TIDMING

RNS Number : 2142M

Ingenta PLC

20 September 2021

20 September 2021

Ingenta plc

Interim Results

Ingenta plc (AIM: ING), ("Ingenta", the "Company" or the

"Group") a leading provider of world-class software and services to

the global publishing industry, is pleased to announce its

unaudited interim results for the six months to 30 June 2021.

Financial Key Points

-- Group revenues GBP5.1m (2020: GBP5.2m)

-- 85% of Group revenues recurring in nature (2020: 82%)

-- Gross profit margin 47% (2020: 44%)

-- Adjusted EBITDA(*) up 34% to GBP0.7m (2020: GBP0.6m)

-- Cash from operations up 10% to GBP1.3m (2020: GBP1.2m)

-- Cash balances increased to GBP3.1m (31 December 2020: GBP2.3m)

-- Cash generation of GBP0.8m (2020: GBP0.9m)

-- Earnings per share of 2.26 pence (2020: 2.10 pence)

-- 0.235m shares repurchased under share buy-back programme

-- Introduction of a progressive dividend policy with an interim 1p per share payment

Operational Key Points

-- 2 Edify deployments completed in the period

-- 2 IP Management deployments in the period

-- Major infrastructure project completed to improve the resilience of hosting services

-- Company profile substantially de-risked with an ongoing annual cost base of GBP9.5m

(*) Earnings before Interest, Tax, Depreciation and Amortisation

is calculated before foreign exchange differences and restructuring

costs. See Statement of Comprehensive Income for reconciliation

As previously announced on 15 September 2021, Ingenta will be

presenting via the Investor Meet Company platform on 23 September

2021 at 15.30 (BST). To sign up to the Ingenta presentation for

free via Investor Meet Company please click the following link:

https://www.investormeetcompany.com/ingenta-plc/register-investor

.

Martyn Rose, Chairman of Ingenta plc, commented:

"The results for the first half of the year have been solid with

an underlying theme of improved operational efficiency. The Group

has embraced a flexible working model and invested in the necessary

infrastructure to further improve resiliency and the breadth of our

service offering. In tandem, a new sales and marketing approach is

being rolled out to widen our reach and improve penetration into

adjacent vertical markets. The current economic climate has

somewhat dampened results in this area, but we remain optimistic

that deals can be concluded in the coming months.

"Additionally, the recurring revenue base of the Group continues

to improve and is the result of a reinvigorated focus on project

delivery along with customer uptake of a broad layer of service

options that are increasingly relevant to businesses changing

needs.

"Financially, I'm pleased to report the Group has continued to

deliver strong operating cash inflows of GBP1.3m (2020: GBP1.2m)

which has enabled us to invest in forward looking infrastructure to

deliver our services whilst also facilitating a share buyback

programme. Given our consistent levels of cash generation and

balance sheet strength, we are aiming to instigate a dividend

policy which pays out 50% of normalised annual free cashflows.

Consequently, we intend to pay an interim dividend of 1p per share

for the 2021 financial year with a final dividend to be

communicated in due course.

Certain information contained in this announcement would have

been deemed inside information as stipulated under the UK version

of the EU Market Abuse Regulation (2014/596) which is part of UK

law by virtue of the European Union (Withdrawal) Act 2018, as

amended and supplemented from time to time, until the release of

this announcement.

For further information please contact:

Ingenta plc Tel: 01865 397 800

Scott Winner / Jon Sheffield

Cenkos Securities plc Tel: 0207 397 8900

Nicholas Wells / Katy Birkin

Financial Review

The Group continues to focus on operational enhancements which

have increased profitability in the first half of the year.

Recurring revenue percentages remain strong at 85% and are being

driven by the efficient implementation of projects plus the

continued uptake of Vista as a Service.

Statement of Comprehensive Income

Although Group revenue remained flat at GBP5.1m (2020: GBP5.2m),

efficiency gains have delivered improved profitability with growth

in our reported gross profit of GBP2.4m (2020: GBP2.3m). Sales and

marketing expenses were also stable but there has been a change in

strategy as the Group focus on more digital campaigns in light of

Covid restrictions. Administrative expenses increased slightly to

GBP1.7m (2020: GBP1.6m) and reflect the investment in a Head of

Professional Services but also include a GBP150,000 uplift in

depreciation. The depreciation increase represents the investments

made in infrastructure to support and grow the Group's hosting

capabilities which further boosts recurring revenues.

Profit from operations remained at GBP0.4m (2020: GBP0.4m) and,

with negligible interest, taxation and exchange costs, the Group

delivered earnings per share of 2.26 pence (2020: 2.10 pence).

Statement of Cash Flows and Financial Position

The Group's cash inflow from operations improved during the

period and amounted to GBP1.3m (2020: GBP1.2m). Other significant

expenditure included GBP0.2m of lease payments on equipment to

bolster the hosting infrastructure as mentioned above. As

previously announced, the Group has continued to exercise its share

buyback authority and purchased a further 235,000 shares for a

combined consideration of GBP0.2m (2020: nil). Closing cash

balances amounted to GBP3.1m (2020: GBP3.5m).

Outlook

The Group will continue its strategy of driving efficiency gains

and we anticipate further benefits as we renegotiate infrastructure

contracts and look to leverage offshore resources. Recurring

revenue remains strong and is being driven by a streamlined

implementation methodology, which was successfully rolled out in

our Content business and is now being deployed across Commercial

projects. Whilst new sales activity remains difficult to predict,

we have a pipeline of new opportunities from both existing and new

customers which we look forward to converting in the coming

months.

Jon Sheffield

Chief Financial Officer

Unaudited Condensed Consolidated Interim Statement of

Comprehensive Income

Unaudited Unaudited

Six months Six months

ended ended

30 June 2021 30 June 2020

Note GBP'000 GBP'000

Revenue 5,106 5,208

Cost of sales (2,692) (2,923)

------------- -------------

Gross profit 2,414 2,285

Sales and marketing expenses (353) (328)

Administrative expenses (1,673) (1,587)

Profit from operations 388 370

Finance costs (14) (8)

Profit before tax 374 362

Tax - 9

Retained profit for the period 374 371

Other comprehensive expenses which

will be reclassified subsequently

to profit or loss:

Exchange differences on translating

foreign operations 2 (17)

Total comprehensive profit for the

period 376 354

Basic profit per share - pence 4 2.26 2.10

------------- -------------

Diluted profit per share - pence 4 2.18 2.02

Analysis of profit from operations:

Profit before net finance costs,

tax, depreciation and amortisation,

restructuring costs and foreign exchange

gains and losses (adjusted EBITDA) 748 560

Depreciation (293) (139)

Amortisation (50) (50)

Foreign exchange gain / (loss) (14) 32

Restructuring costs (3) (33)

------------- -------------

Profit from operations 388 370

Unaudited Condensed Consolidated Interim Statement of Financial

Position

Unaudited Unaudited

30 June 2021 30 June 2020

Note GBP'000 GBP'000

Non-current assets

Goodwill 3 2,661 2,661

Other intangible assets 3 8 108

Property, plant & equipment 889 465

3,558 3,234

Current assets

Trade and other receivables 5 1,434 1,650

Cash and cash equivalents 3,102 3,537

4,536 5,187

Total assets 8,094 8,421

-------------- --------------

Equity

Share capital 1,692 1,692

Merger reserve 11,055 11,055

Reverse acquisition reserve (5,228 ) (5,228)

Translation reserve (837 ) (897)

Share option reserve 80 42

Retained earnings (2,982 ) (2,760)

3,780 3,904

Non-current liabilities

Deferred tax liability 2 22

Leases 336 75

-------------- --------------

338 97

Current liabilities

Trade and other payables 6 1,817 1,997

Deferred income 2,159 2,423

-------------- --------------

3,976 4,420

Total equity and liabilities 8,094 8,421

-------------- --------------

Unaudited Condensed Consolidated Interim Statement of Changes in

Equity

Share Share Merger Reverse Translation Share Retained Total

capital premium reserve acquisition reserve option Earnings

reserve reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

January 2021 1,692 0 11,055 (5,228) -839 61 (3,175) 3,566

Shares bought

back into treasury - - - - - - (181) (181)

Share based

payment expense - - - - - 19 - 19

Transactions

with owners 0 0 0 0 0 19 -181 -162

--------- --------- --------- ------------- ------------ --------- ---------- --------

Profit for the

period - - - - - - 374 374

Other comprehensive

income:

Exchange differences

on translation

of foreign operations - - - - 2 - - 2

--------- --------- --------- ------------- ------------ --------- ---------- --------

Total comprehensive

income / (expense)

for the period - - - - 2 - 374 376

--------- --------- --------- ------------- ------------ --------- ---------- --------

Balance at 30

June 2021 1,692 - 11,055 -5,228 (837) 80 (2,982) 3,780

--------- --------- --------- ------------- ------------ --------- ---------- --------

Share Share Merger Reverse Translation Share Retained Total

capital premium reserve acquisition reserve option Earnings

reserve reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

January 2020 1,692 - 11,055 (5,228) (880) 23 (3,131) 3,531

Share based

payment expense - - - - - 19 - 19

--------- --------- --------- ------------- ------------ --------- ---------- --------

Transactions

with owners - - - - - 19 - 19

--------- --------- --------- ------------- ------------ --------- ---------- --------

Profit for the

period - - - - - - 371 371

Other comprehensive

income:

Exchange differences

on translation

of foreign operations - - - - (17) - - (17)

--------- --------- --------- ------------- ------------ --------- ---------- --------

Total comprehensive

income / (expense)

for the period - - - - (17) - 371 354

--------- --------- --------- ------------- ------------ --------- ---------- --------

Balance at 30

June 2020 1,692 - 11,055 (5,228) (897) 42 (2,760) 3,904

--------- --------- --------- ------------- ------------ --------- ---------- --------

Unaudited Condensed Consolidated Interim Statement of Cash

Flows

Unaudited Unaudited

Six months Six months

ended ended

30 June 2021 30 June 2020

Note GBP'000 GBP'000

Profit before tax 374 362

Adjustments for:

Depreciation and amortisation 343 189

Share based payment expense 19 19

Interest expense 14 8

Unrealised foreign exchange differences 2 (17)

Decrease in trade and other receivables 784 1,560

Decrease in trade and other payables (260) (961)

Cash inflow from operations 1,276 1,160

Tax Paid - -

Net cash inflow from operating activities 1,276 1,160

Cash flows from financing activities

Shares bought back into treasury (181) -

Payment of leases (239) (151)

Interest paid (14) (8)

------------- -------------

Net cash used in financing activities (434) (159)

Cash flows from investing activities

Purchase of property, plant and equipment (63) (65)

Net cash used in investing activities (63) (65)

Net increase in cash and cash equivalents 779 936

Cash and cash equivalents at beginning

of period 2,323 2,601

Cash & cash equivalents at end of period 3,102 3,537

------------- -------------

Notes to the Unaudited Interim Report for the six months ended

30 June 2021

1. Nature of operations and general information

Ingenta plc (the "Company") and its subsidiaries (together "the

Group") is a provider of technology and supporting services to

content providers and publishers. The nature of the Group's

operations and its principal activities are set out in the full

annual financial statements.

The Company is incorporated in the United Kingdom under the

Companies Act 2006. The Company's registration number is 00837205

and its registered office is 8100 Alec Issigonis Way, Oxford OX4

2HU. The condensed consolidated interim financial statements were

authorised for issue by the Board of Directors on 20 September

2021.

The financial information set out in this interim report does

not constitute statutory accounts as defined in section 404 of the

Companies Act 2006. The Group's statutory financial statements for

the year ended 31 December 2020, prepared under IFRS as adopted by

the European Union, have been filed with the Registrar of

Companies. The auditor's report on those financial statements was

unqualified and did not contain a statement under section 498 (2)

or section 498 (3) of the Companies Act 2006.

2. Basis of preparation

These unaudited condensed consolidated interim financial

statements are for the six months ended 30 June 2021. They have

been prepared following the recognition and measurement principles

of IFRS in conformity with the requirements of the Companies Act

2006. They do not include all of the information required for full

annual financial statements and should be read in conjunction with

the consolidated financial statements of the Group for the year

ended 31 December 2020.

These condensed consolidated interim financial statements have

been prepared on the going concern basis under the historical cost

convention and have been prepared in accordance with the accounting

policies adopted in the last annual financial statements for the

year ended 31 December 2020.

The accounting policies have been applied consistently

throughout the Group for the purposes of preparation of these

consolidated interim financial statements.

A detailed set of accounting policies can be found in the annual

accounts available on our website, www.ingenta.com or by writing to

the Company Secretary at the registered office as above.

3. Goodwill and Intangibles

Full details of the Group's policies on Goodwill and Intangibles

is presented in the financial statements for the year ended 31

December 2020.

4. Profit per share

Basic profit per share is calculated by dividing the profit

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the period.

For diluted profit per share, the weighted average number of

ordinary shares in issue is adjusted to assume conversion of all

dilutive potential ordinary shares.

Six months Six months

ended ended

30 June 2021 30 June 2020

Attributable profit (GBP'000) 376 354

Weighted average number of

ordinary basic shares (basic) 16,625,214 16,853,505

Weighted average number of

ordinary shares (diluted) 17,306,459 17,534,750

Profit per share (basic) arising

from both total and continuing

operations 2.26p 2.10p

Profit per share (dilutive)

arising from both total and

continuing operations 2.18p 2.02p

5. Trade and other receivables

Trade and other receivables comprise the following:

30 June 2021 30 June 2020

GBP'000 GBP'000

Trade receivables - gross 1,148 1,318

Less: provision for impairment

of trade receivables (142) (161)

------------- -------------

Trade receivables - net 1,006 1,157

Other receivables 76 69

Prepayments and accrued income 352 424

1,434 1,650

6. Trade and other payables

Trade payables comprise the following:

30 June 2021 30 June 2020

GBP'000 GBP'000

Trade payables 211 470

Social security and other

taxes 383 374

Other payables 631 660

Accruals 592 493

1,817 1,997

7. Contingencies and commitments

There were no contingencies or commitments at the end of this or

the comparative period.

8. Post balance sheet events

There were no material events subsequent to the end of the

interim reporting period that have not been reflected in the

interim financial statements.

9. Copies of the Interim Financial Statements

A copy of the interim statement is available on the Company's

website, www.ingenta.com , and from the Company's registered

office, 8100 Alec Issigonis Way, Oxford OX4 2HU.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KZGMLVNLGMZM

(END) Dow Jones Newswires

September 20, 2021 02:00 ET (06:00 GMT)

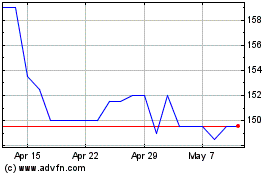

Ingenta (LSE:ING)

Historical Stock Chart

From Feb 2025 to Mar 2025

Ingenta (LSE:ING)

Historical Stock Chart

From Mar 2024 to Mar 2025