RNS Number : 9309J

International Greetings PLC

11 December 2008

11th December 2008

International Greetings plc

("International Greetings" or "the Group")

HALF YEAR RESULTS

International Greetings (AIM: IGR), one of the world's leading designers, innovators and manufacturers of gift wrap, crackers, cards,

stationery and accessories, announces half year results to 30 September 2008.

Financial Highlights:

* Turnover increased to �100.5million (2007: �91.8million);

* Operating profit of �0.6million (2007: �4.1million) - before significant items;

* Finance costs increased to �3.6million (2007: �1.7million) - including re-financing;

* Loss before tax �7.8million (2007: profit �2.4million) - after significant items;

* Basic loss per share 10.8 pence (2007 3.0 pence earning). Adjusted loss per share of 1.0 pence (2007: 4.0 pence earnings);

* Adequate facilities in place to provide the necessary working capital for the business for the foreseeable future.

Operational highlights:

* Restructuring of UK Greetings Division ongoing - due to be concluded by March 2009;

* Hoomark manufacturing division maintaining market share in Europe;

* 30% increase in US sales;

* Investment in Halloween Express sold for net $3.5million;

* Machinery transferred from Latvia to China now commissioned

* Seasonal production in China successfully completed.

Keith James, Chairman of International Greetings commented: Although it is anticipated that the challenging retail environment is likely

to persist for some time, consumers and retailers continue to purchase substantial volumes of our products in all geographical territories.

With the restructuring and cost control initiatives announced last year we have not only prepared our business for the current economic

climate but we will also be in a good position to reap the rewards when market conditions improve.

For further information:

International Greetings PLC: Tel: 01707 630630

Nick Fisher, Chief Executive

Arden Partners plc:

Richard Day Tel: 020 7398 1632

Tavistock Communications: Tel: 020 7920 3150

Jeremy Carey

Matt Ridsdale

Chairman's Statement

Notwithstanding the challenges facing all businesses due to the economic climate we continue to focus on the two year recovery plan for

the turnaround of our business. Our key objectives are cash management, overhead control and margin enhancement. I announce below the

interim results for the six months to 30th September 2008

Financial Review

Turnover for the period was �100.5 million (2007: �91.7 million) with an adjusted operating profit, before significant items of �0.6

million (2007: �4.1 million). After significant items the operating loss was �4.3 million (2007:�4.1 million profit). Finance expenses

during the period increased to �3.6million from �1.7million last year. The Group's share of profits of continuing associates was �0.1million

(2007: Nil) and after significant items this resulted in a loss before tax of �7.8million (2007: �2.4 million profit). Basic loss per share

for the period was 10.8 pence (2007: 3.0 pence earnings). Adjusted loss per share before significant items and discontinued operations was

1.0 pence (2007: 4.0 pence earnings)

In light of current trading conditions the Board is of the opinion that it would not be appropriate to recommend an interim dividend at

this time (2007: 2.0 pence per share)

The increase in finance expenses reflects an increase in working capital required to support growth in turnover and interest rate

changes. In addition, to ensure that funding was secured for the year, detailed financial reviews of the Group were undertaken, and

specialist strategic and banking advice was taken. A significant item of �1.4 million relates to the associated costs of this advice. We

enjoy the continuing support of our banks and have in place adequate facilities to provide the necessary working capital for the business

for the foreseeable future.

Operational Review

In the UK, the restructuring of the Greetings Division continued during the first half of this financial year with significant items of

�1.6million. These costs relate primarily to redundancies with 116 members of staff leaving the business. A further 83 have left since the

period end. We anticipate that the restructuring will be concluded by the year end in March and that our business model will then be aligned

with the current demands of the UK market place.

In Europe, the Hoomark manufacturing division is achieving its goals of maintaining market share, but with a clear focus on improving

efficiency and, in turn, increasing margins.

In the US following last year's purchase of Glitterwrap, together with organic growth of the existing business, sales at the interim

stage increased by 30%. This trend is expected to continue for the full year.

We continue to look for ways to become more efficient in how we manufacture and distribute goods to the US market place and have

identified further rationalisation opportunities which will take place during the second half of the financial year. As previously

announced, the investment in Halloween Express was sold on April 30 with a net $3.5million being received for our share of the business.

In China we have completed a successful peak season of manufacturing at our plant. The equipment transferred from Latvia has now been

installed and commissioned which increases the range of products we are now able to manufacture rather than outsource. In light of the

economic conditions in the region we reassessed the value of this equipment which led to an impairment provision of �1.7 million. This will

result in a reduced depreciation charge in the future.

By investing in our own factory we have reduced the risk to our business from the challenging supply situation currently facing

businesses purchasing goods from China. With many factory closures in the region we, in common with others in our industry, have experienced

disruption of supply. This also includes the loss of a large quantity of seasonal goods due to a fire at a supplier's premises. These

problems have resulted in a significant loss in the period of �1m. We shall be submitting an insurance claim to cover that loss. With

greater control over our supply chain by increasing our own production we will minimise these problems in the future.

The investment in our associate Artwrap, Australia continues to meet our expectations. New business opportunities have been created by

Artwrap offering the Group's large portfolio of products to its customers and we continue to realise synergy benefits from joint sourcing in

China.

Board Changes and Management Incentive

It is being separately announced today that Nick Fisher, our CEO, who has been a key player in the development and growth of the Group

for the last 20 years, having successfully overseen the restructuring and management changes we have made over the last 12 months, has

decided to resign from the Board with effect from 31 December 2008. He has agreed to act as a consultant to the Board for the foreseeable

future and has indicated his intention to remain a shareholder.

On behalf of the Board and the shareholders, I thank Nick for his contribution to the business over many years and wish him well for the

future. Paul Fineman, who joined the Board in 2005 and became Group Managing Director last January, will succeed Nick as CEO.

We believe strongly in the future potential of our business and the motivation of our Executive Directors and Senior Management is key

to our success. To this end, the Board has approved a new share incentive scheme which will be implemented in due course. This scheme will

ensure that as our business succeeds and corporate value is restored for our shareholders, our management will also benefit from their hard

work and commitment.

Current Trading and Outlook

Our busiest trading period spans the half year end with substantial sales made during October and November. The bulk of deliveries have

now been made for the Christmas Season, in line with our expectations. Our sales teams are now actively in discussions with customers for

next year's seasonal orders with a clear focus on margin growth. In addition we continue to secure orders for our growing counter cyclical

spring and summer business which now accounts for approximately 50% of Group revenues.

Sales in the UK have remained stable year-on-year and we expect this trend to continue in the second half. It has been well publicised

that a number of retailers have either closed or are in difficulty. The Board has taken steps to protect our position and to reduce the

Group's exposure to these customers.

Although it is anticipated that the challenging retail environment is likely to persist for some time, consumers and retailers continue

to purchase substantial volumes of our products in all geographical territories. With the restructuring and cost control initiatives

announced last year we have not only prepared our business for the current economic climate but we will also be in a good position to reap

the rewards when market conditions improve.

Keith James OBE

Chairman

11 December 2008

Consolidated income statement

For the six months ended 30 September 2008

Unaudited Unaudited

six months six months

ended 30 ended 30 12 months

September September to 31 March

2008 2007 2008

Before Significant Total Before Significant Total

significant items significant items

items (note 4) items (note 4)

�000 �000 �000 �000 �000 �000 �000

Continuing operations

Revenue 100,503 - 100,503 91,736 194,168 - 194,168

Cost of sales (77,433) (2,477) (79,910) (64,829) (148,366) (4,309) (152,675)

Gross profit 23,070 (2,477) 20,593 26,907 45,802 (4,309) 41,493

Distribution expenses (9,097) (958) (10,055) (7,621) (16,041) (95) (16,136)

Administration expenses (14,024) (1,631) (15,655) (15,920) (30,096) (3,324) (33,420)

Other Operating Income 628 - 628 740 586 - 586

Profit on sales of fixed 21 199 220 - 31 257 288

assets

Operating (loss)/profit 598 (4,867) (4,269) 4,106 282 (7,471) (7,189)

Finance expenses (2,255) (1,379) (3,634) (1,674) (3,861) - (3,861)

Share of profit of associates 126 - 126 - 509 - 509

(net of tax)

(Loss)/profit before tax (1,531) (6,246) (7,777) 2,432 (3,070) (7,471) (10,541)

Income tax credit/(charge) 1,081 1,549 2,630 (552) 1,591 1,287 2,878

(Loss)/profit from continuing (450) (4,697) (5,147) 1,880 (1,479) (6,184) (7,663)

operations

Discontinued operations

Profit/(loss) from 48 - 48 (462) (1,411) (2,964) (4,375)

discontinued operations (net

of tax)

(Loss)/profit for the year (402) (4,697) (5,099) 1,418 (2,890) (9,148) (12,038)

attributable to equity holders

of parent company

(Loss)/earnings per ordinary

share

Basic & Diluted (10.8 p) 3.0 p (25.7 p)

Consolidated balance sheet

as at 30 September 2008

Unaudited Unaudited 12 months to

as at 30 as at 30 31

September September March

2008 2007 2008

�000 �000 �000

Non-current assets

Property, plant and equipment 41,034 43,813 43,485

Intangible assets 35,876 32,502 35,544

Investment in associates 3,217 3,630 3,106

Deferred tax assets 5,376 - 4,169

Total non current assets 85,503 79,945 86,304

Current assets

Inventory 72,862 66,472 56,990

Tax receivable 82 - 918

Trade and other receivables 81,662 84,192 33,779

Cash and cash equivalents 36 20 2,137

Other financial assets 427 - -

Assets classified as held for sale - - 1,718

Total current assets 155,069 150,684 95,542

Total assets 240,572 230,629 181,846

Equity

Share capital 2,353 2,353 2,353

Share premium 3,006 3,007 3,006

Reserves 17,451 13,298 15,263

Retained earnings 43,326 63,100 48,425

Total equity attributable to equity 66,136 81,758 69,047

holders of the parent company

Non-current liabilities

Loans and borrowings 8,632 1,900 1,843

Deferred income 4,276 4,597 4,752

Provisions 1,345 1,345 1,345

Other financial liabilities 924 6,170 2,806

Total non-current liabilities 15,177 14,012 10,746

Current liabilities

Bank overdraft 104,147 93,082 64,898

Loans and borrowings 442 256 241

Deferred income 953 954 954

Provisions 512 - 510

Trade and other payables 34,641 27,150 21,698

Income Tax liabilities 34 789 59

Other financial liabilities 18,530 12,628 13,693

Total current liabilities 159,259 134,859 102,053

Total liabilities 174,436 148,871 112,799

Total equity and liabilities 240,572 230,629 181,846

Consolidated cash flow statement

as at 30 September 2008

Unaudited Unaudited

6 months to 6 months to 12 months to

30 September 30 September 31 March

2008 2007 2008

�000 �000 �000

Cash flows from operating

activities

(Loss)/profit for the period/year (5,099) 1,418 (12,038)

Adjustments for:

Depreciation & impairment losses 4,581 2,833 6,759

Amortisation of intangible assets 101 - 221

Financial expenses 3,634 1,674 3,861

Share of (profit)/loss of (126) 343 390

associates

Gain on sale of property, plant (220) - (288)

and equipment

Equity settled share-based - 65 (213)

payments

Income tax (credit)/charge - (2,630) 552 (2,878)

continuing operations

Income tax charge/(credit) - 29 (54) (1,731)

discontinued operations

(Gain)/ loss on discontinued (77) - 3,969

associate included

within assets held for sale

Negative goodwill recognised - - (189)

Foreign exchange (losses)/gains - - (70)

Operating profit/(loss) before 193 6,831 (2,207)

changes in working

capital and provisions

Change in trade and other (43,048) (43,109) 7,834

receivables

Change in inventory (13,557) (14,402) (3,222)

Change in trade and other payables 12,312 9,665 3,834

Change in provisions and deferred 477 (416) (478)

income

Cash (absorbed by)/generated from (43,623) (41,431) 5,761

operations

Interest and similar charges paid (3,613) (2,074) (4,191)

Tax received/(paid) 861 (497) (1,533)

Net cash (outflow)/inflow from (46,375) (44,002) 37

operating activities

Cash flow from investing

activities

Proceeds from sale of property 1,255 3,715 5,114

plant and equipment

Acquisition of subsidiary, - (10,555) (11,187)

including overdrafts acquired

Acquisition of shares in - (791) (8,252)

associates

Net proceeds from the sale and - - 50

purchase of intangible assets

Acquisition of property plant and (1,815) (3,785) (7,295)

equipment

Receipt of government grants - 1,962 1,960

Receipts from sales of investments 1,796 20 20

Net cash inflow/(outflow) from 1,236 (9,434) (19,590)

investing activities

Cash flows from financing

activities

Change in borrowings 7,044 (159) (433)

Payment of finance lease (39) (48) (132)

liabilities

Dividends paid - (3,629) (4,570)

Net cash inflow/(outflow) from 7,005 (3,836) (5,135)

financing activities

Net decrease in cash and cash (38,134) (57,272) (24,688)

equivalents

Cash and cash equivalents at (62,761) (35,567) (35,567)

beginning of period

Effect of exchange rate (3,216) (223) (2,506)

fluctuations on cash held

Cash and cash equivalents at end (104,111) (93,062) (62,761)

of period

Consolidated statement of changes in equity

For the six months ended 30 September 2008

September 2008 Share Share Merger Retained Capital Hedging Translation

Total equity

capital Premium Reserve Earnings redemption reserve reserve

attributable to

reserve

equity holder

of

the parent

company

�000 �000 �000 �000 �000 �000 �000

�000

Balance at 1 April 2008 2,353 3,006 15,533 48,425 1,340 (125) (1,485)

69,047

Effective changes in fair - - - - - 432 -

432

value of cash flow

hedge (net of tax)

Exchange adjustment - - - - - - 1,756

1,756

Net income recognised directly - - - - - 432 1,756

2,188

in equity

Loss for the period - - - (5,099) - - -

(5,099)

Total income and expense - - - (5,099) - 432 1,756

(2,911)

recognised

for the period

Dividends paid - - - - - - -

-

Equity settled share based - - - - - - -

-

payments

Shares issued - - - - - - -

-

Balance at 30 September 2008 2,353 3,006 15,533 43,326 1,340 307 271

66,136

September 2007 Share capital Share Premium Merger Retained Capital Hedging Translation

Total equity

Reserve Earnings redemption reserve reserve

attributable to

reserve

equity holder

of

the parent

company

�000 �000 �000 �000 �000 �000 �000

�000

Balance at 1 April 2007 2,317 2,515 13,416 65,246 1,340 - (2,997)

81,837

Exchange adjustment - - - - - - (578)

(578)

Net income recognised directly - - - - - - (578)

(578)

in equity

Profit for the period - - - 1,418 - - -

1,418

Total income and expense - - - 1,418 - - (578)

840

recognised

for the period

Dividends paid - - - (3,629) - - -

(3,629)

Equity settled share based - - - 65 - - -

65

payments

Shares issued 36 492 2,117 - - - -

2,645

Balance at 30 September 2007 2,353 3,007 15,533 63,100 1,340 - (3,575)

81,758

March 2008 Share capital Share Premium Merger Retained Capital Hedging Translation

Total equity

Reserve Earnings redemption reserve reserve

attributable to

reserve

equity holder

of

the parent

company

�000 �000 �000 �000 �000 �000 �000

�000

Balance at 1 April 2007 2,317 2,515 13,416 65,246 1,340 - (2,997)

81,837

Effective changes in fair - - - - - (125) -

(125)

value of cash flow

hedge (net of tax)

Exchange adjustment - - - - - - 1,512

1,512

Net income recognised directly - - - - - (125) 1,512

1,387

in equity

Loss for the year - - (12,038)

(12,038)

Total income and expense - - - (12,038) - (125) 1,512

(10,651)

recognised

for the year

Dividends paid - - - (4,570) - - -

(4,570)

Equity settled share based - - - (213) - - -

(213)

payments

Shares issued 36 491 2,117 - - -

2,644

Balance at 31 March 2008 2,353 3,006 15,533 48,425 1,340 (125) (1,485)

69,047

Notes

1. Accounting policies

Basis of preparation

The financial information contained in this interim report does not constitute statutory accounts as defined in Section 240 of the

Companies act and is unaudited.

The group interim report has been prepared and approved by the directors in accordance with International Financial Reporting Standards

as adopted by the EU ("Adopted IFRSs."). The comparative figures for the financial year ended 31 March 2008 are based on the Group's

statutory accounts for that financial year. The report of the auditors was (i) unqualified (ii) did not include a reference to any matters

to which the auditors drew attention by way of emphasis without qualifying their report, and (iii) did not contain a statement under section

237 (2) or (3) of the Companies Act 1985.

The accounting policies set out below have, unless otherwise stated, been applied consistently to all periods presented in this group

interim report and in preparing an opening IFRS balance sheet at 1 April 2006 for the purposes of transition to Adopted IFRS.

The interim report has been prepared on the going concern basis notwithstanding the loss for the period of �5.1 million and net current

liabilities at 30 September 2008 of �4.2 million. The directors believe this to be appropriate because as in previous years, the Group

relies primarily on an overdraft facility for its working capital needs and its principal bank has stated that, without prejudice to the on

demand nature of the facility, it is their present intention that the facility will remain in place until 31 December 2009 when the renewal

of the facility will be reviewed. The bank has also confirmed, assuming the business performs in line with expectations, that the facility

will be renewed on 31 December 2009. The Directors consider that this will enable the company to continue to meet its liabilities as they

fall due for payment. As with any company placing reliance on external entities for financial support, the Directors acknowledge that there

can be no certainty that this support will continue although, at the date of approval of this interim report, they have no reason to believe it will not do so.

Adopted IFRS not yet applied

The following Adopted IFRSs were endorsed and available for early application but have not been applied by the Group in this interim

report.. Their adoption is not expected to have a material effect on the financial statements unless otherwise indicated:

IFRS 8 'Operating Segments' (mandatory for years commencing on or after 1 January 2009). The impact of this standard is to change the

way operating segments are presented in the financial statements. The standard requires disclosure of segment information based on the

internal reports regularly reviewed by Management in order to assess each segment's performance and to allocate resources to them. The Group

is currently reviewing the way in which internal reports are presented and so no segmental analysis is presented in this report.

Measurement convention

The interim report is prepared on the historical cost basis except that financial instruments used for hedging are stated at their fair

value.

Foreign currency translation

The consolidated interim report is presented in pounds sterling, which is the Group's presentational currency.

Transactions in foreign currencies are translated at the foreign exchange rate ruling at the date of the transaction. Monetary assets

and liabilities denominated in foreign currencies at the balance sheet date are translated at the foreign exchange rate ruling at that date.

Foreign exchange differences arising on translation are recognised in the income statement.

The assets and liabilities of foreign operations, including goodwill and fair value adjustments arising on consolidation, are translated

at foreign exchange rates ruling at the balance sheet date. The revenues and expenses of foreign operations are translated at an average

rate for the period where this rate approximates to the foreign exchange rates ruling at the dates of the transactions. Exchange differences

arising from this translation of foreign operations, and of related qualifying hedges are taken directly to the translation reserve. They

are released into the income statement upon disposal.

2. Taxation charge

Taxation for the six months to 30 September is based on the effective rate of taxation, which is estimated to apply in each country for

the year ended 31 March 2009.

3. Earnings per share

6 months to 6 months to 12 months to

30 September 30 September 31 March

2008 2007 2008

�000 �000 �000

Adjusted basic (loss)/earnings per (1.0p) 4.0p (3.2p)

share excluding significant

items and discontinued operations

Loss per share on significant items (9.9p) - (13.2p)

Loss per share on discontinued 0.1p (1.0p) (9.3p)

operations

Basic (loss)/earnings per share (10.8p) 3.0p (25.7p)

Diluted (loss)/earnings per share (10.8p) 3.0p (25.7p)

The basic loss per share is based on the loss of �5,099,000 (2007:1,418,000 profit) and a weighted average number of ordinary shares in

issue of 47,056,685 (2007:46,600,114) calculated as follows:

Weighted average number of shares 30 September 30 September 31 March

at the start of the year in thousands 2008 2007 2008

of shares

Issued ordinary shares at start of 47,056 46,330 46,330

period

Shares issued in respect of - 262 461

acquisitions

Shares issued in respect of exercising - 8 8

of share options

Weighted average number of shares at 47,056 46,600 46,799

the

end of the year

Adjusted basic loss per share excluded significant items charged of �6,246,000 (2007:Nil), the tax relief attributable to those items of

�1,549,000 (2007: Nil), and the profit on discontinued operations (net of tax) of �48,000 (2007:�462,000 loss)

Share options have not been included in the calculation of fully diluted losses per share for 31 March 2008 because their inclusion

would be anti-dilutive. There were no options outstanding at 30 September 2008

4. Significant items

Cost Distribution Administration Profit on Financial Total

of expenses expenses disposal Expense

sales of plant

& equipment

�000 �000 �000 �000 �000 �000

Continuing operations for the

period to

30 September 2008

UK restructuring 208 110 1,436 (199) - 1,555

Financial restructuring - - - - 1,379 1,379

Woolworths bad debt provisions - 408 - - - 408

Latvia closure 1,735 - - - 1,735

Asian supplier disruption 534 440 27 - - 1,001

Other significant - - 168 - - 168

restructuring measures across

Group

2,477 958 1,631 (199) 1,379 6,246

Continuing operations for the

year ended

31 March 2008

UK restructuring 1,507 95 1,085 - - 2,687

Latvia closure 1,988 - 1,185 - - 3,173

Integration of acquisitions 814 - 735 - - 1,549

Aborted acquisition costs - - 319 - - 319

Profit on disposal of plant - - - (257) - (257)

and equipment

4,309 95 3,324 (257) - 7,471

UK restructuring costs, primarily staff redundancy, are due to the rationalisation currently being undertaken within the UK greetings

division.

Financial restructuring relates to the facility fees and external advisor costs incurred in order to secure the Group's banking

facilities of �115m required to provide the necessary working capital for the business for the foreseeable future.

The transfer of the equipment from the Group's Latvian production facility to other parts of the Group announced last year has now been

completed. In the light of current market conditions the economic value of this equipment has been reassessed which resulted in a one off

impairment of �1.7m.

After the half year end a significant UK high street retail customer went into administration, an increase in bad debt provisions of

�0.4m was made to cover the total amount unpaid prior to September. We are currently in negotiations with the administrators to recover some

or all of the amounts due.

During the year the Group incurred significant additional costs due to disruption of the supply of goods from subcontractors based in

Asia. The costs relate to the incremental expenditure incurred by switching to alternative suppliers and for air freight to customers. One

supplier suffered a fire in a warehouse filled with our seasonal products ready for shipment. The Company will be submitting an insurance

claim to cover these losses.

Other significant restructuring costs mainly relate to one off costs incurred due to the movement of production facilities within

Europe.

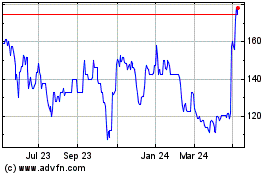

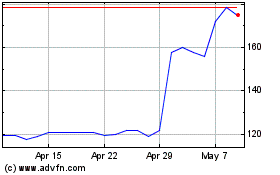

Ig Design (LSE:IGR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Ig Design (LSE:IGR)

Historical Stock Chart

From Jul 2023 to Jul 2024