TIDMJAN

RNS Number : 0625I

Jangada Mines PLC

19 March 2018

Jangada Mines plc / EPIC: JAN.L / Market: AIM / Sector:

Mining

19 March 2018

Jangada Mines plc ('Jangada' or the 'Company')

Unaudited Interim Results to 31 December 2017

Jangada Mines plc, a natural resources company developing South

America's largest and most advanced platinum group metals ('PGM')

project, is pleased to announce its unaudited interim results for

the six-month period ended 31 December 2017.

Overview

-- Successfully admitted to trading on AIM in June 2017, raising

GBP2.25 million, before expenses, through an oversubscribed

placing

-- Generated an updated JORC compliant resource estimate at

Pedra Branca PGM Project ('the Project') that included 1 million

ounces of PGM+Au, 109 Mlbs of nickel, 23 Mlbs of copper, 6.4 Mlbs

of cobalt and 670kt of chrome

-- Successfully upgraded resource so that 77% of the Project's

resources were in the Indicated and Measured categories

-- Completed a scoping study that confirmed Project's potential

to become a robust, shallow, open-pit operation, with a low capital

expenditure requirement, yielding attractive financial returns and

a very short payback period

-- Identified high-grade vanadium-titanium-iron mineralisation

demonstrating the significant exploration potential of the

Jangada's exploration licenses

-- Received local government approval for pilot production

essential for expediated progress to commercial production

-- Post period end, commenced broader metallurgical test

programme; started the application process for a trial mining

permit and associated environmental permit; and appointed Brandon

Hill as broker

Chairman's Statement

During the period under review, which followed the Company's

listing on AIM in late June 2017, we focused on advancing the Pedra

Branca PGM Project ('the Project') in Brazil towards a

prefeasibility study ('PFS'). To this end, we announced in mid-July

an updated JORC (2012) compliant resource estimate, which added an

additional circa US$521 million to the in-situ value of the

declared approximate 1 million ounces of PGM+Au resources at the

Project. The estimate now includes 23.138 Mt of ore in the

Measured, Indicated and Inferred categories, containing 109 million

pounds of nickel and 23 million pounds of copper grading at 0.214%

Ni and 0.045% Cu, which will off-set the costs of producing PGM and

will accrue material profitability upside at no additional

cost.

Other news during the period included the confirmation of

high-grade vanadium-titanium-iron mineralisation from samples

across five locations, and the completion of the Scoping Study,

which confirmed the Project's potential to become a robust shallow

open pit mine with low CAPEX/OPEX and suggested an Internal Rate of

Return of 80% with a payback period of 1.3 years.

More recently, we commenced a broader metallurgical test

programme, including: rougher flotation tests; cleaner and

scavenger simulation; selectivity optimisation tests;

pre-concentration tests; and chrome gravimetric and magnetic

recovery tests to support the definition of robust project

flowsheet. This is ongoing, and the Company hopes to update the

market in the near future. We have also started the application

process for a trial mining permit and associated environmental

permit. Additionally, post period end, on the corporate side, we

were delighted to appoint Brandon Hill as broker to the

Company.

In conclusion, I would point out that the Project has multiple

value upside triggers ahead, including the flowsheet and PFS, and I

therefore anticipate significant news flow during the next six

months.

Finally, I would like to take this opportunity to thank our

shareholders for their ongoing support and our team for their hard

work and valuable contribution to what has been a busy six months.

I look forward to updating our progress on a regular basis.

Brian McMaster

Executive Chairman

JANGADA MINES PLC

Condensed consolidated unaudited statement of comprehensive

income

for the six months ended 31 December 2017

6 Months 6 Months

ended ended

31 December 31 December

Note 2017 2016

$'000 $'000

Project costs (24) (32)

Administration expenses (594) (24)

Loss from operations (618) (56)

Finance expense (163) (20)

------------- -------------

Loss before tax (781) (76)

Tax expense 4 - -

------------- -------------

Loss from continuing operations

and total loss (781) (76)

Currency translation differences 15 (1)

Total comprehensive income/(loss) (766) (77)

============= =============

Total loss attributable to:

Owners of the parent (781) (71)

Non-controlling interests - (5)

(781) (76)

============= =============

Total comprehensive loss attributable

to:

Owners of the parent (766) (72)

Non-controlling interests - (5)

------------- -------------

(766) (77)

============= =============

Loss per share attributable

to the

ordinary equity holders of the

company during the period

- Basic and diluted ($) 5 (0.00) (0.00)

============= =============

JANGADA MINES PLC

Condensed unaudited consolidated statement of financial

position

as at 31 December 2017 and 30 June 2017 (audited)

As at As at

31 December 30 June

Note 2017 2017

$'000 $'000

Assets

Non-current assets

Plant, property and equipment 9 8

Exploration assets 6 247 -

256 8

Current assets

Other receivables 110 227

Cash and cash equivalents 800 2,450

910 2,677

Total assets 1,166 2,685

============= =========

Liabilities

Current liabilities

Trade payables 10 -

Loans and borrowings 7 - 458

Accruals 152 619

------------- ---------

Total liabilities 162 1,077

Issued capital and reserves

attributable to owners of the

parent

Share capital 8 102 102

Share premium 2,844 2,844

Translation reserve 13 (2)

Retained earnings (1,955) (1,336)

------------- ---------

Total equity 1,004 1,608

------------- ---------

Total equity & liabilities 1,166 2,685

============= =========

JANGADA MINES PLC

Condensed unaudited consolidated statement of changes in

equity

for the period ended 31 December 2017

Share Share Translation Retained Total

equity

capital premium reserve earnings attributable

to owners

$'000 $'000 $'000 $'000 $'000

At 30 June 2017 102 2,844 (2) (1,336) 1,608

Comprehensive Income

for the period

Loss - - - (781) (781)

Other comprehensive income - - 15 - 15

-------- -------- ------------ --------- -------------

Total comprehensive loss

for the period - - 15 (781) (766)

Transactions with owners

Share options issued - - - 162 162

-------- -------- ------------ --------- -------------

Total transactions with

owners - - - 162 162

As at 31 December 2017 102 2,844 13 (1,955) 1,004

======== ======== ============ ========= =============

(Share) (Share) (Translation) (Retained) (Total

equity)

(capital) (premium) (reserve) (earnings) (attributable

to owners)

($'000) ($'000) ($'000) ($'000) ($'000)

As at 30 June 2016 - - 1 (39) (38)

Comprehensive Income

for the year

Loss - - - (1,297) (1,297)

Other comprehensive

income - - (3) - (3)

---------- ---------- -------------- ----------- --------------

Total comprehensive

Income for the year - - - (1,297) (1,300)

Transactions with owners

Share issue 102 2,844 - - 2,946

---------- ---------- -------------- ----------- --------------

Total transactions with

owners 102 2,844 - - 2,946

As at 30 June 2017 102 2,844 (2) (1,336) 1,608

========== ========== ============== =========== ==============

JANGADA MINES PLC

Condensed unaudited consolidated statement of cash flows

for the period ended 31 December 2017

6 Months 6 Months

ended ended

31 December 31 December

2017 2016

$'000 $'000

Cash flows from operating activities

Loss before Tax (781) (71)

Add back: depreciation 3 3

Non-cash cost of share options 162 -

issued

Decrease/(increase) in other

receivables 117 (380)

Decrease in trade and other (457) -

payables

Net cash flows from operating

activities (956) (448)

------------- -------------

Investing activities

Development of exploration (247) -

and evaluation assets

------------- -------------

Net cash from investing activities (247) -

------------- -------------

Financing activities

(Repayment)/proceeds from related

party borrowings (58) 20

Capital advance into subsidiary - 59

(Repayment)/issue of convertible

loan notes (400) 380

Net cash from financing activities (458) 459

------------- -------------

Net movement in cash and cash

equivalents (1,609) 11

------------- -------------

Cash and cash equivalents at

beginning of period 2,450 3

Movements in foreign exchange 11 (1)

Cash and cash equivalents at

end of period 800 13

============= =============

JANGADA MINES PLC

Notes forming part of the interim unaudited consolidated

financial information

for the period ended 31 December 2017

1. General information

The Company is a public limited company, incorporated on 30 June

2015 with the registration number 09663756 and with its registered

office at Level 2, 34 Dover Street, London W1S 4NG. The Company's

principal activities are the provision of mining services.

2. Significant Accounting Policies

Basis of preparation

The interim unaudited financial information for the period ended

31 December 2017 has been prepared in accordance with IAS 34

Interim Financial Reporting. The results for the period ended 31

December 2017 are unaudited.

The condensed unaudited consolidated financial information for

the period ended 31 December 2017 has been prepared on a basis

consistent with, and on the basis of, the accounting policies set

out in the financial information on the Company set out in the

Company's published results for the year to 30 June 2017. The

unaudited interim financial statements of the Company have been

prepared on the basis of the accounting policies, presentation,

methods of computation and estimation techniques expected to be

adopted in the financial information by the Company in preparing

its annual report for the year ended 30 June 2018.

The financial information is presented in United States Dollars

($), which is also the functional currency of the Company and Group

and is the preferred currency of the owners of the Company. Amounts

are rounded to the nearest thousand ($'000), unless otherwise

stated.

Accounting standards in issue but not yet effective

At the date of authorisation of this financial information, a

number of standards and interpretations were in issue but not yet

effective. The Directors do not anticipate that the adoption of

these standards and interpretations, or any of the amendments made

to the existing standards as a result of the annual improvements

cycle, will have a material effect on the financial statements of

the year of initial application.

Going concern

In common with many mining companies at this stage of

development, the Group will require further funding to finance its

pre-production programme in Brazil. Without funding in place, such

conditions would indicate the existence of material uncertainty

which may cast significant doubt about the Group and Company's

ability to continue as a going concern. However, the Directors are

confident that the Group will be able to raise funds for such

requirements from investors as required, and the financial

statements do not, therefore, include the adjustment that would

result if the Group and Company were unable to continue as a going

concern.

3. Business Segments AND SEasonality

The Company evaluates segmental performance on the basis of

profit or loss from operations calculated in accordance with IFRS

8. In the Directors' opinion, the Company only operates in one

segment: mining services.

The Directors believe that the Group's operations are not

subject to any significant seasonality.

4. TAXATION

Period Period

ended ended

31 December 31 December

2017 2016

$'000 $'000

Profit on ordinary activities before

tax (781) (71)

------------ ------------

Profit on ordinary activities multiplied

by standard rate of corporation tax

in the UK of 19% (2016: 20%) (148) (14)

Effects of:

Unrelieved tax losses carried forward 148 14

Total tax charge for the period - -

============ ============

Factors that may affect future tax

charges

There were no factors that may affect

future tax charges.

5. EARNINGS PER SHARE

Period Period

ended ended

31 December 31 December

2017 2016

US$'000 US$'000

Loss for the period (781) (76)

============ ============

Weighted average number of shares

(basic and diluted) 197,515,600 197,515,600

============ ============

Loss per share - basic and diluted

(US$'000) (0.00) (0.00)

============ ============

The convertible loan notes included in the balance sheet at 31

December 2016 are ignored for diluted earnings per share

calculation as they are anti-dilutive to the loss for the period.

The 31 December 2016 weighted average number of shares in issue has

been adjusted to reflect the shares issued in the period up to 31

December 2017 in order to allow a direct comparison of the earnings

per share figures in both periods.

6. EXPLORATION & EVALUATION ASSETS

Exploration and evaluation assets represent the costs of

pre-feasibility studies, field costs, government fees and the

associated support costs at the Group's Pedra Branca Platinum Group

Metal project.

7. CONVERTIBLE LOAN NOTES

On 22 August 2017, the Company repaid in full the outstanding

convertible loan notes.

8. SHARE CAPITAL

Issued Value

Ordinary shares of GBP0.0004 Number $'000

each:

At 1 July 2017 and 31 December

2017 197,515,600 102

============ ======

9. RELATED PARTY TRANSACTIONS

During the period the Company entered into the following

transactions with Garrison Capital Partners Limited, a related

party due to having directors in common:

Period Period

ended ended

31 December 31 December

2017 2016

$'000 $'000

Garrison Capital Partners

Limited:

Supply of IT and administration 47 -

expenses

Purchases made on Company's

behalf during the period - 20

Amounts owed and included

within borrowings - 111

=========== =============

10. DIRECTOR'S EMOLUMENTS

The four directors were paid emoluments totaling $190,000 (2016:

$Nil) during the period under review. The Directors were the key

management personnel.

11. NATURE OF FINANCIAL INFORMATION

The unaudited consolidated interim financial information

presented above does not constitute statutory financial statements

for the period under review.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

ENDS

For further information, please visit www.jangadamines.com or

contact:

Jangada Mines plc E: info@jangadamines.com

Strand Hanson Limited (Financial T: +44 (0)20 7409

& Nominated Adviser) 3494

James Spinney / Ritchie

Balmer / Jack Botros

Brandon Hill (Broker) T: +44 (0)20 3463

Jonathan Evans/Oliver Stanstead 5000

St Brides Partners LTD T: +44 (0)20 7236

(Financial PR) 1177

Isabel de Salis/Gaby Jenner

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR FKFDQKBKDNND

(END) Dow Jones Newswires

March 19, 2018 03:00 ET (07:00 GMT)

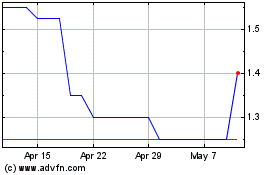

Jangada Mines (LSE:JAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Jangada Mines (LSE:JAN)

Historical Stock Chart

From Jul 2023 to Jul 2024