RNS Number:1788Z

Dart Group PLC

28 June 2007

DART GROUP PLC

PRELIMINARY RESULTS FOR YEAR ENDED 31 MARCH 2007

Dart Group PLC, the aviation services and distribution group, announces its

preliminary results for the year ended 31 March 2007.

CHAIRMAN'S STATEMENT

I am pleased to report on the Group's trading for the year ended 31 March 2007.

Profit before tax, goodwill amortisation and exceptional items amounted to

#16.6m (2006 - #14.5m restated). Profit before tax and after goodwill

amortisation and exceptional items amounted to #18.1m (2006 - #14.8m restated).

Turnover was #352.0m (2006 - #310.6m). Earnings per share before the

amortisation of goodwill and exceptional items were 8.78p (2006 - 7.11p

restated), whilst basic earnings per share were 9.73p (2006 - 7.95p restated).

The Board is recommending a final dividend of 1.430p (2006 - 1.295p), taking the

total dividend for the year to 2.08p (2006 - 1.86p), an increase of 12%. The

dividend, if approved, will be payable on 24 August 2007 to shareholders on the

register on 6 July 2007. The lower tax charge of 25% is as a result of the

largely tax free gain on the Channel Islands' business disposal together with a

number of prior year tax credits, both of which are unlikely to re-occur in

the future.

In total, capital expenditure amounted to #71.8m (2006 - #48.7m), and mainly

related to the acquisition of five Boeing 757-200 aircraft, spare engines and

the Group's spending on capitalised aircraft maintenance. As at 31 March 2007

the Group's net debt amounted to #14.1m (2006 - #5.5m). Gearing as

at 31 March 2007 was 20% (2006 - 9%).

In excess of 72% of the expected 2007/08 Jet2.com fuel requirements have been

hedged for the year ending 31 March 2008, together with 100% of the forecast US$

requirements. Neither Jet2.com's contract charter operations nor Fowler

Welch-Coolchain currently has any material exposure to oil price risk as this is

substantially covered in their commercial contracts.

The Group completed the sale of its non-core Channel Islands' distribution

business on 3 July 2006. The exceptional credit of #2.2m relates to the surplus

of proceeds over book cost.

Jet2.com

Jet2.com, the Group's low-cost airline, expanded its operations from each of its

six Northern UK bases during the year. The move of the administration and

operational offices to Leeds Bradford International Airport was substantially

completed and the Group's owned fleet increased to 29 aircraft with the addition

of the five Boeing 757-200 aircraft. Leased-in aircraft have also been operated

to meet seasonal demand.

Jet2.com's aim is to be the leading supplier of scheduled leisure flights from

the North and the brand is aggressively promoted to achieve the public's

recognition, via on-line advertising, press, posters, TV and radio. During the

year the number of destinations served increased to 38 for summer 2007

(2006: 31). Passengers carried are forecast to rise to 4.3m compared to 3.0m in

the year ended 31 March 2007. The company also operates night-time mail flights

on behalf of Royal Mail and many series and individual charter flights for a

diverse customer base.

In the autumn of 2006 the company commenced services to The Canary Islands from

Leeds Bradford, Manchester, Newcastle, Belfast and Blackpool utilising Boeing

757 aircraft. During the winter of 2007/08 up to 27 services a week will be

flown to Tenerife, Gran Canaria and Lanzarote. It is also planned to introduce

other year-round sun destinations. The company's policy is to offer the lowest

possible fares throughout its network. The revenue from these is supplemented

with value-added ancillary revenue streams such as commission on sales of

insurance, hotels and car hire together with the profits on sales of in-flight

food, drink and gifts. The associated revenues per passenger for the current

year are forecast to increase considerably over that achieved in the last

financial year.

In February 2007, Jet2holidays.com was launched to offer flexible duration

flight, transfers and hotel packages linked, primarily, to our scheduled

services. Whilst this is a highly competitive market, we believe that by

packaging attractive hotels with our low fares we can give our leisure customers

great value holidays. The concept is currently being marketed on a limited basis

whilst the mechanics of the process are developed. However, we are pleased that

customer feedback to date has been good and we look forward to putting full

promotional spend behind the product for the next year.

Jet2.com aims to expand its business by serving traditional leisure markets at

highly competitive prices and developing a range of longer distance low-cost

services that meet the aspirations of leisure travellers. Obviously routes take

time to develop and costs are incurred in building volumes and taking market

share. We will be continuing investment in new routes over the coming year so

profit growth in this area of our business is likely to be flat.

Fowler Welch-Coolchain

The Group's logistics company, Fowler Welch-Coolchain, made considerable

progress in the last financial year with new business wins, increased sales and

improved profits. The company primarily provides an integrated supply chain

solution to supermarkets and their suppliers as well as food manufacturers,

growers and importers. Capabilities include both chilled and ambient (non

temperature-controlled) distribution together with warehousing and pick-to-order

services. The company's warehousing and picking operations, which feed the

distribution network, continue to expand with substantial new business wins at

both Kent and Spalding sites during the year. Volume is important to the

business to increase the load fill of the distribution vehicles.

On 28 April 2006, Fowler Welch-Coolchain acquired the business and assets of R F

Fielding Cheshire Ltd (In Administration), for a de minimis sum. This business

specialises in ambient distribution from its base in North West England.

Employee numbers amounted to 226 and the business utilised 79 tractor units and

133 trailers. It is operated from a 187,500 sq.ft leased premises in Stockport.

Not only has this acquisition provided a foothold in this larger market, it has

also improved the utilisation of the transport fleet via network synergies.

A 40,000 sq.ft. freehold facility on an 8 acre site was acquired in Washington,

Tyne and Wear, on 4 September 2006 This facility replaced the company's existing

premises in Gateshead and is being fitted out for temperature-controlled storage

and distribution. It will provide the North East England platform for growth in

both the company's chilled and ambient business.

It is Fowler Welch-Coolchain's strategy to invest and grow its chilled and

ambient distribution businesses and warehousing by a combination of organic

growth and selective acquisition.

Our Staff

The relocation of Dart Group's and Jet2.com's operational and administrative

headquarters to Leeds Bradford International Airport has now been substantially

completed and I am extremely grateful to the majority of the key staff who have

made the move and ensured that the companies' operations have continued

seamlessly.

We will be sorry to lose our Group Finance Director, Mike Forder, in July and

thank him for his substantial contribution to the Group's development.

However, we are very pleased to welcome his successor, Andrew Merrick, FCMA, who

joins us on 2 July from Bradford and Bingley PLC where he was Director of

Finance. Before, from 1988 to 1997, Andrew had a successful career at Thomas

Cook Group where he undertook a number of operational finance roles. Prior to

this Andrew worked for the international division of Midland Bank Limited.

Andrew will bring valuable banking and travel industry experience to the Group.

It is important to acknowledge the dedication and hard work of each of the

Group's operational and administrative staff in both Fowler Welch-Coolchain and

Jet2.com. Both businesses are customer-focused and operationally demanding at

all hours of the day. We are grateful to all and look forward to continuing to

grow our business together.

Outlook

We expect to grow both our businesses organically in the year ahead, with also

the possibility of selective acquisitions in Fowler Welch-Coolchain when there

are sensibly priced opportunities.

In the competitive scheduled low-cost travel market, which is becoming

progressively later booking and therefore more difficult to predict, whilst our

235 seat Boeing 757s differentiate our product and capabilities from several of

our competitors, new routes take time and money to develop to profitability.

However, the consolidation of the major tour operators, who currently have large

capacity to many of the destinations we also serve, should give real

opportunities both for our scheduled business and Jet2holidays.com. Therefore,

overall, whilst I believe it is unlikely that the Group's profits will increase

this year, growth should resume thereafter.

Philip Meeson

Chairman 28 June 2007

For further information about Dart Group PLC and its subsidiary companies please

visit our website, www.dartgroup.co.uk

REVIEW OF OPERATIONS

Jet2.com

Jet2.com now operates 29 owned Boeing 737-300 and Boeing 757-200 aircraft with

additional capacity leased-in seasonally, as needed, to meet demand, from its

six airport bases in the North - Leeds Bradford, Manchester, Newcastle, Belfast,

Blackpool and Edinburgh. The company has a thriving passenger charter business

and a long-term contract with Royal Mail to fly its unique Boeing 737-300 "Quick

Change" aircraft on nightly mail flights throughout the UK. Following these

flights, the aircraft are reconfigured to make a full operational contribution

to the company's passenger flying programme.

The company has now substantially completed the move to Leeds Bradford

International Airport - even transporting its Portacabin "duplex" office

buildings from Bournemouth for occupation at the new airport site. Some

engineering administration functions, together with the management of the Royal

Mail operation, will remain in Bournemouth.

The company has significantly increased the number of city, sun and snow

destinations it serves from each of its bases this year. Five new routes were

opened from Leeds Bradford, eight from Manchester, seven from Newcastle, five

from Belfast and four from Blackpool. For further details, visit our website at

www.jet2.com.

The company believes that The Canary Islands, which have formerly mainly been

served by charter flights, will become an increasingly popular scheduled service

destination, ideally suited to the performance of our 235 seat Boeing 757

aircraft. After successful services last winter to Tenerife and Lanzarote we

will be operating up to 27 flights a week to the Islands this financial year.

The Canary Islands Tourist Authorities will actively promote the destinations

throughout our region and bookings to date are encouraging. The company plans to

further expand its longer distance services and winter sun routes to enhance our

overall offering to our customers.

Our ancillary revenues are a vital contributor to our income and allow the

company to offer the lowest possible fares. Ancillary revenue per passenger

increased by 39% in the year ended 31 March 2007 and it is anticipated further

growth will be achieved in the new financial year. Contributing to this are

charges for hold bags, extra leg room, seat allocation, internet check-in,

commissions on sales of insurance, hotel and car hire and profits from on-board

sales of food, beverages and gifts. The promotion of this sector of the business

is hugely important. Crews are highly incentivised to continually increase

on-board sales and great effort is made to introduce new products and find the

best and most competitive providers.

The company is also working hard to ensure that its aircraft are flown in the

most environmentally friendly and fuel efficient way. A full time project

General Manager is committed to continuous monitoring of our fuel and

environmental performance.

Jet2.com is committed to contracting out many of its support operations, such as

its call centre and purchase ledger functions, which are now handled extremely

capably in India. However, it was decided this year to undertake our own

check-in and handling of passengers and aircraft at Leeds Bradford and in

several airports in Spain. By bringing these operations in-house, we will offer

a better more efficient service at a competitive price. Our aim is to be

regarded as a friendly airline with good customer service. We know that our

staff will achieve this.

During the year the company acquired five Boeing 757-200 aircraft. The Boeing

757-200 is a versatile aircraft able to carry up to 235 passengers over 3,000

miles. Its overall performance is particularly suited to Leeds Bradford which is

a high airport with some operational constraints. The Boeing 757-200 allows the

company to offer a range of destinations from both Leeds Bradford and its other

bases that other aircraft cannot match. At the same time it is extremely

environmentally friendly in terms of noise, fuel efficiency and emissions. We

expect to increase our Boeing 757 fleet over the coming years and also to

operate similar, larger types which will allow our customers to explore an

expanding range of popular destinations at the lowest possible fares.

On 17 June 2007, we were pleased to sign a 15 year agreement with Pratt &

Whitney for the fixed-price maintenance of the CFM56-3 series engines which

power our Boeing 737-300 aircraft. Pratt & Whitney will also increasingly

supply various parts that they will manufacture for this engine under their

Global Material Solutions Programme. This agreement brings both price certainty

and cost reductions. We look forward to a long and successful association with

Pratt & Whitney.

The company now operates seven Boeing 737 Quick Change and one Freighter for the

Royal Mail nightly. These are based at Newcastle, Belfast, Edinburgh, Stansted

and Exeter. The Northern based aircraft fly Jet2.com passenger services during

the day before their 40 minute transformation into mail aircraft, during which

the seats are removed and mail loaded in containers. The Stansted based aircraft

also flies a very busy charter programme both for tour operators, specialist

holiday providers, and in support of promotional and sporting events. This is a

business in which the company has a long history of success and which we expect

to further develop in the future alongside our low-cost services.

Fowler Welch-Coolchain

Fowler Welch-Coolchain has distribution centres strategically located in

Spalding, Lincs, Teynham, Kent, Stockport, Cheshire, and Washington, Tyne and

Wear, and is one of the UK's leading temperature-controlled distribution

businesses, specialising in the distribution of fresh produce and chilled foods

on behalf of UK supermarkets, other multiple retailers and their suppliers. In

addition the business has substantial pick-to-order and warehousing

capabilities, together with a growing ambient (non temperature-controlled)

distribution business. It is the company's strategy to grow and invest in each

of these business areas. During the year considerable investment has been

made in the development of the company's IT systems to ensure the most cost-

effective and efficient service is delivered to our customers.

The distribution market place is, of course, very competitive and cost-

conscious. Nevertheless despite these challenges the company grew its business

this year with increased sales in both chilled distribution, pick-to-order and

warehousing operations, as well as building its new revenue stream in ambient

distribution.

On 28 April 2006, the Group acquired the business and assets of R F Fielding

Cheshire Ltd (In Administration), a business specialising in ambient

distribution to major retailers and other wholesalers. Sales in this area are

expected to grow in 2007/08 due to a new business win from a major supermarket

group. As a result of its strategic location in Stockport, Cheshire, more

efficient fleet synergy and utilisation for the whole distribution business has

been achieved through the new flows of product for distribution from the North

West.

On 3 July 2006, the Group sold its Channel Islands' transport and distribution

business to a third party specialising in this sector of the market. In the

light of the decline in the Channel Islands' horticultural industry, the Board

considered this business was no longer core, and that management time should be

freed up to concentrate on growing the mainland UK logistics operations.

Pick-to-order operations have been an important area of growth in recent years

and this trend continued in 2006/07. In a typical week Fowler Welch-Coolchain

picks and delivers approximately 1 million cases of prepared meats, cheeses,

ready meals and pasta. An ambient goods picking operation is also carried out in

Stockport providing important volumes which feed into the distribution network.

The new computer system to support the growth in this market segment is also

currently being implemented.

The lack of warehouse space and associated facilities for vehicles at the

Gateshead site had become a constraint on growth in this region. It was,

therefore, necessary to find bigger premises to enable the company to tender for

larger contracts in this area. During the year a new 8 acre freehold site was

purchased in Washington, Tyne and Wear. The 40,000 sq.ft. warehouse facility,

which is currently being converted for the company's operations, will

be the first multi-purpose ambient and chilled warehouse in the business, thus

enabling both ambient and chilled distribution customers to be serviced from the

same depot. Although the premises are currently operational, further coldstores

and seven loading bays are presently being built. When complete, the new

building, costing in the region of #5.5m, will provide a first-class facility

for customers in this important region.

Fowler Welch-Coolchain offers a quality logistics solution to supermarkets,

growers and food manufacturers based both in the UK and mainland Europe. With

the recent investments in new premises in the North East of England, together

with the ambient business in the North West the business offers a truly national

solution to its customers' supply chain needs.

The ongoing need to be cost competitive remains a key business driver and the

company believes that as volumes grow it will increase its competitiveness in

the marketplace. Looking forward, the business anticipates a further year of

growth in 2007/08 and is confident that it is competitively placed to take full

advantage of the opportunities in this sector in the future.

For further information contact:

Dart Group PLC Tel: 01202 597676

Philip Meeson, Mobile: 07785 258666

Group Chairman and Chief Executive

Mike Forder, Mobile: 07721 865850

Group Finance Director

Group Profit And Loss Account

for the year ended 31 March 2007

Notes 2007 2007 2007 2006 2006 2006

Before Exceptional Before

exceptional items exceptional Exceptional

items (note 5) Total items items Total

(restated) (note 5) (restated)

#m #m #m #m #m #m

Turnover 1

Continuing

operations 349.0 - 349.0 289.6 - 289.6

Discontinued

operations 3.0 - 3.0 21.0 - 21.0

-------- -------- ------ -------- -------- -------

352.0 - 352.0 310.6 - 310.6

-------- -------- ------ -------- -------- --------

Net operating

expenses

Excluding goodwill

amortisation (332.8) (0.1) (332.9) (296.6) (6.2) (302.8)

Goodwill

amortisation (0.5) - (0.5) (0.5) - (0.5)

-------- -------- ------ -------- -------- --------

Net operating

expenses (333.3) (0.1) (333.4) (297.1) (6.2) (303.3)

-------- -------- ------ -------- -------- --------

Operating profit

Continuing

operations 18.5 (0.1) 18.4 12.4 (6.2) 6.2

Discontinued

operations 0.2 - 0.2 1.1 - 1.1

-------- -------- ------ -------- -------- --------

18.7 (0.1) 18.6 13.5 (6.2) 7.3

Profit on

disposal of

discontinued

operations - 2.2 2.2 - 3.7 3.7

(Loss)/profit

on disposal of

fixed assets - (0.1) (0.1) - 3.3 3.3

Net interest

(including

exchange

(loss)/gains) (2.6) - (2.6) 0.5 - 0.5

-------- -------- ------ -------- -------- --------

Profit on

ordinary

activities

before

taxation 16.1 2.0 18.1 14.0 0.8 14.8

Taxation (4.3) (0.2) (4.5) (4.7) 0.9 (3.8)

-------- -------- ------ -------- -------- --------

Profit for the

year 11.8 1.8 13.6 9.3 1.7 11.0

-------- -------- ------ -------- -------- --------

Earnings per share - total

- basic 8.42p 9.73p 6.75p 7.95p

- diluted 8.36p 9.66p 6.70p 7.89p

Earnings per share

- continuing operations

- basic 8.10p 7.98p 6.19p 4.74p

- diluted 8.04p 7.92p 6.15p 4.70p

Earnings per

share - discontinued

operations

- basic 0.32p 1.75p 0.56p 3.21p

- diluted 0.32p 1.74p 0.55p 3.19p

Statement of Total Recognised Gains and Losses

for the year ended 31 March 2007

2007 2006

(restated)

#m #m

------------ --------

Profit on ordinary activities after taxation 13.6 11.0

------------ --------

Total recognised gains and losses relating to the 13.6 11.0

period ------------ --------

Prior year adjustment

FRS20 share based payment expense (note 6) (0.3) -

------------ --------

Total recognised gains and losses since previous 13.3 11.0

annual report ------------ --------

Balance Sheet

at 31 March 2007

Group

2007 2006

Notes #m #m

--------- ---------

Fixed assets

Intangible assets 6.3 6.8

Tangible assets 179.1 131.5

--------- ---------

185.4 138.3

Current assets

Stock 8.2 7.5

Debtors 44.0 23.8

Cash at bank and in hand 3.9 26.0

--------- ---------

56.1 57.3

Current liabilities

Creditors: amounts falling due (138.1) (98.6)

within one year

--------- ---------

Net current liabilities (82.0) (41.3)

--------- ---------

Total assets less current liabilities 103.4 97.0

Creditors: amounts falling due after (18.0) (28.0)

more than one year

Provisions for liabilities (14.3) (9.7)

--------- ---------

Net assets 71.1 59.3

--------- ---------

Capital and reserves

Called up share capital 1.8 1.7

Share premium account 9.2 8.6

Profit and loss account 60.1 49.0

--------- ---------

Shareholders' funds - equity interests 2 71.1 59.3

--------- ---------

Group Cash Flow Statement

for the year ended 31 March 2007

2007 2006

Note #m #m

---------- --------

Net cash inflow from operating activities 3 62.2 41.0

Returns on investment and servicing of finance (1.1) (1.6)

Taxation (1.0) (5.2)

Capital expenditure and financial investment (69.0) (45.5)

Disposal of subsidiary undertakings 3.8 4.0

Equity dividends paid (2.7) (2.4)

---------- --------

Cash outflow before financing (7.8) (9.7)

Financing (12.8) 6.8

---------- --------

Decrease in cash in the year (20.6) (2.9)

---------- --------

Reconciliation of net cash flow to movement in net debt

2007 2006

#m #m

---------- --------

Decrease in cash in the year (20.6) (2.9)

Cash outflow/(inflow) from the decrease/(increase) in

debt in the year 13.5 (6.2)

---------- --------

Change in net debt resulting from cash flows (7.1) (9.1)

Exchange differences (1.5) 1.2

Net debt at 1 April (5.5) 2.4

---------- --------

Net debt at 31 March (14.1) (5.5)

---------- --------

NOTES

1. Turnover

Analyses of profit before taxation and net assets between the different segments

of the Group are not given as, in the opinion of the directors, such analyses

would be seriously prejudicial to the commercial interests of the Group.

2007 2006

(restated)

#m #m

Distribution

- continuing operations 110.0 95.2

- discontinued operations 3.0 11.5

Aviation Services

- continuing operations 239.0 194.4

- discontinued operations - 9.5

-------- --------

352.0 310.6

-------- --------

2007 2006

(restated)

#m #m

Turnover arising :

- Continuing operations

Within the United Kingdom and the Channel Islands 156.2 164.3

Between the United Kingdom and Mainland Europe 192.8 125.3

- Discontinued operations

Within the United Kingdom and the Channel Islands 3.0 20.6

Within the Far East - 0.4

-------- --------

352.0 310.6

-------- --------

On 28 April 2006 Fowler Welch-Coolchain Limited acquired the trade and assets of

R F Fielding Cheshire Limited (In Administration) for a de minimis sum. No

goodwill arose on the acquisition and there have been no fair value adjustments

in respect of the assets acquired. The turnover reflected in the Group Profit

and Loss Account in respect of this business amounted to #14.5m during the year.

There were no material profits arising in respect of this business in the year.

2. Reconciliation of movements in equity shareholders' funds

Group

2007 2006

(restated)

#m #m

Profit for the year 13.6 11.0

Dividends paid in the year (2.7) (2.4)

Reserves movement arising from share based

payment charge 0.2 0.2

--------- ---------

11.1 8.8

Issue of shares under share option schemes 0.7 0.6

--------- ---------

Net addition to shareholders' funds 11.8 9.4

Opening equity shareholders' funds 59.3 49.9

--------- ---------

Closing equity shareholders' funds 71.1 59.3

--------- ---------

3. Reconciliation of operating profit to net cash flow from operating activities

2007 2006

(restated)

#m #m

Operating profit 18.6 7.5

Depreciation and impairment 20.9 16.6

Amortisation of goodwill 0.5 0.5

Increase in stock (0.7) (2.9)

(Increase)/decrease in debtors (21.5) 1.7

Increase in creditors 44.2 17.4

Share based payments charge 0.2 0.2

--------- --------

Net cash inflow from operating activities 62.2 41.0

--------- --------

4. Earnings per share

The calculation of basic earnings per share is based on earnings for the year

ended 31 March 2007 of #13,627,637 (2006 as re-stated : #11,009,520). The

calculation of basic earnings per share before exceptional items is based on

earnings for the year ended 31 March 2007 of #11,795,637 (2006 as restated :

#9,349,144). Both calculations are based on 140,073,882 shares (2006 -

138,469,604) being the weighted average number of shares in issue for the year.

The calculation of diluted earnings per share is based on earnings for the year

ended 31 March 2007 of #13,627,637 (2006 as restated : #11,009,520). The diluted

earnings per share before exceptional items is based on earnings for the year

ended 31 March 2007 of #11,795,637 (2006 as restated : #9,349,144). Both

calculations are based on 141,122,024 ordinary shares (2006 - 139,488,044)

calculated as follows:

2007 2006

Basic weighted average number of shares 140,073,882 138,469,604

Dilutive potential ordinary shares:

Employee share options 1,048,142 1,018,440

------------ ------------

141,122,024 139,488,044

------------ ------------

5. Exceptional items

2007 2006

#m #m

Operating items (continuing operations)

Re-organisation costs (0.1) (2.2)

A300 closure costs - (0.7)

Impairment of fixed assets - (3.3)

Profit on disposal of fixed assets and investments

(Loss)/gain on disposal of A300 (continuing operations) (0.1) 3.3

Profit on disposal of discontinued operations 2.2 3.7

--------- ------------

Net exceptional items before taxation 2.0 0.8

--------- ------------

All of the exceptional items in both the current and previous year are

chargeable to corporation tax at a rate of 30%, with the exception of the

profits on disposal of discontinued operations. The 2007 profit on disposal of

discontinued operations of #2.2m (2006: #3.7m) attracted a tax charge of #0.2m

(2006:#nil).

The reorganisation costs in both years relate to the move of the Jet2.com

operational departments from Bournemouth International Airport to Leeds Bradford

International Airport. A decision to withdraw from Airbus A300 airfreight

operations in the prior year resulted in redundancy and other closure costs. One

of the remaining Airbus A300 aircraft was sold prior to 31 March 2006 at a

profit of #3.3m. Whilst an exchange of contracts had taken place for the sale of

the last Airbus A300, the 2006 impairment charge of #3.3m relates to this

aircraft. The impairment was necessary as neither the value in use nor the

anticipated sale proceeds supported the unimpaired book value. The sale of this

aircraft was completed on 22 June 2006 giving rise to a loss on disposal of

#0.1m.

On 3 July 2006 the Group completed the sale of the trade, assets and liabilities

of Channel Express (CI) Limited to a third party specialising in Channel

Islands' distribution.

6. Accounting policy changes

FRS20: Share-based Payments

The fair value of employee share option plans is measured at the date of grant

of the option using the binomial valuation model. The resulting cost, as

adjusted for the expected and actual level of vesting of the options, is charged

to income over the period in which the options vest. At each balance sheet date

before vesting the cumulative expense is calculated, representing the extent to

which the vesting period has expired and management's best estimate of the

achievement or otherwise of non-market conditions, of the number of equity

instruments that will ultimately vest. Cumulative expense since the previous

balance sheet date is recognised in the income statement with a corresponding

entry in reserves. The Group has taken advantage of the transitional provisions

of FRS20 in respect of the fair value of equity- settled awards so as to apply

FRS20 only to those equity-settled awards granted after 7 November 2002 that had

not vested before 31 March 2006. The cost of these share options reflected in

the results of the Group for the year is #0.2m (2006 restated - #0.2m).

7. The financial information set out in the announcement does not constitute the

Group's statutory accounts for the financial years ended 31 March 2007 or 2006.

The financial information for the year ended 31 March 2006 is derived from the

statutory accounts for that year, which have been delivered to the Registrar of

Companies and those for 2007 will be delivered following the Company's Annual

General Meeting. The auditors have reported on those accounts; their reports

were unqualified and did not contain statements under Section 237 (2) of the

Companies Act 1985.

8. The proposed final dividend of 1.430p per share will, if approved, be payable

on 24 August 2007 to shareholders on the Company's register at the close of

business on 6 July 2007.

9. The 2007 Annual Report and Accounts (together with the Auditors Report) will

be posted to shareholders no later than 17 July 2007. The Annual General Meeting

will be held on 9 August 2007.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR FGGZVGNZGNZZ

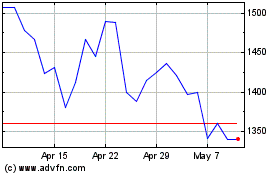

Jet2 (LSE:JET2)

Historical Stock Chart

From Jun 2024 to Jul 2024

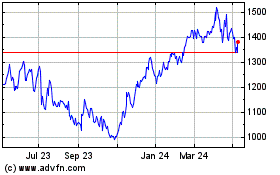

Jet2 (LSE:JET2)

Historical Stock Chart

From Jul 2023 to Jul 2024