TIDMING

RNS Number : 4979Z

Ingenta PLC

21 September 2020

21 September 2020

Ingenta plc

Interim Results

Ingenta plc (AIM: ING), ("Ingenta", the "Company" or the

"Group") a leading provider of world-class software and services to

the global publishing industry, is pleased to announce its

unaudited interim results for the six months to 30 June 2020.

Financial Key Points

-- Group revenues stable at GBP5.2m (2019: GBP5.3m)

-- 82% of Group revenues recurring in nature (2019: 79%)

-- Adjusted EBITDA(*) up 61.8% to GBP0.5m (2019: GBP0.3m)

-- Cash from operations up 20.8% to GBP1.2m (2019: GBP1.0m)

-- Cash balances increased to GBP3.5m at 30 June 2020 from GBP2.6m at 31 December 2019

-- Net cash generation of GBP0.9m (2019: GBP0.5m)

-- Earnings per share of 2.09 pence (2019: loss 1.86 pence)

-- Proposed interim dividend of 1.5p per share and commencement of share buy-back

Operational Key Points

-- Head of Professional Services recruited to drive operational efficiencies

-- 3 Commercial deployments nearing completion in 2020 plus a further 2 for Edify

-- Vista as a Service gaining traction with 2 deals underway and

further opportunities for 2021

-- Music and gaming IP management solutions launched with sales opportunities being progressed

-- Company profile substantially de-risked with an ongoing annual cost base of GBP9.5m

(*) Earnings before Interest, Tax, Depreciation and Amortisation

is calculated before foreign exchange differences and restructuring

costs.

Martyn Rose, Chairman of Ingenta plc, commented:

"The first half of 2020 has seen unprecedented economic upheaval

which has highlighted the need for businesses to be agile and

flexible in the way they operate and service their customers. In

both these respects, I am encouraged by the performance of the

teams in ensuring a seamless transition to remote working whilst

ensuring our services remain unaffected. In many ways this

vindicates the business transformation process we undertook in

prior years to de-risk the operations and improve efficiency.

"Given the economic environment, I am encouraged to report that

we have maintained stable revenues for the first half of the year.

During the period, the Group have been implementing 6 Commercial

projects plus 2 major Vista as a Service migrations, many of which

will go live in the second half of the year. As anticipated, new

sales activity has been impacted by COVID19 with many businesses

delaying major purchasing decisions but I am pleased to report 2

new Edify contracts have been signed this year and we remain

hopeful that further deals will be signed in due course.

"The underlying financial performance of the Group has also been

transformed with profit before tax increasing to GBP0.4m from a

GBP0.2m loss in the prior period. Cash generation has also been

strong, and the Group reported a cash increase of GBP0.9m, closing

the half year with cash reserves of GBP3.5m. Given these results,

the Board propose an interim dividend of 1.5 pence per share should

be payable later in the year and intend to exercise a share buyback

program as authorised at our AGM. Further details on these matters

will be released in due course."

For further information please contact:

Ingenta plc Tel: 01865 397 800

Scott Winner / Jon Sheffield

Cenkos Securities plc Tel: 0207 397 8900

Nicholas Wells / Harry Hargreaves

Financial Review

Trading performance in the first half of the year has been

encouraging given the prevailing conditions and uncertainty caused

by COVID19. The Group's previously announced restructuring efforts

have put the business in a strong position to weather unforeseen

economic events whilst continuing to deliver a full complement of

services. Against these headwinds, the Group has delivered improved

profitability and cash generation as outlined below .

Statement of Comprehensive Income

Group revenue remained stable at GBP5.2m (2019: GBP5.3m) as

current project work has continued to be delivered by flexible,

remote working teams.

Gross profit margins have increased to 43.9% from 39.6% as the

Group's new operational structure continues to deliver results.

Included within these numbers is GBP0.7m of expensed research and

development costs. Further efficiencies are also evident in the

Group's sales and administrative cost base, the latter of which

includes non-recurring costs of GBP0.2m.

Profit from operations has increased by GBP0.6m to GBP0.4m

(2019: loss GBP0.2m) and, with negligible interest, taxation and

exchange costs, the Group delivered earnings per share of 2.09

pence (2019: loss 1.86 pence).

Statement of Cash Flows and Financial Position

The Group's cash inflow from operations during the period has

improved and amounted to GBP1.2m (2019: GBP1m). At the half year,

the Group's cash position increased by GBP0.9m (2019: GBP0.5m) to a

total of GBP3.5m (2019: GBP1.8m). This reflects the high point in

our working capital cycle due to the seasonality of our support and

maintenance invoicing. No dividend was paid in the first half of

2020 (2019: GBP0.3m) as the Group waited to establish the impacts

of COVID19 on the business and the wider economy. The Group now

intends to pay a dividend of 1.5 pence per share in the second half

of the year and an announcement will be made in due course.

Outlook

Ingenta has performed well through the early stages of the

COVID19 crisis, supported by our recurring revenues and Commercial

contracts secured in 2019 which will continue to benefit the

company through 2020 and beyond. Our sales pipeline remains robust,

but clearly the rate of conversion has been impacted by the current

economic environment. This may temper our growth expectation for

the remainder of the year, but we continue to focus on improving

efficiency which will help offset any softness in our end

markets.

Jon Sheffield

Chief Financial Officer

Condensed Consolidated Interim Statement of Comprehensive

Income

Restated

Unaudited Unaudited

Six months Six months

ended ended

30 June 2020 30 June 2019

Note GBP'000 GBP'000

Group revenue 5,208 5,250

Cost of sales (2,923) (3,171)

------------- -------------

Gross profit 2,285 2,079

Sales and marketing expenses (328) (454)

Administrative expenses (1,587) (1,824)

Profit / (loss) from operations 370 (199)

Finance costs (8) (11)

Profit / (loss) before tax 362 (210)

Tax 9 (92)

Retained profit / (loss) for the

period 371 (302)

Other comprehensive expenses which

will be reclassified subsequently

to profit or loss:

Exchange differences on translating

foreign operations (17) (12)

Total comprehensive profit / loss

for the period 354 (314)

Basic profit / loss per share - pence 4 2.09 (1.86)

------------- -------------

Diluted profit / loss per share -

pence 4 2.01 (1.86)

Analysis of (loss) / profit from

operations:

Profit before net finance costs,

tax, depreciation and amortisation,

restructuring costs and foreign exchange

gains and losses (adjusted EBITDA) 560 346

Depreciation (189) (186)

Impairment of intangibles - -

Foreign exchange gain / (loss) 32 (12)

Restructuring costs (33) (347)

------------- -------------

Profit / (loss) from operations 370 (199)

Condensed Consolidated Interim Statement of Financial

Position

Restated

Unaudited Unaudited

30 June 2020 30 June 2019

Note GBP'000 GBP'000

Non-current assets

Goodwill 3 2,661 4,324

Other intangible assets 3 108 208

Property, plant & equipment 465 544

3,234 5,076

Current assets

Trade and other receivables 5 1,650 2,431

Research and development tax credit

receivable - 282

Cash and cash equivalents 3,537 1,809

5,187 4,522

Total assets 8,421 9,598

-------------- --------------

Equity

Share capital 1,692 1,692

Merger reserve 11,055 11,055

Reverse acquisition reserve (5,228 ) (5,228)

Translation reserve (897 ) (888)

Share option reserve 42 18

Retained earnings (2,760 ) (2,031)

3,904 4,618

Non-current liabilities

Deferred tax liability 22 42

Leases 75 265

-------------- --------------

97 307

Current liabilities

Trade and other payables 6 1,997 2,290

Deferred income 2,423 2,383

-------------- --------------

4,420 4,673

Total equity and liabilities 8,421 9,598

-------------- --------------

Unaudited Condensed Consolidated Interim Statement of Changes in

Equity

Share Share Merger Reverse Translation Share Retained Total

capital premium reserve acquisition reserve option Earnings

reserve reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

January 2020 1,692 - 11,055 (5,228) (880) 23 (3,131) 3,531

Dividends paid - - - - - - - -

Transactions

with owners - - - - - - - -

--------- --------- --------- ------------- ------------ --------- ---------- --------

Profit for the

period - - - - - - 371 371

Share based

payment expense - - - - - 19 - 19

Other comprehensive

income:

Exchange differences

on translation

of foreign operations - - - - (17) - - (17)

--------- --------- --------- ------------- ------------ --------- ---------- --------

Total comprehensive

income / (expense)

for the period - - - - (17) 19 371 373

--------- --------- --------- ------------- ------------ --------- ---------- --------

Balance at 30

June 2020 1,692 - 11,055 (5,228) (897) 42 (2,760) 3,904

--------- --------- --------- ------------- ------------ --------- ---------- --------

Share Share Merger Reverse Translation Share Retained Total

capital premium reserve acquisition reserve option Earnings

reserve reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

January 2019 1,692 - 11,055 (5,228) (876) 16 (1,475) 5,184

Dividends paid - - - - - - (254) (254)

Share premium

reduction

--------- --------- --------- ------------- ------------ --------- ---------- --------

Transactions

with owners - - - - - (254) (254)

--------- --------- --------- ------------- ------------ --------- ---------- --------

Loss for the

period - - - - - - (302) (302)

Share based

payment expense 2 2

Other comprehensive

income:

Exchange differences

on translation

of foreign operations - - - - (12) - - (12)

--------- --------- --------- ------------- ------------ --------- ---------- --------

Total comprehensive

income / (expense)

for the period - - - - (12) 2 (302) (312)

--------- --------- --------- ------------- ------------ --------- ---------- --------

Balance at 30

June 2019 1,692 - 11,055 (5,228) (888) 18 (2,031) 4,618

--------- --------- --------- ------------- ------------ --------- ---------- --------

Condensed Consolidated Interim Statement of Cash Flows

Restated

Unaudited Unaudited

Six months Six months

ended ended

30 June 2020 30 June 2019

Note GBP'000 GBP'000

Profit / (loss) before tax 362 (210)

Adjustments for:

Depreciation 189 186

Share based payment expense 19 2

Interest expense 8 11

Unrealised foreign exchange differences (17) (12)

Decrease in trade and other receivables 1,560 2,196

Decrease in trade and other payables (970) (1,220)

Cash inflow from operations 1,151 953

Tax Paid 9 (38)

Net cash inflow from operating activities 1,160 915

Cash flows from financing activities

Dividends paid - (254)

Payment of leases (151) (157)

Interest paid (8) (11)

------------- -------------

Net cash used in financing activities (159) (422)

Cash flows from investing activities

Purchase of property, plant and equipment (65) (7)

Net cash used in investing activities (65) (7)

Net increase in cash and cash equivalents 936 486

Cash and cash equivalents at beginning

of period 2,601 1,323

Cash & cash equivalents at end of period 3,537 1,809

------------- -------------

Notes to the Unaudited Interim Report for the six months ended

30 June 2020

1. Nature of operations and general information

Ingenta plc (the "Company") and its subsidiaries (together 'the

Group') is a provider of technology and supporting services to

content providers and publishers. The nature of the Group's

operations and its principal activities are set out in the full

annual financial statements.

The Company is incorporated in the United Kingdom under the

Companies Act 2006. The Company's registration number is 00837205

and its registered office is 8100 Alec Issigonis Way, Oxford OX4

2HU. The condensed consolidated interim financial statements were

authorised for issue by the Board of Directors on 21 September

2020.

The financial information set out in this interim report does

not constitute statutory accounts as defined in section 404 of the

Companies Act 2006. The Group's statutory financial statements for

the year ended 31 December 2019, prepared under IFRS as adopted by

the European Union, have been filed with the Registrar of

Companies. The auditor's report on those financial statements was

unqualified and did not contain a statement under section 498 (2)

or section 498 (3) of the Companies Act 2006.

2. Basis of preparation

These unaudited condensed consolidated interim financial

statements are for the six months ended 30 June 2020. They have

been prepared following the recognition and measurement principles

of IFRS as adopted by the European Union. They do not include all

of the information required for full annual financial statements

and should be read in conjunction with the consolidated financial

statements of the Group for the year ended 31 December 2019.

These condensed consolidated interim financial statements have

been prepared on the going concern basis under the historical cost

convention and have been prepared in accordance with the accounting

policies adopted in the last annual financial statements for the

year ended 31 December 2019.

The accounting policies have been applied consistently

throughout the Group for the purposes of preparation of these

consolidated interim financial statements.

A detailed set of accounting policies can be found in the annual

accounts available on our website, www.ingenta.com or by writing to

the Company Secretary at the registered office as above.

3. Goodwill and Intangibles

Full details of the Group's policies on Goodwill and Intangibles

is presented in the financial statements for the year ended 31

December 2019.

4. Profit / (loss) per share

Basic profit / (loss) per share is calculated by dividing the

profit / (loss) attributable to ordinary shareholders by the

weighted average number of ordinary shares outstanding during the

period.

For diluted profit / (loss) per share, the weighted average

number of ordinary shares in issue is adjusted to assume conversion

of all dilutive potential ordinary shares.

Six months Six months

ended ended

30 June 2020 30 June 2019

Attributable profit / (loss)

(GBP'000) 354 (314)

Weighted average number of

ordinary basic shares (basic) 16,919,609 16,919,609

Weighted average number of

ordinary shares (diluted) 17,600,854 17,005,942

Loss per share (basic) arising

from both total and continuing

operations 2.09p (1.86)p

Loss per share (dilutive)

arising from both total and

continuing operations 2.01p (1.86)p

5. Trade and other receivables

Trade and other receivables comprise the following:

30 June 2020 30 June 2019

GBP'000 GBP'000

Trade receivables - gross 1,318 1,610

Less: provision for impairment

of trade receivables (161) (68)

------------- -------------

Trade receivables - net 1,157 1,542

Other receivables 69 135

Prepayments and accrued income 424 754

1,650 2,431

6. Trade and other payables

Trade payables comprise the following:

30 June 2020 30 June 2019

GBP'000 GBP'000

Trade payables 470 333

Social security and other

taxes 374 239

Other payables 660 1,311

Accruals 493 407

1,997 2,290

7. Contingencies and commitments

There were no contingencies or commitments at the end of this or

the comparative period. Further details are included within the

2019 financial statements.

8. Post balance sheet events

There were no material events subsequent to the end of the

interim reporting period that have not been reflected in the

interim financial statements.

9. Copies of the Interim Financial Statements

A copy of the interim statement is available on the Company's

website, www.ingenta.com , and from the Company's registered

office, 8100 Alec Issigonis Way, Oxford OX4 2HU.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BRGDCBDBDGGI

(END) Dow Jones Newswires

September 21, 2020 02:00 ET (06:00 GMT)

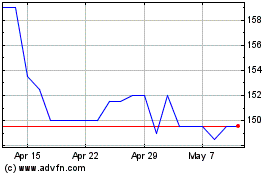

Ingenta (LSE:ING)

Historical Stock Chart

From Feb 2025 to Mar 2025

Ingenta (LSE:ING)

Historical Stock Chart

From Mar 2024 to Mar 2025