TIDMIGR

RNS Number : 6550X

IG Design Group PLC

28 November 2017

28 November 2017

IG Design Group PLC

(the "Company", the "Group" or "Design Group")

Interim Results

IG Design Group plc, one of the world's leading designers,

innovators and manufacturers of gift packaging, greetings,

stationery, creative play products and giftware, announces its

Interim Results for the six months ended 30 September 2017.

Financial Highlights

-- Sales up 14% to GBP166.5m from GBP145.5m

Ø 10% organic growth at like for like FX rates, with the full

effect of Lang (acquired mid H1 2016) adding a further 2%

-- Gross profit up 15% to GBP35.4m from GBP30.8m

Ø 8% organic growth at like for like FX rates, with the

synergies in Lang adding a further 5%

-- Operating profit* up 20% to GBP11.1m from GBP9.3m

Ø 11% organic growth at like for like FX rates, with Lang adding

8%

-- PBT* up 27% to GBP10.5m from GBP8.2m

Ø 22% organic growth at like for like FX rates, 9% Lang

-- Underlying Earnings Per Share up 14% to 10.9p from 9.6p

Ø 9% organic at like for like FX rates, 7% Lang

-- Net Debt reduced by GBP6.2m to GBP70.2m

-- Interim Dividend declared of 2p

* before exceptional items and LTIP charges

Operational Highlights

Group

-- Continued to drive profitable overall organic growth

-- Identified and delivered further commercial, operational and

purchasing synergies to enhance profitability

UK

-- Sales up 4% at GBP57.5m with profit* stable, following the

integration of our three UK operating businesses

-- State-of-the-art manufacturing equipment producing retailer

branded bags is now fully operational on

time and on budget

Continental Europe

-- Sales in local currency up 19% to EUR23.6m with growth in profit* of 26%

-- Second high speed, highly efficient and environmentally

friendly printing press is on track and on

budget for installation early in 2018

-- Strong order book in place for the balance of the financial year

Australia (JV)

-- Sales in local currency up 13% to A$30.9m with growth in profit* of 17%

-- Growth mainly driven in the robust Independents Channel

-- Completion of the acquisition of Biscay Greetings Pty Limited on track

USA

-- Excellent trading performance with overall sales up 18% to $91.3m and profit* up 45%

-- Organic sales and profits* growth of 13% and 27% respectively

-- Synergies following the integration of Lang Companies

(acquired July 2016) are being achieved as

planned, resulting in H1 sales up 46% to $16.2m and H1 profit* up 124%

-- Planned investment to upgrade our IT systems in the USA is

proceeding on time and on budget and is due

for installation during FY19

* before exceptional items and LTIP charges

Outlook

Whilst cost headwinds are undoubtedly stronger than ever, our

businesses are well positioned to combat these. A full order book

and a strong performance in the first half of the year provides

confidence that the Group is fully on track to meet full year

market expectations for profit and other key underlying

metrics.

Paul Fineman, Chief Executive said:

"We are once again delighted to be reporting a robust

performance during the first half of the year, with all regions

trading profitably and growth being achieved both organically and

through acquisition.

Our business is diversified by product category, regional

activity and by customer channel, all with a common theme of adding

value through potent and commercial design, efficient

manufacturing, sourcing and excellent customer service.

Building on our established track record, we are pleased to be

identifying still further compelling investment opportunities to

continuously improve efficiency and enhance capability across all

territories.

We look forward to providing a further update during January and

remain committed to creating sustainable value for our shareholders

through both organic growth and, when the opportunity arises,

through carefully considered acquisitions."

-S -

This announcement contains inside information.

IG Design Group PLC Tel: 01525 887310

Paul Fineman, Chief Executive

Anthony Lawrinson, Chief Financial Officer

Cenkos Securities Tel: 020 7397 8900

Bobbie Hilliam

Harry Hargreaves

Alma PR Tel: 020 3865 9668

Rebecca Sanders-Hewett

Susie Hudson

Helena Bogle

Executive summary

Overview

The first half of FY18 has seen a very pleasing performance with

growth achieved both organically and through acquisition.

Overall, sales and profit before tax, exceptional items and LTIP

charges are up 14% and 27% respectively. Underlying, fully diluted

earnings per share is up 14% whilst net debt is lower than at the

previous half-year period, despite funding the seasonal working

capital at the recently acquired Lang business.

Performance by region

We are pleased to report that all regions have again traded

profitably during the period.

Americas

-- An excellent trading performance with sales up 18% to $91.3

million and underlying profit(a) up 45% to $7.1 million

-- This includes organic growth of sales up 13% and profits up 27%

-- The integration of The Lang Companies (Lang) acquired in July

2016 has progressed very well resulting in sales in the first half

up 46% to $16.2 million and profit up 124% to $2.1 million

-- The planned investment to upgrade our IT systems in the USA

is proceeding on time and on budget and is due for installation

during FY19

Europe

-- Sales in local currency up 19% to EUR23.6 million with growth

in underlying profit(a) of 26% to EUR2.0 million

-- A second high speed, highly efficient, printing press is on

track for delivery and on budget for installation early in 2018

-- A strong order book is in place for the balance of the financial year

Australia

-- Sales in local currency up 13% to AUD30.9 million with growth

in underlying profit(a) of 17% to AUD2.0 million

-- Growth mainly driven by the robust Independents channel

-- The completion of the acquisition of Biscay Greetings Pty

Limited is on track to take place in January 2018

UK

-- Sales up 4% at GBP57.5 million with underlying profit(a)

remaining stable at GBP4.2 million, reflecting the initial impact

of the integration of our three UK operating businesses

-- Our UK business continues to work hand--in--hand with our

manufacturing facility in China, which continues to efficiently

supply record volumes of gift bags and greetings cards, as well as

high volumes of crackers

-- State--of--the--art manufacturing equipment producing

retailer branded bags to be given to consumers is now fully

operational, having been installed on time and on budget in our

manufacturing facility in Wales

(a) Underlying profit is stated before exceptional items and

LTIP charges.

Central costs

Reflect investment to broaden and strengthen our ability to

support growth both organically and through M&A activity.

Financial review

Reported sales are up 14% to GBP166.5 million on the prior

period (2016 H1: GBP145.5 million) with some favourable timing

differences in the USA assisting. Organic growth (excluding Lang)

represents 10% of this growth with foreign exchange translation

effects accounting for 2% and the acquisition in 2016 of Lang a

further 2%. Lang was only owned for half of the period in H1 last

year. As usual, there are geographical variations but overall

phasing of delivery to customers appears to be slightly ahead of

prior years.

Gross margins increased from GBP30.8 million to GBP35.4 million

which was stable as a percentage of sales at 21.2%.

Overhead costs are higher at GBP25.3 million (2016 H1: GBP22.5

million). This is largely driven by a) the impact of Lang ownership

for the full period (GBP0.8 million); b) the effect of overseas

costs translated at current exchange rates; and c) our recent

investments in people, rebranding and growth opportunities.

The LTIP charge is a largely non-cash accounting charge and we

exclude the effect of this when measuring underlying trends in

profitability. As a percentage of sales, and after removing the

effect of the LTIP charge, overhead costs were flat at 15%.

Operating profit before exceptional costs and LTIP charges again

improved strongly by 20% to GBP11.1 million (2016 H1: GBP9.3

million) while profit before tax, exceptional items and LTIP

charges was up 27% to GBP10.5 million from GBP8.2 million in the

equivalent period last year. This strong trading position at the

end of the first half of the year is firmly underpinning

management's expectations for the full year.

The exceptional cost during the period was GBP0.1 million (2016

H1: GBP0.6 million credit) mainly reflecting costs associated with

the acquisition of Biscay.

After allowing for exceptional items in the period, profit

before tax and after exceptional items and LTIP charges was GBP9.5

million, up 20% on the prior year (2016 H1: GBP7.9 million).

Reconciliation to underlying measures

Unaudited Unaudited Twelve

six months six months months

ended ended ended

30 Sept 30 Sept 31 Mar

2017 2016 2017

GBPm GBPm GBPm

------------------ ---------- ---------- -------

Profit before tax 9.5 7.9 13.0

Exceptional items 0.1 (0.6) 1.1

LTIP charges 0.9 0.9 2.2

------------------ ---------- ---------- -------

Underlying profit 10.5 8.2 16.3

------------------ ---------- ---------- -------

Unaudited Unaudited Twelve

six months six months months

ended ended ended

30 Sept 30 Sept 31 Mar

2017 2016 2017

pence pence pence

------------------------------------ ---------- ---------- -------

Fully diluted EPS 9.9 9.5 15.0

Cost per share on exceptional items 0.0 (1.0) 0.4

Costs per share on LTIP charge 1.0 1.1 2.8

------------------------------------ ---------- ---------- -------

Underlying EPS 10.9 9.6 18.2

------------------------------------ ---------- ---------- -------

Finance expenses in the period were again substantially lower on

the prior year period at GBP0.6 million (2016 H1: GBP1.1 million)

reflecting the continued effect of improved borrowing costs,

efficient use of our lower cost asset-based lending working capital

facilities and lower average indebtedness. We also agreed to extend

the term of our global facilities in May 2017 by a further year to

June 2020. The facility is capable of extension for one further

year on the same terms should the parties agree.

The effective underlying tax rate (before exceptional items and

LTIP charges) was 28% (2016 H1: 24%), slightly below the blended

prevailing rate which based upon the current mix of Group profits

would be 28.5%. We now anticipate by the year end that all US

losses will have been used with only GBP3.4 million of tax losses

unutilised in the UK. If growth is heavily fuelled by our US

business as is our expectation, the blended tax rate could continue

to rise; however, should US tax rates be significantly reduced as

is currently under review, this could provide a material additional

advantage to the Group's earnings after tax. Cash tax is

increasingly becoming payable at the prevailing rate in most of our

geographic regions of operation as historical losses are fully

utilised although this will be not be evident in the US or UK until

2018/19.

Stated before exceptional items and LTIP charges, basic earnings

per share were ahead of expectations and much improved at 11.3p

(2016 H1: 9.8p). The equivalent statutory outcome was 10.2p (2016

H1: 9.7p) after exceptional items and LTIP charges. Our primary

measure of performance is underlying fully diluted earnings per

share (stated before exceptional items and LTIP charges) and this

was up 14% to 10.9p (2016 H1: 9.6p). The half year EPS outcome

benefits slightly from the timing of profitability for reasons

explained above.

Capital expenditure in the six months was GBP3.8 million (2016

H1: GBP3.0 million), somewhat higher than the prior period as we

seek out opportunities to invest in efficiency. Notably we have

taken delivery of new machinery in Wales to manufacture retail

branded bags ("Not--for--sale" consumables) as part of our

diversification into new adjacent product categories. This

equipment was already fully operational at 30 September 2017 with a

strong order book in place. Orders have also been confirmed and

deposits placed for a second high definition, high speed, printing

press in Europe and to implement a new ERP system in our US

business. Both are expected to yield attractive paybacks.

Cash used by operations was GBP64.5 million (2016 H1: GBP54.2

million) reflecting the growing scale of the business and the

seasonal funding of the newly acquired Lang business. The

underlying cash dynamic reflects the usual phasing of production,

geared heavily towards H1. As always this is impacted by the high

variability year to year of the exact timing of customer delivery

requirements.

Cash flows associated with interest, tax and dividends in

aggregate were up from GBP2.9 million in 2016 H1 to GBP4.5 million,

with increases in dividend payments (including a modest amount to

our joint venture partner) and taxation accounting for GBP1 million

each while interest payments continue to decline.

Despite the increasing working capital need, net debt at 30

September 2017 was lower than the prior year at GBP70.2 million

(2016 H1: GBP76.4 million). This results from strong underlying

trading cash flows and tight disciplines around working capital

control.

Recent exchange rate translation effects have depressed

underlying profits by a modest GBP0.1 million compared with the

prior year.

Our focus on reduction of average leverage has not wavered and

having achieved our long term target last year, two years ahead of

schedule, we will now continue to target a level of average debt of

between 1.5 and 2.5 times EBITDA.

Dividend

A final dividend for the year ended 31 March 2017 of 2.75p per

share was paid in September 2017 making the total for the year

4.5p. The Board is pleased to declare an interim dividend of 2p per

share in respect of H1 2017/18 (2017 H1: 1.75p) in line with our

intention to steadily increase total dividends. This will be paid

on 18 January 2018 to shareholders on the register on 8 December

2017.

Directorate changes

As previously announced in July, Anthony Lawrinson indicated his

intention to retire from his role as Chief Financial Officer for

family reasons, after six years with the Group. The Board is

pleased to have announced alongside these financial results that it

intends to appoint Giles Willits as its new Chief Financial Officer

effective from 2nd January 2018. Anthony is continuing in his role

until early January 2018 and he has agreed to provide additional

transitional support in order to ensure an orderly handover.

The Board would like to thank Anthony for the diligence,

commitment and dedication he has shown over the past six years. He

has made a significant contribution to the Group, supporting its

turnaround, global diversification and subsequent stellar growth,

executing its M&A strategy and creating a robust finance

function which will serve the Group well over the coming years. We

wish him well for the future.

Current trading outlook

We are once again delighted to be reporting a robust performance

during the first half of the year, with all regions trading

profitably and growth being achieved both organically and through

the successful integration of Lang which we acquired in July

2016.

Our business is diversified by product category, regional and

seasonal activity as well as by customer channel, all with a common

theme of adding value through creating products with potent and

highly commercial designs, efficient manufacturing and sourcing and

excellent customer service.

Whilst we have delivered fast payback through investment in

capital equipment, we are really pleased to be identifying further

compelling investment opportunities to continuously improve

efficiency and enhance capability across all territories.

We look forward to providing a further update during January

2018 and creating sustainable value for our shareholders through

both organic growth and, when the opportunity arises, through

carefully considered acquisitions.

Paul Fineman

Chief Executive Officer

28 November 2017

Anthony Lawrinson

Chief Financial Officer

28 November 2017

Consolidated income statement

six months ended 30 September 2017

Unaudited six Unaudited six Twelve months

months months

ended 30 Sep ended 30 Sep ended 31 Mar

2017 2016 2017

----------------------------------- ----------------------------------- -----------------------------------

Before Exceptional Before Exceptional Before Exceptional

exceptional items exceptional items exceptional items

items (note Total items (note Total items (note Total

3) 3) 3)

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

----------------- ----------- ----------- --------- ----------- ----------- --------- ----------- ----------- ---------

Revenue 166,530 - 166,530 145,525 - 145,525 310,992 - 310,992

Cost of sales (131,168) - (131,168) (114,730) - (114,730) (247,058) (1,532) (248,590)

----------------- ----------- ----------- --------- ----------- ----------- --------- ----------- ----------- ---------

Gross profit 35,362 - 35,362 30,795 - 30,795 63,934 (1,532) 62,402

21.2% 21.2% 21.2% 21.2% 20.6% 20.1%

Selling expenses (9,383) - (9,383) (8,317) - (8,317) (19,019) - (19,019)

Administration

expenses (15,910) (88) (15,998) (14,172) 563 (13,609) (29,832) 495 (29,337)

Other operating

income 179 - 179 99 - 99 210 - 210

----------------- ----------- ----------- --------- ----------- ----------- --------- ----------- ----------- ---------

Operating

profit/(loss) 10,248 (88) 10,160 8,405 563 8,968 15,293 (1,037) 14,256

Finance expenses (660) - (660) (1,045) - (1,045) (1,229) - (1,229)

----------------- ----------- ----------- --------- ----------- ----------- --------- ----------- ----------- ---------

Profit/(loss)

before tax 9,588 (88) 9,500 7,360 563 7,923 14,064 (1,037) 13,027

Income tax

(charge)/credit (2,737) 4 (2,733) (1,792) 26 (1,766) (3,480) 761 (2,719)

----------------- ----------- ----------- --------- ----------- ----------- --------- ----------- ----------- ---------

Profit/(loss) for

the period 6,851 (84) 6,767 5,568 589 6,157 10,584 (276) 10,308

----------------- ----------- ----------- --------- ----------- ----------- --------- ----------- ----------- ---------

Attributable to:

Owners of the

Parent Company 6,432 5,865 9,650

Non--controlling

interests 335 292 658

----------------- ----------- ----------- --------- ----------- ----------- --------- ----------- ----------- ---------

Earnings per ordinary share

Unaudited six months Unaudited six months Twelve months

ended 30 Sep 2017 ended 30 Sep 2016 ended 31 Mar 2017

---------------------- ----------------------- -------------------

Diluted Basic Diluted Basic Diluted Basic

------------------- ------------ -------- ------------- -------- ---------- -------

Earnings per share 9.9p 10.2p 9.5p 9.7p 15.0p 15.7p

------------------- ------------ -------- ------------- -------- ---------- -------

Consolidated statement of comprehensive income

six months ended 30 September 2017

Unaudited Unaudited Twelve

six months six months months

ended ended ended

30 Sep 30 Sep 31 Mar

2017 2016 2017

GBP000 GBP000 GBP000

-------------------------------------------------------------------------------------- ---------- ---------- ------

Profit for the period 6,767 6,157 10,308

Other comprehensive income:

Exchange difference on translation of foreign operations (net of tax) (573) 3,069 3,213

Transfer to profit and loss on maturing cash flow hedges (net of tax) (271) 223 223

Net loss on cash flow hedges (net of tax) (110) (580) 271

Other comprehensive income for period, net of tax, items which may be reclassified to

profit

and loss in subsequent periods (954) 2,712 3,707

Total comprehensive income for the period, net of tax 5,813 8,869 14,015

Attributable to:

Owners of the Parent Company 5,676 8,107 12,795

Non--controlling interests 137 762 1,220

-------------------------------------------------------------------------------------- ---------- ---------- ------

5,813 8,869 14,015

-------------------------------------------------------------------------------------- ---------- ---------- ------

Consolidated statement of changes in equity

six months ended 30 September 2017

Share

premium

and Non--

capital

Share redemption Merger Hedging Translation Retained Shareholder controlling

capital reserve reserves reserves reserve earnings equity interest Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------- ------- ---------- -------- -------- ----------- -------- ----------- ----------- -------

At 31 March 2017 3,132 9,769 17,164 271 2,551 53,330 86,217 3,833 90,050

------------------- ------- ---------- -------- -------- ----------- -------- ----------- ----------- -------

Profit for the

period - - - - - 6,432 6,432 335 6,767

Other comprehensive

income - - - (381) (375) - (756) (198) (954)

------------------- ------- ---------- -------- -------- ----------- -------- ----------- ----------- -------

Total comprehensive

income for the

period - - - (381) (375) 6,432 5,676 137 5,813

Equity--settled

share--based

payment - - - - - 594 594 - 594

Tax on

equity--settled

share--based

payment - - - - - 424 424 - 424

Options exercised 31 - - - - (31) - - -

Equity dividends

paid - - - - - (1,734) (1,734) (575) (2,309)

------------------- ------- ---------- -------- -------- ----------- -------- ----------- ----------- -------

At 30 September

2017 3,163 9,769 17,164 (110) 2,176 59,015 91,177 3,395 94,572

------------------- ------- ---------- -------- -------- ----------- -------- ----------- ----------- -------

six months ended 30 September 2016

Share

premium

and Non--

capital

Share redemption Merger Hedging Translation Retained Shareholder controlling

capital reserve reserves reserves reserve earnings equity interest Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------- ------- ---------- -------- -------- ----------- -------- ----------- ----------- -------

At 31 March 2016 2,963 4,852 17,164 (223) (100) 43,346 68,002 3,370 71,372

------------------- ------- ---------- -------- -------- ----------- -------- ----------- ----------- -------

Profit for the

period - - - - - 5,865 5,865 292 6,157

Other comprehensive

income - - - (357) 2,599 - 2,242 470 2,712

------------------- ------- ---------- -------- -------- ----------- -------- ----------- ----------- -------

Total comprehensive

income for the

period - - - (357) 2,599 5,865 8,107 762 8,869

Equity--settled

share--based

payment - - - - - 514 514 - 514

Tax on

equity--settled

share--based

payment - - - - - 850 850 - 850

Shares issued 150 4,883 - - - - 5,033 - 5,033

Options exercised 19 34 - - - - 53 - 53

Equity dividends

paid - - - - - (1,039) (1,039) (260) (1,299)

------------------- ------- ---------- -------- -------- ----------- -------- ----------- ----------- -------

At 30 September

2016 3,132 9,769 17,164 (580) 2,499 49,536 81,520 3,872 85,392

------------------- ------- ---------- -------- -------- ----------- -------- ----------- ----------- -------

year ended 31 March 2017

Share

premium

and Non--

capital

Share redemption Merger Hedging Translation Retained Shareholder controlling

capital reserve reserves reserves reserve earnings equity interest Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------- ------- ---------- -------- -------- ----------- -------- ----------- ----------- -------

At 1 April 2016 2,963 4,852 17,164 (223) (100) 43,346 68,002 3,370 71,372

------------------- ------- ---------- -------- -------- ----------- -------- ----------- ----------- -------

Profit for the year - - - - - 9,650 9,650 658 10,308

Other comprehensive

income - - - 494 2,651 - 3,145 562 3,707

------------------- ------- ---------- -------- -------- ----------- -------- ----------- ----------- -------

Total comprehensive

income for the

year - - - 494 2,651 9,650 12,795 1,220 14,015

Equity--settled

share--based

payment - - - - - 1,555 1,555 - 1,555

Tax on

equity--settled

share--based

payments - - - - - 913 913 - 913

Shares issued 150 4,883 - - - - 5,033 - 5,033

Options exercised 19 34 - - - - 53 - 53

Capital

contribution from

non--controlling

investor - - - - - - - 110 110

Equity dividends

paid - - - - - (2,134) (2,134) (867) (3,001)

------------------- ------- ---------- -------- -------- ----------- -------- ----------- ----------- -------

At 31 March 2017 3,132 9,769 17,164 271 2,551 53,330 86,217 3,833 90,050

------------------- ------- ---------- -------- -------- ----------- -------- ----------- ----------- -------

Consolidated balance sheet

as at 30 September 2017

Unaudited Unaudited

as at as at As at

30 Sep 30 Sep 31 March

2017 2016 2017

Note GBP000 GBP000 GBP000

---------------------------------------------------- ---- --------- --------- --------

Non--current assets

Property, plant and equipment 33,270 33,450 32,607

Intangible assets 33,879 33,733 33,681

Deferred tax assets 4,640 4,426 5,398

---------------------------------------------------- ---- --------- --------- --------

Total non--current assets 71,789 71,609 71,686

---------------------------------------------------- ---- --------- --------- --------

Current assets

Inventory 70,197 74,355 49,475

Trade and other receivables 120,422 105,810 29,622

Derivative financial assets 188 86 307

Cash and cash equivalents 4 2,282 5,381 3,659

---------------------------------------------------- ---- --------- --------- --------

Total current assets 193,089 185,632 83,063

---------------------------------------------------- ---- --------- --------- --------

Total assets 264,878 257,241 154,749

---------------------------------------------------- ---- --------- --------- --------

Equity

Share capital 3,163 3,132 3,132

Share premium 8,429 8,429 8,429

Reserves 20,570 20,423 21,326

Retained earnings 59,015 49,536 53,330

---------------------------------------------------- ---- --------- --------- --------

Equity attributable to owners of the Parent Company 91,177 81,520 86,217

---------------------------------------------------- ---- --------- --------- --------

Non--controlling interests 3,395 3,872 3,833

---------------------------------------------------- ---- --------- --------- --------

Total equity 94,572 85,392 90,050

---------------------------------------------------- ---- --------- --------- --------

Non--current liabilities

Loans and borrowings 4 (39) (254) (39)

Deferred income 1,048 1,133 1,083

Provisions 883 872 881

Other financial liabilities 1,960 2,242 1,911

Deferred tax liability 584 352 525

---------------------------------------------------- ---- --------- --------- --------

Total non--current liabilities 4,436 4,345 4,361

---------------------------------------------------- ---- --------- --------- --------

Current liabilities

Bank overdraft 4 6,409 4,576 916

Loans and borrowings 4 66,055 75,250 (232)

Deferred income 152 150 111

Provisions 455 220 441

Income tax payable 3,337 2,809 3,153

Trade and other payables 72,763 64,975 37,450

Other financial liabilities 16,699 19,524 18,499

---------------------------------------------------- ---- --------- --------- --------

Total current liabilities 165,870 167,504 60,338

---------------------------------------------------- ---- --------- --------- --------

Total liabilities 170,306 171,849 64,699

---------------------------------------------------- ---- --------- --------- --------

Total equity and liabilities 264,878 257,241 154,749

---------------------------------------------------- ---- --------- --------- --------

Consolidated cash flow statement

six months ended 30 September 2017

Unaudited Unaudited Twelve

six months six months months

ended ended ended

30 Sep 30 Sep 31 Mar

2017 2016 2017

GBP000 GBP000 GBP000

-------------------------------------------------------- ---------- ---------- --------

Cash flows from operating activities

Profit for the year 6,767 6,157 10,308

Adjustments for:

Depreciation 2,198 1,809 4,571

Amortisation of intangible assets 347 328 798

Finance expenses 660 1,045 1,229

Negative goodwill release to income - (1,067) (1,271)

Income tax charge 2,733 1,766 2,719

(Profit)/loss on sales of property, plant and equipment (2) 15 24

Loss on external sale of intangible fixed assets - - 51

Equity--settled share--based payment 874 870 2,216

-------------------------------------------------------- ---------- ---------- --------

Operating profit after adjustments for non--cash items 13,577 10,923 20,645

Change in trade and other receivables (90,306) (78,676) (772)

Change in inventory (21,358) (22,863) 2,670

Change in trade and other payables 33,601 36,436 8,940

Change in provisions and deferred income (45) (58) 44

-------------------------------------------------------- ---------- ---------- --------

(Cash used by)/cash generated from operations (64,531) (54,238) 31,527

Tax paid (1,501) (525) (2,003)

Interest and similar charges paid (734) (1,060) (1,867)

-------------------------------------------------------- ---------- ---------- --------

Net cash (outflow)/inflow from operating activities (66,766) (55,823) 27,657

-------------------------------------------------------- ---------- ---------- --------

Cash flow from investing activities

Proceeds from sale of property, plant and equipment 27 48 58

Acquisition of businesses - (2,669) (2,669)

Capital contribution from non--controlling investor - - 110

Acquisition of intangible assets (462) (77) (534)

Acquisition of property, plant and equipment (3,372) (2,914) (4,633)

Receipt of government grants 15 39 40

-------------------------------------------------------- ---------- ---------- --------

Net cash outflow from investing activities (3,792) (5,573) (7,628)

-------------------------------------------------------- ---------- ---------- --------

Cash flows from financing activities

Net proceeds from issue of share capital - 5,086 5,086

Repayment of secured borrowings - (21,774) (21,774)

Net movement in credit facilities 66,265 68,575 (795)

Payment of finance lease liabilities (17) (229) (2,383)

Loan arrangement fees (67) (287) (319)

Equity dividends paid (1,734) (1,039) (2,134)

Dividends paid to non--controlling interests (575) (260) (867)

-------------------------------------------------------- ---------- ---------- --------

Net cash inflow/(outflow) from financing activities 63,872 50,072 (23,186)

-------------------------------------------------------- ---------- ---------- --------

Net decrease in cash and cash equivalents (6,686) (11,324) (3,157)

Cash and cash equivalents at beginning of period 2,743 6,872 6,872

Effect of exchange rate fluctuations on cash held (184) 5,257 (972)

-------------------------------------------------------- ---------- ---------- --------

Cash and cash equivalents at end of the period (4,127) 805 2,743

-------------------------------------------------------- ---------- ---------- --------

Notes to the interim financial statements

1 Accounting policies

Basis of preparation

The financial information contained in this interim report does

not constitute statutory accounts as defined in Section 434 of the

Companies Act 2006 and is unaudited.

The Group interim report has been prepared and approved by the

Directors in accordance with International Financial Reporting

Standards as adopted by the EU ("Adopted IFRS"). The financial

information for the year ended 31 March 2017 is extracted from the

statutory accounts of the Group for that financial year and does

not constitute statutory accounts as defined in Section 434 of the

Companies Act 2006. The auditor's report was (i) unqualified; (ii)

did not include a reference to any matters to which the auditor

drew attention by way of emphasis without qualifying their report;

and (iii) did not contain a statement under Section 498 (2) of the

Companies Act 2006.

The interim report does not include all the information and

disclosures required in the annual financial statements and should

be read in conjunction with the Group's annual financial statements

for the year ended 31 March 2017.

Going concern basis

The borrowing requirement of the Group increases steadily over

the period from July and peaks in October, due to the seasonality

of the business, as sales of wrap and crackers are mainly for the

Christmas market, before then reducing.

As with any company placing reliance on external entities for

financial support, the Directors acknowledge that there can be no

certainty that this support will continue, although, at the date of

approval of this interim report, they have no reason to believe

that it will not do so.

After making enquiries, the Directors have a reasonable

expectation that the Company and the Group have adequate resources

to continue in operational existence for the foreseeable future.

Thus, they continue to adopt the going concern basis of accounting

in preparing the financial statements.

Significant accounting policies

The accounting policies adopted in the preparation of the

interim report are consistent with those followed in the

preparation of the Group's annual financial statements for the year

ended 31 March 2017.

2 Segmental information

The Group has one material business activity being the design,

manufacture and distribution of gift packaging and greetings,

stationery and creative play products, and design--led

giftware.

For management purposes the Group is organised into four

geographic business units.

The results below are allocated based on the region in which the

businesses are located; this reflects the Group's management and

internal reporting structure. The decision was made during 2011 to

focus Asia as a service provider of manufacturing and procurement

operations, whose main customers are our UK businesses.

Both the China factory and the majority of the Hong Kong

procurement operations are now overseen by our UK operational

management team and we therefore continue to include Asia within

the internal reporting of the UK operations, such that UK and Asia

comprise an operating segment.

Intra--segment pricing is determined on an arm's length basis.

Segment results include items directly attributable to a segment as

well as those that can be allocated on a reasonable basis.

Financial performance of each segment is measured on operating

profit. Interest income or expense and tax are managed on a Group

basis and not split between reportable segments.

Segment assets are all non--current and current assets,

excluding deferred tax and income tax, which are shown in the

eliminations column. Where cash shown in one segment, nets under

the Group's banking facilities against overdrafts in other

segments, the elimination is shown in the eliminations column.

Inter--segment receivables and payables are eliminated

similarly.

UK and Asia Europe USA Australia Eliminations Group

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

----------------------------------------------- ----------- --------- --------- --------- ------------ ---------

Six months ended 30 September 2017

Revenue

- external 57,516 20,817 69,713 18,484 - 166,530

- inter segment 1,737 786 - - (2,523) -

----------------------------------------------- ----------- --------- --------- --------- ------------ ---------

Total segment revenue 59,253 21,603 69,713 18,484 (2,523) 166,530

----------------------------------------------- ----------- --------- --------- --------- ------------ ---------

Segment result before exceptional items 4,003 1,684 5,132 1,227 - 12,046

Exceptional items - - (12) (76) - (88)

----------------------------------------------- ----------- --------- --------- --------- ------------ ---------

Segment result 4,003 1,684 5,120 1,151 - 11,958

----------------------------------------------- ----------- --------- --------- --------- ------------ ---------

Central administration costs (1,798)

Net finance expenses (660)

Income tax (2,733)

----------------------------------------------- ----------- --------- --------- --------- ------------ ---------

Profit for the six months ended 30 September

2017 6,767

----------------------------------------------- ----------- --------- --------- --------- ------------ ---------

Balances at 30 September 2017

Segment assets 147,275 32,870 63,985 16,108 4,640 264,878

----------------------------------------------- ----------- --------- --------- --------- ------------ ---------

Segment liabilities (62,018) (28,276) (65,247) (10,844) (3,921) (170,306)

----------------------------------------------- ----------- --------- --------- --------- ------------ ---------

Capital expenditure

- property, plant and equipment 2,263 789 124 196 - 3,372

- intangible 32 10 420 - - 462

Depreciation 1,192 341 425 240 - 2,198

Amortisation 92 25 219 11 - 347

----------------------------------------------- ----------- --------- --------- --------- ------------ ---------

UK and Asia Europe USA Australia Eliminations Group

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

----------------------------------------------- ----------- --------- --------- --------- ------------ ---------

Six months ended 30 September 2016

Revenue

- external 55,117 16,545 58,560 15,303 - 145,525

- inter segment 1,448 224 - - (1,672) -

----------------------------------------------- ----------- --------- --------- --------- ------------ ---------

Total segment revenue 56,565 16,769 58,560 15,303 (1,672) 145,525

----------------------------------------------- ----------- --------- --------- --------- ------------ ---------

Segment result before exceptional items 4,000 1,258 3,758 1,020 - 10,036

Exceptional items - - 563 - - 563

----------------------------------------------- ----------- --------- --------- --------- ------------ ---------

Segment result 4,000 1,258 4,321 1,020 - 10,599

----------------------------------------------- ----------- --------- --------- --------- ------------ ---------

Central administration costs (1,631)

Net finance expenses (1,045)

Income tax (1,766)

----------------------------------------------- ----------- --------- --------- --------- ------------ ---------

Profit for the six months ended 30 September

2016 6,157

----------------------------------------------- ----------- --------- --------- --------- ------------ ---------

Balances at 30 September 2016

Segment assets 139,043 31,989 66,914 14,869 4,426 257,241

----------------------------------------------- ----------- --------- --------- --------- ------------ ---------

Segment liabilities (78,480) (12,426) (69,222) (8,560) (3,161) (171,849)

----------------------------------------------- ----------- --------- --------- --------- ------------ ---------

Capital expenditure

- property, plant and equipment 1,085 226 554 1,049 - 2,914

- intangible 26 - 49 2 - 77

Depreciation 885 349 424 151 - 1,809

Amortisation 131 21 165 11 - 328

----------------------------------------------- ----------- --------- --------- --------- ------------ ---------

UK and Asia Europe USA Australia Eliminations Group

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------------------------------- ----------- --------- --------- --------- ------------ --------

Year ended 31 March 2017

Revenue

- external 114,113 45,497 117,831 33,551 - 310,992

- inter segment 2,904 227 - - (3,131) -

---------------------------------------- ----------- --------- --------- --------- ------------ --------

Total segment revenue 117,017 45,724 117,831 33,551 (3,131) 310,992

---------------------------------------- ----------- --------- --------- --------- ------------ --------

Segment result before exceptional items 5,541 4,490 6,119 1,710 - 17,860

---------------------------------------- ----------- --------- --------- --------- ------------ --------

Exceptional items - - (1,037) - - (1,037)

---------------------------------------- ----------- --------- --------- --------- ------------ --------

Segment result 5,541 4,490 5,082 1,710 - 16,823

---------------------------------------- ----------- --------- --------- --------- ------------ --------

Central administration costs (2,567)

Net finance expenses (1,229)

Income tax (2,719)

---------------------------------------- ----------- --------- --------- --------- ------------ --------

Profit for the year ended 31 March 2017 10,308

---------------------------------------- ----------- --------- --------- --------- ------------ --------

Balances at 31 March 2017

Segment assets 95,760 20,413 21,461 11,717 5,398 154,749

---------------------------------------- ----------- --------- --------- --------- ------------ --------

Segment liabilities (10,934) (16,382) (27,952) (5,753) (3,678) (64,699)

---------------------------------------- ----------- --------- --------- --------- ------------ --------

Capital expenditure

- property, plant and equipment 1,866 687 812 1,268 - 4,633

- intangible 184 36 263 51 - 534

Depreciation 1,813 1,081 1,306 371 - 4,571

Amortisation 194 45 536 23 - 798

---------------------------------------- ----------- --------- --------- --------- ------------ --------

3 Exceptional items

Six months Six months Twelve months

ended ended ended

30 Sep 30 Sep 31 Mar

2017 2016 2017

GBP000 GBP000 GBP000

------------------------------------------- ---------- ---------- -------------

Acquisition of Biscay Greetings Pty Ltd

Transaction costs(a) 76 - -

Acquisition of Lang Companies Inc.

Transaction and restructuring costs(b) - 504 722

Gain on bargain purchase(c) - (1,067) (1,271)

Restructuring of American operations(d) 12 - 1,586

------------------------------------------- ---------- ---------- -------------

Total before tax 88 (563) 1,037

Income tax credit (4) (26) (761)

------------------------------------------- ---------- ---------- -------------

84 (589) 276

------------------------------------------- ---------- ---------- -------------

(a) Transaction costs relating to the acquisition of the Biscay business.

(b) Transaction and restructuring costs relating to the acquisition of the Lang business.

(c) Gain on the bargain purchase on the acquisition of the Lang

business (see note 7 for further details).

(d) Restructuring of American printing platform.

4 Cash, loans and borrowings

Net debt

Six months Six months Twelve months

ended ended ended

30 Sep 30 Sep 31 Mar

2017 2016 2017

GBP000 GBP000 GBP000

-------------------------------------------------- ---------- ---------- -------------

Cash and cash equivalents 2,282 5,381 3,659

Bank overdrafts (6,409) (4,576) (916)

-------------------------------------------------- ---------- ---------- -------------

Cash and cash equivalents per cash flow statement (4,127) 805 2,743

Bank loans and borrowings (66,265) (75,402) -

Loan arrangement fees 249 406 271

Finance leases (30) (2,200) (45)

-------------------------------------------------- ---------- ---------- -------------

Net debt as used in the executive summary (70,173) (76,391) 2,969

-------------------------------------------------- ---------- ---------- -------------

Split between current and non--current

Six months Six months Twelve months

ended ended ended

30 Sep 30 Sep 31 Mar

2017 2016 2017

GBP000 GBP000 GBP000

---------------------------- ---------- ---------- -------------

Non--current liabilities

Loan arrangement fees 39 254 39

---------------------------- ---------- ---------- -------------

39 254 39

---------------------------- ---------- ---------- -------------

Current liabilities

Asset backed loan (36,374) (51,043) -

Revolving credit facilities (29,891) (24,359) -

---------------------------- ---------- ---------- -------------

Bank loans and borrowings (66,265) (75,402) -

Loan arrangement fees 210 152 232

---------------------------- ---------- ---------- -------------

(66,055) (75,250) 232

---------------------------- ---------- ---------- -------------

Finance leases of GBP30,000 (2016: GBP2,200,000) are included

within other financial liabilities and are split GBP1,000 (2016:

GBP1,703,000) non--current and GBP29,000 (2016: GBP497,000)

current.

Loan arrangement fees represent the unamortised costs in

arranging the three--year Group facilities which commenced in June

2016 and the unamortised costs relating to a one--year

extension.

5 Taxation

Six months Six months Twelve months

ended ended ended

30 Sep 30 Sep 31 Mar

2017 2016 2017

GBP000 GBP000 GBP000

----------------------------------------------------------- ---------- ---------- -------------

Current tax expenses

Current income tax charge 2,082 1,376 3,132

Deferred tax expense

Relating to original and reversal of temporary differences 651 390 (413)

----------------------------------------------------------- ---------- ---------- -------------

Total tax in income statement 2,733 1,766 2,719

----------------------------------------------------------- ---------- ---------- -------------

Taxation for the six months to 30 September 2017 is based on the

effective rate of taxation, which is estimated to apply in each

country for the year ended 31 March 2018.

6 Earnings per share

Six months ended Six months ended Twelve months ended

30 Sep 2017 30 Sep 2016 31 Mar 2017

------------------ ------------------ ---------------------

Diluted Basic Diluted Basic Diluted Basic

pence pence pence pence pence pence

------------------------------------------------------- ---------- ------ ---------- ------ ------------ -------

Underlying earnings per share excluding exceptional

items and LTIP charges 10.9 11.3 9.6 9.8 18.2 19.0

Cost per share on LTIP charge (1.0) (1.1) (1.1) (1.1) (2.8) (2.9)

------------------------------------------------------- ---------- ------ ---------- ------ ------------ -------

Underlying earnings per share excluding exceptional

items 9.9 10.2 8.5 8.7 15.4 16.1

Earnings per share on exceptional items - - 1.0 1.0 (0.4) (0.4)

------------------------------------------------------- ---------- ------ ---------- ------ ------------ -------

Earnings per share 9.9 10.2 9.5 9.7 15.0 15.7

------------------------------------------------------- ---------- ------ ---------- ------ ------------ -------

The basic earnings per share is based on the profit attributable

to equity holders of the Parent Company of GBP6,432,000 (2016:

GBP5,865,000) and the weighted average number of ordinary shares in

issue of 62,868,000 (2016: 60,442,000) calculated as follows:

As at As at As at

30 Sep 30 Sep 31 Mar

In thousands of shares 2017 2016 2017

-------------------------------------------------------- ------ ------ ------

Issued ordinary shares at 1 April 62,642 59,257 59,257

Shares issued in respect of exercising of share options 226 136 260

Shares issued in respect of share placing - 1,049 2,022

-------------------------------------------------------- ------ ------ ------

Weighted average number of shares at end of the period 62,868 60,442 61,539

-------------------------------------------------------- ------ ------ ------

Total number of executive share options, over 5p ordinary

shares, in issue at 30 September 2017 was 710,000 (2016:

710,000).

Total number of Long Term Incentive Plan ("LTIP") options, over

5p ordinary shares, in issue at 30 September 2017 was 1,213,013

(2016: 500,000).

Underlying basic earnings per share excludes exceptional items

and LTIP charges of GBP924,000 (2016: GBP307,000) and tax relief

attributable to those items of GBP196,000 (2016: GBP209,000) to

give underlying profits of GBP7,160,000 (2016: 5,963,000).

7 Acquisitions of businesses

Biscay Greetings Pty Limited

On 21 September 2017 IG Design Group plc announced that it had

signed a contract to acquire the trade and certain assets of Biscay

Greetings Pty Limited, a leading greetings card and paper products

business based in Australia. Completion will take place in January

2018.

The acquisition, to be made through Design Group's Australian

joint venture Artwrap, will be satisfied by a cash consideration of

AUD9.0 million (GBP5.5 million) using local debt facilities. Stock

and fixed assets acquired are estimated at a market value of AUD5.0

million (GBP3.1 million) with the balance of the consideration to

be treated as intangible assets and goodwill. The consideration

represents 2.7x EBITDA for the year ended 30 June 2017 although an

injection of working capital of up to AUD3.0 million (GBP1.8

million) will also be required.

Biscay provides greetings cards and related products to an

extensive base of almost 2,000 customers through regional,

wholesale, and independent retail channels across Australia and New

Zealand.

The Lang Companies Inc.

On 11 July 2016, the Group acquired all of the shares capital of

The Lang Companies Inc, ("Lang") for a cash consideration of

GBP2,669,000 ($3,443,000). Acquisition costs of GBP260,000 were

incurred during the period and expensed in the income statement as

an exceptional item. Lang is a design--led supplier of

high--quality branded consumer home décor and lifestyle products,

based in the USA. Lang is a natural fit with the Group, being a

design--led company with complementary products and markets. There

are natural synergy opportunities with the Group in sourcing and

cross selling. In the period from acquisition to 31 March 2017,

Lang contributed net profit of GBP528,000 to the consolidated Group

net profit for the year ended 31 March 2017. If the acquisition had

occurred on 1 April 2016, Group revenue would have been

GBP316,160,000 and net profit would have been GBP9,224,000. In

determining these amounts, management has assumed that the fair

value adjustments that arose on the date of acquisition would have

been the same if the acquisition occurred on 1 April 2016.

Effect of acquisition

The acquisition had the following effect on the Group's assets

and liabilities:

Recognised

fair values

on acquisition

GBP000

---------------------------- --------------

Property, plant and

equipment 292

Intangible assets 1,230

Inventories 2,967

Trade and other receivables 6,005

Trade and other payables (5,742)

Deferred tax liabilities (812)

---------------------------- --------------

Net identifiable assets

and liabilities 3,940

---------------------------- --------------

Total cash consideration

paid 2,669

---------------------------- --------------

Gain on bargain purchase

recognised immediately

in the income statement 1,271

---------------------------- --------------

The gain on bargain purchase arose as a result of the sum of the

net assets acquired being greater than the amount paid. This was

possible due to the low number of potential acquirers for the

business.

Directors and advisers

John Charlton

Non--Executive Chairman

Anders Hedlund

Founder and Non--Executive Deputy Chairman

Paul Fineman

Chief Executive Officer

Anthony Lawrinson

Chief Financial Officer and Company Secretary

Lance Burn

Executive Director

Elaine Bond

Non--Executive Director

Mark Tentori

Non--Executive Director

Financial and nominated adviser and broker

Cenkos Securities Plc

6, 7, 8, Tokenhouse Yard

London EC2R 7AS

Auditor

KPMG LLP

Altius House

One North Fourth Street

Milton Keynes MK9 1NE

Public Relations

Alma PR

Aldwych House

71-91 Aldwych

London WC2B 4HN

Legal Adviser

Bird & Bird LLP

12 New Fetter Lane

London EC4A 1JP

Registered office

No 7, Water End Barns

Water End

Eversholt MK17 9EA

IG Design Group plc is registered in England and Wales, number

1401155

Share registrar

Link Asset Services

The Registry

34 Beckenham Road

Beckenham BR3 4TU

By phone - UK - 0871 664 0300, from overseas call +44 (0) 371

664 0300 calls cost 12p per minute plus your phone company's access

charge. Calls outside the United Kingdom will be charged at the

applicable international rate. We are open between 09:00 - 17:30,

Monday to Friday excluding public holidays in England and

Wales.

By email - enquiries@linkgroup.co.uk

Visit us online at

thedesigngroup.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR LLFIALELDFID

(END) Dow Jones Newswires

November 28, 2017 02:00 ET (07:00 GMT)

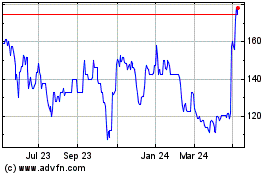

Ig Design (LSE:IGR)

Historical Stock Chart

From Jun 2024 to Jul 2024

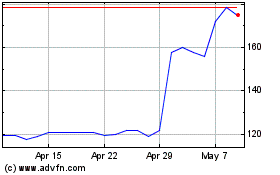

Ig Design (LSE:IGR)

Historical Stock Chart

From Jul 2023 to Jul 2024