TIDMING

RNS Number : 5746U

Ingenta PLC

01 April 2019

Ingenta plc

(the 'Group' or the 'Company')

Final Audited Results

Ingenta plc (AIM: ING) a leading provider of software and

services to the global publishing industry, announces its final

audited results for the year ended 31 December 2018.

Highlights

-- Business reorganisation substantially complete.

-- Cumulative cost reductions of GBP4m on an annualised basis

achieved over the last 18 months.

-- Company profile substantially de-risked with an ongoing

annual cost base of approximately GBP9.5m.

-- Revenues of GBP12.0m (2017: GBP14.7m) reflecting increased

emphasis on higher quality contracts.

-- Over 70% of the reported revenues highly visible and recurring in nature.

-- Operating cash inflows of GBP2.4m in the year (2017:

GBP2.7m), before expenditure on research and development of GBP1.9m

and reorganisation costs of GBP0.8m.

-- Cash balances at year end of GBP1.3m (2017: GBP2.1m) and

GBP2.5m at the end of January 2019.

-- Adjusted EBITDA* GBP0.8m (2017: GBP1.4m).

-- Dividend of 1.5 pence per share proposed (2017: 1.5 pence).

-- New contracts secured with a value of over GBP3.3m over 3

years, and an encouraging pipeline of further prospects.

*Adjusted EBITDA - earnings before interest, tax, depreciation,

amortisation, gains / losses on revaluation, restructuring costs

and foreign exchange gains / losses. See note 2 for details.

Scott Winner, Chief Executive Officer, commented:

"Our strategic move away from product silos towards a more

client centric structure is starting to produce real results, and

we look forward to 2019 with great enthusiasm. Our business is now

leaner and focussed on delivering first class services for all our

customers with significantly improved positioning for the next

stage of our growth".

Chairman's statement

2018 Developments

The Group announced that 2018 would signal the culmination of

its long-term business reorganisation plans and I'm pleased to

announce that the new business structure is in place for 2019. The

Group now has a unified approach to servicing its customer base

which allows it to be significantly nimbler and more responsive to

changing customer demands. The removal of the old product siloes

has already had positive results as the business looks to cross

sell its products and services and improve customer retention.

Obviously, these changes were significant, and the business

incurred some one-off costs during the transition that are reported

in the financial statements.

On an operational level, the business has secured several large

renewals within its customer base and expanded its service

offering. The Group was pleased to recently announce 3 multi-year

customer renewals within its Commercial division with a total deal

value of GBP3.3m over 3 years. The Group also announced two new

customer wins for its CMS product in 2018 and these deployments are

running smoothly to a go live in 2019. One of these customers is an

institution in Qatar and it means the CMS product is now

operational in Arabic which provides scope for further

opportunities within that territory. Within the advertising

business, our new software platform for Sainsburys has successfully

gone live and the new features and functionality are being marketed

to a wider customer base with some interesting leads being followed

up. The Commercial product has one go live scheduled for the first

quarter of 2019 and two new customer implementations underway with

more new contract wins expected to be announced shortly.

Results

As mentioned above, the audited results for the year ended 31

December 2018 have been impacted by the costs associated with the

Group's business reorganisation plans. The costs of this were

approximately GBP0.8m (2017: GBP0.3m) and have contributed to the

loss reported in the year. In addition, the Group also incurred

non-cash impairment charges to intangible assets of GBP0.9m (2017:

nil). These impairment charges included a GBP0.3m (2017: nil) write

down of the Group's shareholding in its Chinese joint venture and a

GBP0.6m (2017: nil) impairment of non-software related goodwill.

The Group deems both items to be non-core assets.

The revenue base has been restructured towards fewer, higher

quality contracts with approximately 70% of the reported revenues

highly visible and recurring in nature. From this revenue base, the

Group generated operating cash inflows of GBP2.3m in the year,

before expenditure on research and development of GBP1.8m,

acquisition costs of GBP0.25m, dividends of GBP0.25m and the

planned reorganisation costs of GBP0.8m, resulting in net cash

balances at year-end of GBP1.3 million. In January 2019 cash

balances increased to GBP2.5m and the Group expects that the new

organisational structure will help deliver improved cash

generation.

Shareholders' returns and dividends

On the 26(th) January 2018, the Board proposed a court approved

reduction of capital and invited shareholders to vote on the

resolution at a General Meeting held on 19(th) February 2018. This

resolution was successfully passed and at a Court hearing on the

27(th) March the reduction of capital was approved and became

effective that day, increasing the Company's distributable reserves

by GBP8,999K.

The Directors declared their intention to pay a dividend in 2019

of 1.5 pence per share (2018: 1.5 pence). This is subject to

shareholder approval at the forthcoming AGM.

M C Rose

Chairman

29 March 2019

Group strategic report

2018 has been a period of change as the Group implemented a new

organisational structure which sets the foundations for a more

responsive business which is better positioned for growth.

Business Strategy

The Business has moved away from a product siloed divisional

structure to a more product agnostic services architecture. The

benefit of this is a much more integrated approach to servicing our

customers whereby we can standardise service levels and utilise

resources more efficiently.

The Group's unified approach is starting to produce results and

we have already announced some significant contract renewals and

customer upgrade projects as the business looks to actively

re-engage and respond to our client's needs. The business strategy

has been to focus on our higher quality revenue streams where the

Group believes it can deliver better margins. Similarly, the sales

and marketing efforts are targeted at improved margins and I'm

extremely encouraged by the progress being made in developing our

sales pipeline and building customer awareness of our suite of

products and services. The aim going forward is to be highly

focussed in our sales prospecting work by targeting key market

areas with a proven and referenceable product set. The previous

decisions to develop a simplified GO! offering with pre-configured

out of the box functionality has been instrumental in this as we

now have some strong leads within the mid-tier market which we hope

to announce shortly.

Our development strategy is also firmly in line with the broader

business goals. Now that the product set is complete and

referenceable, we can be more strategic with our investment

decisions. Our Commercial product offering has the core

functionality to be applicable to a much wider audience and, with

modest development can be tailored to meet those requirements. We

are currently investigating these opportunities as we believe they

offer good prospects for growth.

Product review

Ingenta Commercial

Ingenta Commercial provides enterprise level publishing

management systems for both print and digital products.

All modules of the product are now fully referenceable and live

on customer sites allowing the business to step up its marketing

and sales activity. The indications from the second half of 2018

were positive, with promising opportunities being progressed in the

mid-tier market where the GO! offering is proving successful. The

core of the simplified GO! offering remains intact which means the

software can be configured and enhanced over time as the customers'

needs and requirements change.

Ingenta Content

The Ingenta Content suite of products enable publishers of any

size, discipline or technical proficiency to convert, store,

deliver and monetise digital content.

As in other parts of the software business, Ingenta's Content

Management Solutions (CMS) is offered in a GO! format as well as

the full enterprise version. The business has secured two new deals

in the year which are progressing well with go lives anticipated

for mid-2019. One of these deals involved an Arabic interface for

the software which is now fully functional and provides further

scope for the Group to expand into these new territories.

Ingentaconnect, the divisions content aggregation solution, also

announced a new Open Access solution in 2018 which puts Ingenta at

the forefront of this rapidly evolving area of debate within the

scholarly publishing industry which remains a key focus for the

Group.

Ingenta Advertising

Ingenta Advertising provides a complete browser-based multimedia

advertising, CRM and sales management platform for content

providers.

Within the advertising space, traditional newspaper and magazine

customers are adopting a cautious approach to investment decisions.

The Group remains well placed to service these customers and has an

upgraded platform solution on offer to address the changing

requirements of its customer base. In addition, the business has

developed a new portal with specific application to the retail

business and its management of advertising and promotions. The

solution went live at Sainsburys in 2018 and the Group are pressing

ahead with other potential sales in this sector.

PCG

The PCG consulting arm provides a range of services designed to

support and drive a business's sales strategy.

PCG continues to deliver impressive results to its customer base

and maintained its revenue levels in line with the prior year.

Financial Performance

Group revenues for the year have decreased by GBP2.7m to

GBP12.0m (2017: GBP14.7m) reflecting our focus on higher quality

earnings which we believe will deliver improved margins.

As reported at the half year, the Group incurred GBP0.3m (2017:

nil) of non-cash impairment charges against its joint venture

investment in China. The Company has no further cash or balance

sheet exposure to China and further details are included in note 3.

The Group also incurred a further GBP0.6m (2017: nil) non-cash

impairment charges against its non-software related goodwill. In

terms of the reorganisation, there has also been a GBP0.8m (2017:

GBP0.3m) exceptional charge relating to staff costs and the

business reorganisation plans. In total, these costs amounted to

GBP1.7m (2017: GBP0.3m) and were a key driver in the reported

operating loss of GBP1.2m (2017: profit GBP0.9m).

A tax credit of GBP0.3m (2017: GBP0.2m) is included in the

results for the year and relates to money expected to be received

under the research and development tax credit scheme. The claim has

been calculated using the same methodology as in prior years and is

subject to HMRC approval.

Financial Position

Non-current assets include goodwill and intangibles created in

historic acquisitions. The intangibles relate to the software

technology acquired and were originally valued at GBP0.5m using a

discounted cashflow model. These are being amortised over 5 years.

The goodwill of GBP4.3m (2017: GBP4.9m) was tested for impairment

using discounted cashflows resulting in an impairment charge of

GBP0.6m (2017: nil) was incurred in relation to non-software

items.

Current assets have decreased compared to 2017 because of the

timing of cash receipts from the renewals cycle. The cash balance

was over GBP2.5m at the end of January 2019.

Total liabilities have also declined compared to 2017. The main

contributory factor here was a reduction in accruals of GBP0.3m

relating to the settlement of the earnout on acquisition of the 5

Fifteen business.

On 26 January 2018, the Group announced a court approved

reduction of capital whereby the Company cancelled its share

premium account and increased its distributable reserves by

approximately GBP9m.

Cashflow

The Group generated operating cash inflows of GBP2.3m in the

year, before expenditure on research and development of GBP1.8m,

acquisition costs of GBP0.25m, dividends of GBP0.25m and the

planned reorganisation costs of GBP0.8m, resulting in net cash

balances at year-end of GBP1.3 million. At the end of January 2019,

cash balances increased to GBP2.5m and the Group expects that the

new organisational structure will help deliver improved cash

generation. The Group received a tax credit in the year of GBP0.2m

(2017: GBP0.1m) and the estimate for 2018 is a for a further

GBP0.3m, although this is subject to HMRC approval.

Key Performance Indicators

The Board and senior management review a number of KPI's

continually throughout the year, all of which form part of the

monthly management accounts process and include:

-- Revenue versus budget and monthly reforecast

-- Adjusted EBITDA (see note 2 for calculation) versus budget

-- Group cashflow versus budget

-- Sales pipeline growth and conversion analysis

-- Time utilisation statistics

Any deviations or anomalies are investigated, and corrective

action taken where appropriate.

Full year revenues were below the prior year and have been

impacted by the strategy to focus on higher quality revenue streams

which the Group believe will deliver better margins. The sales and

marketing team has also been restructured and training programmes

initiated which has seen tangible improvements in lead generation

and pipeline development. Management believe this has set the

foundations for commercial success in 2019.

Adjusted EBITDA numbers are included in the segmental

information by business unit in the Group accounts. For the Group,

these results were below budget which meant share options for the

year did not vest. Management took action during the year

implementing cost control measures so that resourcing was kept in

line with sales activity, and operational efficiencies were

identified which helped improve margins.

Year-end cash balances were GBP1.3m. This was impacted by the

restructuring efforts in the year and timing of receipts. The

renewals activity of the business is heavily linked to the calendar

year with some receipts falling into January 2019 when cash

balances rose to over GBP2.5m.

The Group monitor sales activity with reference to monthly sales

pipeline reports. These reports detail sales opportunities by

product with metrics around expected project timelines and revenue

recognition estimates so that management can deploy resources

adequately to ensure the best chance of success in the bidding

process. When any items are removed from the pipeline due to either

a successful sale or a lost opportunity, management carry out a

detailed analysis to ensure the reasons are understood and any

actions required are taken. Such analysis has led to the

development of GO! products designed to meet a market

requirement.

The business has also started to monitor time utilisation rates

of its core functional departments. These are at an early stage of

development and will be enhanced during 2019.

Outlook

The Group can look forward to 2019 with renewed optimism as the

positive benefits from its long-term business reorganisation plan

continue to roll out. The Board believe the business is now

significantly de-risked, producing a higher quality, cash

generative earnings stream whereby the fixed costs of the business

are met by its highly visible recurring revenues. Combined with

this, the Group's efforts to strategically build its sales pipeline

are now paying off and we hope to capitalise on this momentum

through our refreshed sales targets for 2019.

Risks and uncertainties

Sales risk

The major risks for future trading are converting sales of

Ingenta CMS and the Commercial product suite (Ingenta Rights,

Royalties, Product Manager and Order to Cash), and generating

revenue within PCG. Most of the business costs are fixed in the

medium-term, being people and premises costs, and therefore there

is a risk to Group profitability when budgeted revenue is not

delivered as cost reductions will lag behind revenue reductions.

Management undertake detailed monthly revenue forecasting and

assess risk on an ongoing basis. Procurement processes remain

difficult to predict, and any delays during contract negotiation

will impact on the timing of project commencement and the level of

revenue that can be recognised in the year.

Project risk

There are two principal project risks: risk of fixed priced

projects running over and the risk on all projects where there is

development required that we are unable to deliver to the

specification agreed.

Fixed price projects risk relates to the accuracy of project

estimates and the time it will take to complete the tasks as

specified in the customer contract. Management mitigate this risk

by hiring the best staff who are able to estimate projects

accurately and by building in a contingency to fixed priced

contracts. Management also closely monitor contracts to ensure all

work performed is in accordance with the agreement and any new

requests are separately contracted for. Management also mitigate

the risk by taking on new projects on a time and materials basis

wherever possible.

Projects requiring bespoke development also carry the risk that

the development will not be able to be delivered in the way

envisaged at the time of contract. Management take care to fully

scope these development projects and use developers who understand

the products and the complexities of building bespoke elements.

IT risk

Internal IT services are deployed onto fault tolerant platforms

and spread over multiple locations including the Group's offices,

co-location facilities, Infrastructure as a Service (IAAS) and

Office365. Regular backups and securing of data offer multiple

restore points in the event of a critical failure outside of the

scope of the in-built resilience. E-mail is a cloud-based

deployment that staff can access from any working PC/smart phone.

Staff have access to cloud-based storage (OneDrive) in addition to

co-location deployed file servers where data cannot be stored in

e-mail. Key staff have mobile phones and access to resilient

telephony services for the purposes of contacting each other and

customers. Through Remote Working staff can access their data and

customer sites in the event that it was not possible to gain access

to our offices.

Customer facing services are monitored for both stability and

performance; wherever possible proactive maintenance is undertaken

to avoid performance problems and/or downtime. All customer

deployments are done to fault tolerant hardware either in one of

our co-location facilities or to a cloud-based service, both

offering high levels of resiliency and multiple, redundant

access.

The Group's business continuity plan is available from multiple

locations and is regularly updated to cover new services and

deployments.

FX risk

The risk associated with generating revenue and suffering costs

in a currency other than sterling. This is mitigated naturally

within Ingenta plc as revenues and associated costs are generally

denominated in the same currency. Overall the Group is a net

generator of USD.

HR risk

In a company with a high proportion of people-based revenue

there is a risk of key staff leaving or being absent through

sickness. This is mitigated by having appropriate notice periods

built into employee contracts and ensuring there is adequate

coverage for all staff roles with no individual solely responsible

for significant revenue generation.

Brexit

Management continue to monitor the UK's exit from the EU and its

implications for the business. It is not anticipated the UK's exit

from the EU will affect software sales and the majority of its

revenue is within the UK and US markets. At present, the main risks

identified are currency fluctuations which have been reviewed

above.

G S Winner

Chief Executive Officer

29 March 2019

Group Statement of Comprehensive Income

For the year ended 31 December 2018

Year ended Year ended

31 Dec 31 Dec

18 17

note GBP'000 GBP'000

================================================= ===== =========== ===========

Group revenue 12,001 14,695

Cost of sales (7,258) (9,071)

Gross profit 4,743 5,624

Sales and marketing expenses (1,074) (1,253)

Administrative expenses (4,894) (3,441)

(Loss) / profit from operations 2 (1,225) 930

Share of loss from equity accounted investments 3 - (99)

Finance costs (8) (31)

(Loss) / profit before income tax (1,233) 800

Income tax 4 407 185

(Loss) / profit for the year attributable to

equity holders of the parent (826) 985

Other comprehensive expenses which will be

reclassified subsequently to profit or loss:

Exchange differences on translation of foreign

operations (31) 77

Total comprehensive (loss) / income for the

year attributable to equity holders of the

parent (857) 1,062

Basic (loss) / earnings per share (pence) 5 (4.88) 5.82

Dilutive (loss) / earnings per share (pence) 5 (4.88) 5.78

All activities are classified as continuing

Group Statement of Financial Position

As at 31 December 2018

31 Dec 31 Dec 31 Dec

18 17 16

====================================== =====

note GBP'000 GBP'000 GBP'000

====================================== ===== ======== ======== =========

Non-current assets

Goodwill and other intangible assets 4,324 4,900 4,900

Other intangible assets 258 358 458

Property, plant and equipment 218 140 203

Investments accounted for using the

equity method 3 - - 368

======== ======== =========

4,800 5,398 5,929

Current assets

Trade and other receivables 4,627 4,688 5,385

Investments classified as held for

sale 3 - 320 -

Research and Development tax credit

receivable 4 336 180 150

Cash and cash equivalents 1,323 2,131 2,027

======== ======== =========

6,286 7,319 7,562

Total assets 11,086 12,717 13,491

======== ======== =========

Equity

Share capital 1,692 1,692 1,692

Share Premium - 8,999 8,999

Merger reserve 11,055 11,055 11,055

Reverse acquisition reserve (5,228) (5,228) (5,228)

Share option reserve 16 51 -

Translation reserve (876) (845) (871)

Retained earnings (1,505) (9,424) (10,240)

Investment in own shares - - -

======== ======== =========

Total equity 5,154 6,300 5,407

Non-current liabilities

Borrowings - - -

Deferred tax liability 52 72 92

Finance leases 52 8 35

======== ======== =========

104 80 127

Current liabilities

Trade and other payables 2,723 3,394 4,349

Deferred income 3,105 2,943 3,608

Borrowings - - -

5,828 6,337 7,957

Total liabilities 5,932 6,417 8,084

Total equity and liabilities 11,086 12,717 13,491

Group Statement of Changes in Equity

For the year ended 31 December 2018

Total

Reverse Share attributable

Share Share Merger acquisition Translation Retained option to owners

capital Premium reserve reserve reserve earnings reserve of parent

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

================= ========= ========= ========= ============= ============ ========== ========= ==============

Balance at 1

January

2018 1,692 8,999 11,055 (5,228) (845) (9,424) 51 6,300

========= ========= ========= ============= ============ ========== ========= ==============

Dividends paid - - - - - (254) - (254)

Capital

reconstruction - (8,999) - - - 8,999 - -

Share options

lapsed

in the year - - - - - - (35) (35)

--------- --------- --------- ------------- ------------ ---------- --------- --------------

Transactions

with

owners - (8,999) - - - 8,745 (35) 289

Loss for the

year - - - - - (826) - (826)

Other

comprehensive

expense:

Exchange

differences

on translating

foreign

operations - - - - (31) - - (31)

--------- --------- --------- ------------- ------------ ---------- --------- --------------

Total

comprehensive

expense for the

year - - - - (31) (826) - (857)

Balance at 31

December

2018 1,692 - 11,055 (5,228) (876) (1,505) 16 5,154

================= ========= ========= ========= ============= ============ ========== ========= ==============

For the year ended 31 December 2017

Total

Reverse Share attributable

Share Share Merger acquisition Translation Retained option to owners

capital Premium reserve reserve reserve earnings reserve of parent

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

================== ========= ========= ========= ============= ============ ========== ========= =============

Balance at 1

January

2017 1,692 8,999 11,055 (5,228) (871) (10,240) - 5,407

========= ========= ========= ============= ============ ========== ========= =============

Employee Share

Ownership

Trust

transactions - - - - - (169) - (169)

Reclassification

of

share option

reserve - - - - (51) - 51 -

--------- --------- --------- ------------- ------------ ---------- --------- -------------

Transactions with

owners - - - - (51) (169) 51 (169)

Profit for the

year - - - - - 985 - 985

Other

comprehensive

expense:

Exchange

differences

on translating

foreign

operations - - - - 77 - - 77

--------- --------- --------- ------------- ------------ ---------- --------- -------------

Total

comprehensive

expense for the

year - - - - 77 985 - 1,062

Balance at 31

December

2017 1,692 8,999 11,055 (5,228) (845) (9,424) 51 6,300

================== ========= ========= ========= ============= ============ ========== ========= =============

Group Statement of Cash Flows

For the year ended 31 December 2018

Year ended Year ended

31 Dec 31 Dec

18 17

GBP'000 GBP'000

=================================================== =========== ===========

(Loss) / profit before taxation (1,233) 800

Adjustments for

Share of loss from joint venture - 99

Impairment of intangibles 896 -

Depreciation 227 250

Profit on disposal of fixed assets (2) -

Interest expense 8 31

Unrealised foreign exchange differences (31) 26

Decrease in trade and other receivables 61 697

Decrease in trade and other payables (195) (1,552)

Cash (outflow) / inflow from operations (269) 351

Research and Development tax credit received 235 143

Tax paid (6) (8)

=========== ===========

Net cash (outflow) / inflow from operating

activities (40) 486

Cash flows from investing activities

Acquisition of subsidiaries, net of cash acquired (248) -

Purchase of property, plant and equipment (61) (91)

Net cash used in investing activities (309) (91)

Cash flows from financing activities

Interest paid (8) (31)

Payment of finance lease liabilities (162) (95)

Costs of capital restructure (31) -

Dividend paid (254) (169)

Net cash used in financing activities (455) (295)

Net (decrease) / increase in cash and cash

equivalents (804) 100

Cash and cash equivalents at the beginning

of the year 2,131 2,027

Exchange differences on cash and cash equivalents (4) 4

=========== ===========

Cash and cash equivalents at the end of the

year 1,323 2,131

1. Basis of preparation

The principal accounting policies of the Group are set out in

the Group's 2017 annual report and financial statements. A number

of new or amended standards became effective from the 1 January

2018:

-- IFRS 9 'Financial Instruments'

-- IFRS 15 'Revenue from Contracts with Customers'

Full disclosure of the transition will be included in the 2018

Financial Statements, but the Company has not identified any

changes to its accounting policies that require retrospective

adjustment.

2. Profit from operations

Profit from operations has been arrived at after charging:

Year ended Year ended

31 Dec 31 Dec

18 17

GBP'000 GBP'000

=============================================== =========== ===========

Research and development costs 1,867 2,066

Net foreign exchange loss 33 122

Depreciation of property, plant and equipment

- owned assets 12 165

- assets under finance leases 115 84

Operating lease rentals:

- land and buildings 332 342

- other - -

Auditor's remuneration 101 113

Restructuring costs 840 301

An analysis reconciling the profit from operations to adjusted

EBITDA is provided below.

Year ended Year ended

31 Dec 31 Dec

18 17

GBP'000 GBP'000

===================================== =========== ===========

Profit / (loss) from operations (1,225) 930

Add back:

Depreciation 227 249

Profit on disposal of fixed (2) -

assets

Gain on revaluation of deferred

consideration - (178)

Restructuring costs 840 301

Foreign exchange losses 33 122

EBITDA before profit / loss

on disposal of fixed assets,

foreign exchange profits / losses,

restructuring costs and gains

/ losses on revaluation 769 1,424

3. Joint venture

The Group holds a 49% voting and equity interest in Beijing

Ingenta Digital Publishing Technology Ltd (BIDPT) which was

purchased during the year to 31 December 2012.

This investment is accounted for under the equity method. BIDPT

has a reporting date of 31 December. The shares are not publicly

listed on a stock exchange and hence published price quotes are not

available.

Certain financial information on BIDPT is as follows:

As at

31 Dec

17

=============

GBP'000

============= ========

Assets 1,343

Liabilities (690)

Year ended

31 Dec

17

=========================================== ===========

Revenues 1,481

Profit / (loss) (203)

Revenue attributable to the Group 726

Profit / (loss) attributable to the Group (99)

Changes in equity accounted investments

Year ended Year ended

31 Dec 31 Dec

18 17

GBP'000 GBP'000

============================================== ============ ===========

Cost of 49% investment in BIDPT - 368

Retained (loss) / profit attributable to the

Group - (99)

Other comprehensive income - 51

Transfer to investments held for sale - (320)

============= ===========

Investment book value - -

Dividends are subject to the approval of at least 51% of all

shareholders of BIDPT. The Group has received no dividends.

In the 2017 financial statements, the Group outlined it has been

actively engaged in discussions to sell or dispose of its

shareholding in the Chinese Joint Venture and had reclassified it

as an asset held for sale. These discussions are ongoing, but the

Board does not believe a deal is imminent and have subsequently

reclassified the Group's holding in the Joint Venture as an

investment. Given the inherent uncertainty around valuing a Chinese

non-listed, minority shareholding combined with flat earnings and

an uncertain mechanism to repatriate funds, the Group have decided

to fully impair the investment. The Group's strategy going forward

is to concentrate on its core product set and given the lack of

control it exerts over the Joint Venture, it will not continue to

consolidate results into the Group.

4. Tax

Year ended Year ended

31 Dec 31 Dec

18 17

GBP'000 GBP'000

============================================= =========== ===========

Analysis of credit in the year

Current tax:

Current research and development tax credit

- UK 336 180

Current year State tax - US (5) (8)

Adjustment to prior year charge - UK 56 (7)

Deferred tax credit 20 20

=========== ===========

Taxation 407 185

============================================== =========== ===========

The Group has unutilised tax losses at 31 December 2018 in the

UK and the USA of GBP15.0m (2017: GBP15.0m) and $15.5m (2017:

$15.9m) respectively. These losses are still to be agreed with the

tax authorities in the UK and USA. The Board intends to make use of

all losses wherever possible.

The US tax losses are restricted to $491K per annum because of

change of control legislation. Losses carried forward from the

change of control in April 2008 are restricted and must be used

within 20 years. The Board believes the Group will be able to make

use of $8.7m (2017: $8.7m) of the total unutilised losses at 31

December 2018.

No deferred tax has been recognised in accordance with advice

from US tax accountants on the basis that the US losses are

restricted and there is uncertainty on the value of losses which

will be able to be used.

No deferred tax assets have been recognised in relation to any

other Group tax losses due to uncertainty over their

recoverability.

The differences are explained below:

Year ended Year ended

31 Dec 31 Dec

Reconciliation of tax expense 18 17

GBP'000 GBP'000

=================================================== =========== ===========

Profit / (loss) on ordinary activities before

tax (1,233) 800

=========== ===========

Tax at the UK corporation tax rate of 19% (2017:

19.25%) (234) 154

Expenses not deductible for tax purposes 1 2

Additional deduction for Research and Development

expenditure (285) (284)

Surrender of losses Research and Development

tax credit refund 120 69

Group relief 83 -

Utilisation of UK losses 79 (56)

Utilisation of US losses (81) (76)

Difference in timing of allowances (19) (9)

Adjustment to tax charge in respect of prior

years (56) 7

Refund of deferred tax liability (20) (19)

Effect of foreign tax rates 5 8

Unrelieved China losses carried forward - 19

Total taxation (407) (185)

==================================================== =========== ===========

United Kingdom Corporation tax is calculated at 19% (2017:

19.25%) of the estimated assessable profit for the year.

Taxation for other jurisdictions is calculated at the rates

prevailing in the respective jurisdictions.

5. Earnings per share

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the year.

For diluted earnings per share, the weighted average number of

ordinary shares in issue is adjusted to assume conversion of all

dilutive ordinary share options. Management estimate 101,333

ordinary shares will be issued (2017: 125,000) in respect of share

options. In the current year, this calculation would have an

antidilutive effect on earnings per share so has been ignored.

Year ended Year ended

31 Dec 2018 31 Dec 2017

GBP'000 GBP'000

============================================= ============= =============

Attributable (loss) / profit (826) 985

Weighted average number of ordinary shares

used in basic earnings per share ('000) 16,920 16,920

Shares deemed to be issued in respect of

share-based payments 101 125

------------- -------------

Weighted average number of ordinary shares

used in dilutive earnings per share ('000) 17,021 17,045

Basic (loss) / profit per share arising

from both total and continuing operations (4.88)p 5.82p

Dilutive (loss) / profit per share arising

from both total and continuing operations (4.88)p 5.78p

============================================== ============= =============

Dividends

On 25(th) June 2018 the company paid a dividend of 1.5 pence per

share to holders of ordinary shares. After the year end, the

directors declared their intention to pay a dividend of 1.5 pence

per share. No liability in this respect has been recognised in

2018.

6. Share options

The Group have an unapproved Executive Management Incentive

(EMI) share option scheme. Further details are detailed below.

Unapproved EMI scheme

This scheme is part of the remuneration package of the Group's

senior management. Options will vest if certain conditions, as

defined in the scheme, are met. It is based on group performance

compared to budget over a 3 year period and one third of the

options will vest in each of the of the 3 reporting periods if the

performance targets are met in that period. Participating employees

have to be employed at the end of each period to which the options

relate. Upon vesting, each option allows the holder to purchase

ordinary shares at the market price on date of grant.

Share options and weighted average exercise prices are as

follows:

Number Weighted

of shares average

exercise

price

per share

(GBP's)

--------------------------------- ----------- -----------

Outstanding at 31 December 2016 401,000 1.27

Granted 65,000 1.56

Lapsed (25,000) 1.30

---------------------------------- ----------- -----------

Outstanding at 31 December 2017 441,000 1.31

Granted - -

Lapsed (339,667) 1.27

Outstanding at 31 December 2018 101,333 1.33

The fair value of options granted were determined using the

Black Scholes method. The following principle assumptions were used

in the valuation:

Grant date January February August September

2016 2016 2016 2017

----------------------------------------- -------- --------- -------- ----------

Vesting period ends 31 Dec 31 Dec 31 Dec 31 Dec

16 16 16 18

31 Dec 31 Dec 31 Dec 31 Dec

17 17 17 19

31 Dec 31 Dec 31 Dec 31 Dec

18 18 18 20

Share price at grant GBP1.27 GBP1.27 GBP1.30 GBP1.56

Volatility 26% 26% 16% 16%

----------------------------------------- -------- --------- -------- ----------

Risk free investment rate 5% 5% 5% 5%

----------------------------------------- -------- --------- -------- ----------

Fair value of option - 31 December 2016

vesting period 18p 18p 9p -

Fair value of option - 31 December 2017

vesting period 26p 26p 17p -

Fair value of option - 31 December 2018

vesting period 32p 32p 23p 16p

Fair value of option - 31 December 2019

vesting period - - - 24p

Fair value of option - 31 December 2020

vesting period - - - 31p

----------------------------------------- -------- --------- -------- ----------

The underlying volatility was determined with reference to the

historical data of the Company's share price. In total GBP35K has

been credited (2017: GBP1K charged) of employee remuneration

expense has been included in the loss for the year and released to

retained earnings.

7. Publication of non-statutory accounts

The financial information set out in this announcement does not

constitute statutory accounts as defined in the Companies Act

2006.

The Group Statement of Comprehensive Income, Group Statement of

Financial Position, Group Statement of Changes in Equity, Group

Statement of Cash Flows and associated notes have been extracted

from the Group's 2018 statutory financial statements upon which the

auditor's opinion is unqualified and which do not include any

statement under section 498 of the Companies Act 2006.

Those financial statements will be delivered to the Registrar of

Companies following the release of this announcement.

This announcement and the annual report and accounts are

available on the Company's website www.ingenta.com. A copy of the

report and accounts will be sent to shareholders who have elected

to receive a printed copy with details of the annual general

meeting in due course.

For further information please contact:

Ingenta plc

Scott Winner / Jon Sheffield Tel: 01865 397 800

Cenkos Securities plc

Nicholas Wells / Harry Hargreaves Tel: 020 7397 8900

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR LFFEFVVIIVIA

(END) Dow Jones Newswires

April 01, 2019 02:00 ET (06:00 GMT)

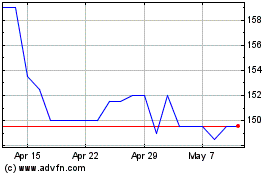

Ingenta (LSE:ING)

Historical Stock Chart

From Feb 2025 to Mar 2025

Ingenta (LSE:ING)

Historical Stock Chart

From Mar 2024 to Mar 2025