBP8 million), the net initial consideration is approximately

US$86 million (GBP66 million). Additional earn-out considerations

are payable in cash, dependent on profit growth in each of the two

financial years to March 2022, up to an aggregate maximum of US$40

million (GBP31 million), with a maximum of US$25 million (GBP19

million) achievable in any single financial year.

NovaBone's revenue and Adjusted EBIT for the twelve months ended

December 2019 are forecast to be US$21.0 million (GBP16.0 million)

and US$6.9 million (GBP5.3 million), respectively.

Acquisition of FireMate Software Pty. Ltd.

Halma has acquired 70 per cent of FireMate Software Pty. Ltd.

("FireMate"), a Brisbane, Australia-based company which provides

cloud-based fire protection maintenance software to fire

contractors.

The cash consideration for 70 per cent of FireMate is payable in

two tranches. An initial A$11.8 million (GBP6.2 million(4) ) is

payable at closing and a further A$6.4 million (GBP3.3 million)

contingent on performance to 30 June 2022, resulting in a maximum

A$18.2 million (GBP9.5 million), which will be funded from Halma's

existing facilities. Halma also has an option to purchase the

remaining 30% of FireMate, exercisable in the six months from 31

March 2025.

FireMate's revenue and EBIT in the twelve months ended June 2019

were A$2.5 million (GBP1.3 million) and A$0.9 million (GBP0.5

million), respectively.

FireMate will be part of the Group's Infrastructure Safety

sector and will continue to be led by its current management

team.

Andrew Williams, Group Chief Executive at Halma, commented:

"These businesses are exciting additions to Halma, bringing new

technologies and market niches to two of our sectors and are highly

aligned to our purpose. Both businesses are well positioned to

benefit from the range of Halma's strategic Growth Enablers and we

look forward to working with their management teams to deliver

further growth.

NovaBone extends our Medical sector's presence in surgical

applications, adding a new niche within the orthopedics market,

which is growing fast due to the ageing population and increasingly

sedentary lifestyles causing joint problems. It has strong

technology and knowhow within the fast-growing biologics segment,

developing biomaterials that harnesses the body's natural healing

process to accelerate bone growth.

FireMate's software solutions are highly complementary to those

currently offered by our Infrastructure Safety sector's fire

businesses and further strengthen our capabilities in connected and

integrated fire systems internationally."

For further information, please

contact:

Halma plc

Andrew Williams, Group Chief Switchboard: +44 (0)1494 721111

Executive

Marc Ronchetti, Chief Financial

Officer

Charles King, Head of Investor Mobile: +44 (0)7776 685948

Relations

MHP Communications

Rachel Hirst/ Andrew Jaques +44 (0)20 3128 8771

About Halma

Halma is a global group of life-saving technology companies,

focused on creating a safer, cleaner and healthier future for

people worldwide. Our innovative products and solutions address

many of the key issues facing the world today. We operate in four

sectors: Process Safety, Infrastructure Safety, Environmental &

Analysis and Medical. We employ over 6,000 people in 20 countries,

with major operations in Europe, the USA and Asia-Pacific. We

target global niche markets where sustainable growth and high

returns are supported by long-term drivers. Halma is listed on the

London Stock Exchange and is a member of the FTSE 100 index.

Notes

1. The orthopaedic and dental bone graft markets are growing

rapidly, driven by ageing populations and increasingly sedentary

lifestyles. NovaBone's growth is further supported by an increase

in spine fusion procedures and the greater use of synthetic bone

grafts rather than traditional surgical methods which use cadavers

or secondary bone graft sites. The global market for bone

replacement products is valued at approximately US$4.3 billion and

is growing at approximately 7% p.a., with the market in the USA

representing approximately US$1.4 billion.

2. NovaBone's primary markets are the orthopaedic synthetic bone

graft market, which accounts for approximately 90% of its revenue,

and the dental market. Approximately 85% of revenue is generated in

the USA, and NovaBone also serves customers in markets including

Australia, China, the Middle East, Brazil and India. NovaBone

intends to retain its current distribution arrangements in the

markets it serves. NovaBone's products are approved for use by the

U.S. Food & Drug Administration (FDA) and in several other

markets globally.

3. US Dollar (US$) values are translated throughout this announcement at a rate of US$1.31: GBP1

4. Australian Dollar (A$) values are translated throughout this

announcement at a rate of A$1.91: GBP1

5. This statement is not intended to constitute a profit

forecast for the current financial period or for any future period.

In addition, this statement should not be taken to mean that the

earnings per share of Halma will necessarily match or exceed the

historic reported earnings per share of Halma.

6. For more information on Halma's Growth Enablers visit:

https://www.halma.com/how-we-grow#page-intro-2

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACQBAMITMTATBJM

(END) Dow Jones Newswires

January 27, 2020 02:00 ET (07:00 GMT)

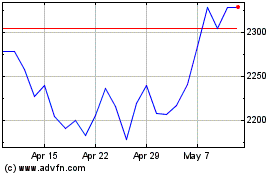

Halma (LSE:HLMA)

Historical Stock Chart

From Jan 2025 to Feb 2025

Halma (LSE:HLMA)

Historical Stock Chart

From Feb 2024 to Feb 2025