TIDMIHR

RNS Number : 1410M

Impact Healthcare REIT PLC

10 January 2023

The information contained in this announcement is restricted and

is not for publication, release or distribution in the United

States of America, any member state of the European Economic Area

(other than the Republic of Ireland or the Netherlands and then

only to professional investors in such jurisdictions), Canada,

Australia, Japan or the Republic of South Africa.

10 January 2023

Impact Healthcare REIT plc

("Impact" or the "Company" or, together with its subsidiaries,

the "Group")

INVESTMENT IN A PORTFOLIO OF SIX CARE HOMES IN SHROPSHIRE AND

CHESHIRE FOR GBP56 MILLION

The Board of Directors of Impact Healthcare REIT plc (ticker:

IHR), the real estate investment trust which gives investors

exposure to a diversified portfolio of UK healthcare real estate

assets, in particular care homes, is pleased to announce that the

Group has invested in a portfolio of six care homes which were

owned and operated by Morris Care Limited. The purchase price is

GBP56 million, which will partly be paid in cash and partly with an

issue of new shares in the Company ("Shares"), as further detailed

below.

Morris Care enjoys a strong local reputation for delivering high

acuity care and has established good working relationships with the

local NHS Clinical Commissioning Groups. The vendors have granted a

licence for the homes to continue to trade under the Morris Care

brand for three years and the operational management team of Morris

Care will transfer to Welford Healthcare ("Welford"), which will

operate the homes. Welford is an existing Group tenant and the

investment will take the Group's relationship with Welford to 18

care homes across England with 1,087 beds.

The portfolio has 438 high quality beds, of which 400 have en

suite bathrooms, with five homes in Shropshire and one in Cheshire.

The homes each have an established track record of delivering

strong operational performance. Four of the homes have EPC ratings

of B, and two are rated C, with outline strategies in place for

achieving an EPC rating of B.

Home Number of

beds

Isle Court Nursing Home 80

----------

Radbrook Nursing Home 63

----------

Oldbury Grange Nursing Home 69

----------

Morris Care Centre 96

----------

Corbrook Park Nursing Home 80

----------

Stretton Hall 50

----------

80% of the GBP56 million consideration is payable in cash

(GBP44.8 million), with the balance paid in Shares. The Company has

issued to the vendors 9,603,841 Shares priced at 116.62 pence per

share, which is the Company's last reported NAV as at 30 September

2022. The Shares have been issued conditional on Admission which is

expected to occur on or around 13 January 2023. The vendors have

agreed to customary lock-up provisions for a period of six months.

100% of the debt drawn down to fund the cash element has been

hedged through a new GBP50 million interest rate cap at a cost of

GBP1.5 million, which caps SONIA at 3.0% for two years. The Group

has now hedged the interest rates on 80% (GBP150 million) of its

current drawn debt of GBP187 million with a gross LTV after this

transaction of 27.6% (1) . The Group has a further GBP54 million of

undrawn debt facilities.

The funding of the investment has been made initially by way of

a loan by the Group to Welford. The structure creates several

benefits for all stakeholders, including enabling Welford to take

immediate operational control of the six homes, thereby avoiding a

potentially lengthy transition period while regulatory approvals

are sought to register the operation of the homes in new legal

entities.

Once CQC regulatory approvals are received, Impact then has the

option to acquire the entire issued share capital of the company

which owns the properties from Welford, which also has the option

to sell the entire issued share capital of the company to Impact in

order to repay the loan. Impact will receive interest payments

equal to 8.4% per annum for the duration of the loan. When either

option is exercised, new 35-year leases on Impact's standard terms,

which have been pre-agreed with Welford, will come into effect.

Initial rent under the new leases is set at GBP3.9 million,

reflecting a gross initial yield of 7.0%.

The loan structure used to make this investment contains

additional protections for Impact's shareholders, including

security over the above property assets and a number of operational

covenants from Welford.

Immediately following Admission, the Company will have

414,368,169 Ordinary Shares in issue and therefore the total voting

rights in the Company will be 414,368,169. This figure may be used

by Shareholders as the denominator for the calculations by which

they may determine whether or not they are required to notify their

interest in, or a change to their interest in, the share capital of

the Company under the FCA's Disclosure Guidance and Transparency

Rules.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Impact Health Partners Via H/Advisors

LLP Maitland

Mahesh Patel

----------------------------------------- ---------------

Andrew Cowley

----------------------------------------- ---------------

D avid Yaldron

----------------------------------------- ---------------

Jefferies International +44 20 7029

Limited 8000

---------------

Tom Yeadon tyeadon@jefferies.com

----------------------------------------- ---------------

Ollie Nott onott@jefferies.com

----------------------------------------- ---------------

Winterflood Securities +44 20 3100

Limited 0000

---------------

Neil Langford neil.langford@winterflood.com

----------------------------------------- ---------------

Joe Winkley joe.winkley@winterflood.com

----------------------------------------- ---------------

H/Advisors Maitland +44 7747 113

(Communications advisor) 930

---------------

James Benjamin impacthealth-maitland@h-advisors.global

----------------------------------------- ---------------

Alistair de Kare-Silver

---------------

The Company's LEI is 213800AX3FHPMJL4IJ53.

Further information on Impact Healthcare REIT is available at

www.impactreit.uk .

NOTES:

Impact Healthcare REIT plc acquires, renovates, extends and

redevelops high quality healthcare real estate assets in the UK and

lets these assets on long-term full repairing and insuring leases

to high-quality established healthcare operators which offer good

quality care, under leases which provide the Company with

attractive levels of rent cover .

The Company aims to provide shareholders with an attractive

sustainable return, principally in the form of quarterly income

distributions and with the potential for capital and income growth,

through exposure to a diversified and resilient portfolio of UK

healthcare real estate assets, in particular care homes for the

elderly.

The Company has a progressive dividend policy with a target to

grow its annual aggregate dividend in line with the

inflation-linked rental uplifts received by the Group under the

terms of the rent review provisions contained in the Group's leases

in the prior financial year.

On this basis, t he Company is targeting a dividend for the year

to 31 December 2022 to increase by 2.0% to 6.54 pence per share (2)

.

The Group's Ordinary Shares were admitted to trading on the main

market of the London Stock Exchange, premium segment, on 8 February

2019. The Company is a constituent of the FTSE EPRA/NAREIT

index.

Neither the content of the Company's website, nor the content on

any website accessible from hyperlinks on its website for any other

website, is incorporated into, or forms part of, this announcement

nor, unless previously published by means of a recognised

information service, should any such content be relied upon in

reaching a decision as to whether or not to acquire, continue to

hold, or dispose of, securities in the Company.

(1) Current debt drawn divided by Gross Assets as at 30

September 2022 plus acquisitions at cost completed since 30

September 2022.

(2) This is a target only and not a profit forecast. There can

be no assurance that the target will be met and it should not be

taken as an indicator of the Company's expected or actual

results.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQEAKFNEANDEFA

(END) Dow Jones Newswires

January 10, 2023 02:00 ET (07:00 GMT)

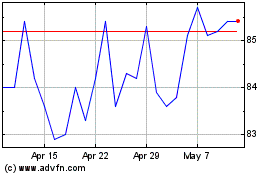

Impact Healthcare Reit (LSE:IHR)

Historical Stock Chart

From Jun 2024 to Jul 2024

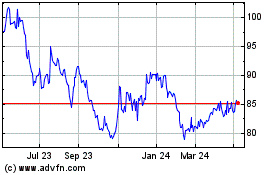

Impact Healthcare Reit (LSE:IHR)

Historical Stock Chart

From Jul 2023 to Jul 2024