TIDMHPAC

RNS Number : 0299T

Hermes Pacific Investments PLC

22 November 2021

22 November 2021

HERMES PACIFIC INVESTMENTS PLC

(the "Company")

Change of Investing Policy

Notice of General Meeting

Hermes Pacific Investments plc (AIM: HPAC) is pleased to

announce details of a proposed change to the Company's investing

policy.

A circular to shareholders is expected to be posted today

setting out details of the New Investing Policy and to explain why

the Board considers the New Investing Policy to be in the best

interests of the Company and its shareholders as a whole and to

recommend that shareholders vote in favour of the resolution to be

proposed at a General Meeting required to implement the New

Investing Policy.

Background to and reasons for the change of investing policy

The Company's current investing policy is:

The proposed investments to be made by the Company may be either

quoted or unquoted; made by direct acquisition of an equity

interest; may be in companies, partnerships, joint ventures; or

direct interests in projects in South East Asia including, but not

limited to, investments in the financial sector. The Company's

equity interest in a proposed investment may range from a minority

position to 100 per cent. ownership.

The Company made a few minor investments when the current

investing policy was first adopted but the Company has not found

any suitable significant deals in South East Asia (in the financial

sector or elsewhere) into which to deploy its cash resources.

Therefore the Board consider that it would be appropriate to change

the strategic direction of the Company and implement a new

investing policy that allowed the Company's resources to be

deployed in other geographic areas and business sectors.

It is proposed that the Company's New Investing Policy will be

to invest principally, but not exclusively, in the property sector.

The Directors consider the property sector will provide the Company

with significantly more suitable investment opportunities that can

provide offer significant growth potential for the future.

In the first instance, the existing capital available to the

Company will be used to locate, evaluate and select investment

opportunities that offer satisfactory potential capital returns for

shareholders.

Proposed New Investing Policy

It is proposed that the Company's new investing policy will be

to invest principally, but not exclusively in the property sector

within Europe and the Middle East.

Accordingly, subject to the passing of the Resolution, the New

Investing Policy will be:-

The proposed investments to be made by the Company may be either

quoted or unquoted; in debt and/or in equity instruments, may be in

companies, partnerships, joint ventures; or direct interests in

property or property projects (either residential or commercial

property). The Company's equity interest in a proposed investment

may range from a minority position to 100 per cent. ownership.

The Directors believe there are opportunities to invest in and

acquire commercial and/or residential properties where the

properties may be undervalued and/or suitable for redevelopment to

enhance capital value.

The Company will identify and assess potential properties and

where it believes further investigation is required, and subject to

assessment of potential risk, intends to appoint appropriately

qualified advisers to assist. Where further investigation is

required, the Company intends to carry out a comprehensive and

thorough investment review process in which all material aspects of

any potential property investment will be subject to due

diligence.

The Company's financial resources may be invested in a small

number of properties or investments or potentially in just one

investment which may be deemed to be a reverse takeover of the

Company under the AIM Rules. Where this is the case, it is intended

to mitigate the risk by undertaking an appropriate due diligence

process. Any transaction constituting a reverse takeover under the

AIM Rules would require Shareholders' approval. The possibility of

building a broader portfolio of properties has not, however, been

excluded. The Company may also continue to review and investigate

non-property related investments as it has done to date.

The Company's investments may take the form of equity, debt or

convertible instruments. Investments may be made in all types of

assets falling within the remit of the New Investing Policy and

there will be no investment restrictions. Proposed investments may

be made in either quoted or unquoted companies and structured as a

direct acquisition, joint venture or as a direct interest in a

project or property. The Directors may consider it appropriate to

take an equity interest in any proposed investment which may range

from a minority position to 100 per cent ownership. The Company may

be either an active investor or passive investor. Where the Company

is an active investor, it may seek representation on the board of

investee companies.

The Directors believe that their broad collective experience

together with their network of contacts will assist them in the

identification, evaluation and funding of suitable property and

non-property investment opportunities. The Board already benefits

from the considerable expertise and experience of its chairman,

Haresh Kanabar, who has been actively involved in the residential

and commercial property markets for over 15 years and is currently

involved with three property companies based in the United Kingdom.

These companies are fully invested and as such no conflicts of

interest in relation to Mr Kanabar's roles are expected to arise.

The Company will also benefit from John Morton's extensive

experience in banking and finance when it comes to the financing of

potential property acquisitions.

If the New Investing Policy is approved by Shareholders, the

Directors hope to commence implementation of the policy in the

comings weeks. The Directors are aware of various potential

investment opportunities that they may seek to pursue in relative

short order.

The Director recognise that the Board is currently made up of

only two directors. If the change of investing policy is approved,

the Directors intend in due course to appoint an additional

director with relevant experience.. Until such time, any investment

decision will require the unanimous support of the Directors.

The objective of the Directors is to generate capital

appreciation and any income generated by the Company will be

applied to cover costs or will be added to the funds available to

further implement the New Investing Policy. In view of this, it is

unlikely that the Directors will recommend a dividend in the early

years. However, they may recommend or declare dividends at some

future date depending on the financial position of the Company.

Given the nature of the Company's New Investing Policy, the Company

does not intend to make regular periodic disclosures or

calculations of net asset value.

The Directors confirm that, as required by the AIM Rules, they

will at each annual general meeting of the Company seek shareholder

approval of its Investing Policy.

General Meeting

A general meeting of the Company will be held at 22 Great James

Street, London WC1N 3ES on 14 December 2021. The Resolution to be

proposed at the General Meeting as an ordinary resolution proposes

the adoption of the New Investing Policy.

This announcement contains inside information as stipulated

under the Market Abuse Regulations (EU) no. 596/2014 ("MAR").

For more information please contact:

Hermes Pacific Investments plc www.hermespacificinvestments.com

Haresh Kanabar, Non-Executive Chairman Tel: +44 (0) 7802 858893

WH Ireland Limited ( Nominated Adviser www.whirelandcb.com

& Broker)

Mike Coe/ Sarah Mather Tel: +44 (0) 207 220 1666

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFFIFWUEFSESF

(END) Dow Jones Newswires

November 22, 2021 02:00 ET (07:00 GMT)

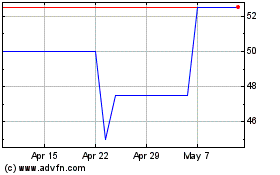

Hermes Pacific Investments (LSE:HPAC)

Historical Stock Chart

From Oct 2024 to Nov 2024

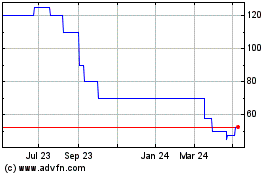

Hermes Pacific Investments (LSE:HPAC)

Historical Stock Chart

From Nov 2023 to Nov 2024