TIDMING

RNS Number : 2054Q

Ingenta PLC

27 June 2022

Ingenta plc

(the 'Group' or the 'Company')

Final Audited Results

Ingenta plc (AIM: ING) a leading provider of software and

services to the global publishing industry, announces its final

audited results for the year ended 31 December 2021.

Financial Key Points

-- Revenues stable at GBP10.1m (2020: GBP10.2m) reflecting a focus on core software offerings.

-- Annual Recurring Revenue (ARR)* of GBP8.9m representing 88%

of total revenue (2020: GBP8.7m, 86%).

-- Operating cash inflows of GBP2.0m in the year (2020: GBP0.8m).

-- Cash balances at year end of GBP3.0m (2020: GBP2.3m).

-- Adjusted EBITDA** of GBP1.5m (2020: GBP1.2m).

-- Net profit of GBP1.8m*** (2020: GBP0.4m).

-- Proposed final dividend of 2 pence per share, subject to

shareholder approval at the 2022 AGM (2021: 1.5 pence).

-- Earnings per share of 10.93 pence (2020: 2.67 pence).

Operational Key Points

-- First music customer won and deployed onto our conChord IP

management platform, leading to increasing interest from other

music publishers within this substantial target market.

-- 4 customer go-lives across the product portfolio during the year.

-- Completion of internal infrastructure plan with improved

resilience and operational flexibility.

Current trading

-- Strong trading in 2022 generating growth in revenues and profit over the prior period.

-- Growth driven by existing customer base with extended sales

cycles persisting for sales to new customers.

-- Whilst cognisant of deteriorating economic conditions, the

Board believe the results for the year ended 31 December 2022 will

be comfortably in line with market expectations.

* ARR - Revenue generated and recognised in the year from

annually recurring software support contracts, hosting services and

managed services.

**Adjusted EBITDA - EBITDA before impairment, gain / loss on

disposal of fixed assets, foreign exchange gain / loss and

exceptional non-recurring costs . See note 2 for details.

***Net profit in 2021 includes a GBP1.2m deferred tax

credit.

Scott Winner, Chief Executive Officer, commented:

"The 2021 results announced today demonstrate the completion of

Ingenta's turn around, delivering stabilised revenue, strong

efficiency gains, higher margins and improved cashflow. This has

been achieved by delivering a broader array of services to existing

customers.

Strategically, we continue to focus on our Intellectual Property

management solutions and web-based content platforms which we

anticipate will deliver revenue growth. In that respect, I'm

pleased to report we have signed and deployed our first music

customer onto our conChord product in 2021. This is an exciting

development for the Group and validates that our expertise in IP

management is applicable in verticals outside of the traditional

publishing sector.

In our web-based digital content distribution business, we

delivered 3 successful go lives on our Edify platform. These

implementations included 2 more prestigious NGO customers and we

look to further enhance our business in this sector."

Certain of the information contained within this announcement is

deemed by the Company to constitute inside information as

stipulated under the UK version of the EU Market Abuse Regulation

(2014/596) which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018, as amended and supplemented from time to

time.

For further information please contact:

Ingenta plc

Scott Winner / Jon Sheffield Tel: 01865 397 800

Cenkos Securities plc

Nicholas Wells / Katy Birkin Tel: 020 7397 8900

Chairman's statement

Overview

I'm pleased to report on the Group's continued progress in 2021

and in particular, the actions taken to improve operational

efficiency as we strive to generate improved margins, profitability

and cashflow. With sound fundamentals in place, the Group is well

positioned to broaden its reach beyond the traditional publishing

sphere of Intellectual Property management and into a variety of

adjacent vertical markets. As previously announced, the first

target for expansion is within the music sector and the Group won

and successfully deployed its first customer onto its multitenancy

music IP management platform, which has been designed to meet the

ever-increasing challenges faced by those operating in this

sector.

Elsewhere, our web-based content platform business has also

performed well, and we successfully deployed 3 new customers to our

Edify solution. Encouragingly, 2 of these go lives were for

prestigious NGO's which represents a growing opportunity for the

Group and a diversification away from scholarly content

providers.

As outlined above, the main success story for the year was the

improved margin and profitability driven from our loyal customer

base. To a large extent this is due to the expansion of our service

offering which has been designed, in part, as a solution for

customers who do not want to manage the peripheral or technology

related requirements of running and maintaining a software package.

In addition to the widened service offering, the Group has

maintained a close focus on internal processes to ensure all

services are designed, contracted and delivered in an efficient

fashion. Our utilisation levels for professional service staff have

been on an upward trend in 2021 and this remains a key focus going

forwards.

Ingenta has a wealth of experience in both technology and its

use within content delivery and IP management, providing a

foundation for growth in an increasingly complicated environment

where customers are continually searching for new and improved ways

of managing their business processes.

Operational flexibility

It has been over 2 years since Covid impacted on us all and I'm

proud of the resilience, flexibility and dedication of all the

teams at Ingenta. In rapid time, the whole Group successfully

migrated to remote working whilst continuing to service our loyal

customer base, many of whom experienced additional support

requirements as they adapted their own business processes. However,

whilst this initial change was enforced, the Group has taken the

initiative and looked to fundamentally adapt and remodel our

infrastructure within physical premises, IT or internal working

processes. Everyone should be proud of their contributions to this,

the new and agile Ingenta.

Shareholders' returns and dividends

During the year, the Company completed a share buyback programme

and repurchased a further 440,826 ordinary shares. At the year end,

the Company had 16,919,609 ordinary shares in issue, with a total

of 587,930 shares held in treasury.

The Directors declare their intention to pay a dividend in 2022

of 2 pence per share (2021: 1.5 pence) subject to approval at the

forthcoming AGM.

Outlook

The Group's core Commercial and Content software solutions

provide a mission critical service enabling publishers to run their

business and manage their IP assets. With our newly established

operating fundamentals firmly in place and generating returns, the

Group can look forward with optimism to the next stage of its

development - generating revenue growth and leveraging our

expertise in the wider IP management arena. The Group has taken its

first step into the music IP sector and will look to expand on this

whilst continuing to drive growth in our existing core markets.

M C Rose

Chairman

24 June 2022

Financial review

Business Strategy

Ingenta is a provider of mission critical software and services

to the publishing sector, with growth aspirations in adjacent

industries. Operationally, the Group has moved to a product

agnostic services architecture enabling it to offer an integrated

approach to servicing customers whereby service levels and software

are standardised, and as a result, resources are utilised more

efficiently. The Group's focus is to accelerate growth in recurring

revenue via the sale of software as a service wherever

possible.

Product review

Ingenta Commercial

Ingenta Commercial provides a variety of modular publishing

management systems for both print and digital products. A core area

of expertise is within Intellectual Property and the Group is

looking to leverage its existing expertise in contracts, rights and

royalties management by expanding into adjacent verticals.

conChord, a solution designed for the music industry, has already

been released and successfully deployed and we believe there are

further opportunities in other verticals where IP management is an

increasing concern for customers.

Reported revenues increased marginally to GBP6.7m (2020:

GBP6.6m) with the Group remaining focussed on driving recurring

revenues by offering ongoing peripheral services in addition to the

standard software support. In this respect, the hosted service

offering has been well received and has helped increase managed

services revenues in the division. The revenues reported in the

year that are recurring in nature increased from GBP5.4m to

GBP6.1m. Reported earnings before interest, tax, depreciation and

amortisation (EBITDA) declined slightly from GBP0.85m to GBP0.78m

and was largely the result of enhanced post go live support on a

number of customers as they transition from implementation to

normalised support.

Ingenta Content

The Ingenta Content suite of products enable publishers of any

size, discipline or technical proficiency to convert, store,

deliver and monetise digital content on the web.

Annual revenue increased from GBP2.3m to GBP2.4m helped by three

new customer go lives on the Edify platform during the year and an

active base of customer change request work. Importantly, the Group

continues to successfully diversify into new markets with the

addition of 2 further NGO customers. Divisional EBITDA increased

from GBP0.32m to GBP0.52m and was driven by the efficient

deployment of the new customers sites which moved onto support

during the year.

Ingenta Advertising

Ingenta Advertising provides a complete browser-based multimedia

advertising, CRM and sales management platform for content

providers.

The business anticipates that the Group's Advertising offering

will become a component of the larger Commercial and Content

Products divisions and, in time, its revenues will be less clearly

distinguished as a separate CGU. Reported revenue remained stable

at GBP0.8m (2020: GBP0.8m). Segmental EBITDA for the advertising

division increased marginally from GBP0.2m to GBP0.24m, largely as

a result of improved support efficiency plus additional project

work undertaken in the year.

PCG

The PCG consulting arm provides a range of non-software services

designed to support and drive a business's sales strategy.

Strategically, the team's skills are being increasingly used to

drive sales pipeline for the wider Group in addition to their own

customer portfolio work.

Annual revenue declined slightly to GBP0.3m (2020: GBP0.4m) and

was a result of a challenging sales market. Part of the divisions

business is driven from sales commission and activity was somewhat

depressed as buyers held off making purchases during Covid

restrictions. Segmental EBITDA improved from a loss of GBP0.2m to a

loss of GBP0.1m driven by the Group's policy of reallocating PCG

resources to the wider Group marketing function in order to improve

sales pipeline growth across the business.

Going forward, it is envisaged that PCG and Advertising will no

longer be reported as separate divisions.

Financial Performance

Group revenue was stable at GBP10.1m (2020: GBP10.2m) but

encouragingly, the recurring revenue base has been expanded

slightly to GBP8.9m or 88% of the reported total (2020: GBP8.7m and

86%). This increase in recurring revenues is due to the uptake of

ongoing managed services where the business is

expanding its offering.

Although revenue was stable, the Group's cost of sales declined

from GBP5.7m to GBP5.5m as the previous actions taken to streamline

operational efficiency begin to take hold. Consequently, gross

profit increased to GBP4.7m (2020: GBP4.4m). Further operational

efficiencies have been generated within administration overheads

helping yield profit from operations of GBP0.8m (2020:

GBP0.5m).

Sales and marketing spend was stable at GBP0.7m but it masks a

conscious switch in tactics as the Group looks to embrace digital

marketing strategies rather than traditional in person event

attendance. These efforts are starting to build a broader pipeline

of opportunities that the Group is looking to exploit going

forward. Administrative costs have declined from GBP3.3m to GBP3.2m

again largely as a result of the previously reported efficiency

drive including removal of operational silos and a change in

infrastructure mix within the business.

No tax charge is anticipated for 2021 as the Group continues to

utilise brought forward tax losses.

Financial Position

Non-current assets include goodwill and intangibles recognised

on historic acquisitions. In 2021, Goodwill relates solely to the

core Content platform software which will be used to drive growth

in the future. Goodwill relating to historic acquisitions is tested

for impairment each year using discounted cashflows. No impairment

was identified in 2021. Property, plant and equipment reductions

are a direct result of the Group's infrastructure strategy which

has seen us move IT and personnel out of physical business

premises.

Current assets have increased from GBP4.5m to GBP4.8m which is

the result of improved profitability driving cash generation.

Additionally, throughout the Covid pandemic there have been very

few instances of bad debt as the Group's customer base remains

relatively shielded in an operational sense from the impacts of

social restriction and the Groups services remain business critical

to end users.

Total liabilities have declined from GBP4.8 to GBP4.6m as prior

year finance lease commitments undertaken for our hosting

infrastructure are paid down.

Cashflow

The Group generated a cash inflow from operations of GBP2.0m

compared to GBP0.8m in 2020. Critically, the Groups restructuring

has improved efficiency and margins which flows through to cash

generation as all research and development efforts are expensed.

Outside of normal operational activity, the Group has paid

dividends of GBP0.4m (2020: GBP0.3m) and completed a share buyback

programme which amounted to an outflow of GBP0.3m (2020: GBP0.1m).

Closing cash balances were GBP3.0m (2020: GBP2.3m)

Key Performance Indicators

The Board and senior management review a number of KPI's

continually throughout the year, all of which form part of the

monthly management accounts process and include:

-- Revenue versus budget and monthly reforecast

-- Adjusted EBITDA (see note 2 for calculation) versus budget

-- Group cashflow versus budget

-- Sales pipeline growth and conversion analysis

-- Time utilisation statistics

Any deviations or anomalies are investigated, and corrective

action taken where appropriate.

Full year revenues were below budget largely because of

shortfalls on new sales targets as the Covid pandemic restricted

activity. As has been widely publicised elsewhere, the pandemic has

slowed sales cycles and occasionally delayed implementations.

However, interest for our products and services remains high.

Adjusted EBITDA was higher than budget driven by acceleration of

certain planned savings in infrastructure, delayed hiring of staff

and restricted marketing activity.

Year-end cash balances were GBP0.7m above budget reflecting

increased profitability and timing of receipts around year end.

The Group monitor sales activity with reference to monthly sales

pipeline reports. These reports detail sales opportunities by

product with metrics around expected project timelines and revenue

recognition estimates so that management can deploy resources

adequately to ensure the best chance of success in the bidding

process. When any items are removed from the pipeline due to either

a successful sale or a lost opportunity, management carry out a

detailed analysis to ensure the reasons are understood and any

actions required are taken.

The business monitors time utilisation at a contract level to

enable accurate pricing decisions to be made ensuring profitable

service delivery. Internal development costs are also reviewed to

ensure the appropriate effort is spent supporting the products and

deliver an effective product roadmap.

Going concern

The core fundamentals of the Group remain strong with cash

reserves of GBP3m and no debt beyond leasing arrangements. In

addition, further cost saving opportunities have been identified as

the Group look to reduce their physical premises cost and

associated overheads as leases naturally expire over the coming

years. Management are satisfied that cash is sufficient for the

needs of the business based on the cash flow forecast. The going

concern review covered the period to the end of June 2023.

The Covid outbreak continues to add some uncertainty to

financial forecasting and modelling. However, at an operating

profit level, the Group's results for the first quarter of 2022

have been better than budget. New sales activity remains subdued

with the timing of any uplift difficult to predict. The Group

continues to embrace established remote working practices without

any significant impact to services. Any ongoing implementations and

professional services can also be delivered remotely by Ingenta

personnel. The internal business infrastructure is contracted with

large multinational corporations and remains resilient. The Group

has modelled various downside scenarios and consider it appropriate

to use the going concern basis to compile these financial

statements. Further details on going concern are included in the

accounting policies section of the financial statements.

Outlook

Ingenta achieved a key milestone in 2021 by successfully

deploying its first music customer onto conChord which

significantly provides us with a referenceable client and

independent validation that our IP engine is flexible enough to

step into adjacent verticals. Our marketing effort is now targeted

on enhancing the messaging in this sector in order to build

momentum and boost sales pipeline growth.

The Group is also actively exploring further opportunities to

drive expansion of the newly invigorated managed services division

which is a key offering that provides real value to customers who

no longer wish to be encumbered with peripheral activities as they

relate to software infrastructure.

Pleasingly, 2022 has started well, with reported profits ahead

of budget and the prior year, giving the Board optimism for the

future.

J R Sheffield

Chief Financial Officer

24 June 2022

Group Statement of Comprehensive Income

For the year ended 31 December 2021

Restated

Year ended Year ended

31 Dec 31 Dec

21 20

note GBP'000 GBP'000

====================================================== ===== =========== ===========

Group revenue 10,145 10,177

Cost of sales (5,487) (5,741)

Gross profit 4,658 4,436

Sales and marketing expenses (690) (671)

Administrative expenses (3,214) (3,301)

Profit from operations 2 754 464

Finance costs (27) (22)

Profit before income tax 727 442

Income tax 3 1,074 7

Profit for the year attributable to equity

holders of the parent 1,801 449

Other comprehensive expenses which will be

reclassified subsequently to profit or loss:

Exchange differences on translation of foreign

operations 56 (137)

Total comprehensive profit for the year attributable

to equity holders of the parent 1,857 312

Basic profit per share (pence) 4 10.93 2.67

Dilutive profit per share (pence) 4 10.50 2.56

See note 5 for further details on the prior period

adjustment

All activities are classified as continuing

Group Statement of Financial Position

As at 31 December 2021

Restated Restated

31 Dec 31 Dec 31 Dec

21 20 19

===============================

GBP'000 GBP'000 GBP'000

=============================== ======== ========= =========

Non-current assets

Goodwill 2,661 2,661 2,661

Other intangible assets - 58 158

Property, plant and equipment 665 1,119 473

Deferred tax asset 1,163 - -

4,489 3,838 3,292

Current assets

Trade and other receivables 1,810 2,226 3,219

Cash and cash equivalents 3,006 2,323 2,600

======== ========= =========

4,816 4,549 5,819

Total assets 9,305 8,387 9,111

======== ========= =========

Equity

Share capital 1,692 1,692 1,692

Merger reserve 11,055 11,055 11,055

Reverse acquisition reserve (5,228) (5,228) (5,228)

Share option reserve 88 61 23

Translation reserve (605) (661) (524)

Retained earnings (2,278) (3,353) (3,487)

Total equity 4,724 3,566 3,531

Non-current liabilities

Deferred tax liability 88 12 32

Leases 192 430 206

======== ========= =========

280 442 238

Current liabilities

Trade and other payables 1,991 2,061 2,459

Deferred income 2,310 2,318 2,883

4,301 4,379 5,342

Total liabilities 4,581 4,821 5,580

Total equity and liabilities 9,305 8,387 9,111

See note 5 for further details on the prior period

adjustment

Group Statement of Changes in Equity

For the year ended 31 December 2021

Total

Reverse Share attributable

Share Merger acquisition Translation Retained option to owners

capital reserve reserve reserve earnings reserve of parent

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- --------- --------- ------------- ------------ ---------- --------- --------------

Balance at 1 January

2021 on prior basis 1,692 11,055 (5,228) (839) (3,175) 61 3,566

Impact of restatement

(note 5) - - - 178 (178) - -

--------- --------- ------------- ------------ ---------- --------- --------------

Restated balance at

1 January 2021 1,692 11,055 (5,228) (661) (3,353) 61 3,566

Dividends paid - - - - (410) - (410)

Shares bought back

into treasury - - - - (316) - (316)

Share options granted

in the year - - - - - 27 27

--------- --------- ------------- ------------ ---------- --------- --------------

Transactions with owners - - - - (726) 27 (699)

Profit for the year - - - - 1,801 - 1,801

Foreign exchange

differences

on translation - - - 56 - - 56

--------- --------- ------------- ------------ ---------- --------- --------------

Total comprehensive

income for the year - - - 56 1,801 - 1,857

Balance at 31 December

2021 1,692 11,055 (5,228) (605) (2,278) 88 4,724

============================ ========= ========= ============= ============ ========== ========= ==============

For the year ended 31 December 2020

Total

Reverse Share attributable

Share Merger acquisition Translation Retained option to owners

capital reserve reserve reserve earnings reserve of parent

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

============================ ========= ========= ============= ============ ========== ========= ==============

Balance at 1 January

2020 on prior basis 1,692 11,055 (5,228) (880) (3,131) 23 3,531

Impact of restatement

(note 5) - - - 356 (356) - -

--------- --------- ------------- ------------ ---------- --------- --------------

Restated balance at

1 January 2020 1,692 11,055 (5,228) (524) (3,487) 23 3,531

Dividends paid - - - - (252) - (252)

Shares bought back

into treasury - - - - (63) - (63)

Share options granted

in the year - - - - - 38 38

--------- --------- ------------- ------------ ---------- --------- --------------

Transactions with owners - - - - (315) 38 (277)

Profit for the year - - - - 449 - 449

Foreign exchange

differences

on translation - - - (137) - - (137)

--------- --------- ------------- ------------ ---------- --------- --------------

Total comprehensive

income for the year - - - (137) 449 - 312

Balance at 31 December

2020 1,692 11,055 (5,228) (661) (3,353) 61 3,566

============================ ========= ========= ============= ============ ========== ========= ==============

Group Statement of Cash Flows

For the year ended 31 December 2021

Restated

Year ended Year ended

31 Dec 31 Dec

21 20

GBP'000 GBP'000

=================================================== =========== ===========

Profit before taxation 727 442

Adjustments for

Depreciation 632 439

Profit on disposal of fixed assets - (2)

Interest expense 27 22

Unrealised foreign exchange differences 56 (137)

Share based payment charge 27 39

Decrease in trade and other receivables 416 954

Increase / (decrease) in trade and other payables

and deferred income 131 (953)

Cash inflow from operations 2,016 804

Tax paid (13) (13)

=========== ===========

Net cash inflow from operating activities 2,003 791

Cash flows from investing activities

Purchase of property, plant and equipment (119) (200)

Net cash used in investing activities (119) (200)

Cash flows from financing activities

Interest paid (21) (5)

Payment of lease liabilities (453) (550)

Dividend paid (410) (252)

Costs of buy back of shares into treasury (316) (63)

Net cash used in financing activities (1,200) (870)

Net increase / (decrease) in cash and cash

equivalents 684 (279)

Cash and cash equivalents at the beginning

of the year 2,323 2,600

Exchange differences on cash and cash equivalents (1) 2

=========== ===========

Cash and cash equivalents at the end of the

year 3,006 2,323

See note 5 for further details on the prior period

adjustment

1. Basis of preparation

The nancial information of the Group set out above does not

constitute statutory accounts for the purposes of Section 435 of

the Companies Act 2006. The nancial information for the year ended

31 December 2021 has been extracted from the Group's audited

nancial statements which were approved by the Board of directors on

24 June 2022.

The nancial information for the year ended 31 December 2021 has

been extracted from the Group's nancial statements for that period.

The report of the auditor on the 2021 nancial statements was

unquali ed, did not include any references to any matters to which

the auditors drew attention by way of emphasis without qualifying

their report and did not contain a statement under Section 498(2)

or Section 498(3) of the Companies Act 2006.

Whilst the nancial information included in this preliminary

announcement has been prepared in accordance with UK adopted

international accounting standards ("IASs") in conformity with the

requirements of the Companies Act 2006, the International Financial

Reporting Interpretations Committee ("IFRIC"), interpretations

issued by the International Accounting Standards Boards ("IASB")

that are effective or issued and adopted as at the time of

preparing these financial statements, and in accordance with the

provisions of the Companies Act 2006 that are relevant to companies

that report under UK adopted IASs, this announcement does not

itself contain su cient information to comply with those IASs. This

nancial information has been prepared in accordance with the

accounting policies set out in the 2020 Report and Accounts and

updated for new standards adopted in the current year.

Items included in the nancial information of each of the Group's

entities are measured using the currency of the primary economic

environment in which the entity operates (the functional currency).

The consolidated nancial information is presented in UK sterling

(GBP), which is the Group's presentational currency.

The Company is a public limited company incorporated and

domiciled in England & Wales and whose shares are quoted on

AIM, a market operated by the London Stock Exchange.

The principal activity of Ingenta plc and its subsidiaries is

the sale of software and ancillary services.

2. Profit from operations

Profit from operations has been arrived at after charging:

Restated

Year ended Year ended

31 Dec 31 Dec

21 20

GBP'000 GBP'000

=============================================== =========== ===========

Research and development costs 1,009 1,409

Net foreign exchange (gain) / loss 61 (138)

Depreciation of property, plant and equipment

- owned assets 179 110

- leasehold property 133 122

- assets under leases 262 107

Amortisation 58 100

Auditor's remuneration

- audit fees 74 71

- taxation services 12 12

Exceptional non-recurring costs 5 447

An analysis reconciling the profit from operations to adjusted

EBITDA is provided below.

Restated

Year ended Year ended

31 Dec 31 Dec

21 20

GBP'000 GBP'000

========================================= =========== ===========

Profit from operations 754 464

Add back:

Depreciation and amortisation 632 439

Gain on disposal of fixed assets - (2)

Exceptional non-recurring costs 5 447

Foreign exchange loss / (gain) 61 (138)

EBITDA before impairment, amortisation,

gain / loss on disposal of fixed

assets, foreign exchange gain

/ loss and exceptional non-recurring

costs 1,452 1,210

Exceptional non-recurring costs include restructuring costs,

premises exit costs, non-recurring professional fees and debt write

offs.

3. Tax

Year ended Year ended

31 Dec 31 Dec

21 20

GBP'000 GBP'000

=========================================== =========== ===========

Analysis of (charge) / credit in the year

Current tax:

Current year State tax - US (10) (10)

Adjustment to prior year charge - UK (3) (3)

Deferred tax credit 1,087 20

=========== ===========

Taxation 1,074 7

============================================ =========== ===========

The Group has unutilised tax losses at 31 December 2021 in the

UK and the USA of GBP16.3m (2020: GBP15.6m) and $11.2m (2020:

$14.2m) respectively. These losses have been agreed with the tax

authorities in the UK and USA. The Board intends to make use of all

losses wherever possible.

Some of the US tax losses are restricted to $491K per annum as a

result of change of control legislation. Losses carried forward

from the change of control in April 2008 are restricted and must be

used within 20 years. The Board believes the Group will be able to

make use of $7.4m (2020: $7.7m) of the total unutilised losses at

31 December 2021.

No deferred tax has been recognised in accordance with advice

from US tax accountants on the basis that the US losses are

restricted and there is uncertainty on the value of losses which

will be able to be used.

From 1 April 2023, the corporation tax rate applicable to

companies with taxable profits above GBP250,000 will be 25 per

cent. Companies with profits below GBP50,000 will, however,

continue to pay tax at the current rate of 19 per cent. Those with

taxable profits between GBP50,000 and GBP250,000 will benefit from

marginal relief, similar to that which applied before the previous

incarnation of the small companies' rate of corporation tax was

abolished with effect from 1 April 2015.

The differences are explained below:

Restated

Year ended Year ended

31 Dec 31 Dec

Reconciliation of tax expense 21 20

GBP'000 GBP'000

================================================== =========== ===========

Profit on ordinary activities before tax 727 442

=========== ===========

Tax at the UK corporation tax rate of 19% (2019:

19%) 138 84

Income / expenses not allowable for tax purposes (16) 14

Unrelieved losses carried forward 354 245

Utilisation of losses (529) (213)

Difference in timing of allowances 56 (129)

Deferred tax movement (1,087) -

Adjustment to tax charge in respect of prior

years 10 (8)

Total taxation (1,074) (7)

=================================================== =========== ===========

United Kingdom Corporation tax is calculated at 19% (2020: 19%)

of the estimated assessable profit for the year.

Taxation for other jurisdictions is calculated at the rates

prevailing in the respective jurisdictions.

4. Earnings per share

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the year.

For diluted earnings per share, the weighted average number of

ordinary shares in issue is adjusted to assume conversion of all

dilutive ordinary share options. Management estimate 681,000

ordinary shares will be issued (2020: 681,000) in respect of share

options. In the current year, this calculation would have an

antidilutive effect on earnings per share so has been ignored.

Restated

Year ended Year ended

31 Dec 2021 31 Dec 2020

GBP'000 GBP'000

============================================= ============= =============

Attributable profit 1,801 449

Weighted average number of ordinary shares

used in basic earnings per share ('000) 16,481 16,834

Shares deemed to be issued in respect of

share-based payments 670 681

------------- -------------

Weighted average number of ordinary shares

used in dilutive earnings per share ('000) 17,151 17,515

Basic profit per share arising from both

total and continuing operations 10.93p 2.67p

Dilutive profit per share arising from both

total and continuing operations 10.50p 2.56p

============================================== ============= =============

Dividends

On 9th August 2021 the Company paid a final dividend of 1.5

pence per share for the year ended 31 December 2020. On 29th

October 2021 an interim dividend of 1 pence per share was paid in

respect of the year ended 31 December 2021.

After the year end, the Directors declared their intention to

pay a final dividend of 2p for the year ended 31 December 2021,

subject to approval at the forthcoming Annual General Meeting.

5. Prior period adjustment

An adjustment has been made to the treatment of foreign exchange

gains and losses on intercompany balance translation at year end.

Previously all intercompany balances were treated as a net

investment and on consolidation any exchange gains and losses were

recorded in other comprehensive income and recognised in the

currency translation reserve in equity. Some of these intercompany

balances have subsequently been reclassified as trading balances on

the basis that transactions occur between trading entities. The

summarised corrections are shown below:

Administration Retained Translation

expenses Earnings Reserve

GBP'000 GBP'000 GBP'000

---------------------------- -------------- --------- -----------

Prior to 1 January 2020 356 (356)

Year ended 31 December 2020 (178) (178) 178

Prior to 1 January 2020, GBP356K of foreign exchange losses have

been reclassified from the translation reserve to retained earnings

within equity. For the year ended 31 December 2020, GBP178K of

foreign exchange gains have been reclassified from the translation

reserve in equity and recognised in the Statement of Comprehensive

Income within administration expenses.

These adjustments have also impacted on the Statement of Cash

Flows. The cash and cash equivalents balances remain the same,

however, changes are reflected within the profit before taxation

and movements in unrealised foreign exchange differences.

The Statement of Changes in Equity has also been restated for

the profit in the year and the foreign exchange differences on

translation of foreign operations.

The impact on reported basic and diluted earnings per share for

the year ended 31 December 2020 was an increase of 1.06p and 1.02p

respectively.

6. Publication of non-statutory accounts

The financial information set out in this announcement does not

constitute statutory accounts as defined in the Companies Act

2006.

The Group Statement of Comprehensive Income, Group Statement of

Financial Position, Group Statement of Changes in Equity, Group

Statement of Cash Flows and associated notes have been extracted

from the Group's 2021 statutory financial statements upon which the

auditor's opinion is unqualified and which do not include any

statement under section 498 of the Companies Act 2006.

Those financial statements will be delivered to the Registrar of

Companies following the release of this announcement.

This announcement and the annual report and accounts, including

the Notice of Annual General Meeting, are available on the

Company's website www.ingenta.com. A copy of the report and

accounts will be sent to shareholders who have elected to receive a

printed copy with details of the annual general meeting in due

course.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FLFSDRVIRFIF

(END) Dow Jones Newswires

June 27, 2022 02:00 ET (06:00 GMT)

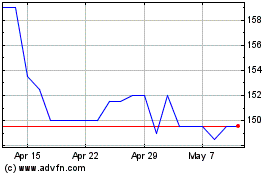

Ingenta (LSE:ING)

Historical Stock Chart

From Feb 2025 to Mar 2025

Ingenta (LSE:ING)

Historical Stock Chart

From Mar 2024 to Mar 2025