TIDMING

RNS Number : 6022O

Ingenta PLC

02 June 2020

Ingenta plc

(the 'Group' or the 'Company')

Final Audited Results

Ingenta plc (AIM: ING) a leading provider of software and

services to the global publishing industry, announces its final

audited results for the year ended 31 December 2019.

Highlights

-- 6 new customer sales of the Commercial product suite with one

off fees of GBP1.4m and recurring fees of GBP0.2m.

-- Vista as a service launched with a significant sale made in

the year and further opportunities being progressed in 2020.

-- Revenues of GBP10.9m (2018: GBP12.0m) reflecting increased

emphasis on higher quality contracts.

-- Company profile substantially de-risked with an ongoing

annual cost base of approximately GBP9.5m.

-- Over 70% of the reported revenues highly visible and recurring in nature.

-- Operating cash inflows of GBP3.6m in the year (2018:

GBP2.4m), including accelerated renewal receipts of GBP0.5m and

before expenditure on research and development of GBP1.4m and

reorganisation costs of GBP0.5m.

-- Cash balances at year end of GBP2.6m (2018: GBP1.3m) with a normalised balance of GBP2.1m.

-- Adjusted EBITDA* up c. 43% to GBP1.3m (2018: GBP0.9m).

*Adjusted EBITDA - earnings before interest, tax, depreciation ,

amortisation , impairment, restructuring costs and foreign exchange

gains / losses. See note 2 for details.

Scott Winner, Chief Executive Officer, commented:

"I'm pleased with the progress made in 2019 and these results

bear testament to the operational efficiencies we have implemented.

The positive news is wide ranging and includes 6 new customer sales

of our Commercial product during the year, having gained

significant traction in our target markets.

"In addition, we have broadened our offering to new verticals,

including Conchord as an IP management solution for the music

industry, and look forward to promoting its benefits in 2020. We

have also taken steps to strengthen Vista's offering for our

customers in the wider publishing industry, and are excited to

continue to serve our loyal client base."

Chairman's statement

Overview

2019 was the first year the business has operated under its new

structure and the results to date have been encouraging. The

overriding aim of the restructuring effort was to remove product

silos and encourage a unified approach to all aspects of business

operations. The benefits of this are a more integrated service

provision to customers across all products allowing efficient use

of resources to meet or exceed customer requirements. In order to

achieve this transformation, the business incurred a further

GBP0.5m of restructuring costs in the year.

Strategically, the business has also switched its focus away

from large bespoke ERP solutions to more productised offerings

aimed at SMEs. The software solutions still retain the

configurability options necessary to satisfy changing customer

requirements, but these are offered after go-live as and when the

need arises. The success of this approach is evidenced by the

business winning 6 new SME customer deals for our Commercial

product. In total these deals are anticipated to deliver initial

implementation fees of approximately GBP1.4m with recurring

revenues of GBP0.2m. From the existing customer base, we are

pleased to report 3 go-lives during the year, 2 for our Edify

content platform and 1 for the Commercial product which will

enhance recurring revenues for 2020 and beyond.

Looking forward, Ingenta is planning to leverage existing

expertise in contracts, rights and royalties developed in the

traditional publishing sector into adjacent verticals with music

being the primary target. The concepts are very closely aligned,

and we released our ConChord product during 2019 to address the

challenges faced in this growing industry.

Another way of driving value is to increase recurring revenue

streams. To this end, we have had notable success selling Vista as

a Service to an existing customer in 2019 and we will promote this

product to our customers more widely in 2020. We also intend to

accelerate growth in recurring revenues from our Commercial and

Content product suites. Ingenta has previously sold perpetual

software licences and annual support contracts, alongside project

implementation revenues. Going forward it is our intention to

prioritise contractually recurring revenues over perpetual licence

and project revenues. This will enhance shareholder value in the

longer term at the expense of revenues in the current period. This

transition is facilitated by our strong financial foundations, and

the board is confident this strategy is the right one for Ingenta

shareholders, customers and employees.

Results

The underlying results of the Group in 2019 were strong but have

been impacted by GBP2.2m of one-off charges which contributed to

the comprehensive loss of GBP1.35m. These one-off costs include a

non-cash GBP1.7m goodwill impairment charge relating to historic

acquisitions and a GBP0.5m restructuring charge relating to the

structural reorganisation mentioned above. The impairment charge

relates to goodwill associated with the advertising and consulting

revenue streams which the business anticipates will become less

discrete and measurable as they are integrated into the commercial

and content sectors of the business. Further details are included

within note 10.

The revenue base continues to be aligned towards fewer, higher

quality contracts with approximately 70% of the reported revenues

highly visible and recurring in nature. From this revenue base, the

Group generated operating cash inflows of GBP3.6m (2018: GBP2.4m),

before expenditure on research and development of GBP1.4m (2018:

GBP1.8m) and the planned reorganisation costs of GBP0.5m (2018:

GBP0.8m), resulting in net cash balances at year-end of GBP2.6m

(2018: GBP1.3m). The Group expects that the new organisational

structure will help deliver improved cash generation.

Shareholders' returns and dividends

During the year, the Company announced a share buyback programme

pursuant to which 66,104 Ordinary 10 pence shares were repurchased.

At year end, these shares were held in treasury meaning 16,853,505

of the Company's total issued shares had voting rights.

Prior to the COVID-19 outbreak, the Directors declared their

intention to pay a dividend in 2020 of at least 1.5 pence per share

(2018: 1.5 pence). Given the current economic uncertainties, the

Board consider it prudent to delay any dividend announcement until

later in the year when a clearer outlook is available.

M C Rose

Chairman

1 June 2020

Group strategic report

2019 is the first year the Group has operated under its new

organisational structure which sets the foundations for a more

responsive business which is better positioned for growth.

Business Strategy

The Business has moved away from a product siloed divisional

structure to a product agnostic services architecture. The benefit

of this is an integrated approach to servicing our customers

whereby we can standardise service levels and utilise resources

more efficiently. In conjunction with this, the Group is now

targeting SME businesses with a standard product offering and 6 new

customer sales were made during the year to this target market.

This version of the product has been rebranded as 'Express' and is

available across the Ingenta product portfolio.

The Group is also looking to leverage its existing expertise in

contracts, rights and royalty's management by expanding into

adjacent verticals. During the year, the business announced the

release of ConChord, a solution designed for the music industry,

where we believe there are further opportunities to pursue.

Product review

Ingenta Commercial

Ingenta Commercial provides enterprise and 'Express' level

publishing management systems for both print and digital

products.

All modules of the product are now fully referenceable and live

on customer sites allowing the business to step up its marketing

and sales activity. These efforts produced positive results and the

business won 6 new customer contracts in the SME market tier.

Encouragingly, the wins were diversified and included wider media

companies and customers in the UK, US and France.

The Group have identified the concepts of intellectual property

and the management associated rights and royalties as a potential

opportunity in associated vertical markets. The most closely

related vertical is music and the Group launched a new product

labelled ConChord to address this market.

Ingenta Content

The Ingenta Content suite of products enable publishers of any

size, discipline or technical proficiency to convert, store,

deliver and monetise digital content.

As in other parts of the software business, Ingenta's Edify

content management solutions is offered in an Express format as

well as the full enterprise version. During the year, there were 2

new go-lives for the content product with one enabling an Arabic

interface for the software which provides further scope for the

Group to expand into a wider geographical market.

Ingenta Advertising

Ingenta Advertising provides a complete browser-based multimedia

advertising, CRM and sales management platform for content

providers.

Within the advertising space, traditional newspaper and magazine

customers are adopting a cautious approach to investment decisions.

The Group remains well placed to service these customers and has an

upgraded platform solution on offer to address the changing

requirements of its customer base. In addition, the business has

developed a new portal with specific application to the retail

business and its management of advertising and promotions which has

already been taken up by J Sainsbury plc. The business anticipates

that the Group's Advertising offering will become a component of

the larger Commercial and Content Products divisions and its

revenues will be less clearly distinguished as a separate CGU. As a

result, GBP1.2m of goodwill associated with the Advertising segment

was impaired.

PCG

The PCG consulting arm provides a range of services designed to

support and drive a business's sales strategy.

PCG delivered impressive results to its customer base and

maintained its revenue levels in line with the prior year. However,

the Group expects that revenue will decline in 2020 with the loss

of a significant contract and this has led to a goodwill impairment

of GBP0.5m as detailed in note 10.

Financial Performance

Group revenues for the year were GBP10.9m (2018: GBP12.0m)

reflecting our focus on higher quality earnings from which the

restructured business can deliver improved margins.

The Group's cost of sales, sales and marketing and

administrative costs have all declined driven by the business

reorganisation to move away from a product siloed structure. The

business incurred GBP1.7m of impairment charges (2018: GBP0.9m) and

these relate to goodwill from historic business combinations.

Further details on the impairment charge are included within note

10. Going forward, the overall cost base of the Group is

approximately GBP9.5m before accounting for impairments,

depreciation and restructuring costs.

No tax credit is included in 2019 (2018: GBP0.3m) as the Group

intends to use losses against future taxable profits rather than

claim cash receipts via the research and development tax credit

scheme.

Financial Position

Non-current assets include goodwill and intangibles recognised

on historic acquisitions. The intangibles relate to Advertising

software technology acquired in 2016 and were originally valued at

GBP0.5m using a discounted cashflow model. These are being

amortised over 5 years. Goodwill relating to historic acquisitions

was tested for impairment using discounted cashflows resulting in

an impairment charge of GBP1.7m (2018: GBP0.6m). Further details

are included within note 10 of the accounts. Property, plant and

equipment now includes a right of use asset in alignment with IFRS

16 'Leases'. The Group have performed a retrospective transition

and restated the comparative balances. Details of the transition

are found in note 1 and 29.

Current assets have decreased compared to 2018 mainly because

the business is not anticipating a tax credit refund (2018:

GBP0.3m). It is believed it will be more beneficial to use these

losses against future taxable income rather than cash them in at a

discount. Net cash and trade other receivables are broadly in

line.

Total liabilities have also declined compared to 2018. The main

contributory factor here is a more efficient cost base meaning year

end creditors and accruals for ongoing costs are lower.

Cashflow

The Group generated a net cash increase of GBP1.3m (2018:

GBP0.8m reduction) during the year. Operating cash inflows of

GBP3.6m (2018: GBP2.4m) were reported before expenditure on

research and development of GBP1.4m and reorganisation costs of

GBP0.5m. The cash balances were improved by accelerated collections

of approximately GBP0.5m compared to the prior year. As a result,

these increased cash collections from the year end renewals cycle

meant the Trade and other receivables were lower.

Key Performance Indicators

The Board and senior management review a number of KPI's

continually throughout the year, all of which form part of the

monthly management accounts process and include:

-- Revenue versus budget and monthly reforecast

-- Adjusted EBITDA (see note 5 for calculation) versus budget

-- Group cashflow versus budget

-- Sales pipeline growth and conversion analysis

-- Time utilisation statistics

Any deviations or anomalies are investigated, and corrective

action taken where appropriate.

Full year revenues were below budget and the prior year and have

been impacted by the strategy to focus on higher quality revenue

streams which the Group believe will deliver better margins. Sales

and marketing efforts have been targeted towards the SME market

sector and this has helped generate the 6 new customer sales wins

reported in the year.

Adjusted EBITDA numbers are lower than budgeted with details

included in the segmental information by product in the Group

accounts. These shortfalls to budget were driven by lower sales

mentioned above. Internally, the Group is moving away from a

product reporting structure to that based around activity service

streams which more closely mirror the new organisational structure

of the business.

Year-end cash balances were GBP0.2m ahead of budget at GBP2.6m.

The business reorganisation has dramatically improved cash

generation within the business which was further boosted by the

annual renewals cycle at the end of the year which continued into

2020.

The Group monitor sales activity with reference to monthly sales

pipeline reports. These reports detail sales opportunities by

product with metrics around expected project timelines and revenue

recognition estimates so that management can deploy resources

adequately to ensure the best chance of success in the bidding

process. When any items are removed from the pipeline due to either

a successful sale or a lost opportunity, management carry out a

detailed analysis to ensure the reasons are understood and any

actions required are taken. Such analysis has led to the

development of Express products designed to meet the needs of the

SME market.

The business monitors time utilisation at a contract level to

enable accurate pricing decisions to be made ensuring profitable

service delivery. Internal development costs are also reviewed to

ensure the appropriate effort is spent supporting the products and

deliver an effective product roadmap.

Section 172(1) Statement

The Directors continually monitor the operations of the business

and take decisions to promote the success of the Group for the

benefit of all its members. As described in the Business Strategy

section of this report, the Directors have selected a business

model and operational structure designed to maximise the

effectiveness of the business for all stakeholders. The likely

consequences of any decisions are modelled to provide assurance

that they are in the long-term interest of stakeholders and, as

detailed in the Corporate Governance Report, risk management and

internal controls are a key oversight to ensure objectives are met.

The Group have also adopted the QCA Corporate Governance code which

is designed to foster strong relations with all stakeholders and

details are included on the company website. In addition to our

shareholders, the Board considers the employees, customers and

suppliers to be critical to the long-term success of the

business.

The Board is committed to maintaining active dialogue with its

shareholders to ensure that its strategy, business model and

performance are understood. The AGM is the main forum for dialogue

between retail shareholders and the Board. The notice of the AGM is

sent at least 21 days before the meeting which is held at the

Companies Head Office and all Board members routinely attend. For

each vote, the number of proxy votes received for, against and

withheld is announced at the meeting. During the meeting, the Board

members are available to answer any questions raised by

shareholders. The results of the AGM are subsequently published on

the Company's corporate website. The Chief Executive Officer and

Chief Financial Officer are primarily responsible for shareholder

liaison and can be contacted on 01865 397 800. The executive

management make presentations to institutional shareholders and

analysts each year following the release of full year and half year

results. Conversations, when requested, are also held at other

points in the year. The corporate website also includes details of

recent annual and interim results plus a listing of the Companies

RNS and RNS reach publications.

Staff are invited to regular Company wide meetings where the

Executive Team share information and updates on strategy and recent

news. At these meetings, there is also a forum where all members of

staff can ask questions. The Company also carries out a formal

staff survey so senior management and the Board can be kept abreast

of major staff concerns. Ingenta also retain an independent HR

resource to ensure all HR issues are dealt with in accordance with

best practice and all rules and regulations are adhered to.

The Group have many customers of differing size and complexity

with a variety of requirements. To best service them, the business

has rolled out a new operating model to standardise its approach to

all customers and provide a consistent level of service and

support. The business also keeps regular contact with customers via

account managers and user groups where demand exists so that our

customers can feed back any issues, share experiences and help

shape the development of our products. To ensure the business is

keeping abreast of wider industry challenges, we actively

participate in a variety of annual trade events.

The Group makes every effort to ensure our suppliers are treated

fairly and paid on time and on average they are paid within 34

days. Ingenta opposes modern slavery in all its forms and

endeavours to make sure any concerns raised are investigated. Where

offshore resourcing is used, the business meets the suppliers prior

to contract signing to satisfy itself that they are operating in a

responsible manner.

The Board and senior management expect everyone in the company

to act in a responsible and ethical manner because the reputation

of the business is key to our success. The company does not let

cost concerns override its ethics and behaviour. For example, we

only contract with offshore resourcing entities who commit to fair

working practices. The Company is committed to minimising negative

environmental impact in terms of energy usage at our offices,

digitising our content and using responsible methods to dispose of

electrical equipment. The Company and staff are also active in the

local community supporting charities and sponsoring good causes.

Feedback from all stakeholders allow the Board to monitor the

Company's culture, as well as the ethical values and behaviours

within the business.

Outlook

Ingenta can look forward to 2020 with cautious optimism. The

Group has a focussed product set tailored to meet the needs of all

sizes of customer, retaining the flexibility to grow with them and

supplement additional services as required. The business intends to

secure new Commercial customers on a recurring revenue model as in

other parts of the business. This change is enabled by our strong

financial footing and will impact short term revenue growth but

will drive contracted revenue into the future adding long term

value to the company.

As these results indicate, the operational structure is much

improved and capable of dealing with fluctuations in activity. In

that respect, we anticipate a reduction in PCG's revenues in 2020

of around GBP0.8m with associated cost savings of GBP0.4m after the

completion of a long-term contract. As a result of this, and the

intention to grow recurring revenues, we anticipate that profits

and cashflow will be lower than 2019 subject to the issues

identified in the risks and uncertainties section of this

report.

Elsewhere, in the software core of the Group's business, we see

further opportunities to leverage our expertise in intellectual

property and rights management outside of traditional publishing

sector markets and into the wider media sectors of music, film and

gaming. The business has geared up its investment to capitalise on

this and ensure software delivery quality.

Risks and uncertainties

COVID-19

The COVID-19 pandemic is considered a principal risk to the

business bringing with it many significant uncertainties over the

remainder of 2020. The Group has analysed the potential impacts and

tailored its business continuity plan in response to the

anticipated threats. All staff within the business have remote

working capabilities and for many this is a normal operating

procedure. In addition, the Group's new operating structure has

fostered teams with interchangeable skills across the product

offerings and technology stacks which, along with remote working,

provides a more flexible staffing model better equipped to deal

with illness and absence. The Group's IT infrastructure is hosted

on resilient platforms using large corporate providers ideally

suited to providing uninterrupted service.

The Group's customer base is reasonably diverse including trade

and academic publishers who are not deemed to be at high risk at

the present time. The Group also considers over 70% of its revenue

to be recurring in nature with many customers on multiyear

contracts. The Ingenta systems are central to the operations of its

customer base and not deemed to be a discretionary spend although

some project work may be impacted as customers wait to see what the

implications of COVID-19 hold for them. The key concern identified

by management is the inevitable delay in new sales as major

investment decisions are put off. However, the Group have modelled

a worst-case scenario of no new sales made in the year and predict

the business will continue to operate profitably with ample working

capital headroom. Also, a significant amount of the Group's

renewals and cash were received in the first quarter of 2020 and at

the end of February cash balances remained over GBP3m with

additional facilities in place with HSBC bank if required.

Sales risk

The major risks for future trading are converting sales of

Ingenta Edify and the Commercial product suite (Ingenta Rights,

Royalties, Product Manager and Order to Cash), and generating

revenue within PCG. Most of the business costs are fixed in the

medium-term, being people and premises costs, and therefore there

is a risk to Group profitability when budgeted revenue is not

delivered as cost reductions will lag behind revenue reductions.

Management undertake detailed monthly revenue forecasting and

assess risk on an ongoing basis. Procurement processes remain

difficult to predict, and any delays during contract negotiation

will impact on the timing of project commencement and the level of

revenue that can be recognised in the year. This is considered a

principal risk for the business.

Project risk

There are two principal project risks: risk of fixed priced

projects running over and the risk on all projects where there is

development required that we are unable to deliver to the

specification agreed.

Fixed price project risk relates to the accuracy of project

estimates and the time it will take to complete the tasks as

specified in the customer contract. Management mitigate this risk

by hiring the best staff who are able to estimate projects

accurately and by building in a contingency to fixed priced

contracts. Management also closely monitor contracts to ensure all

work performed is in accordance with the agreement and any new

requests are separately contracted for. Management also mitigate

the risk by taking on new projects on a time and materials basis

wherever possible.

Projects requiring bespoke development also carry the risk that

the development will not be able to be delivered in the way

envisaged at the time of contract. Management take care to fully

scope these development projects and use developers who understand

the products and the complexities of building bespoke elements.

This is considered a principle risk for the business.

IT risk

Internal IT services are deployed onto fault tolerant platforms

and spread over multiple locations including the Group's offices,

co-location facilities, Infrastructure as a Service (IAAS) and

Office365. Regular backups and securing of data offer multiple

restore points in the event of a critical failure outside of the

scope of the in-built resilience. E-mail is a cloud-based

deployment that staff can access from any working PC/smart phone.

Staff have access to cloud-based storage (OneDrive) in addition to

co-location deployed file servers where data cannot be stored in

e-mail. Key staff have mobile phones and access to resilient

telephony services for the purposes of contacting each other and

customers. Through Remote Working staff can access their data and

customer sites in the event that it was not possible to gain access

to our offices.

Customer facing services are monitored for both stability and

performance, wherever possible proactive maintenance is undertaken

to avoid performance problems and/or downtime. All customer

deployments are done to fault tolerant hardware either in one of

our co-location facilities or to a cloud-based service, both

offering high levels of resiliency and multiple, redundant

access.

The Group's business continuity plan is available from multiple

locations and is regularly updated to cover new services and

deployments.

FX risk

The risk associated with generating revenue and suffering costs

in a currency other than sterling is mitigated naturally within

Ingenta plc as revenues and associated costs are generally

denominated in the same currency. Overall, the Group is a net

generator of USD.

HR risk

In a company with a high proportion of people-based revenue

there is a risk of key staff leaving or being absent through

sickness. This is mitigated by having appropriate notice periods

built into employee contracts and ensuring there is adequate

coverage for all staff roles with no individual solely responsible

for significant revenue generation.

Brexit

Management continue to monitor the UK's exit from the EU and its

implications for the business. It is not anticipated the UK's exit

from the EU will affect software sales and the majority of its

revenue is within the UK and US markets. At present, the main risks

identified are currency fluctuations which have been reviewed

above.

On behalf of the Board.

G S Winner

Chief Executive Officer

1 June 2020

Group Statement of Comprehensive Income

For the year ended 31 December 2019

Restated

Year ended Year ended

31 Dec 31 Dec

19 18

note GBP'000 GBP'000

==================================================== ===== =========== ===========

Group revenue 10,920 12,001

Cost of sales (6,184) (7,258)

Gross profit 4,736 4,743

Sales and marketing expenses (819) (1,074)

Administrative expenses (3,502) (3,948)

Impairment of intangibles and investments (1,663) (896)

Loss from operations 2 (1,248) (1,175)

Finance costs (18) (29)

Loss before income tax (1,266) (1,204)

Income tax 3 (83) 407

Loss for the year attributable to equity holders

of the parent (1,349) (797)

Other comprehensive expenses which will be

reclassified subsequently to profit or loss:

Exchange differences on translation of foreign

operations (4) (31)

Total comprehensive loss for the year attributable

to equity holders of the parent (1,353) (828)

Basic loss per share (pence) 4 (7.98) (4.71)

Dilutive loss per share (pence) 4 (7.98) (4.71)

All activities are classified as continuing

Group Statement of Financial Position

As at 31 December 2019

Restated Restated

31 Dec 31 Dec 1 Jan

19 18 18

===================================== =====

note GBP'000 GBP'000 GBP'000

===================================== ===== ======== ========= =========

Non-current assets

Goodwill 2,661 4,324 4,900

Other intangible assets 158 258 358

Property, plant and equipment 473 583 627

3,292 5,165 5,885

Current assets

Trade and other receivables 3,219 4,627 4,688

Investments classified as held for

sale - - 320

Research and Development tax credit

receivable 3 - 336 180

Cash and cash equivalents 2,600 1,323 2,131

======== ========= =========

5,819 6,286 7,319

Total assets 9,111 11,451 13,204

======== ========= =========

Equity

Share capital 1,692 1,692 1,692

Share Premium - - 8,999

Merger reserve 11,055 11,055 11,055

Reverse acquisition reserve (5,228) (5,228) (5,228)

Share option reserve 23 16 51

Translation reserve (880) (876) (845)

Retained earnings (3,131) (1,477) (9,425)

Total equity 3,531 5,182 6,299

Non-current liabilities

Deferred tax liability 32 52 72

Leases 206 355 455

======== ========= =========

238 407 527

Current liabilities

Trade and other payables 2,459 2,757 3,435

Deferred income 2,883 3,105 2,943

5,342 5,862 6,378

Total liabilities 5,580 6,269 6,905

Total equity and liabilities 9,111 11,451 13,204

Group Statement of Changes in Equity

For the year ended 31 December 2019

Total

Reverse Share attributable

Share Merger acquisition Translation Retained option to owners

capital reserve reserve reserve earnings reserve of parent

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

============================ ========= ========= ============= ============ ========== ========= ==============

Restated balance at

1 January 2019 1,692 11,055 (5,228) (876) (1,477) 16 5,182

========= ========= ============= ============ ========== ========= ==============

Dividends paid - - - - (254) - (254)

Shares bought back

into treasury - - - - (51) - (51)

Share options granted

in the year - - - - - 7 7

--------- --------- ------------- ------------ ---------- --------- --------------

Transactions with owners - - - - (305) 7 (298)

Loss for the year - - - - (1,349) - (1,349)

Foreign exchange

differences

on translation - - - (4) - - (4)

--------- --------- ------------- ------------ ---------- --------- --------------

Total comprehensive

expense for the year - - - (4) (1,349) - (1,353)

Balance at 31 December

2019 1,692 11,055 (5,228) (880) (3,131) 23 3,531

============================ ========= ========= ============= ============ ========== ========= ==============

For the year ended 31 December 2018

Total

Reverse Share attributable

Share Share Merger acquisition Translation Retained option to owners

capital Premium reserve reserve reserve earnings reserve of parent

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

================= ========= ========= ========= ============= ============ ========== ========= ==============

Balance at 1

January

2018 as

previously

reported 1,692 8,999 11,055 (5,228) (845) (9,424) 51 6,300

Adjustment from

the

adoption of

IFRS16 - - - - - (1) - (1)

----------------- --------- --------- --------- ------------- ------------ ---------- --------- --------------

Restated balance

at

1 January 2018 1,692 8,999 11,055 (5,228) (845) (9,425) 51 6,299

Dividends paid - - - - - (254) - (254)

Capital

reconstruction - (8,999) - - - 8,999 - -

Share options

lapsed

in the year - - - - - - (35) (35)

--------- --------- --------- ------------- ------------ ---------- --------- --------------

Transactions

with

owners - (8,999) - - - 8,745 (35) (289)

Loss for the

year

(restated) - - - - - (797) - (797)

Foreign exchange

differences

on translation - - - - (31) - - (31)

--------- --------- --------- ------------- ------------ ---------- --------- --------------

Total

comprehensive

expense for the

year - - - - (31) (797) - (828)

Restated balance

at

31 December

2018 1,692 - 11,055 (5,228) (876) (1,477) 16 5,182

================= ========= ========= ========= ============= ============ ========== ========= ==============

Group Statement of Cash Flows

For the year ended 31 December 2019

Restated

Year ended Year ended

31 Dec 31 Dec

19 18

GBP'000 GBP'000

=================================================== =========== ===========

Loss before taxation (1,266) (1,204)

Adjustments for

Impairment of intangibles 1,663 896

Depreciation 372 349

Loss / (profit) on disposal of fixed assets 2 (2)

Interest expense 18 29

Unrealised foreign exchange differences (4) (31)

Decrease in trade and other receivables 1,408 61

Decrease in trade and other payables and deferred

income (499) (346)

Cash inflow / (outflow) from operations 1,694 (248)

Research and Development tax credit received 282 235

Tax paid (49) (6)

=========== ===========

Net cash inflow / (outflow) from operating

activities 1,927 (19)

Cash flows from investing activities

Acquisition of subsidiaries, net of cash acquired - (248)

Purchase of property, plant and equipment (132) (61)

Net cash used in investing activities (132) (309)

Cash flows from financing activities

Interest paid (4) (8)

Payment of lease liabilities (213) (183)

Dividend paid (254) (254)

Costs of capital restructure - (31)

Costs of buy back of shares into treasury (51) -

Net cash used in financing activities (522) (476)

Net increase / (decrease) in cash and cash

equivalents 1,273 (804)

Cash and cash equivalents at the beginning

of the year 1,323 2,131

Exchange differences on cash and cash equivalents 4 (4)

=========== ===========

Cash and cash equivalents at the end of the

year 2,600 1,323

1. Basis of preparation

The principal accounting policies of the Group are set out in

the Group's 2018 annual report and financial statements. IFRS 16

'Leases' became effective from the 1 January 2019.

IFRS 16 'Leases' replaces IAS 17 'Leases' along with three

Interpretations (IFRIC 4 'Determining whether an Arrangement

contains a Lease', SIC 15 'Operating Leases-Incentives' and SIC 27

'Evaluating the Substance of Transactions Involving the Legal Form

of a Lease').

The adoption of this new Standard has resulted in the Group

recognising a right-of-use asset and related lease liability in

connection with its leased UK Head Office.

The new Standard has been applied retrospectively in line with

IAS 8.

Full disclosure of the transition will be included in the 2019

Financial Statements.

2. Loss from operations

Loss from operations has been arrived at after charging:

Restated

Year ended Year ended

31 Dec 31 Dec

19 18

GBP'000 GBP'000

=============================================== =========== ============

Research and development costs 1,398 1,867

Net foreign exchange loss 37 33

Depreciation of property, plant and equipment

- owned assets 92 12

- leasehold property 122 122

- assets under leases 58 115

Auditor's remuneration 150 101

Restructuring costs 513 840

An analysis reconciling the loss from operations to adjusted

EBITDA is provided below.

Restated

Year ended Year ended

31 Dec 31 Dec

19 18

GBP'000 GBP'000

======================================== =========== ============

Loss from operations (1,248) (1,175)

Add back:

Depreciation and amortisation 372 349

Impairment of intangibles and

investments 1,663 896

Loss / (gain) on disposal of

fixed assets 2 (2)

Foreign exchange losses 37 33

Restructuring costs 513 840

EBITDA before gain / loss on

disposal of fixed assets, foreign

exchange gain / losses, restructuring

costs and gains / losses on

revaluation 1,339 941

3. Tax

Year ended Year ended

31 Dec 31 Dec

19 18

GBP'000 GBP'000

============================================= =========== ===========

Analysis of (charge) / credit in the year

Current tax:

Current research and development tax credit

- UK - 336

Current year State tax - US (49) (5)

Adjustment to prior year charge - UK (54) 56

Deferred tax credit 20 20

=========== ===========

Taxation (83) 407

============================================== =========== ===========

The Group has unutilised tax losses at 31 December 2019 in the

UK and the USA of GBP15.6m (2018: GBP15.0m) and $15.4m (2018:

$15.5m) respectively. These losses are still to be agreed with the

tax authorities in the UK and USA. The Board intends to make use of

all losses wherever possible.

The US tax losses are restricted to $491K per annum because of

change of control legislation. Losses carried forward from the

change of control in April 2008 are restricted and must be used

within 20 years. The Board believes the Group will be able to make

use of $8.7m (2018: $8.7m) of the total unutilised losses at 31

December 2019.

No deferred tax has been recognised in accordance with advice

from US tax accountants on the basis that the US losses are

restricted and there is uncertainty on the value of losses which

will be able to be used.

No deferred tax assets have been recognised in relation to any

other Group tax losses due to uncertainty over their

recoverability.

The differences are explained below:

Restated

Year ended Year ended

31 Dec 31 Dec

Reconciliation of tax expense 19 18

GBP'000 GBP'000

=================================================== =========== ============

Loss on ordinary activities before tax (1,266) (1,204)

=========== ============

Tax at the UK corporation tax rate of 19% (2018:

19%) (241) (229)

Expenses not deductible for tax purposes 297 59

Additional deduction for Research and Development

expenditure - (285)

Surrender of losses Research and Development

tax credit refund - 120

Unrelieved UK losses carried forward 149 -

Utilisation of UK losses (110) 79

Utilisation of US losses (103) (81)

Difference in timing of allowances (13) (19)

Adjustment to tax charge in respect of prior

years 104 (56)

Effect of foreign tax rates - 5

Total taxation 83 (407)

==================================================== =========== ============

United Kingdom Corporation tax is calculated at 19% (2018: 19%)

of the estimated assessable profit for the year.

Taxation for other jurisdictions is calculated at the rates

prevailing in the respective jurisdictions.

4. Earnings per share

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the year.

For diluted earnings per share, the weighted average number of

ordinary shares in issue is adjusted to assume conversion of all

dilutive ordinary share options. Management estimate 685,000

ordinary shares will be issued (2018: 101,333) in respect of share

options. In the current year, this calculation would have an

antidilutive effect on earnings per share so has been ignored.

Restated

Year ended Year ended

31 Dec 2019 31 Dec 2018

GBP'000 GBP'000

============================================== ============= =============

Attributable loss (1,349) (797)

Weighted average number of ordinary shares

used in basic earnings per share ('000) 16,908 16,920

Shares deemed to be issued in respect of

share-based payments 685 101

------------- -------------

Weighted average number of ordinary shares

used in dilutive earnings per share ('000) 17,593 17,021

Basic loss per share arising from both total

and continuing operations (7.98)p (4.71)p

Dilutive loss per share arising from both

total and continuing operations (7.98)p (4.71)p

=============================================== ============= =============

Dividends

On 28(th) June 2019, the company paid a dividend of 1.5 pence

per share to holders of ordinary shares.

Prior to the COVID-19 outbreak, the Directors declared their

intention to pay a dividend in 2020 of at least 1.5 pence per share

(2018: 1.5 pence). Given the current economic uncertainties, the

Board consider it prudent to delay any dividend announcement until

later in the year when a clearer outlook is available.

5. Post balance sheet events

Prior to the COVID-19 outbreak, the Directors declared their

intention to pay a dividend in 2020 of at least 1.5 pence per share

(2018: 1.5 pence). Given the current economic uncertainties, the

Board consider it prudent to delay any dividend announcement until

later in the year when a clearer outlook is available.

Since 31 December 2019, the COVID-19 pandemic has significantly

affected the global economy. Measures taken by governments around

the world to contain the spread of the virus including travel bans,

social distancing and closure of non-essential services have had a

detrimental effect on businesses worldwide. The Group have already

experienced the cancellation of trade shows and other marketing

events which formed part of the sales strategy for 2020. This

combined with a more cautious investment outlook in the wider

economy will cause delays to customer discretionary spend activity

affecting the Group's new revenue targets in 2020. The Ingenta

customer base is relatively diverse and the publishing industry as

a whole has been resilient to date although future impacts are hard

to predict. It would be reasonable to expect that any increase in

severity of the disease may impact on customers and could

potentially cause them to struggle to pay outstanding receivable

balances or go into administration and cancel ongoing services.

The Company has determined that these events are non-adjusting

subsequent events and consequently the financial position and

results of operations for the year ended 31 December 2019 have not

been altered. Furthermore, it is not possible to reliably estimate

the duration and severity of any future consequences of COVID-19

nor the impact they may have on financial statements.

6. Publication of non-statutory accounts

The financial information set out in this announcement does not

constitute statutory accounts as defined in the Companies Act

2006.

The Group Statement of Comprehensive Income, Group Statement of

Financial Position, Group Statement of Changes in Equity, Group

Statement of Cash Flows and associated notes have been extracted

from the Group's 2019 statutory financial statements upon which the

auditor's opinion is unqualified and which do not include any

statement under section 498 of the Companies Act 2006.

Those financial statements will be delivered to the Registrar of

Companies following the release of this announcement.

This announcement and the annual report and accounts are

available on the Company's website www.ingenta.com. A copy of the

report and accounts will be sent to shareholders who have elected

to receive a printed copy with details of the annual general

meeting in due course.

For further information please contact:

Ingenta plc

Scott Winner / Jon Sheffield Tel: 01865 397 800

Cenkos Securities plc

Nicholas Wells / Harry Hargreaves Tel: 020 7397 8900

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR FLFEDRAILIII

(END) Dow Jones Newswires

June 02, 2020 02:00 ET (06:00 GMT)

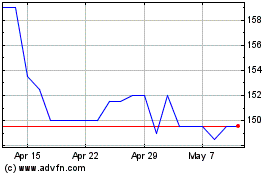

Ingenta (LSE:ING)

Historical Stock Chart

From Feb 2025 to Mar 2025

Ingenta (LSE:ING)

Historical Stock Chart

From Mar 2024 to Mar 2025